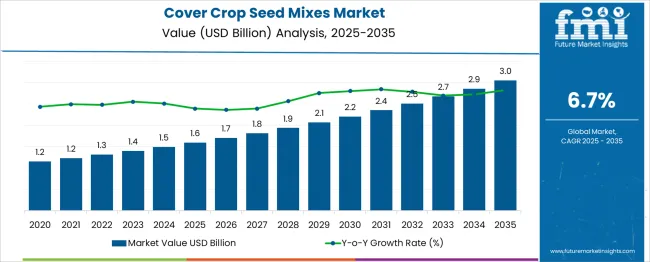

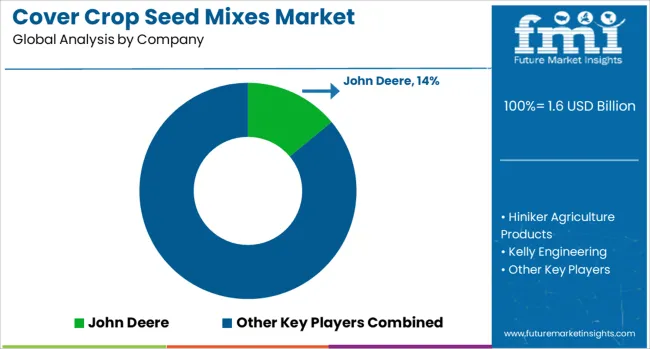

The Cover Crop Seed Mixes Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. This growth translates into an absolute dollar opportunity of USD 1.8 billion over the 15-year period. Increasing adoption of cover crops to improve soil health, reduce erosion, and enhance agricultural sustainability is a primary driver. Farmers and agricultural stakeholders are progressively recognizing the benefits of cover crop seed mixes in maintaining long-term productivity and environmental balance.

Between 2020 and 2025, the market expands from USD 1.2 billion to USD 1.6 billion, indicating a growing awareness and initial uptake phase. From 2025 to 2035, the market accelerates further, increasing by USD 1.4 billion to reach USD 3.0 billion. This period benefits from advancements in seed mix formulations and expanding use in diverse agricultural practices globally. The increasing focus on regenerative agriculture and government support programs further boosts the market. Overall, the cover crop seed mixes market presents substantial opportunities for seed producers and agricultural solution providers aiming to support sustainable farming practices.

| Metric | Value |

|---|---|

| Cover Crop Seed Mixes Market Estimated Value in (2025 E) | USD 1.6 billion |

| Cover Crop Seed Mixes Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The cover crop seed mixes market is experiencing steady growth as sustainable agriculture practices and soil health management gain prominence in farming communities. Increasing awareness among growers about the benefits of cover crops in improving soil fertility, reducing erosion, and enhancing water retention has been driving adoption.

Supportive agricultural policies and incentives have further encouraged farmers to integrate cover crops into rotation systems. Advances in seed technology and improved availability of high-performing mixes have also contributed to the market’s expansion.

The future outlook remains positive with opportunities expected to emerge from growing demand for organic produce, climate-resilient farming techniques, and rising emphasis on regenerative agriculture. Strategic collaboration between seed producers, cooperatives, and large-scale growers is expected to facilitate broader adoption and market penetration.

The cover crop seed mixes market is segmented by product type, crop type distribution channel, and geographic regions. By product type of the cover crop seed mixes market is divided into Legumes, Grasses, Brassicas, Broadleaves Mixed species. In terms of crop type of the cover crop seed mixes market is classified into Corn, Soybean, Rice, Wheat, Canola Others. Based on distribution channel of the cover crop seed mixes market is segmented into Direct sales, Retail outlets, Online retail, Cooperatives and farmer groups Others. Regionally, the cover crop seed mixes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

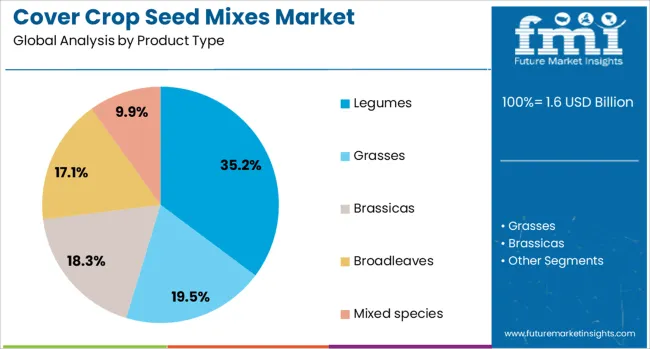

When segmented by product type, legumes are projected to hold 35.2% of the total market revenue in 2025, positioning them as the leading product type. This leadership is attributed to their natural ability to fix atmospheric nitrogen, which reduces the need for synthetic fertilizers and lowers input costs for farmers.

Legumes have been favored in cover crop mixes for their contribution to improving soil structure and increasing organic matter, which enhances long-term productivity. Their versatility to grow in diverse climatic conditions and compatibility with various crop rotations have also supported wider adoption.

The ability to generate measurable improvements in soil fertility while providing forage options in some systems has reinforced their dominance in product preference among growers.

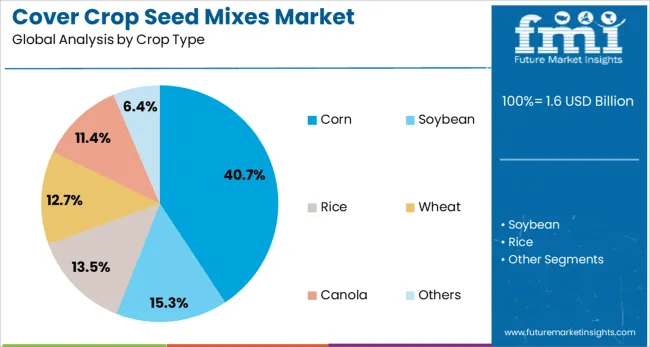

Segmenting by crop type shows that corn accounts for 40.7% of the market revenue in 2025, maintaining its position as the leading crop type. This prominence has been driven by the extensive acreage of corn cultivation globally, which creates substantial opportunities for integrating cover crops into rotations.

Growers have increasingly recognized the value of cover crops in preserving soil moisture, suppressing weeds, and minimizing nutrient leaching in corn systems. The compatibility of cover crop seed mixes with corn planting schedules and machinery has simplified implementation for large-scale operations.

Additionally, the economic importance of corn has incentivized producers to adopt sustainable practices to safeguard yields and soil health, further strengthening the dominance of this segment.

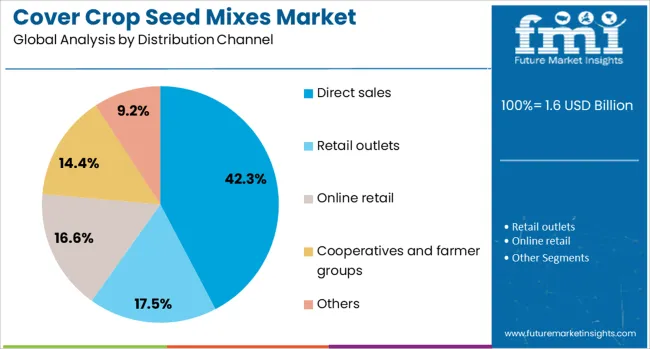

When analyzed by distribution channel, direct sales are expected to capture 42.3% of the market revenue in 2025, establishing themselves as the leading channel. This leadership has been reinforced by farmers’ preference for sourcing seeds directly from trusted suppliers and cooperatives, which ensures access to high-quality, certified mixes tailored to local conditions.

Direct sales have facilitated stronger relationships between seed producers and growers, enabling customized recommendations and technical support that enhance customer confidence. The ability to bypass intermediaries has also allowed for more competitive pricing and faster delivery, which are critical during narrow planting windows.

These advantages have solidified direct sales as the dominant route to market, particularly among large and progressive farming operations.

The cover crop seed mixes market is growing steadily as farmers increasingly adopt sustainable agricultural practices to improve soil health, prevent erosion, and enhance crop productivity. Cover crop mixes combine multiple seed varieties tailored for specific climates, soil types, and cropping systems. Rising awareness about regenerative agriculture and government incentives for soil conservation support market expansion. North America and Europe lead adoption, while emerging interest in Asia-Pacific and Latin America drives future growth. The use of diverse seed blends helps optimize nutrient cycling and pest management in various farming systems.

Construction films serve multiple purposes, including vapor barriers, temporary protective covers, insulation layers, and concrete curing sheets. Polyethylene films are common due to their flexibility, moisture resistance, and affordability, while specialized films offer UV resistance and anti-slip properties. Thickness and tensile strength vary based on application requirements. Innovations include multi-layer films combining durability and breathability. Selection depends on climate, building codes, and specific project needs. Manufacturers offering customizable films for different construction phases gain competitive advantages by catering to diverse client demands.

Films contribute significantly to building envelope performance by preventing moisture ingress, reducing heat loss, and protecting surfaces from dust, dirt, and mechanical damage during construction. Effective vapor barriers help mitigate mold growth and structural deterioration. The rising emphasis on energy-efficient buildings and green construction standards increases demand for high-performance films. Temporary protective films reduce repair and cleaning costs by shielding windows, floors, and fixtures. Growing awareness among contractors about long-term benefits supports broader integration of construction films into project specifications.

Construction films must meet stringent regulations related to fire retardancy, chemical safety, and environmental impact. Compliance with standards such as ASTM, ISO, and local building codes is essential for market acceptance. Growing environmental concerns about plastic waste push manufacturers toward recyclable and biodegradable film options. Regulations restricting single-use plastics influence product development and marketing strategies. Navigating diverse regulatory frameworks across regions requires adaptability and certification, increasing operational complexity. Companies focusing on eco-friendly formulations and transparent supply chains enhance their reputation and market reach.

The market includes global chemical manufacturers, specialty film producers, and regional suppliers competing on product quality, innovation, and pricing. Raw material availability and price fluctuations, especially of polymers derived from petroleum, impact production costs. Supply chain disruptions may affect delivery schedules, prompting companies to diversify sourcing and optimize inventories. Strategic partnerships with construction firms and distributors support market penetration. Offering technical support, customization, and reliable logistics enhances customer loyalty. Product differentiation through durability, ease of use, and environmental compliance remains key to success in a competitive environment.

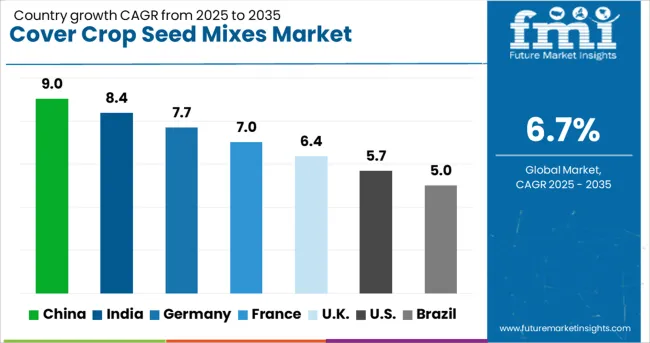

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The global cover crop seed mixes market is growing at a 6.7% CAGR, driven by increasing adoption in sustainable agriculture and soil health management. Among BRICS nations, China leads with 9.0% growth, supported by expanding agricultural practices and government initiatives. India follows at 8.4%, fueled by growing awareness of soil conservation and crop diversification. In the OECD region, Germany records 7.7% growth, reflecting advanced farming techniques and environmental policies. The United Kingdom grows at 6.4%, driven by demand for improved land management. The United States, a mature market, shows 5.7% growth, shaped by established agricultural standards and practices. These countries collectively influence market trends through production capacity, regulatory frameworks, and agricultural demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the cover crop seed mixes market with a growth rate of 9.0%, fueled by increasing awareness of soil health and erosion control among farmers. Compared to India, China has seen stronger government support through agricultural policies promoting sustainable farming practices. The demand for diverse seed mixes that improve soil fertility and moisture retention is growing rapidly in key agricultural regions. Farmers are adopting multi-species cover crops to optimize nutrient cycling and reduce chemical fertilizer use. Investments in research and development have resulted in seed mixes tailored to China’s varied climatic zones. Expansion of mechanized farming and integration with crop rotation systems further drive market growth, establishing China as a dominant player in cover crop seed mixes.

India’s cover crop seed mixes market grows at 8.4%, supported by increasing farmer interest in improving soil quality and crop yields. Compared to Germany, India faces challenges from small-scale farms but benefits from a wide variety of native seed species suitable for different regions. Adoption of cover crops helps manage soil erosion, especially in monsoon-affected areas. Agricultural extension programs educate farmers on the benefits of cover crops, boosting demand for specialized seed mixes. Growing organic farming practices and government subsidies encourage the use of eco-friendly cover crops. Improved access to seeds via rural supply chains strengthens market penetration. The sector shows strong potential as soil degradation concerns intensify.

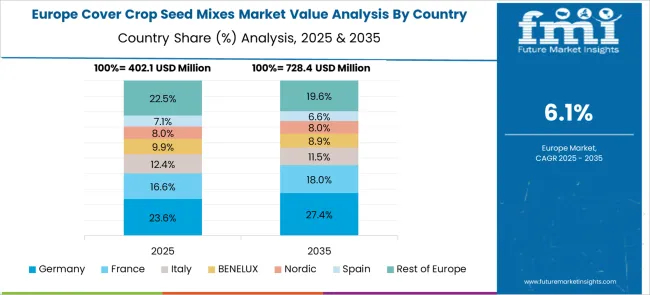

Germany’s cover crop seed mixes market grows at 7.7%, driven by advanced agricultural techniques and environmental regulations. Compared to the United Kingdom, German farmers implement cover crops extensively to reduce nitrogen leaching and improve biodiversity. The use of certified seed mixes tailored for temperate climates is common. Farmers benefit from government incentives aimed at promoting sustainable agriculture and reducing chemical inputs. Precision farming tools help optimize seed mix application based on soil conditions. The focus on long-term soil conservation supports steady growth in cover crop seed mixes. Research collaborations between seed companies and agricultural institutes enhance seed quality and performance.

The United Kingdom cover crop seed mixes market grows at 6.4%, supported by increasing adoption of soil conservation techniques and organic farming. Compared to the United States, the UK market places greater emphasis on reducing chemical fertilizer use through diverse seed blends. Farmers are integrating cover crops into crop rotations to improve soil structure and suppress weeds. Environmental stewardship programs provide financial support for cover crop planting, encouraging adoption. Research on seed mixes suited for UK soils and climates helps expand the market. Demand is rising from both conventional and organic farming sectors as awareness of long-term soil health benefits spreads.

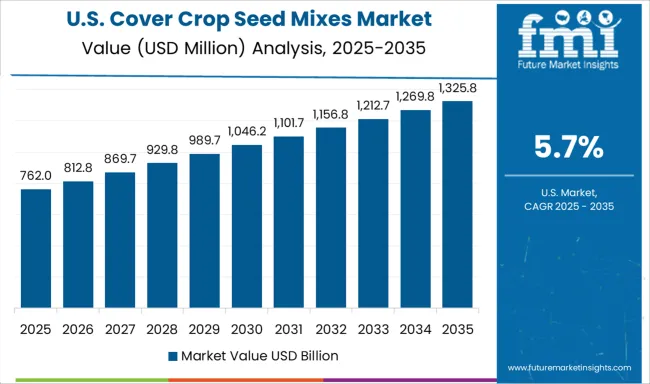

The United States cover crop seed mixes market grows at 5.7%, driven by growing concerns about soil erosion and water quality among farmers. Compared to China, the US market has a larger focus on seed mixes that provide multiple ecosystem services such as nitrogen fixation and pollinator support. Government conservation programs like the Conservation Reserve Program incentivize cover crop planting on marginal lands. Farmers adopt seed blends optimized for diverse climates, from Midwest corn belts to Southern plains. Advances in seed technology improve germination rates and pest resistance. The expansion of precision agriculture tools helps farmers efficiently manage cover crop applications. Increasing demand for sustainable farming practices supports steady market growth.

The cover crop seed mixes market is driven by agricultural equipment and seed solution providers that emphasize soil health, erosion control, and sustainable farming practices. John Deere leads the market with its comprehensive agricultural portfolio, integrating innovative seeding equipment and technology to optimize cover crop planting efficiency. Hiniker Agriculture Products and Kelly Engineering offer specialized machinery and seed drills designed to ensure precise seed placement and maximize germination rates, addressing the specific needs of diverse farming operations. Salford Group and Kuhn provide advanced tillage and seeding equipment that supports the effective establishment of cover crops, improving soil structure and moisture retention.

Great Plains, Gandy, and Fennig Equipment focus on adaptable seeders capable of handling various cover crop species and complex seed mixes, enhancing flexibility for farmers implementing sustainable crop rotations. Bourgault Industries and Unverferth Farm Equipment contribute with rugged, reliable seeding solutions tailored for large-scale operations. AGCO Corporation and Dean Farms Cover Crops combine seed expertise with integrated equipment offerings, delivering custom cover crop seed blends and precision planting systems. Competition in this market centers on innovation in seed technology, equipment precision, and sustainability, driven by increasing adoption of conservation agriculture and regenerative farming practices worldwide.

Key players in the Cover Crop Seed Mixes Market focus on innovation by developing tailored seed blends for diverse climates and soils. They invest in R&D, form strategic partnerships, and expand geographically. Emphasizing sustainability, they promote organic seeds and integrate precision agriculture to boost efficiency and meet growing demand for eco-friendly products.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product Type | Legumes, Grasses, Brassicas, Broadleaves, and Mixed species |

| Crop Type | Corn, Soybean, Rice, Wheat, Canola, and Others |

| Distribution Channel | Direct sales, Retail outlets, Online retail, Cooperatives and farmer groups, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | John Deere, Hiniker Agriculture Products, Kelly Engineering, Salford Group, Kuhn, Great Plains, Gandy, Fennig Equipment, Bourgault Industries, Unverferth Farm Equipment, AGCO Corporation, and Dean Farms Cover Crops |

| Additional Attributes | Dollar sales in the Cover Crop Seed Mixes Market vary by seed type including legumes, grasses, and brassicas, application across soil health improvement, erosion control, and nutrient management, and region covering North America, Europe, and Asia-Pacific. Growth is driven by sustainable agriculture practices, government incentives, and rising awareness of soil conservation benefits. |

The global cover crop seed mixes market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the cover crop seed mixes market is projected to reach USD 3.0 billion by 2035.

The cover crop seed mixes market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in cover crop seed mixes market are legumes, grasses, brassicas, broadleaves and mixed species.

In terms of crop type, corn segment to command 40.7% share in the cover crop seed mixes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cover Crop Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Cover Caps Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Crop Bactericides Market Size and Share Forecast Outlook 2025 to 2035

Crop Micronutrient Market Insights - Precision Farming & Yield Optimization 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Crop Nutrient Management Market

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Micropipette Puller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA