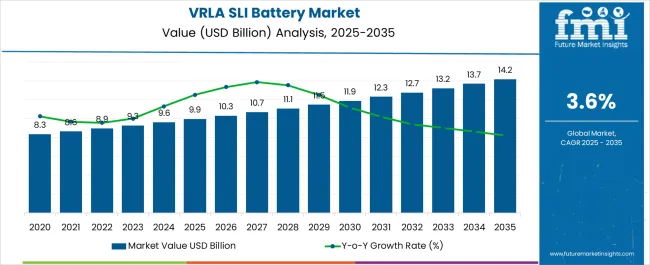

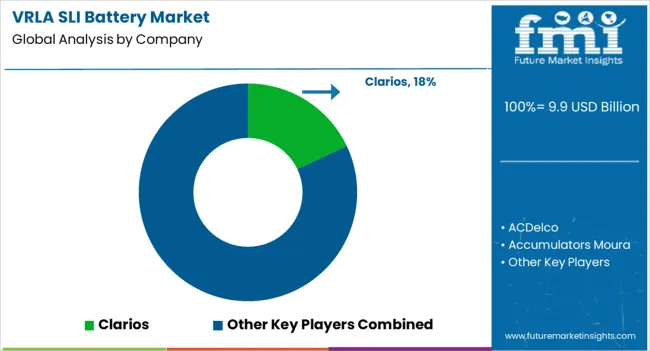

The VRLA SLI Battery Market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 14.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

A saturation point analysis, which examines the stage at which market growth slows due to maturity, indicates that this segment is approaching a late-growth to early-maturity phase. In the initial years (2025–2028), annual increments average USD 0.4 billion, with YoY growth holding close to 3.9%. This reflects stable replacement demand in the automotive sector, particularly for vehicles still reliant on lead-acid starter batteries. However, the relatively low growth rate suggests that adoption ceilings are already visible in mature markets. From 2029–2032, incremental gains remain consistent at USD 0.4–0.5 billion annually, while YoY growth dips slightly toward 3.6%, reinforcing the notion of market stabilization. The limited acceleration is due to competition from lithium-ion alternatives, especially in premium and electric vehicle applications. By 2033–2035, annual increments flatten to around USD 0.5 billion, with growth slowing toward 3.4%, signaling proximity to saturation. The market’s future will rely heavily on aftermarket demand, emerging market vehicle sales, and technological enhancements in VRLA designs. Without significant innovation, the segment risks plateauing post-2035, marking a clear maturity inflection point.

| Metric | Value |

|---|---|

| VRLA SLI Battery Market Estimated Value in (2025 E) | USD 9.9 billion |

| VRLA SLI Battery Market Forecast Value in (2035 F) | USD 14.2 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The VRLA SLI battery market is viewed as a core segment within its broader parent industries. It is assessed at about 2.7% of the global energy storage solutions market, indicating its role in backup power systems. Within the automotive battery systems sector, a share of approximately 4.1% is estimated, driven by starter battery demand in conventional vehicles. In the uninterruptible power supply and telecom backup power market around 3.3% is calculated supported by use in data centers and communication infrastructure. Within the renewable energy integration and microgrid battery segment about 2.0% is evaluated as vrla batteries continue support for off‑grid and hybrid installations. In the industrial standby power systems market a contribution of roughly 3.9% is observed indicating reliance by critical infrastructure and industrial facilities. Trends in this market have been shaped by continued deployment of vrla sli batteries for backup and emergency power applications. Innovations have been focused on advanced valve regulated lead acid designs offering enhanced cycle life, leak‑proof construction and low maintenance requirements. Interest has increased in high‑performance sla variants with absorbent glass mat separators and improved thermal tolerance for high temperature environments. The Asia Pacific region has been observed to exhibit the fastest growth while North America has maintained strong uptake in commercial and telecom usage zones. Strategic initiatives have included collaborations between battery manufacturers and infrastructure operators to deliver modular vrla systems that integrate with monitoring platforms predictive maintenance services and scalable capacity configurations.

The VRLA SLI (Valve-Regulated Lead-Acid Starting, Lighting, and Ignition) battery market is undergoing steady growth driven by the rising demand for maintenance-free batteries, increased vehicle electrification, and the growing presence of stop-start engine systems. These batteries offer spill-proof construction, long service life, and high cranking power, which makes them ideal for modern automotive needs.

Regulatory pressure to reduce carbon emissions has led to the proliferation of start-stop systems, where VRLA batteries, especially AGM variants,are the preferred solution due to their rapid recharge capability and enhanced cycling performance. Furthermore, automotive OEMs are increasingly integrating VRLA SLI batteries into conventional and hybrid vehicles to optimize performance and reduce overall vehicle weight.

The market is also witnessing growth from developing economies, where the replacement and aftermarket demand for reliable, cost-effective SLI solutions continues to rise.

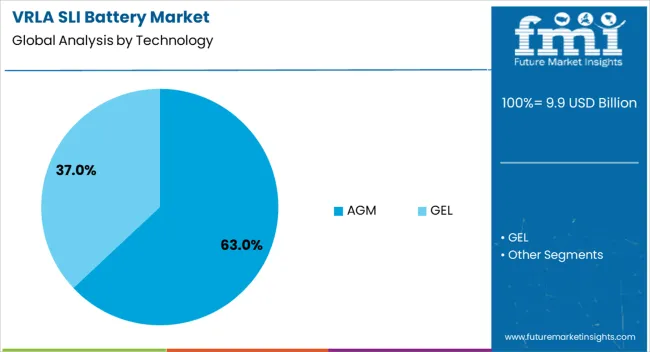

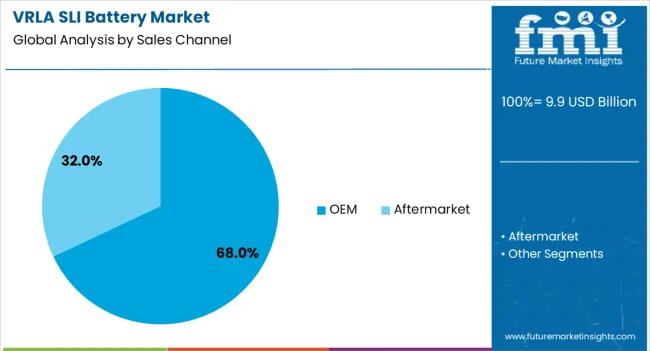

The VRLA SLI battery market is segmented by technology and sales channel, and geographic regions. The technology of the VRLA SLI battery market is divided into AGM and GEL. In terms of the sales channel, the VRLA SLI battery market is classified into OEM and Aftermarket. Regionally, the VRLA Sli battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

By technology, Absorbent Glass Mat (AGM) batteries are projected to dominate with a 63.00% share of the VRLA SLI battery market in 2025. AGM’s dominance is driven by its superior deep-cycle performance, vibration resistance, and suitability for start-stop systems used in modern vehicles.

Unlike conventional flooded batteries, AGM batteries use a fiberglass mat to absorb the electrolyte, resulting in zero maintenance, improved safety, and better performance in high-load electrical environments. Their sealed construction also makes them ideal for installation in tight automotive compartments and ensures compliance with stringent vehicle safety standards.

With automakers aiming for more energy-efficient systems, AGM technology continues to be a strategic choice for both OEM installations and aftermarket replacements.

OEM (Original Equipment Manufacturer) sales are expected to account for 68.00% of the VRLA SLI battery market share by 2025, making it the leading distribution channel. This dominance stems from the strong alignment between OEMs and battery manufacturers to meet evolving vehicle design requirements and electrical load demands.

OEM-installed VRLA batteries offer higher reliability and warranty support, making them the first choice for automakers during assembly. As vehicle production volumes increase, especially in Asia-Pacific and Europe, OEM contracts are expanding for advanced VRLA battery technologies that meet durability, charge retention, and environmental compliance benchmarks.

Additionally, OEMs are investing in VRLA solutions for electric two-wheelers and micro-hybrid vehicles, further expanding the scope of this segment.

VRLA (valve regulated lead acid) SLI (starting, lighting, ignition) batteries have been widely adopted in automotive, marine, and power sports applications due to their maintenance-free operation, spill-proof design, and reliable starting performance. Demand has been influenced by the growth of vehicle production, aftermarket replacement needs, and preference for sealed battery systems in safety-critical environments. Manufacturers have been developing enhanced grid alloys, improved separators, and high-vibration-resistant designs to extend service life. The market has also seen rising demand from fleets and commercial vehicles requiring dependable cold-cranking performance.

Automotive aftermarket demand has been a key driver for VRLA SLI battery sales, with replacement cycles typically ranging from three to five years depending on usage and climate conditions. Passenger cars, motorcycles, and commercial vehicles have relied on VRLA SLI batteries for consistent ignition and electrical system support. Maintenance-free operation has been particularly valued in urban and fleet applications where downtime reduction is critical. In colder regions, VRLA batteries with high cold-cranking amps have been selected to ensure reliable winter starts. Distributors in North America, Europe, and Asia have reported steady sales through both authorized service centers and independent retail outlets. The combination of long shelf life, rapid recharge capability, and sealed construction has contributed to strong aftermarket performance, sustaining demand even during fluctuations in new vehicle sales.

Beyond automotive use, VRLA SLI batteries have been widely applied in boats, jet skis, snowmobiles, and all-terrain vehicles due to their resistance to vibration and ability to operate in varied orientations. Marine users have valued VRLA SLI designs for their sealed construction, which prevents electrolyte leakage and minimizes corrosion risks in harsh environments. Compact form factors and robust casing have made them suitable for limited-space installations in power sports vehicles. Rental operators and recreational users in coastal and mountainous regions have preferred VRLA SLI batteries for their ability to deliver consistent power even after extended periods of storage. Seasonal recreational equipment markets in Europe, North America, and Australia have contributed to steady demand, with many buyers seeking products that balance performance with low maintenance requirements.

Advances in VRLA SLI battery technology have focused on increasing service life, improving charge acceptance, and reducing self-discharge rates. Enhanced lead-calcium grid alloys, glass mat separators, and precision valve designs have been implemented to maintain stable performance over repeated cycles. Fast recharge capability has been an important feature for vehicles with high accessory loads or frequent stop-start operation. Manufacturers in Japan, Germany, and the United States have invested in automated manufacturing processes to ensure consistent plate quality and internal compression. Some VRLA SLI models have incorporated advanced venting systems to manage gas pressure effectively, reducing risk of premature failure. These technological refinements have reinforced the reputation of VRLA SLI batteries as a dependable choice for ignition and electrical systems in multiple transportation and recreational applications.

Despite reliability advantages, the VRLA SLI battery market has faced pressure from price-sensitive buyers and competition from alternative chemistries such as lithium-ion. In budget-focused automotive segments, conventional flooded lead acid batteries have remained a lower-cost option, limiting VRLA adoption in certain markets. Higher initial purchase prices compared to standard designs have been a barrier for some fleet operators and recreational equipment owners. Additionally, lithium-ion batteries have been gaining attention for their lighter weight and longer cycle life in specific high-performance applications. Disposal and recycling requirements for lead-based products have also added regulatory compliance costs. Unless production costs decline and product differentiation remains clear, VRLA SLI battery growth may be concentrated in segments where durability, maintenance-free operation, and sealed construction are prioritized over lowest upfront cost.

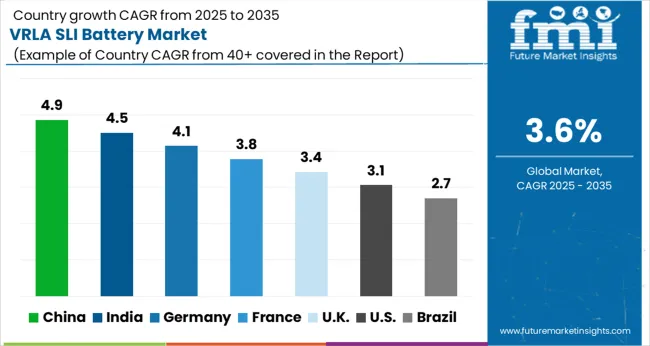

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

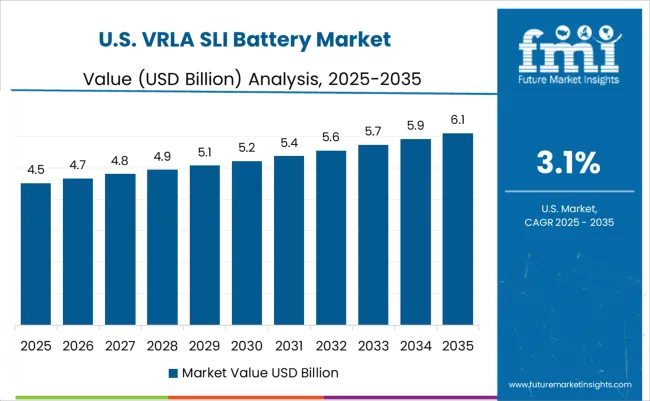

| USA | 3.1% |

| Brazil | 2.7% |

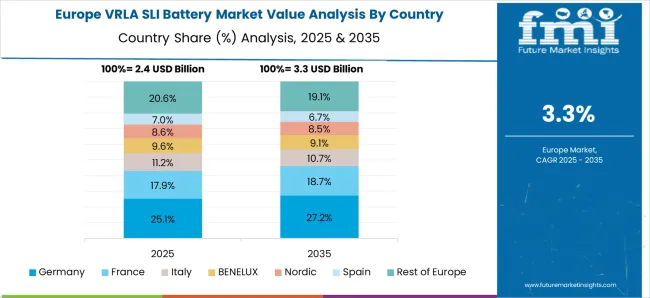

The VRLA SLI battery market is expected to grow at a global CAGR of 3.6% between 2025 and 2035, driven by demand in automotive starting applications, backup power systems, and industrial equipment. China leads with a 4.9% CAGR, supported by large-scale battery manufacturing capacity and growing automotive production. India follows at 4.5%, fueled by increasing vehicle sales and adoption in power backup solutions. Germany, at 4.1%, benefits from advanced battery technologies and integration in premium automotive brands. The UK, projected at 3.4%, sees steady demand from aftermarket automotive and marine applications. The USA, at 3.1%, reflects stable but mature adoption in automotive and standby power markets. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 4.9% from 2025 to 2035 in the VRLA SLI battery market, supported by its strong automotive manufacturing base and rapid adoption of advanced lead-acid battery technologies. Key players such as Chaowei Power Holdings, Leoch International, and Shoto Group are focusing on enhancing battery durability and cold-cranking performance. Growth in commercial vehicle production and the replacement battery segment is also fueling demand. Strategic collaborations with vehicle OEMs are ensuring customized battery specifications for various automotive categories.

India is expected to post a CAGR of 4.5% from 2025 to 2035, driven by rising vehicle parc and strong aftermarket demand. Leading manufacturers like Exide Industries, Amara Raja Batteries, and Okaya Power are developing VRLA SLI batteries with improved charge retention and maintenance-free designs. Growth in two-wheeler and passenger car ownership is accelerating sales, especially in the replacement segment. Distribution network expansion into Tier-2 and Tier-3 cities is widening product accessibility for rural and semi-urban consumers.

Germany is forecasted to grow at a CAGR of 4.1% from 2025 to 2035, driven by demand for high-performance batteries in luxury and premium vehicles. Manufacturers such as Clarios and Exide Technologies Germany are integrating advanced grid alloy technology to improve battery lifespan and corrosion resistance. The shift toward start-stop vehicle systems is increasing demand for VRLA SLI batteries with higher cycle life. Compliance with strict EU automotive regulations is pushing suppliers to enhance recyclability and environmental performance.

The United Kingdom is projected to record a CAGR of 3.4% from 2025 to 2035, supported by steady aftermarket demand and growing adoption in marine and recreational vehicles. Suppliers such as Yuasa Battery UK and Varta Batteries are expanding their maintenance-free VRLA SLI ranges for a broader vehicle mix. Seasonal peaks in demand are common due to battery failures during winter months. Increasing consumer preference for batteries with extended warranties is influencing product design and sales strategies.

The United States is expected to grow at a CAGR of 3.1% from 2025 to 2035, driven by demand in automotive replacement markets and steady growth in light commercial vehicle production. Major players such as East Penn Manufacturing, Johnson Controls (Clarios), and Interstate Batteries are focusing on enhanced vibration resistance and faster recharge capabilities. Demand is also being supported by the popularity of SUVs and pickup trucks that require higher capacity batteries. Expansion of e-commerce distribution channels is improving consumer access to a wider range of VRLA SLI battery models.

The VRLA (Valve Regulated Lead Acid) SLI (Starting, Lighting, and Ignition) battery market is led by major global and regional battery producers supplying the automotive, motorcycle, marine, and industrial sectors. Clarios and Exide Technologies dominate with extensive manufacturing capacity and well-established OEM partnerships with leading vehicle manufacturers. East Penn Manufacturing and Enersys leverage advanced lead-acid technology and robust distribution networks to serve both OEM and aftermarket channels. GS Yuasa International and Amara Raja Group provide high-performance VRLA SLI batteries for passenger cars, commercial vehicles, and two-wheelers, supported by strong regional market penetration in Asia-Pacific. FIAMM Energy Technology and Leoch International Technology focus on durable, maintenance-free designs optimized for varying climate conditions.

Hankook & Company and Banner Batteries emphasize consistent cold-cranking performance and reliability for European and North American markets. Accumulators Moura and MOLL Batterien cater to regional automotive OEMs with tailored battery specifications, while Crown Battery and Continental Battery Systems maintain a strong presence in aftermarket supply chains. ACDelco, backed by General Motors, ensures brand synergy and availability through authorized service centers, while Interstate Batteries operates one of the largest retail and service networks in North America. Competitive strategies include expanding OEM relationships, improving battery longevity through enhanced plate design, and adopting advanced grid alloys for better corrosion resistance. Entry into this market is limited by high manufacturing setup costs, stringent automotive performance standards, established brand loyalty, and extensive distribution requirements to ensure service and availability.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.9 Billion |

| Technology | AGM and GEL |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clarios, ACDelco, Accumulators Moura, Amara Raja Group, Banner Batteries, Continental Battery Systems, Crown Battery, East Penn Manufacturing, Enersys, Exide Technologies, FIAMM Energy Technology, GS Yuasa International, Hankook & Company, Interstate Batteries, Leoch International Technology, and MOLL Batterien |

The global vrla sli battery market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the vrla sli battery market is projected to reach USD 14.2 billion by 2035.

The vrla sli battery market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in vrla sli battery market are agm and gel.

In terms of sales channel, oem segment to command 68.0% share in the vrla sli battery market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA