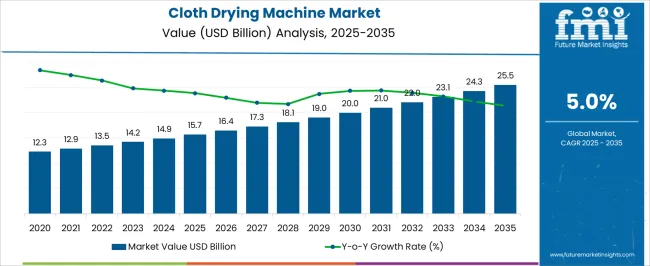

The cloth drying machine market is forecasted to reach USD 25.5 billion by 2035, up from USD 15.7 billion in 2025, with a compound annual growth rate (CAGR) of 5.0%. A Compound Annual Growth Rate (CAGR) analysis highlights the market's steady expansion, driven by the increasing adoption of home appliances and growing demand for energy-efficient drying solutions. From 2021 to 2025, the market grows from USD 12.3 billion to 15.7 billion, with incremental values passing through USD 12.9 billion, 13.5 billion, 14.2 billion, and 14.9 billion.

This phase reflects moderate growth, driven by factors like rising disposable incomes, increasing urbanization, and a preference for convenient home solutions. The market begins to gain traction as consumers look for energy-efficient, space-saving, and eco-friendly drying machines. Between 2026 and 2030, values rise from USD 15.7 billion to USD 20.0 billion, moving through USD 16.4 billion, USD 17.3 billion, USD 18.1 billion, and USD 19.0 billion. This phase sees an acceleration in growth, fueled by advances in drying technology, such as smart dryers with IoT integration, and a broader shift towards green appliances. From 2031 to 2035, the market is projected to progress from USD 21.0 billion to USD 25.5 billion, with intermediate values of USD 22.0 billion, USD 23.1 billion, and USD 24.3 billion. The late phase of growth is driven by continued product innovations and expanding adoption in emerging markets.

The cloth drying machine market is driven by five key parent markets that collectively influence its growth, technological advancements, and application across residential and commercial sectors. The home appliances market contributes the largest share, about 25-30%, as cloth drying machines are integral to modern households, providing convenience, energy efficiency, and quick drying solutions for everyday laundry needs. The commercial laundry services market adds approximately 20-24%, with businesses such as hotels, laundromats, hospitals, and nursing homes relying on industrial-grade drying machines to handle large volumes of laundry efficiently while ensuring hygiene and fabric care.

The textile and garment manufacturing market contributes around 15-18%, as drying machines are essential in post-production processes, where large-scale textile drying is needed for various fabrics, ensuring fast throughput and quality consistency. The renewable energy and smart home market accounts for roughly 12-15%, with advancements in energy-efficient, smart, and connected drying machines that integrate with solar power systems, home automation, and IoT-based monitoring.

| Metric | Value |

|---|---|

| Cloth Drying Machine Market Estimated Value in (2025 E) | USD 15.7 billion |

| Cloth Drying Machine Market Forecast Value in (2035 F) | USD 25.5 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The cloth drying machine market is experiencing steady expansion, supported by rising household appliance adoption, urban lifestyle changes, and the demand for energy-efficient laundry solutions. Consumer preferences have shifted toward automated drying due to limited living spaces, unpredictable weather conditions, and the growing emphasis on convenience in daily chores. Appliance manufacturers have responded with product lines offering enhanced energy ratings, moisture sensors, and fabric care technologies to meet evolving consumer needs.

In addition, marketing campaigns and retail promotions have increased awareness in emerging economies, where market penetration has traditionally been lower. Government energy efficiency regulations and eco-labelling programs have also influenced product development, encouraging the use of advanced drying systems with lower environmental impact.

Over the coming years, market growth is expected to be driven by the dominance of electric models, the rising demand for medium to large capacity machines, and the popularity of vented technology for its cost-effectiveness and straightforward installation.

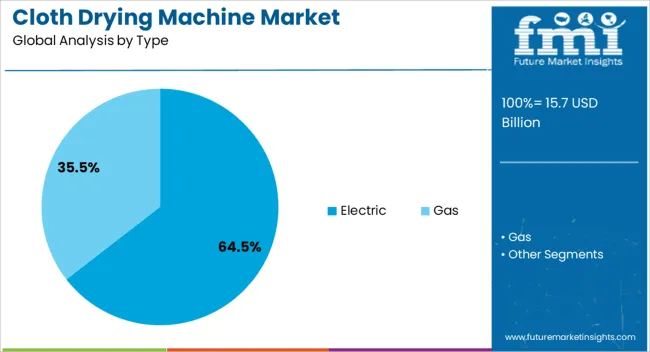

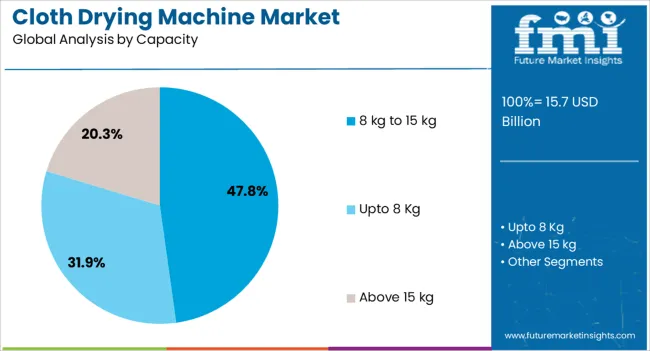

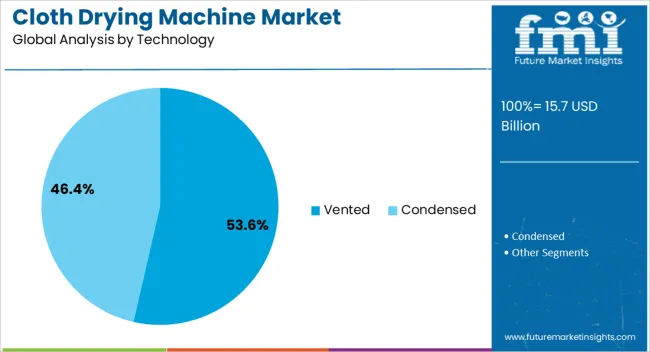

The cloth drying machine market is segmented by type, capacity, technology, price range, end use, distribution channel, and geographic regions. By type, cloth drying machine market is divided into Electric and Gas. In terms of capacity, cloth drying machine market is classified into 8 kg to 15 kg, Upto 8 Kg, and Above 15 kg. Based on technology, cloth drying machine market is segmented into Vented and Condensed. By price range, cloth drying machine market is segmented into Mid-Range, Economy, and High/Premium. By end use, cloth drying machine market is segmented into Residential and Commercial. By distribution channel, cloth drying machine market is segmented into Offline and Online. Regionally, the cloth drying machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric segment is projected to hold 64.5% of the cloth drying machine market revenue in 2025, maintaining its leadership position due to its widespread availability, ease of installation, and compatibility with household power systems. This segment has gained momentum from manufacturers’ ability to produce models across a wide price range, catering to diverse consumer budgets.

Electric dryers have benefited from continuous advancements such as energy-saving heating elements, improved airflow systems, and precision drying controls that protect fabrics. In regions with stable electricity supply and strong retail networks, electric dryers have become the default choice for urban households.

Furthermore, increasing availability of models with smart connectivity and programmable drying cycles has strengthened their appeal. While gas-powered units are preferred in certain niche markets, the accessibility, lower upfront cost, and broad product variety of electric dryers are expected to keep the segment at the forefront of market demand.

The 8 kg to 15 kg capacity segment is projected to account for 47.8% of the cloth drying machine market revenue in 2025, establishing itself as the most popular size range. This capacity category has been favored for its ability to meet the drying needs of medium to large households, accommodating bulk laundry loads and heavier fabrics.

Consumer feedback and retail sales data have shown that this range offers the best balance between load capacity and energy efficiency, reducing the number of drying cycles required. Manufacturers have focused on developing models in this segment with optimized drum design, moisture detection technology, and faster cycle times, enhancing overall convenience.

Additionally, as family sizes and laundry volumes vary globally, the versatility of this capacity range has driven its adoption in both residential and light commercial settings. Continued urbanization, coupled with rising disposable incomes, is expected to sustain the demand for 8 kg to 15 kg capacity machines.

The vented segment is projected to contribute 53.6% of the cloth drying machine market revenue in 2025, retaining its lead due to its lower purchase price and straightforward operational design. Vented dryers have been widely adopted in regions where space and ventilation setups can accommodate external exhaust systems.

This technology’s simplicity, quick drying performance, and relatively low maintenance requirements have made it a preferred choice among cost-conscious consumers. Retail insights indicate that vented models continue to dominate in markets where replacement cycles favor affordable and familiar technologies over more expensive alternatives like heat pump dryers.

Additionally, improvements in airflow control and lint filtration have enhanced the efficiency and safety of vented systems. While energy efficiency regulations are prompting growth in condenser and heat pump technologies, vented dryers are expected to maintain a strong market presence due to their proven performance, accessible pricing, and continued demand in both developed and emerging economies.

The cloth drying machine market is growing due to rising demand from both residential and commercial sectors for energy-efficient, time-saving, and high-performance drying solutions. Smart technologies, energy-efficient designs, and compact machines are key trends driving growth. However, challenges related to high energy consumption, operating costs, and environmental impact are pushing manufacturers to develop more eco-friendly alternatives. Opportunities lie in the integration of IoT, smart features, and heat pump technology. Manufacturers offering connected, energy-efficient, and compact dryers are best positioned to capitalize on the growing market. Asia-Pacific, North America, and Europe are key regions driving demand.

The cloth drying machine market is witnessing significant growth, driven by increasing demand in both residential and commercial sectors. In residential settings, consumers are opting for efficient, time-saving, and energy-saving solutions to dry clothes, especially in regions with high humidity or cold climates. The commercial sector, including laundromats, hotels, and hospitals, also contributes to market growth by adopting high-capacity machines for faster and consistent drying. Key players like Whirlpool, Bosch, and LG Electronics are focusing on improving product performance, durability, and energy efficiency. Advanced features such as smart controls, Wi-Fi integration, and customized drying cycles further enhance consumer adoption across both sectors.

Despite rising demand, the cloth drying machine market faces challenges related to high energy consumption and environmental impact. Traditional drying machines, particularly those using electric or gas-powered heating elements, tend to consume significant amounts of energy, increasing operating costs for consumers. This is driving demand for more energy-efficient alternatives, such as heat pump dryers and eco-friendly models. Regulatory pressure on reducing energy consumption and carbon footprints also adds complexity for manufacturers. Companies are focusing on developing dryers with lower energy consumption, faster drying times, and improved sustainability to meet evolving consumer expectations and comply with regulations.

Opportunities in the cloth drying machine market lie in the integration of smart technology and the development of energy-efficient models. With the growing trend of connected home appliances, smart dryers featuring Wi-Fi and mobile app integration are gaining popularity. These dryers allow users to remotely monitor and control the drying process, receive maintenance alerts, and optimize energy usage. Manufacturers are increasingly focusing on the development of heat pump dryers, which use less energy and offer environmentally friendly alternatives. The demand for compact, space-saving, and multi-functional machines also creates opportunities in both residential and commercial markets, particularly in urban areas with limited space.

Technological trends in the cloth drying machine market include the increasing adoption of automation, IoT integration, and compact designs. Automation features such as load sensors, moisture sensors, and self-diagnosis are becoming standard in modern dryers. IoT connectivity allows users to track and control the machine remotely via smartphones, offering convenience and energy management. Furthermore, compact dryers with advanced drying technologies are becoming more popular in urban settings, where space is limited. Manufacturers are also focusing on reducing noise levels, improving drying efficiency, and offering machines that are easy to install and maintain. These advancements provide a competitive edge to companies in the global market.

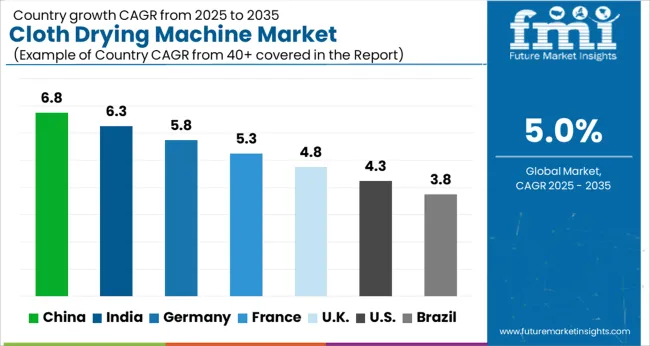

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

Global demand for cloth drying machines is projected to rise at a 5.0% CAGR from 2025 to 2035. Among the five profiled markets, China leads at 6.8%, followed by India at 6.3% and France at 5.3%, while the UK posts 4.8% and the USA records 4.3%. These rates translate to a growth premium of +36% for China, +25% for India, and +8% for France versus the baseline, whereas the UK and the USA trail by –4% and –14%, respectively. The divergence reflects local catalysts: urbanization and disposable income growth in China and India, preference for space-saving appliances in France, and steady demand in mature markets like the UK and USA driven by modern lifestyles and e-commerce. The analysis spans over 40+ countries, with the leading markets shown below.

The cloth drying machine market in China is expected to grow at a CAGR of 6.8% from 2025 to 2035, driven by rapid urbanization and increasing disposable income. The growing demand for home appliances in urban and semi-urban areas, coupled with rising living standards, is boosting the adoption of cloth drying machines. Expanding real estate sector, which includes new residential complexes, is also a key factor driving market growth. As more people shift toward modern and efficient appliances for household tasks, the demand for cloth drying machines, which offer convenience and energy efficiency, continues to rise. Chinese manufacturers are innovating with features like smart controls, eco-friendly technologies, and faster drying times, which appeal to tech-savvy consumers. The increasing trend of working professionals and dual-income households is further driving the need for quick and efficient drying solutions.

The cloth drying machine market in India is projected to expand at a CAGR of 6.3% from 2025 to 2035. The growth is primarily driven by the country’s expanding middle class and rapid urbanization. With the increasing trend of smaller living spaces, consumers are opting for efficient and space-saving appliances like cloth drying machines. As disposable incomes rise, more people are investing in home appliances for convenience, driving the market forward. The demand is also fueled by the growing awareness of energy-efficient solutions and the need for quicker laundry processes. The market is supported by the increasing availability of these machines in both online and offline retail channels, along with the introduction of affordable, high-quality options. Manufacturers are focusing on introducing innovative features, such as moisture sensors and quick-drying capabilities, to meet the evolving needs of consumers.

The cloth drying machine market in France is projected to expand at a CAGR of 5.3% from 2025 to 2035. The demand for cloth drying machines in the country is driven by the increasing focus on convenience and time-saving appliances. As urbanization accelerates and living spaces become smaller, French consumers are increasingly turning to compact, efficient drying solutions for their homes. The French market is also benefiting from a growing demand for energy-efficient and eco-friendly products, with many consumers willing to pay a premium for machines that offer faster drying times and lower energy consumption. As more French households embrace modern appliances, the overall adoption of cloth drying machines is steadily increasing. The market is further supported by the expanding middle class and an increase in dual-income households, which necessitate efficient household solutions.

The UK cloth drying machine market is expected to grow at a CAGR of 4.8% from 2025 to 2035. The increasing trend of compact living spaces and rising urbanization is propelling demand for efficient home appliances like cloth drying machines. As UK households prioritize convenience, the adoption of such appliances is gaining traction. The demand for energy-efficient solutions is growing, with many consumers opting for products that offer faster drying times and lower electricity consumption. With advancements in technology, such as smart controls and improved drying cycles, manufacturers are offering products that cater to the modern consumer's needs. The expansion of the retail and e-commerce sectors in the UK is also helping increase accessibility and awareness of these products.

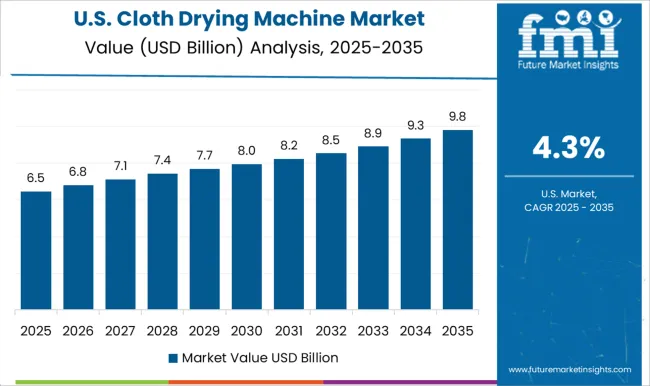

The USA cloth drying machine market is anticipated to rise at a CAGR of 4.3% from 2025 to 2035. The demand for cloth drying machines is driven by changing consumer preferences toward modern, time-saving home appliances. The growing trend of urban living, particularly in metropolitan areas, is pushing the need for more efficient and compact solutions for household tasks. The growing adoption of energy-efficient appliances, especially those offering smart features and faster drying times, is also driving market growth. With increasing disposable income and a growing middle class, USA consumers are willing to invest in high-quality, durable, and advanced machines. The expansion of online retail platforms also plays a crucial role in increasing market penetration.

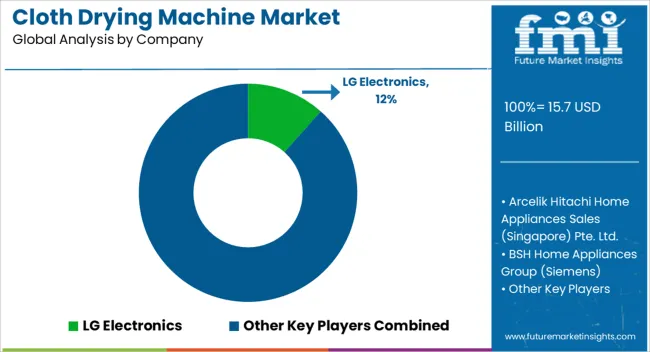

The cloth drying machine market is highly competitive, driven by leading players focusing on technological advancements, energy efficiency, and user convenience. Key competitors include LG Electronics, Arcelik Hitachi Home Appliances Sales (Singapore) Pte. Ltd., BSH Home Appliances Group (Siemens), ELECTROLUX AB, GE Appliances (a Haier company), Godrej Enterprises Group, Havells India Ltd., Maytag, Miele, Panasonic, SAMSUNG, Schulthess Maschinen AG, and Whirlpool. LG Electronics competes with its advanced AI-powered dryers, emphasizing energy savings and smart technology integration. Their product brochures showcase features such as customizable drying cycles, sensor technologies, and Wi-Fi connectivity, appealing to tech-savvy consumers. Arcelik Hitachi and BSH Home Appliances Group target a wide customer base with products that balance affordability and advanced features.

Arcelik’s offerings, marketed through brochures, focus on efficient energy use and compact designs, ideal for urban spaces. BSH Home Appliances (Siemens) highlights its range of dryers with condensation and heat pump technologies. Their brochures focus on innovation in drying quality, energy-saving features, and minimal environmental impact. ELECTROLUX AB places emphasis on reducing drying time while maintaining fabric care, and its brochures highlight features such as EcoFlow and SensiDry technologies. GE Appliances and Godrej Enterprises also offer competitive dryers with advanced moisture-sensing features, targeting a broad consumer market with efficient drying solutions. Havells India Ltd., Maytag, Miele, and Panasonic differentiate with a focus on durability, fabric protection, and high-performance motors.

Maytag’s product brochures highlight its heavy-duty performance for larger households, while Miele emphasizes premium design and superior drying quality for luxury consumers. Panasonic and SAMSUNG market user-friendly, highly efficient machines that appeal to those seeking innovation and reliability in their appliances. Schulthess Maschinen AG, a premium player, focuses on providing high-end drying machines for commercial and industrial use, highlighting efficiency and long-term reliability in their brochures. Whirlpool focuses on smart and energy-efficient dryers, with product brochures showcasing features like 6th Sense technology and Adaptive Drying Systems, emphasizing ease of use and reduced energy consumption. Market competition is largely shaped by features like drying speed, energy efficiency, and added smart features, with product brochures playing a key role in communicating the value proposition.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.7 Billion |

| Type | Electric and Gas |

| Capacity | 8 kg to 15 kg, Upto 8 Kg, and Above 15 kg |

| Technology | Vented and Condensed |

| Price Range | Mid-Range, Economy, and High/Premium |

| End Use | Residential and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LG Electronics, Arcelik Hitachi Home Appliances Sales (Singapore) Pte. Ltd., BSH Home Appliances Group (Siemens), BSH Home Appliances Ltd, ELECTROLUX AB, GE Appliances, a Haier company, Godrej Enterprises Group, Havells India Ltd., Maytag, Miele, Panasonic, SAMSUNG, Schulthess Maschinen AG, and Whirlpool |

| Additional Attributes | Dollar sales by product type (condenser, ventless, heat pump), energy rating (A+++, A++, A+), and drying technology (smart features, steam cycles, moisture sensing). Demand dynamics are influenced by convenience, time-saving technologies, and the growing shift toward smart homes. Regional trends show rapid growth in North America, Europe, and Asia-Pacific, fueled by urbanization, rising disposable incomes, and the increasing adoption of energy-efficient home appliances. |

The global cloth drying machine market is estimated to be valued at USD 15.7 billion in 2025.

The market size for the cloth drying machine market is projected to reach USD 25.5 billion by 2035.

The cloth drying machine market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in cloth drying machine market are electric and gas.

In terms of capacity, 8 kg to 15 kg segment to command 47.8% share in the cloth drying machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloth Cutting Machines Market

Electric Clothes Drying Hanger Market Trends – Growth & Demand 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Clothing Fibers Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Cloth Diaper Market Analysis by Type, Application,Distribution Channel and Region Through 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA