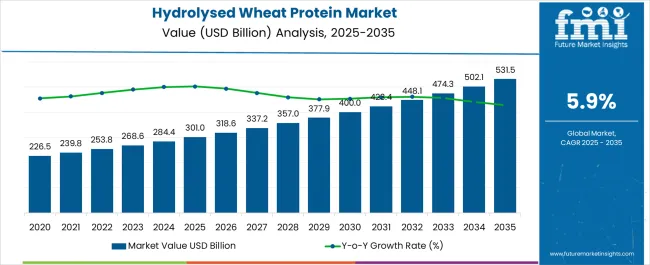

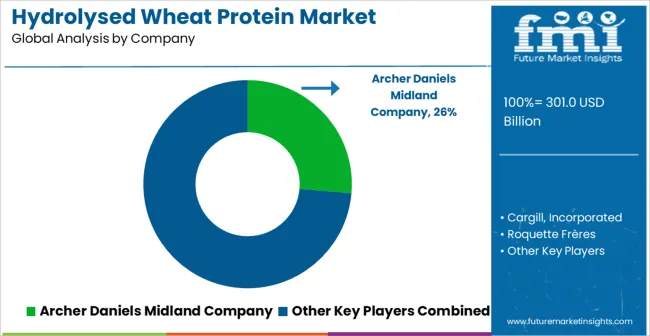

The Hydrolysed Wheat Protein Market is estimated to be valued at USD 301.0 billion in 2025 and is projected to reach USD 531.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Hydrolysed Wheat Protein Market Estimated Value in (2025 E) | USD 301.0 billion |

| Hydrolysed Wheat Protein Market Forecast Value in (2035 F) | USD 531.5 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The Hydrolysed Wheat Protein market is experiencing steady growth driven by increasing consumer demand for protein-enriched formulations across food, beverage, and personal care industries. The current market scenario is characterized by rising health consciousness and awareness of plant-based protein benefits, fueling the adoption of hydrolysed wheat protein in functional foods and nutraceuticals. The market is supported by advances in protein extraction and hydrolysis technologies, which improve solubility, digestibility, and bioavailability, making products more versatile for industrial applications.

Growing investments in bakery and confectionery sectors, where protein fortification enhances texture and nutritional content, further drive market expansion. Additionally, regulatory support for clean-label and organic formulations has encouraged manufacturers to incorporate naturally derived wheat proteins in their formulations.

The future outlook is expected to remain positive, as increasing research into protein-based solutions for sports nutrition, functional foods, and personal care continues to expand potential applications Rising consumer preference for organic and natural ingredients, coupled with the growing trend of protein-fortified products, is anticipated to further enhance market growth and create sustainable opportunities for manufacturers.

The hydrolysed wheat protein market is segmented by nature, application, concentration, sales channel, form, and geographic regions. By nature, hydrolysed wheat protein market is divided into Organic and Conventional. In terms of application, hydrolysed wheat protein market is classified into Bakery, Confectionary, Nutritional Bars, Meat Analogues, Cosmetics, Pet Foods, Personal Care, Nutritional Beverages, and Others. Based on concentration, hydrolysed wheat protein market is segmented into 85% Concentrated, 75% Concentrated, and 95% Concentrated. By sales channel, hydrolysed wheat protein market is segmented into Direct Sales, Indirect Sales, Supermarket/Hypermarket, Online Stores, and Retail Stores. By form, hydrolysed wheat protein market is segmented into Powder Hydrolysed Wheat Protein and Liquid Hydrolysed Wheat Protein. Regionally, the hydrolysed wheat protein industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

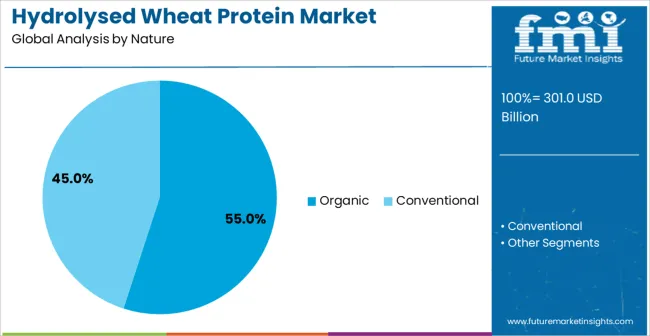

The organic nature segment is projected to hold 55.0% of the Hydrolysed Wheat Protein market revenue share in 2025, establishing it as the leading nature type. This dominance is being attributed to increasing consumer preference for natural and clean-label ingredients, which are perceived as safer and healthier compared to synthetic alternatives. Adoption has been supported by rising awareness regarding organic certifications and their impact on product quality and sustainability.

Organic hydrolysed wheat protein offers enhanced nutritional benefits and reduced allergenicity, making it particularly attractive in food formulations targeting health-conscious consumers. The segment’s growth has been reinforced by expanding applications in bakery, beverages, and personal care products where organic labeling adds value and brand appeal.

Manufacturers have leveraged organic protein to differentiate their offerings in highly competitive markets, while demand from premium product categories has contributed to higher revenue capture Furthermore, the focus on environmentally sustainable production practices aligns with global consumer trends, which has cemented organic hydrolysed wheat protein as the preferred choice among nature-based protein solutions.

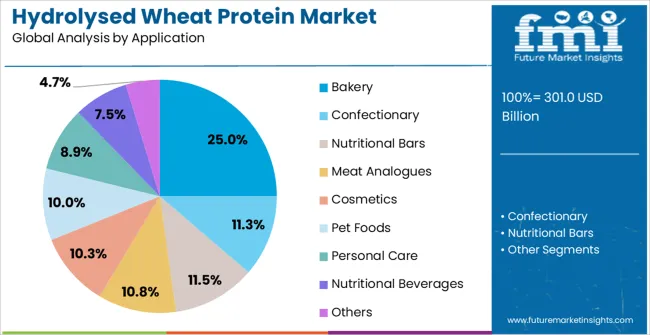

The bakery application segment is expected to account for 25.0% of the Hydrolysed Wheat Protein market revenue share in 2025, emerging as the leading application segment. This growth is being driven by the functional benefits that hydrolysed wheat protein imparts to baked goods, including improved texture, dough strength, and moisture retention. Adoption has been reinforced by the demand for protein-enriched bakery products that cater to health-conscious consumers seeking nutritional enhancement without compromising sensory quality.

Manufacturers have increasingly incorporated hydrolysed wheat protein to extend shelf life and improve structural integrity, particularly in bread, pastries, and specialty baked items. The segment has benefited from rising urbanization and changing dietary habits, which have increased consumption of convenient, protein-fortified bakery products.

Furthermore, the scalability of hydrolysed wheat protein incorporation in industrial bakery production and the ability to meet organic and clean-label criteria have further strengthened its market position As consumer preference for functional and fortified foods continues to rise, the bakery application segment is anticipated to maintain its leadership and drive market growth.

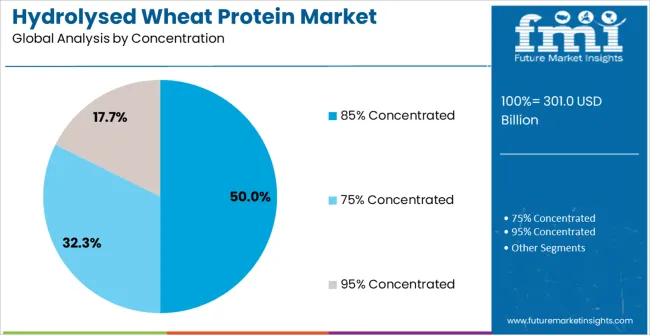

The 85% concentrated hydrolysed wheat protein subsegment is projected to hold 50.0% of the market revenue share in 2025, making it the dominant concentration level. Its growth is being attributed to higher solubility, better nutritional density, and ease of incorporation in diverse formulations, which make it highly desirable for industrial and commercial applications. Adoption has been supported by manufacturers seeking consistent performance in bakery, beverage, and nutraceutical products, where concentrated protein solutions reduce the volume required while maintaining functional properties.

The segment benefits from strong demand in applications requiring rapid mixing, controlled viscosity, and improved texture without compromising protein content. Furthermore, the concentrated formulation allows for greater flexibility in dosage and standardization, which aligns with stringent quality control requirements in commercial food production.

The efficiency and adaptability offered by the 85% concentration have reinforced its preference among formulators, ensuring its leading position within the market Continued focus on functional and clean-label products is expected to sustain growth of this concentrated subsegment across global markets.

Hydrolysed wheat protein is a product derived by the enzymatic hydrolysis of vital wheat gluten. Hydrolysed wheat protein is used in food products such as bakery products, chewy candies, non-dairy creams & nutrition rice flour and as a protein source for fermentation, milk powder replacement, meat products, emulsified sauces and beverages.

Moreover, hydrolysed wheat protein has been known as one of the most impacting pore minimisers in modern personal care products, such as toners, gels, serums, facial cleansers and lotions. It delivers balanced moisture and nourishes gently.

Some of the primary drivers of the hydrolysed wheat protein market include the growing demand for cruelty-free and vegetarian food ingredients, growing obesity issues and the growing incidence of lactose intolerance. These factors have helped increase the overall production and sales of hydrolysed wheat protein.

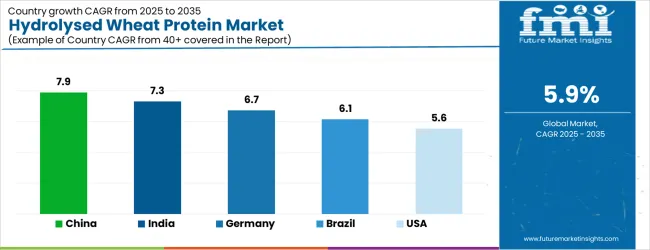

| Country | CAGR |

|---|---|

| China | 7.9% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| USA | 5.6% |

| UK | 5.0% |

| Japan | 4.4% |

The Hydrolysed Wheat Protein Market is expected to register a CAGR of 5.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.9%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Hydrolysed Wheat Protein Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Hydrolysed Wheat Protein Market is estimated to be valued at USD 109.5 billion in 2025 and is anticipated to reach a valuation of USD 109.5 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 14.9 billion and USD 8.6 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 301.0 Billion |

| Nature | Organic and Conventional |

| Application | Bakery, Confectionary, Nutritional Bars, Meat Analogues, Cosmetics, Pet Foods, Personal Care, Nutritional Beverages, and Others |

| Concentration | 85% Concentrated, 75% Concentrated, and 95% Concentrated |

| Sales Channel | Direct Sales, Indirect Sales, Supermarket/Hypermarket, Online Stores, and Retail Stores |

| Form | Powder Hydrolysed Wheat Protein and Liquid Hydrolysed Wheat Protein |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland Company, Cargill, Incorporated, Roquette Frères, MGP Ingredients, Inc., Kerry Group plc, Manildra Group, The Scoular Company, and Tereos SCA |

The global hydrolysed wheat protein market is estimated to be valued at USD 301.0 billion in 2025.

The market size for the hydrolysed wheat protein market is projected to reach USD 531.5 billion by 2035.

The hydrolysed wheat protein market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in hydrolysed wheat protein market are organic and conventional.

In terms of application, bakery segment to command 25.0% share in the hydrolysed wheat protein market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Buckwheat Seed Market Size and Share Forecast Outlook 2025 to 2035

Buckwheat Groat Flour Market

Buckwheat Market

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Spelt Wheat Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Durum Wheat Flour Market

Malted Wheat Flour Market

Organic Wheat Flour Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA