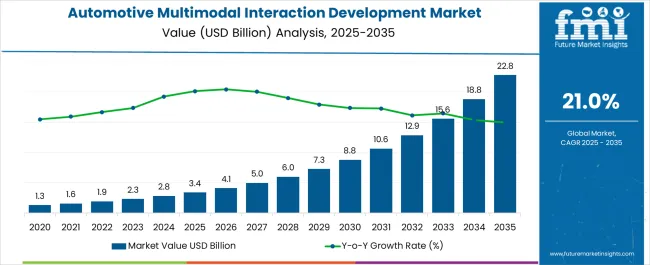

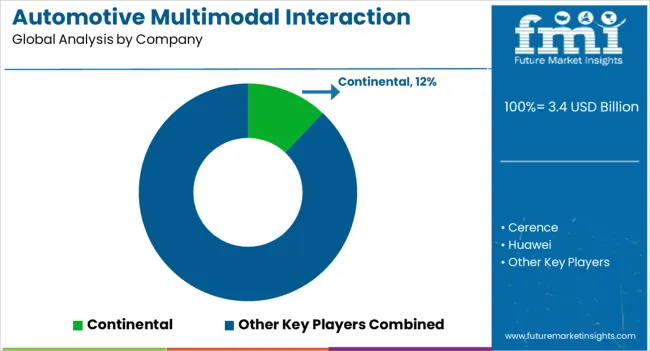

The automotive multimodal interaction development market, valued at 3.4 USD billion in 2025, is projected to reach 22.8 USD billion by 2035, reflecting a CAGR of 21.0% over the period. The market maturity curve indicates early adoption from 2020–2024, when annual market size grows from 1.3 to 2.8 USD billion, driven by pilot programs and initial integration in premium vehicles. By 2025, the curve steepens as mainstream OEMs begin integrating multimodal systems across broader model lines.

Between 2025–2030, the market scales rapidly, reaching 8.8 USD billion by 2030, as production standardizes, partnerships expand, and consumer adoption accelerates. From 2030–2035, growth moderates as the market consolidates with leading suppliers capturing dominant share. The adoption lifecycle mirrors this progression. During 2020–2024, early adopters validate interaction systems, define integration standards, and create reference cases for other OEMs. From 2025–2030, scaling occurs as production ramps, procurement standardizes, and fleet-wide deployments increase.

By 2030–2035, consolidation dominates: late entrants follow proven integration approaches, mergers and partnerships shape competitive dynamics, and procurement emphasizes cost efficiency and reliability. The market transitions from experimental adoption to rapid scale-up, ultimately reaching a stable phase with predictable demand, standardized supply chains, and established OEM-supplier relationships.

| Metric | Value |

|---|---|

| Automotive Multimodal Interaction Development Market Estimated Value in (2025 E) | USD 3.4 billion |

| Automotive Multimodal Interaction Development Market Forecast Value in (2035 F) | USD 22.8 billion |

| Forecast CAGR (2025 to 2035) | 21.0% |

Seasonality in the automotive multimodal interaction development market is largely driven by vehicle production cycles, model launches, and fleet ordering patterns. Data shows that Q3 and Q4 often account for 40–50% of annual procurement, coinciding with peak vehicle assembly and year-end model rollouts. Conversely, Q1 typically sees 10–15% lower activity, as manufacturers adjust inventories and plan for new features. Certain premium vehicle releases are concentrated in specific quarters, creating temporary demand spikes of 15–20% above baseline. Suppliers coordinate development, system integration, and logistics around these seasonal peaks to ensure timely delivery and avoid bottlenecks during lower-demand periods. Cyclicality reflects broader automotive refresh and investment cycles. OEMs generally update models or integrate new interaction systems on 5–7 year cycles, causing periodic surges in multimodal system demand that can raise annual market size by USD 2–3 billion. Regulatory changes, safety standards, or regional incentives can further accelerate procurement, producing short-term spikes of 10–15% above projected growth. These cyclical patterns overlay the underlying CAGR of 21.0%, creating alternating periods of rapid expansion and moderate stabilization. Recognizing these cycles allows suppliers to optimize production, inventory, and deployment schedules efficiently.

Demand is being shaped by the integration of advanced human-machine interfaces that combine voice, touch, gesture, and visual inputs to improve safety, convenience, and personalization. Advancements in artificial intelligence and sensor technologies have enabled more intuitive and context-aware systems, reducing driver distraction while maintaining operational efficiency.

Rising consumer expectations for seamless connectivity and smart features, alongside regulatory emphasis on road safety, are further accelerating adoption. The market is also benefiting from strategic collaborations between automotive OEMs and software providers to deliver customizable, software-upgradable interaction platforms.

With the proliferation of connected and autonomous vehicles, the need for multimodal systems that adapt to diverse driving environments is expected to expand significantly. This shift towards intelligent, multimodal interaction solutions is setting the stage for sustained market growth in both passenger and commercial vehicle segments.

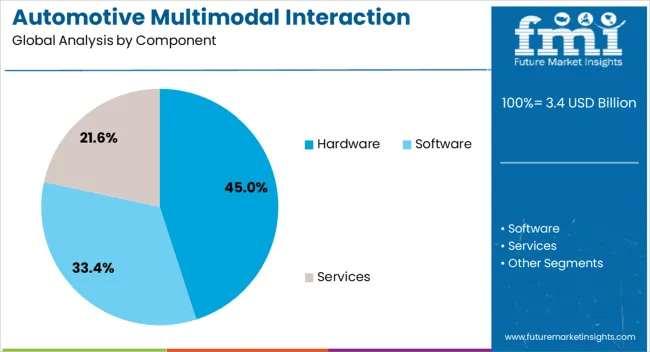

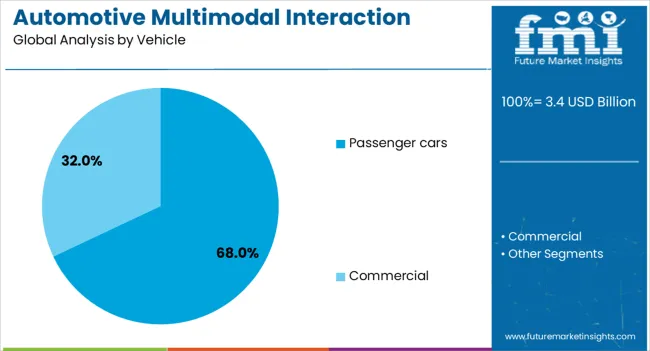

The automotive multimodal interaction development market is segmented by component, vehicle, interaction, and geographic regions. By component, the automotive multimodal interaction development market is divided into Hardware, Software, and Services. In terms of vehicles, the automotive multimodal interaction development market is classified into Passenger cars and Commercial vehicles.

Based on interaction, the automotive multimodal interaction development market is segmented into Speech recognition. Regionally, the automotive multimodal interaction development industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware component segment is projected to account for 45% of the automotive multimodal interaction development market revenue share in 2025, making it the leading component category. The essential role hardware has driven growth in this segment plays in enabling multimodal interaction capabilities, including sensors, microphones, cameras, and haptic devices.

Hardware advancements have allowed more precise detection of driver and passenger inputs, ensuring higher system responsiveness and reliability. The need for robust and durable hardware that can withstand automotive operating environments has reinforced investment in this segment.

Additionally, integration with vehicle infotainment and advanced driver assistance systems has amplified the importance of high-performance hardware. As automotive interaction technologies evolve, hardware platforms that support rapid software upgrades and scalability are being preferred, positioning this segment for continued dominance in the overall market.

The passenger cars segment is anticipated to hold 68% of the automotive multimodal interaction development market revenue share in 2025, establishing it as the largest vehicle category. This leadership is supported by the growing demand for advanced in-cabin experiences among individual consumers, who prioritize convenience, personalization, and safety. Passenger cars have been at the forefront of integrating multimodal interaction systems due to higher production volumes and faster adoption of emerging technologies in this segment. Enhanced infotainment, navigation, and safety features enabled through multimodal interfaces have significantly improved customer satisfaction and brand differentiation.

Automakers have focused on delivering intuitive systems that reduce driver workload and improve accessibility for all occupants. The ability to incorporate premium features across mid-range and luxury passenger car models has further expanded the market base, solidifying this segment’s leading position.

The speech recognition interaction segment is expected to capture 40% of the automotive multimodal interaction development market revenue share in 2025, making it the most prominent interaction mode. This growth has been propelled by advancements in natural language processing and AI-driven voice assistants that allow drivers to control multiple vehicle functions without diverting attention from the road. Speech recognition systems have become more accurate in noisy automotive environments, enabling commands to be executed with minimal error. The increasing integration of cloud-based voice services has enhanced personalization and adaptability of these systems.

Speech recognition has also gained favor due to its ability to provide hands-free control for navigation, communication, and entertainment functions, directly contributing to safer driving experiences As consumer expectations shift towards seamless, conversational interfaces, speech recognition is set to maintain its lead in the automotive multimodal interaction landscape.

The automotive multimodal interaction development market is growing as vehicles integrate voice, gesture, touch, and haptic interfaces to improve driver experience and safety. Multimodal systems combine multiple input and output methods for intuitive control of infotainment, navigation, and vehicle functions. Europe and North America lead adoption in premium and electric vehicles, while Asia-Pacific shows rapid growth in connected car deployment. Manufacturers emphasize seamless integration, real-time response, and personalization to enhance user satisfaction, reduce distraction, and meet evolving mobility demands.

Multimodal interaction systems combine voice, gesture, touch, and haptic feedback to allow drivers to operate vehicle functions without diverting attention from the road. By providing multiple input channels, drivers can interact with infotainment, navigation, and climate systems more efficiently. Haptic feedback on touch surfaces or steering controls alerts drivers to notifications without visual distraction, while gesture recognition allows hands-free operation. OEMs developing systems that provide accurate recognition and rapid response gain preference. Until alternative interaction solutions achieve the same combination of safety, efficiency, and intuitiveness, multimodal systems will remain key in enhancing driving safety and minimizing cognitive load.

Connected and autonomous vehicles require advanced multimodal interfaces to interact with occupants and communicate system status. Passengers may use gestures, voice commands, or touch to control entertainment, comfort settings, and vehicle functions, while the system provides visual, auditory, and haptic feedback. Seamless integration with vehicle electronics and cloud-based AI ensures real-time processing and personalized user experiences. OEMs investing in cross-modal system development, sensor fusion, and adaptive algorithms can deliver consistent performance. Until alternative interface methods provide equivalent adaptability, responsiveness, and user personalization, multimodal interaction remains essential for connected and autonomous vehicle development.

Modern vehicle buyers expect intuitive, responsive, and personalized interfaces that combine multiple modalities. Consumers increasingly value systems that can anticipate intent, allow flexible input, and provide consistent feedback. Gesture and voice commands integrated with touch and haptic surfaces enhance convenience, making vehicle interaction feel natural and seamless. Manufacturers offering interfaces that are easy to learn, adaptable, and responsive gain a competitive advantage in premium and tech-focused segments. Until alternative interaction paradigms match the ease of use, adaptability, and engagement of multimodal systems, OEMs will continue investing heavily in this technology to enhance the in-vehicle user experience.

Developing multimodal interaction systems requires integrating sensors, processors, software, and AI algorithms to interpret multiple input types accurately. Challenges include minimizing latency, avoiding false recognition, and maintaining system reliability under varied lighting, noise, and motion conditions. OEMs and suppliers invest in hardware-software co-design, data training, and real-time signal processing to address these challenges. Until simplified and cost-effective implementation methods are available, system complexity and development costs will influence adoption rates, especially in mid-range vehicles. Companies focusing on modular, scalable, and robust solutions gain a market edge in delivering reliable multimodal interaction systems.

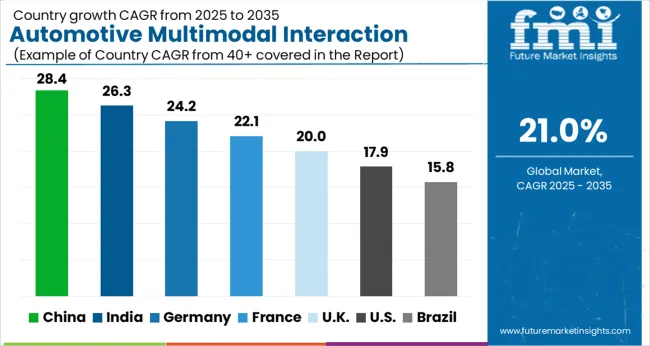

| Country | CAGR |

|---|---|

| China | 28.4% |

| India | 26.3% |

| Germany | 24.2% |

| France | 22.1% |

| UK | 20.0% |

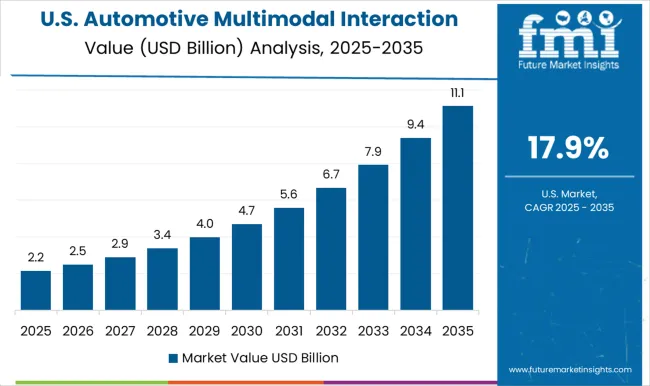

| USA | 17.9% |

| Brazil | 15.8% |

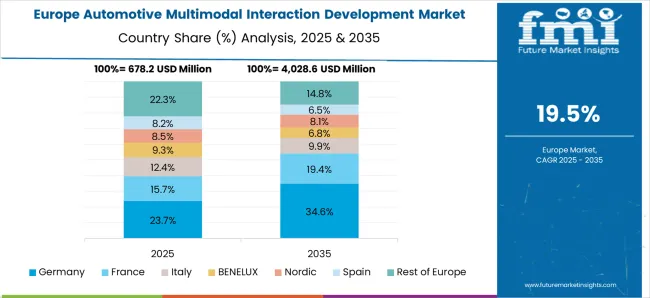

The global automotive multimodal interaction development market is projected to grow at a CAGR of 21.0% through 2035, supported by increasing demand across connected vehicles, human-machine interface systems, and in-vehicle communication technologies. Among BRICS nations, China has recorded a 28.4% growth, driven by large-scale development and deployment of advanced automotive interaction systems, while India has observed a 26.3% growth, supported by rising utilization in vehicle connectivity and interface technologies. In the OECD region, Germany has been measured at 24.2%, where production and adoption of automotive interaction and communication systems have been steadily maintained. The United Kingdom has been noted at 20.0%, reflecting consistent use in connected vehicle interfaces, while the USA has been recorded at 17.9%, with production and utilization across multimodal interaction and in-vehicle communication technologies being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The automotive multimodal interaction development market in China is growing at a CAGR of 28.4%, fueled by the integration of advanced in-vehicle technologies and rising adoption of connected, intelligent vehicles. Multimodal interaction systems enable drivers and passengers to interact with vehicles through touch, voice, gestures, and eye-tracking, enhancing safety, comfort, and user experience. Growing electric vehicle production, luxury vehicle demand, and increasing consumer preference for smart interiors drive market expansion. OEMs are investing in research and development to implement AI-powered, context-aware systems, combining voice recognition, haptic feedback, and gesture control. Government initiatives promoting smart mobility, autonomous driving, and intelligent transportation infrastructure further support adoption. China’s automotive sector, backed by strong manufacturing capabilities and technology innovation, positions it as a leading market for multimodal interaction development.

The automotive multimodal interaction development market in India is expanding at a CAGR of 26.3%, driven by the rising demand for smart, connected vehicles and advanced driver assistance systems. Multimodal interfaces allow seamless communication between occupants and the vehicle via voice, touch, gestures, and haptic feedback. Increasing electric vehicle production, luxury automotive growth, and consumer preference for intelligent interiors support market growth. OEMs are implementing AI-enabled systems for voice recognition, gesture control, and adaptive interfaces to enhance driving comfort and safety. Government initiatives promoting electric mobility, smart vehicle infrastructure, and connected technologies accelerate adoption. India’s automotive industry is investing in multimodal interaction technologies to improve user experience, vehicle intelligence, and competitive differentiation, positioning the market for steady growth.

The automotive multimodal interaction development market in Germany is growing at a CAGR of 24.2%, driven by the strong luxury and electric vehicle sector, technological innovation, and advanced automotive R&D. Multimodal systems integrate touch, voice, gesture, and haptic interfaces, enhancing in-vehicle safety, comfort, and convenience. OEMs are investing heavily in AI-powered, context-aware systems to provide adaptive, intuitive user experiences. Germany’s automotive industry is a global leader in connected and autonomous vehicle technologies, fostering high adoption of multimodal interfaces. Government programs promoting smart mobility, autonomous driving, and intelligent transportation systems support market expansion. Continuous innovation, combined with consumer preference for sophisticated vehicle interiors, positions Germany as a key market for multimodal interaction development technologies.

The automotive multimodal interaction development market in the United Kingdom is expanding at a CAGR of 20.0%, supported by growing adoption of connected, autonomous, and electric vehicles. Multimodal systems integrate voice, touch, gestures, and haptic feedback for improved usability, safety, and passenger experience. OEMs focus on AI-enabled interfaces, combining context-aware technologies with ergonomic design. Government initiatives promoting smart mobility, connected vehicles, and electric vehicle adoption drive market growth. Increasing consumer demand for intelligent automotive interiors and advanced interaction technologies further strengthens the market. The UK is emerging as a key player in multimodal interaction adoption due to industrial innovation, technological readiness, and regulatory support.

The automotive multimodal interaction development market in the United States is growing at a CAGR of 17.9%, driven by adoption in autonomous, connected, and electric vehicles. Multimodal interfaces enable seamless communication through voice, gestures, touch, and haptic feedback, enhancing safety, convenience, and in-vehicle comfort. OEMs are implementing AI-powered, adaptive systems to improve user interaction and vehicle intelligence. Government programs promoting electric mobility, connected vehicle infrastructure, and smart automotive technologies support market expansion. Consumer preference for high-tech, interactive vehicle interiors drives demand across premium and mass-market segments. The USA market benefits from strong R&D capabilities, technological innovation, and regulatory support, positioning it for sustained growth in automotive multimodal interaction development.

The automotive multimodal interaction development market focuses on creating advanced human-machine interfaces (HMI) that allow drivers and passengers to interact with vehicles using multiple input methods such as voice, touch, gesture, eye movement, and facial recognition. These systems enhance safety, convenience, and the overall user experience by reducing driver distraction while enabling more intuitive control of vehicle functions. Increasing adoption of connected, autonomous, and electric vehicles is driving the growth of this market globally. Continental is a key player, offering multimodal interaction solutions that integrate voice recognition, touch interfaces, and gesture control for modern vehicles.

Cerence, a spin-off from Nuance Communications, specializes in voice and AI-driven interaction technologies for automotive applications. Huawei and Horizon Robotics contribute advanced AI processing and computer vision platforms to enable intelligent and context-aware interaction. Baidu and Tencent leverage their expertise in AI, speech recognition, and cloud computing to support connected car ecosystems. Other prominent players include Aptiv, Bosch, NVIDIA, Harman, and Visteon, which provide hardware, software, and integrated platforms to develop multimodal interfaces for both OEMs and tier-one automotive suppliers. These companies focus on creating scalable, user-friendly solutions that can be customized for luxury, electric, and autonomous vehicles. As automotive HMI technology evolves, multimodal interaction systems are becoming a critical differentiator, enhancing in-vehicle experiences and supporting the transition to safer, smarter, and more connected mobility solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Component | Hardware, Software, and Services |

| Vehicle | Passenger cars and Commercial |

| Interaction | Speech recognition |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Continental, Cerence, Huawei, Horizon Robotics, Baidu, Tencent, Aptiv, Bosch, NVIDIA, Harman, Visteon, and [Other suppliers] |

| Additional Attributes | Dollar sales by type including voice recognition, gesture control, touch interfaces, and haptic feedback systems, application across infotainment, navigation, and driver assistance systems, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for enhanced in-vehicle user experiences, advancements in AI and sensor technologies, and increasing adoption of connected vehicles. |

The global automotive multimodal interaction development market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the automotive multimodal interaction development market is projected to reach USD 22.8 billion by 2035.

The automotive multimodal interaction development market is expected to grow at a 21.0% CAGR between 2025 and 2035.

The key product types in automotive multimodal interaction development market are hardware, software and services.

In terms of vehicle, passenger cars segment to command 68.0% share in the automotive multimodal interaction development market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA