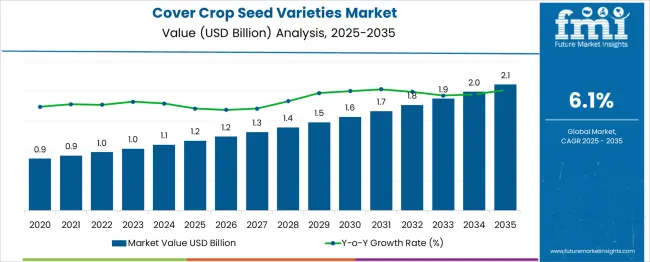

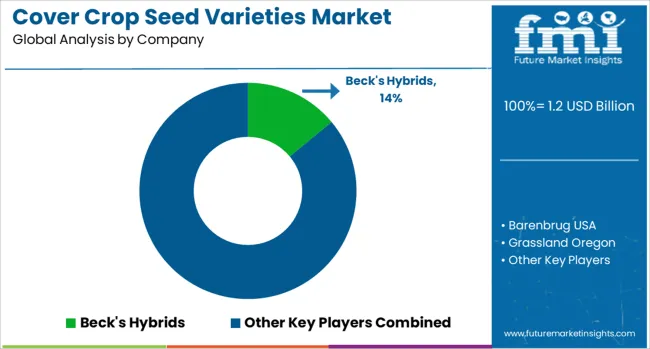

The Cover Crop Seed Varieties Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. Inflection point mapping highlights two key transition phases in this trajectory. The first inflection occurs around 2028–2029, when the market surpasses USD 1.3 billion, supported by policy-driven incentives for soil health, carbon sequestration programs, and rising adoption of regenerative agriculture practices across North America and Europe. This stage signifies a shift from niche to mainstream use of cover crops as farmers increasingly incorporate them for erosion control and nutrient retention.

The second critical inflection appears post-2031, when the market exceeds USD 1.6 billion, driven by technological integration such as precision seeding, data-driven crop rotation strategies, and the commercialization of climate-resilient seed varieties. These developments accelerate adoption in emerging economies, particularly in the Asia-Pacific region, where sustainable farming models are gaining traction. Beyond 2032, growth momentum stabilizes as the market moves toward USD 2.1 billion by 2035, with premiumization opportunities in specialty seed blends offering enhanced drought tolerance and pest resistance. Companies prioritizing R&D for region-specific genetics, advanced distribution channels, and farmer education programs will secure leadership through these inflection points.

| Metric | Value |

|---|---|

| Cover Crop Seed Varieties Market Estimated Value in (2025 E) | USD 1.2 billion |

| Cover Crop Seed Varieties Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The cover crop seed varieties market occupies distinct positions across related agricultural input systems. Within the global seed and agricultural inputs market, cover crop seeds account for roughly 3–4%, as they remain a niche relative to densely planted cash crops like corn, soy, or wheat. In the sustainable farming and soil health sector, they contribute 10–12%, given increasing adoption of soil-improving rotations, erosion control strategies, and nutrient management protocols.

Within the green manure and rotational crop systems market, cover crops represent 15–18%, reflecting their central role in nitrogen fixation, weed suppression, and soil biology enhancement between cash seasons. In the organic and regenerative agriculture input market, these seeds capture 8–10%, supported by rising demand for non-GMO, non-synthetic crop inputs in certified production systems. Within the livestock forage and grazing optimization segment, their share is 6–8%, as species like clovers and cereal grasses are grown specifically to support seasonal or rotational grazing systems. Growth is propelled by regulators promoting conservation farming, rising interest in carbon credits tied to cover cropping, and measurable yield benefits in following crops due to improved soil health. Seed innovation including mixture optimization, region-specific varieties, and multi-purpose legume blends, is improving adoption rates. These factors position the cover crop seed varieties market as a strategic enabler of resilient, cost-efficient, and ecologically beneficial agricultural practices.

Growth is being shaped by increasing awareness among farmers about the long-term benefits of soil regeneration, erosion control, and biodiversity enhancement. Governments and agricultural agencies are also playing a pivotal role through incentive programs and environmental regulations that promote the use of cover crops.

Advancements in seed breeding technologies and agronomic research have improved the adaptability and resilience of cover crop varieties across different climatic zones. As regenerative farming models become more commercially viable and environmentally essential, demand for diverse and high-quality cover crop seeds is expected to continue rising.

Integration of cover crops into conventional crop rotations is being widely adopted to reduce chemical dependency and enhance nutrient cycling. This shift toward sustainable intensification and ecological stewardship is anticipated to provide a robust foundation for continued market growth..

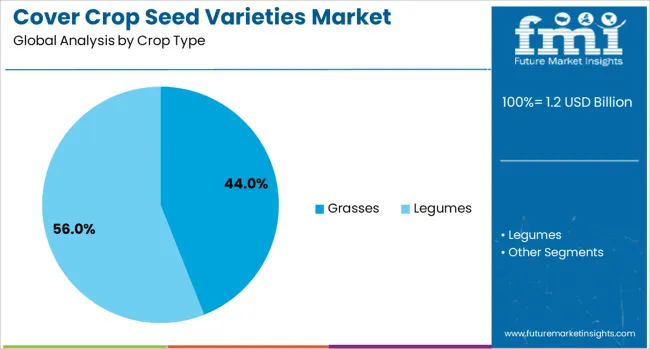

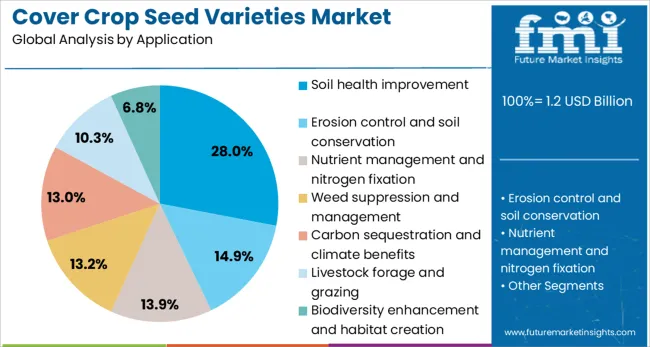

The cover crop seed varieties market is segmented by crop type, application, end use system, and geographic regions. The cover crop seed varieties market is divided by crop type into Grasses, Legumes, Brassicas, and Other cover crops. In terms of application of the cover crop seed varieties market, it is classified into Soil health improvement, Erosion control and soil conservation, Nutrient management and nitrogen fixation, Weed suppression and management, Carbon sequestration and climate benefits, Livestock forage and grazing, and Biodiversity enhancement and habitat creation.

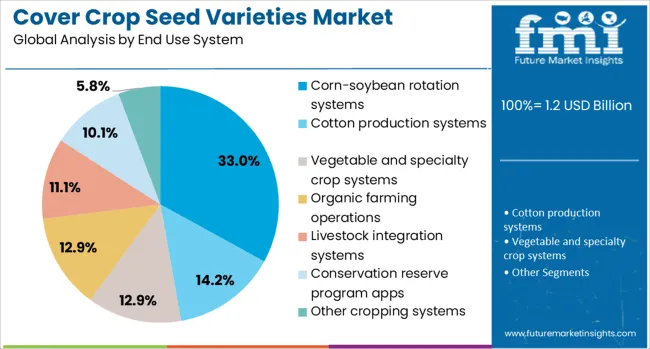

Based on end-use systems of the cover crop seed varieties market, it is segmented into Corn-soybean rotation systems, Cotton production systems, Vegetable and specialty crop systems, Organic farming operations, Livestock integration systems, Conservation reserve program apps, and Other cropping systems. Regionally, the cover crop seed varieties industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The grasses segment is projected to hold 44% of the Cover Crop Seed Varieties market revenue share in 2025, making it the dominant crop type. This leadership position has been attributed to the ability of grasses to establish quickly, produce high biomass, and effectively suppress weeds. Their dense root systems have been recognized for their role in enhancing soil structure and reducing erosion, which are critical components of sustainable farming practices.

Grasses have also been preferred due to their compatibility with a wide range of climates and farming systems, offering versatility to growers across regions. Their contribution to organic matter buildup and nutrient retention has further strengthened their appeal in regenerative agriculture programs.

The market demand has been supported by their proven performance in improving water infiltration and maintaining ground cover during non-cropping periods. These combined agronomic and environmental benefits have positioned grasses as a fundamental component in the cover cropping strategies of commercial and mid-scale farms..

The soil health improvement segment is expected to account for 28% of the Cover Crop Seed Varieties market revenue share in 2025, representing the leading application. Rising concerns over soil degradation and nutrient depletion in conventional agriculture have influenced growth in this segment. Cover crops intended for soil health have been widely implemented to enhance microbial activity, fix atmospheric nitrogen, and break up compaction layers.

Their role in improving soil organic carbon levels and enhancing the overall biological profile of farmland has contributed significantly to their adoption. Farmers have increasingly relied on this application to reduce input costs, particularly fertilizers, while promoting long-term soil productivity. Support from agricultural extension services and sustainability certifications has further validated their use.

As climate resilience becomes a major focus in crop management, solutions that restore and preserve soil function are being prioritized. This shift has helped drive the dominance of soil health improvement as a primary objective in cover crop selection..

The corn soybean rotation systems segment is anticipated to contribute 33% of the Cover Crop Seed Varieties market revenue share in 2025, emerging as the leading end use system. The adoption of cover crops within these rotation systems has been driven by the need to improve nutrient cycling and break pest and disease cycles. In regions where corn and soybeans dominate acreage, particularly in North America, the use of cover crops has become a strategic practice to address yield variability and maintain soil fertility.

This system has allowed for efficient incorporation of biomass into the soil during fallow periods, enhancing nitrogen availability for subsequent crops. The ability of cover crops to reduce runoff, retain moisture, and improve soil tilth has been especially beneficial in these rotations.

Farmers operating in corn-soybean systems have also leveraged cover crops to meet conservation compliance requirements and participate in carbon credit programs. These factors have collectively supported the prominence of this end-use system in the market..

Cover crop seed varieties include plant options such as legumes, grasses, brassicas, and multi-species mixes selected for their soil enrichment, erosion control, and nitrogen-fixing ability. These seeds are used by growers, conservation agencies, and crop advisors to enhance soil health, reduce nutrient loss, and support main crop yields. Demand has been driven by growing interest in regenerative agricultural practices and desire to reduce reliance on synthetic fertilizers. Suppliers offering regionally adapted seed blends, high cover biomass yield, and compatibility with mechanized planting techniques have remained competitive. Product performance in weed suppression, moisture retention, and residue breakdown continues to guide selection.

Interest in cover crops has been enabled by the need to improve soil structure, organic matter levels, and microbial activity between cash crop cycles. Growers have increasingly employed legumes such as vetch or clover to fix nitrogen naturally, reducing fertilizer demand. Grasses and brassica species have been preferred for rapid biomass production and tissue breakdown, helping inhibit weed growth and trap residual nutrients. Adoption has also been supported by incentive programs that reward cover crop use for soil conservation goals. Rotation plans that reduce leaching and preserve moisture during off‑seasons have further strengthened confidence in seed variety choices among farmers and agronomists.

Use of cover crop seeds has been limited by the upfront cost of multi-species mixes and variety-specific seed premiums, especially for certified or regionally adapted blends. Lack of familiarity with establishment methods, such as timing, seeding rate, and termination technique, has discouraged adoption among growers inexperienced in cover cropping. Variability in seed performance across soil types and climatic conditions has introduced the risk of poor germination or competition with primary crops. Integration of planting and termination equipment may require additional modification. Inconsistent quality standards across seed suppliers and limited availability of small‑lot seed blends for specialty farms continue to constrain broader use by smaller-scale producers.

Opportunities are being created by development of seed blends tailored to specific soil types, rainfall zones, or cropping systems. Collaboration between seed companies and research institutions has enabled release of regionally adapted variety mixes with improved biomass output and disease resistance. Expansion into cover crop contracts bundled with advisory services allows growers to trial mixes without first committing capital. Use of specialized blends such as pollinator-friendly or grazing-compatible covers supports niche uptake in orchard or livestock-integrated operations. Supply of seed kits or pre-measured packages for small acreage use encourages experimentation among new adopters and smallhold farmers.

Trends include increasing use of multi-species cover crop mixes that provide complementary functions such as biomass, nitrogen fixation, soil protection, and pest suppression in a single planting. Varieties with improved cold tolerance or fast fall germination are gaining traction in regions with short establishment windows. Data-driven planning tools integrated into farm software now support the selection of optimal seed blends based on soil testing and seasonal forecasts. On-farm seed cleaning and small batch mixing technology enable customized variety trials. Genetic improvement programs aimed at enhancing performance traits like root structure or residue decay rate are shaping next-generation cover crop seed development. Packaging formats such as seed coated csv pellets or precision-metered trail packs are also influencing distribution and ease of use.

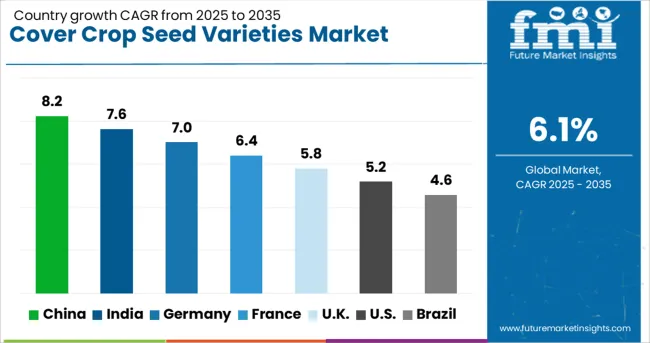

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The cover crop seed varieties market is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by the adoption of soil health improvement practices, crop rotation systems, and demand for nitrogen-fixing species. China, a BRICS nation, leads with 8.2% CAGR, supported by large-scale regenerative farming programs. India follows at 7.6%, driven by integrated crop management initiatives and rising awareness among smallholder farmers. Among OECD countries, Germany posts 7.0%, the United Kingdom records 5.8%, and the United States grows at 5.2%, focusing on sustainable soil fertility and erosion control solutions. The analysis includes over 40 countries, with the top five detailed below.

China is expected to post a CAGR of 8.2% through 2035, fueled by government-led programs promoting regenerative agriculture and soil health restoration. Adoption of leguminous and brassica seed varieties is increasing in grain-producing provinces for nitrogen fixation and pest management. Domestic seed companies are investing in research to develop drought-resistant and region-specific cover crop varieties. Expansion in conservation tillage and mechanized farming practices also supports greater demand for cover crop seeds. The integration of cover crops into rice-wheat and corn-soy rotations is becoming standard practice, reflecting China’s commitment to sustainable land use.

India is projected to record a CAGR of 7.6% through 2035, driven by rising interest in soil fertility enhancement and erosion prevention across rainfed agriculture regions. Farmers are adopting cowpea, mustard, and sorghum-based cover crops to improve soil organic matter and reduce dependency on chemical fertilizers. Government subsidy programs and farmer training initiatives under national agricultural missions are promoting cover cropping as a cost-effective soil management practice. Increased focus on crop diversification and water retention techniques strengthens the adoption of mixed-seed varieties. Seed manufacturers are introducing affordable bulk packs tailored to smallholder farmers.

Germany is forecasted to achieve a CAGR of 7.0% through 2035, supported by strong emphasis on erosion control, soil carbon improvement, and nutrient retention in agricultural practices. Cover crops such as clover, rye, and radish are widely integrated into crop rotations to meet EU soil conservation regulations. Demand is also rising for multi-species cover crop blends that improve biodiversity and enhance soil resilience. German seed producers are investing in precision planting techniques and seed coating technologies to improve germination and performance in diverse soil conditions. The expansion of organic farming systems further boosts market prospects.

The United Kingdom is expected to grow at a CAGR of 5.8% through 2035, driven by incentives under agri-environment schemes and growing interest in soil health strategies among farmers. Adoption of winter cover crops such as ryegrass and vetch is becoming widespread for minimizing nutrient leaching during fallow periods. The market is also witnessing demand for fast-germinating varieties suited for short planting windows between cash crops. Seed companies are introducing pre-blended packs for targeted soil benefits, such as nitrogen enrichment or weed suppression, to cater to specialized farm needs. Increased awareness of soil carbon management enhances adoption trends.

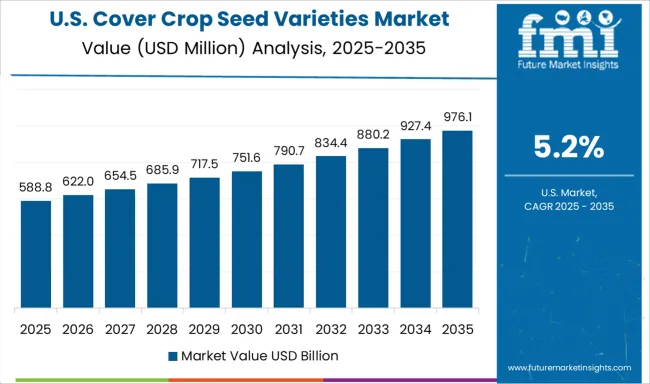

The United States is projected to post a CAGR of 5.2% through 2035, supported by conservation programs and demand for erosion control in large-scale farming systems. Farmers in Midwest states are adopting cover crops such as cereal rye and crimson clover to improve soil health between corn and soybean rotations. The growing interest in carbon credit programs and regenerative farming is encouraging producers to incorporate cover cropping in their sustainability strategies. Seed companies are investing in seed treatment and precision planting compatibility to maximize yields in variable climate conditions. Government cost-sharing initiatives under conservation programs further boost market growth.

The cover crop seed varieties market is competitive, with leading players such as Beck's Hybrids, Barenbrug USA, Grassland Oregon, Blue River Organic Seed, PGG Wrightson Seeds, DLF Seeds, and Albert Lea Seed shaping market dynamics. Beck's Hybrids dominates by offering region-specific cover crop solutions designed for soil health improvement and nutrient retention. Barenbrug USA leverages its extensive research in forage and turf grasses to provide innovative mixes that enhance erosion control and soil structure. Grassland Oregon focuses on developing high-performance legumes and brassicas to meet diverse agronomic requirements, including nitrogen fixation and weed suppression.

Blue River Organic Seed specializes in organic-certified cover crop seeds, appealing to the growing demand for regenerative farming practices. PGG Wrightson Seeds and DLF Seeds emphasize global distribution networks and advanced breeding programs to deliver resilient, multi-purpose cover crops suitable for varied climatic conditions. Albert Lea Seed stands out with customized cover crop blends targeting both organic and conventional farming systems. Competitive differentiation is driven by seed adaptability, germination rates, and added benefits such as pest resistance and moisture retention. Entry barriers are moderate, with regulatory compliance for seed quality and strong distribution channels playing critical roles. Strategic initiatives include partnerships with ag-tech firms, development of multi-species seed mixes, and integration of precision farming tools to optimize cover crop performance.

Breeders are developing hybrid and region-specific seed varieties offering improved nitrogen fixation, deep-root biomass, and resistance to pests and drought. Companies prioritize multi-species mixes and rotational planting guidance to maximize soil benefits and yield potential. Data-driven partnerships with agtech firms support precision planting recommendations and performance tracking. Packaging innovations such as pre-measured, easy-drill seed blends improve on-field usability. Collaboration with sustainable agriculture initiatives, seed distributors, and extension services further boosts adoption. These strategies drive resilience, higher margins, and more sustainable crop systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Crop Type | Grasses, Legumes, Brassicas, and Other cover crops |

| Application | Soil health improvement, Erosion control and soil conservation, Nutrient management and nitrogen fixation, Weed suppression and management, Carbon sequestration and climate benefits, Livestock forage and grazing, and Biodiversity enhancement and habitat creation |

| End Use System | Corn-soybean rotation systems, Cotton production systems, Vegetable and specialty crop systems, Organic farming operations, Livestock integration systems, Conservation reserve program apps, and Other cropping systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Beck's Hybrids, Barenbrug USA, Grassland Oregon, Blue River Organic Seed, PGG Wrightson Seeds, DLF Seeds, and Albert Lea Seed |

| Additional Attributes | Dollar sales by crop type (legumes, grasses, brassicas, multi-species blends) and application (soil health improvement, nitrogen fixation, erosion control, weed suppression), with demand fueled by regenerative agriculture and sustainable soil management practices. Regional dynamics highlight strong adoption in North America and Europe due to government incentive programs and conservation compliance, while Asia-Pacific shows growth driven by climate-resilient farming initiatives. Innovation trends include breeding for drought tolerance, rapid biomass production, and compatibility with no-till farming systems to maximize soil health benefits. |

The global cover crop seed varieties market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the cover crop seed varieties market is projected to reach USD 2.1 billion by 2035.

The cover crop seed varieties market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in cover crop seed varieties market are grasses, _cereal rye, _oats, _winter wheat, _barley, _triticale, _annual ryegrass, _other grass varieties, legumes, _crimson clover, _red clover, _hairy vetch, _austrian winter pea, _other legume varieties, brassicas, _daikon radish, _mustard varieties, _turnips, _other brassica varieties, other cover crops, _buckwheat, _sunflower, _phacelia and _mixed species blends.

In terms of application, soil health improvement segment to command 28.0% share in the cover crop seed varieties market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cover Caps Market Size and Share Forecast Outlook 2025 to 2035

Cover Crop Seed Mixes Market Size and Share Forecast Outlook 2025 to 2035

Recovered Paper Market

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Car Cover Industry

AI-Driven eDiscovery – Enhancing Legal & Compliance Operations

eDiscovery solution Market

Wall Covering Product Market Forecast and Outlook 2025 to 2035

Slip Cover Cans Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Wall Covering Product Manufacturers

Dust Covers Market

Spray Covers Market Size and Share Forecast Outlook 2025 to 2035

Brush Cover Market Size and Share Forecast Outlook 2025 to 2035

Stove Cover Market

Valve Cover Gasket Market

Heat Recovery System Generator Market Size and Share Forecast Outlook 2025 to 2035

Window Coverings Market – Trends, Growth & Forecast 2025 to 2035

Heat Recovery Steam Generator Market Growth – Trends & Forecast 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA