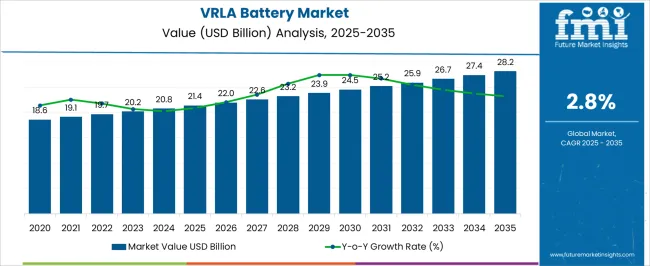

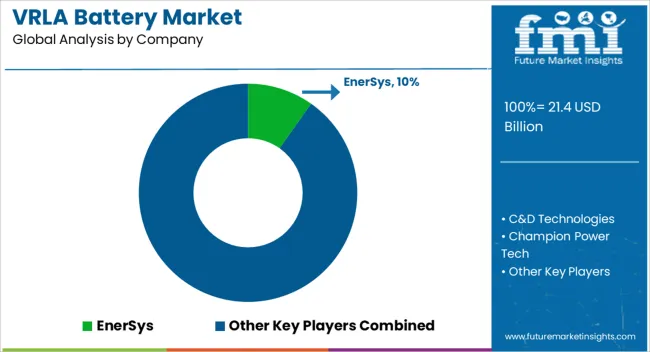

The VRLA Battery Market is estimated to be valued at USD 21.4 billion in 2025 and is projected to reach USD 28.2 billion by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period. This growth represents an absolute dollar opportunity of USD 6.8 billion over the decade. Starting at USD 18.6 billion in the early years, the market demonstrates steady expansion, reaching USD 24.5 billion by 2030. For companies in energy storage and backup power sectors, this growth indicates consistent revenue potential. Aligning production, distribution, and market strategies with this trend allows businesses to capture incremental value and strengthen their position in the gradually expanding VRLA battery market.

The absolute dollar opportunity from 2025 to 2035 emphasizes annual gains rising from USD 22.0 billion in 2026 to USD 27.4 billion in 2034, culminating at USD 28.2 billion in 2035. This predictable growth allows businesses to plan production, partnerships, and supply chain strategies effectively. Capturing market share during this period ensures meaningful revenue gains while maintaining low-risk exposure. Companies entering or scaling operations in line with these trends can maximize returns and secure a strong position in the evolving VRLA battery market.

| Metric | Value |

|---|---|

| VRLA Battery Market Estimated Value in (2025 E) | USD 21.4 billion |

| VRLA Battery Market Forecast Value in (2035 F) | USD 28.2 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

A breakpoint analysis of the VRLA battery market highlights periods of steady and moderately accelerated growth. From 2025 to 2028, the market grows from USD 21.4 billion to USD 22.6 billion, with annual increments of around USD 0.6 billion. This early-stage period represents a stable phase where companies can establish operations, optimize supply chains, and evaluate market demand. Recognizing this initial breakpoint allows businesses to allocate resources efficiently, test strategies, and build market presence. Early engagement during this period provides a foundation for capturing higher-value opportunities as the market continues to expand steadily in subsequent years. The next breakpoint occurs between 2030 and 2035, as the market expands from USD 24.5 billion to USD 28.2 billion, reflecting larger annual increments averaging USD 0.7–0.8 billion.

This stage represents accelerated growth and meaningful absolute dollar opportunity, making strategic positioning essential for maximizing market share. Companies entering or scaling operations during this phase can capture significant revenue gains while strengthening competitive positioning. Understanding these breakpoints helps stakeholders plan investments, production, and market expansion strategies to maximize returns in the evolving VRLA battery market.

The VRLA (valve regulated lead-acid) battery market is experiencing steady expansion, driven by the rising demand for reliable backup power solutions, advancements in battery technology, and the growing penetration of renewable energy systems. Industry updates and manufacturer announcements have underscored the importance of VRLA batteries in applications requiring consistent power supply, such as telecommunications, data centers, and critical infrastructure.

Enhanced safety features, maintenance-free operation, and longer service life have strengthened the adoption of VRLA batteries across both developed and emerging markets. Additionally, increased investment in grid modernization and the deployment of energy storage systems for renewable integration are supporting market growth.

OEM partnerships and the expansion of tailored battery solutions for specific industry needs have further enhanced product adoption. Over the forecast period, market momentum is expected to be led by the stationary application segment, the AGM technology segment, and OEM sales channels due to their operational efficiency, reliability, and strong industry integration.

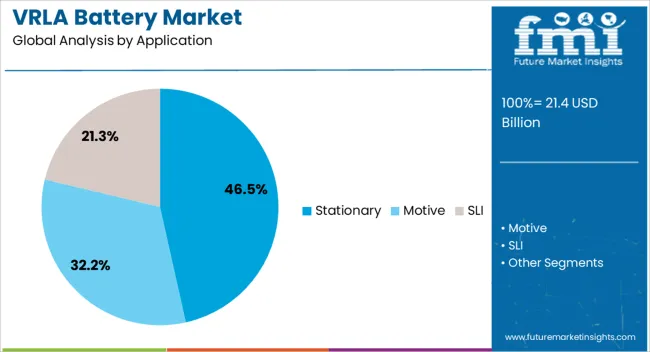

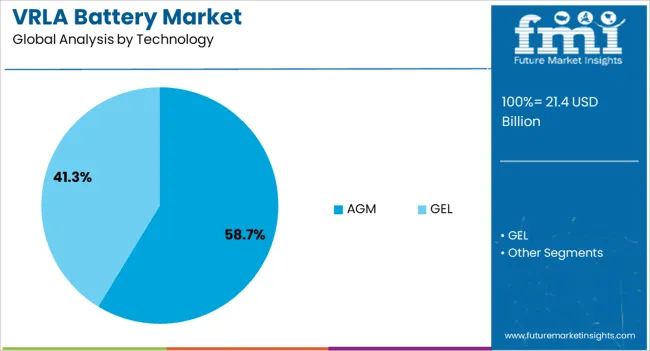

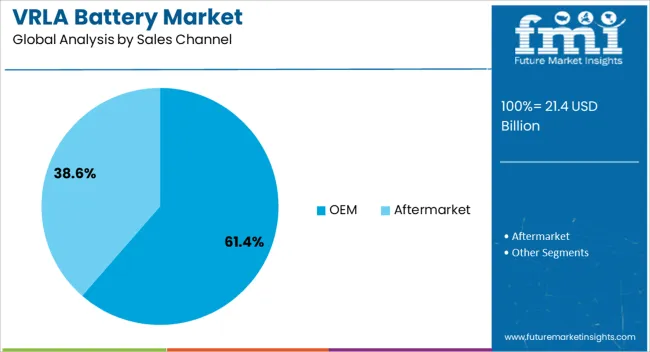

The vrla battery market is segmented by application, technology, sales channel, and geographic regions. By application, vrla battery market is divided into Stationary, Motive, and SLI. In terms of technology, vrla battery market is classified into AGM and GEL. Based on sales channel, vrla battery market is segmented into OEM and Aftermarket. Regionally, the vrla battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stationary segment is projected to account for 46.5% of the VRLA battery market revenue in 2025, maintaining its leading position due to widespread use in backup power systems and critical infrastructure support. The increasing need for uninterrupted power in sectors such as telecommunications, healthcare, and industrial operations has driven growth.

VRLA batteries in stationary applications offer advantages like deep discharge recovery, long service intervals, and stable performance in varying environmental conditions. Infrastructure modernization initiatives and the expansion of urban power grids have further fueled demand for stationary battery systems.

Additionally, rising energy storage requirements for renewable integration have reinforced the importance of stationary VRLA batteries in grid stability and load management. The combination of proven performance, minimal maintenance needs, and adaptability to diverse stationary settings ensures the segment’s continued dominance.

The AGM (absorbed glass mat) segment is projected to contribute 58.7% of the VRLA battery market revenue in 2025, holding its lead over other technologies due to superior performance characteristics and broad application versatility. AGM batteries are valued for their low internal resistance, spill-proof design, and high discharge capabilities, making them suitable for both standby and cyclic applications.

Industry adoption has been boosted by their use in environments requiring high reliability, including UPS systems, security installations, and marine applications. Manufacturing advancements have improved AGM battery energy density and lifespan, enhancing their cost-effectiveness over time.

Their maintenance-free nature and strong resistance to vibration and temperature fluctuations have positioned AGM technology as the preferred choice for industrial and commercial customers. The combination of operational efficiency, durability, and safety continues to underpin the segment’s market leadership.

The OEM segment is projected to hold 61.4% of the VRLA battery market revenue in 2025, dominating sales due to its integration into original equipment across multiple industries. This growth has been supported by strong collaborations between battery manufacturers and equipment producers, ensuring seamless compatibility and performance optimization.

OEM supply contracts often provide stable, long-term demand, particularly from sectors such as automotive, telecommunications, and industrial equipment manufacturing. The ability of OEM channels to deliver customized battery specifications for specialized applications has further strengthened their appeal.

Additionally, the inclusion of VRLA batteries as standard components in a wide range of products ensures consistent market flow without reliance solely on aftermarket sales. As industries continue to prioritize efficiency, reliability, and ready-to-install power solutions, OEM distribution is expected to remain the leading sales channel.

The VRLA battery market is expanding due to increasing energy storage, UPS systems, and renewable integration. Asia-Pacific dominates production and consumption, driven by industrial expansion, telecom growth, and solar energy adoption. Europe and North America focus on high-performance, long-life batteries for critical infrastructure and backup applications. Key manufacturers differentiate through cycle life, maintenance-free designs, and energy density improvements. Market growth is influenced by rising demand for uninterrupted power supply, telecommunication networks, and stationary energy storage solutions.

VRLA batteries vary in cycle life, charge retention, and maintenance requirements across suppliers. Europe and North America prefer long-life, high-reliability batteries for industrial, telecom, and data center applications. In contrast, Asia-Pacific markets often adopt cost-efficient batteries with moderate lifespan for telecom towers and solar projects. Differences in battery chemistry, lead purity, and plate design influence performance, durability, and replacement frequency. Premium suppliers providing extended-life, sealed designs capture high-value applications, while lower-cost regional producers serve bulk demand for general-purpose backup power. Variations in battery lifespan and reliability affect regional adoption patterns, procurement decisions, and competitive positioning among key manufacturers.

Production of VRLA batteries depends on lead, sulfuric acid, and advanced manufacturing processes. Asia-Pacific maintains high-volume production due to local lead smelting and large-scale plants. Europe and North America rely on established high-quality facilities with controlled output. Raw material availability, energy costs, and regulatory compliance impact manufacturing efficiency and supply reliability.

Large manufacturers with integrated supply chains ensure stable year-round availability, whereas smaller regional producers may face delays during peak demand. These contrasts influence pricing, contract terms, and market penetration. Companies capable of consistent, scalable supply gain competitive advantages, while suppliers with limited production capacity may struggle to meet industrial or renewable energy project requirements.

VRLA battery consumption varies across applications and regions. Europe and North America focus on critical infrastructure, UPS systems, and data centers requiring high-performance batteries with consistent output. Asia-Pacific growth is driven by telecom networks, solar energy storage, and industrial backup applications prioritizing cost-efficiency. Differences in sectoral demand influence battery specifications, supplier selection, and production planning. Global manufacturers supply tailored batteries for specific applications, while regional producers primarily offer standard designs for bulk usage. Understanding these contrasts enables suppliers to target high-value sectors, optimize inventory, and differentiate products for performance-sensitive versus cost-sensitive markets.

VRLA battery production and disposal are regulated differently across regions. Europe and North America enforce strict recycling, environmental, and safety standards for lead-acid batteries, affecting manufacturing, labeling, and end-of-life management. Asia-Pacific regulations are evolving, allowing more flexibility in cost-sensitive markets. Differences in compliance influence supplier positioning, adoption in industrial projects, and access to specialty applications. Manufacturers adhering to high environmental standards gain credibility and can command premium pricing. Regional regulatory variations affect global market competitiveness, entry strategies, and long-term growth. Suppliers that balance regulatory compliance with cost-efficient production maintain advantages over competitors with limited adherence to international environmental and safety requirements.

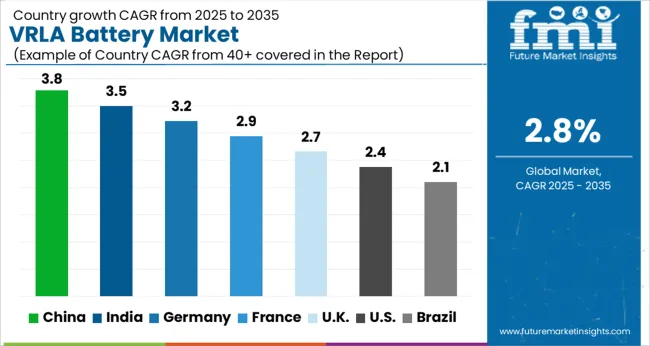

| Country | CAGR |

|---|---|

| China | 3.8% |

| India | 3.5% |

| Germany | 3.2% |

| France | 2.9% |

| UK | 2.7% |

| USA | 2.4% |

| Brazil | 2.1% |

The global VRLA (Valve Regulated Lead Acid) battery market was projected to grow at a 2.8% CAGR through 2035, driven by demand in UPS systems, renewable energy storage, and industrial applications. Among BRICS nations, China recorded 3.8% growth as large-scale production facilities were commissioned and compliance with battery quality and safety standards was enforced, while India, at 3.5% growth, saw expansion of manufacturing units to meet rising regional demand.

In the OECD region, Germany, at 3.2% maintained substantial output under strict electrical and industrial regulations, while the United Kingdom, at 2.7% relied on moderate-scale operations for backup power and energy storage applications. The USA, expanding at 2.4%, remained a mature market with steady demand in commercial and industrial sectors, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The VRLA battery market in China is growing at a CAGR of 3.8%. Between 2020 and 2024, growth was driven by increasing demand from renewable energy storage, telecom infrastructure, and uninterruptible power supply systems. Domestic manufacturers focused on high-capacity and long-life batteries to meet industrial requirements. Expansion of data centers, power utilities, and renewable energy projects supported adoption. In the forecast period 2025 to 2035, growth is expected to accelerate with wider adoption of energy storage systems, electric mobility support, and grid stabilization solutions. Technological innovation, government incentives, and rising industrial and residential energy storage requirements will further boost market expansion. China remains a leading market due to industrial scale, manufacturing capabilities, and growing renewable energy deployment.

The VRLA battery market in India is growing at a CAGR of 3.5%. The historical period from 2020 to 2024 saw growth supported by increasing adoption in telecom, renewable energy storage, and UPS applications. Manufacturers focused on improving battery life, reliability, and cost efficiency. Expansion of industrial and commercial power backup systems supported steady demand. In the forecast period 2025 to 2035, growth is expected to continue with the adoption of high-capacity VRLA batteries for renewable integration, energy storage, and electric mobility infrastructure. Government initiatives for energy storage and industrial modernization will further drive market expansion. India is projected to maintain strong growth due to growing energy infrastructure and industrial demand.

The VRLA battery market in Germany is growing at a CAGR of 3.2%. Between 2020 and 2024, growth was supported by demand in renewable energy storage, industrial UPS, and emergency power applications. Manufacturers focused on high-performance, long-life, and environmentally compliant batteries. In the forecast period 2025 to 2035, growth is expected to continue steadily with the adoption of advanced energy storage solutions, integration with solar and wind power, and grid stabilization. Regulatory compliance, sustainability initiatives, and technological innovation will further support adoption. Germany remains a key European market due to strong renewable energy deployment and industrial demand.

The VRLA battery market in the United Kingdom is growing at a CAGR of 2.7%. From 2020 to 2024, adoption was driven by industrial power backup, renewable energy storage, and UPS systems. Manufacturers focused on high-reliability and long-life battery solutions. In the forecast period 2025 to 2035, growth is expected to continue moderately with adoption in energy storage systems, electric mobility, and smart grid applications. Regulatory compliance and industrial modernization will further support market expansion. The United Kingdom market reflects stable growth with emphasis on battery reliability, efficiency, and environmental compliance.

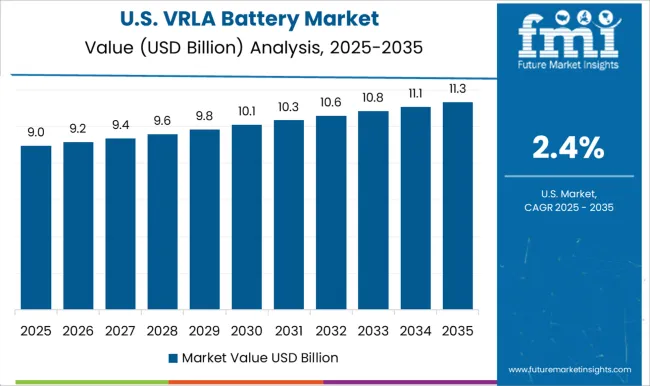

The VRLA battery market in the United States is growing at a CAGR of 2.4%. The historical period 2020 to 2024 saw growth driven by demand for renewable energy storage, telecom UPS systems, and industrial power backup. Manufacturers focused on improving battery efficiency, life span, and cost effectiveness. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption in grid stabilization, renewable integration, and electric mobility support. Government initiatives and technological innovation will further drive market expansion. The United States market demonstrates steady adoption with emphasis on reliability, efficiency, and integration with renewable energy solutions.

The VRLA battery market is supplied by EnerSys, C&D Technologies, Champion Power Tech, Clarios, Dekson Batteries, EverExceed Industrial, Exide Industries, GS Yuasa International, Hoppecke Battery, JYC Battery Manufacturer, Leoch International Technology, Microtex Energy, Mustpower, Mutlu, NorthBatt, Okaya Power, Ritar International Group, Shandong Sacred Sun Power Sources, Zibo Torch Energy, and Z-Power Impex, with competition shaped by capacity, cycle life, and maintenance-free performance.

EnerSys and Clarios brochures highlight sealed lead-acid batteries with high energy density, low self-discharge rates, and reliable deep-cycle performance, specifying nominal voltage, ampere-hour rating, and internal resistance. GS Yuasa and Hoppecke datasheets detail grid and tubular plate designs, charging efficiency, and temperature tolerance. Exide Industries and Leoch provide technical specifications including float voltage, discharge characteristics, and electrolyte immobilization. Observed industry patterns indicate rising demand for VRLA batteries in renewable energy storage, telecom backup, and industrial UPS systems.

Market strategies focus on differentiation through product longevity, reliability, and application support. EnerSys and Clarios invest in advanced AGM and GEL VRLA technologies for critical backup power systems. C&D Technologies and Champion Power Tech target telecom and data center applications with optimized cycle life and low maintenance requirements. Hoppecke, Mutlu, and Mustpower offer modular designs for scalable energy storage installations.

Observed trends show suppliers emphasizing global distribution networks and regional assembly facilities to meet rapid deployment needs. Exide Industries and Leoch focus on emerging markets with cost-effective solutions, while EverExceed Industrial and Okaya Power highlight compliance with international safety standards and certification requirements. Zibo Torch Energy and Shandong Sacred Sun provide customized solutions for renewable integration and off-grid power systems. Product brochures and technical datasheets communicate critical specifications, including nominal voltage, ampere-hour capacity, float and cycle life, internal resistance, operating temperature range, and safety certifications.

Clarios and EnerSys provide discharge curves, charge profiles, and performance under high-temperature conditions. GS Yuasa and Hoppecke include datasheets on electrolyte type, valve regulation, and vibration resistance. Exide Industries and Leoch highlight installation guidelines, maintenance recommendations, and end-of-life handling instructions. Clear technical documentation allows system integrators, telecom operators, industrial engineers, and energy storage designers to evaluate suitability, ensuring adoption based on verified performance, longevity, and compatibility with backup, renewable, and industrial power applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.4 Billion |

| Application | Stationary, Motive, and SLI |

| Technology | AGM and GEL |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | EnerSys, C&D Technologies, Champion Power Tech, Clarios, Dekson Batteries, EverExceed Industrial, Exide Industries, GS Yuasa International, Hoppecke Battery, JYC Battery Manufacturer, Leoch International Technology, Microtex Energy, Mustpower, Mutlu, NorthBatt, Okaya Power, Ritar International Group, Shandong Sacred Sun Power Sources, Zibo Torch Energy, and Z-Power Impex |

| Additional Attributes | Dollar sales vary by battery type, including AGM (Absorbent Glass Mat) and Gel batteries; by application, such as telecom, UPS systems, renewable energy storage, and automotive; by end-use industry, spanning energy, telecommunications, transportation, and industrial sectors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising energy storage demand, renewable integration, and backup power requirements. |

The global VRLA battery market is estimated to be valued at USD 21.4 billion in 2025.

The market size for the VRLA battery market is projected to reach USD 28.2 billion by 2035.

The VRLA battery market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in VRLA battery market are stationary, _telecommunications, _ups, _control & switchgear, _others, motive, sli, _automobiles and _motorcycles.

In terms of technology, agm segment to command 58.7% share in the VRLA battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

VRLA SLI Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA