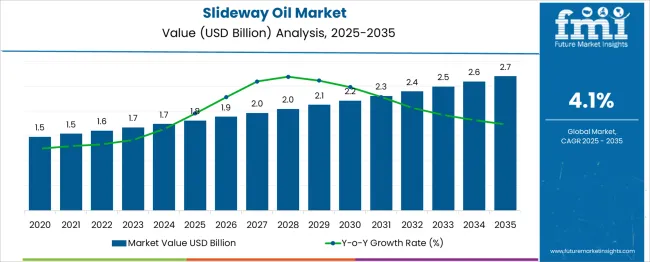

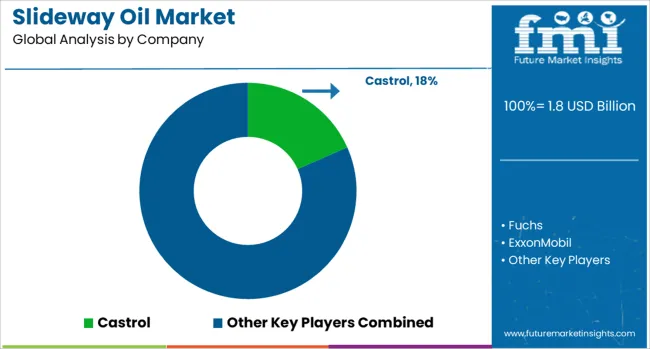

The Slideway Oil Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

From 2025 to 2030, the market expands from USD 1.5 billion to USD 1.9 billion, indicating a modest yet steady demand in heavy machinery lubrication segments. YoY growth over this five-year span fluctuates between 0% and 5.9%, with the lowest growth observed between 2025 and 2026 (flat at USD 1.5 billion), and the strongest between 2026 and 2027 (USD 1.6 billion, +6.7%). From 2027 to 2030, the market rises annually by roughly USD 0.1 billion, maintaining a growth rate of approximately 5.5% per annum. This pattern reflects the stable use of slideway oils in industrial machining environments where surface finish, anti-stick-slip performance, and precision are critical.

Increased output from machine tool industries, particularly in China, Germany, and Japan, alongside higher machine utilization rates, is reinforcing this trend. Technical requirements outlined in journals like Tribology Letters emphasize that demand is less cyclical and more usage-based. As industrial plants prioritize longevity and reduced downtime, demand for high-performance lubricants like slideway oils is expected to remain steady through 2030.

| Metric | Value |

|---|---|

| Slideway Oil Market Estimated Value in (2025 E) | USD 1.8 billion |

| Slideway Oil Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

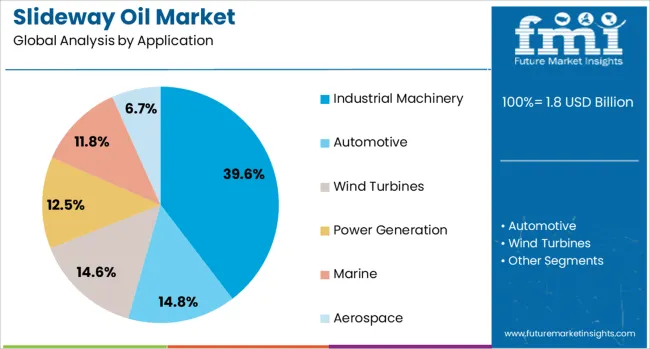

The Slideway Oil Market is primarily driven by the manufacturing and industrial machinery sector, which accounts for approximately 50% of the total market share. This dominance is due to the widespread use of slideway oils in precision equipment such as milling machines, lathes, and grinders, where smooth linear motion and anti-stick-slip properties are critical. The automotive industry follows, contributing around 15–20%, as slideway oils are used extensively in the machining and assembly of vehicle components.

The construction and energy sectors represent about 10–12% of the market, where these oils support the reliable operation of large, heavy-duty machines operating under varying loads. Aerospace and marine industries hold a combined share of 5–8%, utilizing slideway oils in high-performance machinery where temperature stability and corrosion resistance are necessary.

The food and beverage equipment segment, along with other specialized industrial applications such as woodworking and packaging machinery, collectively accounts for the remaining 12–15%. In these sectors, food-grade and environment-friendly formulations are increasingly being adopted to meet hygiene and safety standards. Overall, the market reflects a strong demand in industries where precision, durability, and reliable lubrication of machine tool slideways are essential.

The rising demand for CNC and automated machinery in sectors such as automotive, metalworking, and general manufacturing has elevated the need for slideway oils that support smooth linear motion, reduce chatter, and enhance tool accuracy.

These oils play a critical role in improving productivity, reducing downtime, and extending machine life, especially under harsh and continuous operating conditions. Advancements in oil formulations with optimized viscosity control and superior demulsibility have allowed manufacturers to ensure better separation from cutting fluids, thereby increasing equipment reliability.

The market is further supported by growing investments in smart factories and the resurgence of heavy engineering across developing economies. As sustainability requirements rise, the market is expected to move towards environmentally responsible formulations without compromising on performance, creating new avenues for innovation and competitive differentiation among lubricant manufacturers.

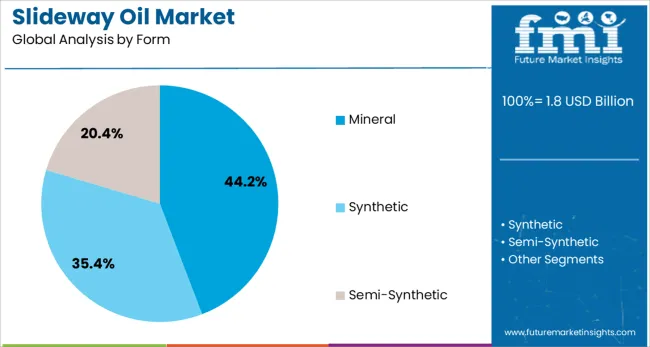

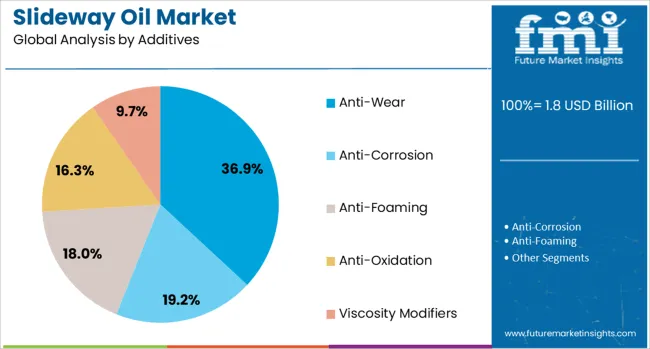

Application, form, additives, viscosity grades, function and geographic regions segment the slideway oil market. By application of the slideway, the oil market is divided into Industrial Machinery, Automotive, Wind Turbines, Power Generation, Marine, and Aerospace. In terms of the form of the slideway, the oil market is classified into Mineral, Synthetic, and Semi-Synthetic. The slideway oil market is segmented based on additives into Anti-Wear, Anti-Corrosion, Anti-Foaming, Anti-Oxidation, and Viscosity Modifiers. The viscosity grades of the slideway oil market are segmented into ISO 68, ISO 32, ISO 100, ISO 150, ISO 220, ISO 320, and ISO 460. The slideway oil market is segmented by function into Lubrication, Heat Dissipation, Corrosion Protection, Wear Reduction, and Sealing. Regionally, the slideway oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial machinery segment is projected to account for 39.6% of the total revenue share in the slideway oil market in 2025, making it the largest contributor by application. This dominance is being driven by the widespread use of slideway oil in milling machines, grinding machines, and other heavy-duty precision equipment used in manufacturing environments.

The need for high positional accuracy, reduced friction, and smooth linear movement has led to the increased use of slideway oils to mitigate wear and eliminate stick-slip phenomena in industrial machinery. Improved surface finish quality and component accuracy have become essential in modern machining operations, and slideway oils are playing a pivotal role in supporting those outcomes.

Their compatibility with water-based coolants and resistance to oxidation further enhances their operational value in long-cycle processes. As manufacturers focus on optimizing machine efficiency, uptime, and precision, the use of high-performance slideway oils in industrial machinery continues to grow steadily.

The mineral form segment is expected to hold 44.2% of the slideway oil market revenue share in 2025, emerging as the leading formulation type. The preference for mineral-based oils has been influenced by their cost-effectiveness, wide availability, and stable performance in standard machining applications. These oils offer reliable film strength, adequate lubricity, and effective protection against wear in both horizontal and vertical slideway systems.

Industrial users continue to favor mineral oils due to their consistent performance under moderate operating conditions, as well as their compatibility with conventional equipment designs. The ease of blending with performance-enhancing additives further supports their continued dominance in the market.

In addition, mineral slideway oils demonstrate favorable demulsibility characteristics, allowing efficient separation from coolants and reducing the risk of emulsification-related breakdowns. Their long-standing usage history and proven reliability have contributed to sustained demand across both emerging and established manufacturing hubs.

The anti-wear additives segment is forecasted to account for 36.9% of the total revenue share in the slideway oil market by 2025, making it the most significant additive category. The growing need to protect high-value machinery from wear and surface damage under heavy loads and continuous operation has increased the reliance on anti-wear formulations.

These additives form a protective boundary film on metal surfaces, minimizing friction and reducing the risk of scoring or galling during operation. Their effectiveness in prolonging equipment life, maintaining alignment accuracy, and ensuring repeatable motion in sliding components has positioned them as essential constituents in modern slideway oils.

The segment’s growth is also being supported by the expansion of high-speed, high-precision manufacturing operations where enhanced lubrication performance is non-negotiable. As operational reliability and maintenance cost reduction remain top priorities in industrial settings, the demand for slideway oils fortified with anti-wear additives is expected to remain robust.

Increasing industrial automation and precision machinery usage are fueling demand for high-performance slideway oils. Growth is supported by tailored formulations, service agreements, and partnerships with equipment OEMs.

Manufacturers across sectors including machine tooling, metalworking, and robotics—are specifying slideway oils to ensure smooth motion, system accuracy, and consistent damping behavior. These lubricants help minimize stick-slip effects and reduce wear on guideways, tables, and feed screws. High-performance properties such as load carrying capacity, rust prevention, and viscosity stability over temperature shifts make slideway oil critical in precision manufacturing environments. Machine shops and component fabrication centers rely upon branded oil grades that deliver predictable performance across batch runs and support maintenance schedules. As operational uptime becomes essential in high-mix, low-volume production settings, the use of refined slideway lubricants is expanding rapidly to support equipment longevity and machining quality.

Suppliers are developing customized slideway oil blends matched to specific machine tool brands and materials, equipped with additives for foam suppression or extreme pressure loading. Partnerships with machine tool OEMs allow oils to be supplied as part of machine commissioning packages, simplifying selection and warranty compliance. Engine users are offering oil-as-a-service agreements that include oil sampling, performance analysis, and scheduled replenishment to optimize maintenance. Regional distribution centers stocked near industrial clusters reduce supply lag and support product standardization for machine shops. Training programs in fluid management paired with online monitoring platforms help maintenance teams track oil condition. These initiatives support broader use in precision engineering workshops and automated production lines where lubricant integrity drives output consistency.

Manufacturers of slideway oil must address the challenge of maintaining consistent viscosity and thermal performance across batches. Variability in base oil quality or additive concentration can lead to erratic film strength and temperature-dependent thinning under load. This issue compromises sliding friction control and surface finish on machine tool tables. CNC machine shops increasingly expect tight control over stick–slip properties to meet micromachining tolerances. Some lubricant suppliers rely on blend stocks from variable refinery streams, reducing predictability. Without stringent quality controls and inline testing of antiwear and extreme pressure additives, performance inconsistency may lead to premature wear and increased downtime. End users in precision engineering sectors such as aerospace or automotive tooling demand validated formulations. Suppliers lacking robust quality monitoring processes may see higher rejection rates in procurement contracts and struggle to secure long-term maintenance agreements.

From 2025 through 2030, the integration of slideway oil condition monitoring into predictive maintenance systems offers a strong opportunity for lubricant suppliers. As more shops deploy onboard sensors measuring oil viscosity, contamination, and additive depletion, maintenance intervals can be optimized. Compared to fixed replacement schedules used in 2025, condition-based lubricant changes will reduce oil consumption by up to 25 percent and extend machine uptime. Labs and OEM tool builders working with IoT-based oil analysis can offer bundled service packages to diagnostics-driven users. This approach strengthens customer relationships and supports recurring revenue beyond one-time sales. Equipment vendors are partnering with lubricant formulators to deliver oil sampling and cloud-based reports to workshop managers. This is especially valuable in high-use environments like multishift machining centers and precision grinding operations. Suppliers offering smart fluid systems position themselves as integral parts of process optimization, not just oil vendors.

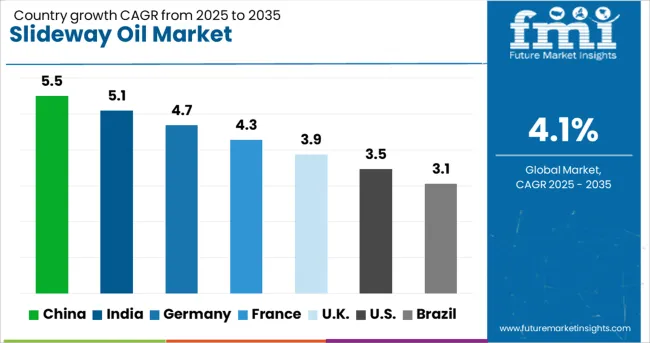

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

China, representing the BRICS bloc, leads with a 5.5% CAGR from 2025 to 2035, propelled by widespread use of automated slideway systems in domestic tool factories and regional expansion of advanced surface grinding operations. India, also in BRICS, follows at 5.1%, where slideway oil consumption is rising across metalworking clusters in Maharashtra and Tamil Nadu, particularly within vertical turret lathe and jig boring operations. In the OECD group, Germany records a 4.7% growth rate, with demand anchored in high-precision guideway lubrication across machining centers used in tier-1 automotive manufacturing. France, growing at 4.3%, shows stable procurement volumes across municipal fabrication workshops and small-batch OEM component finishing units. The United Kingdom, at 3.9%, sees active use in retrofitted turning centers, particularly across contract machine shops supporting defense and rail sectors. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is experiencing strong growth in slideway oil demand, supported by rapid industrial automation and an increase in heavy machining activities. The market is expanding at a CAGR of 5.5% due to the rising adoption of CNC-based production, which requires lubricants that minimize stick-slip and ensure smooth slideway movement. Domestic manufacturers are improving additive packages to enhance anti-wear performance and water separation capabilities. The automotive and aerospace sectors are driving demand for high-performance lubricants, while localized blending and packaging operations are strengthening regional supply chains. The development of environmentally safer lubricants is also shaping product innovation.

The slideway oil market in India is growing at a CAGR of 5.1 %, driven by increasing investment in small and mid-sized machining workshops. Expansion in toolroom equipment and metal forming industries is contributing to higher lubricant consumption. Domestic oil producers are introducing multi-grade slideway lubricants that are compatible with both legacy and modern machinery. Emphasis is being placed on long-life oils with high film strength to support varying load conditions. Government-led skill development initiatives are also fueling lubricant demand through the establishment of CNC training centers. Efforts to substitute imports are boosting the availability of cost-effective, locally blended products.

Germany has a well-established base of advanced machining and precision engineering, supporting steady growth in the slideway oil market at a CAGR of 4.7 %. Lubricants are being developed to meet strict friction control and surface quality requirements in automated production environments. Manufacturers are prioritizing compatibility with synthetic coolants and water-based fluids. Innovations in synthetic base stocks are enabling reduced volatility and longer oil change intervals. German producers are also targeting micro stick-slip issues in linear and vertical guideways. Compliance with REACH and VOC regulations is shaping the development of low-emission, environmentally responsible lubricants.

The slideway oil market in France is expanding at a CAGR of 4.3 %, driven by industrial modernization and the transition from conventional machinery to CNC-based systems. This shift is increasing demand for high-performance lubricants that prevent metal scoring and provide smooth, reliable motion. Formulations are being upgraded with extreme pressure additives and enhanced thermal stability to support operation across wide temperature ranges. Growth in aerospace and precision molding industries is adding to lubricant requirements. Regional distributors are offering value-added services such as oil analysis and predictive maintenance support. Environmental and worker safety regulations are also influencing product formulation.

The slideway oil market in the United Kingdom is growing at a CAGR of 3.9 %, supported by the refurbishment of legacy machinery and the gradual adoption of CNC systems. Lubricant selection is driven by the need for reliable surface finishes and reduced machine tool wear. Local formulators are developing products that minimize stick-slip and prevent scoring, even in older equipment. Compatibility with a range of imported machinery and coolant systems is a key factor in product development. Precision machining in marine, rail, and defense sectors is creating demand for specialized lubricants. There is also growing interest in biodegradable and low-toxicity oils in training centers and prototype labs.

The slideway oil market comprises globally recognized lubricant manufacturers categorized into Tier 1 and Tier 2 suppliers, each addressing distinct market demands based on technological capability, geographic reach, and product specialization. Tier 1 suppliers consist of multinational companies with well-established brands and extensive R&D infrastructure. These manufacturers offer high-performance slideway lubricants engineered for use in precision machine tools, CNC machinery, and automated manufacturing systems.

Their formulations are designed to minimize stick-slip, reduce wear, and ensure smooth, consistent motion critical for maintaining machining accuracy and equipment longevity. These oils also exhibit strong oxidation resistance and compatibility with a wide range of metalworking fluids, making them suitable for high-demand sectors such as automotive, aerospace, heavy engineering, and industrial metal fabrication. Tier 2 suppliers, while not as globally expansive, play a significant role in regional markets, especially in emerging economies.

These companies typically focus on cost-effective formulations that still meet essential lubrication standards, catering to mid-sized workshops and general-purpose machine tools. Their strengths lie in localized supply chains, flexible pricing, and the ability to tailor products to specific industrial conditions and climate requirements. As machine tool usage expands across Asia-Pacific, Latin America, and Eastern Europe, Tier 2 firms are well-positioned to meet rising demand through volume-based strategies and regional partnerships.

FUCHS officially replaced its Glideway oils with the upgraded RENEP CGLP series (grades 32, 68, 150, 220), offering enhanced lubrication, corrosion resistance, and stick-slip control for machine tool slideways, as confirmed on its official website

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Application | Industrial Machinery, Automotive, Wind Turbines, Power Generation, Marine, and Aerospace |

| Form | Mineral, Synthetic, and Semi-Synthetic |

| Additives | Anti-Wear, Anti-Corrosion, Anti-Foaming, Anti-Oxidation, and Viscosity Modifiers |

| Viscosity Grades | ISO 68, ISO 32, ISO 100, ISO 150, ISO 220, ISO 320, and ISO 460 |

| Function | Lubrication, Heat Dissipation, Corrosion Protection, Wear Reduction, and Sealing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Castrol, Fuchs, ExxonMobil, BP, RoyalDutchShell, Valvoline, TheSinopec, and ChevronCorporation(StandardOil) |

| Additional Attributes | Dollar sales by product viscosity grade including ISO VG 68, VG 220 and others, by application sector such as industrial machinery, automotive, and food & beverage, and by geographic region; demand driven by precision machining needs, manufacturing automation, and grid modernization; innovation in synthetic and food‑grade oils; cost dynamics tied to raw material volatility; and emerging use in CNC machine slideways and vertical machining systems. |

The global slideway oil market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the slideway oil market is projected to reach USD 2.7 billion by 2035.

The slideway oil market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in slideway oil market are industrial machinery, automotive, wind turbines, power generation, marine and aerospace.

In terms of form, mineral segment to command 44.2% share in the slideway oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA