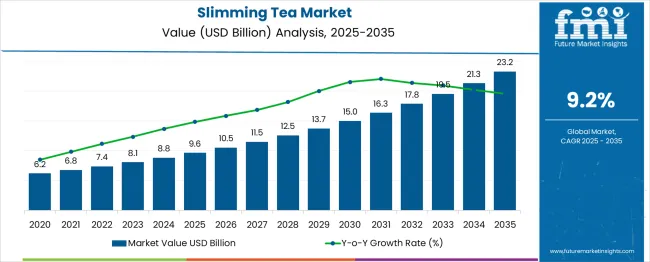

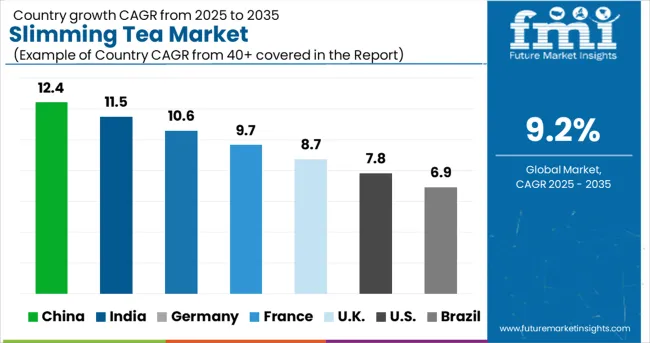

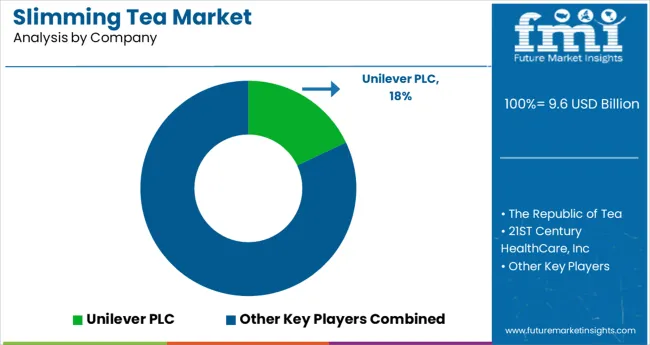

The Slimming Tea Market is estimated to be valued at USD 9.6 billion in 2025 and is projected to reach USD 23.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

The slimming tea market is witnessing consistent growth, fueled by increased consumer focus on wellness, weight management, and natural detoxification. The demand is being reinforced by a global rise in health-conscious behavior, particularly in urban populations seeking convenient and non-invasive solutions for metabolism enhancement.

Functional beverages such as slimming teas are being favored for their botanical compositions and perceived holistic benefits. Additionally, clean-label trends, organic product preferences, and the expansion of e-commerce wellness platforms are improving product accessibility and brand visibility.

Regulatory support for herbal and ayurvedic formulations and growing media influence on diet and lifestyle habits are accelerating product trials across demographics. Forward momentum is expected to come from innovations in flavor infusions, sustainable packaging, and celebrity-backed product endorsements, making slimming tea a prominent subcategory in the functional beverage landscape.

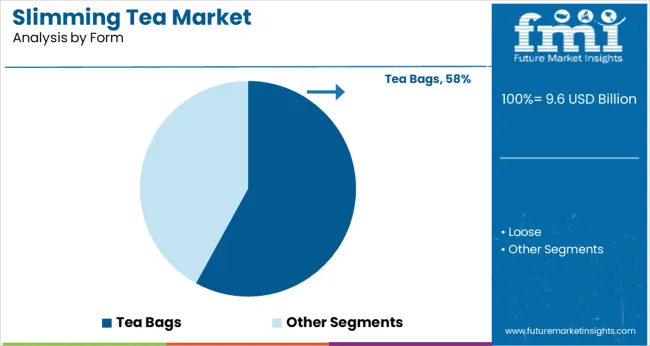

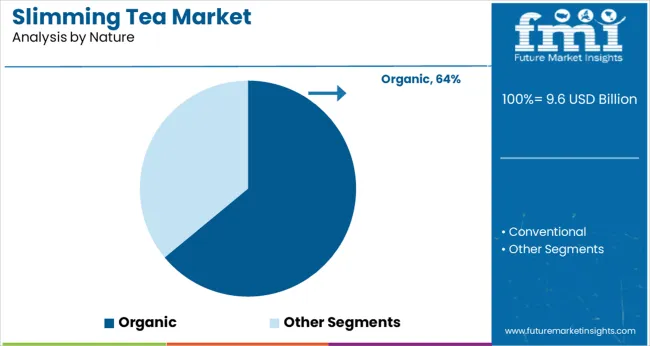

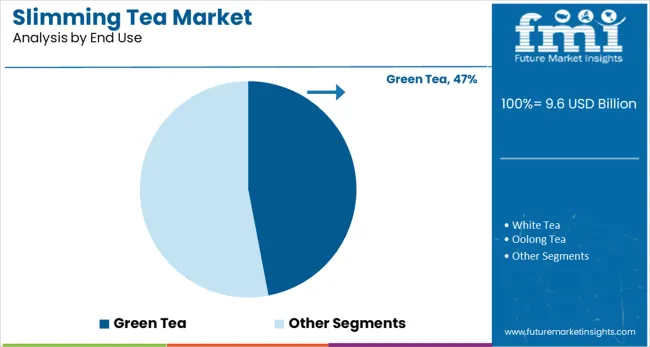

The market is segmented by Form, Nature, End Use, and Distribution Channel and region. By Form, the market is divided into Tea Bags and Loose. In terms of Nature, the market is classified into Organic and Conventional. Based on End Use, the market is segmented into Green Tea, White Tea, Oolong Tea, and Others.

By Distribution Channel, the market is divided into Online Retailers, Supermarket/Hypermarket, Specialty Stores, and Mass Grocery Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Form, Nature, End Use, and Distribution Channel and region. By Form, the market is divided into Tea Bags and Loose. In terms of Nature, the market is classified into Organic and Conventional. Based on End Use, the market is segmented into Green Tea, White Tea, Oolong Tea, and Others.

By Distribution Channel, the market is divided into Online Retailers, Supermarket/Hypermarket, Specialty Stores, and Mass Grocery Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Tea bags are expected to hold 58.0% of the slimming tea market revenue in 2025, establishing this form as the leading format. This dominance is being driven by consumer demand for portion-controlled, mess-free preparation and ease of disposal.

Tea bags offer standardized dosage and longer shelf life, making them ideal for everyday wellness routines. The ability to infuse pre-measured blends with slimming herbs ensures efficacy and convenience for on-the-go users.

Additionally, widespread availability in retail chains, supermarkets, and online health stores has increased consumer preference for this form. Brands are also innovating with pyramid-style and biodegradable tea bags, enhancing brewing quality and aligning with sustainability preferences.

The organic segment is forecast to contribute 64.0% of the total market revenue by 2025, making it the most preferred nature type. This is being supported by heightened consumer awareness of chemical-free consumption and the desire for clean, traceable ingredients in health and wellness products.

Slimming tea blends positioned as organic benefit from the perception of being safer, more potent, and environmentally friendly. Compliance with organic certification standards also boosts trust among buyers, especially in premium and export markets.

As regulatory bodies tighten controls on product labelling and safety, organic-certified slimming teas are expected to retain consumer loyalty and command higher price points in both traditional and digital retail spaces.

Green tea is anticipated to hold 47.0% of the slimming tea market revenue share in 2025, marking it as the top end-use category. Its prominence is attributed to the well-established benefits of green tea in fat oxidation, metabolism regulation, and antioxidant delivery.

Green tea’s compatibility with natural additives like garcinia, ginger, and moringa further enhances its functional positioning in the slimming category. Consumer familiarity, cultural acceptability in both Eastern and Western markets, and its integration into weight management regimens have all reinforced its dominance.

The rise of flavored green tea variants and RTD (ready-to-drink) infusions has also increased its appeal among younger, urban buyers seeking health-focused beverage options with taste and convenience.

Asia Pacific held more than 35% share of the slimming tea market in 2024. The regional market is being driven by the increased demand for healthy teas and functional drinks. Green tea production accounted for 32% of world output in 2020. 84% of the tea imported into the nation is exported as green tea.

Purple tea, fruit teas, and herbal teas are also quite popular. Slimming tea companies in the region are introducing novel tastes to influence customers' purchasing habits. The growing demand for slimming tea from consumers who respect their health presents an opportunity for manufacturers of slimming tea to increase their market share.

Over the projection period, the European market is predicted to grow the quickest. The growing demand for low-sugar meals is what is driving the slimming tea business in Europe.

For instance, the European Commission authorized Rebaudioside M (Reb M) for use in foods and drinks in 2024. With the help of this project, manufacturers should be able to investigate fresh tools for reducing sugar in a range of product categories.

The rising prevalence of various health issues, such as diabetes, cardiovascular diseases, and obesity owing to the lack of physical activities and busy lifestyles of people is expected to bolster the sales of slimming tea in the assessment period. The increasing incidence of diabetes has compelled people to focus more on the adoption of a healthy and convenient diet, which is set to influence the market.

According to the World Health Organization (WHO), the number of people suffering from diabetes grew from 108 million in 1980 to 422 million in 2014. There was a 5% increase in premature mortality associated with the disease between 2000 and 2020. These numbers are estimated to grow at a fast pace in future years, thereby propelling the global market.

The bitter taste of slimming tea often urges consumers to incline toward other alternatives, such as exercise and dieting. This factor may hamper the slimming tea market growth in the evaluation period. In addition to that, some of the slimming teas contain senna, which can cause short-term health problems, such as abdominal cramps, diarrhea, and nausea. The production of this type of tea is not regulated by government bodies and this may decline in its sales in the future.

The rising number of cafes, attractive and convenient packaging of slimming tea and high disposable income of people in China and India are estimated to bolster the Asia Pacific slimming tea market share in the assessment period. The easy availability of slimming tea at offline and online stores is another factor that is set to augur well for the regional market.

In March 2025, for instance, NRI Chaiwala, a reputed tea shop in Delhi, launched multiple flavors of ‘Tea Leaf’ that include herbal chai, kadha chai, tandoori chai, mulethi chai, ginger lemon tea, and many more. This new range of tea flavors has many beneficial properties and will help the company to attract more consumers. Similar other product launches by renowned companies are expected to fuel the Asia Pacific market.

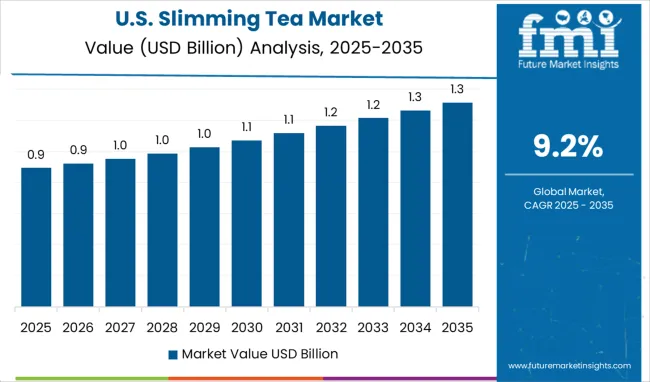

The availability of various types of slimming teas with innovative flavors, such as blueberry, orange, raspberry, and lemon in the USA and Canada is expected to drive the North American slimming tea market size in the forthcoming years. The high demand for caffeine-free and sugar-free teas in these countries is another significant factor that is projected to propel the market.

The presence of many small and medium manufacturers, as well as the low cost of manufacturing, is likely to augur well for the North American market. The rising prevalence of obesity in the USA is also set to accelerate the market.

As per the Centers for Disease Control and Prevention (CDC), the prevalence of obesity was 42.4% in the USA between 2020 to 2020. This trend is projected to continue throughout the forthcoming years, thereby pushing sales of slimming tea across North America.

Some of the leading companies operating in the global slimming tea market include Sira Impex Pvt. Ltd., Tea Treasure, Changzhou Kakoo Tea Foodstuff Co., Ltd., Hyleys, Swastik Eucalyptus Oil Co., 21stCentury Healthcare, Inc., Okuma Nutritionals, Kudos Ayurveda, Triple Leaf Tea Inc., Himalayan Brew Tea Factory, HERBALGREENLAB, Denmark, Tea Aroma, and Imperial Tea Groups among others.

Reputed companies are mainly focusing on launching various innovative products to cater to the surging demand from consumers. Meanwhile, a few other companies are engaging in partnerships and collaborations to co-develop new products as per the specific requirements of consumers to gain a competitive edge.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Form, Nature, End Use, Distribution Channel, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific Excluding Japan; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Sira Impex Pvt. Ltd.; Tea Treasure; Changzhou Kakoo Tea Foodstuff Co., Ltd.; Hyleys; Swastik Eucalyptus Oil Co.; 21stCentury Healthcare, Inc.; Okuma Nutritionals; Kudos Ayurveda; Triple Leaf Tea Inc.; Himalayan Brew Tea Factory; HERBALGREENLAB; Deemark; Tea Aroma; Imperial Tea Groups |

| Customization | Available Upon Request |

The global slimming tea market is estimated to be valued at USD 9.6 billion in 2025.

It is projected to reach USD 23.2 billion by 2035.

The market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types are tea bags and loose.

organic segment is expected to dominate with a 64.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Body Slimming Devices Market Analysis by Product, End-User and Region through 2035

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Tea and Coffee Bags Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tea Infuser Market Analysis & Forecast by Material Type, Product Type, Distribution Store, and Region Through 2025 to 2035

Tea Packaging Market Size, Demand & Forecast 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Teabag Envelope Market Analysis based on Material Type, End Use, and Region through 2025 to 2035

Teak Decking Market Growth Analysis by Grade, Application and Region: Forecast for 2025 and 2035

Market Share Distribution Among Tea Packaging Machine Manufacturers

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Competitive Breakdown of Tear Tape Providers

Market Share Breakdown of Leading Tea Polyphenols Suppliers

Market Share Insights of Tear Tape Dispenser Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA