The single phase gasoline gensets market is estimated to be valued at USD 5.9 billion in 2025 and is projected to reach USD 8.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. The market follows a clear maturity curve reflecting early adoption, scaling, and eventual consolidation. From 2020 to 2024, the market experienced early adoption, with increasing awareness of portable and backup power solutions driving moderate growth.

During this phase, the market value grew steadily from approximately USD 4.8 billion to USD 5.6 billion as consumers and small businesses gradually recognized the reliability and convenience of single phase gensets. From 2025 to 2030, the market enters the scaling phase, with the value rising from USD 5.9 billion to around USD 6.9 billion. This period is characterized by accelerated adoption, driven by technological improvements, enhanced fuel efficiency, and wider availability through retail and industrial channels. Manufacturers focus on expanding production capacity and distribution networks to meet rising demand. Marketing efforts emphasize reliability, ease of use, and cost-effectiveness, facilitating rapid penetration in both urban and rural markets.

From 2030 to 2035, the market shifts to consolidation, as growth moderates and competition centers on brand differentiation, service quality, and incremental innovation. By 2035, the market will reach USD 8.7 billion, with a CAGR of 4.1%. Leading players dominate the landscape, smaller manufacturers consolidate or exit, and incremental efficiency improvements, aftersales service, and regulatory compliance define competitive advantage.

Residential backup power represents the dominant application segment where single phase gasoline generators provide temporary electricity during utility outages affecting lighting, refrigeration, heating, and communication systems essential for household safety and comfort. Homeowners specify generator capacities that accommodate critical load requirements while balancing purchase costs against operational needs and storage considerations in residential settings.

Quality assurance protocols emphasize automatic voltage regulation, overload protection, and reliable starting systems that ensure dependable operation during emergency situations when generator reliability directly affects family safety and property protection.

Small commercial applications demonstrate increasing adoption of portable gasoline generators for construction sites, food service operations, and retail establishments requiring temporary or backup power solutions where permanent generator installations prove impractical or cost-prohibitive.

Contractors utilize gasoline gensets for power tools, lighting, and equipment operation at remote job sites lacking electrical infrastructure while maintaining mobility and setup flexibility throughout project phases. Service businesses deploy generators for outdoor events, emergency response, and mobile operations where reliable power generation enables business continuity and customer service delivery.

| Metric | Value |

|---|---|

| Single Phase Gasoline Gensets Market Estimated Value in (2025 E) | USD 5.9 billion |

| Single Phase Gasoline Gensets Market Forecast Value in (2035 F) | USD 8.7 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The single phase gasoline gensets market is gaining traction due to increasing reliance on backup power solutions in residential and small commercial applications. Rising instances of grid instability, frequent outages, and natural disasters are reinforcing the demand for compact and fuel-efficient generator systems.

Urbanization and infrastructure expansion in developing economies have further propelled genset installations to ensure an uninterrupted power supply. Advancements in engine efficiency, noise reduction technology, and portability features are enhancing consumer preference for gasoline-powered units.

Additionally, the market is supported by growing awareness of energy security and emergency preparedness among end users. The outlook remains optimistic as manufacturers continue to innovate on emission compliance, fuel economy, and ease of maintenance, all of which contribute to broader market penetration across residential and semi-urban regions.

The single phase gasoline gensets market is segmented by power rating, end use, and geographic regions. By power rating, the single phase gasoline gensets market is divided into 2 kW, 2 kW - 5 kW, 6 kW - 8 kW, and > 8 kW - 15 kW. In terms of end use, the single-phase gasoline gensets market is classified into Residential, Commercial, and Construction. Regionally, the single phase gasoline gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 2 kW power rating segment is projected to contribute 38.60 % of total market revenue by 2025, making it the leading segment in the power rating category. This dominance is attributed to the widespread demand for compact and portable generators capable of supporting essential household appliances and small tools.

These units offer an optimal balance between power output and fuel efficiency, which is ideal for residential and light commercial applications. Their affordability and ease of installation have further driven their popularity in urban and rural areas alike.

Additionally, this power range aligns with off-grid energy use cases, such as outdoor events, construction sites, and mobile service units, reinforcing its strong presence in the market.

The residential segment is expected to account for 44.20 % of the total market revenue by 2025, establishing it as the leading end-use category. This growth is being driven by increasing household dependency on uninterrupted power for critical devices such as refrigerators, lighting systems, and communication equipment.

Rising power outage frequencies due to weather events and infrastructure limitations have pushed homeowners to adopt backup power solutions. The compact size, user-friendly operation, and affordability of single-phase gasoline gensets make them an ideal choice for residential users.

Furthermore, increased consumer awareness about energy resilience and preparedness is accelerating the uptake of these systems, sustaining the dominance of the residential segment in the market.

The single phase gasoline gensets are widely used for backup power, construction sites, outdoor events, and small businesses where grid reliability is limited. Asia-Pacific leads with rising electrification needs, while North America and Europe maintain strong demand for emergency backup solutions. Market growth is fueled by innovation in fuel efficiency, noise reduction, compact design, and eco-friendly emissions. Manufacturers are emphasizing durable engines, inverter technology, and multi-fuel adaptability to meet diverse end-user requirements.

Single phase gasoline gensets inherently depend on gasoline as the primary fuel source, making operational costs highly susceptible to fluctuations in global fuel prices and supply constraints. Frequent usage in high-demand applications such as residential backup during grid failures, small-scale construction, or commercial operations can escalate fuel consumption, resulting in increased running expenses. Moreover, continuous operation contributes to engine wear, necessitating routine maintenance, oil changes, and part replacements, which add to the total cost of ownership. Noise and vibration control systems, though improving, may require additional investment for compliance with urban noise regulations. Environmental concerns surrounding emissions and carbon footprint are increasingly influencing consumer preferences, particularly in regions with strict ecological regulations. Until manufacturers introduce more fuel-efficient engines or hybrid and alternative fuel technologies, operational cost challenges and fuel dependency may restrict adoption in cost-sensitive or eco-conscious markets.

Innovation in genset technology is transforming the market by improving operational efficiency, reliability, and user convenience. Modern single phase gasoline gensets are increasingly equipped with inverter technology, allowing stable voltage output and protecting sensitive electronics. Engine modifications, including optimized combustion chambers and fuel injection systems, have enhanced fuel efficiency and reduced emissions. Noise-reduction techniques, such as advanced mufflers and vibration-dampening mounts, improve user comfort, particularly in residential areas. Integration of digital monitoring systems, automatic voltage regulation, and overload protection allows for real-time performance tracking, preventive maintenance, and fault diagnostics. Some manufacturers are exploring IoT-enabled connectivity to provide predictive maintenance alerts and remote control. Companies investing in lightweight, compact designs with higher power-to-weight ratios are gaining a competitive edge, addressing user demands for portability, efficiency, and eco-friendly operation. Continuous R&D ensures that high-performance, low-emission gensets become increasingly feasible for diverse applications.

Compliance with environmental, safety, and energy efficiency regulations is a critical factor influencing the single phase gasoline gensets market. Stringent emission norms in Europe, North America, and selected Asia-Pacific countries require gensets to maintain low levels of NOx, CO, and particulate matter. Regulatory authorities also impose noise limits for urban and residential installations, influencing genset design, muffling systems, and engine calibration. In addition to local regulations, manufacturers targeting international markets must adhere to certifications such as CE, EPA, and ISO standards. Non-compliance may result in restricted sales, fines, or reputational damage. Regulatory alignment also extends to safety measures, including automatic shut-off mechanisms, grounding requirements, and fuel handling protocols. Companies incorporating eco-friendly engines, low-noise technologies, and certified emission-control systems improve market acceptance and strengthen consumer trust, enabling entry into environmentally conscious regions where green energy initiatives are increasingly prioritized.

The single phase gasoline gensets market features intense competition between established global manufacturers and emerging regional players. Established companies differentiate through robust engine performance, advanced technology integration, long service life, and extensive after-sales support. Regional players often compete on cost efficiency and adaptability to local fuel and operational conditions. Supply chain stability is critical, as high-quality engine components, electrical parts, and spare parts availability directly impact production reliability and brand reputation.

Manufacturers with vertically integrated supply chains, strong dealer networks, and readily available maintenance services achieve greater market penetration. Competitive strategies increasingly focus on offering customizable solutions for different power capacities, noise and emission standards, and smart monitoring features. As market rivalry intensifies, product innovation, durability, service quality, and compliance with regional standards remain decisive factors for sustaining growth and capturing new customer segments globally.

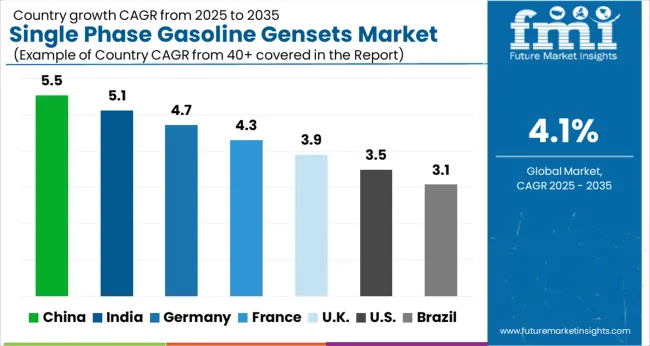

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

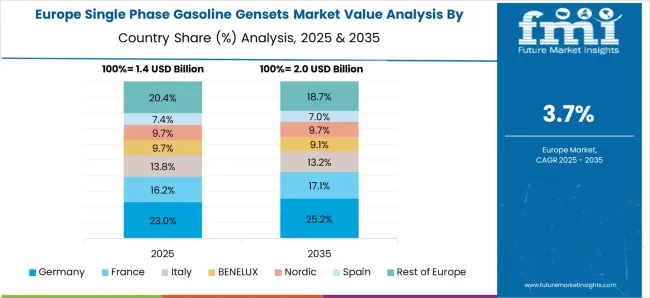

The global Single Phase Gasoline Gensets Market is projected to grow at a CAGR of 4.1% through 2035, supported by increasing demand across residential, commercial, and industrial backup power applications. Among BRICS nations, China has been recorded with 5.5% growth, driven by large-scale production and deployment in power backup and portable energy solutions, while India has been observed at 5.1%, supported by rising utilization in residential and commercial power supply. In the OECD region, Germany has been measured at 4.7%, where production and adoption for industrial, commercial, and residential sectors have been steadily maintained. The United Kingdom has been noted at 3.9%, reflecting consistent use in backup power applications, while the USA has been recorded at 3.5%, with production and utilization across residential, commercial, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The single phase gasoline gensets market in China is growing at a CAGR of 5.5%, fueled by rising energy demands in residential, commercial, and small industrial sectors. Frequent power outages in rural and semi-urban areas create steady demand for portable and reliable power backup solutions. Advanced gensets offer fuel efficiency, low noise, compact design, and ease of operation, making them suitable for homes, small businesses, and construction sites. Government initiatives promoting rural electrification and small-scale industries further support market expansion. The market is also benefiting from the growing preference for lightweight, portable, and environmentally friendly gensets. As China continues to urbanize and industrialize, the adoption of single phase gasoline gensets is expected to maintain a consistent growth trajectory.

Single phase gasoline gensets market in India is expanding at a CAGR of 5.1%, driven by increasing electricity requirements in rural, semi-urban, and urban areas. Power backup solutions are critical for households, small businesses, construction sites, and emergency applications. Advanced gensets with improved fuel efficiency, portability, and reduced emissions are gaining popularity. Government programs promoting rural electrification, small-scale industries, and reliable energy access accelerate market growth. Additionally, growing awareness of environmentally friendly and low-noise gensets enhances adoption. With the country’s focus on consistent electricity supply and industrial development, the single phase gasoline gensets market in India is poised for steady growth.

Single phase gasoline gensets market in Germany is growing at a CAGR of 4.7%, supported by small-scale industrial applications, emergency backup needs, and recreational usage. Gensets with high efficiency, low emissions, and compliance with strict European environmental standards are preferred. Germany’s emphasis on sustainability and clean energy solutions drives demand for technologically advanced and eco-friendly gensets. The market also benefits from the presence of robust distribution networks and growing adoption of portable energy solutions for residential and commercial use. Technological innovations and regulatory compliance ensure steady expansion of single phase gasoline gensets in Germany.

The single phase gasoline gensets market in the United Kingdom is expanding at a CAGR of 3.9%, driven by residential, commercial, and emergency power requirements. Portable gensets provide reliable backup during power outages and for off-grid applications. Advanced features such as fuel efficiency, low noise, and compact design enhance usability and appeal. Government regulations promoting safety, energy efficiency, and low emissions encourage adoption of compliant gensets. The market benefits from growing awareness of emergency preparedness and residential backup solutions. With increasing demand for reliable and portable energy solutions, the UK market for single phase gasoline gensets is expected to maintain stable growth.

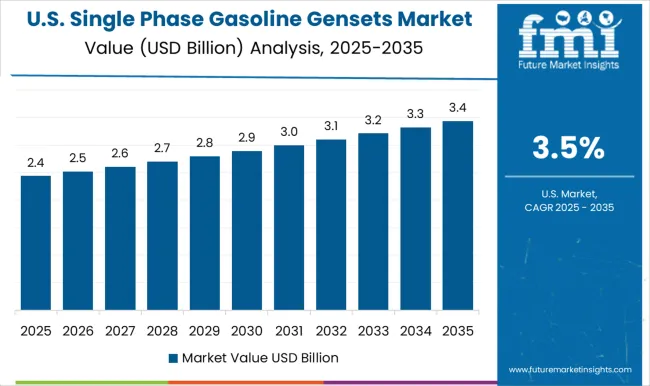

The USA single phase gasoline gensets market is growing at a CAGR of 3.5%, supported by demand for residential, commercial, and recreational power backup. Portable gensets with high fuel efficiency, low emissions, and user-friendly features are increasingly adopted. Growing awareness of emergency preparedness, natural disasters, and off-grid applications drives market expansion. Regulatory compliance related to safety, emissions, and efficiency further supports the adoption of advanced gensets. Technological innovations and durable designs ensure reliable operation, enhancing consumer confidence. The USA market continues to benefit from infrastructure development, increasing adoption in homes, small businesses, and outdoor activities, ensuring steady growth in single phase gasoline gensets.

The single-phase gasoline gensets market is led by global engine and power equipment manufacturers offering portable and standby power solutions for residential, commercial, and light industrial applications. Atlas Copco AB provides high-performance gasoline generators known for compact design, fuel efficiency, and reliability in construction and emergency power settings. Briggs & Stratton dominates the residential and small commercial segments with durable, easy-to-maintain gensets tailored for backup and outdoor use. Caterpillar Inc. and Cummins Inc. supply premium-grade gasoline gensets engineered for reliability, long service life, and integration with automatic transfer systems.

Champion Power Equipment, DuroMax Power Equipment, and FIRMAN Power Equipment hold strong positions in the North American portable generator market, offering value-driven models with enhanced mobility and load handling capacity. Generac Power Systems leads in residential standby gensets featuring smart control panels and remote monitoring, supported by extensive dealer networks.

Honda Motor Co., Ltd. and Yamaha Motor Co., Ltd. dominate the compact inverter generator segment with lightweight, low-noise gasoline gensets popular for recreational, home, and professional use. Kohler Co. and Honeywell International Inc. offer single-phase gensets suited for home backup and small commercial installations emphasizing quiet operation and reliability. Kirloskar Group serves emerging markets with cost-effective units engineered for consistent output in demanding environments. Deere & Company, JET POWER, WEN Products, and Westinghouse Electric Corporation contribute with portable and mid-range gasoline gensets featuring robust engines and user-friendly interfaces.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.9 Billion |

| Power Rating | 2 kW, 2 kW - 5 kW, 6 kW - 8 kW, and > 8 kW - 15 kW |

| End Use | Residential, Commercial, and Construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlas Copco AB; Briggs & Stratton; Caterpillar Inc.; Cummins Inc.; Champion Power Equipment; Deere & Company; DuroMax Power Equipment; FIRMAN Power Equipment; Generac Power Systems; Honda Motor Co., Ltd.; Honeywell International Inc.; JET POWER; Kirloskar Group; Kohler Co.; WEN Products; Westinghouse Electric Corporation; Yamaha Motor Co., Ltd. |

| Additional Attributes | Dollar sales vary by genset type, including portable, standby, and inverter-based single-phase gasoline gensets; by power capacity, spanning low (≤2 kW), medium (2–5 kW), and high (>5 kW) ranges; by application, such as residential, commercial, construction sites, and outdoor events; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by increasing demand for reliable backup power, rising construction and industrial activities, expansion in remote and off-grid areas, adoption of portable and energy-efficient solutions, and government incentives for power infrastructure. |

The global single phase gasoline gensets market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the single phase gasoline gensets market is projected to reach USD 8.7 billion by 2035.

The single phase gasoline gensets market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in single phase gasoline gensets market are 2 kw, 2 kw - 5 kw, 6 kw - 8 kw and > 8 kw - 15 kw.

In terms of end use, residential segment to command 44.2% share in the single phase gasoline gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA