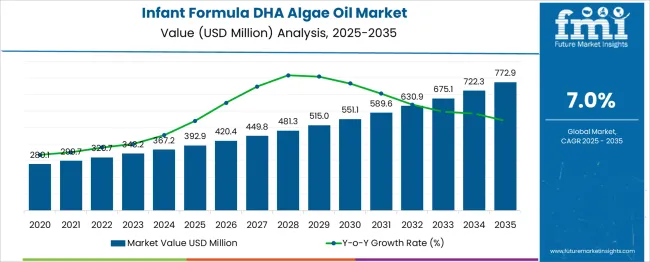

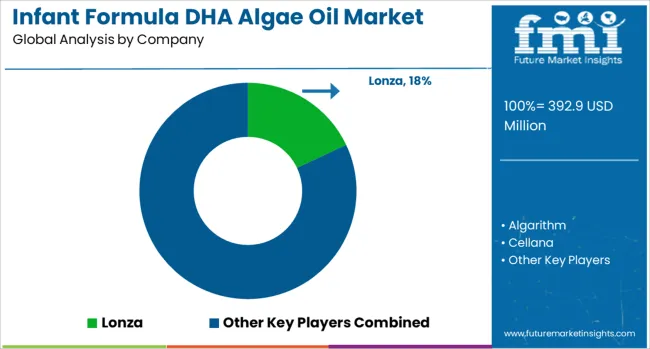

The Infant Formula DHA Algae Oil Market is estimated to be valued at USD 392.9 million in 2025 and is projected to reach USD 772.9 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. Between 2025 and 2030, the market grows from USD 392.9 million to USD 551.1 million, contributing USD 158.2 million in growth, with a CAGR of 7.0%.

This early-stage growth is driven by increasing awareness of the benefits of DHA (docosahexaenoic acid) for infant brain development, along with a growing preference for algae-based oils as a sustainable and plant-derived source of DHA. Rising global demand for infant formula, particularly in emerging markets, fuels the adoption of DHA algae oil as an essential ingredient.

From 2030 to 2035, the market continues its upward trajectory, expanding from USD 551.1 million to USD 772.9 million, contributing USD 221.8 million in growth, with a slightly higher CAGR of 7.3%. Advancements in algae oil extraction technologies, increased regulatory approvals, and the growing adoption of plant-based ingredients in infant nutrition products drive this later-phase acceleration.

The overall USD 380 million absolute dollar opportunity highlights strong market potential driven by both expanding demand and innovations in DHA algae oil, underscoring its growing importance in infant formula products worldwide.

| Metric | Value |

|---|---|

| Infant Formula DHA Algae Oil Market Estimated Value in (2025 E) | USD 392.9 million |

| Infant Formula DHA Algae Oil Market Forecast Value in (2035 F) | USD 772.9 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The Infant Formula DHA Algae Oil market is witnessing consistent growth, supported by increasing awareness of the nutritional benefits of DHA for infant brain and vision development. The current market scenario reflects growing demand for plant-based and sustainable DHA sources, as highlighted in corporate press releases and nutritional science journals. Rising birth rates in emerging economies, coupled with advancements in food fortification technologies, have been contributing to the adoption of DHA algae oil in infant nutrition products.

Regulatory approvals and endorsements of algae-derived DHA as a safe and effective ingredient have further reinforced its acceptance in the infant formula sector. The future outlook remains positive as manufacturers focus on enhancing bioavailability, improving production efficiency, and meeting clean label requirements.

Consumer preference for vegetarian and allergen-free alternatives to fish oil continues to create new growth opportunities. These factors are collectively strengthening the market’s position and paving the way for continued expansion across global markets.

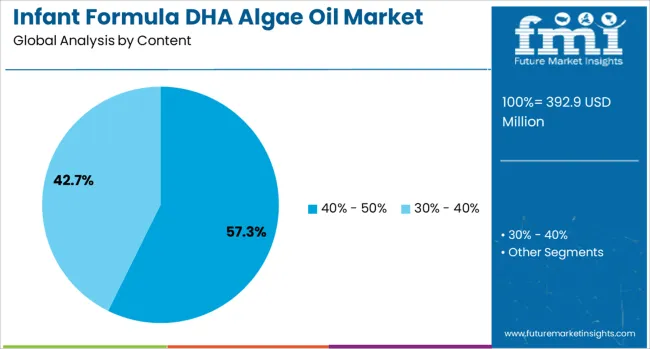

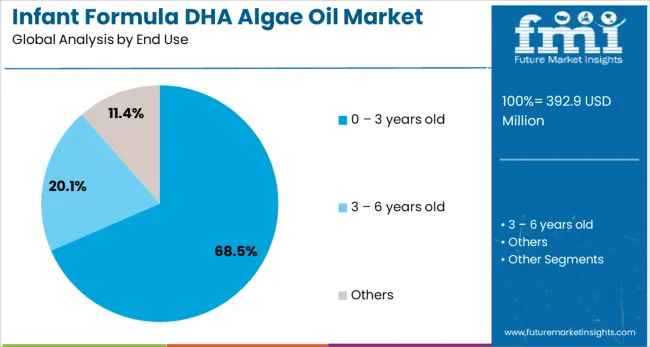

The infant formula DHA algae oil market is segmented by content, end use, and geographic regions. By content of the infant formula, the DHA algae oil market is divided into 40% - 50% and 30% - 40%. In terms of end use of the infant formula DHA algae oil market, it is classified into 0 - 3 years old, 3 - 6 years old, and Others.

Regionally, the infant formula DHA algae oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 40% - 50% content segment is projected to account for 57.3% of the Infant Formula DHA Algae Oil market revenue share in 2025, making it the leading content segment. This dominance has been driven by its optimal balance of concentration and stability, ensuring sufficient DHA delivery without compromising formulation integrity.

As noted in technical specifications and supplier announcements, this content range provides manufacturers with flexibility to meet regulatory and nutritional requirements while maintaining cost-effectiveness. Food science journals have reported that oils in this concentration range exhibit superior oxidative stability, improving shelf life and sensory qualities of the final infant formula product.

The segment’s strong position has also been supported by its compatibility with diverse processing methods and its ability to blend seamlessly into powdered and liquid formulations. These advantages have reinforced its widespread adoption by infant formula producers aiming to meet growing consumer expectations for quality and efficacy.

The 0 - 3 years old end use segment is anticipated to hold 68.5% of the Infant Formula DHA Algae Oil market revenue share in 2025, establishing it as the leading end use segment. This leadership has been shaped by the critical role of DHA in supporting brain and vision development during the early years of life, as highlighted in clinical studies and pediatric nutrition guidelines.

Press releases and health authority recommendations have emphasized the importance of adequate DHA intake during infancy and toddlerhood, which has significantly influenced parental purchasing decisions. The segment’s prominence has also been reinforced by the high consumption of infant formula products within this age group, particularly in regions where breastfeeding rates are lower or supplementation is recommended.

Furthermore, advancements in microencapsulation and delivery technologies have enhanced the incorporation of DHA algae oil in products tailored specifically for this demographic. These factors have collectively ensured the sustained dominance of the 0 - 3 years old segment in the overall market.

The demand for DHA algae oil in infant formula is rising due to its proven health benefits, particularly in supporting brain development and eye health in infants. Algae oil, as a plant-based source of DHA, provides an alternative to fish-derived oils, making it a preferred option for vegan and environmentally-conscious consumers. The market is driven by the growing focus on the health and nutrition of infants, as well as the increasing adoption of plant-based ingredients in baby food. Challenges related to high production costs and regulatory hurdles remain, but opportunities lie in innovations to make DHA algae oil more affordable and accessible

The primary driver of the infant formula DHA algae oil market is the increasing awareness of the importance of DHA for infant brain and eye development. DHA, a type of omega-3 fatty acid, is crucial for the development of the nervous system in infants. As parents become more aware of the benefits of DHA-enriched formula, the demand for products that contain DHA algae oil is growing. Additionally, as the preference for plant-based and sustainable ingredients rises, algae oil is seen as a viable alternative to traditional fish oils, aligning with consumer preferences for environmentally friendly and vegan options. These factors are driving the market for DHA algae oil in infant formulas.

A significant challenge in the DHA algae oil market is the high production cost, which is generally higher compared to traditional fish oils. The cultivation of algae and extraction of DHA requires specialized technology and facilities, making it more expensive to produce. This can result in higher prices for infant formulas that contain DHA algae oil, limiting accessibility for some consumers. Strict regulatory requirements for baby food and formula products, including DHA content verification and safety standards, can delay market entry and increase costs for manufacturers. These challenges may hinder broader adoption of DHA algae oil in the market, especially in cost-sensitive regions.

The infant formula DHA algae oil market presents significant opportunities driven by ongoing technological innovations in algae cultivation and DHA extraction methods. Advances in algae farming and processing technologies are making DHA algae oil more affordable, improving its price competitiveness with fish oil-based alternatives. The growing trend toward plant-based ingredients in the food industry is creating a favorable environment for the expansion of DHA algae oil in infant formula. As more consumers seek plant-based, eco-friendly, and allergen-free options for their babies, the market for DHA algae oil is expected to grow, especially in regions with high demand for vegan and environmentally-conscious baby food products.

A key trend in the infant formula DHA algae oil market is the increasing integration of plant-based DHA into baby food products. With the rise in vegan and vegetarian lifestyles, along with a growing focus on sustainable sourcing, parents are opting for infant formulas that contain plant-derived DHA. Algae oil, as a plant-based source, provides a suitable alternative to fish oils, offering the same nutritional benefits while addressing concerns over sustainability and allergies. As the demand for plant-based baby products continues to rise, the adoption of DHA algae oil in infant formula is expected to increase, further shaping the future of the market.

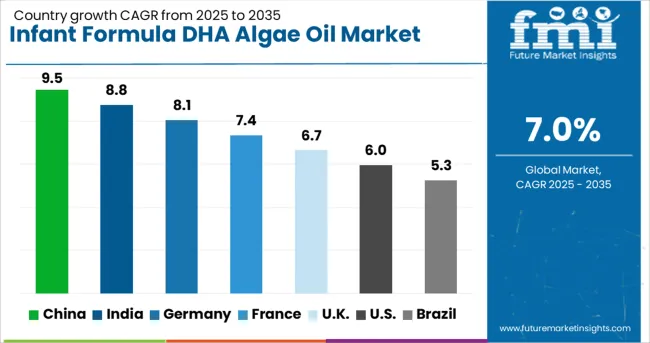

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

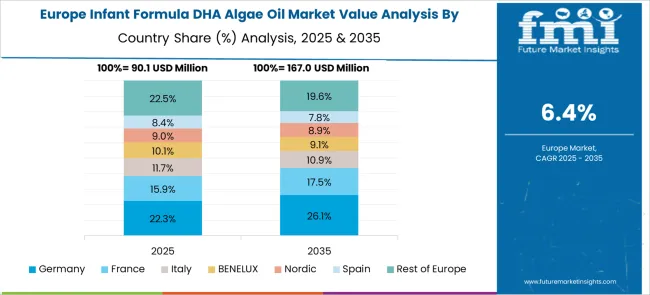

The infant formula DHA algae oil market is witnessing steady growth globally, with a global CAGR of 7.0%. China leads the market at a growth rate of 9.5%, followed by India at 8.8%. Germany experiences steady growth at 8.1%, while the UK and USA show growth rates of 6.7% and 6.0%, respectively. The increasing awareness of DHA’s importance in infant development, particularly for brain and eye function, is a key factor fueling market growth across OECD countries and BRICS nations. The demand for plant-based alternatives, particularly algae oil, is also rising due to concerns over fish-derived DHA's environmental impact. As more parents and healthcare professionals advocate for DHA-enriched infant formulas, the market for DHA algae oil continues to expand. The analysis includes over 40+ countries, with the leading markets detailed below.

China leads the infant formula DHA algae oil market with a growth rate of 9.5%. The demand for DHA-enriched formulas is driven by the country’s booming population and increasing awareness of the importance of early nutrition for infant brain and eye development. The rapid urbanization in China has led to an increase in disposable incomes, allowing parents to invest in higher-quality products for their children. Furthermore, the government’s initiatives to improve food safety and nutrition standards further fuel the market. As the number of working mothers rises, the demand for convenient, nutrient-rich baby formulas has surged, making DHA algae oil a preferred choice for many families.

The infant formula DHA algae oil market in India is projected to grow at a CAGR of 8.8%. With the rise of awareness regarding the importance of DHA for infant brain and eye development, more Indian parents are turning to DHA-enriched formulas. The urbanization and changing lifestyle trends, particularly in metropolitan areas, are driving this shift. As incomes rise, parents are increasingly opting for premium baby food products, including DHA-based formulas. The expansion of the online retail market in India makes DHA algae oil-based products more accessible. With stringent regulations on food safety and growing healthcare awareness, the demand for DHA algae oil is set to continue its upward trajectory.

Demand for infant formula DHA algae oil in Germany is expanding at a CAGR of 6.6%. The market growth is driven by a rising preference for high-quality, scientifically backed infant nutrition. Parents in Germany are becoming more aware of the nutritional needs of their children and the importance of DHA for cognitive and visual development. The demand for DHA-enriched infant formulas is increasing due to the German public’s growing interest in child health and wellness. As more families are choosing organic and premium baby food products, the use of DHA algae oil is rising. Strict regulatory standards for food safety and quality in Germany further ensure that DHA-enriched formulas meet high nutritional and safety benchmarks.

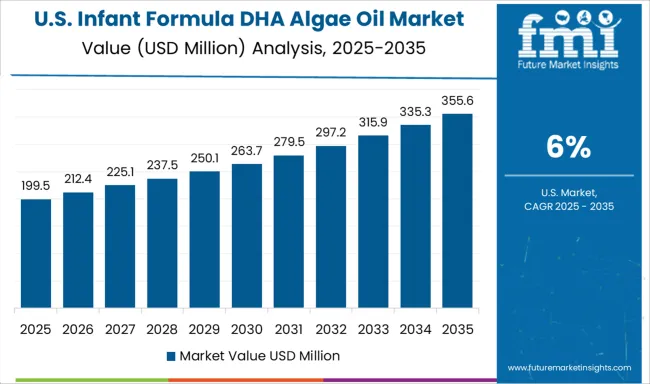

The USA market for DHA algae oil in infant formulas is expected to grow at a CAGR of 6.0%. Increasing awareness among parents about the role of DHA in early childhood development is one of the key drivers of this market. As parents prioritize their children's cognitive and visual development, there is a growing demand for DHA-enriched formulas. The increasing shift towards plant-based ingredients is contributing to the rise in popularity of algae-based DHA. The USA government’s focus on improving child nutrition through various healthcare programs supports the demand for DHA algae oil in infant formulas. The market is also driven by the convenience factor, as more parents prefer ready-to-feed or powdered infant formulas that contain DHA for enhanced brain development.

The UK is expected to see growth at a CAGR of 6.7% in the DHA algae oil market for infant formulas. With parents becoming more informed about the developmental benefits of DHA, particularly for brain and eye health, demand for DHA-enriched formulas continues to rise. The UK market is also benefiting from an increasing number of families opting for organic and plant-based ingredients in baby nutrition. The growing availability of DHA algae oil in both retail and online markets is making it more accessible. Healthcare regulations and initiatives promoting infant health in the UK are helping drive the adoption of DHA algae oil in infant formula.

The infant formula DHA algae oil market is driven by key players specializing in the production of algae-derived DHA (docosahexaenoic acid) oil, essential for infant brain development and overall health. Lonza is a leading player, offering high-quality DHA algae oil products for infant nutrition, with a focus on purity and safety. Algarithm specializes in algae-based DHA oil, meeting the growing demand for plant-based DHA in infant formula.

Cellana and Far East Microalgae provide high-quality algae oil products, focusing on innovative algae cultivation technology to produce DHA oil that meets regulatory standards for infant nutrition. Goerlich Pharma and Guangdong Runke Bio-Engineering are recognized for their expertise in developing DHA-rich algae oil for the infant formula industry, ensuring product quality and consistency.

Henry Lamotte OILS and Hubei Fuxing Biotechnology offer a range of DHA algae oil solutions, focusing on meeting the dietary needs of infants while ensuring product safety and regulatory compliance. JC Biotech and Kingdomway Nutrition provide DHA algae oil with high bioavailability, offering clean, high-quality products for the global infant formula market.

Meteoric Biopharmaceutical and Nordic Naturals specialize in offering DHA algae oil products, ensuring compliance with regulatory standards and meeting the growing demand for vegan and allergen-free alternatives. Polaris and Qingdao Keyuan Marine Biochemistry provide DHA oil solutions derived from algae, focusing on their nutritional benefits and supporting infant growth. Xiamen Huison Biotech also offers DHA algae oil with a focus on purity and safety.

| Item | Value |

|---|---|

| Quantitative Units | USD 392.9 Million |

| Content | 40% - 50% and 30% - 40% |

| End Use | 0 - 3 years old, 3 - 6 years old, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lonza, Algarithm, Cellana, Far East Microalgae, Goerlich Pharma, Guangdong Runke Bio-Engineering, Henry Lamotte OILS, Hubei Fuxing Biotechnology, JC Biotech, Kingdomway Nutrition, Meteoric Biopharmaceutical, Nordic Naturals, Polaris, Qingdao Keyuan Marine Biochemistry, and Xiamen Huison Biotech |

| Additional Attributes | Dollar sales by product type (algae oil powder, liquid algae oil) and end-use segments (infant formula, dietary supplements, functional foods). Demand dynamics are influenced by increasing awareness of the health benefits of DHA for infants, rising consumer preference for plant-based DHA alternatives, and the growing adoption of premium baby formulas. Regional trends show strong growth in North America and Europe, with an expanding market in Asia-Pacific due to increasing birth rates and rising disposable incomes. Innovation trends include improving DHA oil bioavailability and enhancing product traceability. |

The global infant formula DHA algae oil market is estimated to be valued at USD 392.9 million in 2025.

The market size for the infant formula DHA algae oil market is projected to reach USD 772.9 million by 2035.

The infant formula DHA algae oil market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in infant formula DHA algae oil market are 40% - 50% and 30% - 40%.

In terms of end use, 0 – 3 years old segment to command 68.5% share in the infant formula DHA algae oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators & Warmers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutrition Hydrolysate Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Infant Fever Stickers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutritional Premix Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators Market Analysis - Trends & Forecast 2025 to 2035

Infant Care Equipment Market Growth - Trends & Forecast 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Ingredients Market Analysis - Size, Share & Forecast 2025 to 2035

A2 Infant Formula Market Analysis By Form Type, By Age Group, By Distribution Channel and By Region - Forecast from 2025 to 2035

Malignant Infantile Osteopetrosis Market

Probiotic Infant Formula Market – Growth & Infant Nutrition Trends

Lactose-free Infant Formula Market

Noise-muffling Infant Hat Market

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Preformulation intermediates Market Size and Share Forecast Outlook 2025 to 2035

AI-Formulated Custom Serums Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA