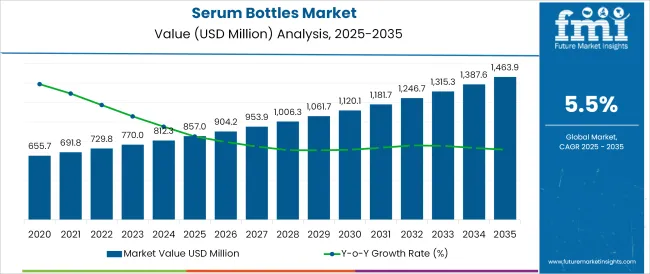

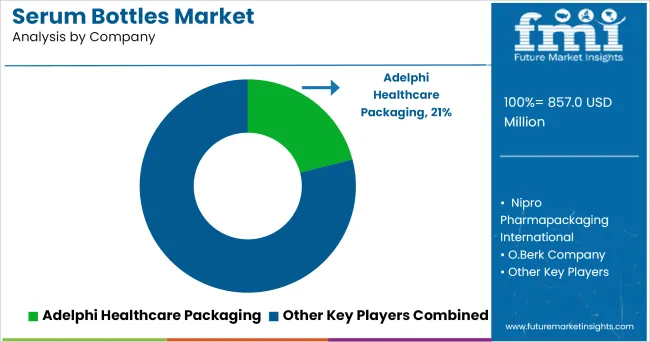

The Serum Bottles Market is estimated to be valued at USD 857.0 million in 2025 and is projected to reach USD 1463.9 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The serum bottles market is experiencing consistent expansion, driven by stringent regulatory standards in pharmaceutical and cosmetic packaging, rising demand for sterile, tamper-evident containers, and growing interest in premium skincare and biotech products.

The market is benefiting from the rise of injectable therapies, specialty formulations, and clinical drug delivery systems that require inert, durable packaging solutions. Increased focus on sustainability and reusability is further pushing manufacturers toward recyclable and chemically stable materials, particularly glass. Enhanced filling line automation, improved sealing technology, and growing R&D investments in personalized medicine are expected to support future market growth.

Additionally, advancements in barrier coatings, dose control mechanisms, and dropper-integrated designs are expanding the utility of serum bottles across broader healthcare and beauty applications. Demand is expected to strengthen with the expansion of biopharmaceutical pipelines and consumer shifts toward clean-label, high-integrity product packaging.

The market is segmented by Material Type, Capacity Range, and End-Use Industry and region. By Material Type, the market is divided into Glass, Borosilicate glass, Moulded glass, Soda lime glass, Plastic, Polyethylene terephthalate (PET), Polyethylene (PE), and High density polyethylene (HDPE). In terms of Capacity Range, the market is classified into 100 to 250 ml, Up to 100 ml, 250 to 500 ml, and Above 500 ml.

Based on End-Use Industry, the market is segmented into Pharmaceutical, Cosmetics & Personal Care, Military, Agrochemical, Pesticides, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

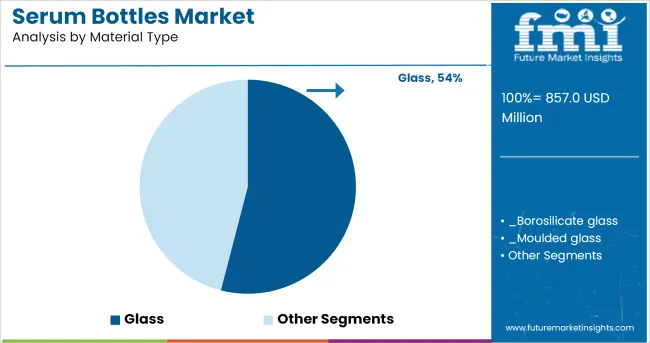

Glass is projected to hold 54.0% of the serum bottles market revenue in 2025, establishing it as the leading material type. This dominance is being driven by glass’s superior chemical resistance, non-reactivity, and ability to preserve the purity of sensitive liquid formulations.

Its inert nature makes it especially suitable for pharmaceutical and high-end cosmetic products, where maintaining stability and efficacy is critical. Glass bottles also offer strong barrier protection against oxygen and moisture, reducing the risk of product degradation.

Additionally, increasing environmental consciousness has prompted both manufacturers and end users to prefer recyclable and reusable packaging formats, with glass fulfilling both criteria. Compatibility with sterilization processes such as autoclaving and gamma irradiation further strengthens glass’s positioning in regulated medical and therapeutic use cases. As demand for high-integrity packaging grows across pharma and dermaceutical applications, glass is expected to retain its leading share.

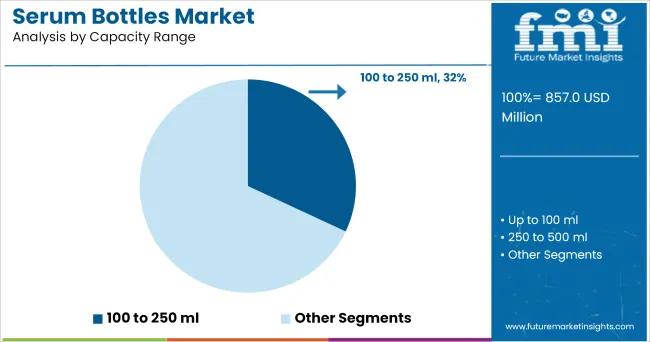

The 100 to 250 ml capacity range is projected to contribute 32.0% of the serum bottles market revenue in 2025, leading other capacity segments. This preference is being shaped by the segment’s suitability for both pharmaceutical dosing and cosmetic product usage cycles.

Bottles in this volume range strike an optimal balance between single-patient use and multi-dose applications while minimizing waste. Their compact size enhances portability and storage convenience for end-users, particularly in over-the-counter and travel-friendly formats.

Additionally, manufacturers favor this capacity range for its adaptability in automated filling and labeling lines without compromising on dosage control or safety compliance. In regulated industries, such mid-range capacities meet batch traceability and stability testing requirements, making them a practical choice for product developers and clinical packagers. As consumer expectations shift toward minimalism and precision in dosing, 100 to 250 ml serum bottles are expected to maintain steady demand.

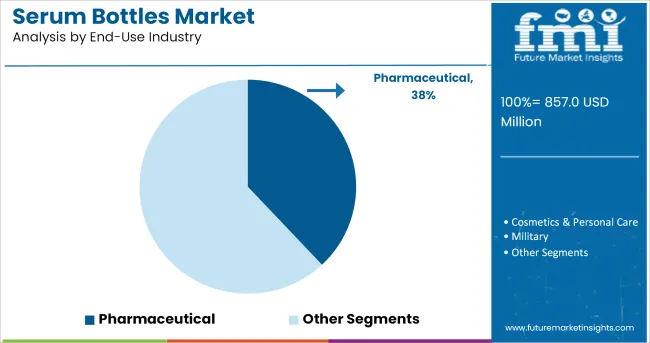

The pharmaceutical industry is expected to lead the serum bottles market with a 38.0% revenue share in 2025. This leadership is being driven by the growing prevalence of biologics, injectable drugs, and specialized formulations that require chemically stable and contamination-resistant packaging.

Serum bottles are essential for maintaining sterility, ensuring accurate dosing, and supporting secure transport and storage of pharmaceutical liquids, vaccines, and suspensions. Increased adoption of preventive healthcare and injectable treatments is amplifying demand from hospital, clinical, and laboratory environments. In addition, tighter global regulatory oversight on packaging safety and traceability is reinforcing the use of compliant, inert containers where serum bottles are favored for their compatibility and performance.

Growth in biotechnology, coupled with personalized medicine and cell therapy development, is further expanding the scope of serum bottle usage in pharmaceutical manufacturing pipelines. As the pharmaceutical sector continues to prioritize safety, precision, and durability in primary packaging, serum bottles are projected to remain a vital packaging format.

Serum packaging involves reliable and sustainable solutions that guarantee safe handling and transport with insignificant environmental impact. Serum bottles are highly suitable for cosmetics and drug packaging. These bottles provides dimensional and cosmetic tolerance to the liquid substances.

The pharmaceutical industry is one of the most dynamic sectors of the economy. The rapid surge in the investments in pharmaceutical industry are impelling substantial changes in the pharmaceutical packaging and hence fueling the demand for serum bottles.

Over recent years, beauty and personal care sector is witnessing lucrative growth in developed and developing countries across the globe. To comply with the increasing consumer demand many small scale cosmetic manufacturers are emerging. This, in turn, is resulting in increasing consumption of serum bottles.

Moreover, serum bottles are ideal for storing and packing chemicals and solutions that require highest purity. This is attributable to their resistance to chemical or thermal reactions with the contents. Rapid growth in the demand for chemicals ascending investments in domestic businesses is also providing impetus for the growth in demand over the coming years.

Serum bottles are suitable to be used as containers for storing samples, vaccines or injectable drugs for long and short term. These bottles are non-porous, impermeable, and does not have any reaction with the products filled inside it. These bottles are also used for avoid contamination and preserving the products for long term.

Asia Pacific region is projected to expand with highest growth rate over the forecast period, owing to increasing investments in pharmaceuticals and cosmetic packaging coupled with technological advancements. The prevalence of large number of manufacturers in the countries such as China, India, etc. is paving the way for market growth in the region.

Presence of world-class healthcare infrastructure coupled with dominance some of the biggest and oldest pharmaceutical companies in the world in the countries such as Germany, UK, Italy, etc. is expected to augment the market growth in the Europe over the forecast period.

USA is also expected to hold substantial market share in the serum bottles market owing to the rising prominence of beauty and cosmetic products in the USA owing to high disposable income and increasing number of new entrants in the cosmetic manufacturing.

Some of the leading manufacturers and suppliers include

Leading manufacturers are focused on expansion of their manufacturing facilities along with sales and distribution network in emerging markets across the globe. Also, continuing efforts are being made to further improve the cost and performance parameters for different applications. Attributing to the presence of number of global & regional players, the market witnesses fierce competition.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global serum bottles market is estimated to be valued at USD 857.0 million in 2025.

The market size for the serum bottles market is projected to reach USD 1,463.9 million by 2035.

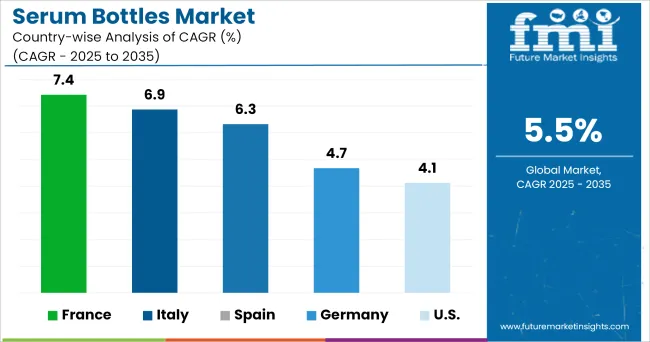

The serum bottles market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in serum bottles market are glass, borosilicate glass, moulded glass, soda lime glass, plastic, polyethylene terephthalate (pet), polyethylene (pe) and high density polyethylene (hdpe).

In terms of capacity range, 100 to 250 ml segment to command 32.0% share in the serum bottles market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Positioning & Share in the Serum Bottles Market

Crimp Neck Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Serum Separation Gels Market Size and Share Forecast Outlook 2025 to 2035

Serum Vials Market Size and Share Forecast Outlook 2025 to 2035

Serum Lactate Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Serum Separating Tubes Market

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cryo Serums Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Facial Serum Market Analysis – Growth & Trends 2024-2034

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Serum Market Report - Demand & Growth Forecast 2025 to 2035

Anti-Aging Serums Market Analysis by Type, Application and Region from 2025 to 2035

Niacinamide Serums Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Free Eye Serum Market Analysis – Growth & Demand 2024-2034

Hair Thickener Serum Market Insights – Growth & Demand 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA