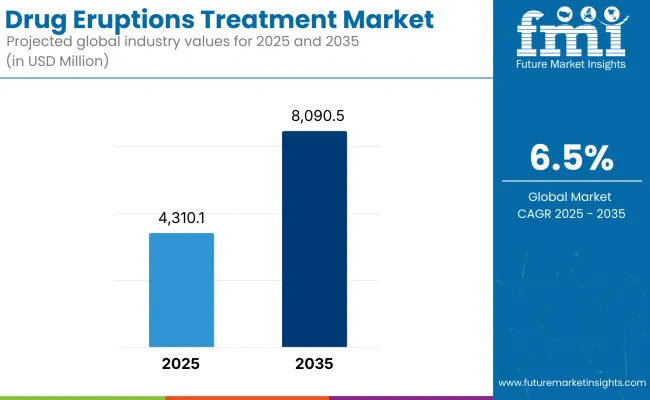

The Drug Eruptions Treatment Market is expected to witness substantial growth between 2025 and 2035, driven by the increasing prevalence of adverse drug reactions (ADRs) and the rising adoption of precision medicine. The market is projected to reach USD 4,310.1 million in 2025 and is set to expand significantly to USD 8,090.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5% over the forecast period.

One major factor contributing to market growth is the growing awareness and early diagnosis of drug-induced skin reactions, such as Stevens-Johnson syndrome and toxic epidermal necrolysis. With the increasing consumption of prescription and over-the-counter medications, cases of hypersensitivity reactions and cutaneous drug eruptions have risen significantly. Healthcare providers and dermatologists are emphasizing effective and rapid treatment protocols, leading to higher demand for corticosteroids, immunosuppressant, and antihistamines.

The Route of Administration category holds the largest market share in the global Allergy market (Oral administration) owing to its convenience, more patient compliance, availability of oral corticosteroids and antihistamines. Most cases of drug eruption are mild to moderate and can be managed just with oral medication.

Even oral corticosteroids and antihistamines remain the first line of therapy in patients with allergic reactions and inflammation. Different reasons supporting this stronghold of oral route in the drug eruptions treatment market include the relative low cost, preference for self-administered approaches.

The North America drug eruptions treatment market is expected to be driven by high incidence of adverse drug reactions, established healthcare infrastructure, and tight pharmacovigilance regulations in the region. The USA and Canada have advanced dermatological and immunological research centers geared to find effective drugs for drug-induced skin reactions. The growing presence of leading pharmaceutical companies and dermatology clinics also contribute to the growth of the market.

Furthermore, rising awareness concerning the adverse effects of drug reactions alongside early diagnosis through advanced diagnostic tools drive up the demand for targeted drugs including, but not limited to, corticosteroids, antihistamines, and immunosuppressant. This is also why drug companies are urged to invest money to study safer alternatives to treat severe symptoms, including Stevens-Johnson syndrome and toxic epidermal necrolysis, are regulated by safety agencies like the FDA.

The drug eruptions treatment market share in Europe is driven by industrialized countries, such as Germany, France, and the United Kingdom. Significant emphasis on clinical research, state-sponsored healthcare initiatives, and the use of precision medicine strategies for treating severe drug-induced dermatoses highlight the region. The area is covered by some of the largest dermatology and allergy research centers, where drug safety surveillance has been improved and drug hypersensitivity reactions therapy has been refined.

Additionally, as intensive pharmacovigilance regulations set out by the European Medicines Agency (EMA), more efficient therapeutic solutions are mandated for the early detection and control of drug eruptions. Different healthcare reimbursement policies among European nations, however, hinder treatment affordability and accessibility and demand for cost-saving biologic and immunomodulatory therapies.

The Asia-Pacific is estimated to witness the highest growth in the treatment market for drug eruptions owing to rising adverse events associated with currently available medicines, expanding healthcare infrastructure, and rising awareness regarding dermatological conditions. In fact, there are investments being made in pharmacovigilance programs to minimize drug-induced hypersensitivity reactions being made out of China, India, Japan and South Korea for dermatology research.

As it is, the demand for corticosteroids, antihistamines, and new biologic drugs is demanded due to acute flares of drug eruption, especially in China and India, due to increased use of antibiotics and NSAIDs. With their cutting-edge work in immunotherapy and precision medicine, new therapies are being developed for severe drug eruptions in Japan.

However, the region also suffers from underreporting of adverse drug reaction and limited access to specialized dermatological facilities in rural areas. The growth of the market in the coming years is further projected to be boosted by initiatives that emphasize legislation focused on drug safety, coupled with efforts directed at expanding healthcare services, specialized in dermatology.

Challenge

Variability in Drug Reaction Severity and Diagnosis

New era of cellular and molecular biology has brought significant advancements in drug eruption diagnosis and treatment; however, still variability in severity of drug reactions, complexities of proper diagnosis and respective treatment are some of the major challenge in the drug eruptions treatment market. Rash reactions from drugs can range from mild skin irritation to more severe life-threatening presentations such as Stevens-Johnson syndrome, making standardization in treatment for them challenging.

In addition, misdiagnosis and delayed identification of offending agents may lead to symptom exacerbation and prolonged hospitalization. Lack of comprehensive diagnostic guidelines and variation in the response of physicians and patients to the treatment make the effective and timely treatment a challenging task.

Opportunity

Advancements in Personalized Medicine and Immunotherapy

Immunotherapy and personalized medicine: a unique opportunity for drug eruptions management Genomic research advances and pharmacogenomics is assisting the healthcare providers in anticipating patient susceptibility to adverse drug effects, thus, reducing the probability of severe drug eruptions.

Moreover, the growing use of immunotherapy agents and biologics is improving treatment of severe hypersensitivity reactions. The treatment of drug eruptions, an increasingly common event in the era of polypharmacy, is predicted to be disrupted by novel rapid diagnostic tests, monitored with AI for drug safety, and precision medicines, benefiting patients and providing a cost savings.

Between 2020 and 2024, the drug eruptions treatment market witnessed steady growth due to rising incidences of adverse drug reactions (ADRs), increasing awareness about dermatological side effects, and advancements in personalized medicine.

The growing consumption of antibiotics, anticonvulsants, and nonsteroidal anti-inflammatory drugs (NSAIDs) contributed to a surge in cases of drug-induced skin reactions, driving demand for effective treatment options. Healthcare providers emphasized early detection and management through antihistamines, corticosteroids, and immunosuppressive therapies.

Between 2025 and 2035, the drug eruptions treatment market will undergo a paradigm shift, driven by AI-powered dermatology, precision medicine, and regenerative therapies. The adoption of machine learning-based diagnostic tools, Nano medicine for targeted drug delivery, and microbiome-modulating therapies will redefine treatment efficacy and patient outcomes.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | More stringent pharmacovigilance regulations, higher surveillance of SCARs, and better ADR reporting standards.. |

| Technological Advancements | AI-based dermatological screening, NGS-enabled genetic predisposition testing, and biologic treatment for severe reactions.. |

| Industry Applications | Hospital-based drug eruption management, outpatient dermatology treatment, and pharmaceutical safety monitoring.. |

| Adoption of Smart Equipment | Digital dermatological imaging, AI-augmented drug interaction monitoring, and Nano carrier-based topical therapies.. |

| Sustainability & Cost Efficiency | Increased access to dermatological care, improved ADR reporting mechanisms, and cost-effective drug eruption management strategies. |

| Data Analytics & Predictive Modeling | AI-based ADR risk assessment, cloud-integrated dermatology data analytics, and machine learning-powered treatment recommendations. |

| Production & Supply Chain Dynamics | COVID-19 disruptions affecting dermatological drug supply, increased demand for biologics, and shortages in critical immunosuppressive drugs. |

| Market Growth Drivers | Growth driven by rising ADR cases, personalized medicine advancements, and regulatory focus on severe drug eruptions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-based ADR monitoring, block chain-enabled pharmacovigilance, and regulatory emphasis on precision dermatology. |

| Technological Advancements | Gene-editing therapies, AI-based ADR risk estimation, and bioengineered regenerative skin therapy. |

| Industry Applications | Growth into AI-based tele dermatology, wearable biosensor-based drug reaction detection, and intelligent pharmacogenomics treatment solutions. |

| Adoption of Smart Equipment | Fully automated AI-driven hypersensitivity diagnostics, real-time skin health tracking, and bioelectronics drug modulation systems. |

| Sustainability & Cost Efficiency | Block chain-enabled pharmacovigilance transparency, AI-optimized healthcare cost reduction, and sustainable Nano medicine formulations. |

| Data Analytics & Predictive Modeling | Quantum-enhanced dermato-pharmacology analytics, decentralized AI-driven hypersensitivity prediction, and block chain-secured patient health records. |

| Production & Supply Chain Dynamics | AI-optimized dermatological drug manufacturing, decentralized pharmaceutical supply chains, and block chain-enabled treatment quality assurance. |

| Market Growth Drivers | AI-powered real-time hypersensitivity detection, regenerative dermatology solutions, and expansion into AI-driven remote drug safety monitoring. |

The market for USA drug eruptions treatment is growing with the rising incidence of adverse drug reactions (ADRs), growing awareness of dermatological side effects of drugs, and increasing prescriptions for immunosuppressant, antibiotics, and anticonvulsants.

The availability of a robust pharmaceutical industry, improvement in dermatological research, and government programs for ensuring drug safety are also contributing to market growth. Further, growth in personalized medicine and rising usage of biologics for extreme skin reactions will drive demand for sophisticated treatments.

| Country | CAGR (2025 to 2035) |

|---|---|

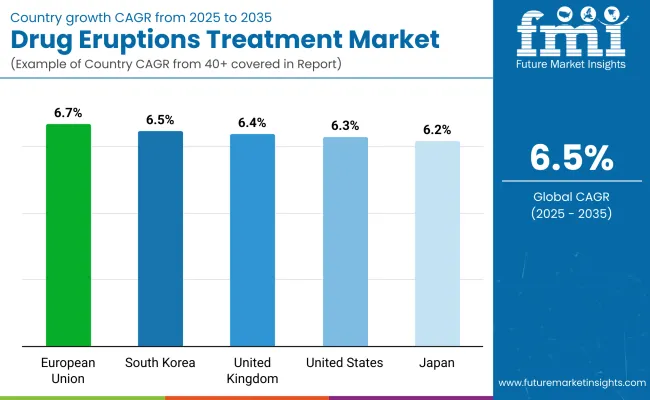

| USA | 6.3% |

The UK drug eruptions treatment market is expanding on account of a rising number of severe cutaneous adverse reactions (SCARs), government guidelines that ensure the safety of drugs, and burgeoning research into dermatological immunology.

The National Health Service (NHS) is continuously enhancing access to specialist dermatologists and high-tech therapies, creating increasing demand in the market. Pharmed innovation as well as innovation in developing therapies specifically targeting drug-induced skin diseases is also sustaining market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.4% |

The European Union's drug eruptions treatment market is witnessing continuous growth as a result of rigorous pharmacovigilance measures, growing concerns regarding drug safety, and widening dermatological research programs in member nations.

Germany, France, and Italy are at the forefront of dermatology drug development and hospital-based treatments for serious drug-induced skin diseases. The growing application of monoclonal antibodies and corticosteroids in treating drug eruptions is also propelling demand. Moreover, the growing use of AI-based diagnostics for ADR detection is anticipated to boost market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.7% |

Japan's market for treating drug eruptions is expanding because of a high incidence of drug hypersensitivity reactions, government initiatives in pharmacovigilance, and accelerated research into dermatological autoimmune disease.

The country's aging population and the high rate of prescribing multiple drugs (polypharmacy) lead to the rising incidence of drug-induced skin diseases. Moreover, biotechnology companies in Japan are aggressively establishing new therapies for life-threatening allergic conditions and immune-mediated skin diseases, which also drives the market forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

The market for South Korea's drug eruptions treatment is growing because of increased awareness regarding drug allergies, improved dermatological research, and government-supported efforts to enhance the monitoring of drug safety.

An increase in availability of dermatologists and the development of precision medicine strategies are pushing the market toward growth. On top of this, the advancement of the pharmaceutical industry and an increase in the demand for biologics and immunomodulatory for bad cutaneous reactions are also enhancing growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

Corticosteroids are among the best-selling drug types in the market for treating drug eruptions due to their capacity to deliver rapid relief from symptoms of inflammation, itching, and severe hypersensitivity reactions. Through direct suppression of immune system reaction, corticosteroids cut off the ongoing development of skin conditions caused by drugs.

The increasing prevalence of adverse drug reactions, particularly among patients receiving polypharmacy treatments, has fueled corticosteroid adoption, as healthcare providers prioritize immediate symptom control. The expansion of targeted corticosteroid therapies, featuring optimized dosage forms, extended-release formulations, and novel delivery mechanisms, has strengthened market growth, ensuring better patient adherence and therapeutic efficacy.

The inclusion of AI-based diagnostic platforms, including machine learning-enabled rash identification, predictive modeling of allergic responses, and computer-aided corticosteroid dosing changes, has complemented growth even further, promoting accuracy in the treatment of drug eruptions.

The formulation of combination corticosteroid medicines, including synergistic anti-inflammatory agents, immunomodulatory, and compounds enhancing the skin barrier, has maximized market expansion, providing enhanced patient healing and minimal adverse effects.

The implementation of personalized medicine programs, including genetic testing for corticosteroid responsiveness, biomarker-based treatment selection, and AI-based prescription protocols, has further supported market growth, with the assurance of personalized drug eruption control.

Though it excels in symptom management, immune control, and inflammation suppression, the corticosteroid segment is challenged by long-term side effects, risks of steroid dependency, and contraindications in immunocompromised patients.

Yet new developments in Nano-formulated corticosteroids, biodegradable steroid-releasing implants, and AI-assisted adverse effect monitoring are enhancing safety, efficacy, and treatment compliance, which will ensure further growth for corticosteroid-based drug eruption treatments globally.

Strong market favor is being gained by oral administration by dermatologists, general practitioners, and immunologists as a systemic, convenient, and efficient treatment for drug eruption. Unlike the topical or parenteral methods, oral treatments of drug eruptions ensure wide distribution, hence global symptom relief.

The growing need for systemic drug eruption therapies, including corticosteroids, antihistamines, and immunosuppressant, has driven adoption of oral use, as healthcare professionals value convenience and patient compliance.

The growth in patient-friendly oral forms, such as fast-melt tablets, controlled-release capsules, and taste-masked liquid suspensions, has consolidated market demand, allowing for easier accessibility and compliance to treatment. Incorporating AI-driven drug compliance tools, including smart pill dispensers, digital reminders of therapy, and real-time feedback systems for patients, has complemented adoption even further, leading to improved compliance and therapeutic success.

Oral combination therapy development, with multi-mechanism drug eruption therapy, prolonged immunomodulatory action, and bioavailability maximization, has maximized market growth, ensuring improved patient healing and lower recurrence rates.

Implementation of ethical and sustainable drug-making practices, including environmentally friendly drug formulations, biodegradable oral medication packaging, and ethical drug eruption treatment clinical trials, has strengthened market growth, ensuring alignment with global healthcare sustainability patterns.

In spite of its benefits in patient convenience, systemic efficacy, and cost-effectiveness, the oral administration category is challenged by drug interactions, gastrointestinal side effects, and uneven absorption rates among some patient groups.

Nevertheless, new developments in AI-based pharmacokinetic modeling, precision dosing algorithms, and microencapsulated oral drug delivery systems are enhancing safety, bioavailability, and patient outcomes, assuring ongoing growth for orally administered drug eruption treatments globally.

Parenteral administration has emerged as a key segment in the drug eruptions treatment market, offering rapid drug delivery for severe allergic reactions, toxic epidermal necrolysis, and life-threatening hypersensitivity syndromes. Unlike oral treatments, parenteral drug administration bypasses the digestive system, ensuring immediate therapeutic effects.

The rising demand for emergency drug eruption treatments, featuring corticosteroid injections, antihistamine infusions, and immunosuppressive biologics, has fueled adoption of parenteral administration, as healthcare providers prioritize fast-acting therapies for critical patients.

Despite its advantages in rapid symptom control, hospital-based administration, and immediate bioavailability, the parenteral administration segment faces challenges such as invasive procedures, higher treatment costs, and the need for trained healthcare professionals.

However, emerging innovations in needle-free injection technology, wearable drug infusion systems, and AI-assisted parenteral drug dosing are improving safety, patient comfort, and treatment efficiency, ensuring continued market expansion for parenteral drug eruption treatments worldwide.

The intravenous administration segment has gained strong market adoption, particularly in severe cases requiring intensive care, systemic immunosuppression, and continuous monitoring. Unlike oral or parenteral options, intravenous drug eruption treatments ensure controlled, high-dose medication delivery for critical patients.

The rising demand for hospital-based drug eruption management, featuring IV corticosteroids, immunoglobulin therapies, and biologic immunosuppressant, has driven adoption of intravenous administration, as healthcare providers prioritize immediate and sustained relief for drug-induced hypersensitivity reactions.

Despite its advantages in controlled drug delivery, immediate therapeutic effects, and high patient response rates, the intravenous administration segment faces challenges such as high hospitalization costs, resource-intensive treatment protocols, and potential infusion-related complications.

However, emerging innovations in closed-loop IV drug delivery systems, AI-guided infusion therapy monitoring, and remote-controlled intravenous medication administration are improving safety, efficiency, and hospital workflow, ensuring continued growth for intravenous drug eruption treatments worldwide.

The Drug Eruptions Treatment Market is experiencing growth due to the rising incidence of adverse drug reactions (ADRs), particularly hypersensitivity reactions affecting the skin. Drug-induced eruptions range from mild rashes to severe conditions like Stevens-Johnson syndrome (SJS) and toxic epidermal necrolysis (TEN), necessitating effective treatment options.

Increasing awareness among healthcare professionals, improvements in diagnostic tools, and advancements in pharmacovigilance systems are driving market demand. The pharmaceutical and dermatology sectors are actively investing in research to develop safer drugs and treatment formulations. Leading companies focus on novel corticosteroids, antihistamines, immunosuppressive therapies, and supportive care treatments to manage drug eruptions effectively.

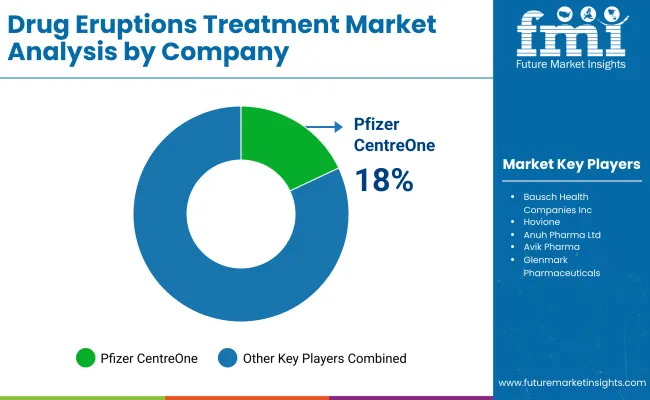

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Pfizer CentreOne | 18-22% |

| Bausch Health Companies Inc. | 14-18% |

| Hovione | 10-14% |

| Anuh Pharma Ltd. | 8-12% |

| Avik Pharma | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pfizer CentreOne | Manufactures active pharmaceutical ingredients (APIs) and formulations for dermatological treatments. |

| Bausch Health Companies Inc. | Specializes in corticosteroids and immunomodulatory drugs for severe drug-induced skin reactions. |

| Hovione | Develops pharmaceutical-grade corticosteroids and customized drug formulations. |

| Anuh Pharma Ltd. | Produces high-quality antihistamines and steroid-based treatments for allergic skin reactions. |

| Avik Pharma | Supplies active ingredients for antihistamines and anti-inflammatory drugs used in drug eruptions treatment. |

Key Company Insights

Pfizer CentreOne (18-22%)

As a leading contract development and manufacturing company (CDMO), Pfizer CentreOne is responsible for API manufacturing and formulation of dermatological medicines. The firm partners with pharmaceutical and biotech companies to produce anti-inflammatory and immunosuppressive drugs for drug eruptions.

Bausch Health Companies Inc. (14-18%)

A major player in dermatologic therapeutics, Bausch Health is an expert in topical and systemic corticosteroids applied in treating drug-induced rashes, SJS, and TEN. The firm is building its biologic therapies portfolio to treat severe allergic reactions.

Hovione (10-14%)

A pharmaceutical API expert, Hovione produces high-quality corticosteroids applied in the treatment of drug eruptions and hypersensitivity disorders. The firm is concentrated on innovative drug delivery systems to enhance treatment efficacy.

Anuh Pharma Ltd. (8-12%)

A prominent vendor of antihistamines and steroid-based APIs, Anuh Pharma is a key player in the international market for dermatology and allergy therapy. Anuh Pharma is expanding its research into next-generation anti-inflammatory molecules.

Avik Pharma (6-10%)

A growing player in the pharmaceutical ingredient supply chain, Avik Pharma provides raw materials for antihistamines, corticosteroids, and immunomodulatory drugs. Its focus on cost-effective production and sustainable manufacturing processes strengthens its market presence.

Other Key Players (30-40% Combined)

The Drug Eruptions Treatment Market also includes regional and emerging players, such as:

The overall market size for drug eruptions treatment market was USD 4,310.1 Million in 2025.

The drug eruptions treatment market is expected to reach USD 8,090.5 Million in 2035.

The increasing prevalence of adverse drug reactions (ADRs) and the rising adoption of precision medicine fuels Drug eruptions treatment Market during the forecast period.

The top 5 countries which drives the development of Drug eruptions treatment Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of drug-class, Corticosteroids to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 17: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Asia Pacific Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 19: Asia Pacific Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Asia Pacific Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 82: Asia Pacific Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Asia Pacific Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 91: Asia Pacific Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: Asia Pacific Market Attractiveness by Drug Class, 2023 to 2033

Figure 98: Asia Pacific Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 101: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 104: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 109: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 110: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 111: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 115: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Discovery Informatics Market Trends - Growth & Future Outlook 2025 to 2035

Drug Testing Equipment Market

Drug Resistant Pulmonary Tuberculosis Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA