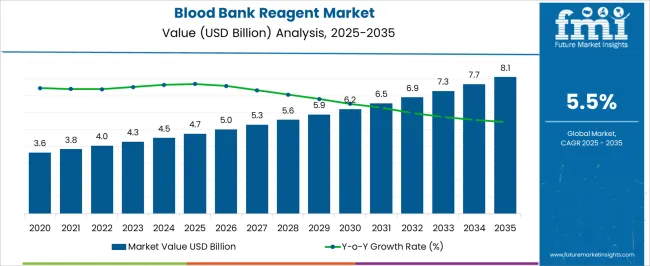

The Blood Bank Reagent Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Blood Bank Reagent Market Estimated Value in (2025 E) | USD 4.7 billion |

| Blood Bank Reagent Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Blood Bank Reagent market is witnessing steady growth due to the increasing demand for safe blood transfusions and rising awareness about the importance of blood group testing. Growing cases of chronic diseases, road accidents, and surgical procedures are contributing to the expansion of this market by increasing the need for accurate blood typing and cross-matching. ABO typing and other reagent-based tests remain essential for preventing transfusion-related complications, ensuring patient safety, and supporting effective healthcare delivery.

Technological advancements, such as automation in diagnostic laboratories and the adoption of advanced analyzers, are enhancing test accuracy and operational efficiency. Moreover, rising government initiatives and investments in strengthening blood banks and diagnostic infrastructure are boosting demand for high-quality reagents. Regulatory compliance with safety and quality standards is also reinforcing the adoption of standardized testing procedures.

The shift toward precision medicine and personalized healthcare further elevates the importance of accurate blood testing With increasing reliance on diagnostic reagents to improve clinical outcomes, the Blood Bank Reagent market is expected to continue expanding, supported by innovation, regulatory emphasis, and growing healthcare needs across global regions.

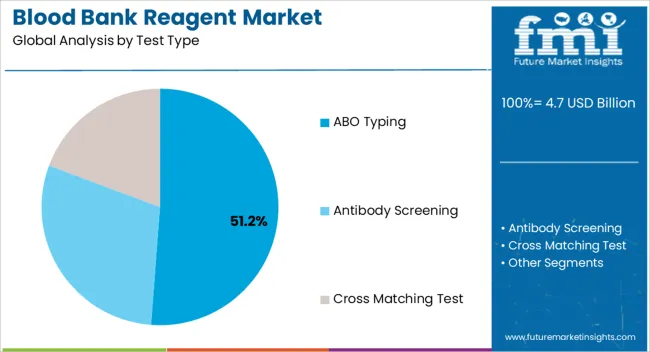

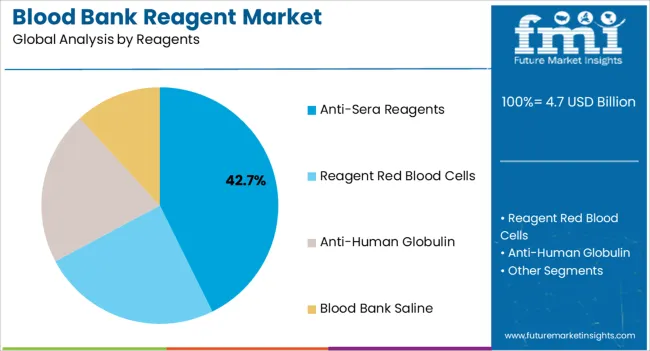

The blood bank reagent market is segmented by test type, reagents, and geographic regions. By test type, blood bank reagent market is divided into ABO Typing, Antibody Screening, and Cross Matching Test. In terms of reagents, blood bank reagent market is classified into Anti-Sera Reagents, Reagent Red Blood Cells, Anti-Human Globulin, and Blood Bank Saline. Regionally, the blood bank reagent industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ABO typing test type segment is projected to hold 51.2% of the Blood Bank Reagent market revenue share in 2025, making it the largest test type segment. This dominance is attributed to its critical role in determining blood compatibility before transfusions, organ transplants, and medical treatments. ABO typing remains a cornerstone in blood banking and transfusion medicine, as mismatches can lead to life-threatening reactions.

Increasing demand for blood transfusions due to surgeries, trauma cases, and chronic illnesses has elevated the importance of this segment. Technological innovations, such as automated blood typing systems and high-throughput analyzers, are enhancing the speed and accuracy of testing. Furthermore, growing awareness regarding voluntary blood donations and large-scale screening initiatives are driving adoption of ABO typing across both developed and emerging healthcare systems.

The segment is further strengthened by its integration into routine diagnostic protocols, ensuring patient safety and improving clinical efficiency With continued advancements in diagnostic technologies and increasing healthcare investments, the ABO typing segment is expected to maintain its leadership in the Blood Bank Reagent market.

The anti-sera reagents segment is anticipated to account for 42.7% of the Blood Bank Reagent market revenue in 2025, underscoring its significant contribution to transfusion safety. Anti-sera reagents are widely used to detect and confirm specific blood group antigens, playing an essential role in cross-matching procedures and compatibility testing. The increasing prevalence of chronic diseases and the rising number of complex surgical interventions have led to higher demand for reliable reagent-based testing.

These reagents are integral for ensuring precision in blood typing and reducing the risks associated with transfusion errors. Continuous improvements in reagent formulations, along with enhanced shelf life and stability, are contributing to their growing adoption. Hospitals, diagnostic laboratories, and blood banks are increasingly deploying anti-sera reagents as part of their standardized testing protocols to improve efficiency and reliability.

Furthermore, rising investments in healthcare infrastructure across developing economies are driving widespread utilization As the focus on patient safety and compliance with stringent transfusion standards continues to grow, the anti-sera reagents segment is expected to sustain its strong position in the Blood Bank Reagent market.

Growing need of blood on the daily basis in hospitals, ambulatory surgical centers and several multispecialty centers increases the demand for blood bank reagents in blood banks in order to maintain the keep up the supply of blood. Reagents are crucial testing reagents used by several hospitals and blood banks to determine and identify the antibody type in the donors and patient’s blood, thus ensuring the blood transfusion to be safe and effective.

During every blood transfusion, patients’ blood is tested with the donor’s reagents in order to identify the harmful antibodies thus, decreasing the risk of any potential infection. Antibodies are blood proteins produced by the plasma cells to protect the body against several infections.

Routinely performed blood banking procedures includes several reagents used for blood groping, antibody screening and cross matching/compatibility testing. Blood groping reagents are intended for determining the ABO blood group and Rh type from the donor’s blood.

Blood groping reagents are made from the antibodies derived from the in-vitro cultures of hybridomas of murine and human origin and include, antigens against blood group A, B, A & B, D, Anti-C, Anti-c, Anti-E, Anti-e, and Anti-K for ABO typing.

Anti-D is the most important Rh reagent for Rh typing. Antibody screening reagents are used for identification of antibodies with specificity of red blood cells (RBC) antigens. Antibody screening reagents are used to test donor plasma cells in order to make sure than no unexpected antibodies are transfused in to the patient’s body thus allowing detection of unexpected antibodies particularly alloantibodies in the RBC’s.

Antibodies including, Duffy, Kell, Kidd, MNS, P, and certain Rh types that are considered clinically significant. Cross matching reagents are used to ensure whether the blood can be transfused in the recipient’s body prior to the blood transfusion procedure.

The market for blood bank reagents is expected to witness healthy growth over the forecast period. The antibody screening testing is essential as it prevents hemolytic transfusion reactions from occurring.

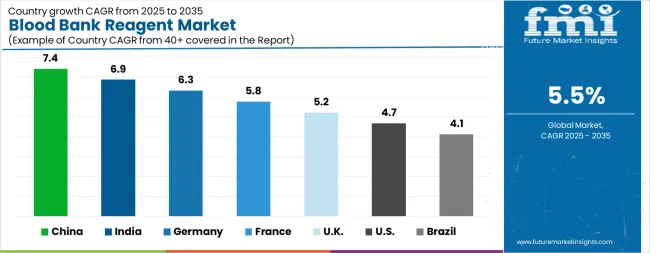

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The Blood Bank Reagent Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Blood Bank Reagent Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Blood Bank Reagent Market is estimated to be valued at USD 1.6 billion in 2025 and is anticipated to reach a valuation of USD 2.6 billion by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 242.4 million and USD 136.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Test Type | ABO Typing, Antibody Screening, and Cross Matching Test |

| Reagents | Anti-Sera Reagents, Reagent Red Blood Cells, Anti-Human Globulin, and Blood Bank Saline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

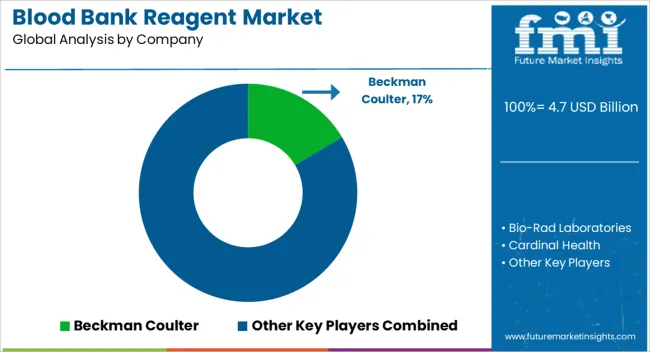

| Key Companies Profiled | Beckman Coulter, Bio-Rad Laboratories, Cardinal Health, Ortho Clinical Diagnostics, Quotient, Lorne Laboratories Limited, Immucor, Thermo Fisher Scientific, BioMRieux, and Beckman Coulter |

The global blood bank reagent market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the blood bank reagent market is projected to reach USD 8.1 billion by 2035.

The blood bank reagent market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in blood bank reagent market are abo typing, antibody screening and cross matching test.

In terms of reagents, anti-sera reagents segment to command 42.7% share in the blood bank reagent market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Banking Equipment Market Analysis – Size, Share & Forecast 2024-2034

Bank Regulatory & Governance Consulting Market Size and Share Forecast Outlook 2025 to 2035

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Banking as a Service (BaaS) Platform Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Reagent Bottle Market Growth & Industry Forecast 2025 to 2035

Blood Coagulation Analyzers Market Growth – Trends & Forecast 2025 to 2035

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA