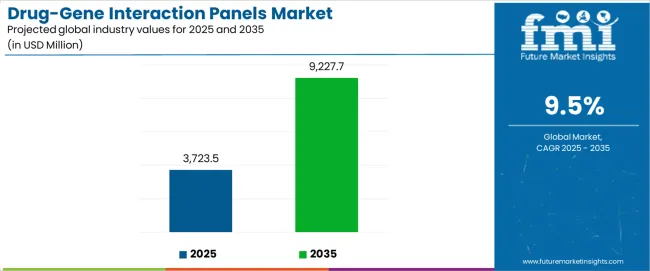

The global drug-gene interaction panels market, valued at USD 3,723.5 million in 2025, is expected to advance to USD 9,227.7 million by 2035, recording an absolute increase of USD 5,504.2 million. At a CAGR of 9.5%, the industry is set to expand nearly 2.5X, reflecting the accelerated integration of genetic insights into clinical decision-making. Market dynamics are shaped by the convergence of genomic science, diagnostic platforms, and clinical applications. Personalized medicine stands at the core, with healthcare providers increasingly utilizing pharmacogenomics testing to determine how specific drugs interact with genetic markers, improving treatment efficacy and minimizing adverse reactions. Hospitals, diagnostic labs, and precision care facilities are adopting drug-gene panels not only to optimize therapeutic outcomes but also to reduce the costs associated with trial-and-error prescribing patterns.

Rising awareness of precision healthcare has created demand for advanced diagnostic solutions across oncology, cardiology, neurology, and psychiatry, where drug response variability is significant. Pharmaceutical companies are also strengthening their role by integrating genetic testing into clinical trials, ensuring that patient stratification aligns with therapeutic targets. This has resulted in partnerships between diagnostics firms and drug developers, reshaping the way therapies are developed and delivered. On the regulatory side, increasing support for pharmacogenomic testing by government agencies and healthcare authorities has accelerated clinical adoption. Reimbursement structures are gradually adapting, enhancing accessibility and making these panels a standard consideration in treatment pathways.

Technological innovation remains another driver of growth. Next-generation sequencing (NGS), advanced bioinformatics platforms, and automated analysis tools have significantly reduced turnaround times for test results, enabling physicians to make real-time treatment decisions. AI-driven interpretation is further enhancing the accuracy of drug-gene interaction predictions, while cloud-based data sharing platforms improve collaboration between healthcare institutions. However, the drug-gene interaction panels market also faces challenges such as the complexity of interpreting genetic data, uneven reimbursement coverage across regions, and ethical considerations regarding patient privacy. Regionally, North America leads adoption, driven by strong healthcare infrastructure and early integration of genomics into clinical practice. Europe follows with regulatory backing and expanding diagnostic programs, while Asia Pacific shows the fastest growth, propelled by large patient populations, rising investment in precision medicine, and government-led healthcare reforms. Latin America and the Middle East are emerging markets, with adoption fueled by growing healthcare modernization efforts.

Between 2025 and 2030, the drug-gene interaction panels market is projected to expand from USD 3,723.5 million to USD 5,861.7 million, resulting in a value increase of USD 2,138.2 million, which represents 38.8% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for precision medicine solutions, increasing applications in oncology and chronic disease management, and growing penetration in emerging pharmacogenomics testing markets. Diagnostic equipment manufacturers are expanding their production capabilities to address the growing demand for customized drug-gene interaction panels in various clinical segments and personalized medicine programs.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3,723.5 million |

| Forecast Value in (2035F) | USD 9,227.7 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

From 2030 to 2035, the drug-gene interaction panels market is forecast to grow from USD 5,861.7 million to USD 9,227.7 million, adding another USD 3,366.0 million, which constitutes 61.2% of the ten-year expansion. This period is expected to be characterized by the expansion of advanced genomic testing infrastructure, the integration of cutting-edge sequencing technologies, and the development of customized pharmacogenomics panels for specific clinical applications. The growing adoption of precision medicine standards and clinical genomics will drive demand for ultra-high accuracy drug-gene interaction panels with enhanced analytical specifications and consistent performance characteristics.

Between 2020 and 2025, the drug-gene interaction panels market experienced steady expansion, driven by increasing recognition of pharmacogenomics testing's importance in clinical decision-making operations and growing acceptance of personalized medicine approaches in complex healthcare markets. The drug-gene interaction panels market developed as healthcare providers recognized the need for high-efficiency genomic testing systems to address patient safety requirements and improve treatment outcomes. Research and development activities have begun to emphasize the importance of advanced genomic technologies in achieving better efficacy and performance in therapeutic optimization processes.

Market expansion is being supported by the increasing demand for personalized healthcare and the corresponding need for high-efficiency pharmacogenomics testing systems in clinical applications across global diagnostic and therapeutic operations. Modern healthcare providers are increasingly focused on advanced genomic technologies that can improve treatment outcomes, reduce adverse drug reactions, and enhance patient safety while meeting stringent regulatory requirements. The proven efficacy of drug-gene interaction panels in various clinical applications makes them an essential component of comprehensive precision medicine strategies and healthcare modernization programs.

The growing emphasis on precision medicine and advanced therapeutic optimization is driving demand for ultra-efficient genomic testing systems that meet stringent analytical specifications and operational requirements for specialized applications. Healthcare providers' preference for reliable, high-performance pharmacogenomics testing systems that can ensure consistent clinical utility is creating opportunities for innovative genomic technologies and customized diagnostic solutions. The rising influence of clinical guidelines and precision medicine standards is also contributing to increased adoption of premium-grade drug-gene interaction panels across different clinical applications and therapeutic areas requiring advanced genomic technology.

The drug-gene interaction panels market represents a specialized growth opportunity, expanding from USD 3,723.5 million in 2025 to USD 9,227.7 million by 2035 at a 9.5% CAGR. As healthcare providers prioritize treatment optimization, adverse reaction prevention, and patient outcomes in complex therapeutic processes, drug-gene interaction panels have evolved from a niche diagnostic technology to an essential component enabling precision medicine, therapeutic optimization, and multi-stage clinical decision-making across healthcare operations and specialized clinical applications.

The convergence of clinical adoption, increasing genomic testing accessibility, specialized diagnostic infrastructure growth, and regulatory support creates momentum in demand. High-efficiency formulations offering superior analytical performance, cost-effective targeted panel systems balancing comprehensiveness with economics, and specialized comprehensive variants for complex applications will capture market premiums, while geographic expansion into high-growth Asian healthcare markets and emerging market penetration will drive volume leadership. Clinical emphasis on precision and safety provides structural support.

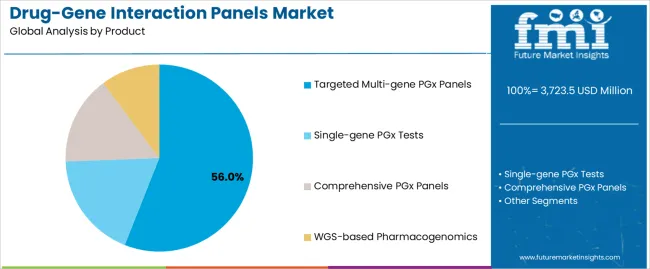

Pathway A - Targeted Multi-gene PGx Panels Dominance: Leading with 56.0% market share, targeted applications drive primary demand through complex clinical workflows requiring comprehensive genomic testing for multiple drug-gene interactions. Advanced formulations enabling improved clinical utility, reduced turnaround times, and enhanced analytical performance command premium pricing from healthcare providers requiring stringent performance specifications and regulatory compliance. Expected revenue pool: USD 2,085.2 million to 5,167.5 million.

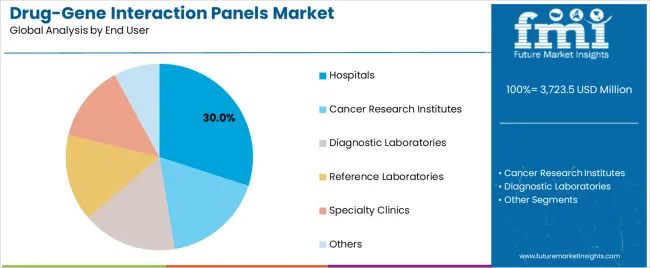

Pathway B - Hospitals Leadership: Dominating with 30.0% market share through an optimal balance of clinical utility and accessibility requirements, hospitals serve most diagnostic applications while meeting patient care requirements. This application addresses both clinical standards and operational considerations, making it the preferred choice for healthcare organizations seeking reliable pharmacogenomics testing. Opportunity: USD 1,117.1 million to 2,768.3 million.

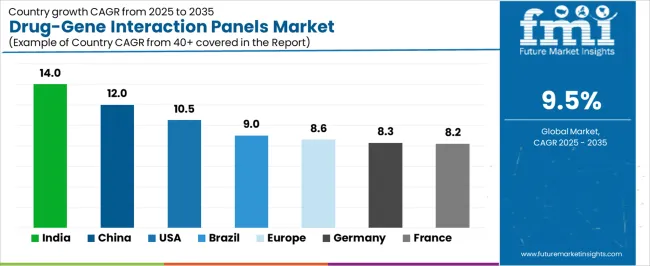

Pathway C - Asian Market Acceleration: India (14.0% CAGR) and China (12.0% CAGR) lead global growth through healthcare infrastructure expansion, genomic testing capabilities development, and domestic demand for high-efficiency pharmacogenomics systems. Strategic partnerships with local healthcare providers, regulatory compliance expertise, and supply chain localization enable the expansion of genomic technology in major clinical hubs. Geographic expansion upside: USD 745.0 million to 1,845.5 million.

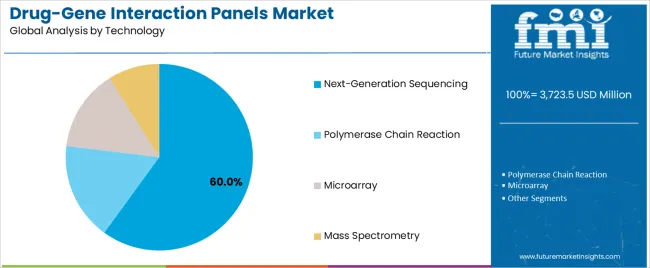

Pathway D - Next-Generation Sequencing Premium Segment: NGS technology applications serve specialized operations requiring exceptional analytical specifications for critical pharmacogenomics testing processes. NGS-based formulations supporting complex genomic analysis requirements, comprehensive panel applications, and performance-sensitive processes command significant premiums from advanced healthcare organizations and specialized diagnostic facilities. Revenue potential: USD 2,234.1 million to 5,536.6 million.

Pathway E - Advanced Bioinformatics & Analysis Systems: Companies investing in sophisticated genomic technologies, automated analysis systems, and intelligent interpretation processes gain competitive advantages through consistent analytical performance and clinical reliability. Advanced capabilities enabling customized clinical reports and rapid turnaround capture premium healthcare partnerships. Technology premium: USD 372.4 million to 922.8 million.

Pathway F - Supply Chain Optimization & Reliability: Specialized distribution networks, strategic inventory management, and reliable supply chain systems create competitive differentiation in clinical markets requiring consistent drug-gene interaction panel availability. Companies offering guaranteed supply security, technical support, and regulatory documentation gain preferred supplier status with quality-focused healthcare providers. Supply chain value: USD 223.4 million to 553.7 million.

Pathway G - Emerging Applications & Market Development: Beyond traditional pharmacogenomics testing, drug-gene interaction panels in novel therapeutic areas, specialized clinical processes, and innovative precision medicine applications represent growth opportunities. Companies developing new applications, supporting clinical research initiatives, and expanding into adjacent healthcare markets capture incremental demand while diversifying revenue streams. Emerging opportunity: USD 148.9 million to 369.1 million.

The drug-gene interaction panels market is segmented by product, technology, end user, and region. By product, the drug-gene interaction panels market is divided into single-gene PGx tests, targeted multi-gene PGx panels, comprehensive PGx panels, and WGS-based pharmacogenomics. Based on end user, the drug-gene interaction panels market is categorized into hospitals, cancer research institutes, diagnostic laboratories, reference laboratories, specialty clinics, and others. By technology, the drug-gene interaction panels market is divided into polymerase chain reaction, microarray, next-generation sequencing, and mass spectrometry. Regionally, the drug-gene interaction panels market is divided into Asia Pacific, North America, Europe, Latin America,the Middle East & Africa.

The targeted multi-gene PGx panels segment is projected to account for 56% of the drug-gene interaction panels market in 2025, reaffirming its position as the category's dominant product type. Healthcare operators increasingly recognize the optimal balance of clinical comprehensiveness and operational efficiency offered by targeted multi-gene panels for most pharmacogenomics applications, particularly in medication management and therapeutic optimization processes. This product type addresses both analytical requirements and cost-effectiveness considerations while providing reliable genomic insights across diverse clinical applications.

This product type forms the foundation of most clinical protocols for pharmacogenomics testing applications, as it represents the most widely accepted and commercially viable level of genomic testing technology in the healthcare industry. Clinical guidelines and extensive validation studies continue to strengthen confidence in targeted multi-gene PGx panel formulations among diagnostic and clinical providers. With increasing recognition of the clinical utility-cost optimization requirements in pharmacogenomics testing, targeted multi-gene systems align with both analytical accuracy and accessibility goals, making them the central growth driver of comprehensive precision medicine strategies.

Hospitals are projected to represent 30% of drug-gene interaction panels demand in 2025, underscoring their role as the primary end user segment driving market adoption and growth. Healthcare facilities recognize that patient care requirements, including complex medication management, specialized therapeutic needs, and multi-disciplinary clinical teams, often require advanced pharmacogenomics testing that standard diagnostic approaches cannot adequately provide. Drug-gene interaction panels offer enhanced medication safety and clinical decision support in hospital care applications.

The segment is supported by the growing complexity of medication regimens, requiring sophisticated genomic testing systems, and the increasing recognition that advanced pharmacogenomics technologies can improve patient outcomes and clinical performance. Hospitals are increasingly adopting evidence-based clinical guidelines that recommend specific drug-gene interaction panels for optimal medication management. As understanding of pharmacogenomics advances and clinical requirements become more stringent, drug-gene interaction panels will continue to play a crucial role in comprehensive patient care strategies within the hospital market.

Next-generation sequencing (NGS) is projected to account for 60% of the drug-gene interaction panels market in 2025. This dominant share underscores the growing adoption of NGS technologies, driven by their ability to meet complex genomic analysis demands. NGS platforms enable precise variant detection, mutation screening, and multi-gene sequencing, offering unparalleled depth in genomic data analysis. Healthcare operators increasingly prefer NGS for pharmacogenomics due to its capacity to handle intricate genetic interactions that conventional technologies cannot fully address.

The NGS segment's leading market position is also bolstered by the technology's operational efficiency and analytical capabilities. It provides clinicians with more accurate and comprehensive insights into drug-gene interactions, facilitating personalized medicine approaches. As demand for precision therapies rises, NGS-based drug-gene interaction panels are becoming indispensable tools in clinical settings, ensuring better treatment outcomes through improved pharmacogenomic insights and reducing trial-and-error in drug prescriptions.

The drug-gene interaction panels market is advancing steadily due to increasing recognition of pharmacogenomics testing importance and growing demand for high-efficiency precision medicine systems across the healthcare and diagnostic sectors. However, the drug-gene interaction panels market faces challenges, including complex interpretation processes, potential for clinical utility variations during implementation and adoption, and concerns about reimbursement consistency for specialized genomic testing. Innovation in genomic technologies and customized clinical protocols continues to influence product development and market expansion patterns.

The growing adoption of advanced diagnostic facilities is enabling the development of more sophisticated drug-gene interaction panels production and analytical control systems that can meet stringent clinical requirements. Specialized diagnostic facilities offer comprehensive genomic testing services, including advanced bioinformatics and interpretation processes that are particularly important for achieving high-accuracy requirements in pharmacogenomics applications. Advanced diagnostic infrastructure provides access to premium services that can optimize clinical utility and reduce interpretation complexity while maintaining cost-effectiveness for large-scale healthcare operations.

Modern healthcare organizations are incorporating digital technologies such as real-time result reporting, automated clinical alerts, and electronic health record integration to enhance drug-gene interaction panels deployment and utilization processes. These technologies improve clinical workflows, enable continuous treatment monitoring, and provide better coordination between healthcare providers and patients throughout the therapeutic optimization cycle. Advanced digital platforms also enable customized clinical recommendations and early identification of potential adverse drug reactions or medication interactions, supporting reliable patient care delivery.

| Country | CAGR (2025-2035) |

|---|---|

| India | 14.0% |

| China | 12.0% |

| USA | 10.5% |

| Brazil | 9.0% |

| Europe | 8.6% |

| Germany | 8.3% |

| France | 8.2% |

| UK | 7.7% |

The drug-gene interaction panels market is experiencing varied growth globally, with India leading at a 14.0% CAGR through 2035, driven by the expansion of healthcare infrastructure development, increasing genomic testing capabilities, and growing domestic demand for high-efficiency pharmacogenomics systems. China follows at 12.0%, supported by clinical adoption expansion, growing recognition of precision medicine importance, and expanding diagnostic capacity. USA records 10.5% growth, with a focus on developing the personalized medicine and clinical genomics industries. Brazil shows 9.0% growth, representing an emerging market with expanding healthcare frameworks. Europe demonstrates 8.6% growth, emphasizing clinical infrastructure expansion and systematic precision medicine approaches.

Revenue from drug-gene interaction panels in India is projected to exhibit robust growth with a CAGR of 14% through 2035, driven by ongoing healthcare expansion and increasing recognition of high-efficiency pharmacogenomics systems as essential clinical components for complex therapeutic processes. The country's expanding healthcare infrastructure and growing availability of specialized genomic testing capabilities are creating significant opportunities for drug-gene interaction panels adoption across both domestic and export-oriented diagnostic facilities. Major international and domestic diagnostic companies are establishing comprehensive testing and analysis networks to serve the growing population of healthcare providers and patients requiring high-performance pharmacogenomics systems across clinical and therapeutic applications throughout India's major healthcare hubs.

The Indian government's strategic emphasis on healthcare infrastructure modernization and precision medicine advancement is driving substantial investments in specialized genomic testing capabilities. This policy support, combined with the country's large domestic patient market and expanding healthcare requirements, creates a favorable environment for the drug-gene interaction panels market development. Indian healthcare providers are increasingly focusing on high-value precision medicine technologies to improve clinical capabilities, with drug-gene interaction panels representing a key component in this healthcare transformation.

Demand for drug-gene interaction panels in China is expanding at a CAGR of 12%, supported by increasing healthcare accessibility, growing precision medicine awareness, and developing genomic testing market presence across the country's major clinical clusters. The country's large patient population and increasing recognition of advanced pharmacogenomics systems are driving demand for effective high-efficiency testing solutions in both diagnostic and therapeutic applications. International diagnostic companies and domestic providers are establishing comprehensive distribution channels to serve the growing demand for quality genomic testing systems while supporting the country's position as an emerging precision medicine technology market.

China's healthcare sector continues to benefit from favorable health policies, expanding diagnostic capabilities, and cost-competitive genomic testing infrastructure development. The country's focus on becoming a global healthcare technology hub is driving investments in specialized pharmacogenomics testing and clinical genomics infrastructure. This development is particularly important for drug-gene interaction panels applications, as healthcare providers seek reliable domestic sources for critical diagnostic technologies to reduce import dependency and improve supply chain security.

Advanced precision medicine market in the USA demonstrates sophisticated pharmacogenomics testing deployment with documented drug-gene interaction panels effectiveness in clinical departments and diagnostic centers through integration with existing healthcare systems and clinical infrastructure. The country leverages clinical expertise in genomic technology and pharmacogenomics systems integration to maintain a 10.5% CAGR through 2035. Healthcare centers, including major metropolitan areas, showcase premium installations where drug-gene interaction panels integrate with comprehensive electronic health record systems and clinical decision support platforms to optimize treatment accuracy and clinical workflow effectiveness.

American healthcare providers prioritize analytical reliability and regulatory compliance in diagnostic development, creating demand for premium systems with advanced features, including clinical validation and integration with US healthcare standards. The drug-gene interaction panels market benefits from established healthcare industry infrastructure and a willingness to invest in advanced genomic technologies that provide long-term clinical benefits and compliance with regulatory requirements.

Drug-gene interaction panels market expansion in Brazil benefits from diverse clinical demand, including healthcare infrastructure modernization in São Paulo and Rio de Janeiro, genomic testing development programs, and government healthcare programs that increasingly incorporate drug-gene interaction panels solutions for clinical enhancement applications. The country maintains a 9.0% CAGR through 2035, driven by rising healthcare awareness and increasing adoption of precision medicine benefits, including superior clinical capabilities and reduced adverse reactions.

Market dynamics focus on cost-effective pharmacogenomics solutions that balance advanced analytical features with affordability considerations important to Brazilian healthcare operators. Growing healthcare infrastructure creates demand for modern genomic testing systems in new diagnostic facilities and clinical equipment modernization projects.

Strategic Market Considerations:

The drug-gene interaction panels market in Europe is projected to grow significantly, with individual country performance varying across the region. Germany is expected to maintain its leadership position with a market value of USD 260.6 million in 2025 and USD 576.1 million by 2035, supported by its advanced healthcare infrastructure, precision medicine capabilities, and strong clinical presence throughout major healthcare regions.

France follows with a market value of USD 187.7 million in 2025 and USD 468.9 million by 2035, driven by advanced clinical protocols, genomic innovation integration, and expanding diagnostic networks serving both domestic and international markets. Italy holds USD 125.1 million in 2025 and USD 314.0 million by 2035, supported by healthcare infrastructure expansion and growing adoption of high-efficiency pharmacogenomics systems. BENELUX commands USD 83.4 million in 2025 and USD 178.5 million by 2035. Nordic accounts for USD 73.0 million in 2025 and USD 183.3 million by 2035. Spain holds USD 104.3 million in 2025 and USD 211.7 million by 2035. The Rest of Europe region, including Eastern Europe and smaller Western European markets, holds USD 208.5 million in 2025 and USD 464.1 million by 2035, representing diverse market opportunities with established clinical and diagnostic infrastructure capabilities.

Japan demonstrates steady market development distinguished by healthcare providers' preference for high-quality pharmacogenomics systems that integrate seamlessly with existing clinical equipment and provide reliable long-term operation in specialized therapeutic applications. Based on the provided split data, Japan's product breakdown shows single-gene PGx tests at 18.0%, Targeted multi-gene PGx panels at 50.0%, Comprehensive PGx panels at 27.0%, and WGS-based pharmacogenomics at 5.0%, indicating a balanced preference for comprehensive testing approaches while maintaining specialized options for targeted clinical needs. The drug-gene interaction panels market prioritizes advanced features, including precision analytical algorithms, clinical validation, and integration with comprehensive healthcare platforms that reflect Japanese clinical expectations for technological advancement and operational excellence.

South Korea demonstrates strong market development with significant emphasis on advanced genomic technologies and healthcare preference for technology-integrated drug-gene interaction panels. The country's sophisticated healthcare ecosystem and high precision medicine adoption rates are creating significant opportunities for pharmacogenomics testing adoption across both domestic and technology-driven clinical facilities. Based on the provided split data, South Korea's technology breakdown shows Next-Generation Sequencing (NGS) at 70.0%, Polymerase Chain Reaction (PCR) at 15.0%, Microarray/SNP chip at 10.0%, and Mass Spectrometry at 5.0%, reflecting the country's strong focus on advanced sequencing technologies and comprehensive genomic analysis capabilities for precision medicine applications.

The drug-gene interaction panels market is characterized by competition among established diagnostic companies, specialty genomics companies, and pharmacogenomics testing suppliers focused on delivering high-efficiency, consistent, and reliable testing systems. Companies are investing in genomic technology advancement, analytical performance enhancement, strategic partnerships, and customer clinical support to deliver effective, efficient, and reliable pharmacogenomics solutions that meet stringent healthcare and regulatory requirements. Clinical utility optimization, analytical validation protocols, and supply chain strategies are central to strengthening product portfolios and market presence.

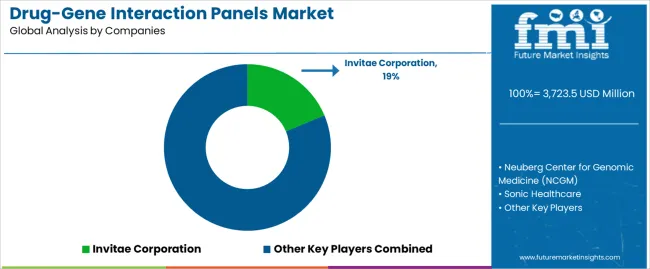

Invitae Corporation leads the drug-gene interaction panels market with an 18.7% market share, offering comprehensive high-efficiency drug-gene interaction panels with a focus on analytical consistency and clinical reliability for healthcare applications. Neuberg Center for Genomic Medicine (NCGM) provides specialized genomic testing systems with emphasis on clinical applications and comprehensive technical support services. Sonic Healthcare focuses on advanced diagnostic technologies and customized clinical solutions for pharmacogenomics testing serving global markets. 10x Genomics delivers established genomic platforms with strong analytical control systems and customer service capabilities.

Integrated DNA Technologies Inc. operates with a focus on bringing innovative genomic technologies to specialized clinical applications and emerging markets. Celemics Inc. provides comprehensive genomic testing portfolios, including advanced bioinformatics services, across multiple clinical applications and therapeutic optimization processes. Agena Bioscience Inc. specializes in customized testing solutions and analytical management systems for clinical applications with emphasis on regulatory compliance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3,723.5 Million |

| Product | single-gene PGx Tests, Targeted Multi-gene PGx Panels, Comprehensive PGx Panels, WGS-based Pharmacogenomics |

| Technology | Polymerase Chain Reaction, Microarray, Next-Generation Sequencing, Mass Spectrometry |

| End User | Hospitals, Cancer Research Institutes, Diagnostic Laboratories, Reference Laboratories, Specialty Clinics, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, USA, Germany, Japan, India, South Korea, Brazil, France, UK and 40+ countries |

| Key Companies Profiled | Invitae Corporation, Neuberg Center for Genomic Medicine (NCGM), Sonic Healthcare, 10x Genomics, Integrated DNA Technologies Inc., Celemics Inc., and Agena Bioscience Inc. |

| Additional Attributes | Dollar sales by product and end user, regional demand trends, competitive landscape, healthcare provider preferences for specific pharmacogenomics systems, integration with specialty diagnostic supply chains, innovations in genomic technologies, analytical performance monitoring, and clinical utility optimization |

The global drug-gene interaction panels market is estimated to be valued at USD 3,723.5 million in 2025.

The market size for the drug-gene interaction panels market is projected to reach USD 9,227.7 million by 2035.

The drug-gene interaction panels market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in drug-gene interaction panels market are targeted multi-gene pgx panels , single-gene pgx tests, comprehensive pgx panels and wgs-based pharmacogenomics.

In terms of end user, hospitals segment to command 30.0% share in the drug-gene interaction panels market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clean Room Panels Market Size and Share Forecast Outlook 2025 to 2035

Hydrophobic Interaction Chromatography Resins Market

Horse Corral Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Wire Livestock Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

OLED Lightening Panels Market

Temporary Fencing Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Temporary Fencing Panels Market Share

Aluminum Honeycomb Panels Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Composite Panels Market

Demand for Clean Room Panels in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Clean Room Panels in USA Size and Share Forecast Outlook 2025 to 2035

Molecular Respiratory Panels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Multimodal Interaction Development Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

Industrial Pump Control Panels Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA