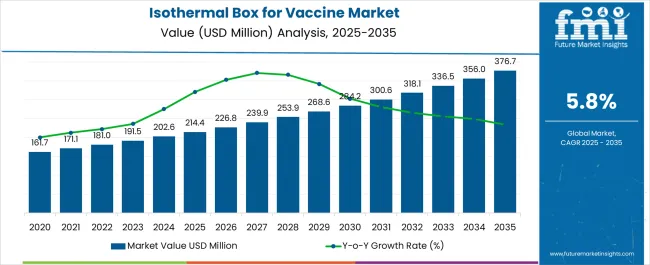

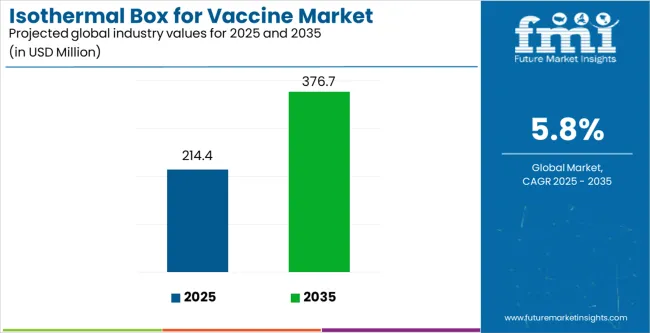

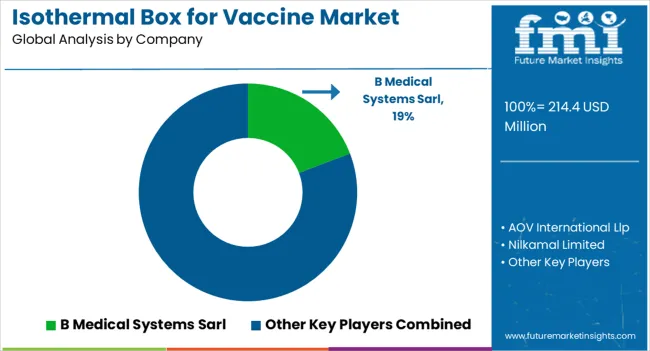

The isothermal box for vaccine market is expected to grow from USD 214.4 million in 2025 to USD 376.7 million by 2035, expanding at a CAGR of 5.8% during the forecast period. This growth underscores the increasing importance of temperature-controlled solutions in safeguarding vaccine efficacy, particularly as global immunization programs expand and the need for reliable cold chain systems intensifies. Governments, healthcare providers, and international health organizations are actively investing in vaccine distribution infrastructure, making isothermal boxes a critical component of large-scale immunization campaigns.

One of the key drivers is the rising demand for effective cold chain logistics to minimize vaccine wastage and maintain potency during transport and storage. Precision in maintaining temperature ranges between +2°C and +8°C is crucial for vaccines like mRNA-based formulations, which are highly sensitive to thermal deviations. Healthcare systems and NGOs are prioritizing advanced insulated boxes that can ensure safe vaccine delivery to both urban centers and remote areas.

Technological advancements in insulation and thermal materials are further enhancing product reliability. Manufacturers are integrating phase change materials (PCMs), vacuum insulation panels (VIPs), and energy-efficient designs to extend temperature retention times, enabling vaccines to be transported across longer distances without degradation. The addition of digital temperature monitoring, GPS tracking, and data logging features is also transforming these boxes into smart vaccine carriers, ensuring compliance with strict regulatory standards.

The market is also seeing strong momentum from public health initiatives and mobile healthcare programs, particularly in regions with limited access to centralized healthcare infrastructure. Outreach campaigns in Africa, South Asia, and Latin America are creating steady demand for portable and durable isothermal boxes that can perform in challenging environments. Developed regions, including North America and Europe, are focusing on premium systems with advanced monitoring to support both pandemic preparedness and routine immunization drives.

Sustainability has become another emerging trend. The development of eco-friendly materials and reusable cold chain solutions is gaining traction as governments and NGOs emphasize both vaccine safety and environmental responsibility. Companies are investing in recyclable components and long-life insulation systems to balance operational efficiency with sustainability goals. The future outlook for this market remains strong as global vaccination programs continue to expand and diversify, with new vaccines for influenza, HPV, and emerging infectious diseases adding to distribution needs. The combination of growing healthcare investments, technological progress, and international collaboration in public health will ensure sustained demand for high-performance isothermal boxes, positioning manufacturers for long-term growth and innovation.

| Metric | Value |

|---|---|

| Isothermal Box for Vaccine Market Estimated Value in (2025 E) | USD 214.4 million |

| Isothermal Box for Vaccine Market Forecast Value in (2035 F) | USD 376.7 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

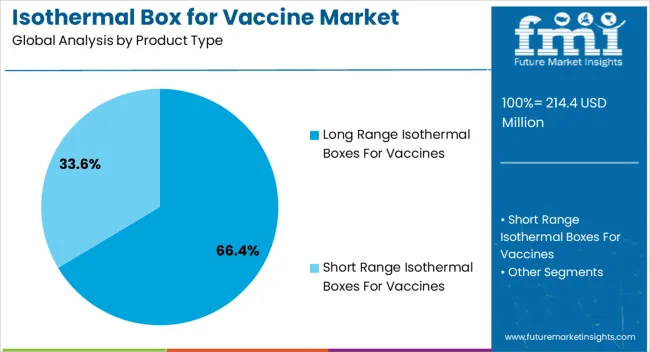

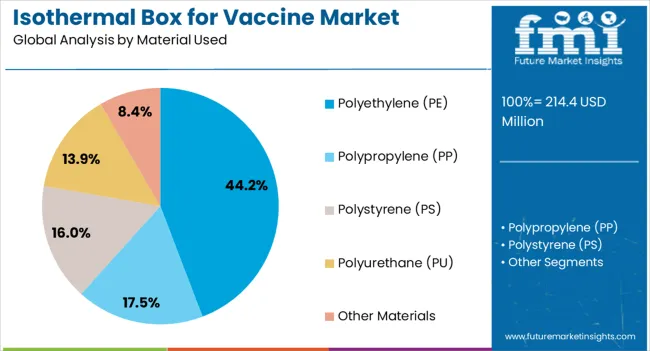

The market is segmented by Product Type and Material Used and region. By Product Type, the market is divided into Long Range Isothermal Boxes For Vaccines and Short Range Isothermal Boxes For Vaccines. In terms of Material Used, the market is classified into Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), Polyurethane (PU), and Other Materials. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The long range isothermal boxes for vaccines segment is projected to hold 66.4% of the market revenue in 2025, establishing it as the leading product type. Its dominance is being driven by the requirement for extended-duration storage and transportation of vaccines over long distances, especially in regions with limited cold chain infrastructure. The ability to maintain consistent internal temperatures for prolonged periods ensures vaccine stability and reduces the risk of spoilage, which is critical for immunization campaigns.

These boxes are designed for durability, lightweight handling, and compatibility with monitoring systems, enabling healthcare providers to transport vaccines efficiently and safely. Integration with temperature tracking technologies and compliance with international cold chain standards further enhance their adoption.

The growing scale of vaccination drives, particularly for COVID-19, influenza, and routine immunization programs, has reinforced the preference for long range isothermal boxes Continuous innovation in design, insulation materials, and energy efficiency is expected to maintain their market leadership, supporting wider distribution and reliable vaccine delivery globally.

The polyethylene (PE) material used segment is anticipated to account for 44.2% of the market revenue in 2025, making it the leading material category. Growth in this segment is being driven by PE’s superior insulation properties, lightweight structure, and chemical resistance, which ensure safe and efficient transport of vaccines. PE provides durability and thermal stability, allowing boxes to maintain consistent temperatures even under varying external conditions.

Its compatibility with advanced manufacturing techniques facilitates the production of robust, hygienic, and reusable containers. The material’s versatility allows for easy integration with temperature monitoring systems, reducing the risk of vaccine spoilage. Increasing demand from large-scale immunization campaigns and cold chain logistics is further reinforcing adoption.

PE-based isothermal boxes are preferred by healthcare providers and logistics operators for their reliability, long service life, and cost efficiency As global vaccination efforts continue to expand, the polyethylene material segment is expected to sustain its leading position, driven by ongoing material innovations, regulatory compliance, and the need for scalable vaccine distribution solutions.

The isothermal container for vaccine market was valued at USD 161.7 million in 2020. The isothermal boxes for vaccines market saw soaring growth in 2024 with five years (2020 to 2025) revenue up by a CAGR of 6.5%. The overall market value was about USD 214.4 million in 2025.

The COVID-19 pandemic has had a positive impact on the isothermal boxes for vaccine market during this historical period. The isothermal box suppliers experienced a rapid rise in demand due to the development of an array of vaccines across the world. This increasing number of vaccine doses across the globe augments the sales of isothermal boxes to store and transport vaccines in appropriate conditions & temperatures.

| Attributes | Details |

|---|---|

| Isothermal Box for Vaccine Market Value (2020) | USD 161.7 million |

| Market Revenue (2025) | USD 214.4 million |

| Market Historical Growth Rate (CAGR 2020 to 2025) | 6.5% CAGR |

Rising awareness for massive immunization programs by government and privately funded alliances such as GAVI and organizations such as UNICEF has led to an increase in vaccination programs globally. Thus, the growing demand for sustainable cold chain packaging solutions such as vaccine storage boxes, vaccine carriers, and others that can maintain the integrity of the vaccines during transit is likely to augment the market.

Despite such prospects, some pressing challenges persist for the industry, including the inability to keep up with the inventory network at the strategic locations. Also, isothermal boxes can provide only temporary solutions to temperature control and maintenance and can be easily replaced by cryogenic refrigerators, especially in the pharmaceutical market.

The table below lists the countries that can provide better growth prospects for isothermal box sellers to vaccine suppliers.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

| Germany | 4.0% |

| United Kingdom | 5.6% |

| India | 7.7% |

| China | 6.9% |

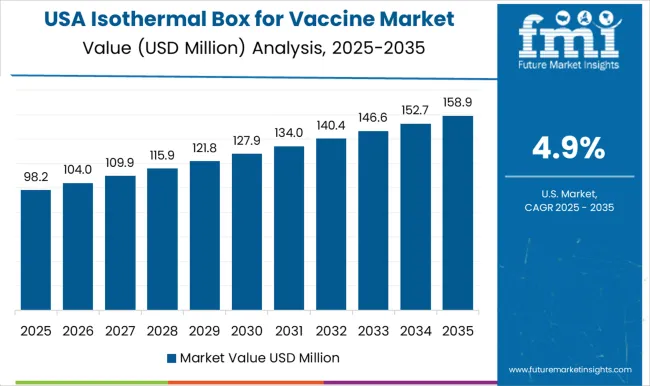

The United States isothermal box for vaccine market is anticipated to advance at a rate of 4.5% per year till 2035.

The large portion of the North American isothermal box for vaccine market is captured by the industry players based in the United States. Some new developments that have taken place in the regional market include the increasing level of investments in research and development along with the prevalence of improved healthcare.

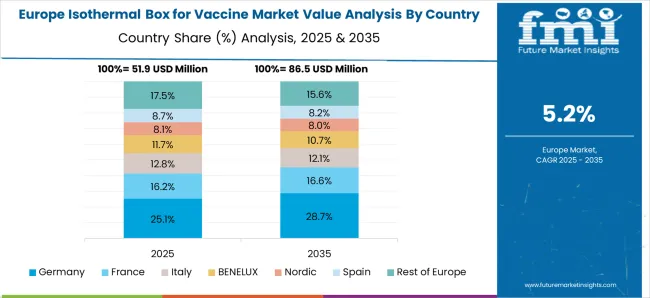

Germany is holding the top position as a supplier of isothermal vaccine boxes in Europe and could progress at 4.0% CAGR from 2025 to 2035.

The requirement for isothermal boxes has grown as vaccine distribution from Germany has expanded into many Eastern European countries. New developments in isothermal box design by German manufacturers to improve thermal efficiency and dependability are popularizing the product in other parts as well.

The regional market in the United Kingdom has the potential to continue rising at a higher CAGR of 5.6% until 2035.

The sales of isothermal boxes skyrocketed during the pandemic period as some drug manufacturers in the United Kingdom were at the forefront in finding vaccination for COVID-19. Vaccine exports are still on the rise in the country, creating a higher demand for isothermal boxes to maintain the integrity of vaccines throughout transit.

Recent occurrences indicate that the isothermal box for the vaccine industry in China is going to expand at a 6.9% CAGR till 2035.

Asia Pacific Excluding Japan (APEJ), followed by the North America, is estimated to remain the leading region generating high demand for different types of vaccines in the coming decade. The increasing production and administration of vaccines in this region is the reason behind the higher export of isothermal boxes from China.

Demand for isothermal boxes for vaccines in the Indian market is set to grow at a 7.7% annual rate over the next ten years.

India is estimated to hold around 40% of the market value share for the Asia Pacific isothermal boxes for vaccines market by the end of 2035. The increasing production of vaccines in India is the major factor propelling the demand for isothermal boxes for vaccines. Serum Institute, located in India, is one of the world’s largest vaccine producers.

Based on the material used in making vaccine boxes, the polyethylene (PE) segment is projected to account for 44.2% of the current market value in 2025.

| Attributes | Details |

|---|---|

| Top Material Type Segment | Polyethylene (PE) |

| Total Market Share in 2025 to 2035 | 44.2% |

Polyethylene (PE) material is preferred by vaccine manufacturers and suppliers as it is highly adaptable, flexible, lightweight, and durable. The Polyethylene (PE) segment, followed by Polyurethane (PU) segment, is anticipated to remain the most lucrative segment among others. Both segments collectively are estimated to hold two-thirds of the demand for the isothermal boxes for vaccines through the projected years.

Based on product type, the long-range segment is anticipated to hold around 66.4% of the market value share in 2025.

| Attributes | Details |

|---|---|

| Top Product Type Segment | Long Range |

| Total Market Share in 2025 | 66.4% |

The long-range isothermal boxes for vaccines are demanded by the end users owing to their high cold life which is a minimum of 96 hours offered by the long-range segment. Demand for long-range isothermal boxes is also booming to facilitate the safe delivery of vaccines to isolated and rural areas without access to any viable refrigeration facilities.

The overall market is evolving fast with the growing emphasis on the use of sustainable materials in healthcare products and industries. Moreover, reusable packaging aids in the reduction of the usage of refrigerants and insulation materials that are linked with ozone depletion and global warming. The use of reusable insulated containers for multiple transportation is also significantly cost-effective.

The key players operating in isothermal boxes for the vaccines sector are adopting the partnership & collaboration strategy to utilize the resources along with efficiently catering to the increasing demand in the market. Also, the key players are expanding their presence by establishing manufacturing facilities across the untapped regions.

Recent Developments in the Global Isothermal Box for Vaccine Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 202.6 million |

| Projected Market Size (2035) | USD 355.8 million |

| Anticipated Growth Rate (2025 to 2035) | 5.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America: Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Product Type, By Material Used, and By Region |

| Key Companies Profiled | B Medical Systems Sarl; AOV International Llp; Nilkamal Limited; Apex International; Blowkings India; AUCMA Co., Ltd.; EBARA Inc.; Termo-Cont MK LLC.; CIP Industries cc; Gio'Style Lifestyle S.p.A.; Coldpack Systems S.A.S. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global isothermal box for vaccine market is estimated to be valued at USD 214.4 million in 2025.

The market size for the isothermal box for vaccine market is projected to reach USD 376.7 million by 2035.

The isothermal box for vaccine market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in isothermal box for vaccine market are long range isothermal boxes for vaccines, _5 liters to 15 liters, _16 liters to 25 liters, short range isothermal boxes for vaccines, _less than 5 liters, _5 liters to 15 liters and _16 liters to 25 liters.

In terms of material used, polyethylene (pe) segment to command 44.2% share in the isothermal box for vaccine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Isothermal Bags Market

Loop-Mediated Isothermal Amplification Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Box Latch Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Box and Carton Overwrap Films Market Demand and Growth

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Boxcar Scars Market – Demand, Growth & Forecast 2025 to 2035

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Competitive Breakdown of Box Pouch Providers

Market Share Insights of Boxboard Packaging Providers

Box Latch Market Positioning & Competitive Analysis

Industry Share Analysis for Box Liners Companies

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Carboxylic Acid Market Size and Share Forecast Outlook 2025 to 2035

Carboxylated Nitrile Rubber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA