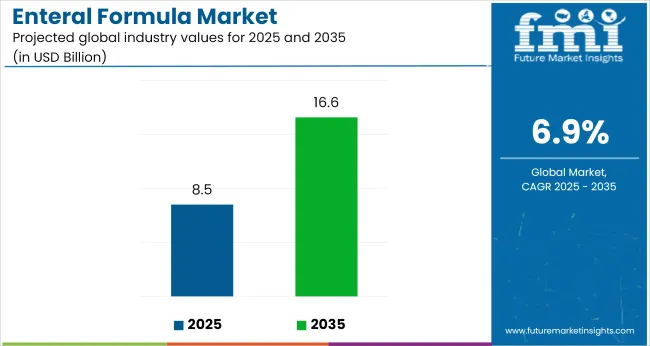

The global enteral formula market is valued at USD 8.5 billion in 2025 and is slated to reach USD 16.7 billion by 2035, which shows a CAGR of 6.9%. This growth is driven by the rising prevalence of chronic diseases such as cancer, diabetes, and gastrointestinal disorders, along with the growing elderly population requiring nutritional support.

| Metric | Value |

|---|---|

| Market Size 2025 | USD 8.5 billion |

| Market Size 2035 | USD 16.7 billion |

| CAGR (2025 to 2035) | 6.9% |

Additionally, technological advancements in delivery systems and increasing home healthcare trends are contributing significantly to market expansion globally.

The market will witness strong growth in Japan with the highest CAGR of 7.5%, driven by its aging population and advanced feeding technologies. The USA will follow with a CAGR of 7.2% due to strong healthcare infrastructure, chronic disease prevalence, and insurance coverage.

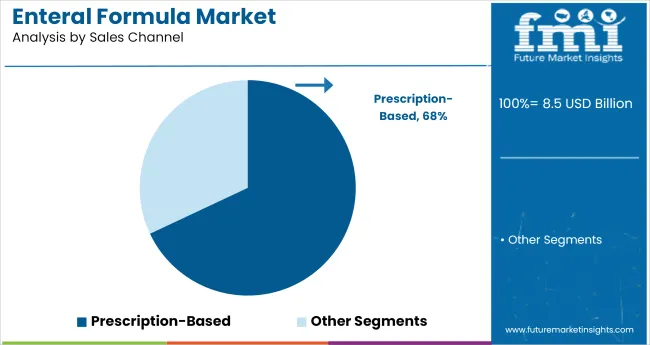

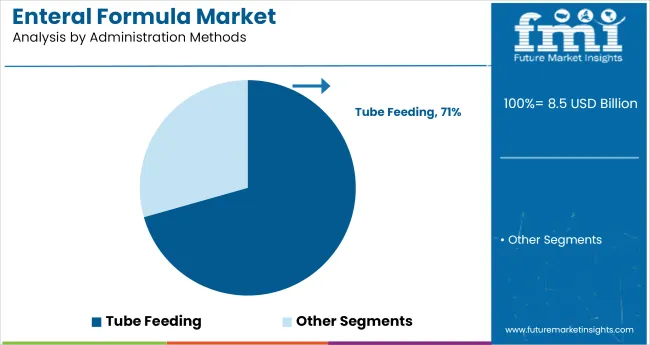

Germany will grow at 6.8% owing to rising clinical nutrition awareness and hospital admissions. Tube feeding is projected to dominate the administration method segment with a 70.6% share, while prescription-based sales will lead the sales channel with a 68% market share in 2025.

The enteral formula market holds a significant share within its parent markets. It accounts for approximately 35-40% of the clinical nutrition market, as enteral feeding is a primary method for delivering clinical nutrition to patients who cannot consume food orally.

Within the medical nutrition market, it holds around a 30-35% share, driven by its use in hospitals and home healthcare. In the food supplement and nutrition market, its share is relatively smaller at 10-12%, as this market includes broader supplements.

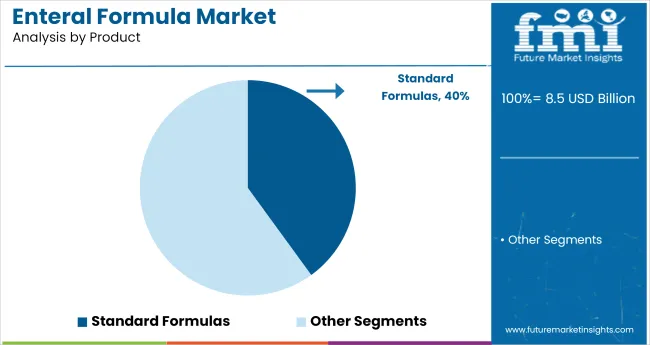

The market segments include product, health claim, product format, sales channel, administration methods, feeding type, and region. The product segment covers standard formulas, elemental formulas, blenderized formulas (with real food ingredients), specialized formulas, high-protein formulas, fiber-enriched formulas, caloric-dense formulas, and peptide formulas (semi-elemental formulas).

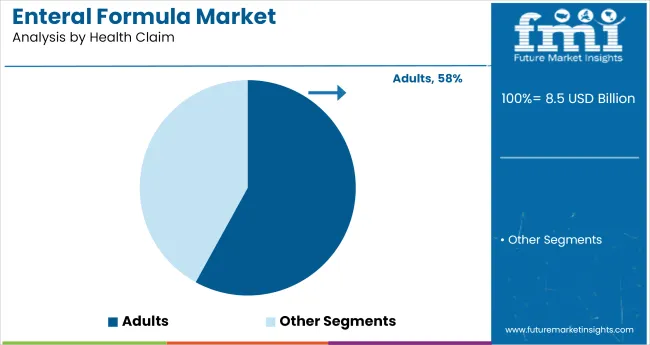

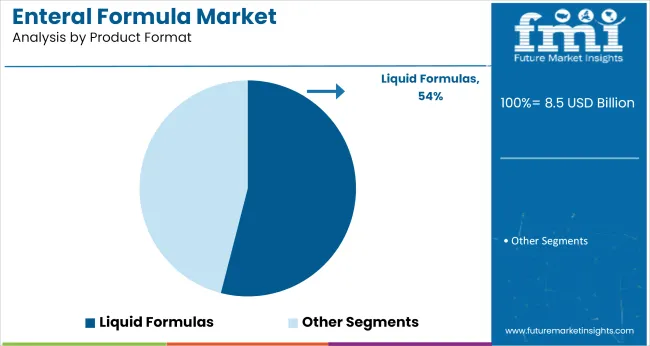

The health claim segment includes adults, kids, and geriatric individuals. The product format segment comprises liquid formulas, powder formulas, semi-solid formulas, and ready-to-use formulas. The sales channel segment consists of prescription-based, over-the-counter, and online pharmacies.

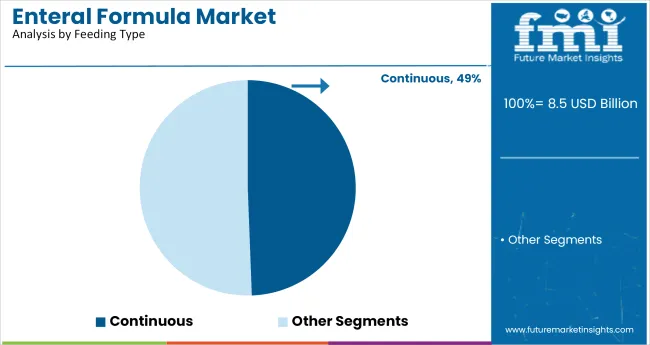

The administration methods segment includes tube feeding and oral administration. The feeding type segment covers continuous, intermittent, and bolus. The regional segment includes North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA.

The most lucrative segment under the product category is standard formulas, holding an estimated market share of approximately 40%.

The most lucrative segment under the health claim category is adults, holding an estimated market share of 58% in 2025.

The most lucrative segment under the product format category is liquid formulas, holding an estimated market share of 54% in 2025.

The most lucrative segment under the sales channel category is prescription-based sales, holding an estimated market share of 68% in 2025.

The most lucrative segment under the administration methods category in the enteral formula market is tube feeding, holding an exact market share of 70.6%.

The most lucrative segment under the feeding type category in the enteral formula market is continuous feeding, holding an exact market share of 49.4% in 2025.

The global market is growing steadily, driven by the rising prevalence of chronic diseases, increasing demand for clinical nutrition solutions, and advancements in specialized formulations and innovative delivery systems across hospital, home healthcare, and long-term care settings.

Recent Trends in the Enteral Formula Market

Challenges in the Enteral Formula Market

Japan is projected to witness the highest growth with a CAGR of 7.5%, driven by its aging population and technological advancements. The USA follows closely with a CAGR of 7.2%, supported by a strong healthcare infrastructure and leading market players.

Germany records a steady CAGR of 6.8%, while France shows slightly lower growth at 6.6%, driven by elderly care programs. The United Kingdom registers the slowest among these at 6.5%, although it maintains strong demand due to hospital nutrition programs and rising chronic disease prevalence.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA enteral formula market is projected to grow at a CAGR of 7.2% through 2035.

Sales of enteral formulas in the UK are projected to grow at a CAGR of 6.5% during 2025 to 2035.

Germany’s enteral formula market is projected to grow at a CAGR of 6.8% over the forecast period.

Sales of enteral formulas in France are expected to grow at a CAGR of 6.6% during 2025 to 2035.

The enteral formula revenue in Japan is anticipated to grow at a CAGR of 7.5% through 2035.

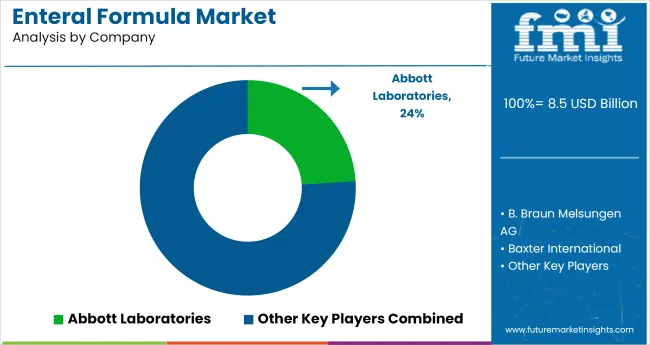

The market is relatively consolidated, with top-tier players such as Abbott Laboratories, Nestlé Health Science, Danone (Nutricia), Fresenius Kabi, and Baxter International dominating global shares. These companies maintain leadership through extensive product portfolios, advanced R&D, strong distribution networks, and established brand reputations.

Top companies are competing through continuous product innovation, development of disease-specific formulas, strategic acquisitions, and expansion into emerging markets to capture increasing demand for clinical nutrition. For instance, Abbott Laboratories focuses on developing specialized nutrition solutions under its Ensure brand, while Danone enhances its medical nutrition portfolio through targeted acquisitions.

Recent Enteral Formula Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 8.5 billion |

| Projected Market Size (2035) | USD 16.7 billion |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion /Volume in Units |

| By Product | Standard Formulas, Elemental Formulas, Blenderized Formulas, Specialized Formulas, High-Protein Formulas, Fiber -Enriched Formulas, Caloric-Dense Formulas, Peptide Formulas |

| By Health Claim | Adults, Kids, Geriatric |

| By Product Format | Liquid Formulas, Powder Formulas, Semi-Solid Formulas, Ready To Use Formulas |

| By Sales Channel | Prescription-Based, Over-the-Counter, Online Pharmacies |

| By Administration Methods | Tube Feeding and Oral Administration |

| By Feeding Type | Continuous, Intermittent, Bolus |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Abbott Laboratories, B. Braun Melsungen AG, Baxter International, Danone (Nutricia), EN Otsuka Pharmaceutical Co., Ltd., Fresenius Kabi AG, Herbalife Nutrition Ltd., Mead Johnson Nutrition (Reckitt Benckiser), Medtrition, Inc., Meiji Holdings Co., Ltd., Nestle SA, Pediatric Nutrition Company (PediaSure), Victus, Inc., Vonco Products, LLC., and WHOLE Enteral Nourishment |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per product type, the industry has been categorized into Standard Formulas, Elemental Formulas, Blenderized Formulas (with Real Food Ingredients), Specialized Formulas, High-Protein Formulas, Fiber-Enriched Formulas, Caloric-Dense Formulas, and Peptide Formulas (Semi-Elemental Formulas).

As per health claims, the industry has been categorized into Adults [Chronic Obstructive Pulmonary Disease (COPD), Cancer, Stroke, Diabetes, Malnutrition, Gastroparesis, Renal Failure, Multiple Sclerosis (MS), Traumatic Brain Injury (TBI), and Heart Failure], Kids [Failure to Thrive, Food Allergies or Intolerances, Cystic Fibrosis, Neurological Disorders, Gastroesophageal Reflux Disease (GERD), Short Bowel Syndrome, Anorexia or Eating Disorders, Inborn Errors of Metabolism, Pediatric Cancer, and Severe Infections], and Geriatric [Dysphagia, Malnutrition, Parkinsons Disease, Alzheimers Disease/Dementia, Post-Surgical Recovery, Chronic Kidney Disease, Heart Failure, Cancer, Chronic Pain Conditions, and Diabetes].

This segment is further categorized into Liquid Formulas, Powder Formulas, Semi-Solid Formulas, and Ready to Use Formulas.

As per sales channel, the industry has been categorized into Prescription (Dietician/Nutritionists, and Hospitals (Private Public) Clinics), Over-the-Counter (Modern Trade, Hospital Pharmacies, Retail Pharmacies, and Drug Stores), and Online Pharmacies.

This segment is further categorized into Tube Feeding (Nasogastric Tube, Gastrostomy Tube, Jejunostomy Tube, and Percutaneous Endoscopic Gastrostomy), and Oral Administration.

This segment is further categorized into Continuous, Intermittent, and Bolus.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East Africa.

The market size is USD 8.5 billion in 2025.

It is projected to reach USD 16.7 billion by 2035.

The market is expected to grow at a CAGR of 6.9%.

Standard formulas lead the market with a 40% share.

Japan is poised to grow at the highest CAGR of 7.5% during 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Parenteral Formula Market Analysis by Type of Nutrient, Indications and Sale Channels Through 2035

Enteral Feeding Devices Market – Growth, Demand & Forecast 2025 to 2035

Enteral Nutrition Market Analysis by Product Type, Feeding Route, By Consumer’s Age and End Users Through 2035

Enteral Stents Market

Parenteral Packaging Market Size and Share Forecast Outlook 2025 to 2035

Parenteral Compounding Market Analysis - Share, Size, and Forecast 2025 to 2035

Market Share Breakdown of Parenteral Packaging Industry

Parenteral Nutrition Market – Demand, Innovations & Industry Trends

Parenteral Drugs Packaging Market

Children Enteral Nutrition Market Size and Share Forecast Outlook 2025 to 2035

Self-administered Parenteral Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Preformulation intermediates Market Size and Share Forecast Outlook 2025 to 2035

AI-Formulated Custom Serums Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Infant Formula DHA Algae Oil Market Size and Share Forecast Outlook 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Ingredients Market Analysis - Size, Share & Forecast 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA