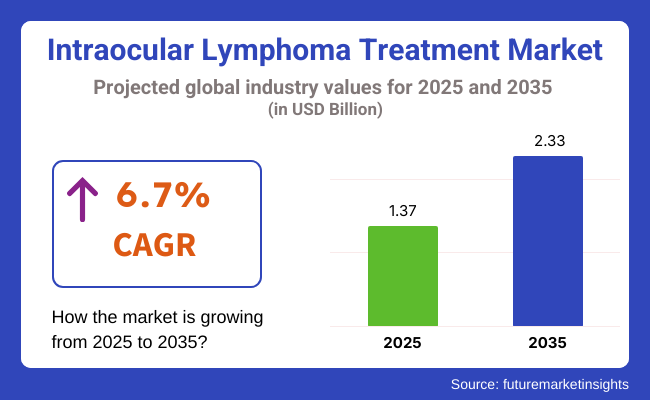

The intraocular lymphoma treatment industry is valued at USD 1.37 billion in 2025. As per FMI's analysis, the intraocular lymphoma treatment segment will grow at a CAGR of 6.7% and reach USD 2.33 billion by 2035. The global segment for intraocular lymphoma treatment is anticipated to be segmented into chemotherapy, radiotherapy, targeted therapy, and others. As the incidence of intraocular lymphoma, a rare but aggressive cancer, increases, so does the need for early detection and effective therapeutic strategies.

The year 2024 brought significant advancements to the intraocular lymphoma treatment sector, particularly in the areas of diagnosis and treatment. The company introduced next-generation monoclonal antibodies and small-molecule inhibitors, which enhanced patient outcomes. At least two new targeted therapies have been approved by the FDA and EMA, increasing the potency of treatments while minimizing adverse events.

The focus on therapies based on targeted agents and checkpoint inhibitors (also known as immunotherapy, including monoclonal antibodies) are changing the paradigm of treatments. The availability of new drugs and ongoing clinical trials in personalized medicine are major growth drivers. North America leads the global biotechnology segment because of strong healthcare infrastructure and research funding, and Asia-Pacific is emerging as a profitable region owing to increasing healthcare expenditure.

The intraocular lymphoma treatment industry is expected to witness steady growth due to rising awareness, improved early diagnosis, and novel therapies. Pharmaceutical and biotech companies offering targeted therapies are likely to benefit, while postponed diagnoses and fewer specialist availability will slow down the industry growth. As precision medicine continues to improve, investors supporting research and specialist care will drive the segment.

Innovationin Targeted Therapies

Focus on research and development to build precision medicine and immunotherapies to escalate treatment efficacy and industry share.

Better EarlyDiagnosing and Access to Specialist

Improve diagnostics through AI-based imaging/biomarkers and enhance patient outcomes by increasing specialist training

IncreaseIndustry Share and Strategic Alliances

Alliances with biotech firms, research institutions, and regional healthcare providers help strengthen distribution, expedite drug approvals, and enrich the quality of global market reach.

| Risk | Probability & Impact |

|---|---|

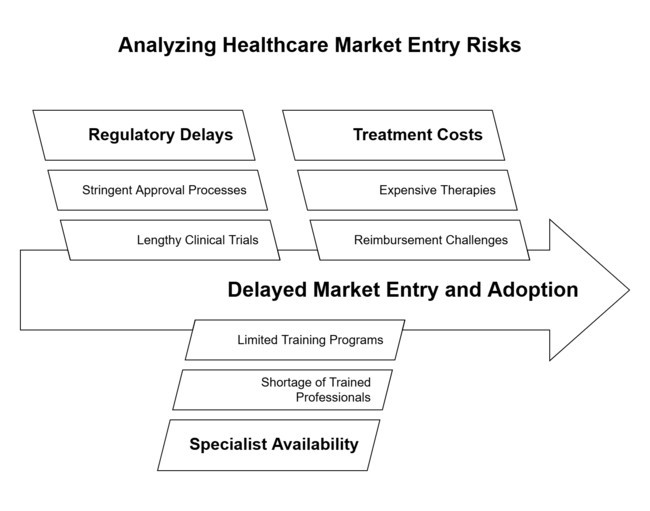

| Regulatory & Approval Delays - Lengthy clinical trials and stringent approvals can slow segment entry. | Medium Probability, High Impact |

| Limited Specialist Availability - A shortage of trained professionals may hinder early diagnosis and treatment adoption. | High Probability, Medium Impact |

| High Treatment Costs & Reimbursement Challenges - Expensive therapies may limit patient access and strain healthcare budgets. | Medium Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| Advance R&D in Targeted Therapies | Accelerate clinical trials for novel treatments and immunotherapies. |

| Improve Early Diagnosis Infrastructure | Invest in AI-driven imaging tools and expand specialist training programs. |

| Strengthen Industry Access & Partnerships | Forge alliances with biotech firms and healthcare providers to enhance distribution and regulatory approvals. |

ASC must embark on discovering groundbreaking targeted therapies that will mitigate intraocular lymphoma; this can be facilitated through the use of AI technology and precision medicine, which will result in improved patient outcomes that are needed to outrun the competition in this space because the patient sector size is not that big as well as the competition.

Forging strategic partnerships with biotechnology firms and research centers will be crucial drivers for speeding up the drug approval process and enhancing global penetration. Training programs and e-healthcare solutions will also mitigate specialist shortages and enhance industry penetration. With competition stiffening and regulatory challenges increasing, the road map needs to target R&D acceleration, sector access initiatives, and reimbursement advocacy to facilitate sustainable growth.

Advancing Targeted Therapies: 81% of stakeholders identified precision medicine approaches (e.g., CAR-T, monoclonal antibodies, and kinase inhibitors) as a critical priority to improve patient outcomes. Enhancing Early Diagnosis & Biomarker Research: 74% emphasized the need for better biomarker detection and AI-driven imaging tools to facilitate early-stage diagnosis.

Regional Variance:

High Variance:

Divergent ROI Perspectives:

Consensus:

Regional Variance:

Shared Challenges:

Regional Differences:

Pharmaceutical Companies:

Hospitals & Oncologists:

Global Alignment:

Regional Focus Areas:

North America:

Europe:

Asia-Pacific:

High Consensus:

Key Regional Variances:

Strategic Insight:

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States |

|

| European Union |

|

| United Kingdom |

|

| China |

|

| Japan |

|

| South Korea |

|

| India |

|

| Australia |

|

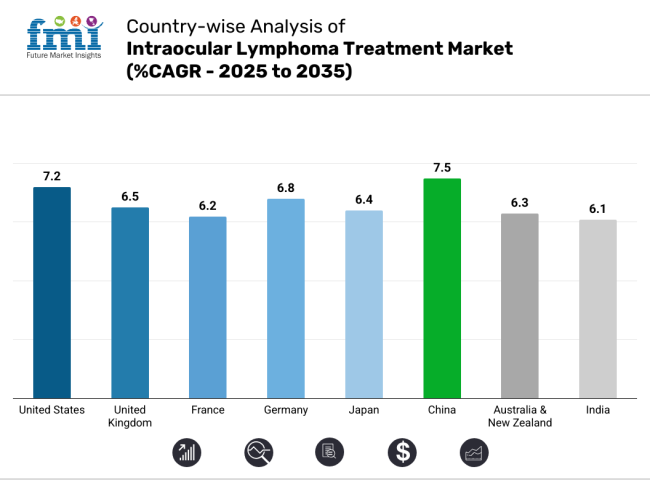

Between 2025 and 2035, the USA is expected to grow at 7.2% CAGR compared to global average growth higher treatment spend per patient, accelerated development of immunotherapeutic therapies and continued regulatory encouragement to treat rare cancers driving this expansion. The FDA has implemented pathways for accelerated approval of new oncology agents which further broadens sector potential.

The orphan drug act also provides financial incentives for companies to develop rare diseases like intraocular lymphoma. However, price regulations, such as the Inflation Reduction Act (IRA) and potential negotiations between medicare and drug manufacturers, can apply pressure to sell drugs lower.

However, demand should remain strong due to the presence of leading biotech companies, specialized cancer centers (MD Anderson, Memorial Sloan Kettering), and a robust clinical trial infrastructure. With high reimbursement coverage from private insurers and Medicare ensuring patient access, the USA makes the largest contribution to global revenue in this space.

The intraocular lymphoma treatment landscape in the UK is anticipated to grow at a CAGR of 6.5% between 2025 and 2035, inlinewith the global average. Brexit regulatory shift and Medicines and Healthcare products Regulatory Agency (MHRA) will be able to offer quicker approvals for oncology drugs than the EU.

The National Health Service (NHS) and National Institute for Health and Care Excellence (NICE) impact drug reimbursement based on cost-effectiveness, resulting in implications for the access to sector. The UK government is driving innovation in intraocular lymphoma treatment through investments in genomic medicine, AI-driven diagnostics, and orphan drug incentives.

It also boasts of vibrant research partnership like The Francis Crick Institute, and Oxford Biomedical Research Centre, working on innovation for lymphoma treatment. On the other hand, cost-containment pressures and long wait times in the NHS might inhibit segment growth.

The intraocular lymphoma treatment sector in France is expected to witness a steady growth of 6.2% CAGR over the next 10 years. The country has an excellent universal healthcare system with high access to oncology drugs among patients. France has made significant strides in cancer immunotherapy and precision oncology. Moreover, state-driven programs like France 2030, which has promised billions for biotech R&D, will spur innovation in treatments.

France’s Economic Committee for Health Products (CEPS) pricing policies tend to regulate prices lower than those in other EU countries, reducing pharmaceutical profitability. Moreover, reimbursement approval can be a lengthy process that risks delaying industry access. For companies that want to benefit from France’s segment potential, early negotiation of pricing, collaboration with top research hospitals, and investment in biosimilars or affordable targeted therapies will help align with national cost control policies.

Germany is anticipated to experience a CAGR of 6.8% that is marginally higher than the global average due to high government funding for oncology research and fast-track drug approvals under the jurisdiction of the Federal Institute for Drugs and Medical Devices (BfArM). Germany tops in biopharmaceutical innovation, with a solid National Cancer Plan and money into the therapeutics of rare disease such as intraocular lymphoma.

The German Healthcare System provides positive reimbursement conditions and the AMNOG process is concluded before sector access, during price negotiation. Price pressure from statutory health insurance (GKV) and compulsory rebates could challenge profitability. Additionally, Germany's increasing adoption of biosimilars may thrust branded therapies into pricing wars. Realizing success means early clinical engagement with regulators, optimized pricing strategies, and combination therapies to differentiate their offering.

Japan's intraocular lymphoma treatment landscape is anticipated to grow at a CAGR of 6.4% between 2025 and 2035, owing to growing elderly population, a firm focus on researching rare diseases and government-backed health care infrastructure. Its life expectancy is among the highest in the world, leading to the increased occurrence of age-related malignancies such as intraocular lymphoma.

Japan's universal healthcare is provided through National Health Insurance (NHI), subsidizing access to treatment, making it an attractive sector for pharmaceutical companies. The Pharmaceuticals and Medical Devices Agency (PMDA) has launched several accelerated approval pathways for novel oncology drugs, enabling foreign and domestic pharmaceutical companies to gain early marketing access.

Moreover, the Japanese government has expanded financial support for rare disease studies, especially on immunotherapy, gene therapy, and targeted monoclonal antibody therapies.

The report expects China to see a 7.5% CAGR from 2025 and 2035 because of the rapidly growing healthcare sector, robust government support for oncology therapies, and rising number of lymphoma cases. Increasing incidence of non-Hodgkin's lymphoma (a precursor to intraocular lymphoma) and better diagnostic capabilities supporting the market growth.

The NMPA has made substantial reforms, such as more rapid label approval for drugs, adaptation to international standards in drug trials, as well as better access to foreign drugs. Moreover, the Healthy China 2030 Plan has included cancer treatment among its major priorities, which has in turn facilitated government investment in novel oncology drugs.

Large domestic biotech companies like BeiGene and Innovent Biologics are pouring millions into the development of CAR-T therapies and immune checkpoint inhibitors for uses against intraocular lymphoma.Foreign pharmaceutical companies should partner with domestic enterprises to facilitate local distribution, ensure regulatory compliance, and navigate reimbursement policies.

The Australian and New Zealand (ANZ) intraocular lymphoma treatment landscape is expected to grow by 6.3% CAGR through 2025 to 2035, owing to robust regulatory frameworks, relatively high per capita healthcare spending. Australia's therapeutic goods administration (TGA) and New Zealand's medsafe provide fast-track approvals for oncology drugs, providing access to patients ahead of broader availability.

Australia is another notable player due to its basis on the Pharmaceutical Benefits Scheme (PBS) that provides government reimbursement for high-cost cancer treatments, making it a very attractive sector for pharmaceutical companies. Australia and New Zealand have high cancer awareness, well-developed clinical trial infrastructure, and a favorable regulatory environment.

Institutions like the Peter MacCallum cancer centre and the Garvan Institute of Medical Research lead the way into new treatment approaches towards targeted therapies and immunotherapy for intraocular lymphoma.

The Indian intraocular lymphoma treatment landscape is anticipated to steadily grow at a CAGR of 6.1% during the period of projection from 2025 to 2035 due to the increasing burden of cancer cases, advancement in healthcare infrastructure, and rising interest towards affordable biologics and immunotherapy. Finally, the growing incidence of HIV-related lymphoma cases also has driven demand for advanced treatment solutions.

To address this, the Government of India has been working to increase access to cancer care through several public health schemes, including the Ayushman Bharat - Pradhan Mantri Jan Arogya Yojana andthe latter provides reimbursements for expensive cancer therapies.

Even the technology development board has identified this space for supporting domestic biotech in biosimilars, targeted therapy, and CAR-T cells.Multinational pharmaceutical companies face profit constraints due to India's strict price controls on drug sales in India, due to regulations set by the National Pharmaceutical Pricing Authority (NPPA) and the Drug Price Control Order (DPCO).

The overall CAGR for the intraocular lymphoma treatment segment from 2025 to 2035 is projected to be 6.7%. The intraocular lymphoma treatment is segmented based on drug class, mode of administration, distribution channel, and end users. Rituximab is the most common type of drug used, and its targeted effect on CD20-positive B cells makes it easier to use. As a result, it has been able to dominate this segment, particularly as it pertains to total therapies and combination therapies.

Methotrexate, a decades-old chemotherapeutic agent, remains pivotal to treatment for patients who need either systemic or intravitreal chemotherapy. However, the emergence of more selective biologics is likely to moderate its growth. Few cases utilize cisplatin, another chemotherapeutic agent, due to its high toxicity and prominent adverse effects. Newer, safer treatments are now crowding out demand for this product.

The CAGR for the mode of administration segment (2025 to 2035) in the intraocular lymphoma treatment landscape is projected to be 6.9%. When it comes to delivery methods, injectable therapies are the most popular because they allow for direct drug delivery, which improves bioavailability and effectiveness, especially in aggressive types of intraocular lymphoma.

Due to the urgent need for interventions among these patients, the segment is expected to grow faster. Oral therapies, however, are gaining more and more traction because of their increased level of convenience for patients and improved compliance, while also allowing for maintenance therapy or longer-term management. The oral segment is expected to have a higher growth because oral drug formulations are always getting better and more patients want minimally invasive options.

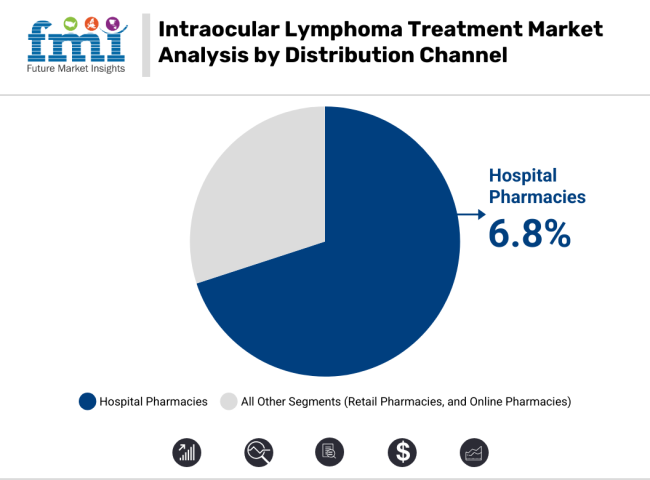

The CAGR for the distribution channel segment (2025 to 2035) in the intraocular lymphoma treatment segment is projected to be 6.8%. On the distribution channel front, hospital pharmacies are by far the most common provider of intraocular lymphoma therapies, as such drugs are often high-cost with specific logistics surrounding their storage and administration.

Amidst the strong role of hospitals in the treatment of rare malignancies, this segment is likely to witness a steady growth. While retail pharmacies do not hold a significant share, they are gaining momentum due to the increasing availability of oral therapies. However, the fastest-growing segment has been online pharmacies, powered by the trends in digital healthcare and a growing patient preference for at-home delivery of medication. Increased accessibility to specialized treatment via e-commerce platforms is driving high growth in this segment.

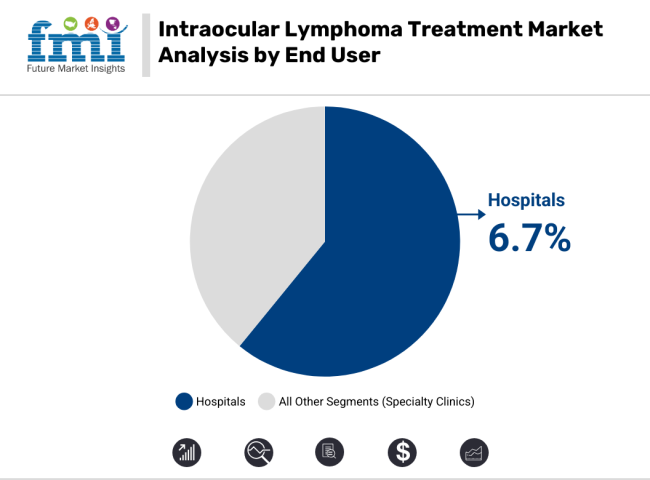

The CAGR for the end-user segment (2025 to 2035) in the intraocular lymphoma treatment segment is projected to be 6.7%. On the basis of end users, hospitals are the leading segment, as these have advanced diagnostic and treatment facilities for the patients suffering from intraocular lymphoma. Focally, the hospital segment is poised to grow steadily, which can be attributed to a rise in the number of patient admissions, coupled with growing access to multidisciplinary oncology care.

A fast-growing segment is specialty clinics that provide targeted and more personalized care to patients. With the changing healthcare paradigm focusing on specialty and decentralized treatment centers, specialty clinics are poised for robust growth.

Competitive LandscapeThe competitors in the intraocular lymphoma treatment segment are concentrating on price synchronization, innovation, strategic partnerships, and international presence. Biologics like Rituximab are expensive, and treating intraocular lymphoma is a complicated process. Companies are prioritizing value-based pricing.

Leading players use growth strategies such as aggressive R&D investments, geographical expansion, and mergers & acquisitions. Companies are partnering with hospitals, research institutions, and biotech companies to speed drug development and increase their clinical trial networks. Many companies are also focusing on establishing local partnerships to target emerging sectors like China and India to get around pricing laws and give themselves a competitive edge.

Methotrexate, Rituximab, and Cisplatin

Injectable and Oral

Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies

Hospitals and Specialty Clinics

North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa

The industry is growing due to the development of targeted therapies, a rising number of lymphoma cases, advancements in diagnostic techniques, and the availability of specialized drugs in hospitals and specialty clinics.

Due to its targeted action, rituximab remains the most widely used in this context, and methotrexate remains a standard choice for a chemotherapeutic agent. New biologics and immunotherapies are also climbing in interest.

Diagnostics powered by AI, precision medicine techniques, and innovations in biologics are providing for earlier detection of disease, safer treatment options with greater efficacy, and fewer side effects-all of which result in better outcomes for patients.

Benefitting the online pharmacy market are home delivery options for specialized therapies, greater patient convenience, and a wider reach to remote areas.

Regulatory frameworks like the FDA in the USA, EMA in Europe, and NMPA in China impact drug approvals, pricing policies, and reimbursement structures that affect the speed at which new therapies reach patients.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 22: Global Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 47: North America Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 48: North America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 97: Europe Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 98: Europe Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 99: Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 124: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 149: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 174: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 197: MEA Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 198: MEA Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 199: MEA Market Attractiveness by End User, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peripheral T-Cell Lymphoma Treatment Market Size and Share Forecast Outlook 2025 to 2035

Central Nervous System (CNS) Lymphoma Treatment Market Analysis by Treatment, End User, and Region: Forecast for 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Intraocular Lens Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA