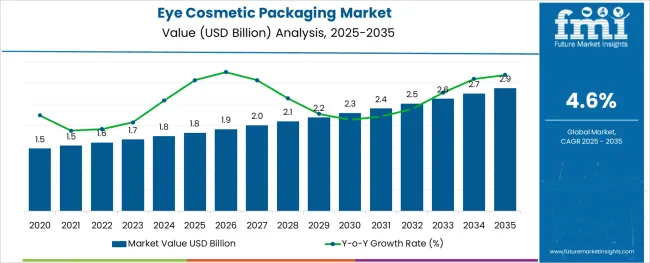

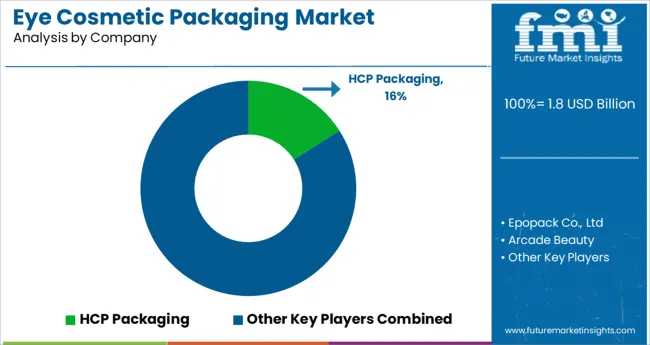

The Eye Cosmetic Packaging Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The eye cosmetic packaging market is experiencing robust development due to increased global demand for eye makeup products and a growing emphasis on aesthetic packaging design that supports brand identity and consumer appeal. Innovations in applicator precision, lightweight materials, and contamination-resistant closures are becoming essential for delivering functional and safe packaging for mascaras, eyeliners, and under-eye treatments.

Heightened consumer awareness around hygiene, along with regulatory standards for cosmetic product safety, has led to growing investment in packaging materials that maintain product integrity over time. Additionally, as sustainability becomes a purchasing factor, manufacturers are incorporating recyclable materials and eco-conscious packaging designs, particularly within premium and mid-tier product lines.

The market is also responding to the rising influence of social media and visual merchandising, prompting brands to prioritize packaging that enhances shelf presence and unboxing experiences. Moving forward, opportunities will continue to emerge from product personalization trends, refillable formats, and regional expansion of premium cosmetics.

The market is segmented by Material, Product Type, and Distribution Channel and region. By Material, the market is divided into Plastic, Glass, Paper & Paperboard, and Metal. In terms of Product Type, the market is classified into Tubes, Bottles, Jars, Boxes, and Others (Dispenser Pumps, Stick Pens, etc.).

Based on Distribution Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

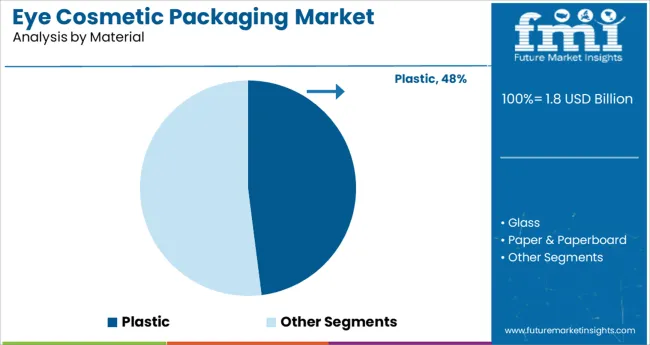

Plastic is projected to dominate the eye cosmetic packaging market with a 48.0% revenue share in 2025. This leadership is being driven by plastic’s adaptability, lightweight characteristics, and compatibility with various decoration techniques that support brand differentiation. Its ability to mold into compact, sleek, and functional packaging shapes allows for efficient protection and dispensing of cosmetic formulations.

Plastic offers cost-effective scalability for both mass-market and luxury products, while providing high design flexibility that enhances user convenience and on-the-go application. Moreover, advancements in recyclable plastics and bio-based polymers are supporting sustainability objectives without compromising aesthetics or performance.

The use of plastic has also been strengthened by its compatibility with air-tight, tamper-evident closures, making it well-suited for high-sensitivity cosmetic applications where product preservation and user safety are critical.

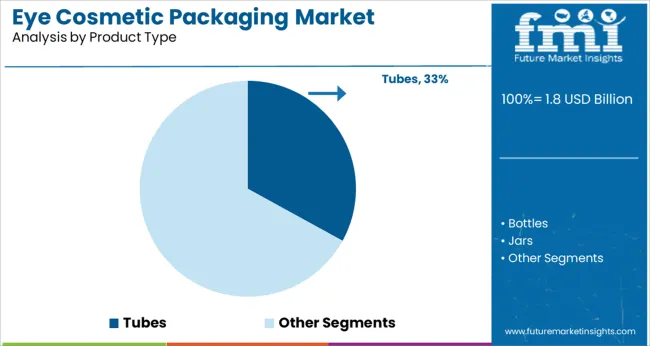

Tubes are expected to account for 33.0% of the total revenue share in the eye cosmetic packaging market in 2025. This segment’s strength is attributed to the ease of controlled dispensing, portability, and hygienic application they offer across a variety of gel-based or cream-based eye cosmetics. Tubes enable precise usage and are ideal for packaging products that require squeezable functionality, minimizing waste and contamination.

Their compact form and compatibility with applicator tips or twist mechanisms make them a preferred choice for under-eye treatments, concealers, and eye primers.

Additionally, tubes align with emerging trends in minimalist, functional beauty packaging offering high visual appeal and customizability through printing and labeling technologies. As consumers increasingly seek convenience and aesthetic clarity in product formats, tubes continue to be favored for their ergonomic design and formulation compatibility.

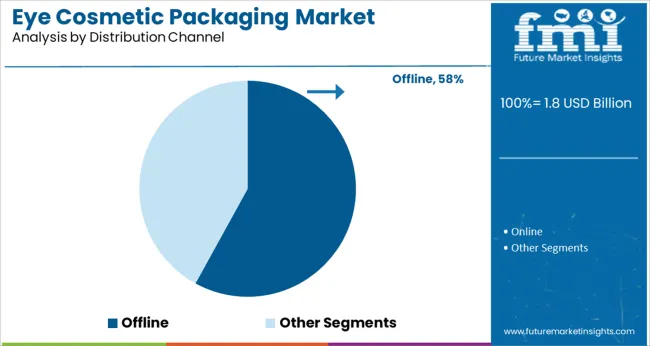

Offline distribution channels are projected to lead with a 58.0% revenue share in the eye cosmetic packaging market by 2025. This segment’s continued dominance is supported by the importance of tactile product evaluation, brand trust, and in-store consultation in beauty purchasing behavior. Consumers often rely on physical retail environments to test formulations, view packaging aesthetics, and receive guided product recommendations, especially for eye cosmetics where precision and texture are crucial

The presence of established beauty retailers, pharmacies, and department stores reinforces offline accessibility and consumer confidence. Additionally, premium packaging strategies are often showcased more effectively in physical retail formats, where visual merchandising plays a key role in brand perception.

Despite e-commerce growth, the offline channel remains central to product discovery and experiential marketing, especially in regions with strong in-store beauty culture and brand loyalty.

The global eye cosmetic packaging market witnessed a CAGR of 4.3% during the historic period with a market value of USD 1.8 Billion in 2024.

The eye cosmetic packaging market flourished in recent years because of the increasing consumption of cosmetic products and the increasing awareness of cosmetic products among all consumers to uphold a more attractive look.

Also, increasing demand for eye cosmetic products such as kajal, mascara, liner, and others on online platforms leads to the rise in e-commerce, which has driven up the eye cosmetic packaging market.

Eye cosmetic product manufacturers are using various attractive packaging solutions to gain customer attention from the shelf itself, which boosts the demand for eye cosmetic packaging. The eye cosmetic packaging includes various packaging formats made from plastic, glass, paper & paperboard, and metal such as bottles, jars, tubes, boxes, and others.

In the cosmetics industry, glass packaging will be gaining a decent pace in the span of the next 10 years because glass packaging offers zero chemical interaction and ensures that the products inside the glass jars/bottles keep their aroma.

Besides this, the growing sustainability concern around the world creates a growth opportunity for paper eye cosmetic packaging and plastic eye cosmetic packaging made from recycled material. The increasing trend among consumers to use various eye cosmetic products is bolstering the market growth at a comparatively higher rate during the forecast period than the historical.

Nowadays, cosmetic brands are more focused on marketing and branding than they were in the last decade. With the evolution of social media and the introduction of intelligent packaging solutions, end-use brands are offering sustainable and smart packaging solutions for eye cosmetics.

With QR and RFID codes on the packaging, virtual pop-ups and augmented reality filters are some of the features that are influencing the eye cosmetic packaging market.

The packaging brands for eye cosmetics are concerned about delivering intelligent solutions with a touch of traditional elements for the product. Advanced fill-seal technology has provided products with a multi-dimensional look on retail shelves. Hence, technological evolution is playing a major role in shaping the dynamics of the eye cosmetic packaging market.

The bottles segment followed by the jars segment by product type is expected to create growth opportunities for the global eye cosmetic packaging market from 2025 to 2035. The reason behind the same is the increased adoption of rigid packaging solutions for filling, storing, and delivering eye cosmetic products by manufacturers.

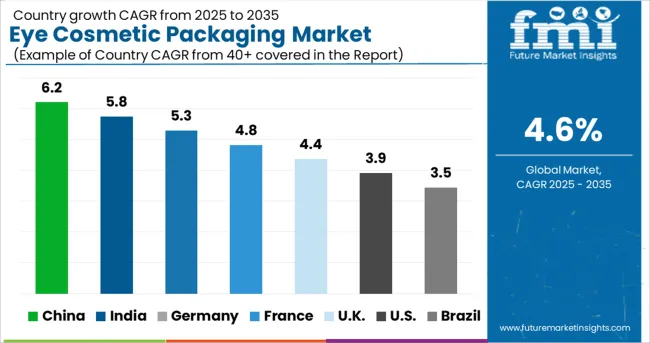

Germany is projected to hold approximately 22% of the European eye cosmetic packaging market due to the surge in demand for cosmetic products in Germany. As per the data provided by the Cosmetic, Toiletry and Perfumery Association (CTPA), Germany’s cosmetic & personal care market is the largest market in Europe.

The German cosmetic and personal care market stood at USD 13 Billion in 2024. Thus, Germany considered the largest market for cosmetic and personal care products is projected to supplement the sales of eye cosmetic packaging.

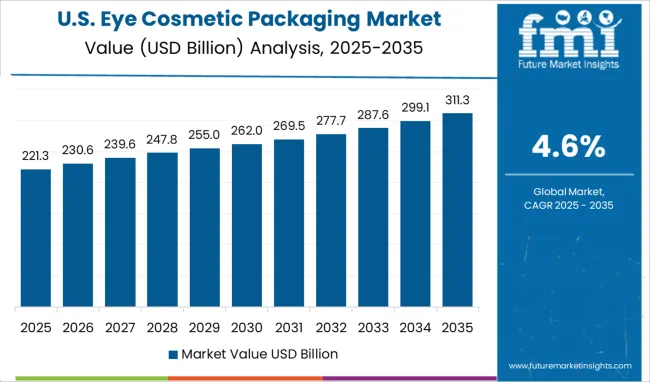

The USA eye cosmetic packaging market is anticipated to expand 1.6 times the current market value during the forecast period. According to Cosmetic Europe - the Personal Care Association, the retail sales price of The USA cosmetic and personal care market accounted for USD 1.8 Billion in 2024.

The expanding cosmetic and personal care industry in the USA is estimated to augment the demand for eye cosmetic packaging.

The key players in the eye cosmetics packaging market faced negative demand during the pandemic. This also affected its sales and market share of eye cosmetic packaging market. Now, the key players in the market are trying to gain market share to recapture their position in the eye cosmetics packaging market. Some of the recent key changes by the leading players are as under:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.6% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material, Product Type, Distribution Channel, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa; Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Epopack Co., Ltd; HCP Packaging; Arcade Beauty; APC Packaging; Quadpack Group; Berry Global Inc.; 3C Inc.; Libo Cosmetics Co. Ltd.; Aptar Group; Albea Group; Gerresheimer AG; H&K Müller GmbH & Co. KG; CORPACK GMBH; Plásticos FACA S.A.; LUMSON S.p.A.; Frapak Packaging; HCP Packaging; WG Pro-Manufacturing Inc.; The Packaging Company |

The global eye cosmetic packaging market is estimated to be valued at USD 1.8 USD billion in 2025.

It is projected to reach USD 2.9 USD billion by 2035.

The market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types are plastic, glass, paper & paperboard and metal.

tubes segment is expected to dominate with a 33.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Eye Cosmetic Packaging Providers

Competitive Overview of Eyewear Packaging Companies

Eyewear Packaging Market by Material Type from 2024 to 2034

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Evaluating Eyeliner and Kajal Sculpting Pencil Packaging Market Share & Provider Insights

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Single Portion Cosmetic Packaging Companies

Anti-counterfeit Cosmetic Packaging Market Growth - Demand & Forecast 2025 to 2035

Injection Moulding Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Injection Moulding Cosmetic Packaging Manufacturers

Eyebrow Makeup Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA