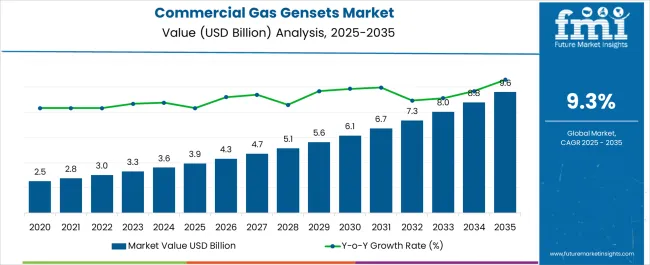

The Commercial Gas Gensets Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 9.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.3% over the forecast period. This growth is driven by increasing demand for reliable, fuel-efficient, and eco-friendly backup power solutions in commercial applications.

In the first five-year phase (2025-2030), the market is expected to grow from USD 3.9 billion to USD 6.5 billion, adding USD 2.6 billion, which accounts for 45.6% of the total incremental growth, driven by the rising adoption of natural gas as a cleaner alternative to diesel in commercial sectors.

The second phase (2030-2035) will contribute USD 3.1 billion, representing 54.4% of the total growth, reflecting stronger momentum as the market matures and gas-powered generators become even more popular due to their lower environmental impact and cost-effectiveness.

Annual increments will rise from USD 0.4 billion in early years to USD 0.7 billion by 2035, signaling faster growth as more industries, including healthcare, education, and data centers, increase their reliance on gas gensets. Manufacturers focusing on performance, sustainability, and adaptability to varying energy demands will capture the largest share of this USD 5.7 billion opportunity.

| Metric | Value |

|---|---|

| Commercial Gas Gensets Market Estimated Value in (2025 E) | USD 3.9 billion |

| Commercial Gas Gensets Market Forecast Value in (2035 F) | USD 9.6 billion |

| Forecast CAGR (2025 to 2035) | 9.3% |

The commercial gas gensets market is gaining traction as industries and service providers seek reliable and cleaner backup power solutions amidst rising grid instability and energy transition goals. Increasing preference for gas-based gensets over diesel alternatives is driven by environmental regulations, lower operating costs, and availability of cleaner natural gas sources.

The shift toward sustainable energy infrastructure, particularly in commercial facilities such as data centers, telecom towers, and hospitals, is reinforcing demand. Technological advancements in engine efficiency, remote monitoring, and hybrid integration are further enhancing operational performance.

With growing emphasis on emission reduction, operational continuity, and cost optimization, the commercial gas gensets market is expected to continue its upward trajectory across diverse end use sectors.

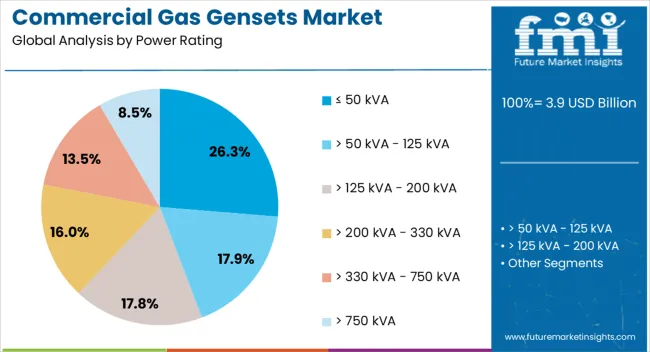

The commercial gas gensets market is segmented by power rating, end use, application, and geographic regions. By power rating, the commercial gas gensets market is divided into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA.

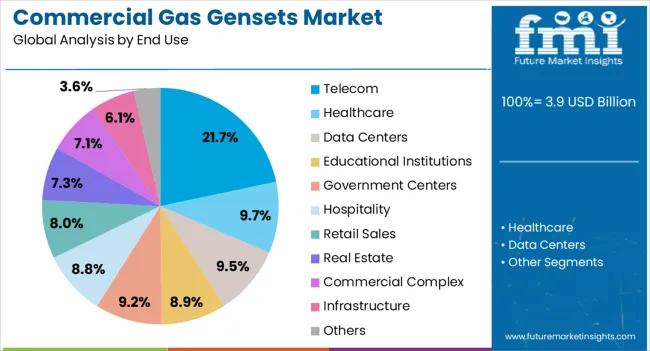

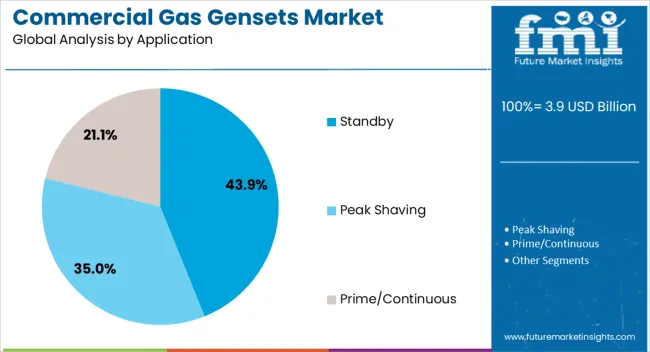

In terms of end use, the commercial gas gensets market is classified into Telecom, Healthcare, Data Centers, Educational Institutions, Government Centers, Hospitality, Retail Sales, Real Estate, Commercial Complex, Infrastructure, and Others. Based on application, the commercial gas gensets market is segmented into Standby, Peak Shaving, and Prime/Continuous.

Regionally, the commercial gas gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 50 kVA segment is projected to contribute 26.30% of the total market revenue by 2025, emerging as a key power rating category. This dominance is driven by its suitability for small scale commercial facilities and decentralized infrastructure.

The segment’s compact size, lower capital investment, and ease of installation make it an optimal choice for telecom towers, retail outlets, and small business units requiring dependable auxiliary power. Its efficiency in light load applications and compatibility with cleaner fuels have further enhanced its adoption.

As remote connectivity and digital infrastructure continue to expand, the demand for compact and efficient gensets in this power range is expected to remain strong.

The telecom segment is expected to account for 21.70% of total market revenue by 2025 within the end use category, making it a major contributor to market growth. This is primarily due to the rising number of telecom towers and the critical need for uninterrupted power in remote and urban locations.

Increased mobile data consumption, 5G rollout, and network densification are driving investments in backup power infrastructure. Gas gensets are being favored for their reliability, lower emissions, and reduced fuel storage requirements compared to diesel alternatives.

Their ability to operate efficiently in varied climatic conditions supports robust deployment in telecom operations, especially in off-grid and weak-grid areas.

The standby segment is projected to hold 43.90% of market revenue by 2025, making it the leading application area. This growth is attributed to the critical need for uninterrupted operations across commercial establishments during grid outages.

Gas gensets used for standby applications offer clean, immediate, and consistent power, which is vital for sectors such as banking, healthcare, and retail. The segment’s appeal is strengthened by increasing weather-related disruptions and infrastructure vulnerabilities that demand immediate power backup.

The reliability, low maintenance, and compliance benefits of gas-based standby systems continue to position this application segment as the cornerstone of commercial genset deployments.

The commercial gas gensets market is driven by increasing demand for reliable backup power solutions and expanding commercial and industrial applications. Emerging trends such as hybrid gensets and improved fuel efficiency are reshaping the market. However, challenges like high initial investment and maintenance costs remain significant obstacles. By 2025, overcoming these challenges through affordable financing options and cost-effective solutions will be crucial for the market’s continued growth, ensuring that businesses can access efficient, reliable power backup systems.

The commercial gas gensets market is experiencing growth due to the increasing demand for reliable backup power in commercial sectors. These generators are essential in maintaining operations during power outages, especially in industries such as healthcare, manufacturing, and hospitality, where uninterrupted power supply is critical. Gas-powered gensets offer cleaner and more efficient energy solutions compared to diesel models, making them increasingly popular. By 2025, the demand for reliable power backup solutions in these sectors will continue to drive the market.

Opportunities in the commercial gas gensets market are rising with the expansion of commercial and industrial applications. As businesses continue to expand, especially in emerging economies, the need for efficient, cost-effective power solutions is growing. Gas gensets are being increasingly adopted due to their efficiency, lower emissions, and availability of natural gas in various regions. By 2025, the growth in commercial infrastructure and industrial activities in emerging markets will provide significant opportunities for the gas genset market, driving demand for clean and reliable power solutions.

Emerging trends in the commercial gas gensets market include the growing demand for hybrid gensets and improved fuel efficiency. Hybrid systems that combine renewable energy sources with gas generators are gaining traction due to their ability to provide consistent power while reducing operational costs. Additionally, advances in fuel efficiency are allowing gas gensets to offer greater performance at lower fuel consumption, making them more cost-effective for commercial applications. By 2025, these trends will continue to drive the development of more efficient and flexible genset solutions.

Despite growth, challenges such as high initial investment and maintenance costs persist in the commercial gas gensets market. The upfront cost of purchasing and installing gas-powered gensets can be high, particularly in larger commercial applications. Additionally, maintenance costs for these generators, while generally lower than for diesel counterparts, can still be significant over time. By 2025, addressing these challenges through financing options and reducing maintenance requirements will be essential for increasing the accessibility and adoption of gas gensets in commercial markets.

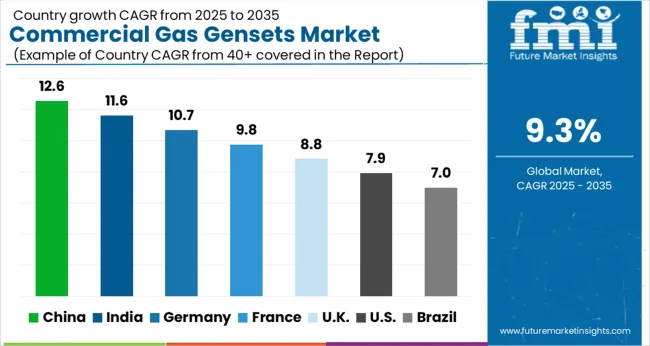

| Country | CAGR |

|---|---|

| China | 12.6% |

| India | 11.6% |

| Germany | 10.7% |

| France | 9.8% |

| UK | 8.8% |

| USA | 7.9% |

| Brazil | 7.0% |

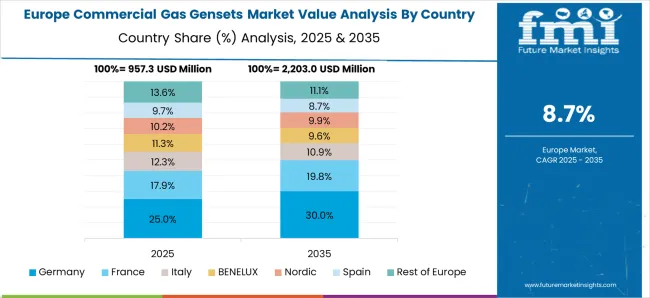

The global commercial gas gensets market is projected to grow at a 9.3% CAGR from 2025 to 2035. China leads with a growth rate of 12.6%, followed by India at 11.6%, and Germany at 10.7%. The United Kingdom records a growth rate of 8.8%, while the United States shows the slowest growth at 7.9%. These varying growth rates are driven by increasing demand for clean, efficient, and reliable power generation solutions in industries such as construction, manufacturing, and telecommunications. Emerging markets like China and India are experiencing higher growth due to industrial expansion, urbanization, and government incentives for clean energy solutions, while more mature markets like the USA and the UK see steady growth driven by environmental regulations, technological advancements, and the adoption of energy-efficient backup power systems in commercial applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The commercial gas gensets market in China is growing rapidly, with a projected CAGR of 12.6%. China’s booming industrial sector, combined with the country’s focus on reducing carbon emissions and promoting cleaner energy sources, is driving the demand for gas gensets. The country’s growing infrastructure development, particularly in urban areas and industrial hubs, continues to increase the need for reliable and efficient power generation solutions. Additionally, China’s government policies supporting clean energy technologies, coupled with rising investments in renewable energy projects and urbanization, are contributing to the expansion of the commercial gas gensets market. China’s strong industrial base and focus on sustainability ensure continued growth in the market.

The commercial gas gensets market in India is projected to grow at a CAGR of 11.6%. India’s increasing demand for reliable and cost-effective power generation solutions, driven by its rapidly expanding industrial sector and rising urban population, is fueling market growth. The country’s focus on cleaner energy sources and energy efficiency, along with government initiatives to improve power reliability, is accelerating the adoption of gas gensets. Additionally, India’s growing infrastructure development, along with increasing investments in renewable energy, continues to drive demand for efficient power generation systems. The rise of industrial hubs and smart city projects further boosts the market for commercial gas gensets.

The commercial gas gensets market in Germany is projected to grow at a CAGR of 10.7%. Germany’s strong industrial base, coupled with a focus on reducing carbon emissions and increasing energy efficiency, is driving steady market growth. The country’s emphasis on sustainability, energy transition, and investments in clean energy solutions is contributing to the growing demand for commercial gas gensets. Additionally, Germany’s growing industrial demand for reliable and efficient backup power solutions, along with its leadership in the renewable energy sector, further accelerates the adoption of gas gensets. The integration of energy-efficient technologies and automation in commercial applications further boosts the market growth in Germany.

The commercial gas gensets market in the United Kingdom is projected to grow at a CAGR of 8.8%. The UK emphasis on energy efficiency, sustainability, and low-carbon technologies is driving steady demand for commercial gas gensets. The country’s regulatory support for clean energy, coupled with ongoing investments in industrial and commercial infrastructure, is accelerating the adoption of gas gensets. The UK focus on reducing reliance on traditional fossil fuels, combined with the increasing need for reliable and efficient power solutions, particularly in the commercial sector, further contributes to the growth of the market. Additionally, the rise of decentralized energy solutions and green building practices in commercial real estate boosts demand for gas gensets.

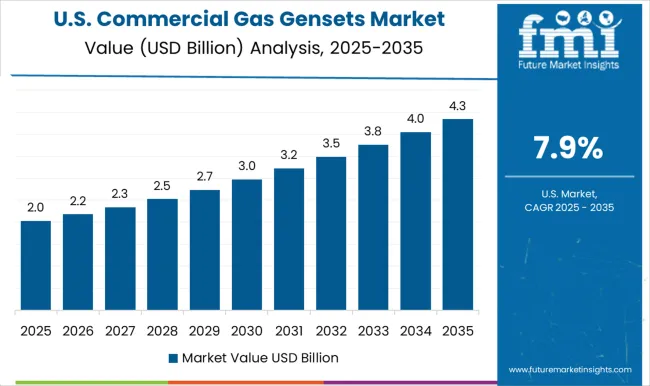

The commercial gas gensets market in the United States is expected to grow at a CAGR of 7.9%. The USA market remains steady, driven by the growing demand for reliable and energy-efficient power generation solutions in industrial, commercial, and residential applications. The country’s increasing focus on reducing carbon emissions, along with regulatory incentives for clean energy technologies, is fueling market growth. The USA government’s focus on energy security and infrastructure modernization, along with the rise in renewable energy adoption, continues to accelerate the demand for commercial gas gensets. The growing need for backup power solutions in critical sectors, such as telecommunications and healthcare, further supports the market’s steady expansion.

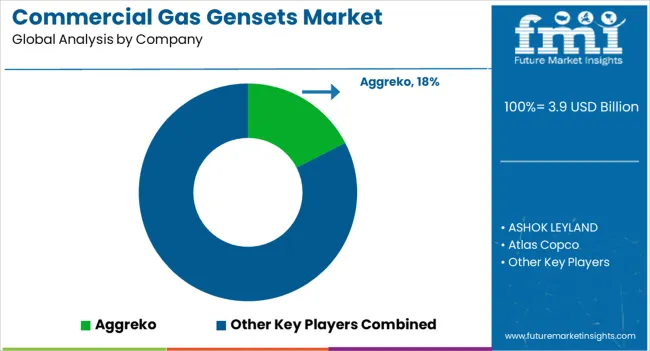

Aggreko’s dominance is supported by its global presence, strong rental business, and ability to deliver flexible, scalable solutions tailored to customer needs. Key players, such as Caterpillar, Cummins, Inc., and Kohler, maintain significant market shares by offering gas gensets that provide high efficiency, low emissions, and enhanced fuel economy, thereby meeting the growing demand for sustainable power generation. These companies focus on integrating cutting-edge technology, such as digital controls and IoT connectivity, to improve system performance and enable real-time monitoring.

Emerging players like Mahindra Powerol, Kirloskar, and Wartsila are expanding their market presence by providing specialized gas gensets for niche commercial applications, such as large-scale construction projects, telecom, and off-grid power generation. Their strategies include enhancing fuel efficiency, reducing maintenance costs, and offering customizable solutions for diverse operational needs.

Market growth is driven by increasing demand for reliable backup power solutions, the rising focus on reducing carbon emissions, and the growing adoption of natural gas as a cleaner energy alternative. Innovations in hybrid systems, fuel-efficient technologies, and energy storage integration are expected to continue shaping competitive dynamics and drive further growth in the global commercial gas gensets market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Power Rating | ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA |

| End Use | Telecom, Healthcare, Data Centers, Educational Institutions, Government Centers, Hospitality, Retail Sales, Real Estate, Commercial Complex, Infrastructure, and Others |

| Application | Standby, Peak Shaving, and Prime/Continuous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aggreko, ASHOK LEYLAND, Atlas Copco, Caterpillar, Cooper Corp., Cummins, Inc., Generac Power Systems, Inc., GENESAL ENERGY, Green Power International Pvt. Ltd, J C Bamford Excavators Ltd., Kirloskar, Kohler, MAHINDRA POWEROL, MITSUBISHI HEAVY INDUSTRIES, LTD., Powerica Limited, Rolls-Royce plc, Siemens AG, Sudhir, Supernova Genset, and Wartsila |

| Additional Attributes | Dollar sales by genset type and application, demand dynamics across commercial, industrial, and healthcare sectors, regional trends in commercial gas genset adoption, innovation in fuel efficiency and emissions reduction technologies, impact of regulatory standards on safety and performance, and emerging use cases in backup power systems and renewable energy integration. |

The global commercial gas gensets market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the commercial gas gensets market is projected to reach USD 9.6 billion by 2035.

The commercial gas gensets market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in commercial gas gensets market are ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 330 kva, > 330 kva - 750 kva and > 750 kva.

In terms of end use, telecom segment to command 21.7% share in the commercial gas gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA