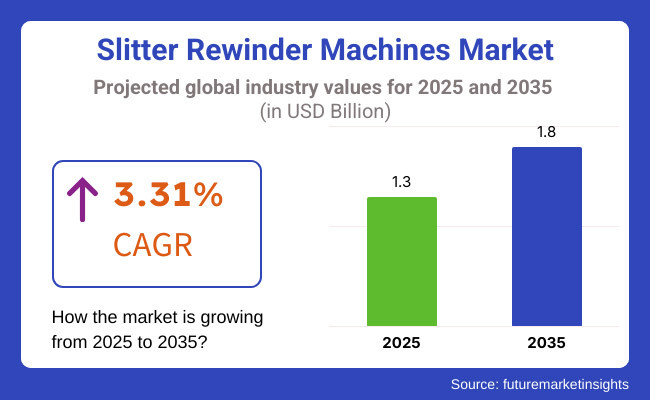

The slitter rewinder machines market is anticipated to reach USD 1.3 billion in 2025. It is expected to grow at a CAGR of 3.31% during the forecast period and reach a value of USD 1.8 billion in 2035. The slitter rewinder machines market is experiencing steady growth owing to rising demand across different industries such as packaging, paper, film, and flexible materials.

Slitter rewinder machines are essential for converting large rolls into smaller, customized sizes with precision and efficiency. The rising need for automation, high-speed production, and sustainability in material processing is expected to drive market expansion over the next decade.

Market development is also driven by improvements in cutting accuracy, enhanced safety features, and automation in slitter rewinder machine manufacturing. With the transitional development of the flexible packaging and labeling industries, coupled with the rising investments in AI-integrated quality control systems, market development stands to gain. On the other hand, the application of IoT and smart monitoring technologies are leading to better operational efficiency and production optimization.

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Early focus on reducing material waste. | Tighter global regulations requiring sustainable material processing technologies. |

| Evolution of energy-saving slitting machines. | Growing adoption of AI-based, high-speed, and precision slitting technologies. |

| Widely used in packaging, labels, and flexible films. | Increased use in pharmaceutical, electronics, and premium industrial applications. |

| Dominance by major machine makers. | Expansion of new automation-focused startups and eco-focused companies. |

| Expansion fueled by demand for flexible packaging options. | Market growth driven by automation, AI integration, and smart manufacturing. |

| Early adoption of sustainable slitting options. | Massive shift towards energy-efficient, low-waste, and circular economy-based processing. |

| Restricted use of AI in machine monitoring. | AI-based predictive analytics, automated inspection for defects, and real-time monitoring of processes. |

| Basic improvements in cutting accuracy. | Development of servo-controlled, IoT-based, and cloud-integrated slitting solutions. |

In between 2020 and 2024, the fluctuations were steady, taking upward trends yet again, and would promise growth in the future with increased demand from consumers from the packaging and labeling sectors and flexible materials industries. Added to this were the real challenges that supply chain disruptions, among other frequent variable costs, made to manufacturers.

There was also investment growth relative to research performance improvement on cutting precision, automation, and sustainability. This was seen within the context of growing concern about material waste that motivated regulatory bodies to encourage energy-efficient and recyclable processing solutions. Moreover, advancements towards automation technologies also favor more productive efficiencies under slitter rewinder machine production processes.

Eventually, the market will grow through innovations in high-speed slitting, AI defect detection, and IoT-based real-time monitoring. Moreover, integration of AI towards predictive maintenance and high-precision slitting systems will also enhance the competitiveness of the market.

Furthermore, increased demand for high-speed, high-volume processing in flexible packaging and labeling will open other avenues for growth. The focus of companies is on improving energy efficiency, system automation, and recyclability of materials through connected production systems. Intelligent cutting solutions with remote monitoring and cloud-based analytics are expected to witness significant momentum in the upcoming years.

Challenges

High Initial Investment Costs

The adoption of advanced automated slitter rewinder machines requires substantial capital investment, making it difficult for small and mid-sized manufacturers to compete. The high costs of precision engineering, automation features, and maintenance add to the financial burden, often limiting access to cutting-edge technology and slowing market penetration.

Regulatory Compliance and Environmental Concerns

Stringent sustainability regulations are pushing manufacturers to develop energy-efficient and waste-reducing slitter rewinder machines. Compliance with environmental standards demands continuous innovation in material handling and recycling capabilities. Companies are investing in advanced cutting mechanisms and automation to minimize scrap generation and enhance resource efficiency while maintaining regulatory adherence.

Opportunities

Expansion in Sustainable and High-Precision Slitting Solutions

The rising demand for eco-friendly material processing is creating new growth opportunities for slitter rewinder machine manufacturers. Companies are focusing on developing high-precision slitting solutions that minimize material waste and improve efficiency. Sustainable innovations, such as energy-efficient motors and recyclable material compatibility, are gaining traction in the market.

Advancements in AI-Integrated Automation and IoT Connectivity

AI-driven automation and IoT-enabled monitoring are revolutionizing the market. Real-time defect detection, predictive maintenance, and data-driven process optimization enhance production efficiency and reduce downtime. These advancements improve quality control while enabling manufacturers to meet evolving industry standards and customer demands for smart, automated solutions.

Three basic types of winders drive the market. These are a center winder, a surface winder, and a combined type, center-surface winder. Each of these machines would cater to their specifications on the different types of material processing them. Center winders are primarily used for high-tension processing materials such as films, foils, and laminates, serving uniformity of winding and accurate slitting, specifically for industrial applications.

Preferably, it is used for very gentle treatment and faster operation of low-tension soft materials such as paper, nonwovens, and tissues. Center-surface winders combine both types of machines. They are most suitable in versatile applications where controlled tension is applicable. This capability will be useful in handling a wide variety of materials, such as in packaging, printing, or flexible material industries.

The market is segmented by maximum operating speed, catering to diverse industrial requirements. Machines operating below 300 m/min are widely used in small-scale packaging, label production, and specialty materials, where precision and controlled processing is crucial over high-speed output.

For mid to high-speed operations (300-800 m/min), slitter rewinders are essential in the flexible packaging, paper, and film industries, ensuring efficient and high-volume processing. Machines above 800 m/min are favored in large-scale industrial applications, where rapid production, minimal downtime, and enhanced automation drive productivity in sectors like printing, laminates, and industrial films.

The key substrates include paper, plastic, metals, and textiles. Paper-based slitter rewinders are essential equipment for converting efficiency in packaging, publishing, and label manufacturing where precision cutting and high-speed processing are required during roll conversion.

Plastic and metal slitting rewinders are important equipment in flexible packaging, foil, and industrial film manufacture, providing accurate tension control and edge finishing. Slitter rewinders for textiles can deliver straight cuts and manage rolls of different types of fabrics, ensuring uninterrupted processing for apparel, upholstery, and technical textiles. They are very easily adaptable to high-volume applications in materials processing industries.

Asia-Pacific is expected to dominate the market, driven by rapid industrialization, increasing demand for flexible packaging, and growing regulatory measures promoting sustainability. Countries such as China, India, and Japan are witnessing strong demand for slitter rewinder machines, particularly in the film, paper, and packaging sectors.

The region's market growth is further supported by innovations in automated, high-speed slitting technology and precision cutting systems. Additionally, government policies promoting manufacturing efficiency and waste reduction are encouraging manufacturers to invest in energy-efficient and recyclable slitting solutions. The increasing presence of global machine manufacturers in Asia-Pacific is also boosting local production capabilities. Furthermore, research and development in AI-powered slitting accuracy and predictive maintenance systems are expected to create new growth opportunities in the region.

North America remains a key market for slitter rewinder machines due to strong demand from the flexible packaging, printing, and labeling industries. The USA and Canada are leading the region with technological advancements in precision cutting, automation, and sustainable material processing. Additionally, increasing investment in smart manufacturing and AI-driven defect detection systems is driving efficiency and reducing operational costs in the industry.

The adoption of digital printing and sustainable packaging solutions is gaining traction, influenced by government regulations promoting recyclable packaging and corporate sustainability initiatives. Increasing investments in research and development for high-speed, multi-functional slitting machines are further propelling market growth. Additionally, the rise in demand for compact, energy-efficient machines in small- to mid-sized manufacturing operations is driving product innovation.

Many companies in North America are also focusing on integrating IoT-enabled monitoring systems for real-time quality control. Innovations in servo-driven slitting technology for enhanced precision and lower material waste are expected to further shape the market in the coming years.

Europe holds a significant share of the market, driven by stringent environmental regulations, increasing adoption of circular economy initiatives, and the high demand for advanced material processing technologies. Leading economies such as Germany, France, and the UK are at the forefront of technological advancements in recyclable materials and precision slitting systems.

Additionally, investments in advanced automation techniques are further enhancing the efficiency of slitter rewinder machine manufacturing. The development of closed-loop waste management systems is also accelerating the shift toward sustainable material processing in the region.

Stringent policies promoting energy-efficient manufacturing and sustainable materials are shaping the future of the market. Furthermore, increasing consumer awareness and demand for high-performance, low-waste material processing solutions are expected to contribute to long-term market growth.

The region is also witnessing an increasing number of collaborations between machine manufacturers and sustainability-focused organizations to develop innovative solutions. Research institutions across Europe are investing in next-generation equipment with enhanced speed, automation, and IoT-enabled monitoring systems. These advancements are expected to enhance overall efficiency and adoption across various industries.

| Countries | CAGR |

|---|---|

| USA | 5.3% |

| UK | 4.9% |

| Japan | 4.7% |

| South Korea | 5.1% |

The USA leads the market, driven by growing demand for high-speed, precision-cutting, and cost-effective solutions across industries such as packaging, paper, film, and flexible materials. The need for efficient, automated, and multi-functional equipment has encouraged manufacturers to develop advanced models with improved web tension control, laser-guided slitting, and waste reduction capabilities. Government regulations promoting sustainable and recyclable packaging materials are pushing companies to adopt eco-friendly and energy-efficient processing solutions.

Moreover, advancements in servo-driven, modular, and AI-integrated systems are improving operational efficiency and production flexibility. Businesses are also exploring Industry 4.0-enabled machines with real-time monitoring, predictive maintenance, and automated quality control. Furthermore, the increasing adoption of these technologies in flexible packaging, label manufacturing, and specialty films is driving innovation in high-precision, user-friendly, and durable cutting solutions.

The UK is expanding as businesses prioritize sustainability, regulatory compliance, and automation in packaging and label production. The rising demand for high-speed, digitally controlled, and waste-reducing slitting solutions has led to increased adoption across multiple sectors, including flexible packaging, specialty paper, and medical films. Government initiatives promoting energy efficiency and circular economy practices are further motivating companies to integrate high-precision and recyclable materials into slitting operations.

Innovations in dual-shaft, turret, and compact slitter rewinders are also making these solutions more attractive for small and medium-sized enterprises. Companies are also exploring smart sensor-based slitting systems and robotic-assisted material handling to enhance accuracy and reduce downtime. Furthermore, the shift toward automation in industrial finishing and label converting is increasing the demand for high-performance in the UK market.

Japan is growing steadily due to the increasing need for precision engineering, high-speed processing, and sustainable material handling solutions in industries such as electronics, flexible films, and adhesive tapes. Companies are developing slitter rewinders with ultra-precise blade adjustments, servo-driven controls, and non-contact web guiding systems to improve production quality and minimize waste. With strict regulations on energy efficiency and material optimization, businesses are transitioning toward fully automated, high-yield slitting machines with minimal scrap rates.

Advancements in compact, high-speed slitter rewinders for specialty materials such as optical films and lithium-ion battery separators are driving demand in high-tech applications. Businesses are also investing in AI-integrated defect detection and robotic-assisted roll changeovers to enhance automation and reduce manual intervention. Furthermore, the rise of high-performance packaging and digital printing industries in Japan is fueling demand for high-speed, technologically advanced slitter rewinders.

South Korea is experiencing significant growth due to increased demand for highly automated, energy-efficient, and compact slitting solutions in flexible packaging, printing, and industrial film applications. The need for precision slitting with high repeatability has led manufacturers to develop machines with improved roll handling, automated tension control, and real-time quality inspection. Government regulations promoting sustainable manufacturing and waste reduction further support market expansion.

In addition, businesses are integrating IoT-enabled slitter rewinders with cloud-based data analysis to optimize performance and minimize downtime. The growing demand for digitally printed labels, flexible food packaging, and ultra-thin film processing is further boosting adoption. Moreover, research into non-contact slitting, laser cutting, and friction-free web handling is helping businesses develop innovative solutions tailored to high-speed, delicate, and specialized material processing.

The slitter rewinder machines industry is fragmented, with numerous companies competing globally. This competitive landscape fosters innovation and diverse product offerings, benefiting various sectors such as packaging, printing, and labeling. Companies continually strive to enhance machine efficiency and precision to meet the evolving demands of these industries.

Despite being industry leaders like Atlas Converting Equipment, Kampf, GOEBEL IMS, and others, who put innovative technology advancement in slitter rewinders, most have also invested in research and development aimed at developing high-speed and high-technology slitter rewinders to meet the demands of flexible packaging and labeling sectors. Their commitment to developing their capacities in innovation strengthens their positions in the market.

Midsized companies such as ASHE Converting Equipment and Euromac Costruzioni Meccaniche customize their products to specific materials (e.g., paper, plastic, and metal foils) thereby allowing them to survive in the competitive market. This agility in addressing niche market needs gives them a competitive advantage.

New entrants focus on automating their devices and using digital technology because of the importance of using things like self-positioning knives and web guiding systems. It also offers benefits to customers who insist on economical yet advanced technology, thus making the industry more dynamic.

Even though the industry remains fractured, it can at least be said that competition in the field significantly leads to increasing improvements. All manufacturers, from small to large, are working on energy-efficient machines and eco-friendly materials to meet international environmental standards. As demand for sustainable production processes grows, the industry is keeping pace with these requirements.

The slitter rewinder machines market is expanding due to increasing demand in paper, packaging, and industrial applications. These industries require efficient and high-performance cutting solutions to enhance productivity and reduce material waste. The need for precision, speed, and adaptability in slitting operations is driving manufacturers to develop advanced machinery.

Technological advancements are transforming the market, with innovations such as servo-driven automation, real-time defect monitoring, and non-contact cutting solutions improving efficiency and quality. These developments address sustainability concerns by minimizing material loss and enhancing precision. As industries move toward smarter manufacturing, integrating automation into processing equipment is becoming a key focus.

AI-driven predictive maintenance and machine learning-assisted precision are shaping market trends, ensuring optimal machine performance and reducing downtime. Smart sensors and data analytics help manufacturers predict mechanical failures before they occur, improving operational efficiency. These technologies enable companies to optimize production, reduce maintenance costs, and enhance overall equipment lifespan.

Sustainability and energy efficiency are becoming central to market growth. Companies are investing in hybrid slitter rewinder solutions that combine precision cutting with energy-saving mechanisms. Collaborations between machine manufacturers and flexible packaging companies are fostering the development of customized solutions tailored to specific industrial needs, ensuring higher productivity and sustainable operations.

| Company Name | Estimated Market Share (%) |

|---|---|

| Kampf Schneid- und Wickeltechnik GmbH | 12-16% |

| Atlas Converting Equipment Ltd. | 8-12% |

| GOEBEL Schneid- und Wickelsysteme GmbH | 6-10% |

| ASHE Converting Equipment | 4-8% |

| Parkinson Technologies Inc. | 3-7% |

| Other Companies (combined) | 45-55% |

By machine type, the market is segmented into center winder, surface winder, and center-surface winder.

Based on the maximum operating speed, the market is categorized into less than 300 m/min, 300 to 600 m/min, 601 to 800 m/min, and above 800 m/min.

According to substrate, the industry is categorized into paper, plastic, metal, and textile.

Region-wise, the industry studied across North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The overall market size for the market is USD 1.3 billion in 2025.

The market is expected to reach USD 1.8 billion in 2035.

The market will be driven by increasing demand from packaging, paper, and film processing industries. Innovations in automation, AI-based defect detection, and energy-efficient slitting solutions will further propel market expansion.

Key challenges include high initial investment costs, the need for skilled labor to operate and maintain advanced systems, and fluctuating raw material prices affecting machine affordability. However, ongoing advancements in predictive maintenance, AI-driven automation, and cost-efficient machine designs are mitigating these concerns.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Machine Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Machine Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Maximum Operating Speed, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Maximum Operating Speed, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Substrate, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by Substrate, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Machine Type, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Machine Type, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Maximum Operating Speed, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Maximum Operating Speed, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Substrate, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by Substrate, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Machine Type, 2017 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Machine Type, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Maximum Operating Speed, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Maximum Operating Speed, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Substrate, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Substrate, 2017 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Machine Type, 2017 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Machine Type, 2017 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Maximum Operating Speed, 2017 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Maximum Operating Speed, 2017 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Substrate, 2017 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Substrate, 2017 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Machine Type, 2017 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Machine Type, 2017 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Maximum Operating Speed, 2017 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Maximum Operating Speed, 2017 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Substrate, 2017 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Substrate, 2017 to 2033

Table 41: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Machine Type, 2017 to 2033

Table 44: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Machine Type, 2017 to 2033

Table 45: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Maximum Operating Speed, 2017 to 2033

Table 46: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Maximum Operating Speed, 2017 to 2033

Table 47: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Substrate, 2017 to 2033

Table 48: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Substrate, 2017 to 2033

Table 49: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 51: Japan Market Value (US$ Million) Forecast by Machine Type, 2017 to 2033

Table 52: Japan Market Volume (Units) Forecast by Machine Type, 2017 to 2033

Table 53: Japan Market Value (US$ Million) Forecast by Maximum Operating Speed, 2017 to 2033

Table 54: Japan Market Volume (Units) Forecast by Maximum Operating Speed, 2017 to 2033

Table 55: Japan Market Value (US$ Million) Forecast by Substrate, 2017 to 2033

Table 56: Japan Market Volume (Units) Forecast by Substrate, 2017 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Machine Type, 2017 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Machine Type, 2017 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Maximum Operating Speed, 2017 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Maximum Operating Speed, 2017 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Substrate, 2017 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Substrate, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Substrate, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Machine Type, 2017 to 2033

Figure 10: Global Market Volume (Units) Analysis by Machine Type, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 14: Global Market Volume (Units) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Substrate, 2017 to 2033

Figure 18: Global Market Volume (Units) Analysis by Substrate, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Substrate, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Substrate, 2023 to 2033

Figure 21: Global Market Attractiveness by Machine Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 23: Global Market Attractiveness by Substrate, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Substrate, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Machine Type, 2017 to 2033

Figure 34: North America Market Volume (Units) Analysis by Machine Type, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 38: North America Market Volume (Units) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Substrate, 2017 to 2033

Figure 42: North America Market Volume (Units) Analysis by Substrate, 2017 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Substrate, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Substrate, 2023 to 2033

Figure 45: North America Market Attractiveness by Machine Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 47: North America Market Attractiveness by Substrate, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Substrate, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Machine Type, 2017 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Machine Type, 2017 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Substrate, 2017 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Substrate, 2017 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Substrate, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Substrate, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Machine Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Substrate, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Substrate, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Machine Type, 2017 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Machine Type, 2017 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Substrate, 2017 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Substrate, 2017 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Substrate, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Substrate, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Substrate, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Substrate, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Machine Type, 2017 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Machine Type, 2017 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Substrate, 2017 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Substrate, 2017 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Substrate, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Substrate, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Substrate, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Excluding Japan Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 122: Asia Pacific Excluding Japan Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 123: Asia Pacific Excluding Japan Market Value (US$ Million) by Substrate, 2023 to 2033

Figure 124: Asia Pacific Excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 127: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Machine Type, 2017 to 2033

Figure 130: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Machine Type, 2017 to 2033

Figure 131: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 132: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 133: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 134: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 135: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 136: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 137: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Substrate, 2017 to 2033

Figure 138: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Substrate, 2017 to 2033

Figure 139: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Substrate, 2023 to 2033

Figure 140: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Substrate, 2023 to 2033

Figure 141: Asia Pacific Excluding Japan Market Attractiveness by Machine Type, 2023 to 2033

Figure 142: Asia Pacific Excluding Japan Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 143: Asia Pacific Excluding Japan Market Attractiveness by Substrate, 2023 to 2033

Figure 144: Asia Pacific Excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 145: Japan Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 146: Japan Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 147: Japan Market Value (US$ Million) by Substrate, 2023 to 2033

Figure 148: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 150: Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 151: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Japan Market Value (US$ Million) Analysis by Machine Type, 2017 to 2033

Figure 154: Japan Market Volume (Units) Analysis by Machine Type, 2017 to 2033

Figure 155: Japan Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 156: Japan Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 157: Japan Market Value (US$ Million) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 158: Japan Market Volume (Units) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 159: Japan Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 160: Japan Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 161: Japan Market Value (US$ Million) Analysis by Substrate, 2017 to 2033

Figure 162: Japan Market Volume (Units) Analysis by Substrate, 2017 to 2033

Figure 163: Japan Market Value Share (%) and BPS Analysis by Substrate, 2023 to 2033

Figure 164: Japan Market Y-o-Y Growth (%) Projections by Substrate, 2023 to 2033

Figure 165: Japan Market Attractiveness by Machine Type, 2023 to 2033

Figure 166: Japan Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 167: Japan Market Attractiveness by Substrate, 2023 to 2033

Figure 168: Japan Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Substrate, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Machine Type, 2017 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Machine Type, 2017 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Maximum Operating Speed, 2017 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Substrate, 2017 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Substrate, 2017 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Substrate, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Substrate, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Machine Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Substrate, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Ice Maker Machines Market

Granulator Machines Market Size and Share Forecast Outlook 2025 to 2035

Laminating Machines Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Machines Market - Size, Share, and Forecast 2025-2035

Nugget Ice Machines Market – Market Innovations & Future Trends 2025 to 2035

Compaction Machines Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA