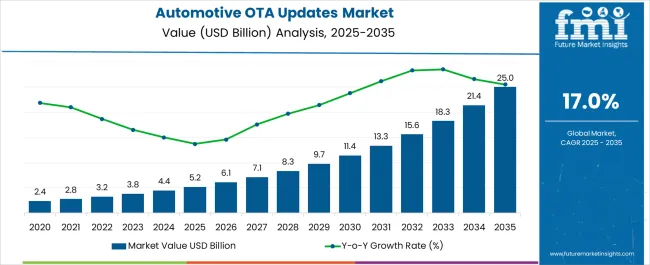

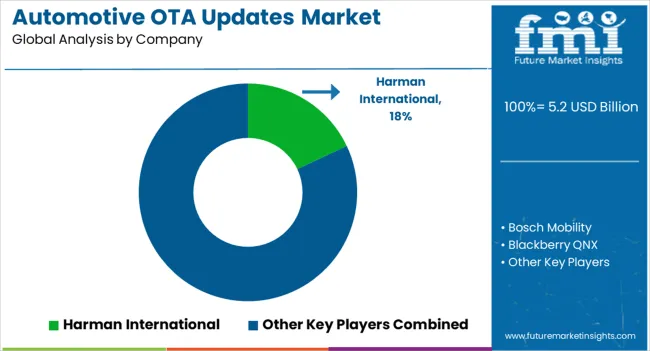

The Automotive Over-The-Air (OTA) Updates Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 25.0 billion by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period. Comparing two 5-year blocks within this decade highlights an acceleration in value addition and market penetration. During the initial half from 2025 to 2030, the market expands from USD 5.2 billion to USD 11.4 billion, registering an absolute gain of USD 6.2 billion.

This growth is driven primarily by early adoption of OTA technology in connected vehicles, advancements in automotive software platforms, and increasing consumer demand for remote updates and cybersecurity features. The second 5-year period from 2030 to 2035 reflects an increase from USD 11.4 billion to USD 25.0 billion, producing an absolute gain of USD 13.6 billion.

This phase is marked by accelerated adoption across electric vehicles and autonomous driving platforms, as well as OEM integration of sophisticated OTA ecosystems for enhanced vehicle performance and maintenance. The value accumulation in the latter half more than doubles the early period, indicating a steepening growth curve.

The acceleration signals growing reliance on wireless software management, improved data infrastructure, and expanding aftermarket solutions, establishing OTA updates as a critical element of vehicle lifecycle management.

| Metric | Value |

|---|---|

| Automotive Over-The-Air (OTA) Updates Market Estimated Value in (2025 E) | USD 5.2 billion |

| Automotive Over-The-Air (OTA) Updates Market Forecast Value in (2035 F) | USD 25.0 billion |

| Forecast CAGR (2025 to 2035) | 17.0% |

The automotive over-the-air (OTA) updates market is gaining momentum as automakers transition to software-defined vehicles and connected car ecosystems. The need to reduce recall costs, improve vehicle performance remotely, and enhance cybersecurity is accelerating the adoption of OTA technologies across both premium and mass-market segments.

Increased integration of electronic control units (ECUs), cloud platforms, and telematics systems has expanded the scope of real-time software management. Automakers and Tier-1 suppliers are collaborating with technology firms to streamline update delivery via secure networks, minimizing dealership visits and enhancing user experience.

The regulatory focus on safety, emissions, and cybersecurity compliance is further driving the uptake of OTA solutions. With EV proliferation and rising demand for in-car infotainment personalization, the OTA market is positioned as a strategic enabler of innovation and post-sale value creation.

The automotive over-the-air (OTA) updates market is segmented by vehicle type, component, application, connectivity, and geographic regions. By vehicle type, the automotive over-the-air (OTA) updates market is divided into Passenger Vehicles and Commercial Vehicles. In terms of the components of the automotive over-the-air (OTA) updates market, it is classified into Software Services. Based on the application of the automotive over-the-air (OTA) updates market, it is segmented into Telematics Control Unit (TCU), Electronic Control Unit (ECU), Infotainment, Safety & Security, and Others. The connectivity of the automotive over-the-air (OTA) updates market is segmented into Cellular (4G/5G), Wi-Fi, Bluetooth, and Satellite. Regionally, the automotive over-the-air (OTA) updates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

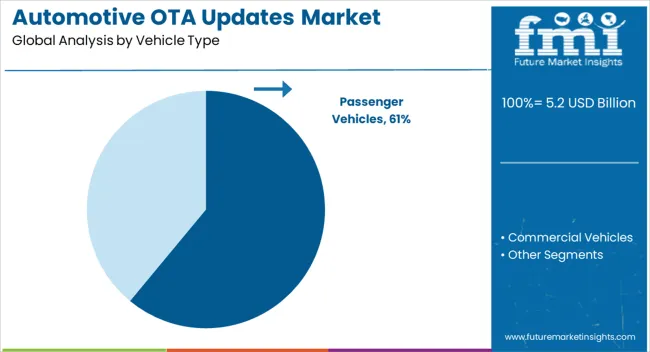

Passenger vehicles are projected to dominate the market with a 61.0% share in 2025.

This growth is driven by the rising number of connected passenger cars, growing consumer expectations for feature updates, and the surge in software-driven services across infotainment, ADAS, and powertrain systems.

Manufacturers are using OTA to deploy improvements faster, reduce maintenance costs, and support seamless user experiences.

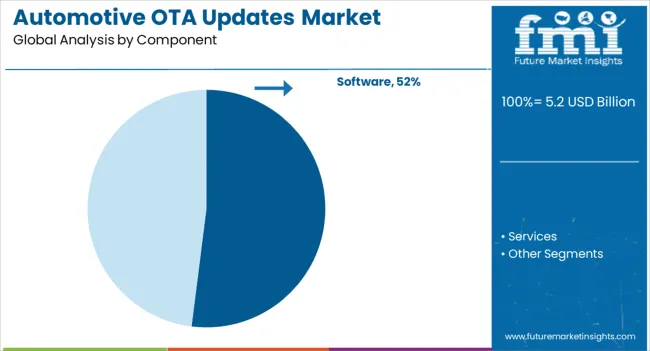

The software segment is expected to account for 52.0% of the OTA updates market by 2025, making it the leading component.

The dominance of software stems from its critical role in delivering functionality enhancements, bug fixes, and feature rollouts across connected systems.

As vehicles increasingly rely on embedded code for operation, software OTA becomes essential for lifecycle management and competitive differentiation.

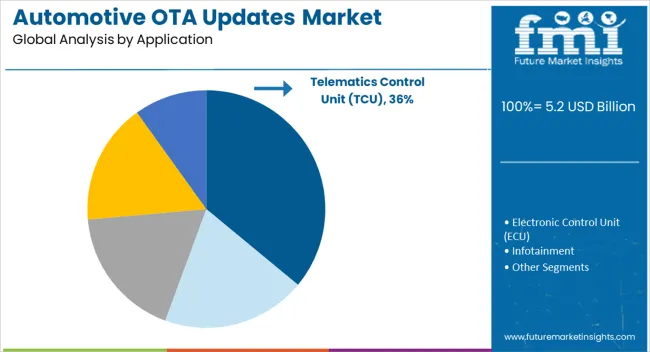

Telematics Control Units (TCUs) are forecast to contribute 36.0% of the market share in 2025, leading the application segment.

TCUs serve as the central communication hub for data transmission and remote update delivery.

Their importance has grown with the expansion of V2X communication, predictive diagnostics, and location-based services, solidifying their role in enabling secure and reliable OTA functions.

The automotive OTA updates market is expanding due to increased adoption of connected vehicles and software-defined architectures. Over 70% of new vehicles globally have OTA capabilities, enabling remote feature upgrades, bug fixes, and cybersecurity patches without dealer visits. Growth in electric vehicles and advanced driver assistance systems (ADAS) boosts OTA deployment. Network enhancements including 5G support improve update speed and reliability. OEMs leverage OTA to reduce recall costs and enhance customer experience. Demand is rising in both passenger and commercial segments for seamless software management, positioning OTA as a core vehicle lifecycle component.

Connected vehicle platforms serve as the primary driver, with nearly all new models integrating telematics control units capable of OTA updates. OTA allows real-time delivery of firmware and software upgrades across infotainment, navigation, and safety systems. The growth of electric vehicles and autonomous features increases dependency on remote updates to maintain system accuracy and security. Enhanced network connectivity via 5G facilitates rapid, stable transmissions, expanding OTA use cases. This reduces service downtime and eliminates physical recall logistics, creating operational efficiency for manufacturers and improved user satisfaction for drivers.

OTA systems are evolving with advances in firmware over-the-air (FOTA) and software over-the-air (SOTA) updates, which currently make up approximately 60% and 40% of OTA traffic respectively. Integration of telematics units and electronic control units (ECUs) across vehicle subsystems requires robust edge-computing and AI-driven predictive maintenance capabilities. Network slicing and low-latency 5G enable secure, faster, and continuous updates. This complexity demands scalable OTA platforms capable of handling diverse vehicle architectures and layered security measures, essential to protect against cyber threats and maintain regulatory compliance.

The rollout of OTA updates faces challenges from cybersecurity risks and stringent regulatory frameworks. Compliance with vehicle safety and data protection regulations requires secure update mechanisms that include rollback capability and threat monitoring. Legacy vehicles without standardized communication protocols face integration difficulties, limiting OTA applicability in older fleets. Consumer data privacy and varying regional compliance requirements add complexity. Fragmentation in network band support and the need for certification of update processes contribute to deployment delays. These factors restrict universal adoption despite the clear operational benefits.

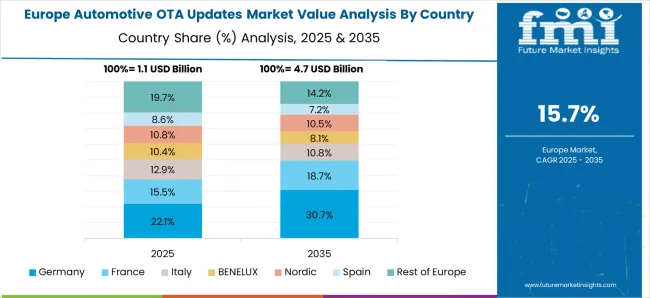

North America leads OTA adoption with an estimated 35–40% market share due to advanced infrastructure and regulatory support. Europe follows with 25–30%, supported by strong emission regulations and automotive innovation. Asia-Pacific is the fastest-growing region, driven by large vehicle markets in China, Japan, and South Korea adopting OTA in new electric and autonomous vehicles. Commercial fleets, ride-share, and logistics sectors are increasingly incorporating OTA for remote diagnostics and updates. Internal combustion engine vehicles are also adopting OTA, mainly for safety and emissions updates, increasing overall market penetration across vehicle types and geographies.

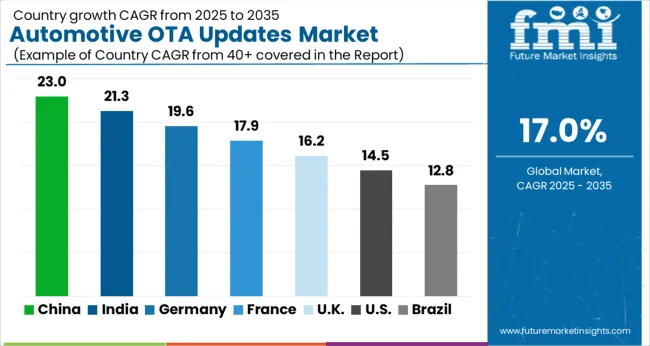

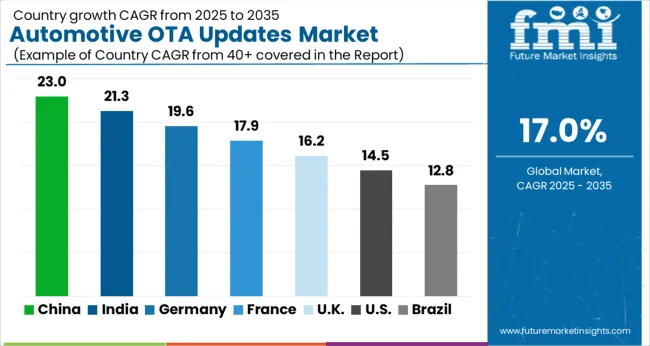

| Country | CAGR |

|---|---|

| China | 23.0% |

| India | 21.3% |

| Germany | 19.6% |

| France | 17.9% |

| UK | 16.2% |

| USA | 14.5% |

| Brazil | 12.8% |

The global automotive over the air (OTA) updates market is expected to expand at a CAGR of 17% from 2025 to 2035. China is projected to lead growth at 23%, followed by India at 21.3% and France at 17.9%. The United Kingdom and the United States are expected to grow at 16.2% and 14.5% respectively. OTA systems are gaining traction due to their cost-efficiency in software management, reduced recall rates, and improved user experience across EV and connected car platforms. Automakers are leveraging cloud connectivity and modular architecture to deliver real-time performance enhancements, cybersecurity patches, and infotainment updates across markets experiencing accelerated electrification and digital adoption.

China is forecast to witness a CAGR of 23% in automotive OTA updates from 2025 to 2035. Surge in EV penetration and government mandates on software-defined vehicles have influenced the expansion of OTA capabilities. Automakers such as BYD and NIO are deploying full-stack OTA architecture for chassis, ADAS, and infotainment updates across premium and mass-market models. Telecom carriers have collaborated with OEMs to enhance 5G V2X connectivity in urban testing zones. OEM-driven OTA capabilities are being integrated into 70% of new electric vehicles manufactured domestically. Edge computing installations in Beijing and Shanghai support real-time update deployment at scale.

India is projected to grow at a CAGR of 21.3% during the forecast period. Rising digital consumer expectations and telematics integration in new vehicle models are driving OTA adoption. Automakers including Tata Motors and Mahindra have expanded in-house OTA platforms to offer updates across powertrain, entertainment, and diagnostic systems. The rising share of connected vehicle variants across premium hatchbacks and entry-level SUVs has boosted adoption. 4G and 5G rollouts across metro cities support real-time update capability. OTA systems are being bundled with extended warranty plans and connected mobility subscriptions to increase adoption in Tier 1 and Tier 2 cities.

France is expected to register a CAGR of 17.9% from 2025 to 2035 in the automotive OTA updates market. Domestic manufacturers such as Renault and PSA Group are scaling software-defined architectures allowing seamless OTA integration. Government-led automotive digitization roadmaps have incentivized local cloud and cybersecurity infrastructure development. OTA services are expanding beyond infotainment to include powertrain control units and battery thermal management. Regional component manufacturers have aligned with OEMs to ensure ECU compatibility across models. The growing EV charging network and increased remote diagnostics adoption are further accelerating demand for OTA capabilities.

The United Kingdom is forecast to grow at a CAGR of 16.2% through 2035. The expansion of connected vehicle services and electric mobility platforms has driven the adoption of OTA technologies across automotive OEMs and fleet operators. Jaguar Land Rover and EV startups are increasingly implementing OTA updates for real-time calibration and cybersecurity updates. The country’s V2X innovation hubs in Midlands and Cambridge have supported pilot deployment of autonomous OTA modules. 5G-enabled vehicle testbeds funded by public-private partnerships have improved over-the-air service latency and bandwidth across different weather and topographic conditions.

The United States is expected to expand at a CAGR of 14.5% between 2025 and 2035. High growth is driven by premium OEM deployment of multi-domain OTA architecture, covering infotainment, driver assistance, and climate control modules. Tesla, GM, and Ford have scaled proprietary OTA platforms across sedan, pickup, and SUV models. OTA functionality is being integrated with customer mobile apps and fleet monitoring dashboards. Regulatory alignment around vehicle cybersecurity and telematics integration has supported ecosystem maturity. Automotive software vendors are building modular OTA stacks that enable scalable update strategies for large fleets.

Automakers such as Tesla, BMW, Mercedes-Benz, and Volkswagen have pioneered OTA adoption by embedding connectivity platforms that allow vehicles to receive firmware, infotainment, and even performance updates remotely, turning cars into continuously evolving digital products. Tesla set the early benchmark by deploying OTA for both convenience features and safety-critical functions, while premium brands such as BMW and Mercedes-Benz have positioned OTA as part of their digital service ecosystems, linking updates with subscription-based features and personalization.

Tier-1 suppliers including Continental, Bosch, and Aptiv compete by providing modular OTA platforms that integrate cybersecurity, cloud connectivity, and ECU management into vehicle electronics. Their strategies focus on scalability, enabling automakers to extend OTA capabilities from infotainment units to dozens of control modules across the vehicle. Harman, owned by Samsung, leverages its expertise in connected infotainment to deliver end-to-end OTA frameworks, emphasizing seamless user experience, media updates, and integration with mobile ecosystems. Semiconductor and connectivity providers such as Qualcomm and Intel support this ecosystem by embedding secure communication protocols and processing capabilities directly into chipsets, reinforcing the hardware backbone of OTA solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Vehicle Type | Passenger Vehicles and Commercial Vehicles |

| Component | Software and Services |

| Application | Telematics Control Unit (TCU), Electronic Control Unit (ECU), Infotainment, Safety & Security, and Others |

| Connectivity | Cellular (4G/5G), Wi-Fi, Bluetooth, and Satellite |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Harman International, Bosch Mobility, Blackberry QNX, Infineon Technologies, Thales, Digi International, and NXP Semiconductor |

| Additional Attributes | Dollar sales by vehicle segment and OTA service type, demand dynamics across OEM fleets and aftermarket, regional trends in North America and Asia-Pacific adoption, innovation in secure firmware delivery and edge AI, environmental impact via lifecycle software updates, and emerging use cases in connected EVs and autonomous updates. |

The global automotive over-the-air (OTA) updates market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the automotive over-the-air (OTA) updates market is projected to reach USD 25.0 billion by 2035.

The automotive over-the-air (OTA) updates market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in automotive over-the-air (OTA) updates market are passenger vehicles, commercial vehicles, _light commercial vehicles and _heavy commercial vehicles.

In terms of component, software segment to command 52.0% share in the automotive over-the-air (OTA) updates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA