The inflatable tent market is experiencing consistent growth, driven by rising demand for portable, lightweight, and quick-setup shelter solutions across recreational, military, and emergency use scenarios. Product developments highlighted in trade publications and corporate press releases have focused on the integration of high-strength materials, modular structures, and automated inflation systems.

Consumer interest in outdoor activities such as camping, glamping, and festivals has increased significantly, supported by trends in wellness travel and nature-based tourism. Additionally, government agencies and defense forces have expanded procurement of inflatable shelters due to their rapid deployability and structural resilience in challenging environments.

Manufacturers have responded with innovations in air beam technology and UV-resistant coatings to enhance durability and performance. The market outlook remains positive, with future growth supported by advancements in smart tent features, increased product visibility through e-commerce, and expanding demand in disaster relief operations. Segmental momentum is expected to be led by PVC as the primary material, self-erecting tents for their setup convenience, and dome-shaped designs that offer optimal wind resistance and space utilization.

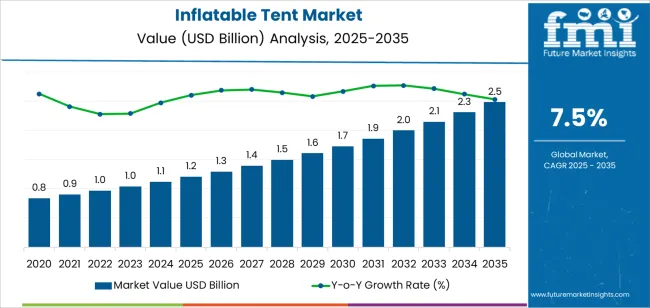

| Metric | Value |

|---|---|

| Inflatable Tent Market Estimated Value in (2025 E) | USD 1.2 billion |

| Inflatable Tent Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The market is segmented by Material Type, Tent Type, Shape, and End Use and region. By Material Type, the market is divided into PVC, Poly-cotton, and Nylon. In terms of Tent Type, the market is classified into Self-erecting and Hybrid. Based on Shape, the market is segmented into Dome Shape, Tunnel Shape, and Geodesic Shape. By End Use, the market is divided into Military, Commercial, and Personal. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

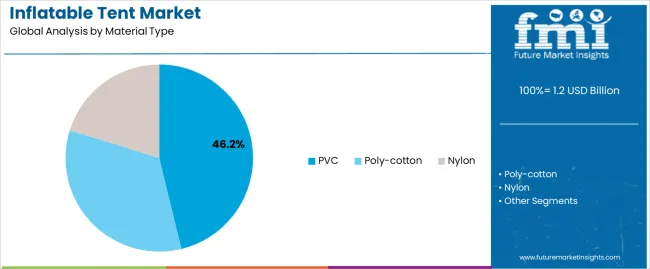

The PVC segment is projected to hold 46.2% of the inflatable tent market revenue in 2025, positioning it as the leading material type. Growth of this segment has been driven by PVC’s favorable performance characteristics, including waterproofing, UV resistance, flame retardancy, and durability under varying climatic conditions.

Manufacturers have widely adopted PVC for its ability to retain structural integrity over repeated inflation-deflation cycles and ease of maintenance in rugged use cases. Industry updates have pointed to PVC’s compatibility with heat-sealing processes, which enhances seam strength and reduces leakage risks.

Additionally, cost-efficiency and ready availability have made PVC the preferred choice for large-scale production, especially in defense, disaster response, and commercial applications. As sustainability initiatives grow, the segment is also witnessing innovation in eco-friendlier PVC formulations. With its balance of performance, affordability, and production scalability, the PVC segment is expected to remain the top material category in the inflatable tent market.

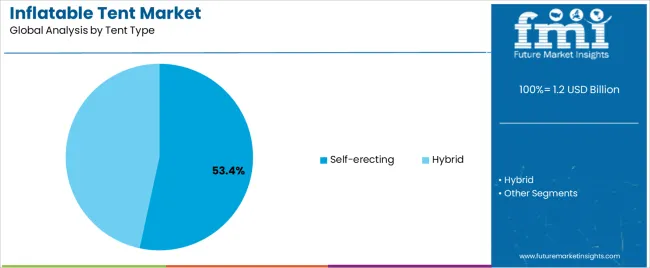

The Self-erecting segment is projected to contribute 53.4% of the inflatable tent market revenue in 2025, emerging as the leading tent type. Growth in this segment has been driven by strong consumer and institutional preference for tents that require minimal setup time and technical skill.

Self-erecting tents have gained traction due to their integrated air beam support systems that eliminate the need for traditional poles, enabling rapid deployment in field conditions. Camping and outdoor recreation product reviews have frequently cited the convenience and time savings offered by this tent type, particularly in adverse weather or emergency scenarios.

Military and relief organizations have also favored self-erecting tents for their tactical advantages in temporary field operations. Additionally, commercial rental companies have adopted these tents for events and exhibitions due to ease of transport and reusability. As automation in outdoor gear continues to advance, the Self-erecting segment is expected to maintain its leadership through product reliability and user-friendly innovation.

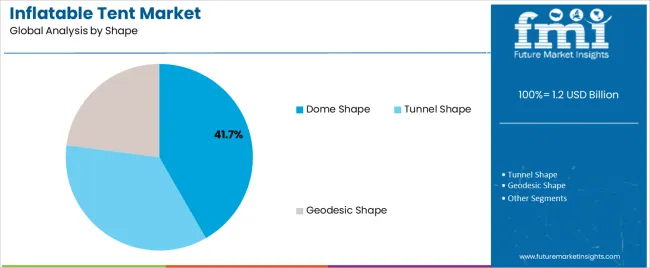

The Dome Shape segment is expected to capture 41.7% of the inflatable tent market revenue in 2025, maintaining its position as the most preferred structural design. The popularity of dome-shaped tents has been supported by their aerodynamic architecture, which offers superior stability in windy environments and efficient internal space distribution.

Outdoor gear specialists and architectural design publications have highlighted the dome shape’s ability to evenly distribute stress across the tent surface, reducing structural fatigue and extending product life. This design is particularly well-suited for varied terrains, making it a go-to choice among recreational campers, mountaineers, and rescue teams.

Dome-shaped tents are also easier to set up and pack down, enhancing their appeal for temporary installations in both civilian and institutional settings. As users seek shelters that combine compactness, strength, and spatial efficiency, the Dome Shape segment is projected to retain its stronghold in the inflatable tent market.

The table below showcases the estimated CAGR for the global inflatable tent sector over semi-annual periods collectively spanning from 2025 to 2035. In the first half (H1) of the decade, ranging from 2025 to 2035, the sector is projected to experience an upsurge at a CAGR of 6.8%, followed by a moderately higher growth rate of 7.6% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 6.8% (2025 to 2035) |

| H2 | 7.6% (2025 to 2035) |

| H1 | 7.3% (2025 to 2035) |

| H2 | 7.9% (2025 to 2035) |

Entering into the next period, the first half (H1) of 2025 to 2035 is expected to have a minor decline at a CAGR of 7.3%. The industry will then see robust growth in the second half (H2) with a CAGR of 7.9%.

Impact of Social Media and Travel Influencers on Inflatable Tent Popularity

The inflatable tent market’s future outlook suggests that social media platforms have a good impact on the industry. These are ideal for showcasing the visually appealing aspects of travel and camping setups to capture the attention of the audience.

Informative posts and videos enable influencers and brands to educate new viewers about the benefits of air tube tents compared to traditional tents.

Social media can assist in creating online communities around these tents where users can share their experiences, tips, and recommendations for tent models and camping destinations.

It also provides a platform for manufacturers and retailers to reach a wide audience and build brand awareness. Partnering with influencers and creating eye-catching visuals can help increase brand recognition.

Travel influencers can showcase airframe tents on unique adventures, thereby providing detailed, authentic, and relatable perspectives and reviews. This can act as valuable information for potential buyers. Micro-influencers with small but highly engaged followers might become more impactful in promoting these niche products.

Role of Ecotourism and Rise of Glamping in Driving Demand for Inflatable Tents

Ecotourism and glamping have been the driving forces behind the increased demand for air-camping tents. Ecotourism emphasizes responsible travel that minimizes environmental impact.

These tents align with these values. For instance, the tents leave a less physical footprint on campsites, and fast setup and takedown time minimize disruption to the natural environment.

The tents are also easily portable and thereby assist usage in various locations, reducing the requirement for extensive infrastructure development in pristine areas.

The growing popularity of ecotourism and glamping has surged demand for comfortable yet stylish lodging options that have a low impact on nature. This trend has opened doors for manufacturers to develop eco-friendly materials, production processes, and glamping-specific tents.

Government Regulations on Outdoor Camping and Temporary Structures in National Parks or Campsites

Air-camping tents made of durable and recyclable materials are seen as a sustainable option. Certain parks and campsites have weight and size restrictions on tents. Inflatable tents come in various sizes, are lighter in weight, and can be easily packed.

A few campsites have restrictions on occupancy. These tents have easy setup and takedown, thereby becoming attractive to campers who are required to meet these constraints. These perfectly meet the government regulations and park or campsite rules, making these a great choice for campers.

The global inflatable tent market size and growth rate rose at a CAGR of 4.6% during the historical period 2020 to 2025. The total industry size is estimated to reach USD 2.5 million by the end of 2035.

The sector experienced a steady growth rate from 2020 to 2025. This growth was attributed to increased applications of novel tents in the military sector.

The growing popularity of camping and adventure tourism, post-COVID-19 augmented further expansion. The use of these tents in disaster relief shelters, sports facilities, and events also surged during this period.

North America and Europe were the dominant regions for inflatable tents owing to the presence of a robust camping culture. The sector is predicted to rise in the assessment period of 2025 to 2035 with a CAGR of 7.5%.

High disposable income levels and consumer spending on outdoor recreation activities are the primary factors expected to boost demand in the sector. This leads to an increase in individuals who will have the budget for camping equipment and outdoor recreation. Rising popularity of glamping is anticipated to augment demand.

Technological advancements in tent materials and designs are projected to make these appealing to consumers. Innovations coupled with sustainability are set to make for a solid selling point compared to traditional tents. Asia Pacific is estimated to emerge as the dominant region, with India leading with an estimated CAGR of 11.2% during the forecast period.

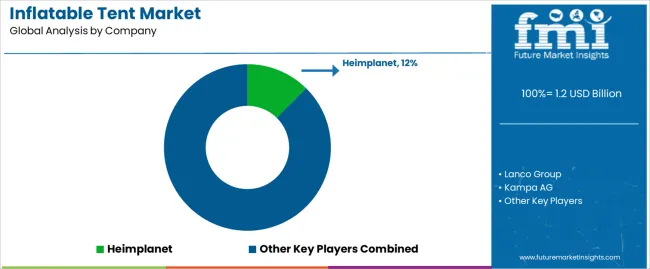

Tier 1 companies incorporate key players having a revenue of above USD 100 million. Those that capture a value share of 22% come under the Tier 1 category. These leaders stand out for having a wide geographic reach, high production capacity, and an extensive product portfolio.

The companies offer an abundance of services such as recycling, reconditioning, and manufacturing while employing cutting-edge technology and adhering to government regulations. Esteemed industry players in Tier 1 include Lanco Group, Kampa AG, Oase Outdoors ApS (Outwell), AMG Group Ltd, Zempire Camping Equipment, and Heimplanet.

Tier 2 companies comprise mid-size players with a share of 48%. These companies are based in specific regions and have a significant impact on the local market. These are distinguished by an influential international presence and have robust industry knowledge.

The companies ensure compliance with regulations and adoption of good technology for the manufacturing process. The leading companies in Tier 2 are Exxel Outdoors, LLC (Kelty), Sports Direct International (Gelert), Skandika GmbH, Sunncamp Limited, Losberger GmbH, and Coleman Company, Inc.

Tier 3 primarily consists of small-scale businesses with a share of 30%. These companies operate locally and cater to specific industries. These are oriented toward fulfilling niche sector demands. These companies also have a limited geographical reach.

Hence, competitive landscape and inflatable tent market share distribution are relatively less between these companies.

Tier 3 is characterized by a lack of formalization and extensive structure compared to organized competitors coming under Tier 1 and Tier 2 categories. Companies that come in Tier 3 include Unirub Techno, Panda Air, RBM Outdoors, and Icon.

The below section illustrates the predictions for the leading countries. The section aims to evaluate the drivers, restraints, and trends impacting the global sector. The information will likely help companies understand the inflatable tent market investment considerations and risks.

India is set to emerge as the leading country in the inflatable tent industry. It is estimated to experience high growth at a CAGR of 11.2% during the assessment period of 2025 to 2035. China is closely following with a CAGR of 8.4%. The dominance of India and China in the industry makes Asia Pacific a leading region.

| Countries | CAGR 2025 to 2035 |

|---|---|

| Canada | 4.6% |

| Italy | 4.9% |

| Spain | 5.6% |

| China | 8.4% |

| India | 11.2% |

India has a strong potential in the inflatable tent sector. The growing middle-class population of the country is more likely to invest in leisure activities such as camping, thereby fueling demand for these tents. The glamping trend is gaining popularity in India, and pump-up tents cater well to this trend.

The country is also seeing a rise in the adventure tourism sector. These tents are suitable for outdoor activities like mountain climbing and trekking. India has a diverse climate that offers opportunities for year-round travel, creating a sustained demand for these tents.

A significant portion of the Indian population may be a little price-sensitive, and hence, domestic manufacturers might prioritize affordability over premium features.

Fluctuations in raw material prices (PVC and nylon) affecting the production costs of inflatable tents are also key factors that manufacturers will be required to monitor, especially in India. The country has a growing base of tent manufacturers who are set to cater to domestic requirements and reduce the reliance on imports.

A confluence of factors makes inflatable tents suitable for various leisure and professional applications in Italy.

The country has a well-established tourism industry that is progressively embracing the glamping trend. Glamping offers luxurious camping experiences in scenic locations, and these tents provide a comfortable and stylish alternative to traditional tents for tourists.

The country’s campsites cater to families and outdoor enthusiasts. The tents are often appealing for these campers as these are quick to set up and provide comfort and weather protection.

Italy hosts numerous outdoor events, festivals, and trade shows year-round. Hence, these tents serve as temporary shelters, promotional booths, or exhibition spaces. Italy's diverse climate makes these tents a great option.

One of the key factors driving inflatable tent market growth in Canada is that these cater to the country’s unique climate, outdoor culture, and evolving leisure preferences.

Canadians have a well-established camping culture. Individuals in the country enjoy outdoor activities all year round, making inflatable tents ideal for specific needs. The fast setup feature is beneficial during the winter season when time spent outdoors is limited.

Modern tents are made with durable materials that are suitable for harsh winter conditions, thereby extending the camping season. These tents offer great insulation and weather protection compared to basic tents.

The section below provides an analysis of the leading segments in the inflatable tent sector. The section contains details regarding the anticipated growth rates of the respective divisions through the forecast period, thereby helping businesses identify the dominating sectors in the industry and invest accordingly.

Based on material type, PVC is leading the sector with a value share of 98.4% in 2025. By type, the self-erecting tents segment is dominating, with a value share of 65.4% in 2025.

| Segment | PVC (Material Type) |

|---|---|

| Value Share (2025) | 98.4% |

PVC material is dominating the inflatable tent market with a value share of 98.4% in 2025. PVC can withstand harsh weather conditions owing to sturdy construction. The reinforced inflatable beams provide stability and protection against rain, wind, and other environmental factors.

The tents can be quickly inflated and deflated, making these highly convenient for users. PVC is naturally waterproof, which is an essential aspect for tents as the interiors need to be dry to protect users from rain or moisture.

PVCs are relatively affordable compared to other alternatives, making these a cost-competitive choice for manufacturers and consumers. High versatility enables usage in various scenarios, including military, commercial, and camping. PVC tents are easy to clean and maintain, and hence, several manufacturers use fire retardant PVC to meet safety standards.

| Segment | Self-erecting Tents (Type) |

|---|---|

| Value Share (2025) | 65.4% |

Based on type, self-erecting tents are leading the industry with a value share of 65.4% in 2025. This growth is primarily attributed to ease of setup and take down, making this ideal for people seeking hassle-free camping experiences.

The tents are easily portable as these can be deflected for compact storage. Several self-erecting tents are nowadays being made from lightweight materials.

Self-erecting tents come in various sizes and configurations, thereby catering to different needs. Tents designed with inflatable beams often provide good structural stability, especially in windy conditions. The popularity of adventurous activities is further increasing the demand for self-erecting tents.

Key industry players, including Lanco Group, Kampa AG, and AMG Group Ltd, are constantly improving and innovating to attract customers. These players are competing with one another by incorporating various features in existing tent portfolios.

A few of the features include pre-attached awnings for shade, a built-in lighting system for nighttime use, mesh walls for ventilation, and docking ports for connecting multiple tents.

Manufacturers are capitalizing on unique selling points, such as making tents using lightweight materials (nylon or TPU) and eco-friendly alternatives (PVC). By marketing new products to the targeted demographic, brands establish a reputation by emphasizing features like the quality and durability of tents.

Several companies also offer extended warranties on existing products along with after-sales service. This helps improve brand image and maintain brand loyalty.

Merger and acquisition activities in the inflatable tent industry are helping companies expand product portfolios, improve product quality, develop novel technologies, and compete in the global industry.

Technological advancements in the industry are paving the way for a flourishing market. For instance, improvements in mechanisms or integration of self-inflation mechanisms with portable power sources enable a quick setup.

Offering long-term sustainability of inflatable tents and potential end-of-life solutions would help brands attract environmentally conscious consumers while adhering to government and environmental regulations.

Industry Updates

Based on material type, the industry is divided into PVC, polycotton, and nylon.

Based on type, the sector is segmented into hybrid and self-erecting.

Based on shape, the industry is divided into dome, tunnel, and geodesic.

By end-use, the sector is divided into military, commercial, and personal.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

The global inflatable tent market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the inflatable tent market is projected to reach USD 2.5 billion by 2035.

The inflatable tent market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in inflatable tent market are pvc, poly-cotton and nylon.

In terms of tent type, self-erecting segment to command 53.4% share in the inflatable tent market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inflatable Packaging Market Forecast and Outlook 2025 to 2035

Inflatable Bags Packaging Market Size, Share & Forecast 2025 to 2035

Inflatable Pouches Market

Inflatable Pet Collars Market

Inflatable Void Fill System Market

Foldable Inflatable Boats Market Size and Share Forecast Outlook 2025 to 2035

Portable & Inflatable Swimming Pool Market Trends - Growth & Demand to 2025 to 2035

Automotive Inflatable Seat Belt Market

Stent Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Stent Graft Balloon Catheter Market Insights - Growth & Forecast 2025 to 2035

Potentiometric Titrators Market Size and Share Forecast Outlook 2025 to 2035

Intent-Based Networking IBN Market Size and Share Forecast Outlook 2025 to 2035

Potentiometer Market Growth – Trends & Forecast 2025-2035

Patent Analytics Market Trends – Growth & Industry Outlook 2024-2034

Patent Management Software Market

Content Analytics Discovery And Cognitive Systems Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Content Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Content Distribution Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA