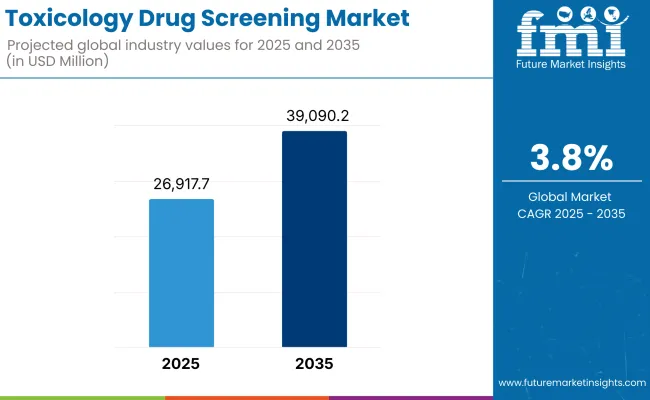

In the coming years the toxicology drug screening market is expected to reach USD 26,917.7 million by 2025 and is expected to steadily grow at a CAGR of 3.8% to reach USD 39,090.2 million by 2035. In 2024, toxicology drug screening generated roughly USD 25,923.1 million in revenues.

Toxicology Drug Screening Market Includes in-depth analysis with a data study as two-dimensional, characterized by differentiability and Relationship between homogeneous member’s object sparse, with a certain limited connection.

Factors such as public health concerns regarding drug abuse, increasing demand for workplace drug testing, and a growing pipeline of pharmaceutical and biopharmaceutical compounds are the major drivers of this market.

Furthermore, the continuous focus of the regulatory authorities towards safety assessment in the drug development and food safety evaluation range, is driving laboratories and research organizations to implement the advanced toxicology screening platforms.

Advancements in analytical instruments like high-throughput screening systems and mass spectrometry-based technologies have enhanced efficiency and accuracy, contributing to increased adoption rates. Apart from it, growing global emphasis on personalized medicine and preventive healthcare, which requires early detection of toxicity to mitigate adverse drug effects, is another vital implication.

Moreover, the increasing burden of lifestyle related and chronic diseases have necessitated comprehensive toxicology assessments to confirm therapeutic safety. In summary, a confluence of regulatory requirements, clinical requirements and scientific advances continues to drive the demand for toxicology drug screening solutions worldwide.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 26,917.7 million |

| Industry Value (2035F) | USD 39,090.2 million |

| CAGR (2025 to 2035) | 3.8% |

The toxicology drug screening market was charged in the forecast period for 2020 to 2024 owing to various reasons. Globally, the rising trend of substance abuse resulted in demand for effective screening approaches for drug use detection and deterrence. To minimize alcohol abuse and drug poisoning, regulatory agencies enforced stringent regulations, such as drug and alcohol testing in organizations, government agencies, and healthcare facilities, which further drove market growth.

This growth was in no small part driven by advances in technology. Advancements in high-throughput screening, portable testing devices, and artificial intelligence integration have improved the accuracy and efficiency of toxicology testing. These advancements paved the way for faster turnaround times and superior results, thereby making drug screening more accessible and effective in multiple industries.

Market growth was also bolstered by the pharmaceutical and biotechnology industries. Because these sectors are boosting their research and development activities more, they require more advertisement to ensure their drug safety and also efficacy through toxicology screening. This demand resulted in the usage of advanced screening technologies and methodologies.

Additionally, the COVID-19 pandemic highlighted the critical need for strong healthcare systems and preventative strategies, which included drug screening. The pandemic's effects underscored the need for quick and reliable testing solutions, which propelled the implementation of breakthrough toxicology testing techniques.

North America has experienced steady growth in the toxicology drug screening market, accounting for the largest share of the market. In fact, this is mainly due to a robust healthcare architecture and ingrained regulatory systems that require drug testing across different industries, including workplace, criminal law, and sports.

High awareness about substance abuse prevention and a significant number of diagnostic laboratories and life sciences companies providing innovative screening services across the region.. Workplace drug testing programs and pre-employment screenings have also fueled demand for drugs testing.

Major pharmaceutical companies engaged in clinical and preclinical drug development also dominate the area, and they substantially increase the demand for toxicity assessments. Furthermore, the growing inclination towards personalized medicine and preventive healthcare in North America is also augmenting the demand for safer drug profiling and early toxicity detection.

The emerging application of novel diagnostic technologies [e.g. mass spectrometry and high-throughput automated platforms] has improved Workplace drug testing programs and pre-employment screenings have also fueled demand for drugs testing.

Major pharmaceutical companies engaged in clinical and preclinical drug development also dominate the area, and they substantially increase the demand for toxicity assessments. Furthermore, the growing inclination towards personalized medicine and preventive healthcare in North America is also augmenting the demand for safer drug profiling and early toxicity detection. The emerging application of novel diagnostic technologies [e.g. mass spectrometry and high-throughput automated platforms] has improved.

Europe is representing major market for toxicology drug screening next to North America, spurred by government-sponsored healthcare programs, increasing rates of foot infections, and increasing demand for alternative antifungal therapies. Germany, France, and the UK are leading countries, with high consumer demand for prescription-based and OTC treatments.

Some regulatory hurdles under the European Medicines Agency (EMA) affect new product launches, and ongoing fears of antifungal drug resistance further influence the market. The growing use of laser treatment, digital health platforms for tele-consultation in dermatology, and emphasis on plant-based, sustainable antifungal solutions are changing the market dynamics in Europe. Also, collaborations between dermatology clinics and pharmaceutical firms are enhancing access to new treatment options.

Asia Pacific is projected to be a fastest-growing region in the global toxicology drug screening market due to economic development, increasing healthcare investments, and growing concerns for drug safety across the region.

For example, nations including China, India, South Korea, and Japan are raising their pharmaceutical and biotechnology capabilities that require extensive toxicity assessments during product development. The expansion of clinical research organizations (CROs) and contract testing laboratories in the region is also supporting the growth of this industry.

Furthermore, growing awareness regarding the substance abuse and increasing urban population is further anticipated to fuel governments to impose stringent drug testing. Moreover, Asia Pacific has a large and diverse population that creates significant demand for both diagnostic and screening services (diagnostic as well as screening services are significantly in demand in cities and rural areas). Centralized and decentralized environments are quickly adopting technological innovations.

High Cost of Advanced Testing Technologies and Instruments Barrier in New Product Development

This targeted drug screening industry in toxicology, encounter various challenges, which affects its productivity, coverage and expansion. One of the main challenges is the cost of expensive testing technologies and instruments.

Mass spectrometers or high-throughput analyzers cannot be put at every neighborhood clinic or research lab because that equipment’s are expensive and not feasible for clinics, research labs, and institutions with limited financial resources. It is financially constraining and encumbering adoption rates, especially in developing areas where cost containment is a key focus.

Another significant hindrance is the limited number of trained scientists in fields like toxicology, pharmacokinetics, and analytical techniques. Interpreting toxicological results is a complex task requiring significant expertise, and a lack of such personnel can delay testing or lead to erroneous interpretations or mismanagement of screening protocols. This directly influences the reliability of toxicology screening, preventing their implementation in routine healthcare and research laboratories.

The industry also faces complications in its development due to regulatory variability across regions. Implementation of toxicology tests is not consistent, as different countries have different sets of standards and approval processes. Instead, the lengthy and complicated compliance requirements of international markets often lead to delays for manufacturers and service providers in launching across these markets.

And privacy issues and ethical questions about drug testing in workplace or student populations make people resistant. These worries hinder public acceptance and uptake by institutions of drug screening protocols, even when such testing shows clear medical or social justification.

Cost constraints as well as shortages in the workforce needed for all stages of drug screening are further exacerbated by regulatory fragmentation and ethical limitations, and ultimately these barriers collectively hinder the growth of toxicology drug screening services, meaning they fall short of their full potential benefit to public health, drug safety and workplace compliance.

Increased Focus on Predictive Toxicology Using organ-on-chip and 3D Tissue Culture ModelsOpportunities for the Toxicology Drug Screening

The key opportunity is also in predictive toxicology which is enhanced by organ-on-chip and 3D tissue culture-based models. With human cellular networks and pathways, these complex biological systems can better predict human responses than classical animal models. Their incorporation into toxicity testing is paving the way for safer drug development and personalized medicine applications while decreasing the time and cost of evaluations.

There is also a growing opportunity in chronic exposure and low-dose toxicity assessments. Traditional toxicology methods have focused on short-term toxicity; however, high-throughput methods to assess long-term exposure to chemicals, environmental pollutants, and therapeutic agents are gaining scientific and regulatory interest.

This evolution is thus generating a demand for more sensitive testing systems for longer duration, especially in the assessment of endocrine disruptors or carcinogens, hence giving a broader scope to toxicological investigations.

A big opportunity lies in the development of multiplexed assays capable of detecting several toxins or drug metabolites at the same time. These platforms also allow for increased throughput with reduced sample volume requirements, thus enabling more informative and cost-effective testing. This is especially important in forensic investigations, anti-doping programs, and post-market monitoring of drugs.

Furthermore, the complexity of new drug formulations such as biologics, gene therapies, and nano-based carriers (e.g., mRNA and CRISPR) necessitates engineering specific toxicity profiles. This complexity is driving innovation in assay development, computational toxicology, and biomarker-mediated screening.

These evolving scientific demands are broadening the applications base, as well as driving a more integrative approach towards toxicology, thus providing the industry with sustainable growth opportunities.

Drug testing sessions has been seeking to grow their benefits in routine general wellness services through tests such as a drug test and tox-screening services. Over this time-frame toxicology screening was not confined to forensic or occupational environments; it permeated chronic disease management, behavioral health and therapeutic drug monitoring.

The pandemic has caused global transitions in most domains, including toxicology due to the deployment of healthcare systems that emphasized remote diagnostic capabilities and infection-safe counts for sample acquisition.

This prompted investment in home-based and point-of-care toxicology kits for flexible population testing. Additionally, there was increasing focus on automating and miniaturizing systems to minimize manual intervention and turnaround times in the toxicology pipeline.

In 2025 through 2035, industry towards more integration and personalize diagnostic environment, tracking the sensors and making appropriate note will also be made as doctors will give proper diagnosis with the help of these devices. Toxicology screening will be more closely associated with genomic data for risk profiling and individualizing drug safety assessments.

Such integration will drive better outcomes through predisposition finding for adverse reactions and precision dosing navigation. Environmental toxicology also stands to benefit, as awareness grows around chemical exposure from consumer-level products and industrial zones.

An emerging future in which data-driven platforms with predictive capabilities for toxic effects of exposure (as seen for example through the integration of high-throughput bimolecular measurement methods) can monitor real time exposure and is being used to assess health impact.

Shifts in the Toxicology Drug Screening Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Standardization and post-market surveillance of testing protocols. |

| Technological Advancements | Movement towards automation, miniaturization, and remote devices for toxicology tests. |

| Consumer Demand | Increasing demand for workplace testing, drug abuse detection, and patient safety effort. |

| Market Growth Drivers | Pharmaceutical R&D (Research and Development), forensic, and clinical safety driven expansion |

| Sustainability | Not much of investigation on eco-friendly materials and waste management |

| Supply Chain Dynamics | Heavy dependence on the centralized laboratories and international test kit suppliers. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Also the broader adoption of unified global testing frameworks and inclusion of new substances. |

| Technological Advancements | Predictive modeling, AI-supported analytics and organ-on-chip platforms integration |

| Consumer Demand | Increasing awareness around chemical exposures and demand for routine toxicity screening |

| Market Growth Drivers | Expansion led by tailor-made medicine, persistent toxicity observation, and new drug varieties. |

| Sustainability | Developing tests with biodegradable components and using green chemistry-based assay development |

| Supply Chain Dynamics | In the second area, new decentralized manufacturing. |

In the USA, the toxicology drug screening sector has enjoyed a monopoly, owing to a myriad of factors that include aggressive drug enforcement regulations and its penetrative capacity across multiple industries. For years, the country has pushed for routine testing in workplaces, correctional facilities, sports organizations and military institutions.

This cross-sectoral strategy has created a solid base for sustained demand. The country’s investment in biomedical research and also major diagnostic firms helps with the rapid adoption of new screening technologies, too.” As doctors place greater reliance on screening to manage polypharmacy and prevent drug interactions, toxicology tests have become more integrated into emergency rooms and primary care services.

Moreover, the rise in substance misuse - particularly the prevalence of fentanyl and other synthetic opioids - has pushed toxicology testing to a public health imperative. Particular pressures have driven innovation and funding in testing platforms, and have helped to increase service capacity and new product development in urban and rural healthcare systems alike.

Market Growth Factors

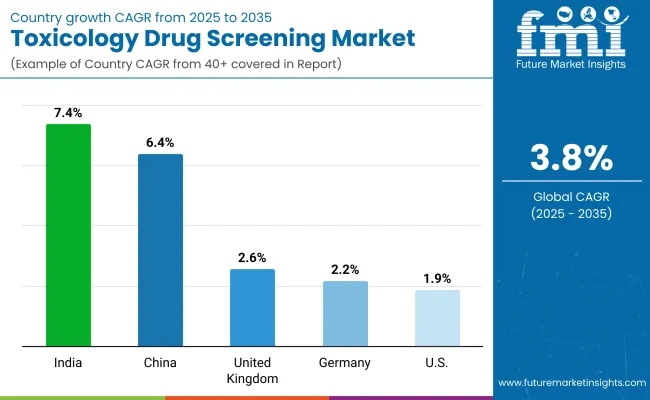

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 1.9% |

Market Outlook

The cylindrical showing in Germany’s toxicology drug screening stream is propelled by its severe administrative concern measures for pharmaceuticals, and solid adherence to compliance orders on the level of nervous system Europe.

This robust toxicity evaluation is especially important in ensuring the safety of consumer health products, medical devices, and industrial chemicals. German laboratories prioritize analytical accuracy, promoting cutting-edge screening technology and strict compliance with testing standards.

In addition to workplace environments, the automotive and manufacturing companies frequently use drug testing to help provide a safe working environment, which creates its own unique industrial demand. Germany's approach to ethical testing has also translated to investments in alternative in vitro models and computational approaches, expanding the technology landscape of screening services.

New public health programs to tackle prescription misuse and environmental exposure have also brought new dimensions to the toxicology sector. Taken together, this multidimensional approach, grounded in security, ethics, and precision of technology, perpetuates the growth of Germany’s toxicology infrastructure.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.2% |

Market Outlook

Due to increasing awareness, the toxicology drug screening ecosystem in the UK is growing thanks to mental health and addiction recovery as well as safeguarding policies in public settings, which require frequent testing.

In contrast, drug screening programs have become more routine within social service departments and educational environments, particularly in conjunction with support programs for at-risk populations. Analytical services also have expanded because toxicological evidence is heavily relied upon in the UK’s forensic science units, which are routinely used in criminal investigations and legal proceedings.

This is further corroborated by recent regulatory updates on the need for post-incident testing especially in transport and safety-critical roles. Next-generation toxicology models to evaluate drug safety more efficiently have already been developed by the academic and research community in the UK and are now available to enhance laboratory capabilities.

Digital innovations to improve workflows can be linked with remote consultation services to help allow timely diagnosis of toxicology results and improved integration of electronic data within the UK system. The mix of clinical, legal and social health applications is part of the country’s dynamic and responsive toxicology testing framework.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.6% |

Fuelling this growth are turning fortunes in drug development, pharmaceutical R&D innovations, and men's health awareness and public health surveillance programs. The country’s emphasis on domestic drug development has created a demand for thorough preclinical toxicity testing.

On the back of government reforms orientated towards greater healthcare safety and transparency, hospitals -- particularly in tier-one cities have begun implementing drug screening protocols.In addition, public health campaigns related to over-the-counter medication misuse and environmental toxicants have vaulted toxicology onto the national health policy agenda.

Demand is also growing domestically in China, where workplace safety rules are tightening for industry and manufacturing. At the same time, automated laboratory systems are being adopted in urban diagnostic centers and research institutions to improve testing efficiency and scalability. With such alignment in regulatory frameworks, China is expected to facilitate its infrastructure at home and abroad.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.4% |

The toxicology drug screening market in India is undergoing significant growth due to increasing drug abuse cases and wider regulatory inspection of healthcare and pharmaceutical industries. Public health officials are ramping up detection of exposure to harmful substances, especially in rural Akre and areas hardest hit.

More recently, judicial and law enforcement systems have started to incorporate toxicology services more frequently into their assessments and investigations, resulting in increasing demand for forensic analysis. At the same time, India’s booming pharmaceutical manufacturing base is shifting its focus to product safety, leading companies to invest in stringent toxicity evaluation protocols.

Low-cost diagnostic solutions, especially point-of-care devices, have become popular in secondary and tertiary hospitals. Moreover, there has been a growing burden of accidental poisonings and adverse drug reactions in the clinic setting, and toxicology testing has become a staple in emergency care.

Academic research and public-private partnerships are helping to build up technical capabilities across regions. These distinct factorsare transforming India’s toxicology landscape from a niche segment into an essential component of its broader healthcare delivery system.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.4% |

Monitoring and Logging Dominate Due to Real-Time Decision Support

As such, monitoring and logging have a major stake in the toxicology drug screening ecosystem, granting them essential, continuous data capture to support immediate clinical and operational decision making. This allows toxicologists and healthcare professionals to monitor exposure levels, metabolite clearance, and toxicity progression in real time.

In areas such as emergency and critical care, monitoring changes in real time significantly increases treatment accuracy and responsiveness. In research environments, the enhancement of reproducibility and documentation through continuous monitoring is critical for validating new drug candidates.

This functionality is especially useful in regulated environments, where the audit trail and traceability are key concern. Systems monitoring also provides a means of quality assurance, by revealing issues with sample handling or processing, thereby providing a mechanism to avoid false positives or false negatives. With their integration into centralized labs, as well as point-of-care systems, they are ideal tools to be used in any institution looking to leverage data-driven toxicology to improve efficiency and patient outcomes.

Networking and Data Management Lead Through Enhanced Laboratory Integration

Networking and data management services account for a large share due to their critical role in managing high-volume toxicology work streams. Contemporary toxicology screening combines a range of instruments, assay formats, and data outputs that need to be integrated and interpreted in concert.

Such services integrate those various platforms across a given laboratory, so results of analysis on different instruments are corralled into a single reporting framework. They also aid compliance by automating documentation and decreasing transcription errors.

Such services offer centralized analytics and synchronized access to the data across multisite testing facilities or organizations conducting large clinical trials. Additionally, integration with electronic health records and hospital information systems contributes to the clinical relevance of toxicology reports through the enabling of contextual decision-making.

Taken together, these capabilities enhance operational throughput and enable rapid, evidence-based responses in clinical and research settings. They are at the heart of enabling broader toxicology services, as they help reduce turnaround times, enhance collaboration, and support interoperability.

Acute Systemic Toxicity Leads Due to its Immediate Clinical Relevance

Acute systemic toxicity ranks first among the various endpoints in toxicology drug screening since its application is immediate in the field of emergency medicine and drug safety evaluation. As a type of test that primarily characterizes an overall toxic response of the body after short exposure to external substances, it is vital for the screening of unknown intoxications or when studying an accidental overdose.

It is used to help triage patients with suspected poisoning or adverse drug events in the clinical setting, providing an important indication of potential systemic damage.Its significance also extends to drug development, where acute toxicity studies are conducted before a new drug can undergo human testing.

It has consistent demand due to its wider applicability across the board in regulated testing and urgent medical care. Moreover, data derived from systemic acute evaluation is pivotal in risk stratification and dosing decisions. It is recommended as a powerful tool for high-throughput approaches in many diagnostic and regulatory frameworks in toxicology, owing to its speed, determination and implications for protocols for patient response to treatment.

Carcinogenicity Screening Dominates Due to Long-Term Safety Concerns

Carcinogenicity testing is a critical aspect of toxicology drug screening that meets the need for long-term safety of drugs, industrial chemicals, and food additives. Carcinogenicity testing, unlike acute or short-term toxicity tests, determines the substance's potential for causing the formation of a neoplasm over the long-term or after repeated dosing.

These evaluations are mandated globally by regulatory bodies during the development and registration of new products, especially in the consumer and therapeutic spheres.Such tests are important for informing public health policy and establishing exposure limits for environmental and occupational hazards.

In addition, the rising incidence of chronic diseases has contributed to a heightened awareness of the cumulative effects of chemical exposure, prompting many industries to emphasize cancer risk assessment under product stewardship programs.

In fact, the complexity of in vitro systems and long-term animal models used in carcinogenicity studies highlights just how deep and complex they can become. This strong influence on safety labeling, use limitations, and consumer confidence leads.

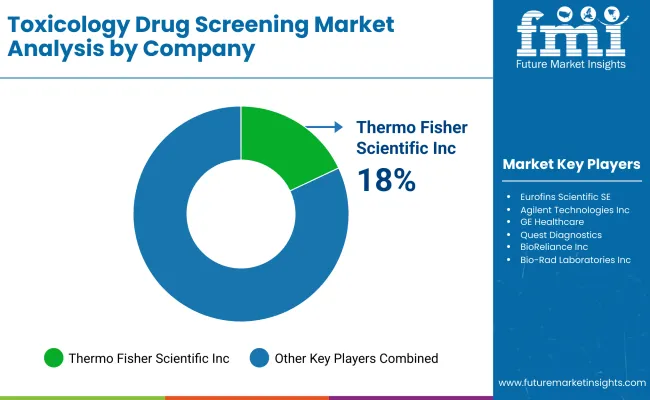

The toxicology drug screening market is defined by the presence of a diverse range of competitors, including established providers of diagnostic technologies, specialized laboratories, and new entrants with innovative computational toxicology approaches. As a result, companies are prioritizing the development of better, higher-throughput screening platforms that can accommodate many test types.

The increasing need for fast, multi-analytic detection and individualized toxicology services over time have been motivators in R&D. Factors affecting vendor selection are regulatory compliance, ability to integrate data and scalability of services. In clinical, forensic and industrial segments, competition is likely to increase as the field of toxicology broadens beyond traditional applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific, Inc. | 18-19% |

| Eurofins Scientific SE | 14-15% |

| Covance, Inc. (LabCorp Drug Dev) | 11-12% |

| Agilent Technologies, Inc. | 9-10% |

| Other Companies (combined) | 43-45% |

| Company Name | Thermo Fisher Scientific, Inc. |

|---|---|

| Year | 2025 |

| Key Company Developments and Activities | Its product portfolio includes toxicology analyzers, immunoassay kits, and sample preparation equipment: scalable, automation-ready solutions for clinical and forensic toxicology laboratories. |

| Company Name | Eurofins Scientific SE |

|---|---|

| Year | 2024 |

| Key Company Developments and Activities | Eurofins runs a £GLP£ environment in-house laboratory network, which specializes in a variety of in vivo and in vitro toxicological evaluations and strong focus on environmental and regulatory toxicology for chemical threat assessments. |

| Company Name | Covance, Inc. (LabCorp Drug Dev) |

|---|---|

| Year | 2024 |

| Key Company Developments and Activities | Covance integrates preclinical and clinical toxicology services from early safety screening through late-stage human trials to assist large-scale pharmaceutical development with strict regulatory oversight. |

| Company Name | Agilent Technologies, Inc. |

|---|---|

| Year | 2024 |

| Key Company Developments and Activities | Agilent provides high-performance liquid chromatography and mass spectrometry systems that can be optimized for toxicology applications using cutting-edge instrumentation and specialized software solutions, enabling laboratories to obtain a precise identification of complex mixtures of compounds. |

Key Company Insights

Thermo Fisher Scientific, Inc. (18-19%)

Accelerating its capabilities in biologics and cell and gene therapy manufacturing. The investment also focuses on enabling the manufacturing of complex therapies that are increasingly supplementing the modern arsenal of treatments and necessitate the usage of increasingly complex toxicology studies. This approach not only expands their service capabilities but also aligns them with the changing landscape of pharmaceutical requirements in toxicology services.

Eurofins Scientific SE (14-15%)

One of the strategies is focused on digital transformation and automation of the laboratory processes and as part of that strategy Eurofins has implemented. The company employs advanced informatics and robotic systems to enhance efficiency, streamline turnaround times and improve testing data quality in toxicology testing. In more detail, it means that Eurofins can do more analyses of this kind, and high-volume/complex analyses enable the increasing need for rapid and reliable toxicological risk assessments.

Covance, Inc. (LabCorp Drug Dev) (11-12%)

Covance to integrate translational science and biomarker discovery into toxicology studies to enhance early development services This approach aims to offer further prospective data on the drug safety profile and improve clinical decision-making in the drug development process. As pharmaceutical research partner, Covance expands its position by providing integrated solutions where toxicology is coupled with state-of-the-art scientific methods.

Agilent Technologies, Inc. (9-10%)

They have a dedicated team focused on cutting-edge analytical systems for toxicology, and Agilent has several next-generation analytical solutions in the pipeline. The company is further augmenting its software solutions to offer more robust data analysis and reporting features. As testing requirements become increasingly complex for laboratories, these advancements seek to ensure they can reach the highest standards of accuracy and efficiency in toxicology testing.

Other Key Players (43-45% Combined)

A number of other companies are major contributors to the toxicology drug screening market through advanced technologies and increased distribution networks. They include:

With the demand for toxicology drug screening procedures growing unabated, firms are focusing on product innovations, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

Monitoring and logging, Security, Storage and continuous integration/continuous deployment, Management and orchestration, Networking and data management services and Others

Acute Systemic Toxicity, Dermal Toxicity, Carcinogenicity, Ocular Toxicity, Genotoxicity, Neurotoxicity and Organ-Specific Toxicity

High-Throughput Screening, Genomics, Transcriptomics, and Toxicogenomics,Molecular Screening

Hospitals and Trauma Centers, Forensic Laboratories, Diagnostic Laboratories, Rehabilitation Centers and Pharmaceutical & Biotechnology Companies

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for toxicology drug screening market was USD 26,917.7 million in 2025.

The toxicology drug screening market is expected to reach USD 39,090.2 million in 2035.

Rising burden of drug abuse and substance misuse as well as increasing use of toxicology in drug development pipelines has significantly increased the demand for toxicology drug screening.

The top key players that drives the development of toxicology drug screening market are Thermo Fisher Scientific, Inc., Eurofins Scientific SE, Covance, Inc. (LabCorp Drug Dev), Agilent Technologies, Inc. and GE Healthcare.

Monitoring and logging by product is toxicology drug screening market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Test Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Technology Type, 2023 to 2033

Figure 24: Global Market Attractiveness by End Use, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 46: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Test Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Technology Type, 2023 to 2033

Figure 49: North America Market Attractiveness by End Use, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Test Type, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Technology Type, 2023 to 2033

Figure 74: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Technology Type, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Technology Type, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Test Type, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Technology Type, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Test Type, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Technology Type, 2023 to 2033

Figure 174: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Test Type, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Technology Type, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Drug Discovery Informatics Market Trends - Growth & Future Outlook 2025 to 2035

Drug Testing Equipment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA