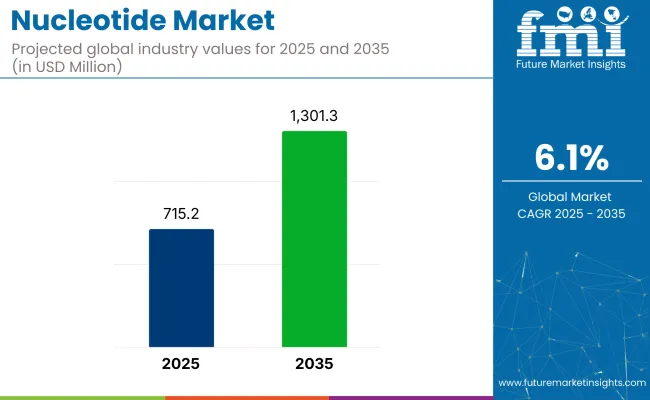

The global nucleotide market is valued at USD 715.2 million in 2025 and is expected to reach USD 1,301.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.1%.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 715.2 million |

| Projected Value (2035) | USD 1,301.3 million |

| CAGR (2025 to 2035) | 6.1% |

This growth is attributed to the increasing applications of nucleotides in the pharmaceutical, diagnostics, and food sectors. Technological advancements in nucleotide synthesis and extraction methods are expected to further reduce production costs, making these vital molecules more accessible. The demand for personalized medicine, coupled with advancements in genomics, will continue to drive the market.

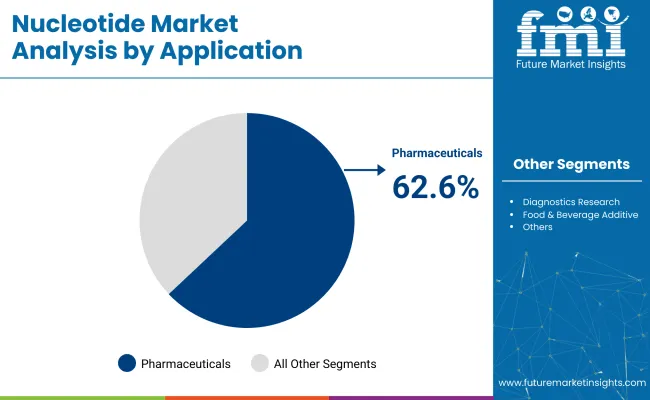

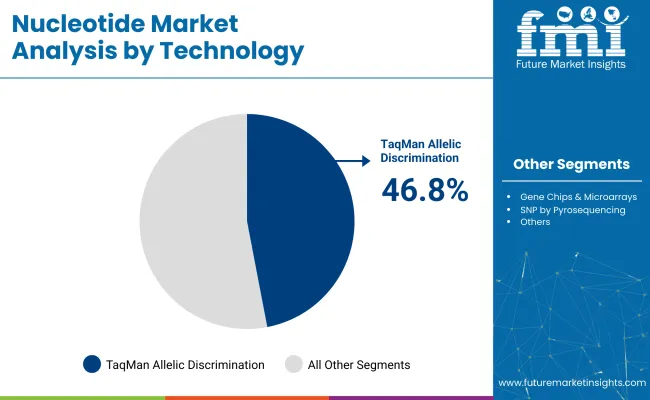

In 2025, the nucleotide market is expected to be predominantly driven by diagnostics research, with this application segment holding a 62.6% share. On the other hand, TaqMan Allelic Discrimination technology accounts for 46.8% market Share in 2025. The USA will remain the largest market, supported by its robust pharmaceutical and research industries, and is anticipated to grow at a CAGR of 5.7%. Meanwhile, Japan and the UK closely follow this growth with significant CAGRs of 7.1% and 5.6% respectively.

The nucleotide market represents a niche but increasingly significant share within its parent markets. It is estimated to account for approximately 3-4% of the global biotechnology market, due to its role in genetic research and synthesis. Within the pharmaceutical ingredients market, it holds around 2%, largely driven by its use in antiviral and cancer therapies.

In the functional food ingredients and animal feed additives segments, it constitutes nearly 1.5%-2% each, as applications continue expanding. In the genomics and molecular diagnostics markets, its share is higher, estimated at 5-6%, due to its critical role in assay development and personalized medicine.

Looking ahead, the market is expected to witness continued innovations, particularly in the synthesis of nucleotides. The integration of next-generation sequencing technologies and advancements in genomics will further fuel the growth of the nucleotide industry. Companies are also likely to expand their operations through strategic partnerships and acquisitions, particularly in high-growth regions like Asia-Pacific and Latin America. These efforts will help meet the rising global demand for high-quality nucleotides in both human and veterinary healthcare, as well as in food technology applications.

The global nucleotide market is segmented into application, technology and region. By application, it includes pharmaceuticals, diagnostics research, food & beverage additives, animal feed additives, and others (including cosmetics, nutraceuticals, and clinical nutrition).

By technology, it is segmented into Taqman allelic discrimination, gene chips & microarrays, SNP by pyrosequencing, and others (such as real-time PCR probes, sequencing-by-synthesis methods, and multiplex ligation techniques). By region, it covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Pacific, the Middle East, and Africa.

The pharmaceuticals segment dominates the global nucleotide market, holding 62.6% of the market share in 2025 due to the increasing use of nucleotides in drug development, particularly for antiviral and cancer treatments. Diagnostics Research follows as a close second, driven by the need for more efficient molecular diagnostic techniques. Animal Feed Additive is emerging as a lucrative segment, with rising demand for enhanced livestock health.

TaqMan Allelic Discrimination leads the technology segment with 46.8% market share in 2025, owing to its widespread use in gene sequencing and diagnostics. Gene Chips & Microarrays are also significant and are used extensively in genomic research. SNP by Pyrosequencing is gaining traction for its high accuracy in detecting genetic variations, particularly in personalized medicine.

Recent Trends in the Nucleotide Market

Challenges in the Nucleotide Market

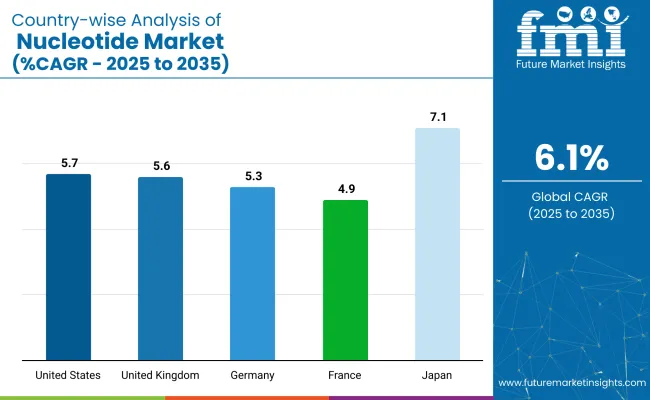

Among the top five countries in the nucleotide market, Japan is projected to witness the fastest growth, with a CAGR of 7.1% from 2025 to 2035, driven by its leadership in genomic research and strong biotech investments. The USA follows with a CAGR of 5.7%, supported by its robust pharmaceutical infrastructure and personalized medicine initiatives. The UK and Germany show stable expansion at 5.6% and 5.3%, respectively, due to advanced diagnostics and healthcare systems. France, while growing more slowly at 4.9%, remains a significant market due to rising R&D in molecular diagnostics and genomics.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA nucleotide revenue is projected to grow at a CAGR of 5.7% from 2025 to 2035. The USA remains the largest market for nucleotides, driven by its leading pharmaceutical and biotechnology industries. Major advancements in genomic research, diagnostics, and drug development support the demand for nucleotides. The strong presence of multinational pharmaceutical companies and a well-established healthcare system further boost market expansion. Additionally, the rising focus on personalized medicine and growing healthcare expenditures ensure sustained growth in the market.

The revenue from nucleotides in the UK is expected to grow at a CAGR of 5.6% from 2025 to 2035. The country benefits from its well-established pharmaceutical sector and high investments in biomedical research. The UK also plays a significant role in diagnostics, with a rising demand for advanced molecular diagnostic tools. The healthcare sector's focus on improving disease detection methods drives further adoption of nucleotides, especially in genetic research and drug development.

The nucleotide market in Germany is forecasted to grow at a CAGR of 5.3% from 2025 to 2035. As one of the leading pharmaceutical hubs in Europe, Germany has a strong market for nucleotides, especially in diagnostics and therapeutic applications. The nation's commitment to advancing biomedical research, combined with its highly efficient healthcare infrastructure, ensures the ongoing demand for nucleotides. Furthermore, Germany’s support for innovation and biotechnology is expected to foster continued market growth.

The sales of nucleotides in France are projected to grow at a CAGR of 4.9% from 2025 to 2035. France has a growing pharmaceutical and biotechnology sector, with increasing investments in research and development. The demand for nucleotides is driven by their application in molecular diagnostics and therapeutic research. Furthermore, France's increasing focus on personalized medicine and genomic research, supported by robust healthcare funding, is propelling the nucleotide market forward.

The revenue from the nucleotide in Japan is expected to grow at a CAGR of 7.1% from 2025 to 2035. Japan has become a leader in advanced genomic research, driving the demand for high-quality nucleotides. The country's pharmaceutical and biotechnology industries are investing heavily in new technologies, creating a strong market for nucleotides. Additionally, the aging population is driving the demand for personalized healthcare solutions, further boosting the market for nucleotides used in drug development and diagnostics.

The market is moderately consolidated, with a few global leaders accounting for a significant share of revenues. Top companies like ThermoFisher Scientific Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies Inc., DSM Nutritional Products Ltd., and Nanjing Bio Together Co., Ltd. are competing based on technological innovation, strategic partnerships, and geographical expansion. These companies focus on developing cutting-edge products in genomics, diagnostics, and therapeutics, using pricing strategies, new product launches, and global collaborations to strengthen their market positions.

These leading companies are heavily investing in R&D to introduce advanced nucleotide solutions and improve production efficiency. Pricing competition remains tight, with firms offering cost-effective products to penetrate emerging markets. Many of these companies also collaborate with research institutions and pharmaceutical firms to further their reach, improve product offerings, and drive demand for nucleotides in diagnostics, personalized medicine, and therapeutics.

Recent Nucleotide Industry News

In February 2025, Thermo Fisher Scientific announced to acquire Solventum’s Purification and Filtration Business to boost its position.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 715.2 million |

| Projected Market Size (2035) | USD 1,301.3 million |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions/Volume in Kilotons |

| By Application | Pharmaceuticals, Diagnostics Research, Food & Beverage Additive, Animal Feed Additive, Others |

| By Technology | TaqMan Allelic Discrimination, Gene Chips & Microarrays, SNP by Pyrosequencing, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Nanjing Bio Together Co., Ltd., Affymetrix Inc., DSM Nutritional Products Ltd., F. Hoffmann-La Roche Ltd., ThermoFisher Scientific Inc., CJ CheilJedang Corporation, Agilent Technologies Inc., PR Omega Corporation, Biorigin, Ohly GmbH, Star Lake Bioscience Co., NuEra Nutrition, Lallemand Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per application, the industry has been categorized into Pharmaceuticals, Food & Beverage Additives, Diagnostics Research, Animal Feed Additives, and Others.

This segment is further categorized into TaqMan allelic discrimination, Gene chips & microarrays, SNP by pyrosequencing, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market size is valued at USD 715.2 million in 2025.

The market is forecasted to reach USD 1,301.3 million by 2035, reflecting a CAGR of 6.1%.

Pharmaceuticals are expected to lead the market, accounting for a 62.6% share in 2025.

TaqMan Allelic Discrimination is expected to account for 46.8% of the market share in 2025.

Japan is anticipated to be the fastest-growing market with a CAGR of 7.1% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nucleotide Premixes Market Analysis by form, application and region Flavors Through 2035

USA Nucleotide Premixes Market Report – Size, Trends & Industry Forecast 2025-2035

Oligonucleotide API Market Forecast and Outlook 2025 to 2035

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Single Nucleotide Polymorphism (SNP) Genotyping Market

Microbial Nucleotides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antisense Oligonucleotides Market Size and Share Forecast Outlook 2025 to 2035

Nicotinamide Adenine Dinucleotide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA