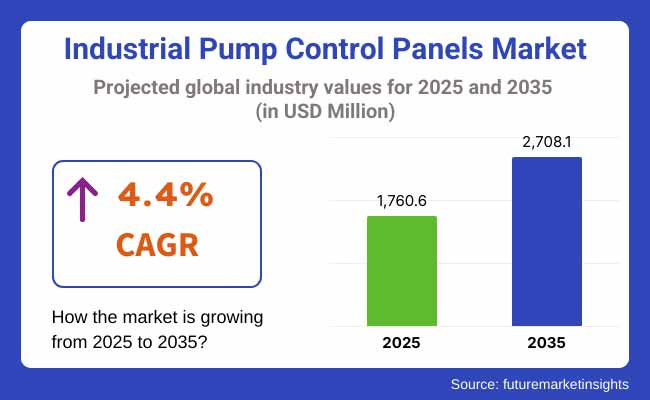

The market for industrial pump control panels will hit USD 1,760.6 Million by 2025. It is set to grow to USD 2,708.1 Million by 2035, at a yearly increase of 4.4%. The rise of smart pump tech, more use of variable frequency drives (VFDs) in pump controls, and more spending on sustainable water systems are driving this market. Growth is also boosted by new cloud tools for pump checks and predictive care systems. This blend of trends is shaping the market's bright future.

The market for industrial pump control panels will grow steadily from 2025 to 2035. This is due to more automation in factories, a need for pumps that save energy, and new technology that lets people monitor pumps remotely. These control panels are key for making sure pumps work well and don't break. They help in fields like water treatment, oil and gas, chemicals, farms, and making products.

North America is set to lead the industrial pump control panels market. This is due to the rise in smart water use, more need for automated work, and the strong oil, gas, and manufacturing sectors. The USA and Canada are at the forefront with new infrastructure, focus on energy-saving rules, and increased use of IoT-based pump controls.

More need for remote pump control and VFD-integrated pump panels, plus the rise of digital twin tech in managing fluids, is pushing market growth. On top of that, government incentives for energy-saving industrial practices are speeding up the changes in the industry.

Europe plays a big part in the industrial pump control panels market. Germany, the UK, France, and Italy are at the top. They push for automation and new ways to handle water. They also follow strict energy rules. The EU aims to cut carbon use in factories. They need real-time pump checks and spend more on Industry 4.0 tech.

More firms use predictive maintenance and AI-powered pump panels. There are also more high-efficiency pump stations for wastewater. Trends are clear. Europe's green energy focus and circular economy ideas are changing products.

The Asia-Pacific region will see the fastest growth in the industrial pump control panels market. This is due to quick growth in industries, more need for water for farming, and rising spending on smart factories and water systems. Nations like China, Japan, India, and South Korea are at the forefront in using pump control tech, building water treatment plants, and setting up remote pump stations.

China is investing more in industrial automation. There’s a high demand for smart pump systems in power plants and petrochemicals. The government's strong backing for smart water use is boosting the market. In India, the use of automated irrigation systems is going up. There's more need for affordable pump control in villages, and a big push for smart cities is helping growth.

Japan and South Korea are leading in IoT-based pump monitoring and making high-efficiency control panels, which is driving market expansion in the area.

Challenges

High Installation Costs and Cybersecurity Concerns in IoT-Enabled Pump Control

One big problem in the industrial pump control panels market is the high starting cost of smart pump control solutions. This is especially true for advanced pump panels that use VFDs and AI for predicting issues. Cybersecurity risks linked to IoT-connected pumps also cause problems. These systems need strong protection and must follow cyber rules.

Finding skilled workers to run and fix these advanced pump systems is tough. These workers ensure the systems run well and catch issues early, which is vital for both the makers and users of these pump systems.

Opportunities

AI-Driven Pump Optimization, Cloud-Based Remote Monitoring, and Smart Water Management Systems

Even with challenges, the industrial pump control panels market shows great chances for growth. The rise of AI pump control methods helps improve how systems work and saves energy, which makes them more efficient and lowers maintenance costs.

The increase of cloud-based remote pump monitoring allows for predictive maintenance, real-time checks, and automatic system changes. This opens up new ways for pump makers and automation firms to earn money. More businesses are using smart water systems that use sensors and data to better control water flow. This trend is set to push the market forward.

The creation of smart pump control panels that use machine learning to find and fix issues also promises to speed up market growth.

From 2020 to 2024, the market for industrial pump control panels market grew steadily. More demand for automatic fluid systems in water treatment, oil and gas, manufacturing, and farming drove this growth. Using energy-saving pump controllers and connecting with SCADA systems helped operations run smoother and save power. Also, advances in VFDs (variable frequency drives) helped too. Still, there were problems like high start-up costs, tricky setups, and supply chain issues that slowed growth.

From 2025 to 2035, the industrial pump control panels market will see big changes. These changes come from smarter machines (AI), the Internet of Things (IoT), and clean energy. Self-running and smart control systems will make pumps work better. Watching and fixing them from afar (using the cloud) will be easier and faster. The move towards green and smart energy panels will help save the Earth. As companies want to save energy and be dependable, the need for these new control panels will keep going up.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with industrial safety and energy efficiency standards. |

| Technological Advancements | Adoption of VFDs and basic SCADA integration. |

| Industry Applications | Widely used in water treatment, oil & gas, and manufacturing. |

| Adoption of Smart Equipment | Limited remote monitoring and basic automation. |

| Sustainability & Cost Efficiency | Focus on energy efficiency through VFDs and optimized motor controls. |

| Data Analytics & Predictive Modeling | Basic diagnostics and periodic maintenance tracking. |

| Production & Supply Chain Dynamics | Dependence on traditional manufacturing and hardware-based control solutions. |

| Market Growth Drivers | Demand driven by industrial automation, energy efficiency, and regulatory compliance. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental regulations, smart grid integration, and cybersecurity protocols for connected systems. |

| Technological Advancements | AI-powered automation, IoT-enabled predictive maintenance, and blockchain-secured data management. |

| Industry Applications | Expansion into renewable energy-based water management, precision agriculture, and autonomous industrial processes. |

| Adoption of Smart Equipment | Full integration of cloud-based analytics, real-time performance monitoring, and self-learning pump control systems. |

| Sustainability & Cost Efficiency | Adoption of solar-powered and energy-harvesting control panels for sustainable fluid management. |

| Data Analytics & Predictive Modeling | AI-driven predictive analytics, real-time fault detection, and automated response systems. |

| Production & Supply Chain Dynamics | Shift toward modular, software-driven control systems with decentralized production and supply chain resilience. |

| Market Growth Drivers | Growth fueled by AI and IoT integration, sustainability initiatives, and the expansion of smart water and energy management systems. |

The market for industrial pump control panels in the USA is growing. This growth is due to the need for better water and waste systems, more use of automation in pumping, and strict rules for safe pump use. The EPA and NEMA set the rules for how these pump panels should work and be efficient.

Smart pump panels that use IoT are on the rise. There is also more money going into automating industrial processes. Demand for remote monitoring in water plants and oil and gas sites is growing, too. New developments in energy-saving control panels with variable speeds are trending in this field.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

The market for industrial pump control panels in the UK is growing. This comes from more money put into smart water systems and more use of pump automation in factories and farms. The government is also pushing for energy savings.

Safety and operations of these panels are watched by the Health and Safety Executive and the British Pump Manufacturers Association. The use of control panels connected to the cloud, the need for safe panels in risky places, and the rise of flexible and custom designs help the market grow. Changes in AI tools for fixing pumps before they break are shaping the market as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The industrial pump control panels market in the EU is growing well. This growth comes from strict energy rules, more demand for smart water systems, and more use of automation in wastewater plants. The European Committee for Standardization and the European Environment Agency set efficiency and safety rules for these pumps.

Germany, France, and Italy are leading the way. They use high-efficiency pump control panels in city water systems. They also invest more in IoT solutions for real-time checks and in renewable-energy powered pump systems. Plus, new motor protection tech and digital twins in pump control panels are helping the market grow more.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.4% |

The industrial pump control panels market in Japan is growing. This is because of the higher need for automated pumps in factories, more spending on accurate water treatment, and strong help from the government for smart industry automation. METI and JEMA set rules for pump control panels and efficiency.

Japanese firms are spending on small, energy-saving pump panels, making AI-based fault detection systems, and making remote control solutions for water and oil & gas fields. Also, new wireless pump control tech and real-time data check are big trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The market for industrial pump control panels in South Korea is growing. More places are using smart tech and there is a higher need for automated water treatment. Also, there are rules for energy use in factories. The Ministry of Environment and the Korea Electrical Manufacturers Cooperative (KEMC) watch over pump safety and efficiency.

Trends show more pumps with VFD-based control. There are more remote-control systems like SCADA and smart pump systems in factories and buildings. People are putting money into new tech like 5G for real-time checks and fixing issues before they happen.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

The market for Industrial Pump Control Panels is growing. This growth is fueled by the need for more automation in handling industrial fluids. There is also a greater push for saving energy, and better remote monitoring tools are coming out. By 2025, three-phase power control panels are the top choice. These panels hold an estimated 61% of the market share. They offer more power, better motor efficiency, and are ideal for big industrial tasks.

| Type | Market Share (2025) |

|---|---|

| Three-Phase Power | 61.0% |

Three-phase power pump control boxes are often used in big-load factories, water systems, and moving large amounts of fluid. They are good because they save energy, needless fixing, and run motors well. These boxes make sure power is shared well, so they work great in big places like factories.

More and more people use these control boxes because factories are getting smarter, there is a need for strong pumps, and smart grids are growing. Plus, new ideas like smart AI fixes, watching things in real-time through IoT, and self-controlling panels make them work better and last longer.

Even with the good things, there are some problems, like high first costs, hard installation, and needing a steady three-phase power source. But new tech like AI load balance, modular panel designs, and panels that work with green energy are expected to help more people use them and save money in the long run.

Industrial pump control panels are needed mainly because of what the end-use industries need. In 2025, water and wastewater uses will be the top group, with a market share of about 48%. This is because there is a greater need to manage water well, expand wastewater treatment, and follow rules for using water in sustainable ways.

| End Use | Market Share (2025) |

|---|---|

| Water & Wastewater | 48.0% |

Pump control panels help in water and wastewater tasks. They are used for city water, factory waste, and watering fields. These panels’ help run pumps, check systems from afar, and save energy. They make moving water and getting rid of waste more efficient.

More people need water and wastewater systems because water is getting scarce worldwide. Money is being spent on smart water ideas and factory water reuse is growing. AI now helps pumps work better, find leaks, and monitor them from the cloud. This helps save money and work well.

But there are problems. Smart water systems can be costly to set up. IoT panels might face security risks. Old water systems need care. New ideas like AI for finding faults, better water flow methods, and green energy pump panels are likely to help more people use them and make them better.

The industrial pump control panels market is growing. There is more need for better pump checks, automation, and ways to save energy in water treatment, oil and gas, and making things. IoT systems, environmental rules, and the need for predictive fixes drive the market.

Companies work on smart control panels, cloud monitoring, and better motor safety to boost work efficiency, safety, and remote access. The market has top automation firms, electrical gear makers, and pump system suppliers. They are improving variable frequency drives (VFDs), programmable logic controllers (PLCs), and industrial IoT.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schneider Electric SE | 18-22% |

| Rockwell Automation, Inc. | 14-18% |

| Siemens AG | 12-16% |

| Eaton Corporation plc | 10-14% |

| ABB Ltd. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schneider Electric SE | In 2024, launched IoT-enabled pump control panels with real-time remote monitoring and predictive maintenance features. |

| Rockwell Automation, Inc. | In 2025, introduced advanced PLC-based control systems with enhanced automation and energy efficiency. |

| Siemens AG | In 2024, expanded its VFD-integrated control panel solutions for improved motor efficiency and performance. |

| Eaton Corporation plc | In 2025, unveiled next-generation smart pump controllers with cloud-based data analytics for industrial applications. |

| ABB Ltd. | In 2024, enhanced its industrial pump control panels with AI-driven diagnostics and fault prediction capabilities. |

Key Company Insights

Schneider Electric SE (18-22%)

Schneider Electric leads the industrial pump control panels market, offering IoT-integrated solutions that enhance monitoring, automation, and energy savings.

Rockwell Automation, Inc. (14-18%)

Rockwell specializes in PLC-based control systems, ensuring seamless automation and process optimization.

Siemens AG (12-16%)

Siemens focuses on VFD-integrated pump control panels, optimizing motor performance and operational efficiency.

Eaton Corporation plc (10-14%)

Eaton provides smart pump controllers with cloud-based analytics, ensuring enhanced remote monitoring and diagnostics.

ABB Ltd. (6-10%)

ABB develops AI-driven industrial pump control solutions, enhancing predictive maintenance and fault detection capabilities.

Other Key Players (30-40% Combined)

Many tech firms, gear providers, and IoT groups help improve smart pump systems, save energy, and monitor from afar. These include:

The overall market size for the industrial pump control panels market was USD 1,760.6 Million in 2025.

The industrial pump control panels market is expected to reach USD 2,708.1 Million in 2035.

Increasing demand for automation in water and wastewater management, rising adoption of energy-efficient pump control systems, and growing applications in oil & gas and industrial processing will drive market growth.

The USA, China, Germany, India, and Japan are key contributors.

Variable frequency drive (VFD) control panels are expected to dominate due to their energy efficiency, precision control, and ability to optimize pump performance.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: North America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: Latin America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 37: East Asia Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ billion) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ billion) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ billion) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ billion) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ billion) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ billion) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ billion) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ billion) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ billion) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ billion) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ billion) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ billion) by End Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ billion) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ billion) by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ billion) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ billion) by End Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ billion) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ billion) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ billion) by End Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ billion) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ billion) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ billion) by End Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ billion) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pump Market Growth Opportunities & Forecast 2024-2034

Industrial Control Transformer Market

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Noise Control Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grout Pumps Market

Industrial Access Control Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Digital Pump Controller Manufacturers

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Industrial Pumps Market Analysis – Size, Share & Forecast 2025-2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Demand for Patient-Controlled Analgesia Pumps in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Patient-Controlled Analgesia Pumps in USA Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA