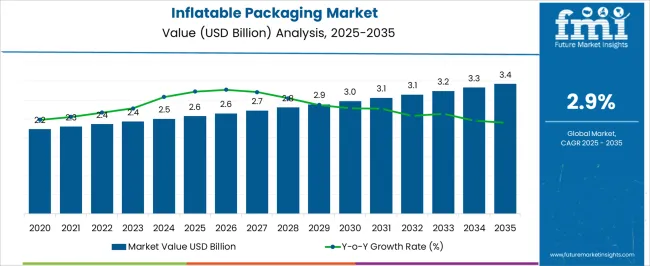

The Inflatable Packaging Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period.

The Inflatable Packaging market is experiencing steady growth driven by increasing demand for protective, lightweight, and cost-effective packaging solutions across various industries. The market outlook is shaped by the rising need to reduce product damage during storage and transit, coupled with growing e-commerce penetration and logistics activities. Advancements in material technology have enhanced the durability and flexibility of inflatable packaging, allowing for better cushioning and reduced packaging waste.

Sustainability trends and regulatory pressure to minimize environmental impact are also supporting the adoption of recyclable and reusable packaging solutions. The market is further propelled by the expansion of industries such as personal care, cosmetics, electronics, and consumer goods, where product protection and presentation are critical.

The increasing emphasis on operational efficiency, supply chain optimization, and customer satisfaction has driven businesses to adopt innovative packaging solutions that ensure safety while lowering transportation costs As global trade and online retail continue to expand, inflatable packaging is anticipated to remain a key choice for companies seeking reliable and adaptable protective packaging solutions.

| Metric | Value |

|---|---|

| Inflatable Packaging Market Estimated Value in (2025 E) | USD 2.6 billion |

| Inflatable Packaging Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

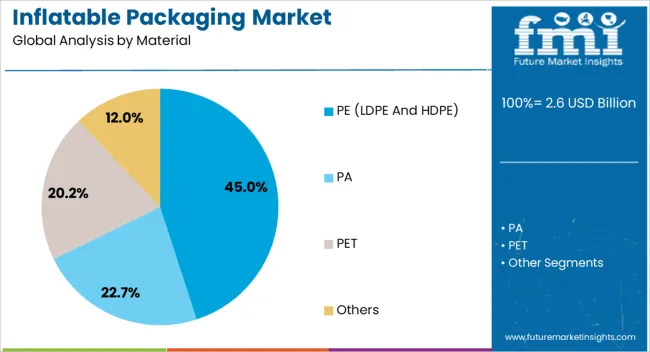

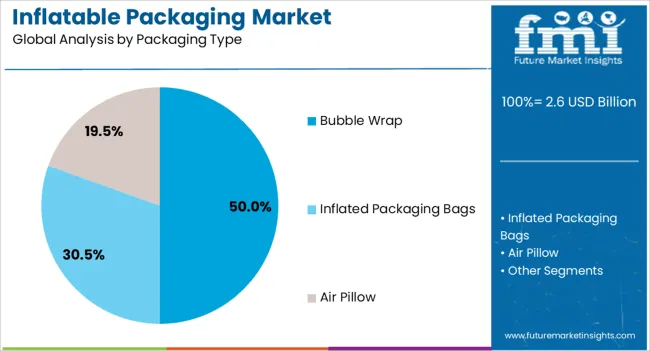

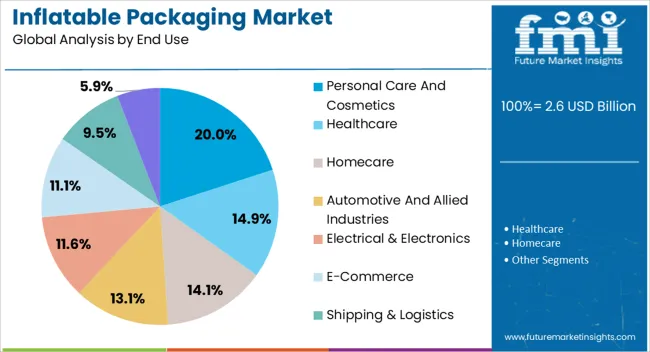

The market is segmented by Material, Packaging Type, and End Use and region. By Material, the market is divided into PE (LDPE And HDPE), PA, PET, and Others. In terms of Packaging Type, the market is classified into Bubble Wrap, Inflated Packaging Bags, and Air Pillow. Based on End Use, the market is segmented into Personal Care And Cosmetics, Healthcare, Homecare, Automotive And Allied Industries, Electrical & Electronics, E-Commerce, Shipping & Logistics, and Food & Beverages. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PE (LDPE and HDPE) material segment is projected to hold 45.00% of the Inflatable Packaging market revenue share in 2025, establishing it as the leading material type. This growth is driven by the inherent strength, flexibility, and lightweight characteristics of polyethylene, which provide superior protection for fragile products. The material’s versatility allows it to be easily molded into various packaging formats, enhancing its adoption across multiple industries.

Moreover, PE-based packaging is cost-effective and compatible with recycling initiatives, making it an environmentally favorable choice. The segment has benefited from increasing consumer awareness regarding product safety and packaging sustainability, reinforcing its prominence in the market.

Continuous improvements in manufacturing processes have also enabled higher production efficiency and consistency, further boosting its usage in packaging solutions The strong combination of durability, affordability, and adaptability has made PE the preferred material for inflatable packaging applications.

The bubble wrap packaging type segment is expected to capture 50.00% of the Inflatable Packaging market revenue share in 2025, positioning it as the leading packaging type. The growth of this segment has been driven by its superior cushioning properties and ability to protect fragile and high-value products during transit. Bubble wrap allows for secure packaging of irregularly shaped items, minimizing damage and returns, which is critical for logistics and e-commerce sectors.

Its ease of use and compatibility with various materials and products have further strengthened adoption. Moreover, advancements in bubble wrap technology have improved durability, reducing material consumption while maintaining protection efficiency.

The segment has been further supported by growing awareness of sustainable packaging practices and the ability to reuse bubble wrap, which aligns with environmental considerations The combined benefits of product protection, operational efficiency, and environmental friendliness have solidified bubble wrap as a dominant packaging type.

The personal care and cosmetics end-use segment is anticipated to account for 20.00% of the Inflatable Packaging market revenue in 2025, making it the leading industry segment. The segment’s growth is influenced by the high value and fragility of cosmetic and personal care products, which require reliable protective packaging. Inflatable packaging ensures that these products are delivered without damage, preserving brand reputation and customer satisfaction.

The sector has benefited from rising global demand for personal care and beauty products, driven by changing lifestyles, urbanization, and increased disposable income. Moreover, the need for aesthetically appealing and functional packaging has encouraged adoption of innovative inflatable solutions that enhance product presentation.

Integration with e-commerce and direct-to-consumer channels has also accelerated the use of inflatable packaging in this segment, as secure and lightweight packaging reduces shipping costs and minimizes product returns The combination of product protection, consumer appeal, and operational efficiency has made the personal care and cosmetics segment a key driver of market growth.

Sustainability Trends Gain More Traction in the Industry

Consumers are becoming more conscious about environmental sustainability. Packaging companies are tilting to paper and other materials to address these shifts. Solutions like Storopack’s PAPERbubble, a paper-based packaging alternative to prefilled air bubble film, have already made waves in the industry.

Businesses are keen on getting their sustainability licenses and complying with regulations. Inflatable packaging manufacturers are investing in research and development to introduce sustainable solutions. The focus on minimizing carbon emissions during transportation is beneficial for the industry in the long run.

Developing Solutions for Temperature-sensitive Products can be Opportunistic

The demand for pharmaceuticals and gourmet foods is rising. This rise is creating a need for packaging that can keep them at the right temperature during shipping. Inflatable packaging can become a popular choice because it can protect these items from temperature changes and shocks.

Developing inflatable packaging solutions that even have special materials inside to control temperatures better can be a unique selling proposition. This can help keep products safe and effective. With industries relying more on these sensitive products, the demand for packaging that can control temperature is likely to go up.

Focus on Reduced Packaging Waste is Beneficial for the Industry

Abundance of single-use packaging is causing big problems with trash all around the world. Consumer preferences in protective packaging are increasing. Inflatable packaging is one answer because it can be used again and again or recycled when it's not needed anymore. Unlike foam or bubble wrap, which usually gets thrown away after one use, this packaging can be reused many times.

This helps cut down on how much packaging waste we make. When companies use this packaging, it shows they care about the environment and want to make smart choices. This makes people who care about the environment content and reverses industrial waste impact too.

The inflatable packaging industry generated considerable revenues between 2020 and 2025. In 2020, the industry size stood at USD 2.6 billion, and in 2025, it was USD 2.4 billion. Developments in material science and manufacturing technologies have led to innovations in functionality and packaging designs.

New materials with improved strength and durability are helping the industry thrive. Emerging technologies and innovations in inflatable packaging are leading to more efficiency and smooth operations. Cost-effective solutions are emerging as businesses seek to reduce their packaging costs. Also, sustainability concerns are leading to more product adoption.

The ongoing boom in e-commerce is likely to benefit the industry in the long run. As the shift from offline to online ascends, the demand for inflatable packaging is bound to rise. A CAGR of 2.9% has been expected for 2025 to 2035. The convenience and accessibility to various products online is predicted to benefit manufacturers and suppliers of inflatable packaging.

Expansion into niche domains like sports equipment, disaster relief, and others can be opportunistic. Partnerships and collaborations can lead to more opportunities. Businesses can enter new markets and develop new products with an expanded knowledge base.

This section covers the future forecast of the inflatable packaging industry in top three countries. Information on regions like North America, Europe, Asia Pacific, and others is granulated, focusing on the top countries.

India is anticipated to be at the forefront with a CAGR of 6.3% through 2035. China and Thailand follow next, at CAGR of 4.7% and 4.2%, respectively, indicating immense growth in the Asia Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| India | 6.3% |

| China | 4.7% |

| Thailand | 4.2% |

The demand for inflatable packaging in India is set to amplify at a 6.3% CAGR until 2035. The rise of online grocery shopping through brands like BlinkIt, Big Basket, Amazon Delivery, and others means more need of packaging solutions. Fruits, vegetables, and dairy products are being shipped using this packaging type. Also, online pharmacies are thriving in the country.

As such, the demand for packaging medicine and medical equipment is rising in the country. Even in rural areas and smaller towns, this packaging is being preferred for delivering various products, as eCommerce proliferates.

The government is also helping by encouraging domestic production. These macroeconomic forces collectively signify a promising growth trajectory for the industry in India.

The inflatable packaging market revenues in China are estimated to rise at a 4.7% CAGR until 2035. China, with platforms like Alibaba and JD, augment demand for robust packaging solutions. Being lightweight and customizable, inflatable packaging demand is high in China.

The quick growth of fresh food delivery services is elevating the need for this packaging type. Also, the popularity of platforms like Douyin and Taobao Live can create more demand. Live video broadcasts and unboxing experiences can draw attraction through promotions. With sustainability being a priority in Chinese packaging sector, manufacturers can benefit by using recyclable materials and reducing waste.

The sales of inflatable packaging in Thailand will amplify at a 4.2% CAGR till 2035. Thailand's booming tourism industry drives the need for this packaging type to protect fragile souvenirs, enhancing the tourism experience. Simultaneously, the expansion of the food delivery sector augments demand to keep the freshness intact of delivered items.

Embracing sustainability, Thailand promotes eco-friendly tourism with inflatable packaging, aligning with environmental goals. Moreover, the rise of urban farming necessitates this type of packaging for transporting fresh produce, supporting agricultural innovation.

This section takes a closer look at the market segmentation of inflatable packaging. The research highlights that Polyethylene (PE) is the leading material. The segment holds 52.3% of shares in 2025. Under the packaging type, the bubble wrap segment leads with 80.1% of shares in 2025.

| Segment | PE (Material) |

|---|---|

| Value Share (2025) | 52.3% |

the PE material segment captured the leading inflatable packaging market shares in 2025. Polyethylene (PE) leads as the top material choice due to its versatility, cushioning prowess, and cost-effectiveness. Its flexibility enables custom-made protection for various products.

Moreover, its lightweight nature trims shipping costs and emissions while simplifying handling and storage. PE's resistance to moisture and chemicals ensures product integrity, suitable for diverse items. These factors increase the adoption of PE in inflatable packaging.

| Segment | Bubble Wrap (Packaging Type) |

|---|---|

| Value Share (2025) | 80.1% |

The bubble wrap packaging type segment holds the leading inflatable packaging market share in 2025. Bubble wrap is popular for its adaptability and cushioning. It is a cost-effective option that is reusable and recyclable too.

The air-filled bubbles protect fragile items like electronics and others during transportation. It is lightweight which means lower shipping costs and improved operation efficiency. It is an option for various industries, indicative of its high shares in the industry.

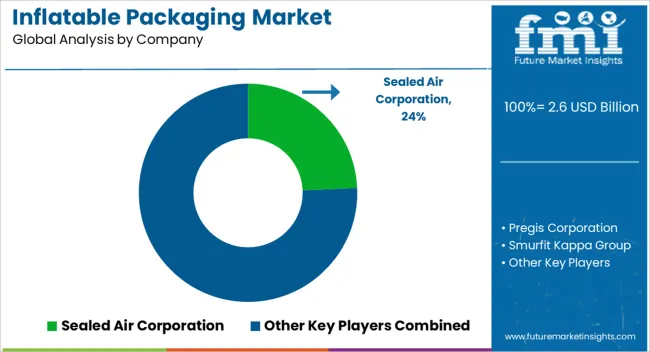

In the inflatable packaging market, significant competitors such as SEE (formerly Sealed Air Corporation), Pregis LLC, and Storopack Hans Reichenecker GmbH contend fiercely. These businesses compete for supremacy by ongoing innovation, collaborations, and international growth.

Product innovation fosters competitiveness, with an emphasis on environmentally friendly materials and smart technology integration. Strategic collaborations with material suppliers and distribution partners enable businesses to expand their reach and provide greater value to their consumers. Geographical expansion into high-growth regions enhances their position.

Recent Developments

The market fragments into PE (LDPE and HDPE), PA, PET, and Others.

The industry trifurcates into Bubble Wrap, Inflated Packaging Bags, and Air Pillow.

The sector is segmented into Personal Care and Cosmetics, Healthcare, Homecare, Automotive and Alllied Industries, Electrical & Electronics, E-commerce, Shipping & Logistics, and Food & Beverages.

Analysis of the market has been conducted in the countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA).

The global inflatable packaging market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the inflatable packaging market is projected to reach USD 3.4 billion by 2035.

The inflatable packaging market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in inflatable packaging market are pe (ldpe and hdpe), pa, pet and others.

In terms of packaging type, bubble wrap segment to command 50.0% share in the inflatable packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inflatable Bags Packaging Market Size, Share & Forecast 2025 to 2035

Inflatable Tent Market Size and Share Forecast Outlook 2025 to 2035

Inflatable Pouches Market

Inflatable Pet Collars Market

Inflatable Void Fill System Market

Foldable Inflatable Boats Market Size and Share Forecast Outlook 2025 to 2035

Portable & Inflatable Swimming Pool Market Trends - Growth & Demand to 2025 to 2035

Automotive Inflatable Seat Belt Market

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA