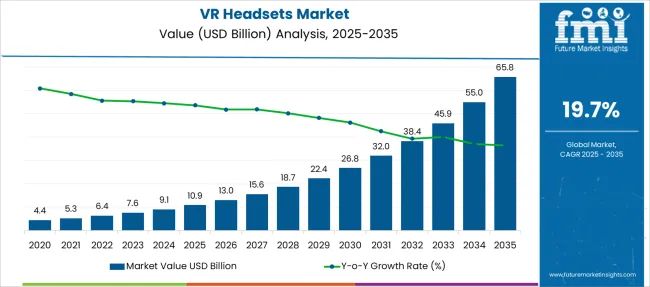

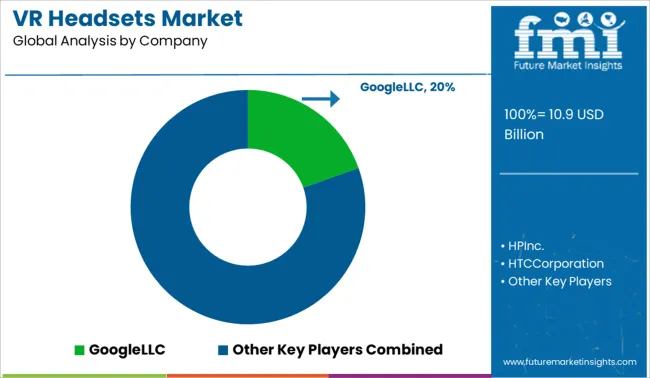

The VR Headsets Market is estimated to be valued at USD 10.9 billion in 2025 and is projected to reach USD 65.8 billion by 2035, registering a compound annual growth rate (CAGR) of 19.7% over the forecast period.

| Metric | Value |

|---|---|

| VR Headsets Market Estimated Value in (2025 E) | USD 10.9 billion |

| VR Headsets Market Forecast Value in (2035 F) | USD 65.8 billion |

| Forecast CAGR (2025 to 2035) | 19.7% |

The VR headsets market is undergoing rapid evolution as immersive technologies transition from niche applications into mainstream consumer and enterprise use cases. Demand is being driven by advancements in motion tracking, visual rendering, and ergonomic design, alongside the emergence of new content ecosystems in gaming, training, education, and healthcare. Hardware developers are investing heavily in sensor integration, wireless transmission stability, and processing power to deliver uninterrupted virtual experiences.

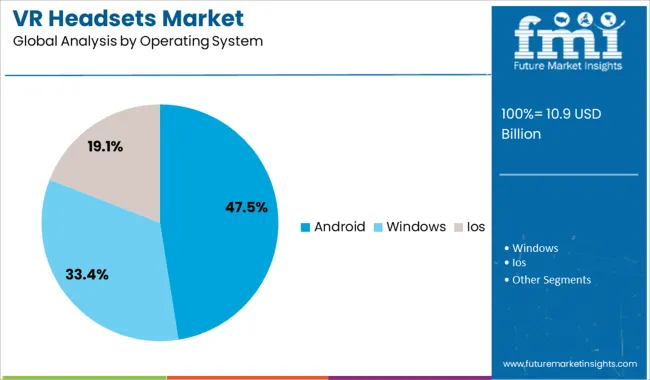

Platforms built on open operating systems like Android are empowering developers with scalable environments to deploy applications across industries. Consumer expectations for lightweight, high-resolution, and low-latency experiences are pushing innovation in optics, display technology, and on-device AI processing.

The future outlook points toward multi-device connectivity, 5G-enabled mobile VR, and hybrid hardware configurations that combine augmented and virtual reality. As market readiness improves across consumer and enterprise segments, VR headsets are expected to experience sustained growth supported by platform interoperability and ecosystem-driven product strategies.

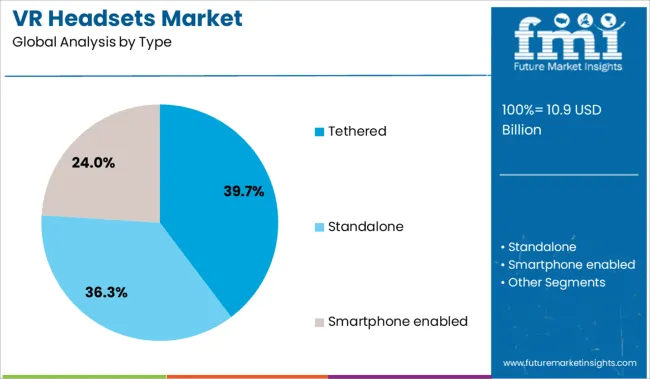

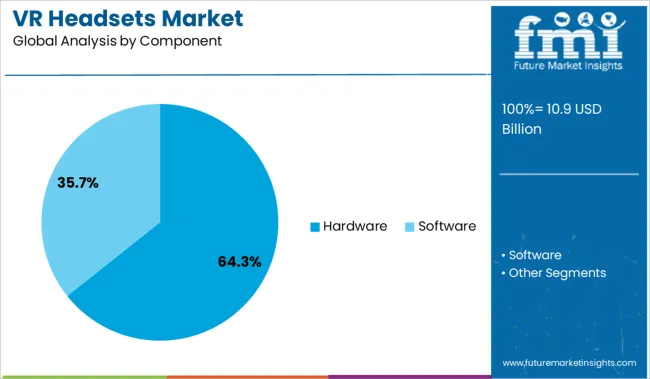

The market is segmented by Type, Component, Operating System, Connectivity Technology, Application, Distribution Channel, and region. By Type, the market is divided into Tethered, Standalone, and smartphone-enabled. In terms of components, the market is classified into Hardware and Software.

Based on the Operating System, the market is segmented into Android, Windows, and iOS. By Connectivity Technology, the market is divided into Wi-Fi, Bluetooth, HDMI, and Others (NFC, etc.). By Application, the market is segmented into Gaming & entertainment, Education, Healthcare, Retail & ecommerce, Military & defense, Engineering & design, and Others. By Distribution Channel, the market is segmented into Online, E-commerce, Company websites, Offline, Supermarkets & department stores, Specialty stores, Gaming stores, and Others (b2b channels, subscription services, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tethered segment is expected to account for 39.7% of the total revenue share by 2025 in the type category, establishing itself as the leading format. This dominance is being influenced by its ability to offer superior graphical fidelity, high frame rates, and minimal latency through direct connection to high-performance computing systems.

Tethered headsets have been favored for use in professional training, enterprise simulation, and high-end gaming due to their processing power advantage. Manufacturers continue to refine cable management and headset weight distribution to enhance comfort without compromising performance.

The availability of tethered headsets with advanced tracking systems and external sensors supports multi-user and room-scale applications. These features, combined with a growing ecosystem of compatible VR-ready PCs and consoles, are reinforcing tethered headsets as the preferred option where performance reliability is prioritized over full mobility.

The hardware component category is anticipated to lead the market with a 64.3% revenue share in 2025. This segment’s strength is being driven by continued demand for high-quality displays, lenses, tracking modules, and processing units integrated into VR headsets.

Consumer and enterprise users are prioritizing immersive display capabilities, spatial audio, and ergonomic fit, all of which require ongoing hardware refinement. Investments in compact form factors and standalone processing modules have intensified as manufacturers seek to balance comfort with computing power.

Additionally, the integration of biometric sensors, inside-out tracking, and eye-tracking features is expanding hardware’s role in enabling next-generation VR experiences. As headset refresh cycles accelerate and new formats such as mixed reality devices enter the market, the hardware segment is expected to retain its leadership due to its foundational role in user experience and device capability.

Within the operating system category, Android is projected to capture 47.5% of total revenue by 2025, making it the most widely adopted platform in the VR headsets market. The widespread use of Android stems from its open-source architecture, flexible integration with diverse hardware types, and established developer ecosystem.

Manufacturers are leveraging Android’s customizable interface and native compatibility with ARM-based chipsets to deliver efficient, lightweight VR headsets that offer wireless mobility without sacrificing interactivity. The platform's compatibility with app stores, mobile ecosystems, and content distribution networks supports rapid content deployment and cross-platform synergy.

Android’s ability to support standalone devices and deliver scalable software updates over the air is especially critical for users demanding consistent performance and access to evolving VR content. This adaptability has made Android the operating system of choice for many mainstream and emerging VR headset brands.

The VR headsets market is gaining traction as immersive content, ergonomic designs, and enterprise interest reshape the product landscape. Enhanced display resolution, mixed reality compatibility, and hands-free controls are now standard across many models. Headsets are no longer confined to gaming; their role in training, remote collaboration, and live media streaming has expanded the user base significantly. Leading brands are revisiting product ecosystems to suit both personal and professional needs.

VR headsets are seeing widespread adoption as immersive gaming experiences, enterprise training modules, and creative content platforms become more mainstream. Device manufacturers are refining comfort, spatial tracking, and visual fidelity, with new models being designed to support longer usage sessions. The market is shifting towards untethered headsets that offer greater freedom without external sensors. Lower-cost units are helping to drive volume in price-sensitive markets, while advanced variants cater to simulation-intensive sectors. Companies are also bundling VR headsets with proprietary platforms and exclusive content to build user stickiness. Across both commercial and consumer segments, rapid refresh cycles are keeping device capabilities aligned with user expectations.

The convergence of VR and AR features within a single headset is opening new growth avenues in healthcare, education, defense, and events. Mixed reality headsets now offer pass-through vision, hand-tracking, and spatial anchoring, making them adaptable to varied professional scenarios. Content creators are leveraging this flexibility to design simulations, real-time walkthroughs, and blended learning experiences. As interoperability improves, users expect seamless integration with mobile devices, collaborative platforms, and 3D visualization software. Brands that can deliver lightweight, wearable systems with minimal latency and intuitive UI are better positioned to appeal across sectors. The expanding scope of application is redefining the value proposition of VR headsets.

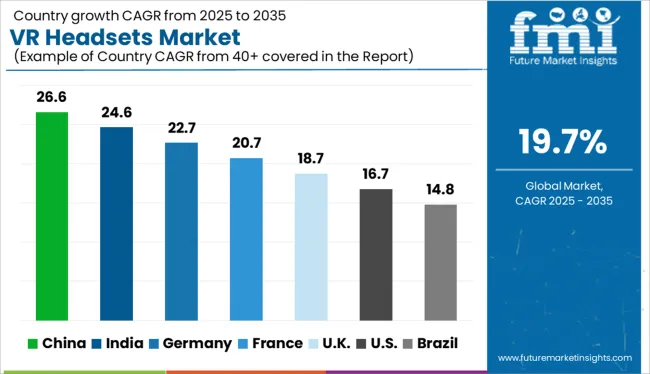

| Country | CAGR |

|---|---|

| India | 24.6% |

| Germany | 22.7% |

| France | 20.7% |

| UK | 18.7% |

| USA | 16.7% |

| Brazil | 14.8% |

The global VR headsets market is expanding at a CAGR of 19.7% between 2025 and 2035, with pronounced acceleration in key BRICS and OECD economies. China leads at 26.6%, outpacing the global average by nearly seven percentage points. Domestic hardware firms are scaling ODM production and consolidating optics supply chains, supported by government-backed digital infrastructure programs. India follows at 24.6%, where demand is rising across education, gaming, and enterprise simulation. Local startups are leveraging Make in India grants and fiber-based network upgrades to enable smoother deployment. Germany, at 22.7%, reflects strong B2B adoption in automotive design and vocational training. The country is integrating XR into industrial workflows and technical institutes. France posts 20.7%, driven by enterprise VR pilots in defense and architecture. The United Kingdom trails at 18.7%, just below the global benchmark, as hardware innovation is more dependent on imports and localization of use cases remains fragmented.These five countries represent strategic benchmarks from a wider 40+ country analysis.

The United Kingdom’s VR headset market is projected to rise at a CAGR of 18.7% between 2025 and 2035. Growth stems from increasing use in academic visualization, museum curation, and virtual event production. Retailers and automakers experiment with VR showrooms to enhance buyer experience. Film studios and sports broadcasters use VR to enable behind-the-scenes and immersive storytelling. The UK’s strong digital infrastructure and demand for hybrid content support multi-platform VR deployments, particularly in education, real estate, and remote collaboration spaces.

Demand for VR headsets in China dominates globally with a forecast CAGR of 26.6%. Rapid advancements in hardware capabilities, 5G infrastructure, and public-private innovation hubs have enabled mass-scale deployments. Key sectors include e-commerce, vocational training, and virtual social networking. Domestic brands are increasingly innovating with standalone headsets and spatial computing features, pushing prices down while improving functionality. China’s strategic focus on metaverse-linked industries has placed VR at the center of consumer-tech convergence.

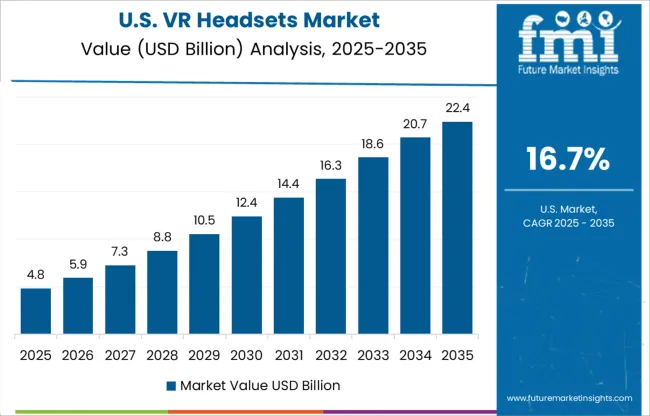

The US VR headsets market is set to grow at a CAGR of 17.2% from 2025 to 2035. Expansion is primarily shaped by demand in enterprise applications, immersive entertainment, and defense simulation training. Major tech firms are reinforcing investments in VR platforms for productivity, collaboration, and wellness. While consumer adoption is steady, commercial use cases are gaining stronger traction. Strategic partnerships between software developers and hardware manufacturers are helping unlock tailored solutions for niche sectors like real estate and healthcare.

Demand for VR headsets in Japan is expected to expand at a CAGR of 16.9% through 2035. While the market remains niche in consumer electronics, high-end gaming and specialized healthcare applications have gained traction. The cultural emphasis on precision and comfort has led to demand for ergonomically optimized devices. Anime studios and wellness startups are leveraging VR to enhance user immersion, with focus on eye-tracking and spatial realism. Japanese firms prioritize durable headgear design and localized content to suit aging demographics and niche hobbyist groups.

Sales for VR headsets in India are projected to register a CAGR of 24.6% through 2035. Affordable mobile VR solutions, increasing smartphone penetration, and regional content are stimulating demand. Edtech and entertainment remain core application areas, with gaming cafes and experience centers playing a key role in public exposure. Supportive government initiatives for digital learning and skilling further accelerate adoption in educational institutions. Manufacturers are targeting lightweight, low-cost devices suited for multilingual content formats to scale volume.

The VR headsets market remains competitive, with Meta Platforms Inc. leading through its Quest series, dominating the standalone segment. Sony Group Corporation holds a strong position with PS VR2, integrating deeply with console gaming. Valve Corporation continues catering to high-end PC VR users. HTC Corporation and Pico Interactive Inc. focus on both enterprise and consumer markets, especially in Asia and Europe. Microsoft Corporation targets industrial applications via HoloLens, while Magic Leap Inc. pivots to medical use cases. HP Inc. and Lenovo Group Limited support professional users. Samsung Electronics and Google LLC are investing in spatial computing platforms. Xiaomi Corporation and Shenzhen Baofeng Mojing serve China’s consumer base, whereas Pimax and Razer appeal to enthusiasts demanding advanced optics and immersion.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.9 Billion |

| Type | Tethered, Standalone, and Smartphone enabled |

| Component | Hardware and Software |

| Operating System | Android, Windows, and Ios |

| Connectivity Technology | Wi-Fi, Bluetooth, HDMI, and Others (NFC, etc.) |

| Application | Gaming & entertainment, Education, Healthcare, Retail & ecommerce, Military & defense, Engineering & design, and Others |

| Distribution Channel | Online, E-commerce, Company websites, Offline, Supermarkets & department stores, Specialty stores, Gaming stores, and Others (b2b channels, subscription services, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GoogleLLC, HPInc., HTCCorporation, LenovoGroupLimited, MagicLeapInc., MetaPlatformsInc., MicrosoftCorporation, PicoInteractiveInc., PimaxTechnology(Shanghai)Co.Ltd., RazerInc., SamsungElectronicsCo.Ltd., ShenzhenBaofengMojingTechnologyCo.Ltd., SonyGroupCorporation, ValveCorporation, and XiaomiCorporation |

| Additional Attributes | Dollar sales by tethered and standalone categories, share by consumer and enterprise applications, surge in mixed reality headset integration, adoption in training and simulation for aerospace and healthcare, advancements in OLED and pancake lens optics, demand acceleration from gaming, metaverse development, and 6DoF motion tracking innovations |

The global VR headsets market is estimated to be valued at USD 10.9 billion in 2025.

The market size for the VR headsets market is projected to reach USD 65.8 billion by 2035.

The VR headsets market is expected to grow at a 19.7% CAGR between 2025 and 2035.

The key product types in VR headsets market are tethered, standalone and smartphone enabled.

In terms of component, hardware segment to command 64.3% share in the VR headsets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

VRLA SLI Battery Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

VR Stroke Rehabilitation Market Insights – Growth & Trends 2023-2033

VR HMD Shipment Market

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

AR VR Software Market Trends - Growth & Forecast 2025 to 2035

AR and VR in Training Market Size and Share Forecast Outlook 2025 to 2035

Stationary VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

Tourists Virtual Reality Headsets Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA