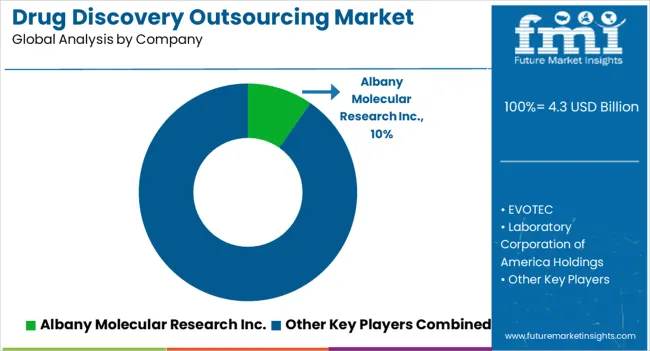

The Drug Discovery Outsourcing Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 8.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Drug Discovery Outsourcing Market Estimated Value in (2025 E) | USD 4.3 billion |

| Drug Discovery Outsourcing Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The drug discovery outsourcing market is witnessing steady growth driven by increasing complexity in drug development, rising R&D costs, and the need for specialized expertise across the pharmaceutical value chain. Outsourcing enables biopharmaceutical companies to accelerate timelines, access advanced technologies, and manage costs effectively while maintaining focus on core competencies.

Contract research organizations are investing in AI driven platforms, high throughput screening, and integrated data analytics to enhance drug discovery outcomes. Regulatory pressure for efficient clinical pipelines and the growing prevalence of chronic diseases are further reinforcing reliance on outsourcing models.

As precision medicine and biologics continue to shape the industry, partnerships with specialized outsourcing providers are expected to expand, ensuring flexibility, scalability, and global reach. The market outlook remains positive with outsourcing positioned as a strategic enabler of innovation and efficiency in modern drug discovery programs.

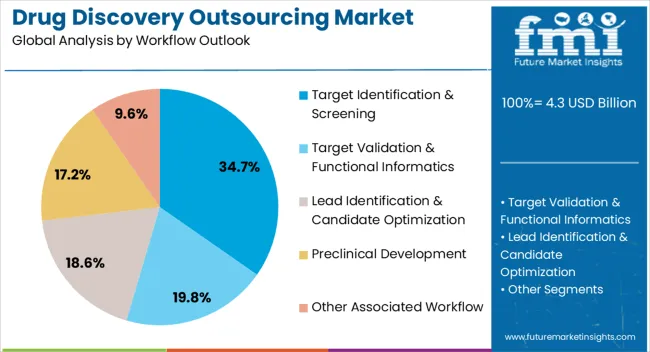

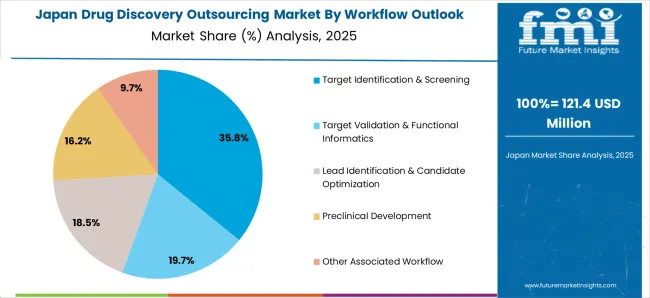

The target identification and screening workflow segment is projected to represent 34.70% of the overall market by 2025, making it the leading workflow category. Growth in this segment is supported by the increasing demand for early stage discovery processes that identify viable drug targets with precision and speed.

Investment in advanced technologies such as CRISPR, genomics, and proteomics is enabling efficient identification of molecular pathways and biomarkers. Outsourcing in this workflow has been driven by the need to access specialized equipment, technical expertise, and high throughput capabilities that may not be available in house.

These advantages have reinforced the prominence of target identification and screening as the cornerstone of outsourced drug discovery workflows.

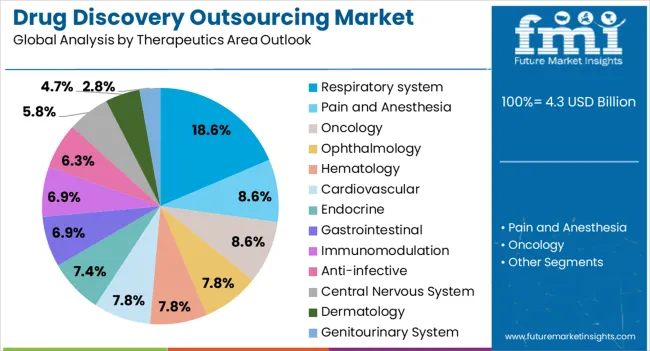

The respiratory system therapeutic area is expected to account for 18.60% of total market revenue by 2025, positioning it as a significant therapeutic focus. Rising incidence of respiratory conditions including asthma, COPD, and emerging viral infections has amplified the need for novel therapeutics.

Outsourcing within this domain has been accelerated by the demand for specialized preclinical models, inhalation technologies, and safety studies tailored to respiratory drug development. Regulatory emphasis on developing targeted therapies and the surge in biologics and inhaled drug formulations are further contributing to the growth of this segment.

As respiratory health continues to be a global public health concern, outsourcing partners are increasingly relied upon to deliver efficient and scalable solutions in this therapeutic area.

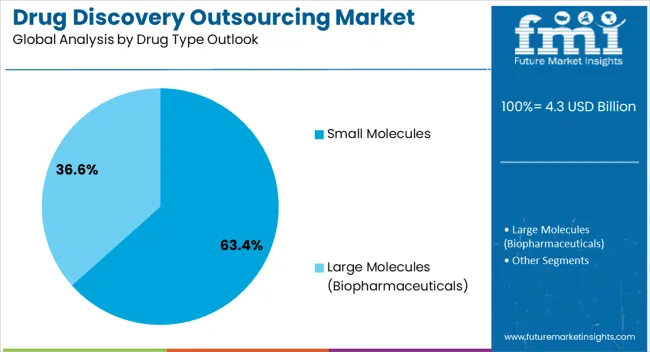

The small molecules segment is projected to capture 63.40% of total market revenue by 2025, establishing itself as the dominant drug type in the outsourcing landscape. Their long established role in therapeutics, cost efficiency, and scalability in manufacturing make them a preferred focus for outsourcing.

Advancements in computational chemistry, structure based design, and combinatorial screening have further strengthened their position in early discovery pipelines. Outsourcing partners provide specialized services including lead optimization, ADME studies, and toxicity profiling, which are critical for small molecule development.

The strong regulatory familiarity and robust commercial potential of small molecules have reinforced their dominance, ensuring continued investment and reliance on outsourcing models within this category.

According to FMI analysis, the drug discovery outsourcing market was valued at USD 4.30 billion in 2025 and is likely to be worth USD 8.6 billion by 2035.

AI-enabled drug discovery methods, along with the expanding research and development programs, are garnering market growth. The increased penetration of innovation, reduced costs, and pharmaceutical companies collaborating for the research part fuel the market growth.

The application of AI in protein modeling, digital organ simulation, and organ-on-a-chip is also easing the drug discovery process. Developing nations like India and China are becoming the center stage for the pharmaceutical revolution with mass drug production and extended research and development programs. The AI-driven drug discovery is anticipated to increase the capital investment in distant lands to expand their production and research workforce. Alongside this, the new AI drug discovery outsourcing services are likely to enhance target identification, patient stratification, and biomarker development.

As COVID-19 pandemic garnered the pharmaceutical industry, new viruses and their penetration in developed nations are also increasing drug consumption. Even developing nations enhancing public health conditions are adopting advanced drug discovery measures. Similarly, they are indulged in collaborating with cheaper third-party research and development vendors.

Key restraints for the drug discovery outsourcing market are governmental restrictions, higher outsourcing costs, and tariffs restraining market growth. The rapidly expanding space for alternative medicine and limited medical budgets are limiting the growth of the market.

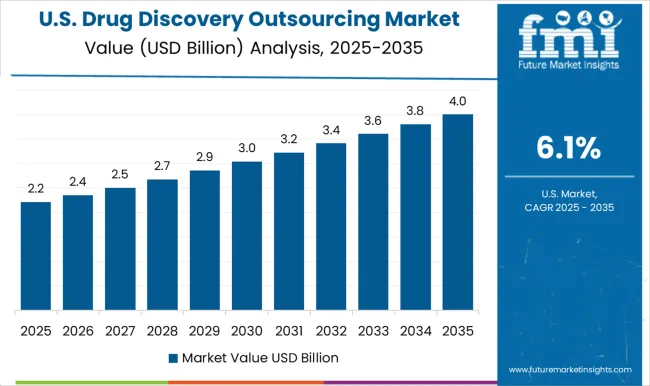

Increased Demand for Research and Development along with Expanding Bilateral Ties are making North America the Top Growing Region

North America region leads in terms of the market share in the drug discovery outsourcing market with a market share CAGR of 35.5%. The growth is attributed to lower research costs, higher innovative experiments, and increasing demand for generic and disease-specific drugs. Furthermore, companies collaborating with third-party drug discovery service vendors are likely to impact the market positively. The rising competition is fueled by factors such as higher efficiency, quality, and innovation is garnering regional growth.

Integration of Smart Technologies coupled with Heavy Demand for Generic Medicine is Fuelling the Demand for Drug Discovery Outsourcing

Asia Pacific region leads the market in terms of CAGR between 2025 and 2035. Japan drug discovery outsourcing markets in the Asia Pacific region. Apart from the higher population and higher investment, the Japanese market comes in the pharmaceutical market due to smart technology integration. The AI-enabled drug discovery method is transforming the industry with fast, reliable, inexpensive, and cruelty-free drug discovery.

Concepts like Digital Organ Simulation and Organ-on-a-chip are collectively flourishing the Regional Growth

The United Kingdom is another significant market for drug discovery outsourcing systems. The increase in virus mutations and deadly chronic diseases is pushing the demand for drug discovery outsourcing. Better prediction in human drug discovery also impacts the various treatment garnering market growth.

| Category | By Workflow |

|---|---|

| Leading Segment | Lead Identification & Candidate Optimization |

| Market Share % (2025) | 32.3% |

| Category | By Therapeutic Area |

|---|---|

| Leading Segment | Respiratory Systems |

| Market Share % (2025) | 14% |

Based on the workflow, lead identification & candidate optimization held the leading share of 32.3% in 2025. The growth is attributed to better workflow management. Also, increased activity around the non-bonded interaction and reduced side effects are making this segment more popular in the category. It is expected to improve potency and dynamics as well.

Based on the therapeutic area, the respiratory systems segment held a share of 14.0% in 2025. The higher amount of chronic diseases impacting the respiratory organs and developing various chronic and non-chronic diseases are thriving segmental growth. The therapeutic areas involve oncology, ophthalmology, hematology, cardiovascular, endocrine, and others. The diseases like bronchitis, tuberculosis, COPD, and asthma fuel the segment growth.

The key players focus on adopting advanced AI-enabled drug discovery outsourcing services. The end users choose the vendors that not only provide better pricing but also efficient quality and timing. Companies also merge, collaborate, and acquire in order to expand their sales and distributional channels.

Market Developments

The global drug discovery outsourcing market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the drug discovery outsourcing market is projected to reach USD 8.6 billion by 2035.

The drug discovery outsourcing market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in drug discovery outsourcing market are target identification & screening, target validation & functional informatics, lead identification & candidate optimization, preclinical development and other associated workflow.

In terms of therapeutics area outlook, respiratory system segment to command 18.6% share in the drug discovery outsourcing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Drug Testing Equipment Market

Drug Resistant Pulmonary Tuberculosis Market

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA