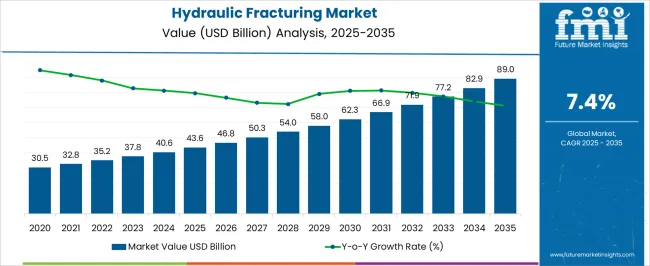

The hydraulic fracturing market stands at USD 43.6 billion in 2025 and is expected to reach USD 89.0 billion by 2035, growing at a CAGR of 7.4%, with a multiplying factor of about 2.04x. Assessing the sensitivity of market growth to macroeconomic conditions reveals how the sector responds to changes in energy demand, oil and gas prices, and industrial activity. Periods of high commodity prices trigger accelerated drilling and stimulation projects, boosting service uptake and revenue generation. Conversely, economic slowdowns or price declines lead to restrained expansion, delayed capital investments, and lower utilization of fracturing services. Regional dynamics also influence growth responsiveness.

North America, particularly the United States, shows strong sensitivity to crude oil and natural gas price fluctuations due to its dependence on shale production. In emerging markets such as parts of Asia and Latin America, growth is initially less reactive, constrained by infrastructure development, regulatory frameworks, and financing availability.

Over the decade, periods of rapid expansion alternate with phases of relative stability, reflecting the interaction between economic conditions and operational scaling. Understanding this responsiveness is critical for stakeholders to optimize project timing, manage investment risks, and align operational strategies, ensuring consistent growth and long-term profitability in the hydraulic fracturing sector.

| Metric | Value |

|---|---|

| Hydraulic Fracturing Market Estimated Value in (2025 E) | USD 43.6 billion |

| Hydraulic Fracturing Market Forecast Value in (2035 F) | USD 89.0 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The hydraulic fracturing market is influenced by multiple upstream sectors. Oil and gas exploration and production companies account for approximately 40%, as fracturing services are essential for shale and tight oil recovery. Equipment and service providers contribute around 27%, supplying pumps, valves, proppants, and fracturing fluids. Chemical manufacturers represent roughly 17%, producing specialized fluids and additives for efficiency and corrosion control. Energy infrastructure and pipeline operators hold close to 10%, providing transport and storage solutions for produced hydrocarbons. Technology, research, and consulting firms make up the remaining 6%, offering monitoring, optimization, and regulatory support.

Advanced fracturing techniques are driving market growth while reducing resource use. Engineered proppants and high-performance fracturing fluids now account for over 34% of total fluid consumption, improving fracture conductivity. Real-time monitoring and automation have enhanced operational efficiency by 10–12%, minimizing downtime. Multi-stage horizontal fracturing in shale formations has increased recovery rates by 15–18% compared to conventional methods. Water recycling and optimized fluid formulations are gaining traction to reduce environmental impact. Digital platforms are increasingly used for predictive maintenance and workflow optimization, ensuring more precise operations and consistent well performance.

The hydraulic fracturing market is experiencing sustained growth, driven by the rising global demand for oil and natural gas and the need to enhance recovery from unconventional reserves. Industry reports and upstream energy sector publications have underscored the role of hydraulic fracturing in optimizing production efficiency, particularly in shale formations and tight reservoirs. Technological advancements in fracturing fluids, proppant materials, and well stimulation equipment have improved operational effectiveness while reducing environmental impact.

Strategic investments by exploration and production companies have expanded drilling activities in both mature and emerging oilfields, supported by favorable government policies in resource-rich regions. Additionally, digital monitoring systems and real-time data analytics have enhanced well performance management, leading to higher recovery rates and cost efficiency.

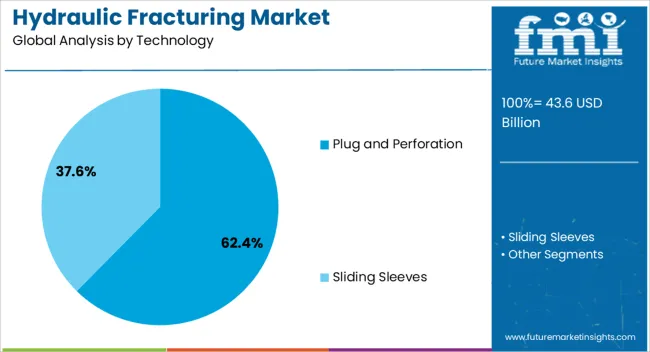

With crude oil prices stabilizing and energy demand projected to grow in the medium term, hydraulic fracturing is expected to remain a critical technology for meeting production targets. Market leadership is anticipated to be driven by plug and perforation technology, horizontal well drilling, and crude oil extraction applications due to their proven performance and economic advantages.

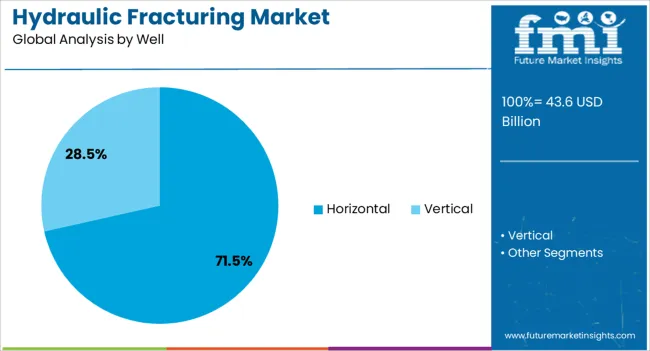

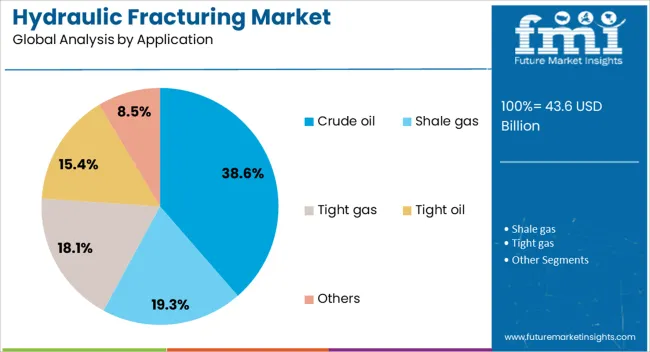

The hydraulic fracturing market is segmented by technology, well, application, and geographic regions. By technology, hydraulic fracturing market is divided into Plug and Perforation and Sliding Sleeves. In terms of well, hydraulic fracturing market is classified into Horizontal and Vertical. Based on application, hydraulic fracturing market is segmented into Crude oil, Shale gas, Tight gas, Tight oil, and Others. Regionally, the hydraulic fracturing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plug and perforation segment is projected to account for 62.4% of the hydraulic fracturing market revenue in 2025, maintaining its dominance as the preferred completion method in unconventional wells. Its growth has been supported by operational flexibility, cost efficiency, and suitability for multi-stage fracturing in horizontal wells.

Field performance data from oilfield service companies have shown that plug and perforation technology enables precise zonal isolation and targeted stimulation, leading to improved hydrocarbon recovery. The ability to adapt to varying geological formations and optimize fracture placement has further increased its adoption.

Additionally, ongoing improvements in plug materials and perforation techniques have reduced operational downtime and enhanced well productivity. As shale development projects expand and operators seek reliable stimulation methods, plug and perforation is expected to retain its leading market share due to its efficiency, scalability, and proven track record in large-scale operations.

The horizontal well segment is projected to contribute 71.5% of the hydraulic fracturing market revenue in 2025, reflecting its critical role in maximizing production from unconventional reserves. Horizontal drilling has been favored for its ability to access larger reservoir areas and enhance contact with hydrocarbon-bearing formations.

Industry analyses and drilling performance reports have highlighted that horizontal wells, when combined with multi-stage hydraulic fracturing, deliver significantly higher output compared to vertical wells. The segment’s growth has also been driven by advances in directional drilling technologies, enabling more precise well placement and reduced surface footprint.

Additionally, horizontal wells offer improved economic returns by increasing recovery rates and reducing the number of wells needed to exploit a given reservoir. With shale and tight oil plays continuing to dominate upstream development, horizontal wells are expected to remain the primary well configuration in hydraulic fracturing operations.

The crude oil segment is projected to account for 38.6% of the hydraulic fracturing market revenue in 2025, sustaining its position as a major application area. Growth in this segment has been supported by the ongoing development of unconventional oil resources and the need to maintain production levels in mature oilfields.

Hydraulic fracturing has been instrumental in boosting output from tight oil formations, particularly in North America and parts of the Middle East. Energy industry publications have noted that crude oil-focused fracturing projects benefit from favorable market pricing, which supports investment in enhanced recovery techniques.

The integration of advanced fracturing fluids, proppants, and monitoring systems has further optimized oil recovery rates while minimizing operational risks. As global oil demand remains robust and operators seek to maximize asset value, the crude oil application segment is expected to maintain its importance in the hydraulic fracturing market, supported by both technological innovation and market fundamentals.

The hydraulic fracturing market is growing due to rising global energy demand and the development of unconventional oil and gas reserves. Fracturing techniques enhance extraction from shale, tight gas, and other low-permeability formations, improving productivity and resource efficiency. North America is a leading region due to extensive shale gas development, while Asia Pacific is emerging with increasing exploration and production activities.

Technological advancements in high-pressure pumps, proppants, and fluid additives improve fracture efficiency, reduce operational costs, and enhance safety. Growing investment in energy infrastructure and digital monitoring systems is driving adoption across onshore and offshore operations. The integration of advanced fracturing technologies supports optimized hydrocarbon recovery and operational performance across multiple geographies.

The growing extraction of shale oil, tight gas, and other unconventional hydrocarbons is a primary driver for hydraulic fracturing. Operators deploy high-pressure fracturing to increase well productivity and enhance reservoir contact. Advancements in horizontal drilling combined with fracturing technology allow operators to access previously uneconomic reserves. Increasing energy consumption, rising natural gas demand for power generation, and industrial applications drive adoption. Fracturing operations also support the development of infrastructure for LNG, petrochemicals, and downstream industries. Enhanced efficiency, improved recovery rates, and scalability reinforce continued growth in hydraulic fracturing adoption worldwide.

Advanced fracturing fluids and engineered proppants create growth opportunities by improving efficiency, fracture propagation, and well longevity. Water-based, slickwater, and gelled fluids enhance permeability and reduce environmental impact. Specialty proppants increase fracture conductivity and maintain structural stability under high pressures. Operators are adopting real-time monitoring and digital analytics to optimize injection parameters and reduce resource consumption. Companies focusing on innovative fluid formulations, environmentally compliant additives, and high-performance proppants are expected to capture significant market opportunities. Integration of these technologies supports enhanced recovery, operational safety, and regulatory compliance across unconventional oil and gas operations globally.

Automation, data analytics, and real-time monitoring are emerging trends in hydraulic fracturing operations. Automated pump systems, sensor integration, and remote monitoring reduce operational errors and improve efficiency. Data-driven fracturing allows precise control of pressure, fluid composition, and proppant injection to optimize recovery. Predictive analytics help anticipate reservoir behavior and reduce operational risks. Companies integrating AI-based modeling, IoT sensors, and digital twins are enhancing operational safety, reducing downtime, and improving overall well performance. These trends support adoption in both mature and emerging markets, enabling more efficient and cost-effective hydrocarbon extraction.

Environmental concerns related to water usage, chemical additives, and induced seismicity present challenges for hydraulic fracturing adoption. Strict regulations on waste disposal, emissions, and well integrity increase operational costs. Compliance with local, national, and international standards requires investment in monitoring, treatment, and reporting systems. Public opposition and permitting delays can also affect project timelines. Operators focusing on eco-friendly fluid formulations, resource optimization, and transparent reporting are better positioned to mitigate risks. Managing environmental impact and regulatory requirements is critical to sustaining growth and maintaining competitiveness in the hydraulic fracturing market.

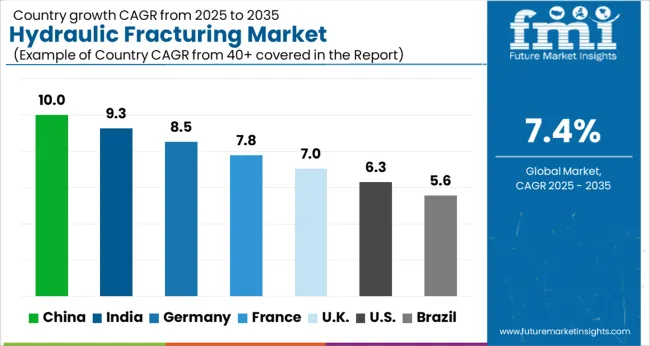

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

The hydraulic fracturing market is growing at a global CAGR of 7.4% from 2025 to 2035, driven by rising energy demand, unconventional resource development, and technological advances in extraction methods. China leads with a CAGR of 10.0%, +35% above the global benchmark, supported by BRICS-driven expansion in shale gas projects, domestic energy initiatives, and investment in advanced fracking technologies. India follows at 9.3%, +26% over the global rate, reflecting growing natural gas exploration, energy security programs, and government-backed infrastructure expansion. Germany records 8.5%, +15% above the global CAGR, shaped by OECD-supported innovations in environmentally compliant extraction and increased focus on alternative energy integration. The United Kingdom posts 7.0%, slightly below the global rate, influenced by selective fracking projects and regulatory oversight. The United States stands at 6.3%, −15% under the global benchmark, reflecting mature shale gas operations and tighter environmental regulations. BRICS economies are driving volume growth, while OECD nations emphasize precision, efficiency, and sustainable operations.

China is recording a CAGR of 10.0%, which is 2.6% higher than the global CAGR of 7.4%, indicating rapid adoption of hydraulic fracturing in shale gas and tight oil extraction. Increasing demand for natural gas in industrial and power generation sectors is driving market expansion. The country is investing in advanced drilling systems, high-efficiency fracturing fluids, and durable proppants to enhance operational performance. Collaboration between domestic energy companies and international technology providers is accelerating deployment of large-scale projects, optimizing recovery rates, and reducing operational downtime. Rising export opportunities for extracted hydrocarbons further strengthen market potential. Growth is supported by technology innovation, expanding shale basins, and government initiatives promoting energy diversification, which collectively position China as a leading market in hydraulic fracturing worldwide.

India is expanding at a CAGR of 9.3%, 1.9% above the global average, driven by growing unconventional hydrocarbon exploration and rising energy requirements. Investment in high-pressure pumps, chemical additives, and optimized fracturing techniques is enhancing efficiency and production yield. Government initiatives to boost domestic natural gas output, coupled with growing industrial and power sector demand, are supporting sustained adoption. Indian operators are forming strategic collaborations with international technology suppliers to deploy advanced hydraulic fracturing systems in emerging shale basins. Expanding domestic capabilities in chemical formulation, proppant sourcing, and equipment manufacturing further strengthens market potential. Rising shale gas and tight oil exploration projects, along with growing industrial consumption, continue to drive steady growth, positioning India as a significant regional contributor to global hydraulic fracturing activity.

Germany is advancing at a CAGR of 8.5%, 1.1% above the global CAGR, supported by industrial natural gas consumption and limited unconventional hydrocarbon exploration. Operators focus on high-precision fracturing techniques to maximize recovery and maintain environmental compliance. Research initiatives in efficiency, operational safety, and risk mitigation are driving adoption in industrial and energy sectors. Germany’s regulatory framework ensures that hydraulic fracturing projects adhere to strict safety and environmental standards. The market is also supported by specialized equipment providers and R&D institutions that supply advanced fracturing solutions for shale and tight formations. Exports of processed hydrocarbons for industrial use, coupled with technological advancements in fracturing methods, maintain consistent demand, enabling Germany to remain a moderately high-growth market within Europe’s hydraulic fracturing sector.

The United Kingdom is expanding at a CAGR of 7.0%, slightly below the global CAGR of 7.4%, reflecting cautious growth due to limited shale reserves and stringent environmental regulations. Hydraulic fracturing activities are concentrated in select unconventional oil and gas projects, focusing on safe and efficient recovery. Operators are adopting environmentally optimized fracturing fluids, precise proppants, and process innovations to improve performance while minimizing risk. Collaboration with European technology providers facilitates access to advanced equipment and operational expertise. Investment in smaller-scale projects and innovative fracturing methods supports incremental growth. Gradual adoption in the industrial, power, and niche hydrocarbon sectors ensures steady market activity. The UK market demonstrates consistent, controlled expansion within the framework of regulatory and environmental constraints.

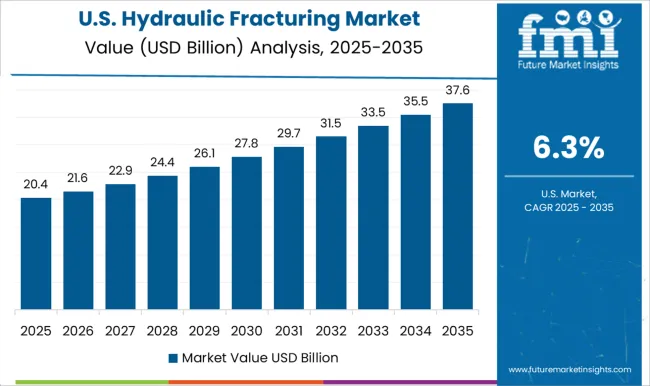

The United States is growing at a CAGR of 6.3%, 1.1% below the global CAGR of 7.4%, reflecting slower expansion due to market maturity. Hydraulic fracturing is concentrated in regions with high shale reserves, including major basins for shale gas and tight oil production. Operators focus on advanced drilling technologies, optimized proppant deployment, and efficiency-enhancing fracturing fluids. Regulatory frameworks limit rapid expansion in certain regions, but investment in process optimization and environmental management sustains steady market activity. Imports of specialized fracturing chemicals and equipment complement domestic production. Increasing adoption of high-efficiency fracturing techniques in commercial and industrial applications, combined with ongoing technological upgrades, ensures consistent output and steady growth, even as the US market approaches saturation relative to emerging countries.

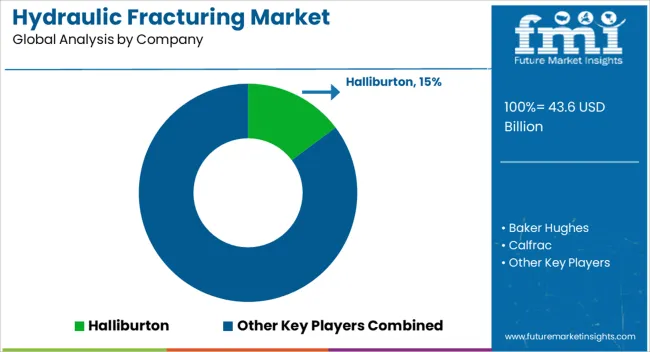

The competitive landscape in the hydraulic fracturing industry has been shaped by consolidation, technology-driven differentiation, and regional service capacity. Dominant players such as Halliburton, Schlumberger, and Baker Hughes maintain scale advantages through integrated service portfolios, advanced fluid chemistries, and digital monitoring capabilities. Key players including Liberty Energy and ProPetro focus on fleet efficiency, electric fracturing spreads, and flexible contract structures to win regional contracts, particularly in North America.

Emerging players compete through specialized sand logistics, water management, and cost-optimized pumping services. Competition is influenced by pricing volatility, where operators balance service costs against well productivity. Differentiation increasingly depends on access to low-emission fleets, digital pressure monitoring, and closed-loop water recycling programs. While North America remains the most competitive and consolidated region, international markets such as Argentina, China, and the Middle East show opportunities for regional service companies.

| Item | Value |

|---|---|

| Quantitative Units | USD 43.6 Billion |

| Technology | Plug and Perforation and Sliding Sleeves |

| Well | Horizontal and Vertical |

| Application | Crude oil, Shale gas, Tight gas, Tight oil, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Halliburton, Baker Hughes, Calfrac, Evolution, Liberty, National Energy Services, NexTier, NOV, ProFrac, Schlumberger, Shell, Tacrom, TechnipFMC, Trican, and Weatherford |

| Additional Attributes | Dollar sales by fracturing type and application, demand dynamics across oil, natural gas, and shale formations, regional trends across North America, Europe, and Asia-Pacific, innovation in waterless fracturing, proppant technologies, and real-time monitoring, environmental impact of water usage, chemical management, and seismic risk, and emerging use cases in unconventional reservoirs and enhanced resource recovery. |

The global hydraulic fracturing market is estimated to be valued at USD 43.6 billion in 2025.

The market size for the hydraulic fracturing market is projected to reach USD 89.0 billion by 2035.

The hydraulic fracturing market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in hydraulic fracturing market are plug and perforation and sliding sleeves.

In terms of well, horizontal segment to command 71.5% share in the hydraulic fracturing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Shale Gas Hydraulic Fracturing Market Outlook – Trends & Forecast 2025–2035

Hydraulic Anchor Drilling Vehicle for Mining Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Gear Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Recloser Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Power Unit Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Squeeze Chute Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Filters Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Dosing Pump Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Fluids Market Analysis - Size, Share, and Forecast 2025 to 2035

Hydraulic Fluids & Process Oil Market Size 2025 to 2035

Hydraulic Pumps Market Growth & Outlook 2025 to 2035

Hydraulic Intensifiers Market Growth – Trends & Forecast 2025 to 2035

Hydraulic Spreader Market

Hydraulic Demolition Machine And Breaker Market

Hydraulic Cab Tilt System Market

TBR Hydraulic Curing Press Market Size and Share Forecast Outlook 2025 to 2035

Electrohydraulic Pump Market Insights by Type, End Use, Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA