The atelocollagen market is progressing steadily, supported by rising demand for bioactive and biocompatible materials across medical, cosmetic, and research applications. Industry updates and scientific publications have emphasized the growing preference for purified collagen types that exhibit reduced immunogenicity and improved biocompatibility, with atelocollagen gaining traction as a safe and effective biomaterial.

Advancements in extraction and purification techniques have enhanced product consistency and safety, increasing its applicability in dermatology, wound healing, and soft tissue regeneration. Cosmetic brands and pharmaceutical companies have expanded their atelocollagen portfolios, driven by consumer demand for natural and functional ingredients in skincare and regenerative therapies.

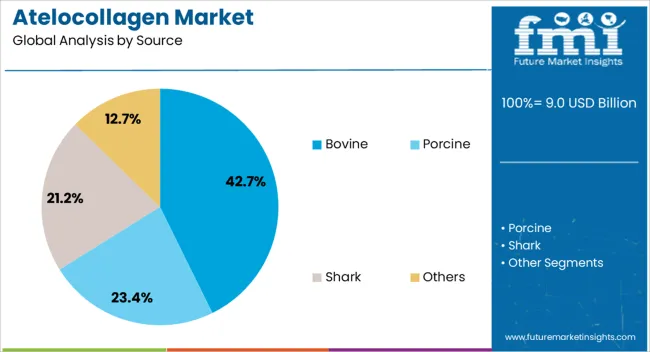

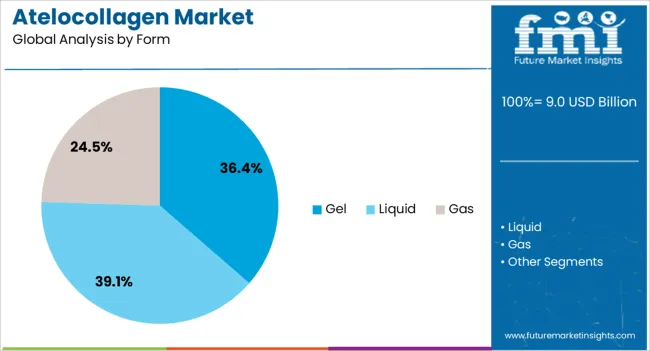

Regulatory approvals and clinical validations have further established the safety profile of atelocollagen, expanding its use in injectable fillers, bioadhesives, and tissue scaffolds. Looking ahead, the market is expected to grow on the back of emerging applications in 3D bioprinting, drug delivery, and aesthetics, with ongoing R&D focused on developing synthetic and recombinant alternatives. Segmental momentum is led by bovine-derived sources, gel-based formulations, and high uptake in the cosmetics industry due to their established clinical performance and scalability.

| Metric | Value |

|---|---|

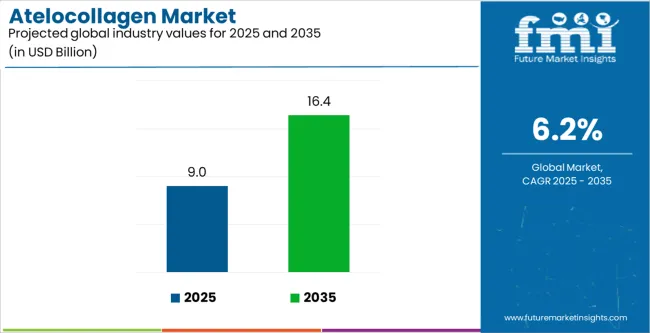

| Atelocollagen Market Estimated Value in (2025 E) | USD 9.0 billion |

| Atelocollagen Market Forecast Value in (2035 F) | USD 16.4 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

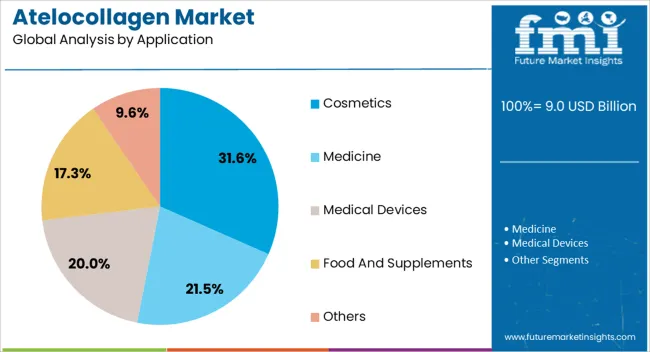

The market is segmented by Source, Form, and Application and region. By Source, the market is divided into Bovine, Porcine, Shark, and Others. In terms of Form, the market is classified into Gel, Liquid, and Gas. Based on Application, the market is segmented into Cosmetics, Medicine, Medical Devices, Food And Supplements, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Bovine segment is projected to contribute 42.7% of the atelocollagen market revenue in 2025, maintaining its lead due to widespread availability and established safety data. Bovine collagen has been extensively studied and used in biomedical applications, with optimized purification processes enabling the production of atelocollagen with reduced antigenicity.

Manufacturers have favored bovine sources due to their cost-effectiveness, scalability, and regulatory familiarity, which simplifies product development and approval pathways. Additionally, pharmaceutical and cosmetic companies have prioritized bovine atelocollagen due to its mechanical strength and biochemical properties that closely resemble human collagen.

Scientific journals have consistently validated its use in tissue regeneration, dermal fillers, and wound repair, further reinforcing market acceptance. While alternative sources such as porcine or marine collagen are gaining interest, bovine-derived atelocollagen continues to dominate based on historical use, abundant supply, and adaptability to various formulation types.

The Gel segment is projected to account for 36.4% of the atelocollagen market revenue in 2025, establishing itself as the leading form due to its superior versatility and ease of application. Gel-based atelocollagen has been widely adopted in both clinical and cosmetic settings, where its spreadability and ability to conform to tissue structures are critical.

Clinical reports and product literature have highlighted its effectiveness in injectable formulations, wound coverings, and scaffold matrices. Manufacturers have favored gel forms due to their ability to deliver collagen in a hydrated, bioavailable state, which enhances cellular interaction and tissue integration.

Additionally, cosmetic applications have increasingly relied on gel-based formulations for topical and intradermal treatments that improve skin texture and elasticity. Its compatibility with active ingredients and controlled-release systems has further strengthened its market position. As demand grows for minimally invasive and biofunctional products, the Gel segment is expected to retain its leadership due to its broad applicability and formulation flexibility.

The Cosmetics segment is projected to hold 31.6% of the atelocollagen market revenue in 2025, leading application-based adoption due to the growing consumer demand for collagen-enhancing skincare solutions. The incorporation of atelocollagen into cosmetic formulations has been driven by its ability to improve skin hydration, elasticity, and barrier function.

Industry press releases and dermatological studies have reported favorable clinical outcomes from topical and injectable collagen therapies, which has increased consumer trust and product uptake. Skincare brands have actively marketed atelocollagen as a premium ingredient with reduced immunogenic risk, enabling its use in sensitive skin products and anti-aging regimens.

Moreover, rising demand for clean-label and bioactive cosmetic products has aligned well with the properties of atelocollagen, which is perceived as both effective and natural. Growth in aesthetic dermatology, particularly in Asia and North America, has further elevated demand for collagen-based dermal treatments. As innovation in delivery formats and multifunctional formulations continues, the Cosmetics segment is expected to sustain its growth trajectory and remain a central pillar in the atelocollagen market.

Atelocollagen Finds Growth in Regenerative Medicine

Atelocollagen is in demand due to the increasing need for regenerative medicine. Its application is utilized in wound healing, among others. The industry is expanding because of rising biomaterials and increasing awareness about regenerative therapies. Additional collagen works perfectly in cosmetic surgeries and dermal fillers, famous for their aesthetic uses. The industry is enhanced by intensified acceptability and awareness of aesthetic operations.

The significant focus on the research and development sector has impacted the innovation of novel products in the sector, resulting in industrial expansion. New advancements in technologies are improving the characteristics and application.

Manufacturers Struggle with Approval and Marketing

The difficulty faced in production methods associated with atelocollagen products is affected by the cost of manufacturing. This is impacting the worth of finished goods and reducing their purchase. To increase sales, effective industrial and educational activities might be necessary. The advantages are ignored by consumers and health professionals, hindering the potential for industry expansion.

Manufacturers face difficulties in approval and marketing sections due to strict government regulations standards. Some of its components can cause allergic reactions in numerous populations, leading to negative reactions. Safety concerns are acknowledged by manufacturers in the atelocollagen market.

Atelocollagen Emerged as the Rising Star in Skincare Products

The demand in skincare products is increasing. Its popularity is gained due to the moisturizing property used in multiple skincare products such as skin lotions, creams, and beauty essences. Companies are increasing their sales through numerous advantages related to atelocollagen for the skin. It is biodegradable and is utilized for various purposes due to its great flexibility. This results in its employment in different sectors and in various forms.

Continually investing in research and innovation helps develop beneficial goods and improves sales. The increasing demand for manufacturing has already improved the lives of millions of individuals. This expansion has been achieved by increasing the purchase of atelocollagen in various sectors through multiple products.

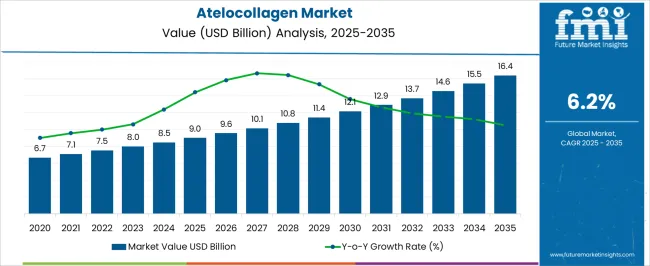

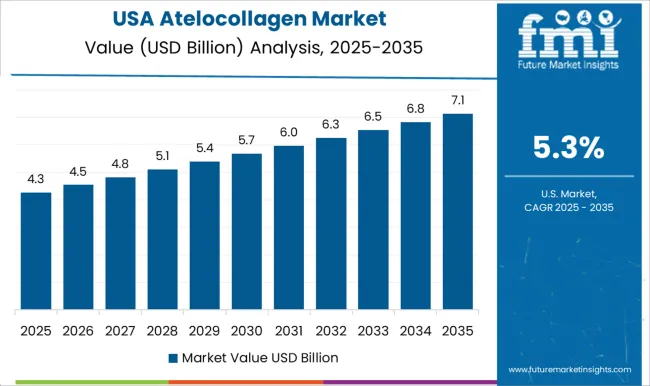

In the comparison of the projected sector, the growth speed was slower at a 4.5% CAGR from 2020 to 2025. The lack of knowledge and technologies in the derma-cosmetic sector impacted growth. Also, the limited availability of products with high cost hindered the growth of the industry.

Additionally, the complexity involved in the process of extraction and the efforts to uphold its soluble form of collagen impacted minimal manufacturing. However, ongoing research and developments could promote an increasing demand among the population in the upcoming years.

The advancement in technologies and rising awareness about skincare and cosmetics are supporting the industry in increasing revenue. The latest trend is that people are getting educated about skin therapy. Hence, adoption of treatments like for aging and fillers to enhance individual looks is apparent. They are searching for safe and beneficial options while affording expensive treatments.

Atelocollagen is the main component that plays the role of a drug in this scenario. It is utilized in different ways for multiple treatment areas. Due to this rising awareness, the industry is on track to experience growing popularity in several sectors, with an anticipated value CAGR of 6.2% from 2025 to 2035.

The forecast of the atelocollagen market reveals its potential in key countries of North America, Asia Pacific, Europe, and others. In Asia Pacific, India is set to experience significant progress with an 8.5% CAGR, surpassing China at 5.7%. The industrial outlook for Australia is also very promising, with an expected CAGR of 6.4%.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United state | 3.5% |

| Germany | 4.2% |

| China | 5.7% |

| India | 8.5% |

| Australia | 6.4% |

The atelocollagen market in the United States is en route to showcase a 3.5% CAGR during the forecast period. The United States is aiming for innovations in cosmetics and regenerative medicine, magnifying the demand for atelocollagen.

With the rapidly improving healthcare infrastructure and a strong emphasis on research and development, the industry has experienced significant growth here. The cosmetics sector utilizes this collagen as a dermal filler. Regenerative tissue is most preferred by consumers in the United States searching for effective anti-aging solutions.

The production of cosmetics provides several opportunities for the industry in China. The country is anticipated to register a value with a CAGR of 5.7% in the forecast period in the atelocollagen market.

China is booming in the medical and pharmaceutical sectors to develop new products related to cosmetics. The sector is estimated to witness rapid revenue growth due to the rising spending power, thriving healthcare equipment, and growing medical tourism in China. China is popular for its cost-effective cosmetics products. The increasing demand for high-end cosmetics production has encouraged manufacturers to innovate applications and stay competitive in the market.

India is projected to showcase a CAGR of 8.5% from 2025 to 2035 in the atelocollagen market. Growing advanced product innovation plays a vital role in pushing demand.

In India, the presence of lucrative opportunities to make it the most attractive country in the Asia Pacific region during the forecast duration. The country has demonstrated the presence of well-developed meat formulation industries. Government agencies focus on expanding the industries to support economic development. Additionally, they are investing in scientific studies to innovate collagen-based products to intensify the growth rate of the industry.

Atelocollagen in liquid form has multiple properties, with the anticipated industry share set at 45.5%. On the other hand, it is mainly in demand in the cosmetics sector, with a of 34.7% share of the atelocollagen market.

| Segment | Liquid (Form) |

|---|---|

| Value Share (2025) | 45.5% |

The atelocollagen can be shared in various forms such as liquid and gel. Its liquid form is easily incorporated into multiple formulations, such as serums, lotions, and creams. Its versatility allows industries to produce a wide range of cosmetic and medicinal products. Liquid atelocollagen is highly used in the cosmetic industry as the main ingredient in anti-aging products.

The liquid formulation offers ease of application and absorption properties. In the clinical medicine sector, liquid collagen is utilized as a healing solution for wounds, tissue repair, and regenerative medicine. Its high purity level and re-engineering capability make it suitable for medical devices and therapeutic applications.

| Segment | Cosmetics (Application) |

|---|---|

| Value Share (2025) | 34.7% |

Owing to its nourishing properties, the demand for atelocollagen is rising fastest due to its utilization in skincare and cosmetics products. Its various beneficial components play a crucial role in manufacturing cosmetic products. Increasing awareness about skincare and cosmetic products surges its popularity in the cosmetic area.

Industry players are also focusing on innovation to attract a wide population and boost sales, thereby magnifying market successes. This collagen is highly used in various skin treatments such as skin repairing, anti-aging, and others.

Atelocollagen plays a crucial role in the pharmaceutical industry. With the growing innovation in the medicinal sector, it is utilized for various purposes, and ongoing development by key players is an important component of the industry. To stay competitive, multiple industry players are focusing on innovations.

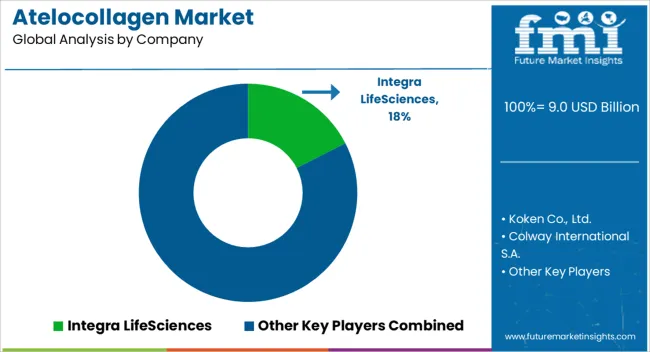

Key atelocollagen market players engage in multiple activities in the industry to stay ahead in the race. Investments in the research department provide them with new product options. Strategic collaboration support to manufacture new products using highly advanced technologies. Partnerships mostly work to reduce competition.

Industry Updates

In January 2025, Essent Biologics, a nonprofit biotechnology company, announced the extraction and purification of human native tissue-derived type I atelocollagen. This includes comprehensive properties. It is the first choice for two- and three-dimensional cell culture, labware coating applications, drug delivery, bioprinting, and as a scaffold for a myriad of tissue engineering modalities.

Based on sources, the industry is categorized into bovine, porcine, shark, and others.

When it comes to form, the industry is trifurcated into liquid, gas, and gel.

Atelocollagen find application in cosmetics, medicine, medical devices, food and supplements, and others.

A regional examination is conducted across key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

The global atelocollagen market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the atelocollagen market is projected to reach USD 16.4 billion by 2035.

The atelocollagen market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in atelocollagen market are bovine, porcine, shark and others.

In terms of form, gel segment to command 36.4% share in the atelocollagen market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Atelocollagen Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA