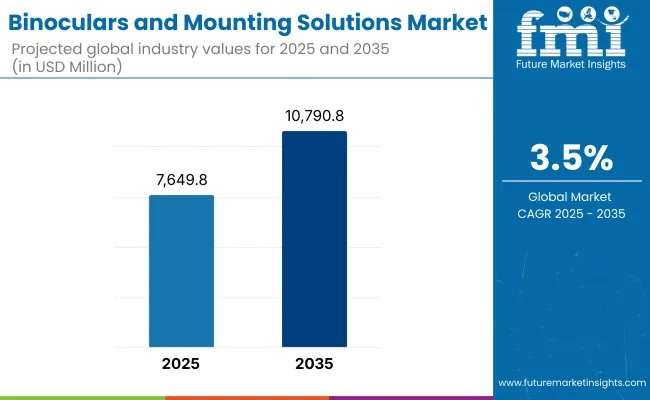

The binoculars and mounting solutions market will be growing at CAGR of 3.5% and is expected to reach USD 10,790.8 Million by 2035. In addition, the increasing popularity of adventure tourism and ecological monitoring, along with the availability of small-sized, high-performance optical devices in the market, is another factor that drives the consumer acceptance.

The binoculars and mounting solutions market is set to see strong growth from 2025 to 2035. This growth is driven by more demand for military use, wildlife watching, outdoor fun, and sports. New tech in lenses, a rise in birdwatching and stargazing fans, and higher defense spending around the globe are pushing the market ahead. Also, new light materials, better image stability, and links with digital tech are making binoculars and their mounts more useful and attractive.

The demand for binoculars is particularly on the rise in the defense sector, with words and contracts seeing increased usage of binoculars for land survey, space exploration as well as maritime navigation acts as a prime growth driver of the binoculars and mounting solutions market. The market is also advantageous for modernisation of optical technologies, image stabilisation and robust and weather resistant mounting solutions that are well suited in rough conditions.

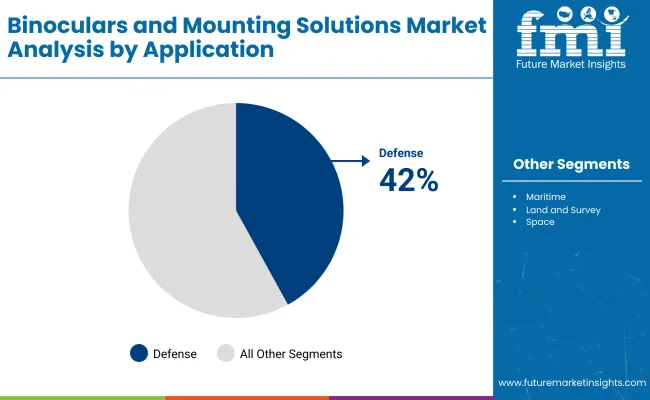

Defense Segment Dominates with Demand for Tactical and Long-Range Vision Systems

The largest segment is defense, assisted by increasing investments in border monitoring, reconnaissance missions, and binoculars mounted with night vision. Military militaries worldwide are increasingly adopting tripod or combat-type binocular systems mounted either on legs only or on vehicles to improve day and night operational efficiency.

Increasing defense modernization programs in various regions including North America, Europe and Asia-Pacific are continuously promoting the market for high-performance optics and mounting accessories.

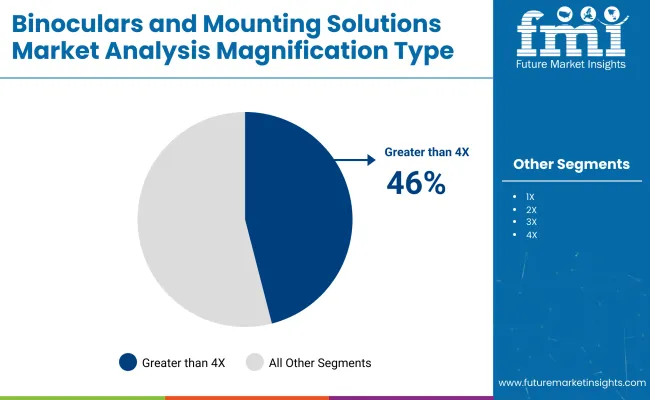

High-Magnification (4X+) Binoculars Lead with Precision and Long-Distance Capability

The greater than 4X magnification segment accounted for the largest market share owing to their application in long-range surveillance, marine spotting as well as astronomical viewing. Binoculars with high magnification, often with gyroscopic stabilizers and laser rangefinders, are critical for both military reconnaissance and for observation of outer space.

Technological innovations such as multi-coated lenses, thermal imaging integration, and lightweight yet durable mounts are improving usability and driving adoption and usage in mission-critical applications.

Price Sensitivity and Market Fragmentation

Price sensitivity among consumers is one of the major challenges faced in the binoculars and mounting solutions market, especially in emerging markets. The high-end binoculars in the premium segment also boast of excellent functionality while a considerable percentage of people choose the economy type to suffer from poor construction. The market is further fragmented, with multiple local and international brands competing at different price levels, which can restrict profitability.

Integration of Smart Features and Customization

Smart technologies like augmented reality (AR), GPS tagging, and connectivity to mobile apps are starting to break new ground in the binoculars and mounting solutions market. These innovations are particularly appealing in the adventure and defence context, where improved situational awareness matters more than ever. Customizable options in design, lens configuration, and mounting features allow vendors to cater to niche user needs, driving brand loyalty and repeat purchases.

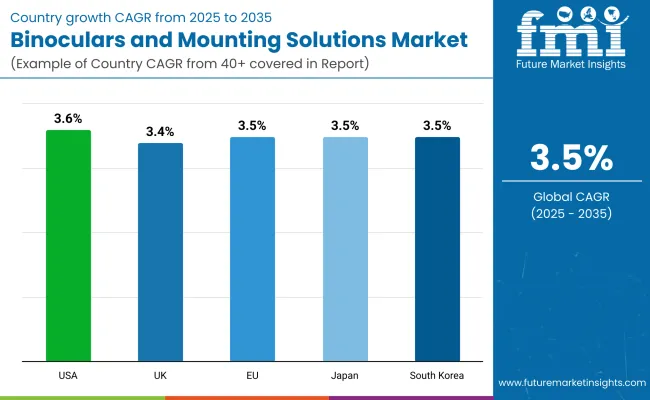

The binoculars and mounting solutions market in the USA is anticipated to grow at a considerable rate during the forecast period, between 2023 and 2028. People are more fond of outdoor activities such as birdwatching, hiking, and hunting. More of these products are also needed in the defense and security sectors. Agencies including the USA Fish and Wildlife Service and the Department of Defense help prop up demand by purchasing goods and tracking wildlife.

Among such trends is the increasing use of image-stabilized and night-vision binoculars, the willingness to pay more for robust but lightweight mounting systems and more people using binoculars for stargazing.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.6% |

In the UK, more people are buying binoculars. They use them for eco-trips, watching wildlife, and fun sports such as sailing and shooting. The Ministry of Defence and nature groups also help the market by updating gear and doing ecological surveys.

People want small, waterproof binoculars. They're also shopping more online. New ideas for binoculars include those that can stand on a tripod and hands-free sets.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

The market for binoculars and mounting solutions in the European Union is growing fast. People are more into nature walks, mountain sports, and there is rising demand for new military gear. Programs across the EU that help with studying the environment and watching over borders add to this demand.

Germany, France, and Italy are important spots for this market. We see new trends like a move toward easy-to-handle and high-zoom binoculars, more use in military practice, and a rise in using mounting kits that fit many optical tools.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

Japan's market grows due to widespread use of binoculars at cultural events, marine sports, and nature watching. There is also more need in sea surveillance and defense. The Ministry of Defense, along with local outdoor gear brands, help expand the market.

Trends involve making better optics, more use of binoculars for stargazing and concerts, and creating mounts that adjust and resist shocks.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.5% |

In South Korea, the market for binoculars and mounting solutions is growing quickly. This is because more people are traveling for fun, and there is a need for better border safety. There is also more money going into sports optics. Government groups and private safety firms are main users of new optical tools.

Key trends in the market are making high-power binoculars smaller, adding digital imaging, and creating modular mounting systems for fast use in the field.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

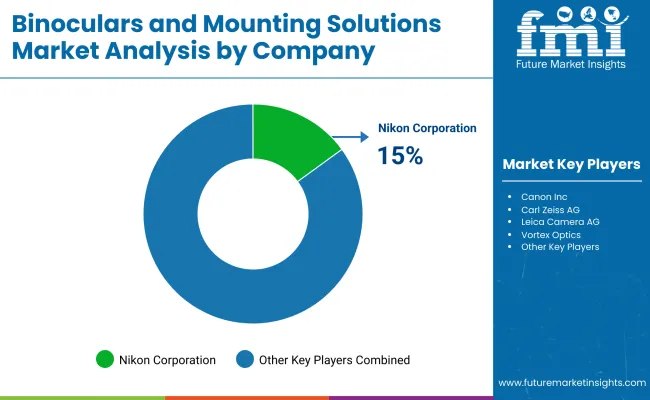

The binoculars and mounting solutions market is growing well. This growth comes from outdoor fun, birdwatching, stargazing, and defense uses. Big names like Nikon, Canon, Carl Zeiss, Leica, and Vortex Optics lead the charge. They use top-notch lens tech, picture stabilization, comfy designs, and strong mounts. These help both hobbyists and pros.

Companies aim to stand out, grow reach worldwide, and connect with Gen Z through social media about stars and nature. New ideas like waterproof, fog-proof, and good in low light have spread uses. Though big firms hold most of the market, local brands and new firms are rising with cheap but good products for outdoor and tactical needs. Growing wants in North America, Europe, and Asia-Pacific show a bright future for 2025 and later. Green practices, digital features, and easy-to-carry products are key to winning.

Nikon Corporation (15-18%)

Nikon leverages its extensive experience in optics to offer a diverse range of binoculars, focusing on durability and performance in various environmental conditions.

Canon Inc. (12-15%)

Canon integrates advanced image stabilization technologies into its binoculars, appealing to users requiring steady viewing experiences, such as in marine and astronomical observations.

Carl Zeiss AG (10-13%)

Carl Zeiss emphasizes precision engineering and optical clarity, catering to professional and enthusiast markets in birdwatching and nature observation.

Leica Camera AG (8-11%)

Leica focuses on premium craftsmanship and optical performance, attracting users seeking high-end binoculars for various applications.

Vortex Optics (6-9%)

Vortex targets the hunting and tactical markets with robust and reliable optics and mounting solutions, emphasizing customer service and warranty programs.

Other Key Players (35-49% Combined)

Several other companies contribute significantly to the binoculars and mounting solutions market:

The overall market size for the binoculars and mounting solutions market was approximately USD 7,649.8 Million in 2025.

The binoculars and mounting solutions market is projected to reach approximately USD 10,790.8 Million by 2035.

Increasing participation in outdoor recreational activities, advancements in optical technologies, and growing demand from military and defense sectors are expected to drive market growth.

The United States, China, Germany, Japan, and the United Kingdom are key contributors.

The roof prism binoculars segment is expected to lead due to their compact design and superior image quality.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA