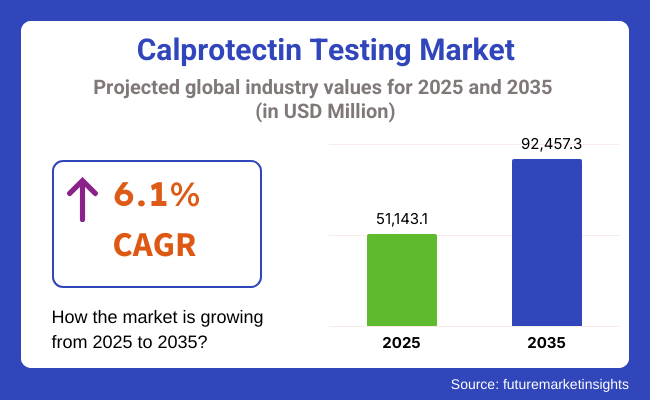

The global Calprotectin Testing Market is estimated to be valued at USD 51,143.1 million in 2025 and is projected to reach USD 92,457.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. The market is driven by rising prevalence of inflammatory bowel diseases (IBD), growing awareness of early non-invasive diagnostics, and efforts to reduce colonoscopy reliance.

Technological innovations in rapid lateral flow assays and immunoturbidimetric platforms have improved testing efficiency and turnaround time. Hospitals and diagnostic laboratories are increasingly adopting these tests as first-line monitoring tools. Additionally, regulatory support for point-of-care testing and integration of calprotectin testing in primary care pathways have widened access.

Expansion of telehealth initiatives and home testing options is further enhancing patient compliance and market reach. As global count of IBD patients continues to rise, particularly in Asia-Pacific and North America, demand for accurate and cost-effective calprotectin tests is expected to accelerate.

Leading vendors in the calprotectin market include BÜHLMANN Laboratories, Gentian Diagnostics, ALPCO, EliTechGroup, R‑Biopharm, Euroimmun, and Abbexa. are enhancing test accuracy, assay speed, and lab integration. In 2025, Gentian Diagnostics, in partnership with Beckman Coulter, launched GCAL® Calprotectin Immunoassay for clinical chemistry analyzers.

"We are pleased to officially announce that Beckman Coulter Diagnostics, a leader in the field of clinical diagnostics, is launching our GCAL® assay," says Matti Heinonen, CEO of Gentian Diagnostics. "This partnership builds on our long-standing relationship with Beckman Coulter and marks a significant milestone in our commitment to advancing market development for circulating calprotectin. By combining our innovative GCAL® assay with Beckman Coulter's industry expertise and reach, we are poised to empower healthcare professionals with more accurate and timely diagnostic tools, enhancing patient care and outcomes." These launches are expected to expand clinical utility across gastroenterology, rheumatology, and infectious disease care, while enhancing lab workflow efficiency and test adoption among clinicians.

North America accounts for over 46% of global calprotectin test revenue in 2025. This market is being driven by high IBD prevalence, robust diagnostic infrastructure, and strong payer support for non-invasive tests. Expansion of telehealth and home-use rapid tests is supported by FDA clearances and reimbursement pathways.

Furthermore, collaborations between gastroenterology clinics and testing firms have accelerated adoption of POC calprotectin tests in primary care. Europe market is expected to witness a stable growth due to national health initiatives for IBD screening and cost-effective diagnostics. Adoption of CE-marked assays, combined with centralized procurement in countries like Germany, the UK, and France, has improved access across the Europe.

In 2025, ELISA (enzyme-linked immunosorbent assay) testing kits are projected to dominate the calprotectin market, accounting for 29.9% of the total revenue share. This leadership position has been driven by the high analytical sensitivity, reproducibility, and cost-efficiency offered by ELISA platforms.

ELISA kits have been extensively adopted in both hospital and research laboratories due to their compatibility with high-throughput workflows and capacity for simultaneous multi-sample analysis. Additionally, the availability of CE-marked and FDA-approved ELISA-based calprotectin kits has enhanced their regulatory credibility, especially in diagnostic use cases across Europe and North America.

The segment has also benefited from integration with semi-automated and automated microplate readers, reducing operational complexity and improving lab efficiency. Furthermore, academic institutions and CROs have continued to rely on ELISA kits for IBD and IBS biomarker research due to their standardization and scalability. As awareness and clinical guidelines increasingly favor fecal calprotectin testing for differential diagnosis, the ELISA segment is expected to retain its leadership role over the forecast period.

The irritable bowel syndrome (IBS) segment is anticipated to hold a commanding 70.1% revenue share in the calprotectin market in 2025. This dominance has been attributed to the critical role calprotectin testing plays in differentiating IBS from inflammatory bowel diseases (IBD), such as Crohn’s disease and ulcerative colitis.

Clinical guidelines across the USA and Europe have increasingly recommended fecal calprotectin as a non-invasive, first-line diagnostic marker for ruling out IBD in patients presenting with chronic gastrointestinal symptoms. As IBS cases continue to rise due to dietary changes, stress-related disorders, and sedentary lifestyles, the demand for calprotectin testing has correspondingly surged.

Physicians have shown a strong preference for calprotectin tests over colonoscopy in the initial diagnostic phase, particularly in primary care. In addition, payer policies in developed countries have supported reimbursement of fecal calprotectin tests for IBS screening, further driving adoption. Continued research on biomarker-driven gastrointestinal diagnosis is also expected to reinforce the segment’s dominance.

Challenge

Test Variability and Regulatory Compliance

The presence of variability in calprotectin test results due to differences in assay techniques and sample handling has hampered the growth of the market. A major concern has been the consistency and accuracy of results obtained by different laboratories across the globe.

Moreover, the complexity and time-consuming nature of regulatory compliance and approvals for emerging diagnostic technologies, particularly in regions with strict healthcare standards, can be a challenge. Solutions to these challenges will be found through progressive work to standardize assays, implement stringent quality control protocols, and adhere to global diagnostic standards.

Opportunity

Expansion of Point-of-Care and Home Testing Solutions

Rising implementation of point-of-care and home-based diagnostic testing is likely to act as a growth promoter. As lateral flow assay technology and portable diagnostic devices evolve, calprotectin tests are becoming increasingly available for patients outside of laboratory settings. Now companies are preparing simple, fast diagnostic kits that allow people to have the own gastrointestinal health checked only at home.

Also, the inclusion of AI with cloud-based platforms for the interpretation of test results is enhancing your diagnostic efficiency. As healthcare moves toward patient-centric models, the trend toward decentralized testing solutions will only increase long-term market growth. Increasing partnerships between diagnostic makers and healthcare providers are also signalling the departure from one-size-fits-all solutions by both parties to which innovations will be adopted by healthcare solutions providers.

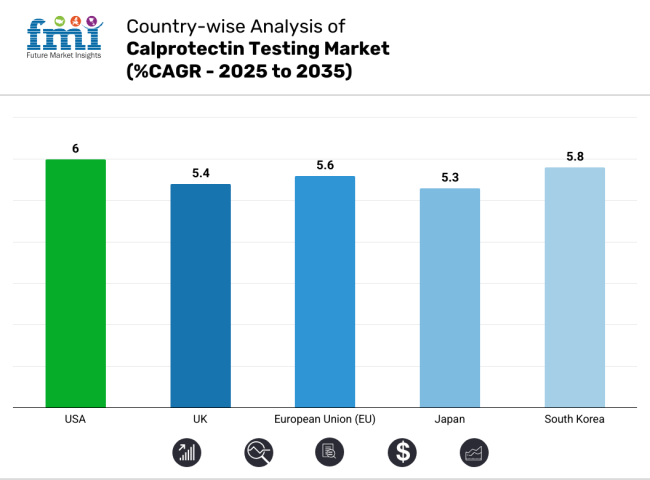

The United States is by far the largest market of the calprotectin test market across the globe due to the growing number of inflammatory bowel diseases (IBD) such as Crohn’s disease and ulcerative colitis, increasing preference for non-invasive diagnostic techniques, and advancements in biomarkers research.

Market growth is further accelerated by an increasing focus on disease detection in the early stages and personalized medicine. Further, the growth of market is also propelled by increasing presence of leading diagnostic companies and better reimbursement policies for fecal calprotectin testing. New developments, such as the growing uptake of point-of-care testing and the provision of home-based diagnostic kits, are improving accessibility and patient compliance. Thus, the growth of the immunoassay and automation technologies is also contributing to the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

The market for calprotectin testing in the UK is steadily growing with the increasing government initiatives aimed at improving the diagnostics for gastrointestinal diseases, rising adoption of fecal calprotectin testing as a first-line screening tool, and growing awareness among healthcare providers. Both US and Europe, NHS (National Health Service) in UK has implemented fecal calprotectin testing into their standard diagnostic algorithms for the differential diagnosis of IBS and IBD, contributing to the increasing usage of fecal calprotectin in the market.

Moreover, the changing nature of healthcare which includes the advent of telemedicine and home diagnostics is providing a patient access to different calprotectin testing solutions. Market growth is also driven by the increasing number of clinical laboratories and diagnostic service providers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

While Germany, France, and Italy are hold a prominent position in the European Union calprotectin testing market due to their strong healthcare infrastructure, burgeoning research on inflammatory diseases, and government initiatives to promote early disease detection programs. Rising adoption of automated and rapid diagnostic technologies in the hospitals and clinical laboratories are driving the growth in the European market. Moreover, rigorous regulations on diagnostic precision and productivity are increasing the demand for high-sensitivity immunoassays.

Rising public awareness regarding gut health together with the growing burden of gastrointestinal disorders is likely to drive demand for fecal calprotectin testing in the region. Market accessibility is being further improved by the growing transition towards digital health platforms to interpret tests and their results.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.6% |

The Japanese conjugate calprotectin testing market is anticipated to grow owing to the increasing prevalence of gastrointestinal diseases, growing aging population, and rising demand for non-invasive diagnostic solutions. Fecal calprotectin is one of the most commonly used tests in India that are still in the early adoption stage due to its advanced healthcare system and focus on early disease detection.

Moreover, currently available high-throughput testing and automated immunoassay platforms streamline diagnostics. Japan’s initiatives in biomarker-based disease detection are similarly enabling innovation in testing for calprotectin. Soaring the importance of home-based testing solutions and telemedicine platforms are expected to increase market accessibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

Strong demand for calprotectin testing in South Korea attributed to rising healthcare investments, growing prevalence of inflammatory gastrointestinal disorders, and increasing adoption of point-of-care diagnostic solutions. Market expansion is supported further by the government's emphasis on improving diagnostic capabilities and preventive healthcare measures. Furthermore, coups over the monopolistic lab industry by Korean manufacturers of automies and diagnostic interpretation based on AI are expected to support better calprotectin use in Korea.

Home-based testing kits and digital health platforms are also helping patients obtain access to early disease screening. This is further propelling demand for high-quality calprotectin testing solutions with the expansion of private healthcare providers and diagnostic centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The Calprotectin Testing Market is driven by the rising incidences of inflammatory bowel diseases (IBD), the development of non-invasive diagnostic methods, and growing use of calprotectin as a marker for gastrointestinal diseases. The rapid diagnostic kits and laboratory automation are the included innovations boosting the market growth. Trending topics influencing the industry are point-of-care, integration with digital health, and expanding clinical applications towards early disease detection.

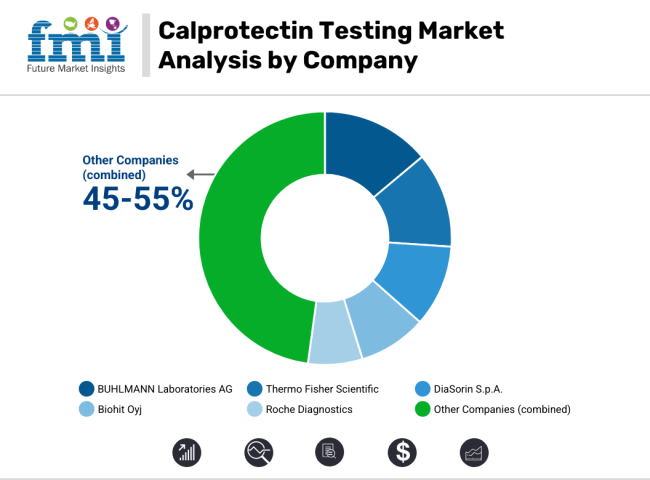

BUHLMANN Laboratories AG (12-16%)

BÜHLMANN leads in calprotectin testing solutions, offering high-sensitivity ELISA and point-of-care testing kits.

Thermo Fisher Scientific (10-14%)

Thermo Fisher specializes in automated calprotectin assays, improving efficiency in laboratory diagnostics.

DiaSorin S.p.A. (8-12%)

DiaSorin enhances its presence in the market with immunoassay-based calprotectin testing solutions for early disease detection.

Biohit Oyj (6-10%)

Biohit focuses on rapid and point-of-care calprotectin tests, making diagnosis more accessible and efficient.

Roche Diagnostics (4-8%)

Roche integrates calprotectin testing into its diagnostic platforms, streamlining analysis for gastrointestinal disorders.

Other Key Players (45-55% Combined)

Several diagnostic companies and biotech firms contribute to the expanding calprotectin testing market.

These include:

The overall market size for the Calprotectin Testing market was USD 51,143.1 million in 2025.

The Calprotectin Testing market is expected to reach USD 92,457.3 million in 2035.

The demand for calprotectin testing will be driven by increasing prevalence of inflammatory bowel diseases (IBD), rising awareness about early disease diagnosis, growing adoption of non-invasive diagnostic methods, and advancements in laboratory automation.

The top 5 countries driving the development of the Calprotectin Testing market are the USA, Germany, China, the UK, and Japan.

The ELISA-Based Calprotectin Testing segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Test Kits, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Sample, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Test Kits, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Sample, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Test Kits, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Sample, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Test Kits, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Sample, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Test Kits, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Sample, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Test Kits, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Sample, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Test Kits, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Sample, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Test Kits, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Sample, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Test Kits, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sample, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Indication, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Test Kits, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Test Kits, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Test Kits, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Sample, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Sample, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Sample, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 21: Global Market Attractiveness by Test Kits, 2023 to 2033

Figure 22: Global Market Attractiveness by Sample, 2023 to 2033

Figure 23: Global Market Attractiveness by Indication, 2023 to 2033

Figure 24: Global Market Attractiveness by End-User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Test Kits, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sample, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Test Kits, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Test Kits, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Test Kits, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Sample, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Sample, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Sample, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 46: North America Market Attractiveness by Test Kits, 2023 to 2033

Figure 47: North America Market Attractiveness by Sample, 2023 to 2033

Figure 48: North America Market Attractiveness by Indication, 2023 to 2033

Figure 49: North America Market Attractiveness by End-User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Test Kits, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Sample, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Test Kits, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Test Kits, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Test Kits, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Sample, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sample, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sample, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Test Kits, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Sample, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 74: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Test Kits, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Sample, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Test Kits, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Test Kits, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Test Kits, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Sample, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Sample, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Sample, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Test Kits, 2023 to 2033

Figure 97: Europe Market Attractiveness by Sample, 2023 to 2033

Figure 98: Europe Market Attractiveness by Indication, 2023 to 2033

Figure 99: Europe Market Attractiveness by End-User, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Test Kits, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Sample, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Test Kits, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Test Kits, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Test Kits, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Sample, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Sample, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Sample, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Test Kits, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Sample, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Indication, 2023 to 2033

Figure 124: South Asia Market Attractiveness by End-User, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Test Kits, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Sample, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Test Kits, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Test Kits, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Test Kits, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Sample, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Sample, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Sample, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Test Kits, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Sample, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Indication, 2023 to 2033

Figure 149: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Test Kits, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Sample, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Indication, 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by End-User, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Test Kits, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Test Kits, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Test Kits, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Sample, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Sample, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Sample, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Test Kits, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Sample, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Indication, 2023 to 2033

Figure 174: Oceania Market Attractiveness by End-User, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Test Kits, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Sample, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Indication, 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End-User, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Test Kits, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Test Kits, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Test Kits, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Sample, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Sample, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Sample, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 196: MEA Market Attractiveness by Test Kits, 2023 to 2033

Figure 197: MEA Market Attractiveness by Sample, 2023 to 2033

Figure 198: MEA Market Attractiveness by Indication, 2023 to 2033

Figure 199: MEA Market Attractiveness by End-User, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Faecal Calprotectin Testing Market

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA