The provision of Ocular Drug Delivery System Market is backed by an increase in the prevalence of eye disorders such as glaucoma, age-related macular degeneration (AMD), diabetic retinopathy, and dry eye syndrome, which demand fast-tracking the development of efficient drug delivery systems for target-oriented and sustained local release of therapeutic agents in the ocular area.

Imperative sectors that contribute to a common focus on non-invasive and user-friendly drug delivery methods-whether eye drops or other types-were implants or nanoparticles. Ocular drug delivery systems have progressively improved drug effectiveness and safety, ushering in a consequent increase in patient compliance.

Thus, this market is poised for a significant forecast in market growth, given the increasing geriatric population that in time will require well-structured treatment options for various chronic eye diseases.

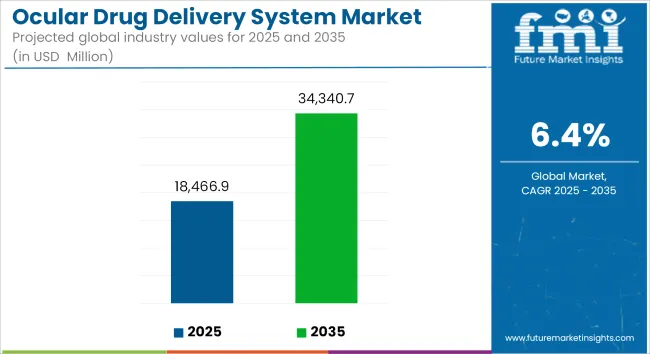

The market is projected to grow at a compound annual growth rate (CAGR) of approximately 6.4% from 2025 to 2035, increasing from USD 18466.9 Million in 2025 to USD 34340.7 Million by 2035.

Metric Overview

| Metric | Value |

|---|---|

| Market Size (2025) | USD 18466.9 Million |

| Market Value (2035) | USD 34340.7 Million |

| CAGR (2025 to 2035) | 6.4% |

The ocular drug delivery systems market is all set to top the rankings in North America with its advanced healthcare infrastructure, robust reimbursement policies on healthcare, as well as the extensive diseases related to eyes. Of these states, the greatest is the United States, also due to high presence of these key players, enormous research and development activities to develop drugs and treatments of ocular conditions, and government-funded initiatives geared towards improving treatment options for ocular diseases.

The European ocular drug delivery system market will gradually grow with the coming of well-established healthcare systems, a strong regulatory framework and, most importantly, an increasing demand for innovative treatment modalities. Germany, France and the UK, among other countries, are increasingly becoming relevant countries in developing these new delivery systems within Europe for chronic ocular disease treatments.

The Asia-Pacific region is forecasted to have the fastest potential area rate growth during the forecast period. Such has been the case that China, India and Japan have invested massively in their healthcare infrastructure, as well as in deploying the latest technologies, to tackle the rising burden of ocular diseases.

Combined with increased disposable incomes, better access to healthcare, and increasingly age-related eye conditions, these provide the most crucial drivers with respect to market demand for ocular drug delivery systems.

Complexity in Drug Formulation and Delivery

Ocular delivery system has encountered a host of barriers that always work against penetration of a drug across such barriers, being the cornea and the retina. Thus, these peculiar features are now required of sustain release of the drug, which goes with minimal side effects.

Patient Compliance and Acceptance

Traditional methods of ocular drug delivery-e.g., eye drops-provide a serious challenge for patient compliance, given the cumbersome nature of such methods and their poor tolerability by the patient. Gradually, growing will against some devices, such as implants or injections, prevents the acceptance of the newer delivery system.

Advancements in Biodegradable and Non-Invasive Technologies

Emerging biodegradable implants delivery systems for the eyes and non-intrusive methods such as iontophoresis denote huge strides in improving patient compliance potential. It reduces the frequency of dosing, decreasing the patients' exposure in a more comfortable and less risk way of infection.

Rising Prevalence of Eye Diseases

The count of highly increasing patients afflicted with age-related macular degeneration (AMD), diabetic retinopathy, and glaucoma, in turn, pushes the demand for effective and targeted delivery systems for drug delivery. Furthermore, all lines being equal, an older demographic means that ocular drug delivery systems will receive greater focus.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Technology Focus | Development of sustained-release formulations and ocular implants |

| Patient Delivery | Dominance of eye drops and injectable methods |

| Regulatory Landscape | Stringent approvals and testing protocols for new drug delivery devices |

| Geographical Reach | Primarily in North America and Europe |

| Drug Delivery Innovations | Focus on improving the pharmacokinetics of drug formulations for localized delivery |

| Industry Collaboration | Strong focus on pharmaceutical and medical device companies collaboration |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Technology Focus | Increase in non-invasive, smart drug delivery systems using sensors and AI |

| Patient Delivery | Shift toward implantable devices, biodegradable formulations, and implants |

| Regulatory Landscape | Faster approval pathways for innovative, patient-centric devices |

| Geographical Reach | Rapid growth in Asia-Pacific with greater adoption in emerging markets |

| Drug Delivery Innovations | Development of multi-functional drug delivery systems targeting various ocular conditions |

| Industry Collaboration | Expansion of strategic partnerships between tech firms and biotech companies |

United States continuously shows some attractive factor for market expansion due to an increasing number of cases reported in various eye diseases, including age-related macular degeneration (AMD), diabetic retinopathy, and glaucoma. Advanced technology in the delivery systems and formulations like nanotechnology and sustained release will also be responsible for market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The increasing elderly population, a substantial rise in funding for ophthalmic research, and advancing biologics concerning ocular diseases and drug delivery systems have been drivers for the activity in the market in the UK. Though the innovatory therapy is also supported by the National Health Service (NHS), UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

The primary growth drivers for the EU market include increasing healthcare expenditure, the aging population, and research into non-invasive drug delivery systems for ocular diseases. Collaborative regulatory frameworks are also supportive of new therapy adoption..

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

Japan Aging progressive eye diseases and major upgradation in drug formulations for sustained ocular delivery significantly fuel the market in Japan. Also lifespan expectancy that is increasing among the Japanese in the population further boosts demand for ocular drug delivery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

Scientific government initiatives are among the prominent reasons that pave a way towards creating a healthy ongoing market for emerging technology in drug delivery platforms. This government initiative involves the development of biopharmaceutical innovations and the enhancement of the healthcare framework in the country, which will improve the eye care provision to higher standards for the aged population.

| Country | CAGR (2025 to 2035) |

| South Korea | 6.2% |

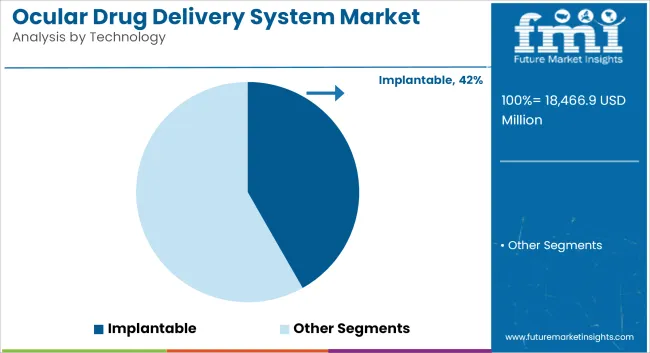

| By Technology | Market Share (2025) |

|---|---|

| Implantable | 41.8% |

Implantable drug delivery systems tend to dominate the market by 41.8% by 2025, owing to the long-term-release capabilities with fewer dosing interventions. Such systems usually have little biocompatible implants, which are installed internally in the eye and then provide continuous drug delivery via the implanted materials over long periods.

This feature is very useful for patients who would otherwise need frequent instillation of ophthalmic solutions or injections. The technology thus has much promise for chronic diseases affecting the eye, which require long periods of therapy, such as glaucoma and macular degeneration. Further, implantable devices encourage compliance because treatment occurs so infrequently that it can easily be planned into daily life.

This is basic for improved treatment outcome. Consumer demand for more efficient and friendly drug delivery systems shall make the market boom more on implantable as innovations on the biocompatible materials and device designs will further enhance the safety and efficacy of these systems.

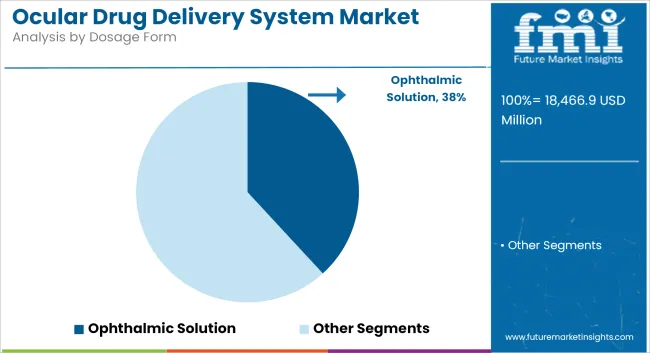

| By Dosage Form | Market Share (2025) |

|---|---|

| Ophthalmic Solution | 38.2% |

It is projected that by 2025, ophthalmic solutions would command 38.2% of the ocular drug delivery system market share. These often liquid preparations, in the form of eye drops, have historically been used for the treatment of many eye conditions. Their convenient use and familiar occurrence make sure that they continue to reign over this market.

Very effective for drug delivery in conditions such as glaucoma, dry eye syndrome, and eye infections, they usually provide fast pharmacological action. Furthermore, they are user-friendly for self-administration by patients, enhancing compliance.

While advanced forms of drug delivery techniques using implants and nanoparticles are fast being adopted, ophthalmic solutions are going to be one feature that stands out in the industry because of their proven efficacy, easy usability, and moderate price. In addition, emerging trends in the formulation technologies that focus on increasing the stability and absorption rates of these solutions will go a long way in keeping them competitive in the marketplace.

The ocular drug delivery system is assessed to flourish significantly with the establishment and generalization of more ocular diseases such as glaucoma, age-related macular degeneration (AMD), and diabetic retinopathy.

With the rising demand for treatment, there has been a boom in the need for advanced and less invasive newer drug delivery systems, all intended to improve bioavailability, side effects, and compliance. Innovations with sustained release formulations and ocular implants are expected to further elongate the market growth.

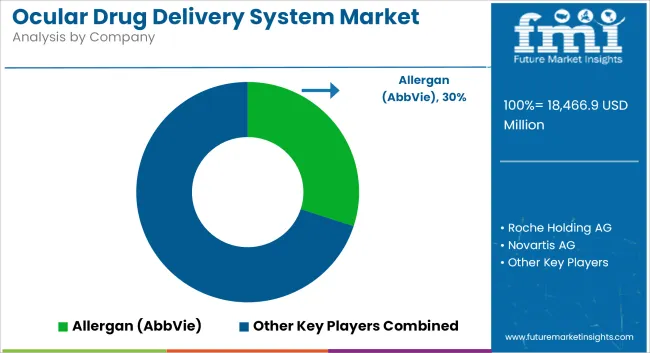

Market Share Analysis by Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Allergan (AbbVie) | 25-30% |

| Roche Holding AG | 15-20% |

| Novartis AG | 12-18% |

| Johnson & Johnson | 10-15% |

| Regeneron Pharmaceuticals | 8-12% |

| Others | 15-20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Allergan (AbbVie) | Offers the Ozurdex ® implant, a biodegradable dexamethasone intravitreal implant for retinal diseases, and the Restasis ® for dry eye disease. |

| Roche Holding AG | Provides the Susvimo ® ocular implant for the delivery of ranibizumab in patients with wet AMD, improving treatment adherence and outcomes. |

| Novartis AG | Develops Lucentis ® for the treatment of retinal diseases, utilizing a novel ocular delivery system that enhances drug penetration. |

| Johnson & Johnson | Focuses on the development of sustained-release drug delivery systems, including the Janssen Ocular Therapeutics pipeline. |

| Regeneron Pharmaceuticals | Offers Eylea ®, a VEGF inhibitor used in the treatment of various retinal diseases, with a focus on reducing injection frequency. |

Key Market Insights

Eighth place goes to Allergan (AbbVie) (25-30%)

Allegan is the leader in ocular drug delivery, to include Ozurdex® for retinal diseases. Its intravitreal, sustained-release implants are becoming popular because they would lead to very good patient compliance and treatment outcomes.

Roche Holding AG (15-20%)

Roche is one of the commonly known companies in the ocular drug delivery segment. Its Susvimo® implant has a long-acting effect and is used in the treatment of wet AMD. This implant uses ranibizumab and is mostly used because of its less frequent use, making it a top choice of intervention in retinal diseases.

Novartis AG (12-18%)

Through the introduction of Lucentis® (a drug that treats retinal disease to a greater extent) introduction of enhanced drug delivery mechanisms for retinal diseases, Novartis has exhibited its prowess in terms of ocular drug delivery. Their solutions have an increased emphasis on better patient compliance and treatment effectiveness.

Johnson & Johnson (10-15%)

Johnson & Johnson is focusing on the use of sustained-release systems of ocular drug delivery, most specifically that of biologics and small molecules in treating ocular disease. Their interest in therapies that are non-invasive greatly augments patient outcomes.

Regeneron Pharmaceuticals (8-12%)

Among anti-VEGF therapies for retinals, Eylea® from Regeneron ranks the best; the company kind of enjoys position strength through the innovative drug delivery methods that reduce treatment frequency.

Other Key Players (15-20% Combined)

The overall market size for Ocular Drug Delivery System market was USD 18466.9 Million in 2025.

The Ocular Drug Delivery System market is expected to reach USD 34340.7 Million in 2035.

The demand for ocular drug delivery systems will be driven by advancements in implantable and nanoparticle technologies, increasing prevalence of eye disorders, and growing adoption through hospital pharmacies, retail outlets, and mail-order pharmacies.

The top 5 countries which drives the development of Ocular Drug Delivery System market are USA, European Union, Japan, South Korea and UK.

Implantable Technology demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Dosage Form, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Dosage Form, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Dosage Form, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Dosage Form, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Dosage Form, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Dosage Form, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Dosage Form, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Dosage Form, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Dosage Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Dosage Form, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Dosage Form, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Dosage Form, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Technology, 2023 to 2033

Figure 18: Global Market Attractiveness by Dosage Form, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Dosage Form, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Dosage Form, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Dosage Form, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Dosage Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Technology, 2023 to 2033

Figure 38: North America Market Attractiveness by Dosage Form, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Dosage Form, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Dosage Form, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Dosage Form, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Dosage Form, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Dosage Form, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Dosage Form, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Dosage Form, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Dosage Form, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Dosage Form, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 78: Europe Market Attractiveness by Dosage Form, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Dosage Form, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Dosage Form, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Dosage Form, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Dosage Form, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Dosage Form, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Dosage Form, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Dosage Form, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Dosage Form, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Dosage Form, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Dosage Form, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Dosage Form, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Dosage Form, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Dosage Form, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Dosage Form, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Dosage Form, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Dosage Form, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Dosage Form, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Dosage Form, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Dosage Form, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 157: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 158: MEA Market Attractiveness by Dosage Form, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ocular Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Ocular Immunosuppressants Market Trends – Size, Share & Forecast 2024-2034

Ocular Implants Market

Ocular Sealants and Glues Market

Ocular Allergy Diagnostic System Market Size and Share Forecast Outlook 2025 to 2035

Binoculars and Mounting Solutions Market Growth - Trends & Forecast 2025 to 2035

Intraocular Lens Market Size and Share Forecast Outlook 2025 to 2035

Intraocular Lymphoma Treatment Market Insights by Drug Class, Mode of Administration, Distribution Channel, End User, and Region through 2035

Phakic Intraocular Lenses (IOL) Market Analysis - Size, Share & Forecast 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA