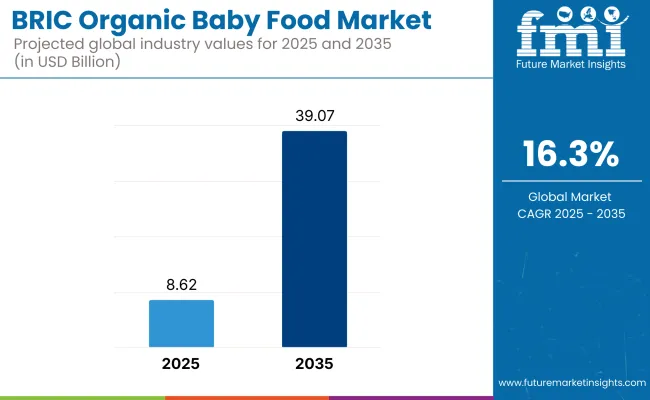

The global BRIC organic baby food market is estimated to be worth USD 8.62 billion by 2025 and is projected to reach a value of USD 39.07 billion by 2035, reflecting a CAGR of 16.3% over the assessment period 2025 to 2035.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 8.62 Billion |

| Projected Global Industry Value (2035F) | USD 39.07 Billion |

| Value-based CAGR (2025 to 2035) | 16.3% |

This impressive expansion has been driven by a confluence of socio-economic and demographic shifts across Brazil, Russia, India, and China-collectively accounting for a significant portion of the global infant population. The rise of dual-income households and the resultant demand for convenient yet healthy infant nutrition options have actively encouraged parents to adopt premium organic baby food products. Increasing disposable income levels, rising female workforce participation, and an improved understanding of nutritional labeling among urban consumers are further expected to shape market dynamics positively across BRIC nations.

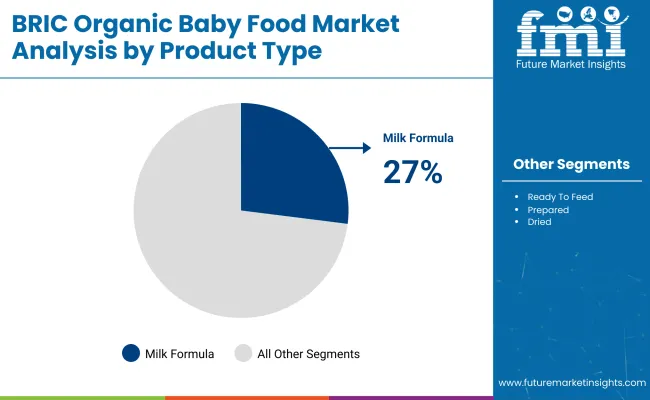

Heightened concerns surrounding food safety, pesticide residues, and synthetic additives in conventional baby food have further reinforced demand for organic-certified products. The milk formula category, which already commands a 27% value share in 2025, has emerged as the backbone of the BRIC organic baby food landscape, supported by expanding breastfeeding education campaigns and a gradual shift away from sugary infant cereals.

Meanwhile, the emergence of e-commerce and subscription-based D2C models has significantly eased access to niche organic baby food products, particularly among millennial and Gen Z parents in metro and Tier-1 cities.

On the manufacturing side, multinational giants like Nestlé S.A., Groupe Danone, and Abbott Laboratories continue to scale their certified organic offerings in these markets, often localizing production and sourcing to cater to region-specific preferences and regulatory nuances.

Strategic partnerships with organic farms, the use of traceability-enabled packaging, and functional claims (such as gut health, immune support, and allergen-free nutrition) have been positioned as key differentiators.

Additionally, government policies promoting maternal and child health, as seen in India’s POSHAN Abhiyaan and Brazil’s public nutrition programs, are expected to indirectly support the organic category’s momentum. Looking forward, product innovation, investment in organic ingredient traceability, and customized infant meal plans will play a crucial role in sustaining the market’s double-digit growth through 2035.

Accounting for approximately 27% of the market in 2025, the milk formula segment is projected to expand at a CAGR of 15.9% through 2035, retaining its status as the most dominant product category. Its continued growth is being underpinned by increasing breastfeeding advocacy, rising awareness of early-life nutrition, and a shift away from carbohydrate-heavy infant diets toward protein-rich, gut-supportive alternatives. In BRIC nations, particularly China and India, urban working mothers are actively seeking organic-certified formula solutions that can supplement breastfeeding without compromising on quality or purity.

Government initiatives emphasizing child health, including Brazil’s National Breastfeeding Policy and India’s ICDS reforms, have accelerated market penetration by creating a conducive ecosystem for formula innovation and parent education.

Brands competing in this space have strategically emphasized organic traceability, hypoallergenic claims, and probiotic inclusions, further boosting the credibility of milk formula among health-conscious consumers. Backed by scientific research and pediatric endorsement, this segment has attracted heavy investment in R&D and packaging personalization.

Over the forecast period, demand for regional variants addressing lactose sensitivity, plant-based formats, and bioavailable micronutrients is expected to rise. As regulatory clarity improves and clinical validation becomes more central to brand positioning, milk formula will likely continue to anchor the value expansion of the organic baby food category.

With an expected CAGR of 18.5% during 2025 to 2035, the online retailing segment is emerging as a high-growth channel, particularly across urban and semi-urban zones of BRIC countries. Parents, increasingly accustomed to digital platforms for nutritional research and product comparisons, are turning to e-commerce for assured quality, convenience, and access to specialty brands unavailable in brick-and-mortar outlets.

Post-pandemic shifts in shopping behavior and the growing popularity of subscription-based baby food services have further accelerated this channel’s relevance. Across Brazil and India, mobile-first commerce, combined with social media-driven parenting communities, has played a pivotal role in reshaping how organic baby food is discovered and purchased.

Global manufacturers and emerging D2C startups are leveraging AI-based recommendations, transparent sourcing disclosures, and verified customer reviews to build digital trust and reduce purchase hesitancy. Meanwhile, online-exclusive SKUs emphasizing regional sourcing, immunity-boosting nutrition, and recyclable packaging are being tailored to millennial parental expectations. The integration of pediatrician advice tools and loyalty programs has also improved platform stickiness.

As fulfillment networks become more agile and digital payment infrastructure matures in Tier-2 and Tier-3 cities, online retailing is expected to shift from being an experimental channel to a default access point for high-quality organic infant nutrition in the BRIC region.

Demand for Healthy Food is Driving Market Growth

The rise in the number of parents who are concerned about their children being exposed to harmful chemicals in conventional baby food is one of the main factors driving the growth of organic baby food. Compared to conventional produce organic food products have significantly fewer pesticide residues. As new-borns may be more vulnerable to potential harm from pesticides than adults some people choose to buy organic baby food to limit their infant’s exposure to pesticide residues.

Demand for Vegan Food is Driving Market Growth

The market for organic baby food products is anticipated to grow as a result of the growing demand for plant-based infant formula. In addition, a strong distribution network and rising consumer awareness of the advantages of eco-friendly products in southern India are anticipated to support the expansion of the BRIC organic baby food market.

During the period 2020 to 2024, the sales grew at a CAGR of 15.2%, and it is predicted to continue to grow at a CAGR of 16.3% during the forecast period of 2025 to 2035.

It is projected that the consumption of organic baby food will increase exponentially throughout the BRIC nations during the assessment period due to parental worries about providing their infants with a healthy diet. India and China will remain the industry’s two biggest sources of income. Government programs aimed at combating childhood malnutrition in these areas should create an environment that is conducive to development.

In order to preserve steady revenue streams in the industry top manufacturers are urging these emerging economies to expand their production capacities. For milk formula products which are becoming more and more popular as a good alternative to breast milk this is particularly true.

A notable increase in clean-label trends in the food and beverage industry has led to a rise in the use of organic baby food. Furthermore, the industry is being driven by advancements and investments made in these nations organic farming sectors.

Tier 1 companies includes industry leaders acquiring a 55% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 25%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies includes mostly of small-scale businesses serving niche economies and operating at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 here refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

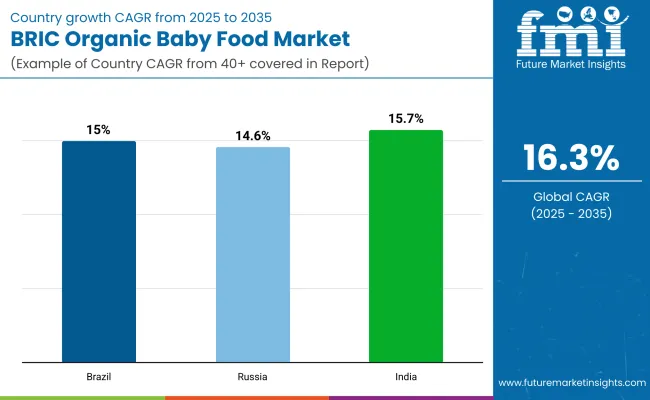

The following table shows the forecasted growth rates of the significant three geographies revenues. Brazil, Russia and India come under the exhibit of high consumption, recording CAGRs of 15%, 14.6% and 15.7%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| Brazil | 15% |

| Russia | 14.6% |

| India | 15.7% |

International corporations like Nestle S. A have demonstrated their ability to consolidate the Brazilian organic baby food market. and having significant market shares are Heinz. A WHO report projects that the demand for organic baby food will increase significantly as a result of shifting feeding habits increased disposable income and worries about added chemicals among other factors.

In 2019 Brazil registered over 20.8 million births which presented market participants with profitable opportunities. Market movements will be heavily influenced by political and economic stability in the years to come for the foreseeable future.

A sizable market for infant milk formula which is seen as a good substitute for breastfeeding has developed in India. Formula feeding has become more popular due to healthcare recommendations which are being supported by an increasing number of working parents. India’s birth rate which was 17.3 births per 1000 people in 2021 is higher than Chinas. Through 2035 this is a major factor that could make the nation a profitable market for manufacturers.

Sales of organic food increased by more than 20% annually according to the Russian Ministry of Agriculture. Russia imports more consumer-oriented goods than any other country in Europe with 145 million consumers. A USDA report claims that since 2014 economic sanctions have reduced reliance on imports and raised domestic production rates.

The organic baby food market will continue to expand as a result of major market players investing heavily in RandD to expand their product lines. With significant market developments like new product launches contractual agreements mergers and acquisitions increased investments and cooperation with other organizations market participants are also implementing a variety of strategic initiatives to expand their global footprint. In an increasingly competitive and growing market environment competitors in the organic baby food industry must provide affordable products in order to grow and thrive.

By product type, industry has been categorized into Ready To Feed, Prepared, Milk Formula and Dried

By distribution channel industry has been categorized into Chemists/Drugstores, Internet, Specialty Outlet, Super Market

Industry analysis has been carried out in key countries of North America, Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 16.3% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 39.07 Billion.

Demand for healthy food is increasing demand for BRIC Organic Baby Food.

South America is expected to dominate the global consumption.

Some of the key players in manufacturing include Otsuka Holdings Co. Ltd., Campbell Soup Company, Nestle S.A. and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Foods Market Analysis by Category, Product Type, Distribution Channel, and Region Through 2035

Organic Baby Shampoo Market

Analysis and Growth Projections for Organic Pet Food Business

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Dried Baby Food Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Prepared Baby Food Market Size and Share Forecast Outlook 2025 to 2035

Hypo Anti-Allergic Baby Food Market Analysis by Product Form, Product Origin, Distribution Channel and others Through 2035

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA