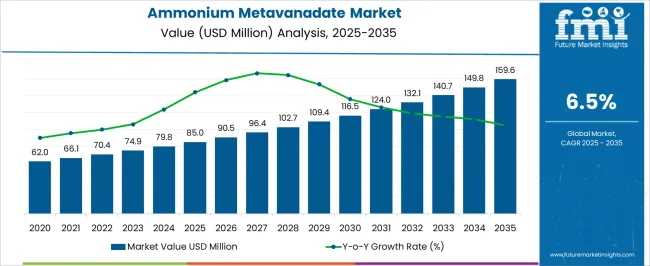

The ammonium metavanadate market is projected to grow at a compound annual growth rate (CAGR) of 6.5% from USD 62.0 million in 2020 to USD 159.6 million by 2035. This steady growth trajectory reflects increased demand for ammonium metavanadate in various industries such as electronics, metallurgy, and energy storage systems. Between 2020 and 2025, the market experiences gradual growth, expanding from USD 62.0 million to USD 85 million. This initial phase is driven by rising applications in the manufacturing of specialty alloys, catalysts, and lithium-ion battery production, which benefits from the growing demand for energy-efficient solutions and sustainable technologies. From 2026 to 2030, the market further accelerates, reaching USD 102.7 million by 2030, with advancements in production methods and increased industrial applications across emerging markets contributing to the growth. The growing interest in electric vehicles (EVs), where ammonium metavanadate plays a crucial role in battery development, propels this growth. Between 2031 and 2035, the market continues to expand at a faster pace, reaching USD 159.6 million, supported by technological innovations and expanding applications in energy storage and high-performance materials.The ammonium metavanadate market is positioned for sustained growth driven by increasing demand in energy storage technologies, industrial applications, and the ongoing push for sustainable and efficient materials across multiple industries. The market's CAGR of 6.5% reflects its robust and consistent expansion through 2035.

| Metric | Value |

|---|---|

| Ammonium Metavanadate Market Estimated Value in (2025 E) | USD 85.0 million |

| Ammonium Metavanadate Market Forecast Value in (2035 F) | USD 159.6 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The ammonium metavanadate market is witnessing consistent growth, supported by its critical role as a precursor in producing vanadium-based compounds and catalysts for various industrial processes. Rising demand from the steel, chemical, and energy sectors is significantly influencing market expansion, as the compound is extensively utilized in alloy production, pollution control catalysts, and specialty chemicals. Technological advancements in production processes have improved purity levels and yield rates, making high-quality ammonium metavanadate more accessible for specialized applications.

Environmental regulations aimed at reducing emissions are encouraging the use of vanadium-based catalysts in industries such as petrochemicals and power generation. Furthermore, the growing focus on renewable energy and energy storage technologies, particularly in vanadium redox flow batteries, is opening new avenues for demand.

Expanding industrialization in emerging economies and increased investment in advanced materials research are expected to drive long-term market growth As applications diversify and quality requirements rise, producers are focusing on capacity expansion and developing high-purity grades to cater to evolving end-user needs across global markets.

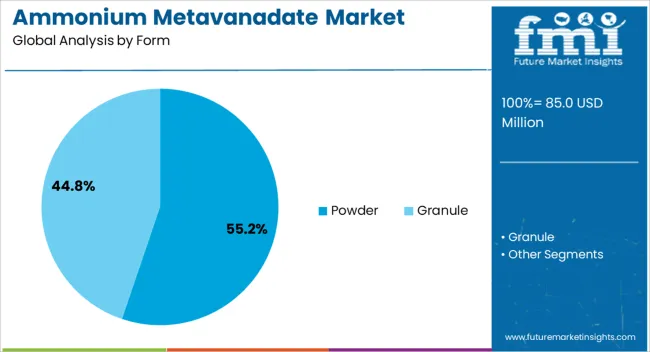

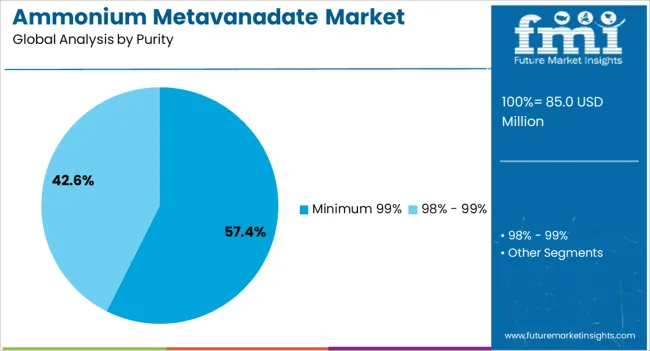

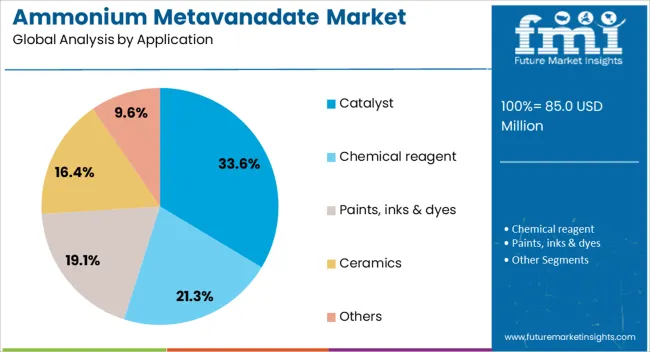

The ammonium metavanadate market is segmented by form, purity, application, and geographic regions. By form, ammonium metavanadate market is divided into Powder and Granule. In terms of purity, ammonium metavanadate market is classified into Minimum 99% and 98% - 99%. Based on application, ammonium metavanadate market is segmented into Catalyst, Chemical reagent, Paints, inks & dyes, Ceramics, and Others. Regionally, the ammonium metavanadate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder form segment is projected to hold 55.2% of the ammonium metavanadate market revenue share in 2025, making it the leading form type. This dominance is being driven by the powder’s versatility, ease of handling, and suitability for a wide range of industrial processes. Powdered ammonium metavanadate offers a higher surface area, improving reactivity and enabling efficient processing in catalyst manufacturing, metallurgy, and pigment production.

Its compatibility with high-purity refinement processes makes it the preferred choice for applications that require stringent quality control. The segment’s growth is also supported by its cost-effectiveness in large-scale operations, where uniform particle size and consistent composition are crucial for process optimization.

Additionally, powdered forms allow for precise dosing and blending in chemical formulations, further enhancing their industrial utility The adaptability of powder form in both high-volume manufacturing and specialized niche applications ensures its continued leadership in the market as industries increasingly seek efficient and consistent raw materials for advanced production needs.

The minimum 99% purity segment is expected to account for 57.4% of the ammonium metavanadate market revenue share in 2025, positioning it as the leading purity grade. This dominance is primarily due to the growing demand for high-purity materials in advanced industrial and energy applications, where impurities can significantly impact product performance and quality.

High-purity ammonium metavanadate is essential for producing vanadium catalysts, specialty alloys, and high-performance energy storage systems, ensuring superior efficiency and durability. The segment benefits from stricter industry regulations and standards that require consistent material quality, particularly in environmental and energy-related applications.

Technological advancements in purification processes have made it possible to achieve such purity levels at competitive costs, enabling broader adoption across industries The ability of minimum 99% purity grades to deliver reliable performance in demanding applications is reinforcing their preference among manufacturers, further supported by ongoing growth in sectors such as renewable energy, advanced metallurgy, and high-specification chemical synthesis.

The catalyst application segment is projected to hold 33.6% of the ammonium metavanadate market revenue share in 2025, establishing itself as the leading application category. This leadership is supported by the compound’s exceptional catalytic properties, particularly in oxidation and pollution control processes. Its use in manufacturing sulfuric acid and in selective catalytic reduction systems for emissions control is a major driver for demand.

The increasing enforcement of environmental regulations across various industries is further accelerating the adoption of vanadium-based catalysts, where ammonium metavanadate serves as a critical raw material. The segment also benefits from advancements in catalyst formulation technologies, which improve activity, selectivity, and lifespan, thereby enhancing process efficiency.

Growing investment in clean energy technologies, including catalytic applications in fuel cells and hydrogen production, is expanding the scope of use The combination of proven performance, adaptability to evolving industrial requirements, and alignment with sustainability goals is expected to maintain the catalyst application segment’s strong market position in the years ahead.

The ammonium metavanadate market is experiencing steady growth, driven by its increasing use in various industries. This compound is a key precursor in the production of vanadium alloys, catalysts, and pigments, all of which are essential for high-performance materials. The growing demand for vanadium alloys in the steel industry, where vanadium enhances strength and toughness, is one of the primary factors contributing to the market’s expansion. The compound’s application in the electronics sector, particularly for the production of semiconductors, is also supporting market demand. As production technologies advance, ammonium metavanadate synthesis is becoming more cost-effective and efficient, allowing for broader adoption across different industries.

The growth of the ammonium metavanadate market is primarily driven by the increasing demand for high-performance materials in key sectors. The automotive and infrastructure industries are major drivers, as they require vanadium steel alloys for their enhanced strength and resistance to wear. Vanadium redox flow batteries (VRFBs), which use vanadium compounds like ammonium metavanadate, are gaining popularity due to their ability to store large amounts of energy for grid applications, supporting the transition to cleaner energy. The growing electronics sector, particularly in semiconductor manufacturing, is driving the need for specialized materials like ammonium metavanadate for electronic components. Research and development are also playing a crucial role, as innovations in vanadium-based materials open up new applications and increase market demand for ammonium metavanadate.

Extracting vanadium from ores can result in pollution and environmental degradation, leading to stricter regulations and higher costs for mining companies. The volatility of vanadium prices can cause instability in the market. Since vanadium is a critical component in the production of ammonium metavanadate, fluctuations in its price can affect production costs and overall profitability. The specialized nature of ammonium metavanadate, with limited applications to specific industries such as energy storage and metallurgy, also restricts broader market adoption. For industries to continue expanding their use of ammonium metavanadate, innovation is required to improve extraction processes, reduce environmental impacts, and stabilize market prices, ensuring long-term growth potential in a competitive and regulatory environment.

A significant opportunity lies in the development of sustainable vanadium extraction methods, such as recycling vanadium from industrial waste. This process could reduce the reliance on traditional mining methods, mitigating environmental impacts and improving the market’s overall sustainability. Another opportunity for expansion is the growing demand for vanadium in energy storage applications, especially in vanadium redox flow batteries (VRFBs), which are crucial for renewable energy storage. The increasing adoption of these systems for grid-scale energy storage presents a lucrative market for ammonium metavanadate. In addition, there is an increasing focus on developing high-performance materials in the electronics and automotive sectors, which could lead to further applications for ammonium metavanadate. By investing in R&D and collaborating with industrial partners, companies can unlock new market potential, driving innovation and creating new demand for ammonium metavanadate in emerging sectors.

As industries face increasing pressure to reduce their environmental footprints, the adoption of cleaner technologies and alternative vanadium sourcing methods is becoming more prevalent. Advancements in materials science, particularly in energy storage technologies, are driving innovation in ammonium metavanadate applications. The integration of artificial intelligence (AI) and machine learning in manufacturing processes is enabling more precise and efficient production of ammonium metavanadate, optimizing operations and reducing costs. Furthermore, the demand for high-performance, long-lasting materials is increasing, particularly in energy storage and electronics, where vanadium’s unique properties are leveraged. These trends indicate that the ammonium metavanadate market will continue to evolve rapidly, with innovation playing a key role in addressing market demands and overcoming existing challenges.

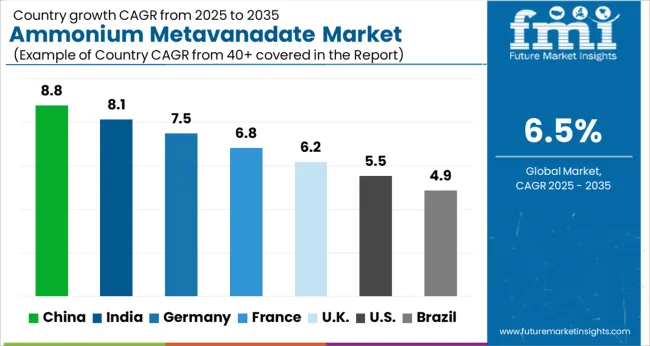

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global ammonium metavanadate market is projected to grow at a CAGR of 6.5% from 2025 to 2035. Among the key markets, China leads with a growth rate of 8.8%, followed by India at 8.1%, and France at 6.8%. The United Kingdom and the United States show more moderate growth rates of 6.2% and 5.5%, respectively. This growth is driven by the increasing demand for vanadium-based alloys in sectors like steel manufacturing, automotive, and energy storage. Emerging markets such as China and India are experiencing rapid growth due to industrial expansion, while developed markets focus on process optimization and advanced materials for energy efficiency. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the global ammonium metavanadate market, growing at a projected CAGR of 8.8% from 2025 to 2035. The country’s rapidly expanding industrial sector, particularly in electronics, steel manufacturing, and energy storage, is driving the demand for ammonium metavanadate. China’s growing focus on high-performance materials for the production of vanadium-based alloys and energy storage solutions, such as vanadium redox flow batteries, is contributing to the market’s growth. Additionally, China’s strong presence in the chemical industry, along with government initiatives to improve industrial processes, is further boosting the demand for ammonium metavanadate.

India’s ammonium metavanadate market is projected to grow at a CAGR of 8.1% from 2025 to 2035. The increasing demand for vanadium-based alloys in industries like automotive, construction, and steel manufacturing is driving the demand for ammonium metavanadate in the country. As India continues to develop its manufacturing capabilities and invest in infrastructure projects, the need for high-performance materials, including ammonium metavanadate, is rising. The growing interest in energy storage solutions, such as vanadium-based batteries, is contributing to market growth. With India’s expanding industrial base, the ammonium metavanadate market is poised for significant growth.

The ammonium metavanadate market in France is expected to grow at a steady pace, with a projected CAGR of 6.8% from 2025 to 2035. The country’s strong focus on renewable energy and energy storage solutions, including vanadium redox flow batteries, is driving the demand for ammonium metavanadate. France’s presence in the aerospace, automotive, and steel manufacturing sectors is further contributing to the market growth, as vanadium-based alloys are increasingly used in these industries for improved performance and durability. The growing emphasis on high-performance materials in manufacturing and energy storage is expected to continue driving market expansion in France.

The ammonium metavanadate market in the United Kingdom is projected to grow at a CAGR of 6.2% from 2025 to 2035. The UK’s demand for ammonium metavanadate is driven by the growing use of vanadium-based alloys in industries like construction, automotive, and energy. The expansion of energy storage technologies, including vanadium redox flow batteries, is contributing to the market’s growth. Additionally, the UK’s increasing focus on developing sustainable and high-performance materials for its manufacturing sector is further driving the adoption of ammonium metavanadate. As the demand for energy-efficient solutions continues to rise, the market for ammonium metavanadate in the UK is set to experience steady growth.

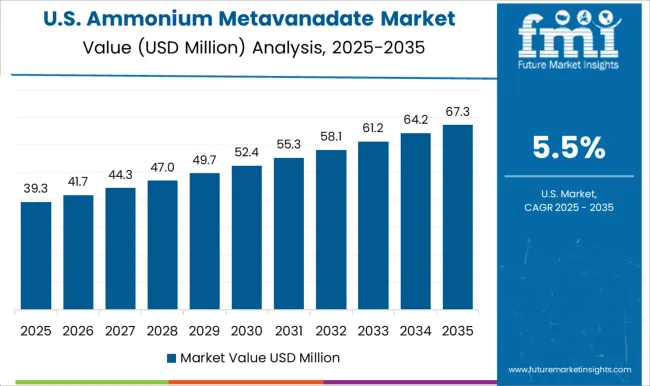

The ammonium metavanadate market in the United States is projected to grow at a CAGR of 5.5% from 2025 to 2035. The USA market is driven by the increasing demand for vanadium-based alloys in industries like automotive, aerospace, and steel manufacturing. The country’s focus on renewable energy and energy storage solutions, such as vanadium redox flow batteries, is further driving the demand for ammonium metavanadate. The rising need for high-performance materials and the growth of the renewable energy sector are expected to continue boosting the USA market. With continued investments in industrial applications and energy storage technologies, the ammonium metavanadate market in the USA is set to experience steady growth.

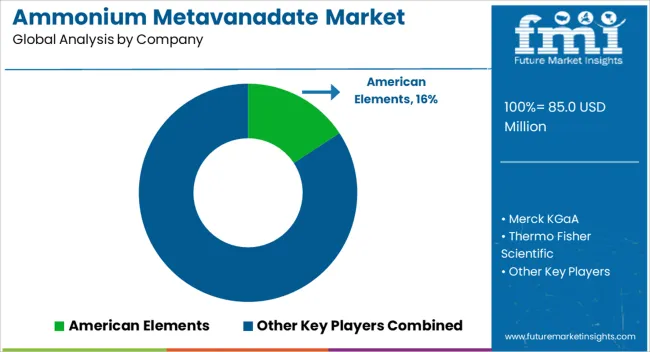

The ammonium metavanadate market is experiencing steady growth, driven by increasing demand for efficient catalysts and energy storage solutions. Leading players in this market include American Elements, Merck KGaA, Thermo Fisher Scientific, Santa Cruz Biotechnology, Yogi Dye Chem Industries, ACS Chemicals, Avanschem, Motiv Metals, GfE Gesellschaft für Elektrometallurgie, Sisco Research Laboratories, and Strem Chemicals. These companies offer a range of ammonium metavanadate products catering to various applications such as chemical reagents, catalysts, paints, inks and dyes, and ceramics. Their strategies focus on technological advancements, product quality, and customer support to meet the evolving needs of the market. For instance, American Elements provides high-purity ammonium metavanadate for industrial and laboratory applications, while Merck KGaA offers a variety of vanadium compounds, including ammonium metavanadate, for research and development purposes. Thermo Fisher Scientific supplies ammonium metavanadate for analytical chemistry applications, ensuring high-quality standards. Santa Cruz Biotechnology offers ammonium metavanadate for use in forensic science and research. Yogi Dye Chem Industries provides ammonium metavanadate for use in dyes and pigments. ACS Chemicals offers ammonium metavanadate for laboratory and industrial applications. Avanschem supplies ammonium metavanadate for chemical synthesis processes. Motiv Metals provides ammonium metavanadate for alloy production. GfE Gesellschaft für Elektrometallurgie offers ammonium metavanadate for use in the steel industry. Sisco Research Laboratories supplies ammonium metavanadate for research and development purposes. Strem Chemicals offers ammonium metavanadate for use in chemical synthesis and research. These companies differentiate themselves through innovation, product quality, and customer support, addressing the growing demand for high-quality ammonium metavanadate across various industries.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Form | Powder and Granule |

| Purity | Minimum 99% and 98% - 99% |

| Application | Catalyst, Chemical reagent, Paints, inks & dyes, Ceramics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | American Elements, Merck KGaA, Thermo Fisher Scientific, Santa Cruz Biotechnology, Yogi Dye Chem Industries, ACS Chemicals, Avanschem, Motiv Metals, GfE Gesellschaft für Elektrometallurgie, Sisco Research Laboratories, and Strem Chemicals |

| Additional Attributes | Dollar sales by form (powder, granule) and purity (98%–99%, minimum 99%) and end-use segments (chemical reagents, catalysts, paints, inks and dyes, ceramics). Demand dynamics are driven by the increasing adoption of vanadium-based energy storage systems, the growing need for efficient catalysts in industrial processes, and advancements in material science. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, fueled by technological advancements and industrial expansion. |

The global ammonium metavanadate market is estimated to be valued at USD 85.0 million in 2025.

The market size for the ammonium metavanadate market is projected to reach USD 159.6 million by 2035.

The ammonium metavanadate market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in ammonium metavanadate market are powder and granule.

In terms of purity, minimum 99% segment to command 57.4% share in the ammonium metavanadate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ammonium Dichromate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Nitrate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Thiosulfate Market – Size, Share, and Forecast 2025 to 2035

Ammonium Sulphate Supply Market-Trends & Forecast 2025 to 2035

Ammonium Chloride Food Grade Market Growth - Demand & Trends 2025 to 2035

Ammonium Sulfate Food Grade Market Report - Industry Insights 2025 to 2035

Ammonium Carbonate Market Growth 2024-2034

Ammonium Phosphate Market Trends & Analysis 2019-2029

Ammonium Phosphatides Market

Diammonium Hydrogen Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Diammonium Phosphate Market

Triammonium Citrate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Food Grade Ammonium Carbonate Market Growth - Product Type & Application Analysis

Food Grade Ammonium Bicarbonate Market

Quaternary Ammonium Compounds Market

Cetyl Trimethyl Ammonium Chloride Market

Benzyl Trimethyl Ammonium Chloride Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA