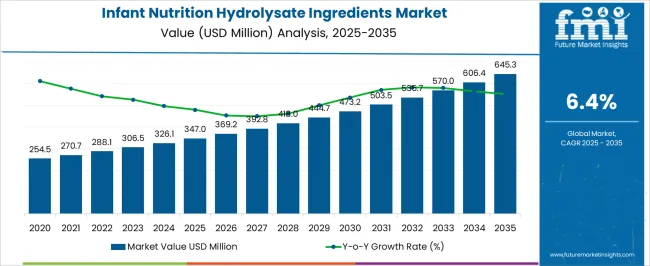

The infant nutrition hydrolysate ingredients market is estimated to be valued at USD 347.0 million in 2025 and is projected to reach USD 645.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The infant nutrition hydrolysate ingredients market is set to grow from USD 347.0 million in 2025 to USD 645.3 million in 2035, reflecting a CAGR of 6.4%. This growth represents an absolute dollar opportunity of USD 298.3 million over the decade. Annual increments show steady expansion, starting from USD 347.0 million in 2025, reaching USD 392.8 million in 2028, USD 444.7 million in 2031, and progressing to USD 606.4 million by 2034. The consistent upward trend highlights strong market potential, providing manufacturers and suppliers with a predictable revenue trajectory and opportunities to expand production and distribution to meet rising demand.

The absolute dollar opportunity underscores the growing value within the infant nutrition hydrolysate ingredients market over the next ten years. Incremental growth from USD 347.0 million in 2025 to USD 645.3 million in 2035 emphasizes a cumulative increase of USD 298.3 million. Key years such as USD 418.0 million in 2029 and USD 535.7 million in 2033 indicate periods of accelerated adoption. This growth pattern provides stakeholders with opportunities to optimize product lines, scale operations, and align investments with predictable market expansion, ensuring they capture a significant portion of the expanding market value.

| Metric | Value |

|---|---|

| Infant Nutrition Hydrolysate Ingredients Market Estimated Value in (2025 E) | USD 347.0 million |

| Infant Nutrition Hydrolysate Ingredients Market Forecast Value in (2035 F) | USD 645.3 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

The infant nutrition hydrolysate ingredients market is a segment of the broader infant formula and baby nutrition market, which includes standard formula, organic formula, specialized formula, and functional ingredients. In 2025, hydrolysate ingredients account for approximately 14% of the total infant formula market, highlighting their role in specialized nutrition for infants with specific dietary needs. With the parent market projected to grow from roughly USD 2.5 billion in 2025 to USD 4.6 billion in 2035, the hydrolysate segment’s growth from USD 347.0 million in 2025 to USD 645.3 million in 2035 at a CAGR of 6.4% represents a significant share of the incremental market growth, contributing about 13% of total expansion in the parent market.

Within the parent market, standard infant formula holds around 45% of total value, organic formulas account for 25%, and other specialized ingredients contribute 16%. Hydrolysate ingredients, with their 6.4% CAGR, are among the faster-growing segments, reflecting rising demand for easily digestible and hypoallergenic formulations. The incremental growth of USD 298.3 million over the decade represents roughly 12–13% of total parent market growth, providing manufacturers and suppliers with clear opportunities to expand production, enhance distribution networks, and capture a larger share of the growing infant nutrition market.

The infant nutrition hydrolysate ingredients market is experiencing steady expansion, driven by rising global awareness of early-life nutrition and the health benefits of hydrolyzed proteins for infants with sensitive digestive systems or allergies. Growing parental preference for products that promote improved digestion, reduced allergenic potential, and enhanced nutrient absorption is fueling market adoption. Advances in protein hydrolysis technology are enabling the production of ingredients with better functional properties, taste, and nutrient retention, increasing their acceptance in both developed and emerging markets.

Regulatory support for hypoallergenic and specialized infant formulas, combined with increased availability in mainstream retail and e-commerce channels, is broadening consumer access. Manufacturers are investing in innovative formulations that meet international nutritional guidelines while catering to regional preferences and price sensitivities.

With birth rates stabilizing in some regions but rising in others, coupled with a strong emphasis on premiumization in infant nutrition products, the market is positioned for sustained growth Strategic collaborations between ingredient suppliers and infant formula producers are expected to further accelerate innovation and market penetration in the coming years.

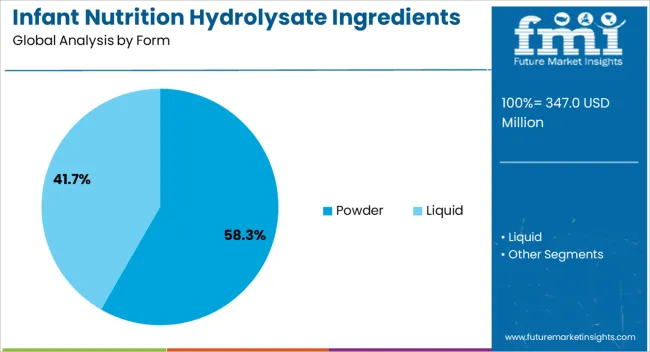

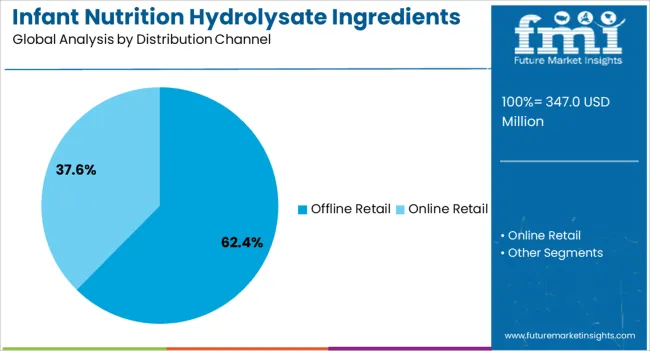

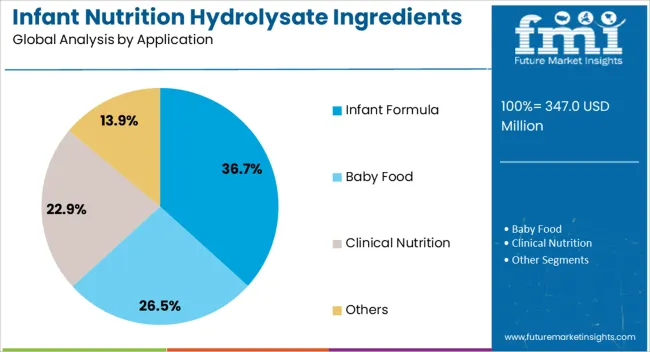

The infant nutrition hydrolysate ingredients market is segmented by form, distribution channel, application, and geographic regions. By form, infant nutrition hydrolysate ingredients market is divided into powder and liquid. In terms of distribution channel, infant nutrition hydrolysate ingredients market is classified into offline retail and online retail. Based on application, infant nutrition hydrolysate ingredients market is segmented into infant formula, baby food, clinical nutrition, and others. Regionally, the infant nutrition hydrolysate ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder form segment is projected to hold 58.3% of the infant nutrition hydrolysate ingredients market revenue share in 2025, making it the leading form type. This leadership is being driven by the product’s extended shelf life, ease of transportation, and cost-effectiveness compared to liquid alternatives. Powder formulations offer greater stability during storage and shipping, ensuring nutrient integrity until preparation.

Their convenience for portion control and the ability to reconstitute with water or milk make them a preferred choice among caregivers. Manufacturers are increasingly enhancing powder formulations with advanced processing techniques to improve solubility, taste, and bioavailability of hydrolyzed proteins.

The segment’s dominance is further supported by its widespread availability in retail and healthcare distribution channels, catering to both mass-market and specialized nutritional needs Growing demand for lightweight, non-perishable products in emerging markets, coupled with the established consumer familiarity and trust in powder-based infant nutrition products, is expected to reinforce this segment’s market position in the forecast period.

The offline retail distribution channel segment is anticipated to account for 62.4% of the infant nutrition hydrolysate ingredients market revenue share in 2025, positioning it as the leading channel. Its dominance is supported by consumer preference for in-store product evaluation, brand comparison, and direct consultation with sales or healthcare professionals before purchase. Pharmacies, supermarkets, and specialty baby stores provide immediate product availability, reinforcing trust through physical presence and established brand credibility.

The segment is also benefiting from organized retail expansion in emerging economies, where improved store infrastructure and accessibility are increasing product reach. Manufacturers frequently leverage offline retail to offer promotions, in-store demonstrations, and personalized guidance, which are influential in purchasing decisions for sensitive infant nutrition products.

Despite the growth of e-commerce, the tactile and advisory aspects of offline retail continue to resonate strongly with caregivers seeking reassurance in product safety and authenticity This enduring preference for physical retail environments is expected to sustain the segment’s leading position.

The infant formula application segment is expected to represent 36.7% of the infant nutrition hydrolysate ingredients market revenue share in 2025, making it the dominant application. This leadership is attributed to the increasing use of hydrolyzed proteins in infant formulas to address cow’s milk protein allergies, lactose intolerance, and digestive sensitivities in newborns and infants. The segment’s growth is supported by a rising emphasis on early nutritional intervention to promote optimal growth, immune development, and long-term health outcomes.

Technological advancements in enzymatic hydrolysis are improving ingredient digestibility and reducing allergenic potential while preserving essential amino acids and bioactive peptides. Regulatory recognition of hydrolyzed protein formulas as suitable for infants with specific health conditions is further driving adoption.

The segment also benefits from the growing premiumization of infant nutrition products, where parents are willing to invest in scientifically backed formulations that deliver proven health benefits With healthcare professionals increasingly recommending specialized formulas, the infant formula application is poised to remain the largest revenue contributor in this market.

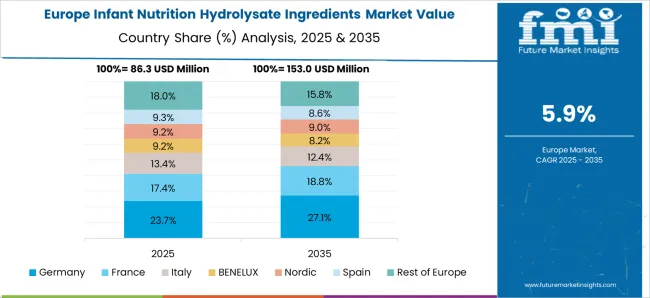

The infant nutrition hydrolysate ingredients market is expanding due to rising demand for hypoallergenic, digestible, and fortified infant formulas. North America and Europe lead adoption with advanced infant formula formulations, strict regulatory frameworks, and high consumer awareness of allergen management. Asia-Pacific shows rapid growth driven by increasing birth rates, urbanization, and rising disposable income. Manufacturers differentiate through protein hydrolysis degree, nutrient profile, and functional benefits. Regional differences in regulatory approvals, healthcare awareness, and formulation preferences strongly influence market adoption and competitiveness globally.

Adoption of hydrolysate ingredients is largely driven by the demand for hypoallergenic infant formulas that reduce the risk of allergic reactions. North America and Europe prioritize extensively hydrolyzed proteins and partially hydrolyzed proteins tailored for infants with milk protein sensitivities. Asia-Pacific markets are increasingly adopting hydrolyzed formulas for allergy prevention and digestive health in infants, particularly in urban and high-income populations. Differences in protein hydrolysis degree, formulation standards, and clinical validation affect ingredient selection, formula acceptance, and feeding efficacy. Leading suppliers provide standardized, high-purity protein hydrolysates with proven bioavailability and hypoallergenic performance, while regional manufacturers focus on cost-effective, locally compliant alternatives. Variations in allergy prevalence, consumer awareness, and clinical guidance directly shape adoption, product positioning, and competitive differentiation globally.

Hydrolysate ingredients adoption is influenced by their role in supporting infant nutrition, digestive comfort, and growth. North America and Europe emphasize hydrolyzed proteins enriched with vitamins, minerals, prebiotics, and probiotics to enhance nutrient absorption and immune function. Asia-Pacific markets adopt hydrolysates optimized for gut health, digestibility, and formula palatability at competitive pricing. Differences in infant dietary requirements, formula regulation, and cultural feeding practices affect ingredient formulation, processing standards, and functional claims. Leading suppliers invest in research-backed hydrolysates with consistent peptide profiles and bioactive compounds, while regional players focus on safe, cost-efficient alternatives. Nutritional fortification contrasts shape adoption, product differentiation, and competitiveness in the global infant formula market.

Regulatory compliance and safety standards strongly influence the hydrolysate ingredients market. North America and Europe enforce stringent guidelines under FDA, EFSA, and Codex Alimentarius for protein hydrolysis, allergen labeling, and microbial safety. Asia-Pacific regulations vary, with developed markets following international norms and emerging regions implementing local approval processes. Differences in regulatory requirements, clinical substantiation, and labeling norms affect ingredient selection, market entry timelines, and product acceptance. Leading suppliers ensure compliance through certified, traceable, and lab-tested hydrolysates, while regional manufacturers focus on cost-effective solutions meeting basic safety standards. Regulatory contrasts shape adoption, product credibility, and competitive positioning across global infant nutrition markets.

The growing birth rate and increasing parental awareness about infant health are major drivers for hydrolysate ingredient adoption. North America and Europe focus on specialized formulas for infants with allergies, digestive challenges, and nutritional deficiencies, supported by healthcare recommendations and clinical endorsements. Asia-Pacific markets experience rapid growth due to rising urban populations, higher disposable income, and greater demand for premium infant nutrition products. Differences in birth trends, healthcare guidance, and consumer purchasing power affect ingredient demand, formula innovation, and market penetration. Leading suppliers provide clinically validated, high-quality hydrolysates, while regional players offer cost-efficient alternatives. Population and awareness contrasts directly influence adoption, product development strategies, and market competitiveness globally.

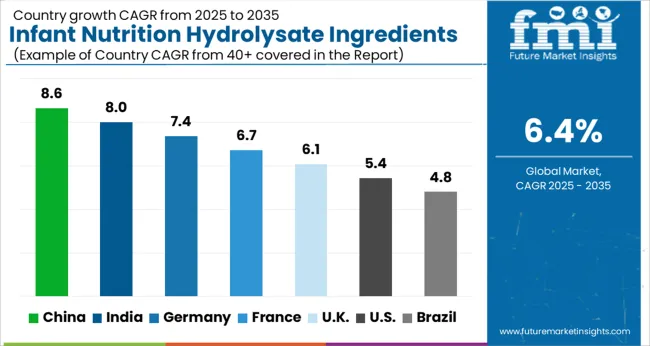

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The global infant nutrition hydrolysate ingredients market is projected to grow at a 6.4% CAGR through 2035, driven by demand in infant formula, clinical nutrition, and specialized dietary products. Among BRICS nations, China led with 8.6% growth as large-scale production and deployment across infant formula manufacturers were carried out, while India at 8.0% expanded manufacturing and adoption to support rising nutritional requirements. In the OECD region, Germany at 7.4% maintained steady integration under strict regulatory and safety standards, while the United Kingdom at 6.1% implemented hydrolysate ingredients across commercial and clinical nutrition products. The USA, growing at 5.4%, advanced utilization in infant and specialized nutrition applications while complying with federal and state-level food and safety regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The infant nutrition hydrolysate ingredients market in China is projected to grow at a CAGR of 8.6%, driven by increasing demand for hypoallergenic formulas, specialty infant nutrition, and functional ingredients. Adoption is being encouraged by ingredients that provide high digestibility, protein quality, and safety for infant consumption. Manufacturers are being urged to supply cost effective, reliable, and high quality products. Distribution through infant formula manufacturers, retail channels, and pharmaceutical suppliers is being strengthened. Research in protein hydrolysis techniques, allergen reduction, and nutrient fortification is being conducted. Rising awareness of infant allergies, increasing urban birth rates, and higher spending on premium nutrition are considered key factors driving the infant nutrition hydrolysate ingredients market in China.

In India, the infant nutrition hydrolysate ingredients market is expected to grow at a CAGR of 8.0%, supported by adoption in infant formula, clinical nutrition, and fortified milk products. Emphasis is being placed on ingredients that provide digestibility, protein quality, and safety. Local manufacturers are being encouraged to enhance production capabilities and offer cost effective, high quality solutions. Distribution through formula manufacturers, hospitals, and retail channels is being expanded. Awareness campaigns promoting infant nutrition and hypoallergenic benefits are being conducted. Increasing infant population, growing health consciousness among parents, and rising demand for premium nutrition products are recognized as primary drivers of the infant nutrition hydrolysate ingredients market in India.

Germany is witnessing steady growth in the infant nutrition hydrolysate ingredients market at a CAGR of 7.4%, driven by demand from infant formula manufacturers, hospitals, and specialty nutrition providers. Adoption is being encouraged by ingredients that ensure protein digestibility, nutritional balance, and compliance with European safety standards. Manufacturers are being urged to supply advanced, high quality, and safe ingredients. Distribution through formula companies, pharmacies, and retail chains is being optimized. Research in protein hydrolysis, nutrient fortification, and allergen control is being pursued. Rising demand for hypoallergenic products, growing health awareness, and premium nutrition trends are considered key factors driving the infant nutrition hydrolysate ingredients market in Germany.

The infant nutrition hydrolysate ingredients market in the United Kingdom is projected to grow at a CAGR of 6.1%, supported by demand from infant formula, clinical nutrition, and specialized milk products. Adoption is being emphasized for ingredients that provide digestibility, safety, and high protein quality. Manufacturers are being encouraged to supply reliable, high quality, and safe ingredients. Distribution through formula manufacturers, retail pharmacies, and hospitals is being strengthened. Awareness programs highlighting infant nutrition benefits and hypoallergenic properties are being conducted. Increasing birth rates, parental focus on infant health, and premium nutrition demand are recognized as major contributors to the infant nutrition hydrolysate ingredients market in the United Kingdom.

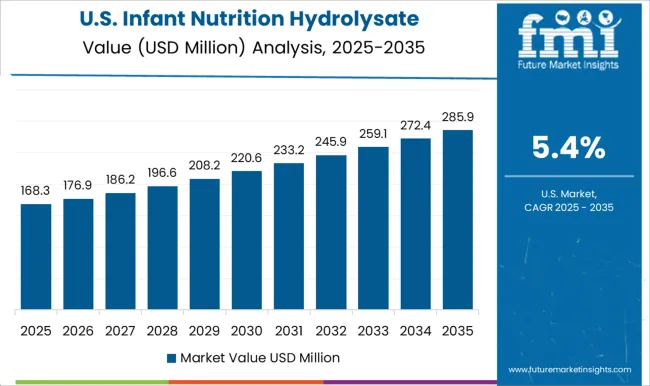

The infant nutrition hydrolysate ingredients market in the United States is projected to grow at a CAGR of 5.4%, driven by demand from formula manufacturers, hospitals, and specialty nutrition providers. Adoption is being encouraged by ingredients that ensure protein quality, digestibility, and compliance with safety standards. Manufacturers are being urged to develop advanced, reliable, and high quality solutions. Distribution through formula companies, retail channels, and healthcare providers is being maintained. Research in protein hydrolysis, allergen reduction, and nutrient enrichment is being pursued. Rising health awareness, increasing demand for hypoallergenic products, and growing infant formula consumption are considered key drivers of the infant nutrition hydrolysate ingredients market in the United States.

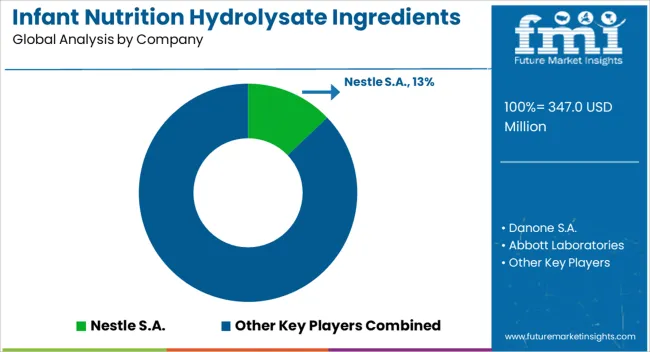

The infant nutrition hydrolysate ingredients market is dominated by a group of global leaders who have established strong footholds through extensive research, high-quality products, and broad distribution networks. Key suppliers in this market include Nestle S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition (now RB Health), FrieslandCampina, Arla Foods Ingredients Group, Glanbia plc, Kerry Group plc, DSM Nutritional Products, Chr. Hansen Holding A/S, Fonterra Co-operative Group Limited, Palsgaard A/S, Tatua Co-operative Dairy Company Ltd., Lactalis Ingredients, and Carbery Group. These companies focus on delivering specialized hydrolysate proteins that cater to the nutritional needs of infants, particularly in hypoallergenic formulas and digestive-sensitive applications.

Their products are used extensively in infant formulas, toddler nutrition products, and functional dairy-based foods, emphasizing safety, digestibility, and optimal nutrient bioavailability. Market growth is largely driven by increasing awareness among parents about infant allergies, intolerances, and the need for specialized nutrition. Suppliers such as Nestle S.A., Danone S.A., Abbott Laboratories, and FrieslandCampina have been at the forefront of innovation, developing partially hydrolyzed and extensively hydrolyzed protein formulations designed to reduce allergenicity while maintaining essential nutritional profiles.

Arla Foods Ingredients Group, Glanbia plc, and Kerry Group plc have also contributed to the market by focusing on clean-label ingredients and high-quality whey and casein protein hydrolysates, ensuring compliance with stringent international safety and quality standards. These companies leverage advanced enzymatic processes and stringent quality controls to provide consistent and reliable ingredient solutions for infant nutrition manufacturers worldwide. In addition to innovation and quality, sustainability and supply chain efficiency are critical factors shaping market leadership.

DSM Nutritional Products, Chr. Hansen Holding A/S, Fonterra, and Lactalis Ingredients have emphasized sustainable sourcing, reduced environmental footprint, and traceable supply chains to meet evolving consumer expectations and regulatory requirements. Furthermore, companies like Palsgaard A/S, Tatua Co-operative Dairy Company Ltd., and Carbery Group have strengthened their market positions through collaborations with infant formula manufacturers, enabling co-development of tailored hydrolysate solutions. The combination of cutting-edge research, high-quality production, and strong industry partnerships ensures that these suppliers remain at the forefront of the infant nutrition hydrolysate ingredients market, driving innovation, consumer trust, and long-term growth.

| Items | Values |

|---|---|

| Quantitative Units | USD 347.0 million |

| Form | Powder and Liquid |

| Distribution Channel | Offline Retail and Online Retail |

| Application | Infant Formula, Baby Food, Clinical Nutrition, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestle S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition (now RB Health), FrieslandCampina, Arla Foods Ingredients Group, Glanbia plc, Kerry Group plc, DSM Nutritional Products, Chr. Hansen Holding A/S, Fonterra Co-operative Group Limited, Palsgaard A/S, Tatua Co-operative Dairy Company Ltd., Lactalis Ingredients, and Carbery Group |

| Additional Attributes | Dollar sales vary by ingredient type, including partially hydrolyzed proteins, extensively hydrolyzed proteins, and enzymatically treated nutrients; by application, such as infant formula, follow-on formula, and clinical nutrition; by end-use, spanning manufacturers, healthcare providers, and retail; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising infant formula demand, protein allergy management, and functional nutrition awareness. |

The global infant nutrition hydrolysate ingredients market is estimated to be valued at USD 347.0 million in 2025.

The market size for the infant nutrition hydrolysate ingredients market is projected to reach USD 645.3 million by 2035.

The infant nutrition hydrolysate ingredients market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in infant nutrition hydrolysate ingredients market are powder and liquid.

In terms of distribution channel, offline retail segment to command 62.4% share in the infant nutrition hydrolysate ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators & Warmers Market Size and Share Forecast Outlook 2025 to 2035

Infant Formula DHA Algae Oil Market Size and Share Forecast Outlook 2025 to 2035

Infant Fever Stickers Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators Market Analysis - Trends & Forecast 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Care Equipment Market Growth - Trends & Forecast 2025 to 2035

Infant Formula Ingredients Market Analysis - Size, Share & Forecast 2025 to 2035

Infant Nutritional Premix Market Size and Share Forecast Outlook 2025 to 2035

A2 Infant Formula Market Analysis By Form Type, By Age Group, By Distribution Channel and By Region - Forecast from 2025 to 2035

Probiotic Infant Formula Market – Growth & Infant Nutrition Trends

Malignant Infantile Osteopetrosis Market

Lactose-free Infant Formula Market

Noise-muffling Infant Hat Market

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Yeast Market Size, Growth, and Forecast for 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

Nutritional Lipids Market

Nutrition Therapy Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA