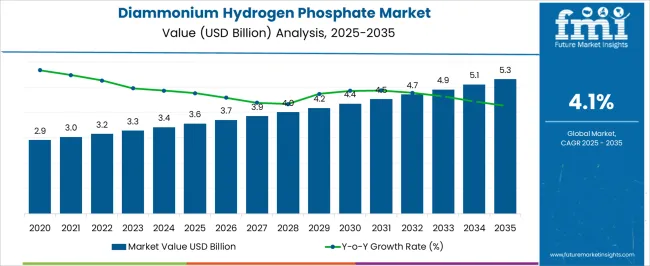

The Diammonium Hydrogen Phosphate Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. Market share erosion or gain analysis reveals a gradual increase in market value over the forecast period, driven primarily by sustained demand from the agricultural sector, where diammonium hydrogen phosphate is widely used as a fertilizer. From 2025 to 2029, the market moves from USD 2.9 billion to USD 3.6 billion, reflecting a modest gain in market share as agricultural productivity rises globally.

The growth during this phase is attributed to expanding farming activities, particularly in emerging economies, alongside increasing awareness of the importance of high-quality fertilizers for crop yield improvements. Between 2029 and 2031, the market shows a slight acceleration, reaching USD 3.9 billion. This phase sees a more substantial market gain due to increased adoption of advanced fertilizer formulations and government support for sustainable agriculture. From 2031 to 2035, the market continues to show incremental growth, reaching USD 5.3 billion, with gains in market share driven by innovations in fertilizer technologies and a shift toward more efficient and environmentally friendly solutions. Overall, the market is expected to experience consistent share gains, driven by evolving agricultural practices and rising global demand for efficient, high-performance fertilizers.

| Metric | Value |

|---|---|

| Diammonium Hydrogen Phosphate Market Estimated Value in (2025 E) | USD 3.6 billion |

| Diammonium Hydrogen Phosphate Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The diammonium hydrogen phosphate market is experiencing consistent growth as demand for efficient phosphate-based fertilizers and industrial-grade phosphates continues to rise globally. The market outlook is being shaped by expanding agricultural output, intensifying pressure on food security, and evolving industrial applications in fire retardants, food additives, and chemicals.

Governments across emerging economies are increasingly investing in sustainable farming practices, including the widespread use of high-nutrient fertilizers, which has led to a spike in diammonium hydrogen phosphate consumption. Simultaneously, rising environmental concerns are fostering innovations in cleaner production processes and better nutrient management, supporting long-term adoption.

The market has also seen growing engagement from large agrochemical manufacturers and distributors focused on regional expansion and supply chain optimization. With increasing emphasis on balanced fertilization, crop yield enhancement, and agro-industrial integration, diammonium hydrogen phosphate is expected to play a central role in nutrient delivery solutions and aligned industrial processes in the years ahead.

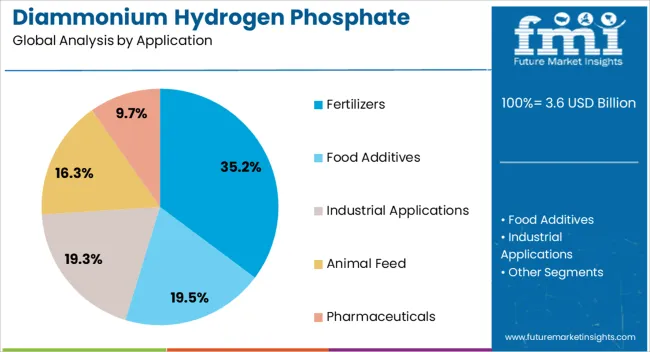

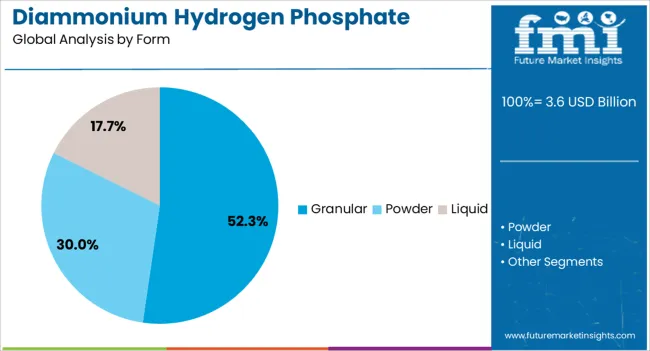

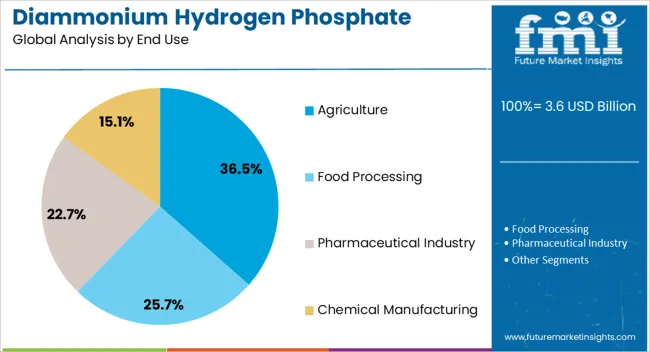

The diammonium hydrogen phosphate market is segmented by application, form, end use, distribution channel, and geographic regions. By application, the diammonium hydrogen phosphate market is divided into Fertilizers, Food Additives, Industrial Applications, Animal Feed, and Pharmaceuticals. In terms of form, the diammonium hydrogen phosphate market is classified into Granular, Powder, and Liquid. Based on end use, the diammonium hydrogen phosphate market is segmented into Agriculture, Food Processing, Pharmaceutical Industry, and Chemical Manufacturing. By distribution channel, the diammonium hydrogen phosphate market is segmented into Direct Sales, Online Sales, and Retail. Regionally, the diammonium hydrogen phosphate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fertilizers application segment is projected to account for 35.2% of the diammonium hydrogen phosphate market revenue in 2025, reflecting its pivotal role in global crop nutrition strategies. The prominence of this segment has been driven by the compound’s high nitrogen and phosphorus content, which makes it highly effective for boosting plant growth and improving soil fertility.

Widespread application in cereal, grain, and vegetable production has been supported by ongoing efforts to increase agricultural productivity and food security. Favorable regulatory frameworks promoting balanced nutrient application and controlled-release fertilizers have further contributed to market penetration.

Additionally, the ability to integrate diammonium hydrogen phosphate with other micronutrient blends has enhanced its utility in varied soil conditions and climatic regions The consistent demand from large-scale farming operations and government-subsidized fertilizer programs has reinforced its position as a preferred phosphate source in modern agriculture.

The granular form segment is expected to command 52.3% of the total market revenue for diammonium hydrogen phosphate in 2025, emerging as the most preferred physical form. The dominance of this form has been attributed to its ease of handling, efficient storage characteristics, and superior compatibility with mechanical application equipment used in modern agriculture.

Granular diammonium hydrogen phosphate is widely adopted due to its slow and uniform nutrient release profile, which supports extended nutrient availability to crops while minimizing leaching. Additionally, its physical stability and resistance to caking under varying humidity conditions have supported its widespread use in both large farms and smallholder applications.

The segment has also benefited from supply chain efficiencies and reduced product loss during transportation and field-level application Its high demand across fertilizer blending operations and direct-to-field usage has ensured its consistent growth across developed and developing markets alike.

The agriculture end use segment is projected to hold 36.5% of the diammonium hydrogen phosphate market revenue in 2025, maintaining its dominance due to sustained demand from the farming and agronomy sectors. The increasing global need for enhanced crop yields, efficient land utilization, and nutrient-dense food production has largely supported this growth.

Diammonium hydrogen phosphate has emerged as a key input in soil enrichment programs, precision farming, and integrated nutrient management systems aimed at sustainably boosting productivity. Its dual nutrient value has enabled broader adoption in regions with phosphorus-deficient soils and intensive cropping systems.

Government initiatives focused on fertilizer subsidy schemes and extension services have further accelerated product uptake among farmers As climate variability and soil degradation continue to challenge traditional farming practices, the use of diammonium hydrogen phosphate in agricultural systems is expected to remain strong, supported by research institutions and agricultural cooperatives promoting science-based fertilization approaches.

The diammonium hydrogen phosphate (DAP) market is experiencing growth driven by its increasing demand in agriculture, especially as a key ingredient in fertilizers. DAP is one of the most commonly used phosphorus-based fertilizers, providing essential nutrients for plant growth. The growing global population and the increasing need for efficient food production are fueling the demand for high-quality fertilizers. DAP’s use in water treatment, flame retardants, and chemical applications further contributes to the market expansion. The market is expected to continue its growth trajectory as agricultural production intensifies globally to meet the rising food demand.

The primary driver of the diammonium hydrogen phosphate market is the rising demand for fertilizers and the need to improve agricultural productivity. DAP, as a phosphorus-rich fertilizer, provides essential nutrients to plants, particularly in soils with phosphorus deficiency. The increasing global population, combined with limited arable land, has led to higher demand for fertilizers that can enhance crop yields. As farming practices evolve to maximize productivity, DAP remains a crucial component in ensuring efficient plant growth. The continued demand for high-quality fertilizers in developing economies is further driving the market for DAP.

Despite its widespread use, the diammonium hydrogen phosphate market faces challenges related to price fluctuations and environmental concerns. The cost of raw materials required for DAP production, such as ammonia and phosphate rock, can fluctuate, which directly impacts the price of DAP. These price variations create market uncertainty and can influence consumer purchasing decisions. Furthermore, there are growing concerns about the environmental impact of phosphorus-based fertilizers, particularly with regard to water runoff and pollution. These issues have prompted regulatory scrutiny in certain regions, which may impose restrictions on the usage of DAP and affect market growth.

The diammonium hydrogen phosphate market presents significant opportunities, particularly with advancements in fertilizer technology and the exploration of new applications. Research into enhanced fertilizers, such as controlled-release DAP, aims to improve nutrient efficiency and reduce the environmental impact of fertilizer use. The growing adoption of precision agriculture, which uses data to optimize fertilizer use, presents opportunities for DAP to be applied more effectively, reducing waste and improving crop yields. Beyond agriculture, DAP’s use in water treatment processes and as a flame retardant in industrial applications offers new growth avenues, expanding its market reach.

A key trend in the diammonium hydrogen phosphate market is the increasing shift towards high-efficiency fertilizers and integrated nutrient solutions. As farmers seek ways to maximize crop yields while minimizing environmental impact, there is a growing demand for fertilizers that provide optimal nutrient release and uptake. Innovations in DAP formulations, such as those that integrate micronutrients or enhance solubility, are becoming more common. The integration of DAP with other nutrients, such as nitrogen or potassium, to create more balanced and efficient fertilizer solutions is gaining popularity. These trends are driving the demand for more sophisticated DAP products, enhancing their appeal to modern agricultural practices.

| Countries | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

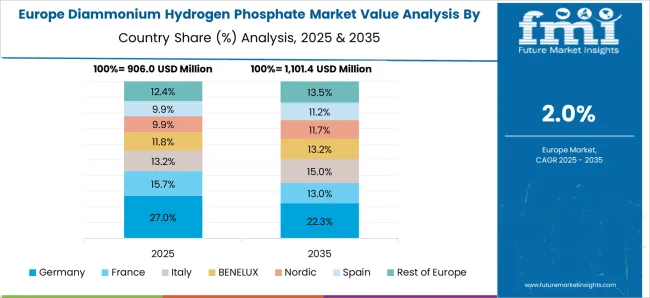

The global diammonium hydrogen phosphate market is projected to grow at a global CAGR of 4.1% from 2025 to 2035. China leads the market with a growth rate of 5.5%, followed by India at 5.1%. France records a growth rate of 4.3%, while the UK shows 3.9% and the USA follows at 3.5%. The market is primarily driven by the increasing demand for diammonium hydrogen phosphate in the fertilizer industry, particularly in crop production, and the rising need for efficient fertilizers to improve soil health. China and India are leading the growth due to their large agricultural sectors and government support for improving crop yields. Developed markets like France, the UK, and the USA are witnessing steady growth, driven by the rising demand for nutrient-rich fertilizers in sustainable agricultural practices. The analysis spans over 40+ countries, with the leading markets shown below.

Demand for diammonium hydrogen phosphate in China is expanding at a 5.5% CAGR, driven by the country’s large-scale agricultural production and increasing demand for fertilizers. The growing population and the need to enhance agricultural productivity are major drivers of the market. The government’s focus on improving crop yields and adopting advanced agricultural technologies, including the use of efficient fertilizers like diammonium hydrogen phosphate, is fueling market growth.China’s initiatives to improve food security and reduce dependence on chemical fertilizers are pushing the adoption of more efficient, environmentally friendly fertilizers.

The diammonium hydrogen phosphate market in India is expected to grow at a 5.1% CAGR, supported by the country’s rapidly expanding agricultural sector. As India focuses on increasing crop yields to feed its growing population, the demand for fertilizers like diammonium hydrogen phosphate is rising. The Indian government’s agricultural initiatives, such as subsidies for fertilizers and promoting advanced farming techniques, are also contributing to market growth. The need for more efficient fertilizers to enhance soil quality and boost crop production further fuels the demand for diammonium hydrogen phosphate in India’s agriculture sector.

Sale of diammonium hydrogen phosphate in France is projected to grow at a 4.3% CAGR, driven by the increasing demand for high-quality fertilizers in the country’s agricultural sector. France’s commitment to sustainable farming practices and improving soil health is boosting the adoption of nutrient-rich fertilizers like diammonium hydrogen phosphate. The need for efficient, high-performance fertilizers to improve crop production, especially in the context of food security and environmental concerns, is a key factor driving market growth. France’s strong agricultural research and development initiatives are contributing to the advancement of more efficient fertilizer solutions.

The USA diammonium hydrogen phosphate market is projected to grow at a 3.5% CAGR, supported by the growing demand for efficient fertilizers in agriculture. With an increasing focus on improving agricultural productivity and soil health, the USA market for diammonium hydrogen phosphate is expanding. The adoption of advanced fertilizers to enhance crop production is being driven by the need to meet the growing food demands of a rising population. The USA government’s support for agricultural innovation and sustainable farming practices is further driving the demand for more effective and efficient fertilizers like diammonium hydrogen phosphate.

The UK’s diammonium hydrogen phosphate market is expected to grow at a 3.9% CAGR, driven by the demand for high-quality fertilizers in the agricultural industry. As the UK continues to modernize its agricultural sector, there is increasing adoption of efficient fertilizers like diammonium hydrogen phosphate to improve crop yields. The UK is also focusing on sustainable farming practices and reducing reliance on chemical fertilizers, which supports the growth of eco-friendly and nutrient-rich fertilizers. The need for efficient fertilizers to ensure food security and support agricultural productivity is further fueling the market for diammonium hydrogen phosphate.

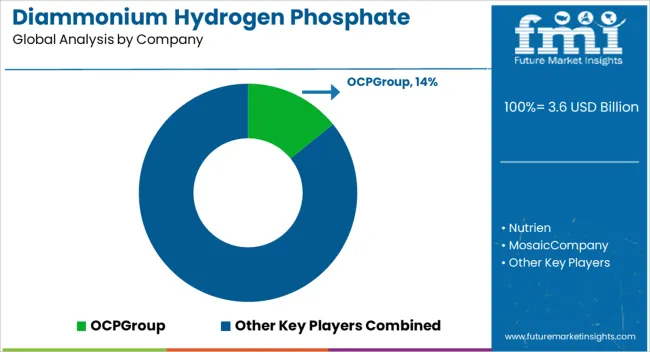

OCP Group is a prominent player, producing DAP fertilizers that are essential for improving soil fertility, focusing on both local and global agricultural needs. Nutrien, a major player in the fertilizer industry, manufactures DAP and other phosphate-based fertilizers, emphasizing efficient nutrient release for various crops and ensuring global accessibility. Mosaic Company is a global leader in the production of DAP fertilizers, providing high-quality products that meet the growing demand for phosphorus-based fertilizers in agriculture. EuroChem is recognized for its wide portfolio of agricultural products, including DAP, designed to optimize crop yield and soil health, with a strong focus on innovation and sustainability in fertilizer production. PhosAgro is a significant supplier of DAP fertilizers, known for its sustainable practices and high-quality phosphate-based solutions. Agrium (now part of Nutrien) produces high-quality DAP fertilizers, serving the agricultural sector with a focus on enhancing crop growth and soil quality. CF Industries offers DAP and other nitrogen-based fertilizers that improve agricultural productivity, with a focus on efficiency and cost-effectiveness.

Yara International is a leading global provider of fertilizers, including DAP, with a focus on improving crop yields and soil health through sustainable agricultural practices. ICL Group is involved in the production of DAP fertilizers, offering solutions designed to meet the nutritional needs of plants for efficient growth and development. Ravensdown supplies high-quality DAP fertilizers with a strong focus on enhancing farming productivity. Haifa Group manufactures specialty fertilizers, including DAP, with a focus on enhancing crop quality and sustainability in agriculture. Bunge Limited offers a wide range of fertilizers, including DAP, to optimize crop yields, focusing on efficient distribution and customer needs. K+S AG produces DAP fertilizers, emphasizing high-performance and environmentally responsible practices. Siemens, while not a direct manufacturer of fertilizers, contributes to the DAP market through its automation and technology solutions, improving efficiency in fertilizer production processes.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Application | Fertilizers, Food Additives, Industrial Applications, Animal Feed, and Pharmaceuticals |

| Form | Granular, Powder, and Liquid |

| End Use | Agriculture, Food Processing, Pharmaceutical Industry, and Chemical Manufacturing |

| Distribution Channel | Direct Sales, Online Sales, and Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | OCPGroup, Nutrien, MosaicCompany, EuroChem, PhosAgro, Agrium, CFIndustries, YaraInternational, ICLGroup, Ravensdown, HaifaGroup, BungeLimited, K+SAG, and Siemens |

| Additional Attributes | Dollar sales by product type (fertilizer-grade DAP, industrial-grade DAP) and end-use segments (agriculture, industrial applications). Demand dynamics are driven by the increasing need for effective, high-performance fertilizers to support global food production, rising agricultural productivity, and the growing demand for phosphorus-based fertilizers. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with innovations in fertilizer formulations, sustainable production practices, and the growing demand for efficient agricultural solutions contributing to market expansion. |

The global diammonium hydrogen phosphate market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the diammonium hydrogen phosphate market is projected to reach USD 5.3 billion by 2035.

The diammonium hydrogen phosphate market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in diammonium hydrogen phosphate market are fertilizers, food additives, industrial applications, animal feed and pharmaceuticals.

In terms of form, granular segment to command 52.3% share in the diammonium hydrogen phosphate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diammonium Phosphate Market

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Detection Market Growth & Outlook 2024-2034

Hydrogen Storage Tank Market Growth – Trends & Forecast 2024-2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA