The silos market is expected to expand from USD 2.6 billion in 2025 to USD 4.2 billion in 2035, with a CAGR of 4.8%. The growth contribution index highlights gradual, steady progress, with values rising from 2.6 billion in 2025 to 3.0 billion in 2028 and 3.3 billion by 2030. This incremental growth reflects the growing demand for silos across agriculture, food processing, and industrial storage sectors, where the need for efficient bulk storage and material handling remains constant.

The curve illustrates a balanced, yet continuous adoption. By 2031, the industry value is projected to reach 3.5 billion, advancing to 3.8 billion in 2033 and 4.2 billion in 2035. The growth contribution index underscores the market’s stable nature, driven by ongoing demand for large-scale storage solutions and automation in materials handling. The curve reveals silos as essential infrastructure assets in industries such as agriculture, mining, and chemicals. With consistent performance and minimal volatility, this index confirms silos as integral components of efficient supply chains and long-term operational strategies, solidifying their role in global commodity and resource management.

| Metric | Value |

|---|---|

| Silos Market Estimated Value in (2025 E) | USD 2.6 billion |

| Silos Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The silos segment is estimated to contribute nearly 12% of the storage and warehousing market, about 15% of the agricultural equipment market, close to 10% of the bulk handling equipment market, nearly 9% of the food and beverage processing market, and around 7% of the industrial infrastructure market. Collectively, this equals an aggregated share of approximately 53% across its parent categories. This proportion highlights the essential role silos play in the efficient storage, preservation, and handling of bulk materials such as grains, feed, and industrial products. Their importance is emphasized in industries where storage capacity, material protection, and space optimization directly influence cost efficiency and operational reliability.

Demand has been reinforced by the growing need for organized, long-term storage solutions in global supply chains, where bulk handling and storage systems are pivotal in maintaining consistent production and distribution cycles. Silos have also gained prominence in industrial infrastructure, where they support the safe storage of raw materials for large-scale manufacturing processes. As such, the silos market is regarded as a foundational component within its parent markets, shaping procurement, design, and operational strategies for industries that rely on bulk material management and long-term storage solutions.

The silos market is experiencing steady expansion, supported by the rising demand for efficient bulk storage solutions across agriculture, manufacturing, and industrial sectors. Growth in the current scenario is being driven by the need to store and manage large volumes of materials while minimizing losses and maintaining quality.

Technological enhancements in design, material handling systems, and sealing mechanisms are improving operational efficiency and extending the service life of silos. The future outlook remains positive, with factors such as increasing grain production, expansion of the food processing industry, and the growth of infrastructure projects supporting sustained demand.

Investments in automation and remote monitoring systems are enabling optimized storage operations and reducing maintenance costs. As industries focus on improving supply chain efficiency and meeting stringent storage standards, the adoption of silos with advanced features is expected to increase, ensuring continued market growth across diverse regions.

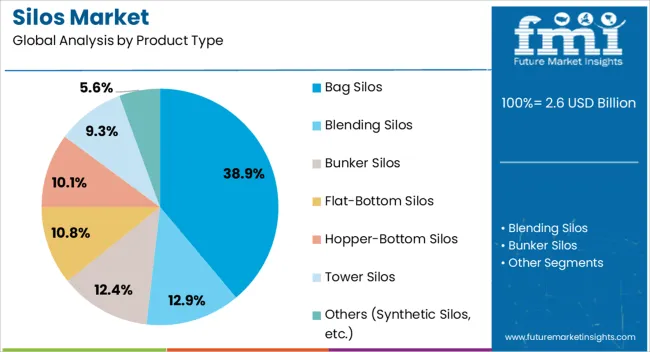

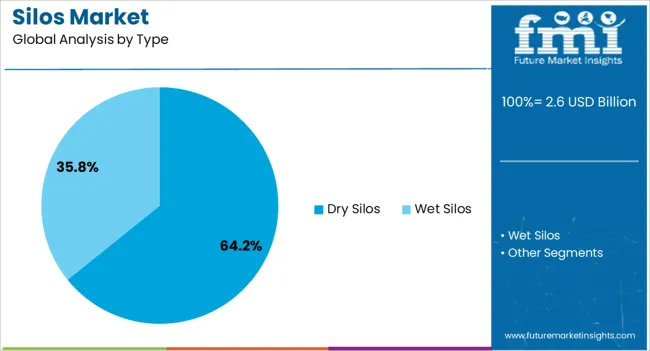

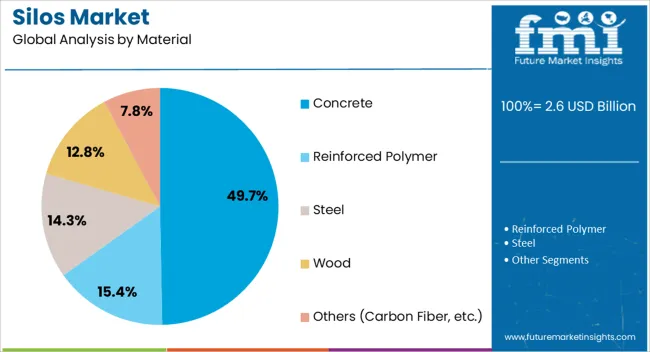

The silos market is segmented by product type, type, material, capacity, installation, application, distribution channel, and geographic regions. By product type, silos market is divided into bag silos, blending silos, bunker silos, flat-bottom silos, hopper-bottom silos, tower silos, and others (Synthetic Silos, etc.). In terms of type, silos market is classified into dry silos and wet silos. Based on material, silos market is segmented into concrete, reinforced polymer, steel, wood, and others (Carbon Fiber, etc.). By capacity, silos market is segmented into 100-500 tons, Below 100 tons, 500-1000 tons, and Above 1000 tons. By installation, silos market is segmented into Fixed and Portable Silos.

By application, silos market is segmented into agriculture, cement industry, chemical industry, food processing, energy sector, pharmaceutical industry, plastic and polymer industry, mining and metals, and others (Paper, Paint and Coatings Industry, etc.). By distribution channel, silos market is segmented into direct sales and indirect sales. Regionally, the silos industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bag silos product type is projected to hold 38.9% of the overall silos market revenue in 2025, making it a leading segment in the market. This position is being driven by its cost-effectiveness, portability, and ease of installation, which make it suitable for both small and large-scale storage needs.

Bag silos require minimal infrastructure and can be deployed quickly in varying environments, enabling flexibility in seasonal and temporary storage applications. The ability to store different types of grains and feed while maintaining quality has contributed to their growing adoption in agriculture.

Lower initial investment compared to permanent silo structures and reduced operational complexity have further reinforced their market appeal. As farmers and storage operators seek solutions that offer scalability and adaptability without heavy capital expenditure, the demand for bag silos is expected to continue its upward trajectory.

The dry silos type is expected to account for 64.2% of the silos market revenue in 2025, emerging as the dominant type segment. This dominance is being attributed to their suitability for storing a wide range of dry bulk materials, including grains, cement, and minerals, under controlled conditions.

Dry silos are favored for their ability to protect stored goods from moisture and contamination, ensuring long-term preservation of quality. The growing need for efficient bulk material handling in agriculture, construction, and manufacturing has fueled their adoption.

Additionally, advances in loading and unloading mechanisms, along with integration of automated monitoring systems, have improved operational efficiency. Their high capacity and durability make them a preferred choice for large-scale operations, and the ongoing modernization of storage facilities is expected to strengthen the position of dry silos in the market.

The concrete material segment is anticipated to hold 49.7% of the silos market revenue in 2025, securing its place as a key material choice. This leading share is being supported by the inherent strength, durability, and longevity offered by concrete in storage construction.

Concrete silos are capable of withstanding extreme environmental conditions and heavy structural loads, making them suitable for long-term, high-capacity storage. Their resistance to corrosion and minimal maintenance requirements have further increased their adoption in both agricultural and industrial settings.

The ability to design custom dimensions and integrate advanced material handling systems has also contributed to their preference. As end-users focus on reliable and sustainable infrastructure for bulk storage, concrete silos are expected to remain a favored option, particularly in regions with high agricultural output and large-scale industrial activities.

The silos market is expected to expand steadily, driven by rising demand for efficient bulk storage in agriculture, food processing, and industrial applications. Demand is reinforced by the need for secure storage solutions for grains, feed, and chemicals. Opportunities are emerging in emerging markets, expansion of food supply chains, and the adoption of smart silo systems. Trends highlight modular designs, corrosion-resistant materials, and integration with digital monitoring platforms. However, challenges such as high capital costs, maintenance complexity, and fluctuating raw material prices continue to affect market growth.

Demand for silos has been reinforced by their essential role in agriculture and food processing, where they provide secure and efficient storage for grains, feed, and seeds. As global food production increases, the need for bulk storage solutions that prevent spoilage and ensure quality has risen significantly. Demand is particularly strong in regions with expanding agricultural industries and food supply chains. The ability of silos to preserve food products and reduce wastage has further boosted adoption, especially as supply chain efficiency becomes a priority. As demand for long-term food storage capacity rises, silos are increasingly seen as crucial assets in agriculture, ensuring a stable and consistent food supply.

Opportunities in the silos market are being driven by the integration of smart silo systems, automation, and remote monitoring technologies. Automation in grain and feed management systems has created demand for silos with integrated sensors and digital platforms that provide real-time data on inventory, temperature, and humidity levels. These smart systems enhance operational efficiency and minimize manual intervention, providing a clear competitive edge. Emerging markets in Asia and Africa, where agricultural production and storage infrastructure are expanding rapidly, represent significant growth opportunities for silo manufacturers. These factors highlight how silo systems are evolving from basic storage solutions into sophisticated, automated, and data-driven assets in modern agricultural practices.

Trends in the silos market focus on improved materials, modular designs, and customized storage solutions. The demand for corrosion-resistant materials, such as galvanized steel and stainless steel, is trending as manufacturers prioritize durability and longer service life. Modular designs, which allow for easy expansion and reconfiguration, are gaining traction in both agricultural and industrial sectors. Customization options, such as climate-controlled silos for specialized products, are increasingly being integrated to meet the unique storage needs of various industries. The growing adoption of silos in non-agricultural sectors like chemicals and construction is further driving demand for these tailored solutions. These trends indicate a shift towards more flexible, efficient, and specialized silo designs to accommodate a broader range of storage needs.

Challenges in the silos market stem from high initial costs, maintenance complexity, and fluctuating raw material prices. The capital required for building and installing large-scale silos, particularly those equipped with advanced technologies, remains a significant barrier for smaller players in the market. Maintenance costs can be high, particularly when dealing with older systems that require frequent repairs or upgrades. Supply chain disruptions and price volatility in materials like steel, cement, and aluminum further add to financial pressures for manufacturers. Regulatory compliance and safety standards can also be burdensome, especially in industries dealing with volatile substances like chemicals. These challenges highlight that while demand for silos remains robust, economic barriers and ongoing maintenance will need to be addressed for broader adoption.

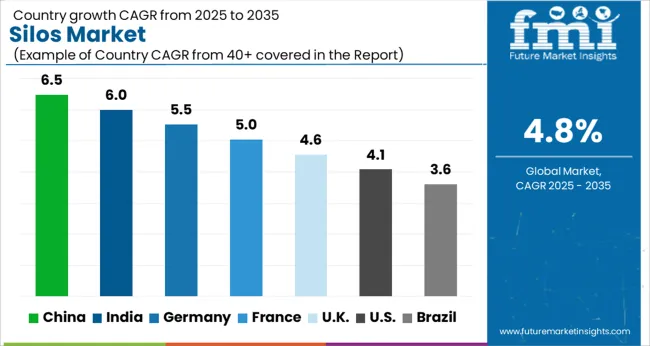

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

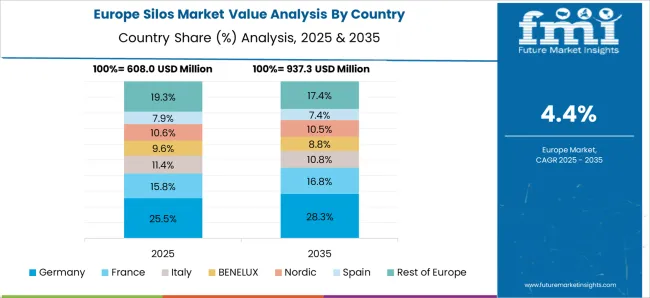

The global silos market is projected to expand at a CAGR of 4.8% from 2025 to 2035. China leads with 6.5%, followed by India at 6.0% and Germany at 5.5%. The United Kingdom is forecast to grow at 4.6%, while the United States records 4.1%. Growth is driven by rising demand for grain storage, industrial applications, and capacity expansion in agriculture and food processing industries. Asian markets show faster adoption due to large scale agricultural production and industrial development, while Europe emphasizes high quality, weather-resistant materials and regulatory compliance. The USA shows moderate growth, supported by increasing demand in the food and beverage sector, infrastructure projects, and rural electrification initiatives. This report includes insights on 40+ countries; the top markets are shown here for reference.

The silos market in China is projected to grow at a CAGR of 6.5%. Expansion is driven by the country’s large scale agricultural output, rising demand for grain storage solutions, and the increasing mechanization of farming practices. China’s food processing industry continues to modernize, requiring more efficient storage solutions. Government investments in agricultural infrastructure, combined with rising demand for industrial silos, ensure steady growth. China’s strong manufacturing base and competitive pricing position it as a leader in both domestic consumption and global exports of silo systems. Additionally, demand from animal feed production and biofuel industries reinforces the market’s positive outlook.

The silos market in India is forecast to grow at a CAGR of 6.0%. Growth is supported by the country’s agricultural modernization, increasing grain storage needs, and government initiatives for agricultural infrastructure. India’s expanding food processing industry further drives demand, as well as the rise of large scale farming operations. Silos are increasingly being adopted by large commercial farms, agro-processing units, and government storage schemes. Domestic manufacturers focus on providing affordable, durable, and weather resistant silo systems to meet diverse market needs. With strong government backing and growing industrial demand, India emerges as one of the fastest growing markets for silos in Asia.

The silos market in Germany is projected to expand at a CAGR of 5.5%. Growth is driven by demand from the agricultural sector, industrial food production, and the bioenergy industry. German manufacturers emphasize high quality, durable silo solutions that comply with EU safety and environmental regulations. As Germany transitions to more sustainable agricultural practices, demand for energy-efficient and weather-resistant storage solutions increases. Additionally, the rise of mechanized farming and large-scale food processing operations in Germany sustains the demand for both small and large silos, ensuring steady growth in the market.

The silos market in the UK is forecast to grow at a CAGR of 4.6%. Demand is largely driven by the agricultural sector, with an emphasis on improving grain storage efficiency, especially in light of changing weather patterns and crop production requirements. Industrial silos are also in demand for food processing plants, and larger scale agricultural facilities are gradually adopting more advanced storage solutions. Import reliance shapes the UK’s supply chain for silo systems, with European and Asian suppliers fulfilling a significant portion of demand. Though growth is moderate, steady demand from both the agriculture and industrial sectors ensures long-term market stability.

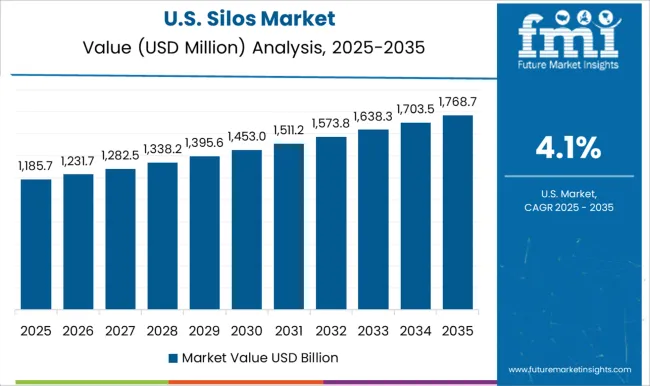

The silos market in the US is expected to expand at a CAGR of 4.1%. Growth is steady, influenced by the maturity of the agriculture sector and increasing demand for efficient grain storage systems. With the rise of mechanized farming and large-scale agribusinesses, the demand for high-quality silo systems remains strong. USA manufacturers emphasize durable, long-lasting materials and compliance with local safety standards. Additionally, demand from renewable energy producers, particularly biofuels, is helping to sustain growth in silo installations. While growth is slower compared to Asia, the USA market remains significant due to its robust agricultural infrastructure and consistent demand from commercial farms and food processors.

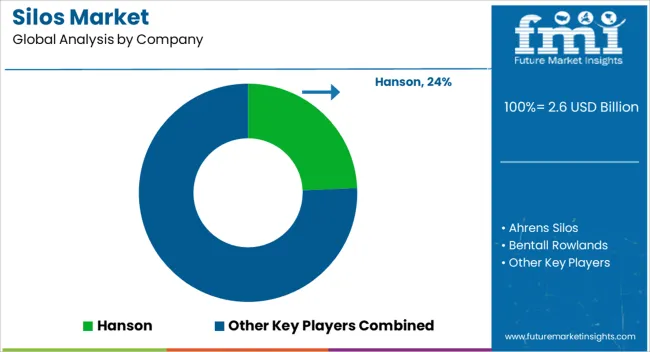

The global silos market is highly competitive, driven by the growing demand for efficient storage solutions in agriculture, food processing, cement, and bulk material industries. Market competition is shaped by product quality, storage capacity, material type (steel, concrete, or corrugated), pricing, and after-sales services. Key players focus on technological innovation, modular design, and corrosion-resistant materials to differentiate their offerings and meet diverse client requirements.

Hanson dominates the market, leveraging extensive distribution networks and long-term contracts with agricultural cooperatives, industrial processors, and government agencies. Regional manufacturers compete by offering customized solutions at competitive prices, addressing specific climate and storage challenges. Strategic partnerships, mergers, and acquisitions are commonly used to expand geographic reach and enhance production capabilities. The market is moderately consolidated, with top players focusing on automation, IoT-enabled monitoring, and integrated material handling systems to strengthen market share. Emerging players are gaining traction through specialized, cost-effective, and environmentally friendly storage solutions, creating a dynamic and evolving competitive landscape that prioritizes efficiency, reliability, and scalability.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 billion |

| Product Type | Bag Silos, Blending Silos, Bunker Silos, Flat-Bottom Silos, Hopper-Bottom Silos, Tower Silos, and Others (Synthetic Silos, etc.) |

| Type | Dry Silos and Wet Silos |

| Material | Concrete, Reinforced Polymer, Steel, Wood, and Others (Carbon Fiber, etc.) |

| Capacity | 100-500 tons, Below 100 tons, 500-1000 tons, and Above 1000 tons |

| Installation | Fixed and Portable Silos |

| Application | Agriculture, Cement Industry, Chemical Industry, Food Processing, Energy Sector, Pharmaceutical Industry, Plastic and Polymer Industry, Mining and Metals, and Others (Paper, Paint and Coatings Industry, etc.) |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hanson, Ahrens Silos, Bentall Rowlands, CST Industries, G.E. Silos, Kotzur, Nelsons, P+W Metallbau, Rowlands Woodhouse, SCUTTI, Silo Warehouse, Silos Córdoba, Sioux Steel, Superior Grain Equipment, Symaga, TSC, and Zibo Boda |

| Additional Attributes | Dollar sales by silo type (steel, concrete, fiberglass), Dollar sales by application (grain storage, cement, chemicals, food processing), Trends in automated monitoring and temperature control systems, Role in improving storage efficiency and minimizing spoilage, Growth driven by agricultural and industrial expansion, Regional demand across North America, Europe, Asia Pacific. |

The global silos market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the silos market is projected to reach USD 4.2 billion by 2035.

The silos market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in silos market are bag silos, blending silos, bunker silos, flat-bottom silos, hopper-bottom silos, tower silos and others (synthetic silos, etc.).

In terms of type, dry silos segment to command 64.2% share in the silos market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Silos Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA