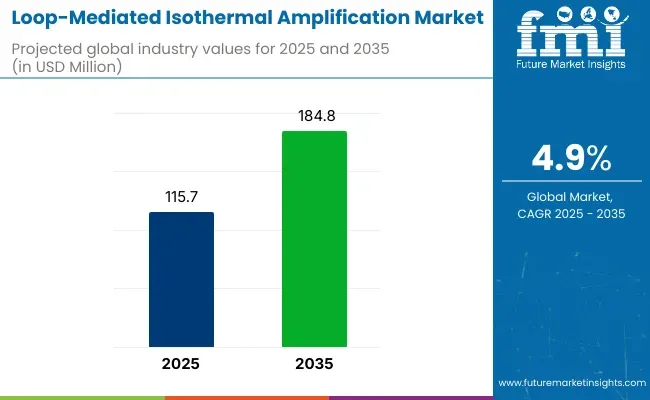

The global loop-mediated isothermal amplification (LAMP) market is projected to grow from USD 115.7 million in 2025 to USD 184.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.9% during the forecast period. LAMP is an innovative nucleic acid amplification technique that offers rapid, cost-effective, and reliable diagnostics without the need for complex thermal cycling equipment. This simplicity makes it particularly advantageous for point-of-care testing and resource-limited settings.

Recent developments in the LAMP market underscore its expanding applications across various sectors. The technique has gained prominence in infectious disease diagnostics, enabling the detection of pathogens such as Zika virus, tuberculosis, and SARS-CoV-2. Its robustness against inhibitors commonly found in clinical samples, coupled with the ability to perform under isothermal conditions, has further fueled its adoption. Additionally, LAMP's integration with microfluidic devices and real-time detection systems has enhanced its sensitivity and throughput, making it suitable for large-scale screening and surveillance programs.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 115.7 million |

| Market Size in 2035 | USD 184.8 million |

| CAGR (2025 to 2035) | 4.9% |

On May 15, 2025, Jena Bioscience GmbH introduced its new RT-LAMP Kit, designed for ultra-fast and efficient RNA detection. This product leverages the Loop-Mediated Isothermal Amplification (LAMP) technology, known for its simplicity and speed, making it ideal for rapid diagnostics in various applications, including infectious disease detection and genetic research. The RT-LAMP Kit aims to provide researchers and healthcare professionals with a reliable tool for RNA analysis, enhancing the capabilities of molecular diagnostics. This was officially announced in the company's press release.

The market's growth is also driven by increasing investments in healthcare infrastructure, particularly in emerging economies where the need for affordable diagnostic tools is critical. Governments and non-governmental organizations are recognizing the potential of LAMP in strengthening healthcare systems and improving disease control measures.

As the LAMP market continues to evolve, ongoing research and development efforts are expected to lead to the introduction of more specialized and efficient products. These advancements will cater to the diverse needs of healthcare providers and researchers, further driving the market's expansion and impact on global health outcomes

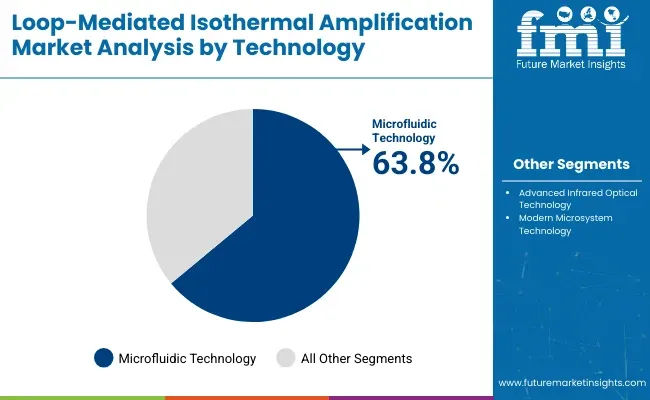

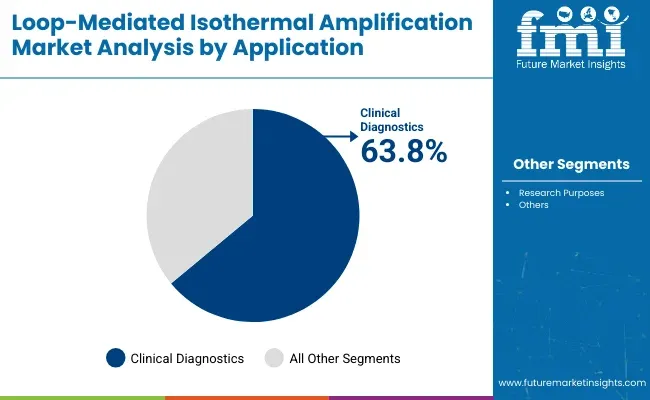

The global loop-mediated isothermal amplification (LAMP) market is expected to experience significant growth from 2025 to 2035. Key segments contributing to this growth include microfluidic technology and clinical diagnostics. These segments are driven by the increasing demand for rapid, cost-effective, and precise diagnostic solutions, particularly in infectious disease testing and point-of-care applications.

Microfluidic technology is expected to account for 63.8% of the loop-mediated isothermal amplification market share in 2025. This segment is seeing significant growth due to the increasing use of microfluidic systems in LAMP-based assays, which offer high precision and efficiency in nucleic acid amplification.

Microfluidic platforms enable the integration of multiple processes, such as sample preparation, amplification, and detection, into a single, compact device. These devices are highly valued for their ability to provide rapid results, reduced reagent consumption, and portability, making them ideal for field diagnostics and point-of-care settings.

Key players such as Thermo Fisher Scientific and Abbott are advancing microfluidic technologies by developing compact, easy-to-use platforms that integrate LAMP with real-time detection. The application of microfluidics in LAMP systems is also expanding into various sectors, including environmental monitoring, food safety, and veterinary diagnostics. As the demand for faster and more efficient diagnostic tools increases, microfluidic technology is expected to continue its dominance in the LAMP market, driving its growth in both developed and emerging markets.

The clinical diagnostics segment is projected to hold 63.8% of the LAMP market share in 2025. This growth is driven by the rising demand for rapid, accurate, and affordable diagnostic tests for infectious diseases, particularly in resource-limited settings. LAMP is gaining popularity in clinical diagnostics due to its ability to amplify DNA or RNA without the need for thermal cycling, making it well-suited for use in point-of-care (POC) settings and in-field applications.

The clinical diagnostics market is expanding due to the increasing prevalence of infectious diseases such as COVID-19, malaria, and tuberculosis, which require fast and accurate diagnostic tools. The ease of use, affordability, and rapid results offered by LAMP technology are making it an attractive option for healthcare providers, especially in rural or underserved regions.

Companies like Bio-Rad Laboratories and Eiken Chemical are at the forefront of developing LAMP-based diagnostic kits and systems designed to provide reliable results in a wide range of healthcare settings. As the need for timely diagnostics continues to grow, the clinical diagnostics segment is expected to be a significant driver of growth in the LAMP market.

The Asia Pacific is emerging as a hub for healthcare research, thus aiding the loop-mediated isothermal amplification’s cause in the region. The growing incidence of genetic disorders in the region is also positively affecting the market in the Asia Pacific.

Europe being at the forefront of healthcare technology is proving conducive to the market’s progress in the region. The European Union’s initiatives to control the spread of newer diseases is also helping the market’s cause in Europe.

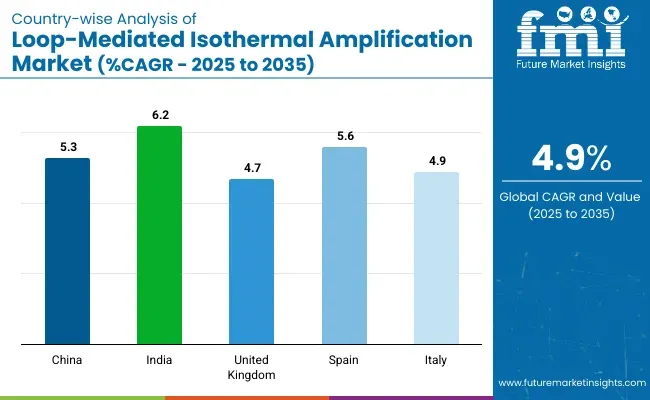

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.3% |

| India | 6.2% |

| United Kingdom | 4.7% |

| Spain | 5.6% |

| Italy | 4.9% |

The market is anticipated to register a CAGR of 6.2% in India for the forecast period. Some of the factors driving the growth of the market in the country are:

The United Kingdom is set to see the market expand at a CAGR of 4.7% over the forecast period. Prominent factors driving the growth of the market are:

The market is expected to register a CAGR of 5.3% in China during the forecast period. Some of the factors driving the growth of the market in China are:

The market is set to progress at a CAGR of 5.6% in Spain during the forecast period. Factors influencing the growth of the market in Spain include:

The market is expected to register a CAGR of 4.9% in Italy. Some of the reasons for the growth of loop-mediated isothermal amplification in the country are:

Since loop-mediated isothermal amplification is still a developing process, the market is currently being controlled by a few reputed names. However, as the knowledge about the procedure grows, new entrants are steadily making their way into the market.

Market players are collaborating with healthcare and research institutions to eradicate the lack of awareness about the procedure. Both public and private investment are being sought by market players in their bid to develop the procedure further.

Recent Developments in the Loop-mediated Isothermal Amplification Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 115.7 million |

| Projected Market Size (2035) | USD 184.8 million |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for dollar sales |

| Product Types Analyzed (Segment 1) | Instruments (Incubation Systems, Turbidimeters, Agarose Gel Electrophoresis, Fluorescence Measuring Systems), Kits & Reagents (DNA Polymerase, Primer Mix, DNA Polymerase & Primer Mix, Dyes, Other Reagents) |

| Technologies Analyzed (Segment 2) | Microfluidic Technology, Advanced Infrared Optical Technology, Modern Microsystem Technology |

| Applications Analyzed (Segment 3) | Diagnostic Purposes, Research Purposes |

| End-users Analyzed (Segment 4) | Hospital Laboratories, Research and Academic Institutes, Diagnostic Centers |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East and Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Loop-Mediated Isothermal Amplification Market | Jena Bioscience GmbH, HiberGene Diagnostics, Meridian Bioscience, Inc., Mast Group Ltd., Excellgen, Inc., Merck KGaA, QIAGEN N.V, NIPPON GENE CO., LTD, New England Biolabs, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific |

| Additional Attributes | dollar sales, CAGR trends, product type segmentation, technology adoption, application-based demand, end-user distribution, competitor dollar sales & market share, regional growth trends |

The market size of the loop-mediated isothermal amplification industry is estimated to be USD 115.7 million in 2025.

Jena Bioscience GmbH, HiberGene Diagnostics, Meridian Bioscience, Inc., and Mast Group Ltd. are some of the key companies in the loop-mediated isothermal amplification market.

The loop-mediated isothermal amplification market is expected to reach a valuation of USD 184.8 million in 2035.

The loop-mediated isothermal amplification industry is expected to progress at a solid CAGR of 4.9% over the period from 2025 to 2035.

The loop-mediated isothermal amplification market can be segmented into the following categories: product, technology, application, and end-user.

The loop-mediated isothermal amplification market is predicted to progress at a CAGR of 6.2% in India over the period from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Isothermal Box for Vaccine Market Forecast and Outlook 2025 to 2035

Isothermal Bags Market

Whole Genome Amplification Market Size and Share Forecast Outlook 2025 to 2035

Strand Displacement Amplification Market - Growth & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA