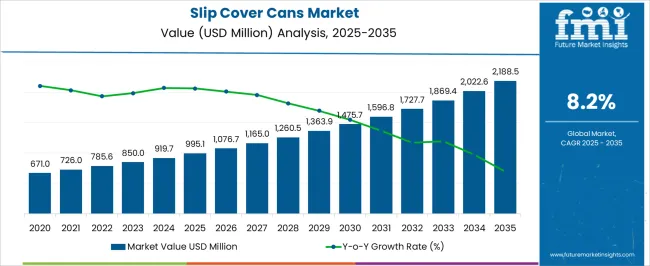

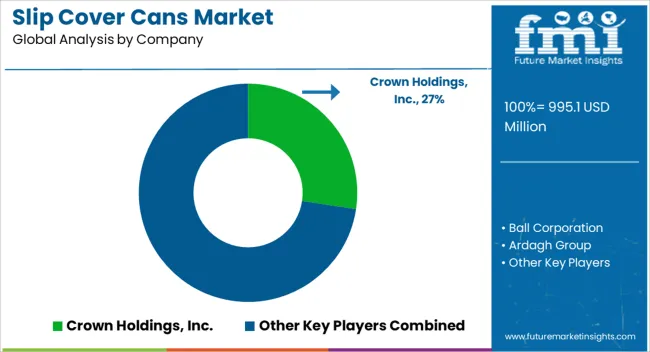

The Slip Cover Cans Market is estimated to be valued at USD 995.1 million in 2025 and is projected to reach USD 2188.5 million by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

| Metric | Value |

|---|---|

| Slip Cover Cans Market Estimated Value in (2025 E) | USD 995.1 million |

| Slip Cover Cans Market Forecast Value in (2035 F) | USD 2188.5 million |

| Forecast CAGR (2025 to 2035) | 8.2% |

The Slip Cover Cans market is experiencing notable expansion as demand continues to rise across packaging, consumer goods, and industrial sectors. The current market scenario is shaped by the increasing adoption of slip cover cans for both durability and presentation purposes. Growth is being influenced by the ability of these containers to provide secure sealing, extended shelf life, and compatibility with a wide range of materials, coatings, and decorative finishes.

The future outlook is supported by rising demand for sustainable and recyclable packaging, particularly in industries emphasizing eco-friendly product lines. The adoption of aluminum and other recyclable materials has further positioned slip cover cans as a preferred packaging choice in food, cosmetics, and specialty chemical applications.

Additionally, the versatility of slip cover cans in handling varying volume capacities and product types has provided significant opportunities for scale and customization With consumer preferences shifting toward premium and sustainable packaging, the Slip Cover Cans market is anticipated to expand consistently, driven by innovation in material usage and product design adaptability.

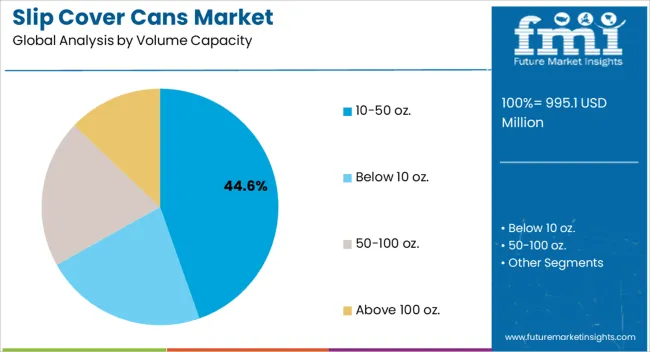

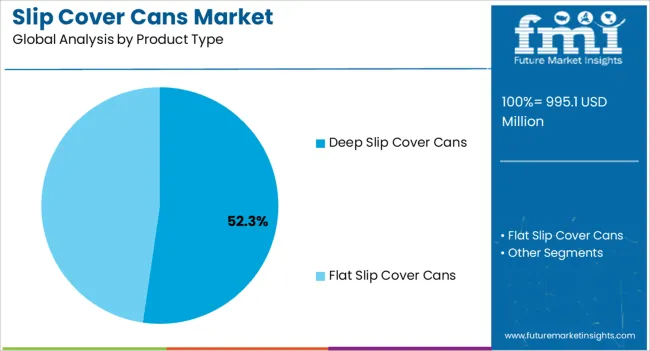

The slip cover cans market is segmented by volume capacity, product type, material, end use, and geographic regions. By volume capacity, slip cover cans market is divided into 10-50 oz., Below 10 oz., 50-100 oz., and Above 100 oz.. In terms of product type, slip cover cans market is classified into Deep Slip Cover Cans and Flat Slip Cover Cans.

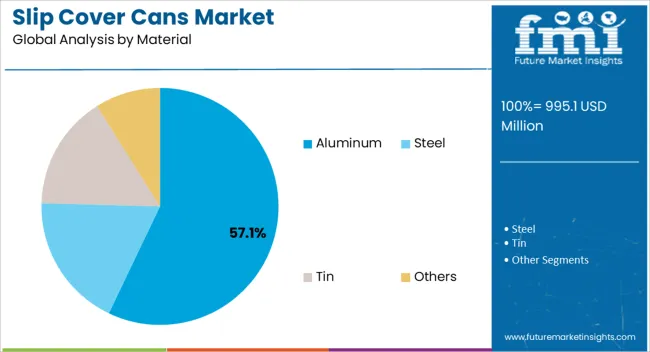

Based on material, slip cover cans market is segmented into Aluminum, Steel, Tin, and Others. By end use, slip cover cans market is segmented into Beverages, Food, Industrial Wax, Oil & Pastes, Petroleum And Chemical Packaging, Cosmetics Packaging, and Others (Aerosols, Etc.). Regionally, the slip cover cans industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 10-50 oz. volume capacity segment is projected to hold 44.60% of the overall Slip Cover Cans market revenue in 2025, making it the leading category by volume capacity. This dominance is being attributed to the widespread demand for mid-range capacities, which are highly suitable for applications across food packaging, household products, and specialty items. The 10-50 oz.

range offers an ideal balance between portability and storage capacity, making it a preferred choice for both consumers and businesses. Growth in this segment has been reinforced by increasing demand in the food and beverage industry, where moderate packaging sizes align with consumption patterns and inventory efficiency. Additionally, the adaptability of these cans for both bulk and individual use has made them a versatile solution.

Manufacturers have increasingly prioritized this volume range due to its higher turnover rates and widespread applicability across end-user industries As product differentiation and branding gain more importance, the 10-50 oz segment is expected to sustain leadership, supported by its cost efficiency and functional versatility in packaging solutions.

The Deep Slip Cover Cans product type is anticipated to account for 52.30% of the Slip Cover Cans market revenue in 2025, emerging as the leading product type. This strong position has been driven by their enhanced capacity to provide protection for products that require secure storage and long-term preservation. The deep design allows for greater containment of goods, making them suitable for packaging materials with higher volume or bulk density.

The ability to incorporate advanced coatings and decorative finishes on these cans has also elevated their appeal for premium product packaging, particularly in cosmetics, luxury goods, and specialty food categories. Adoption has been further supported by the durability and strength associated with deep slip cover structures, ensuring product safety during storage and transportation.

The ease of customization and compatibility with sustainable materials have made this product type increasingly relevant as industries move toward recyclable solutions Future growth in this segment is expected to be propelled by expanding industrial and commercial applications that demand secure, versatile, and visually appealing packaging solutions.

The Aluminum material segment is projected to dominate the Slip Cover Cans market with a 57.10% revenue share in 2025, highlighting its leading role among material choices. This leadership is being driven by aluminum’s unique combination of recyclability, lightweight properties, and durability. Aluminum slip cover cans are widely recognized for their ability to maintain product integrity while offering strong resistance against external factors such as moisture, light, and air.

The increasing focus on sustainable packaging solutions has further reinforced aluminum’s position, as recycling infrastructure for this material is well-established globally. Additionally, aluminum provides excellent compatibility with decorative finishes, embossing, and printing, making it an attractive option for branding and premium positioning. Industries such as food, cosmetics, and specialty chemicals have shown heightened adoption due to these functional and aesthetic advantages.

The material’s favorable strength-to-weight ratio also contributes to cost savings in logistics and transportation As consumer demand for eco-friendly packaging continues to rise, aluminum is expected to maintain its dominant share, supported by both functional benefits and alignment with sustainability goals.

Slip cover cans are tin or aluminum based cans that are primarily used for storing food items like spices; paints, oils and other chemical related products. These cans have microscopic layer of tinplating which gives the silver appearance. These cans are also referred as ink cans or ointment cans. Slip cover cans provide cost efficient solutions as compared to other metal cans. Usually these cans are ideal for auto body filler, heavy pastes, cosmetics, candles, tea etc. These cans are offered in various styles like flat, plain or deep. Performance of such cans can be improved by applying label or window cover. Many manufacturers are innovating slip cover cans with electroplating cans with continuously welded seam side which give better appearance to the product.

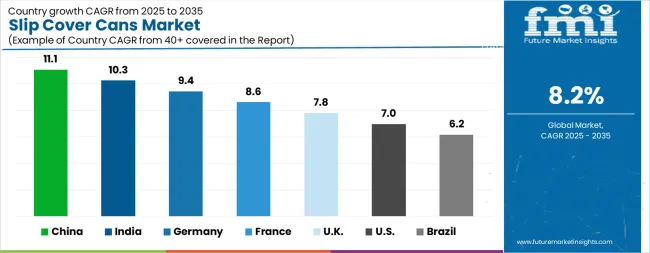

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The Slip Cover Cans Market is expected to register a CAGR of 8.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.1%, followed by India at 10.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Brazil posts the lowest CAGR at 6.2%, yet still underscores a broadly positive trajectory for the global Slip Cover Cans Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.4%.

The USA Slip Cover Cans Market is estimated to be valued at USD 370.1 million in 2025 and is anticipated to reach a valuation of USD 726.0 million by 2035. Sales are projected to rise at a CAGR of 7.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 51.1 million and USD 33.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 995.1 Million |

| Volume Capacity | 10-50 oz., Below 10 oz., 50-100 oz., and Above 100 oz. |

| Product Type | Deep Slip Cover Cans and Flat Slip Cover Cans |

| Material | Aluminum, Steel, Tin, and Others |

| End Use | Beverages, Food, Industrial Wax, Oil & Pastes, Petroleum And Chemical Packaging, Cosmetics Packaging, and Others (Aerosols, Etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Crown Holdings, Inc., Ball Corporation, Ardagh Group, Silgan Holdings Inc., Toyo Seikan Group Holdings Ltd., CAN-PACK S.A., Kian Joo Can Factory Berhad, and Hubei Dinglong Co., Ltd. |

The global slip cover cans market is estimated to be valued at USD 995.1 million in 2025.

The market size for the slip cover cans market is projected to reach USD 2,188.5 million by 2035.

The slip cover cans market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in slip cover cans market are 10-50 oz., below 10 oz., 50-100 oz. and above 100 oz..

In terms of product type, deep slip cover cans segment to command 52.3% share in the slip cover cans market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Slip Lid Can Market Size and Share Forecast Outlook 2025 to 2035

Slip Tip Syringe Market Size and Share Forecast Outlook 2025 to 2035

Slipcases Market Size and Share Forecast Outlook 2025 to 2035

Slip Resistant Shoes Market Insights - Trends & Forecast 2025 to 2035

Slip-on Shoes Market Trends - Demand & Forecast 2025 to 2035

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Slippery Elm Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

Competitive Landscape of Slip Tip Syringe Providers

Anti-Slip Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in Anti-Slip Coated Paper Sector

Market Share Breakdown of Anti-Slip Agents Manufacturers

Anti-Slip Floor Tape Market Trends – Growth & Forecast 2024-2034

Pallet Slip Sheet Market Trends, Growth and Forecast from 2024 to 2034

Push-Pull Slip Sheets Market Size, Share & Forecast 2025 to 2035

Lubricants / Slip Agents Market Size and Share Forecast Outlook 2025 to 2035

Cover Crop Seed Mixes Market Size and Share Forecast Outlook 2025 to 2035

Cover Crop Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Cover Caps Market Size and Share Forecast Outlook 2025 to 2035

Recovered Paper Market

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA