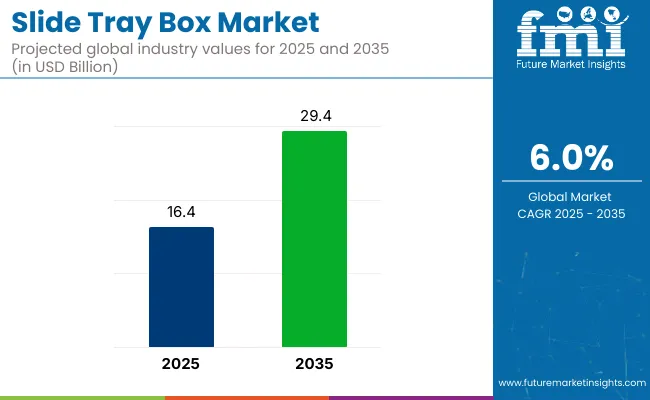

The slide tray box market is projected to be valued at USD 16.4 billion in 2025 and is anticipated to reach USD 29.4 billion by 2035, registering a CAGR of 6.0% over the forecast period. Sales in 2024 were estimated to reach approximately USD 15,622.3 billion, reflecting consistent demand from premium retail packaging and organized storage applications.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 16.4 billion |

| Market Value (2035F) | USD 29.4 billion |

| CAGR (2025 to 2035) | 6.0% |

Expansion of the market has been driven by the growing appeal of high-quality, customizable paperboard packaging in sectors such as cosmetics, personal care, electronics, and fashion. Consumer preferences for sustainable, gift-ready, and brand-elevating formats have resulted in the widespread adoption of rigid drawer boxes across global packaging operations.

In 2025, The Yebo Group expanded its production capabilities by investing in a second tray forming machine from H+S, reinforcing its focus on packaging automation. “We started looking for a new Tray Former to expand our capabilities back in mid‑2021.

When we took delivery of the first machine in January 2022, we knew it was going to have a good impact on our business, so we had no hesitation in ordering the second machine from H+S. It is great to extend our relationship with them and we have been impressed with the build quality and training on this easy to use machine,” said Andrew Tosh, CEO, The Yebo Group.

Demand has grown for environmentally friendly packaging formats that do not compromise product safety or aesthetics. Sustainability has emerged as a major influence on purchasing decisions, prompting manufacturers to adopt recyclable, biodegradable, and FSC-certified paperboards and substrates in slide tray box production.

Demand has grown for environmentally friendly packaging formats that do not compromise product safety or aesthetics. Brands have increasingly used this format to communicate environmental responsibility while preserving luxury appeal. Advances in manufacturing processes have allowed reduced material usage, minimized waste, and increased production efficiency, enabling companies to meet both ecological and economic goals.

Brands have increasingly used this format to communicate environmental responsibility while preserving luxury appeal. Advances in manufacturing processes have allowed reduced material usage, minimized waste, and increased production efficiency, enabling companies to meet both ecological and economic goals.

Advancements in die-cutting, finishing, and folding-gluing machinery have significantly improved the scalability and customization potential of drawer box formats. These innovations have enabled the creation of intricate structures using recyclable and FSC-certified paperboards without compromising on design precision or structural strength.

Growing investment in sustainable materials and plastic-free packaging by personal care brands has aligned well with drawer box solutions. As brand storytelling, eco-consciousness, and consumer experience remain central to packaging strategies, the drawer box market is expected to grow steadily as a premium yet practical format across diverse product categories.

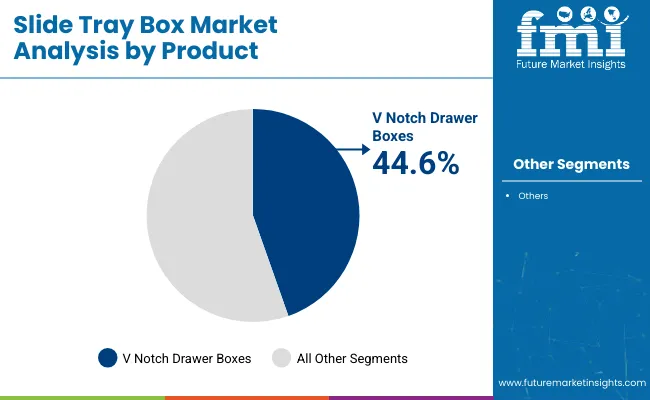

The market is segmented based on product, material, capacity, end use industry, and region. By product, the market includes V notch drawer box, box with ribbon pull, and box with handle. In terms of material, the market is categorized into plastic, metal, wood, and cardboard and paper.

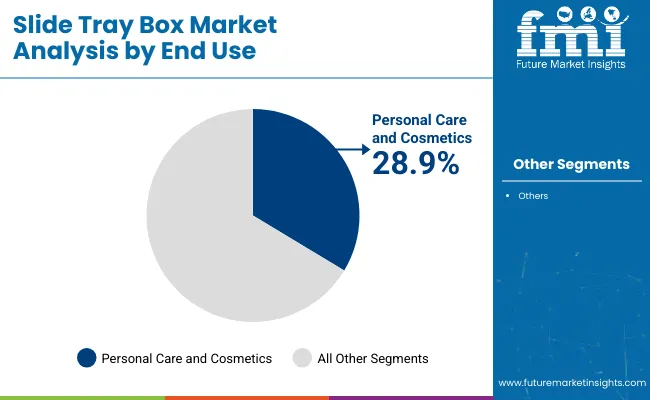

By capacity, the market comprises up to 1 kg, 1.1 kg to 3 kg, 3.1 kg to 5 kg, and above 5 kg. By end use industry, the market includes food and beverages, electronics and electrical, textile, chemicals, pharmaceuticals and health care, personal care and cosmetics, and others. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

V Notch drawer boxes have been projected to account for 44.6% of the rigid paper drawer box market in 2025, due to their sharp-angled corners, seamless construction, and premium visual appeal. This format allows manufacturers to produce clean, refined drawer boxes that enhance unboxing experiences, making them highly favored in gifting and luxury packaging applications. The V-notch scoring process reduces material bulk at folds and allows for a tighter structure with minimal warping.

These boxes offer both functional durability and design sophistication, which are critical in high-end retail. Their compatibility with foil stamping, textured laminates, and custom inserts makes them ideal for branding. As sustainability becomes a key focus, many brands have adopted V notch drawer boxes using FSC-certified paperboard and biodegradable adhesives, balancing aesthetics with eco-conscious consumer preferences.

Personal care and cosmetics have been estimated to hold a 28.9% market share in the rigid paper drawer box market in 2025, driven by the demand for elegant and sustainable secondary packaging. Drawer boxes are commonly used to house skincare kits, perfumes, lipsticks, and compact mirrors, offering both protection and luxury presentation. Their drawer-style mechanism enhances shelf presence and aligns with premium branding strategies in the beauty industry.

Cosmetics brands increasingly use drawer boxes to convey sophistication, build brand equity, and support influencer-driven unboxing experiences. As e-commerce gains prominence in beauty retail, sturdy rigid drawer boxes are favored to ensure product safety during transit. Furthermore, the growing shift toward refillable and limited-edition packaging has contributed to the adoption of rigid paper drawer boxes as reusable and collectible packaging solutions that resonate with environmentally aware consumers.

High Manufacturing Costs and Competition from Alternative Packaging Solutions

However, one of the major challenges for the slide tray box market is the high cost of manufacturing rigid packaging, especially for premium and custom-made boxes. Also, the presence of alternatives packaging options such as folding cartons and magnetic closure boxes acts as restraints for market development.

Small-scale manufacturers also face cost hurdles due to the necessity of advanced printing and finishing techniques to achieve high aesthetic appeal and durability.

Sustainable Materials, Smart Packaging, and Personalization Trends

Segmentation by the end-user types provides firsthand insights into the actual development of the Slide Tray Box Market, which directly dictates the revenue generation. For instance, the increasing use of recyclable paper board, moldedfiber, kraft paper tray boxes, and other sustainable and biodegradable packaging materials is enhancing market attractiveness among eco-conscious consumers.

The increase in smart packaging solutions using QR codes, RFID, NFC and augmented reality (AR) for interactive unboxing experiences creates new business opportunities for luxury brands. Further, the growing demand for custom-printed and personalized slide tray boxes, used for gift packaging, limited-edition product launches, and subscription services are expected to upsurge the market adoption.

The emergence of aesthetically pleasing, lightweight, and durable die-cut slide tray boxes that add more protection to the product and branding opportunities will also benefit market growth.

This drives the slide tray box market in the United States to experience steady growth as premium and protective packaging in retail, which is increasingly needed with the expansion of e-commerce, and which tends to be made from sustainable and recyclable substances. Standards for packaging sustainability and recyclability are set by two governing bodies: the USA Environmental Protection Agency (EPA) and the Sustainable Packaging Coalition (SPC).

Market growth is driven by the expansion of luxury and custom packaging solutions, growing utilization of slide tray boxes in electronics and cosmetics packaging, and increasing investments in biodegradable and compostable packaging materials. Other industry trends include advancements in digital printing and high-end finishing techniques for slide tray boxes.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

The UK slide tray box market is experiencing growth driven by rising demand for attractive and sustainable packaging solutions, increased adoption in food, beverage and pharmaceutical industries, and the government's stringent regulations against plastic waste generation. Packaging compliance and sustainability schemes in the UK here (UK Environment Agency, British Retail Consortium (BRC))

The growth of sustainable rigid boxes, increasing customization in slide tray wrap packaging for branding purposes, and expansion of anti-counterfeit packaging solutions for high-end products are some factors aiding market expansion. In turn, investments in FSC-certified and 100% recycled paperboard materials are also shaping some of the trends in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

The market for slide tray box in the European Union is growing at a steady pace owing to stringent package sustainability regulations in the European Union, increasing demand from consumers for plastic-free options and growing investments in premium and high-end packaging. Packaging sustainability and recyclability standards are governed by the European Environment Agency (EEA) and the European Paper Packaging Alliance (EPPA).

High-end consumer goods packaging, tamper-proof pharmaceutical packaging, and luxury rigid packaging solutions for retail are driving the adoption of slide tray boxes, especially across European nations like Germany, France, and Italy. Moreover, the introduction of smart packaging technology, such as RFID-enabled and interactive slide tray boxes, aids in the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.0% |

Owing to this, the Japan slide tray box market is growing due to high demand for precision-engineered and aesthetically refined packaging, increasing consumption of premium packaging for a variety of gift items, and growing consumer preference for minimalist and eco-friendly packaging solutions. Packaging innovation and sustainability policies are regulated by METI (Japan's Ministry of Economy, Trade, and Industry) and JPI (Japan Packaging Institute).

Companies involved in high-quality paperboard and rigid packaging solutions in Japan are focusing on customized slide tray boxes for cosmetic and confectionery; as well as light and durable packaging for electronics with anti-moisture properties. The industry trends include growth of biodegradable or reusable slide tray packaging materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korea slide tray box market is growing at a rapid rate, as e-commerce and luxury retail sectors expanding, demand for tailored and unique packaging is increasing, and strong regulatory push for sustainable materials. Packaging waste management and compliance regulations fall under the Ministry of Environment of South Korea and the Korea Packaging Recycling Cooperative (KPRC).

Other trends driving growth of the Rigid Box packaging market include the rising trend of rigid box packaging in the high-end electronics and beauty industries, growing adoption of smart packaging with QR codes that make it easier for end-users to authenticate their products and sales of premium branding with high-gloss and textured slide tray box designs. Moreover, there is also growing interest in AI-driven packaging design and manufacturing for mass customization use cases.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

Their versatility, durability, and reusability further encourage the spread of the Slide Tray Box Market. Demand for high-end packaging, innovations in bio-based products, and the ascending e-commerce trends are the major factors justifying the growth of the market.

Businesses are now interested in high-strength, lightweight and aesthetic appeal in the slide tray boxes which help in adding value to brand, safety of product and sustainability. Contains Leading Packaging Manufacturers, Specialty Box Suppliers & Eco-packaging Innovators Contributing Towards Innovations in Recyclable, Biodegradable & High-end Custom Slide Tray Packaging

The overall market size for the slide tray box market was USD 16.4 billion in 2025.

The slide tray box market is expected to reach USD 29.4 billion in 2035.

Growing demand for premium and sustainable packaging, increasing adoption in luxury goods and electronics, and rising preference for eco-friendly rigid packaging solutions will drive market growth.

The USA, China, Germany, Japan, and India are key contributors.

Paperboard slide tray boxes are expected to dominate due to their recyclability, durability, and widespread use in retail and gift packaging.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Slide Gate Valves Market Size and Share Forecast Outlook 2025 to 2035

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

Slide Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tray Market Forecast and Outlook 2025 to 2035

Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Slide Top Tins Market Size and Share Forecast Outlook 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Tray Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Slideway Oil Market Size and Share Forecast Outlook 2025 to 2035

Tray and Sleeve Packing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tray Former Machines Market Size and Share Forecast Outlook 2025 to 2035

Slider Pouches Market Size and Share Forecast Outlook 2025 to 2035

Tray Sealer Machines Market Size and Share Forecast Outlook 2025 to 2035

Slider Bags Market Size and Share Forecast Outlook 2025 to 2035

Box Latch Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Box and Carton Overwrap Films Market Demand and Growth

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA