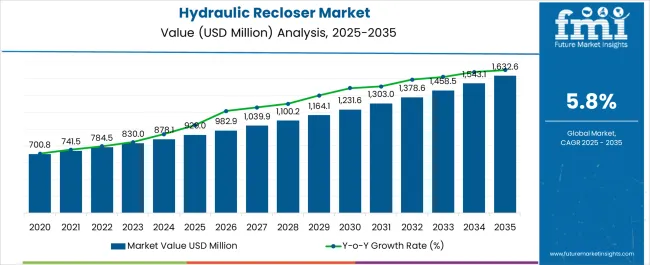

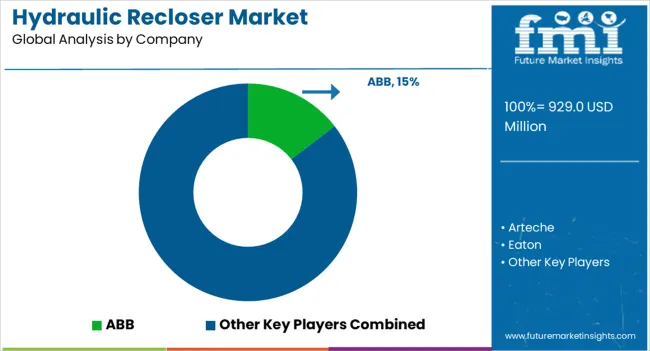

The hydraulic recloser market is expected to expand from USD 929.0 million in 2025 to USD 1,632.6 million by 2035, reflecting a 5.8% CAGR and generating an absolute dollar opportunity of USD 703.6 million. Growth is driven by increasing investment in power distribution networks, the need to improve grid reliability, and rising adoption of automated fault management systems. Hydraulic reclosers are critical for restoring electricity quickly after transient faults while protecting equipment and minimizing downtime, making them essential for utilities in both developed and emerging markets.

Technological enhancements, including remote monitoring, smart grid integration, and improved fault detection capabilities, further support market expansion. Compound absolute growth analysis highlights the cumulative value added over the forecast period. From 2025 to 2028, annual increments are steady, with early adoption concentrated in North America and Europe, driven by grid modernization projects and the replacement of aging equipment. Between 2029 and 2032, growth accelerates as Asia Pacific and Latin America scale up distribution infrastructure to support urbanization, industrial expansion, and renewable energy integration, contributing a larger share of absolute gains. From 2033 to 2035, growth continues at a moderate pace, with revenue increasingly derived from system upgrades, high-capacity models, and advanced monitoring solutions. Overall, the USD 703.6 million opportunity demonstrates how both early adoption and infrastructure-driven acceleration contribute to long-term, compounding expansion in the hydraulic recloser market.

| Metric | Value |

|---|---|

| Hydraulic Recloser Market Estimated Value in (2025 E) | USD 929.0 million |

| Hydraulic Recloser Market Forecast Value in (2035 F) | USD 1632.6 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The hydraulic recloser market is driven by five primary parent markets with specific shares. Power distribution leads with 40%, as hydraulic reclosers enhance grid reliability by automatically restoring power after temporary faults. Transmission networks contribute 25%, using reclosers to protect high-voltage lines and minimize outage impact. Industrial facilities account for 15%, ensuring uninterrupted power for manufacturing, processing, and critical operations. Renewable energy installations represent 10%, integrating reclosers to manage variable generation and grid stability. Utilities and smart grid projects hold 10%, adopting advanced protection devices to improve energy management. These segments collectively define global demand for hydraulic reclosers. Recent developments in the hydraulic recloser market focus on automation, digital monitoring, and energy efficiency. Manufacturers are introducing intelligent reclosers with remote control, fault detection, and predictive maintenance capabilities.

Integration with IoT, SCADA systems, and smart grids enhances real-time monitoring, rapid fault isolation, and operational reliability. Innovations in compact and modular designs are reducing installation space and maintenance requirements. Growing investments in grid modernization, renewable energy integration, and power reliability are driving the adoption of these technologies.

The hydraulic recloser market is expanding steadily, supported by the increasing need for reliable power distribution and fault management in utility networks. These devices provide automated protection by isolating and restoring power after temporary faults, enhancing grid stability and reducing downtime.

Market growth is driven by ongoing investments in rural electrification, network modernization, and grid resilience initiatives. Hydraulic reclosers are valued for their mechanical simplicity, proven reliability, and suitability for remote and challenging environments where electronic reclosers may be less practical.

The market also benefits from growing adoption in regions with aging grid infrastructure, where cost-effective fault protection solutions are in demand. Looking ahead, modernization programs and integration with smart grid monitoring systems are expected to further expand the application scope of hydraulic reclosers, ensuring their continued relevance alongside advanced alternatives.

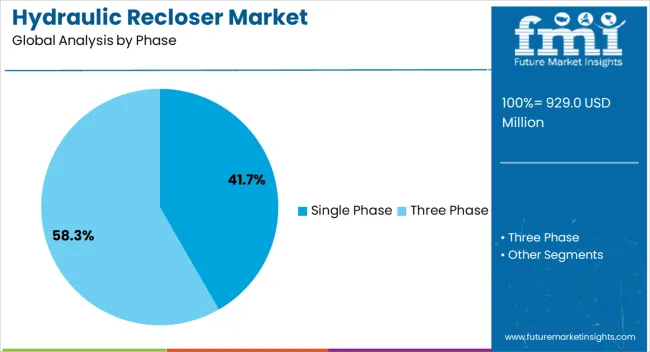

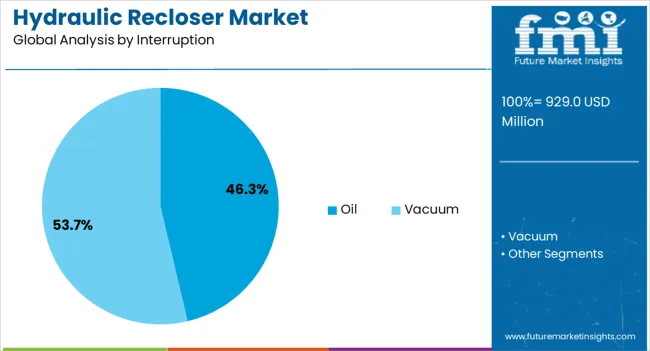

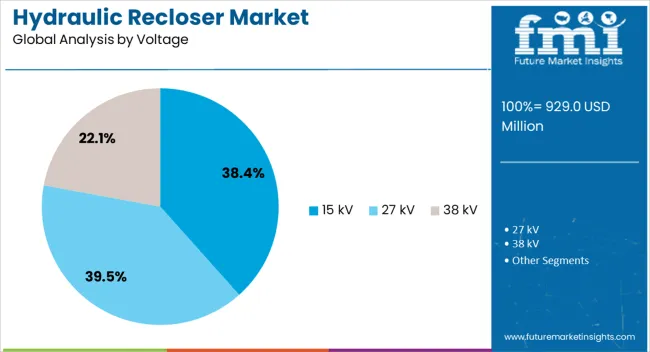

The hydraulic recloser market is segmented by phase, interruption, voltage, and geographic regions. By phase, hydraulic recloser market is divided into Single Phase and Three Phase. In terms of interruption, hydraulic recloser market is classified into Oil and Vacuum. Based on voltage, hydraulic recloser market is segmented into 15 kV, 27 kV, and 38 kV. Regionally, the hydraulic recloser industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single phase segment holds approximately 41.7% share of the phase category in the hydraulic recloser market. This dominance is linked to the extensive use of single-phase distribution lines in rural and suburban areas, where lower load demands and longer feeder lengths are common.

Single-phase hydraulic reclosers offer a cost-effective and reliable means of maintaining service continuity in these networks, minimizing outage duration after transient faults. The segment benefits from ease of installation, reduced maintenance requirements, and adaptability to existing infrastructure without extensive upgrades.

With ongoing rural electrification and network reliability programs, single-phase solutions are expected to retain a significant share of the market.

The oil segment accounts for approximately 46.3% share in the interruption category, supported by its proven insulation and arc-quenching capabilities. Oil-interruption reclosers are preferred in many utility applications due to their ability to handle high fault currents and provide long service life under varying environmental conditions.

Their mechanical robustness and operational stability make them suitable for remote and less-accessible installations. Despite the gradual shift toward vacuum and solid dielectric technologies, oil reclosers maintain strong market presence where cost constraints and existing operational familiarity favor their use.

Continued demand from regions prioritizing durable, field-tested solutions will likely sustain the oil segment’s relevance.

The 15 kV segment leads the voltage category with approximately 38.4% share, primarily due to its suitability for medium-voltage distribution networks in both urban and rural settings. This voltage level strikes an effective balance between capacity and cost, making it widely adopted in overhead line protection.

The segment benefits from its compatibility with common feeder configurations and ease of integration into existing systems.

As utilities expand and upgrade their medium-voltage networks to improve reliability and reduce downtime, 15 kV hydraulic reclosers are expected to maintain their leadership position.

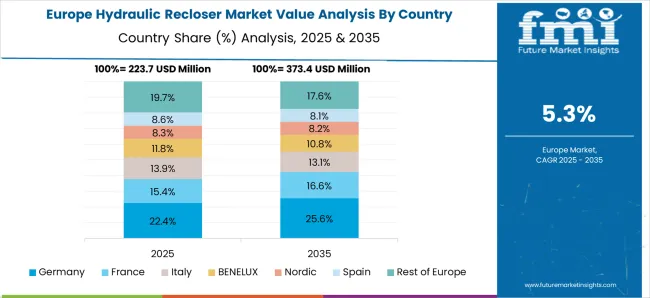

The hydraulic recloser market is expanding due to rising electricity demand, grid modernization, and the need for reliable distribution networks. North America accounts for approximately 30% of adoption, driven by upgrades in rural and urban distribution grids. Europe emphasizes smart grid integration and automation, while Asia Pacific leads in high-voltage rural electrification projects in China, India, and Southeast Asia. Hydraulic reclosers enhance power reliability, reduce outage times, and improve system safety. Adoption is rising in utility, industrial, and renewable energy sectors, driven by operational efficiency and regulatory compliance.

The primary driver of the hydraulic recloser market is the need for enhanced power distribution reliability. Utilities in North America and Europe are modernizing aging grids, replacing conventional fuses with hydraulic reclosers to minimize outage duration and improve fault management. Asia Pacific’s rapid rural electrification programs require reclosers to maintain uninterrupted supply in industrial, agricultural, and residential areas. Hydraulic reclosers can automatically restore power after transient faults, reducing downtime by 30–50% compared with traditional systems. Rising investment in renewable energy integration and distribution network automation further accelerates adoption, making hydraulic reclosers a critical component in modern power distribution systems.

Opportunities are arising from renewable energy adoption, microgrid development, and smart grid deployment. Integration of distributed generation sources, such as solar and wind farms, necessitates protective devices capable of handling variable loads and fault currents. Hydraulic reclosers are increasingly installed in distribution networks with high penetration of renewable energy to maintain stability and safety. Asia Pacific’s industrial and rural electrification projects present strong growth potential. Europe is investing in automated recloser networks connected to SCADA and advanced monitoring systems. Manufacturers offering intelligent, modular, and remotely controllable hydraulic reclosers can capture opportunities across utility, industrial, and renewable energy segments globally.

Key trends include smart grid integration, remote operation, and digital monitoring. Modern hydraulic reclosers come with IoT-enabled sensors, providing real-time data on current, voltage, and device status for predictive maintenance. Europe and North America lead in integrating hydraulic reclosers with SCADA systems for automated fault isolation and grid optimization. Asia Pacific is adopting compact and modular designs for rural and industrial applications. Electrification of distribution lines combined with advanced control software allows utilities to monitor and control reclosers remotely, improving operational efficiency by 15–20%. These trends reflect the global shift toward digitalized, intelligent power distribution networks.

Despite benefits, hydraulic reclosers face constraints due to high capital investment and technical complexity. High-voltage units require skilled installation, calibration, and regular maintenance to ensure safe and reliable operation. Costs are higher than conventional fuses or air-break switches, limiting adoption in small utilities and developing regions. Environmental conditions, such as extreme temperatures and humidity, can impact performance, requiring additional protective measures. In emerging economies, limited trained personnel and lack of standardized maintenance protocols slow adoption. Manufacturers are focusing on modular, energy-efficient, and easy-to-install designs to mitigate these challenges and expand global adoption across utility and industrial distribution networks.

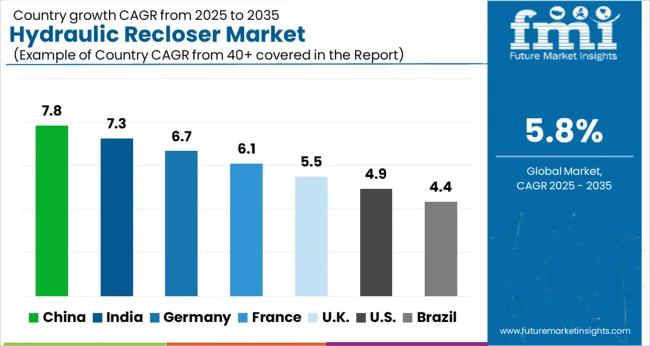

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The hydraulic recloser market is expected to grow at a global CAGR of 5.8%, supported by increasing demand for reliable power distribution, grid modernization, and industrial electrification. China leads with 7.8%, a 1.34× multiple of the global benchmark, driven by BRICS-backed infrastructure development, renewable energy integration, and urban electrification projects. India follows at 7.3%, a 1.26× multiple, reflecting rising industrial demand, government-led rural electrification, and smart grid initiatives. Germany records 6.7%, a 1.15× multiple, shaped by OECD-focused energy efficiency, grid automation, and renewable deployment. The United Kingdom posts 5.5%, slightly below the global rate, supported by urban infrastructure and selective industrial applications. The United States stands at 4.9%, 0.85× the benchmark, with demand driven by grid reliability improvements and modernization projects. BRICS countries drive volume growth, OECD markets emphasize advanced technology and operational efficiency, and ASEAN regions contribute through expanding electrification and industrial infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The hydraulic recloser market in China is projected to grow at a CAGR of 7.8%, driven by grid modernization, renewable energy integration, and increasing electricity demand. Domestic manufacturers such as TBEA, XD Electric, and ABB supply advanced hydraulic reclosers designed for reliability, automation, and minimal maintenance. Adoption is concentrated in distribution networks, renewable energy substations, and urban industrial areas requiring voltage stability and outage minimization. Technological trends include remote monitoring, intelligent control, and integration with smart grid systems. Government initiatives to enhance power reliability and expand renewable energy networks support market growth. Rising investment in urban and industrial infrastructure further reinforces the adoption of hydraulic reclosers across China.

The hydraulic recloser market in India is expected to grow at a CAGR of 7.3%, supported by rural electrification, renewable energy integration, and urban grid upgrades. Companies such as ABB, Crompton Greaves, and BHEL are supplying hydraulic reclosers with intelligent controls, automation features, and enhanced reliability. Adoption is concentrated in rural and semi-urban distribution networks, industrial hubs, and renewable energy substations. Government initiatives for smart grids, improved power reliability, and reduction of outage times encourage growth. Technological trends include remote monitoring, fault detection automation, and compact designs for urban substations. Increasing electricity demand and grid expansion drive market momentum across India.

The hydraulic recloser market in Germany is projected to grow at a CAGR of 6.7%, driven by grid automation, renewable power integration, and industrial demand. Key suppliers such as Siemens, ABB, and Schneider Electric are providing advanced reclosers with high reliability, automation, and remote monitoring. Adoption is concentrated in distribution networks serving urban areas, industrial facilities, and renewable energy substations. Technological trends include smart grid compatibility, automated fault detection, and energy-efficient designs. Germany’s emphasis on renewable integration, grid reliability, and industrial efficiency strengthens adoption. Investments in modernizing substations and industrial distribution networks reinforce market growth.

The hydraulic recloser market in the United Kingdom is expected to expand at a CAGR of 5.5%, supported by grid reliability initiatives, renewable energy integration, and industrial power demand. Suppliers including ABB, Siemens, and Schneider Electric provide advanced hydraulic reclosers with automation, fault detection, and remote monitoring capabilities. Adoption is concentrated in distribution networks, industrial hubs, and renewable energy substations. Government policies promoting low-emission power, efficient distribution, and smart grid adoption reinforce growth. Expansion of urban and industrial power infrastructure, combined with automation initiatives, further drives market adoption.

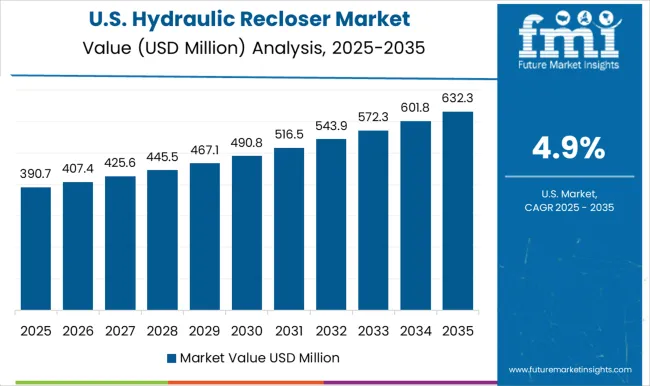

The hydraulic recloser market in the United States is projected to grow at a CAGR of 4.9%, driven by distribution network modernization, renewable energy integration, and industrial power demand. Leading suppliers such as ABB, Eaton, and Siemens provide hydraulic reclosers with intelligent controls, fault detection automation, and remote monitoring. Adoption is concentrated in urban and industrial substations, renewable power facilities, and utility distribution networks. Technological trends include smart grid integration, automation, and energy-efficient designs. Federal and state initiatives supporting renewable energy and grid reliability encourage adoption, while rising electricity consumption strengthens demand across the United States.

Competition in the hydraulic recloser market is driven by global electrical equipment providers and specialized switchgear manufacturers, focusing on reliability, automation, and fault management. ABB, Eaton, and S\&C Electric lead with high-performance reclosers, emphasizing rapid response, remote monitoring, and integration with smart grid systems in their brochures. G\&W Electric, Noja Power, and Hughes Power System target distribution networks, highlighting durability, maintenance ease, and precise fault interruption. Arteche, Entec, and Ensto focus on modular and compact designs, suitable for urban and rural distribution environments, emphasizing adaptability and long service life. Hubbell combines advanced control systems with rugged mechanical design, catering to diverse operational conditions. Brochures highlight switching capacity, operational cycles, and compliance with international standards, enabling buyers to assess reliability and technical performance. Marketing materials shape competitive positioning, combining schematics, operational guidance, and maintenance recommendations. Frequent updates reflect technological advances, enhanced automation features, and evolving regulatory requirements. Larger manufacturers leverage global networks and brand recognition, while smaller players emphasize customization, niche applications, and rapid deployment. Market leadership is determined by how effectively brochures communicate durability, operational precision, and long-term value in hydraulic recloser solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 929.0 Million |

| Phase | Single Phase and Three Phase |

| Interruption | Oil and Vacuum |

| Voltage | 15 kV, 27 kV, and 38 kV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Arteche, Eaton, Entec, Ensto, G&W Electric, Hubbell, Hughes Power System, Noja Power, Rockwell, and S&C Electric |

| Additional Attributes | Dollar sales by recloser type and end use, demand dynamics across utilities, industrial, and commercial power distribution, regional trends in grid modernization and outage management, innovation in automation, fault detection, and reliability, environmental impact of oil use and disposal, and emerging use cases in smart grids, renewable integration, and remote monitoring. |

The global hydraulic recloser market is estimated to be valued at USD 929.0 million in 2025.

The market size for the hydraulic recloser market is projected to reach USD 1,632.6 million by 2035.

The hydraulic recloser market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in hydraulic recloser market are single phase and three phase.

In terms of interruption, oil segment to command 46.3% share in the hydraulic recloser market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydraulic Anchor Drilling Vehicle for Mining Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Gear Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Fracturing Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Power Unit Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Squeeze Chute Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Filters Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Dosing Pump Market Size and Share Forecast Outlook 2025 to 2035

Recloser Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Fluids Market Analysis - Size, Share, and Forecast 2025 to 2035

Hydraulic Fluids & Process Oil Market Size 2025 to 2035

Hydraulic Pumps Market Growth & Outlook 2025 to 2035

Hydraulic Intensifiers Market Growth – Trends & Forecast 2025 to 2035

Hydraulic Spreader Market

Hydraulic Cab Tilt System Market

Hydraulic Demolition Machine And Breaker Market

TBR Hydraulic Curing Press Market Size and Share Forecast Outlook 2025 to 2035

Electrohydraulic Pump Market Insights by Type, End Use, Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA