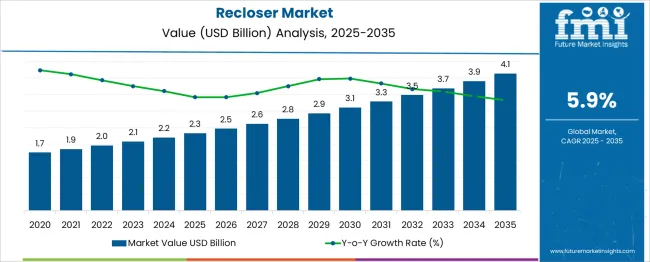

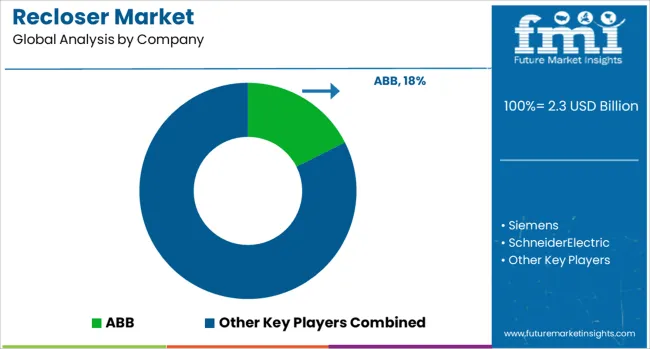

The Recloser Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 4.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. Analysis of the market maturity curve and adoption lifecycle indicates a structured progression through three distinct phases over the forecast period. During the early adoption phase, prior to 2025, market penetration was concentrated in technologically advanced regions where utilities and industrial operators prioritized reliability and grid automation. The market during this phase experienced modest growth as investments were directed toward pilot projects and selective upgrades, establishing foundational demand and proving operational benefits. From 2025 to 2030, the market transitions into a scaling phase.

The steady increase from USD 2.3 billion to USD 3.3 billion reflects broader adoption across both mature and emerging electricity distribution networks. Technological improvements in digital monitoring, remote control capabilities, and integration with smart grid infrastructure support this growth, driving adoption among utilities seeking enhanced grid resilience and reduced downtime. Beyond 2030, from 2030 to 2035, the market enters a consolidation phase, with values approaching USD 4.1 billion. Growth during this period reflects standardization of recloser technologies, wider integration into automated grid systems, and gradual saturation in established markets. The lifecycle positioning of different product segments, such as mechanical, solid-state, and hybrid reclosers, aligns with their technological maturity, with solid-state devices occupying a growth-driven phase while mechanical reclosers reflect late-stage consolidation. The Market demonstrates a predictable adoption lifecycle with progressive scaling and stabilization over the 2025–2035 horizon.

| Metric | Value |

|---|---|

| Recloser Market Estimated Value in (2025 E) | USD 2.3 billion |

| Recloser Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The recloser market is experiencing robust growth driven by the increasing need for automated and efficient electrical distribution systems worldwide. The modernization of power grids, particularly in developing economies, has necessitated advanced fault detection and isolation solutions, positioning reclosers as critical components in minimizing outage durations and enhancing grid reliability.

Investments in smart grid technologies and growing adoption of renewable energy sources have further accelerated demand for intelligent recloser systems. Regulatory mandates emphasizing grid resilience and the reduction of power interruptions are fostering the deployment of more sophisticated recloser designs.

The transition from traditional electromechanical devices to electronic and vacuum interruption technologies is enabling faster response times and improved operational flexibility. As utilities and industrial users seek to optimize load management and reduce maintenance costs, the recloser market is anticipated to witness sustained expansion through 2035, supported by integration with digital monitoring and control platforms.

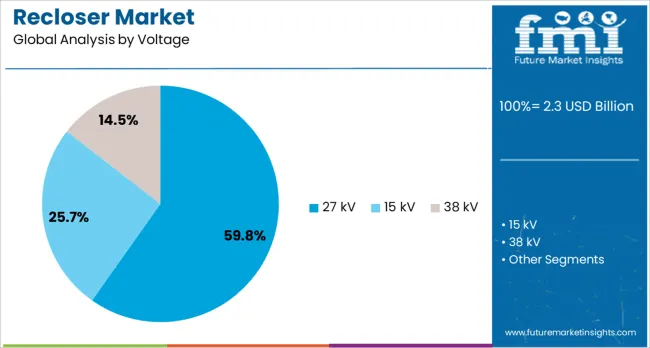

The recloser market is segmented by phase, control, interruption voltage, and geographic regions. By phase, the recloser market is divided into single-phase and three-phase. In terms of control, the recloser market is classified into Electronic and Hydraulic. The recloser market is segmented based on interruption into Vacuum Oil. The voltage of the recloser market is segmented into 27 kV, 15 kV, and 38 kV. Regionally, the recloser industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

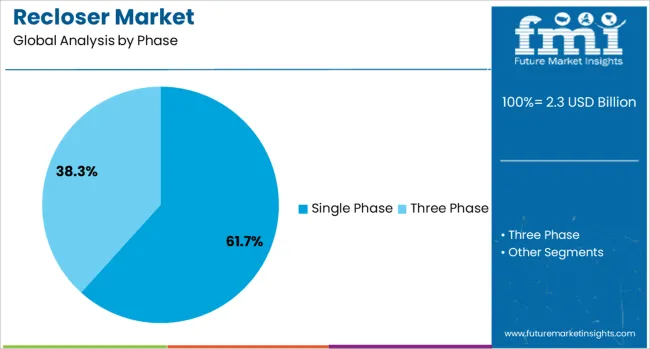

The single phase segment is expected to capture 61.7% of the recloser market revenue share by 2025, reflecting its dominance in distribution network applications. This segment's growth is driven primarily by the widespread presence of single-phase lines in residential and rural electrification projects.

Single phase reclosers are favored for their cost efficiency, ease of installation, and suitability for lower voltage systems where load demands are moderate. The segment benefits from the increasing focus on improving the reliability of low-voltage distribution networks, especially in regions expanding grid access to remote areas.

Their compatibility with smart grid upgrades and ability to support remote operation and fault management contribute to their leading position. Additionally, ongoing technological advancements in sensor integration and electronic trip controls have enhanced the performance and responsiveness of single phase reclosers, further supporting market expansion.

The electronic control segment is projected to hold 58.3% of the market revenue share in 2025, underscoring the shift toward digital and intelligent control systems in recloser technology. Electronic controls provide enhanced precision in fault detection and improved automation capabilities compared to traditional mechanical controls.

The segment's growth is supported by increasing adoption of microprocessor-based relays and communication-enabled devices, which facilitate integration with supervisory control and data acquisition systems (SCADA). Enhanced programmability and remote configuration have made electronic control reclosers attractive to utilities aiming to reduce outage times and optimize asset management.

Moreover, electronic controls enable advanced features such as adaptive reclosing and sectionalizing, contributing to improved grid resilience and operational efficiency. These capabilities have made the electronic control segment a key driver of innovation in the recloser market.

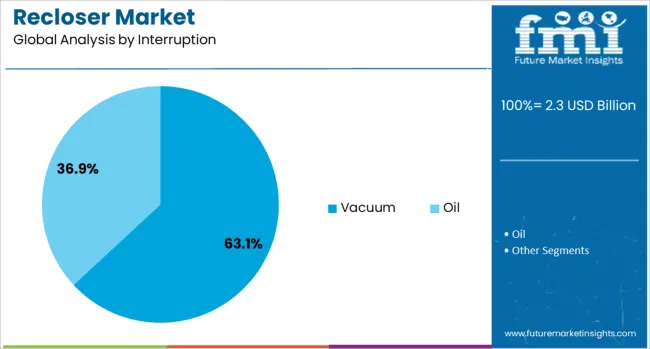

The vacuum interruption segment is expected to command 63.1% of the recloser market revenue share by 2025, reflecting its prominence as the preferred interruption technology. Vacuum interrupters offer significant advantages such as longer service life, minimal maintenance requirements, and superior arc quenching performance, making them highly suitable for medium voltage applications.

Their environmentally friendly design, which eliminates the use of gases such as SF6, aligns with the growing regulatory emphasis on sustainable electrical equipment. The high dielectric strength and rapid interruption capabilities of vacuum technology enhance the reliability and safety of reclosers under various fault conditions.

These factors have led to accelerated adoption of vacuum interrupters in new installations and retrofits, particularly in regions emphasizing grid modernization and sustainability. The segment’s growth is further supported by continuous improvements in vacuum interrupter manufacturing and design, enhancing their efficiency and cost-effectiveness.

The market has been growing steadily due to the rising demand for reliable power distribution, grid resilience, and automation in electrical networks. Reclosers have been extensively used to detect, isolate, and restore faults in medium- and low-voltage distribution systems, reducing downtime and improving operational efficiency. Market growth has been supported by technological advancements, integration with smart grid systems, and regulatory emphasis on grid reliability. Increasing electricity demand, aging infrastructure, and the adoption of digital monitoring systems have further driven the deployment of reclosers globally.

The growing need for uninterrupted electricity supply and efficient distribution has been a major driver of the recloser market. Utilities have relied on reclosers to automatically isolate faults, reduce outage durations, and maintain stability in medium- and low-voltage networks. The increasing complexity of distribution systems, particularly in urban and industrial areas, has necessitated the deployment of automated switching devices to minimize manual intervention and operational costs. Adoption has been further influenced by expanding renewable energy integration, which introduces variable loads and requires responsive fault management. Additionally, modernization of aging infrastructure in North America, Europe, and Asia-Pacific has emphasized the need for reclosers to improve grid resilience, reduce system losses, and enhance overall reliability. The combination of operational efficiency, cost reduction, and improved power quality has reinforced recloser utilization in contemporary electricity networks.

Advances in recloser technology have enhanced fault detection, switching speed, and remote operability. Modern reclosers are equipped with digital sensors, communication modules, and intelligent control units that enable integration into supervisory control and data acquisition systems (SCADA) and smart grid platforms. These systems allow utilities to monitor performance, predict maintenance needs, and optimize distribution network operations in real time. Intelligent reclosers support adaptive protection schemes, load management, and coordination with other grid devices, reducing outage durations and minimizing equipment damage. The development of solid-state and vacuum interrupter technologies has improved switching reliability and reduced environmental impacts. These technological enhancements have allowed reclosers to meet stringent operational and regulatory requirements while enabling utilities to implement automated, data-driven grid management strategies efficiently.

The increasing integration of renewable energy sources, such as solar and wind, has significantly influenced recloser deployment. Distributed generation introduces variable voltage and load fluctuations, increasing the risk of faults and power interruptions in distribution networks. Reclosers have been employed to detect and isolate faults swiftly, ensuring stable electricity supply and protecting downstream equipment. In regions with high renewable penetration, adaptive recloser configurations allow utilities to balance load flows and maintain grid stability. The growing adoption of microgrids and off-grid renewable systems has also reinforced the importance of reclosers in fault management and load control. By enabling seamless coordination between distributed energy resources and the main grid, reclosers have become critical for modern electricity networks seeking resilience, efficiency, and reliability.

Emerging economies have created significant growth opportunities for the recloser market due to rapid urbanization, industrialization, and expansion of electricity infrastructure. Upgrading existing distribution networks and implementing modern protection systems have driven demand for advanced reclosers. Investments in smart grid initiatives, rural electrification programs, and industrial power distribution projects have increased the deployment of both mechanical and solid-state reclosers. Manufacturers have also introduced cost-effective solutions tailored for developing regions, with features such as simplified installation, remote monitoring, and modular design. Furthermore, regulatory policies promoting grid resilience and reliability have encouraged utilities to adopt modern recloser solutions. As power networks expand and upgrade globally, the market for reclosers is expected to continue growing, supported by infrastructure modernization, technology adoption, and increasing electricity consumption.

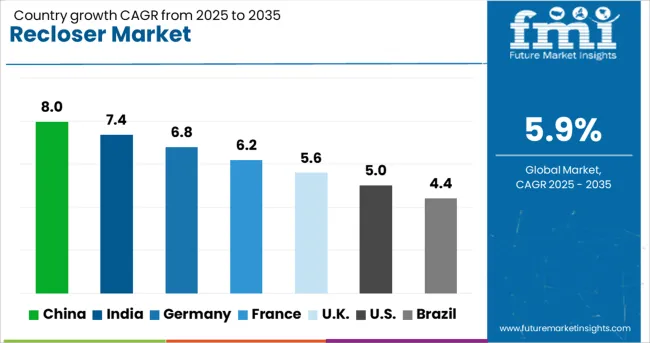

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The market is projected to grow at a CAGR of 5.9% between 2025 and 2035, driven by the modernization of electrical distribution networks, integration of smart grid technologies, and rising demand for reliable power restoration systems. China leads with an 8.0% CAGR, supported by large-scale grid upgrades and advanced distribution automation. India follows at 7.4%, fueled by increasing electrification initiatives and smart grid deployments. Germany, at 6.8%, benefits from investments in grid resilience and renewable energy integration. The UK, with a 5.6% CAGR, sees growth through modernization of aging distribution infrastructure. The USA, at 5.0%, experiences steady adoption due to grid reliability and automation efforts. This report includes insights on 40+ countries; the top markets are shown here for reference.

The demand for reclosers in China is projected to grow at a CAGR of 8.0% from 2025 to 2035, driven by investments in smart grid modernization and distribution network reliability. Utilities are deploying advanced reclosers to reduce outage durations and improve fault detection capabilities. Domestic manufacturers such as State Grid Electric and TBEA are integrating digital control systems to optimize operational efficiency. Expansion of renewable energy projects and decentralized power generation is further increasing the requirement for automatic switching and fault isolation solutions.

The Indian recloser industry is expected to expand at a CAGR of 7.4%, supported by grid reliability projects and rural electrification initiatives. Manufacturers including Crompton Greaves and ABB India have introduced compact and automated solutions to manage low and medium voltage networks efficiently. The need for faster fault clearing and improved operational safety is driving adoption. Government-backed programs for renewable energy integration and distribution network upgrades are strengthening demand.

Sales of reclosers in Germany are forecast to grow at a CAGR of 6.8%, propelled by the modernization of power distribution systems and renewable energy integration. Companies such as Siemens Energy and Schneider Electric are implementing digital reclosers with advanced diagnostics and communication capabilities. Microgrid projects and industrial automation have increased the demand for reliable switching equipment. Energy efficiency programs and regulatory standards are encouraging utilities to upgrade aging infrastructure.

The United Kingdom is anticipated to see recloser demand grow at a CAGR of 5.6%, driven by urban and rural distribution network upgrades. Leading manufacturers including Schneider Electric UK and ABB are focusing on compact, automated reclosers to manage distributed generation and improve reliability. Investments in smart grid technologies and fault monitoring solutions are increasing adoption across residential and commercial segments.

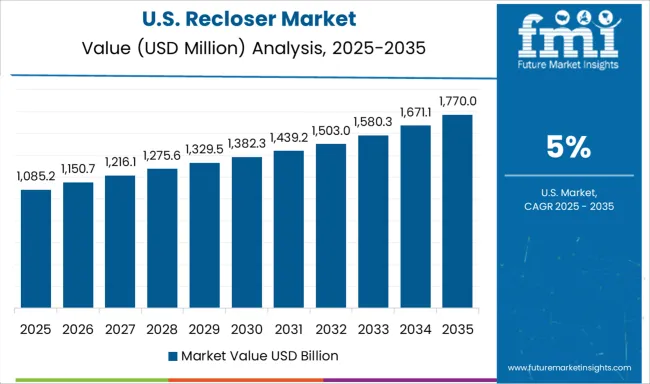

In the United States, the recloser market is forecast to grow at a CAGR of 5.0% between 2025 and 2035, supported by grid automation and reliability improvement projects. Companies such as Eaton and ABB are providing intelligent reclosers with enhanced fault detection, sectionalizing, and communication capabilities. Increased renewable energy penetration and distributed generation have strengthened demand. Utilities are upgrading aging infrastructure with advanced switching solutions to reduce downtime and improve operational efficiency.

The market is driven by demand for reliable and automated fault protection systems across distribution networks. ABB, Siemens, and Schneider Electric lead the market with high-voltage and medium-voltage reclosers offering advanced monitoring, remote control, and integration with smart grid technologies. Eaton and S&C Electric provide durable solutions designed for harsh environmental conditions and complex distribution topologies, enhancing grid resilience. Noja Power and G&W Electric focus on innovative vacuum and solid dielectric reclosers optimized for compact installations and rapid fault clearance.

ABB, Eaton, Siemens, and Schneider Electric are emphasizing advanced automation and digital reclosers with SCADA and IoT integration, strengthening their role in smart grid deployments. Eaton has focused on modular designs that reduce maintenance time while providing real-time monitoring, targeting utilities in North America and Europe. General Electric has expanded its offering with adaptive protection features to handle fluctuating renewable inputs, aligning its strategy with the fast adoption of distributed generation. G&W Electric has differentiated itself with its Viper-HV recloser, the industry’s first pole-mounted solution at 72.5 kV, directly targeting the gap between traditional reclosers and substation breakers. NOJA Power has pursued a sustainability-driven strategy, expanding its OSM series reclosers that are free from SF₆ gas or mineral oil and already deployed in more than 100 countries, supported by a manufacturing expansion in Brisbane to meet export demand. Hubbell and Tavrida Electric have focused on compact and cost-efficient recloser systems, offering utilities competitive pricing while maintaining reliability, making them strong contenders in emerging markets. Arteche and ENTEC have concentrated on regional expansion with partnerships to local utilities, emphasizing customization and after-sales support as differentiating factors.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Phase | Single Phase and Three Phase |

| Control | Electronic and Hydraulic |

| Interruption | Vacuum and Oil |

| Voltage | 27 kV, 15 kV, and 38 kV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Siemens, SchneiderElectric, S&CElectric, Eaton, NojaPower, G&WElectric, Rockwell, Hubbell, Arteche, Shinsung, TavridaElectric, Ensto, HughesPowerSystem, and Entec |

| Additional Attributes | Dollar sales by recloser type and application segment, demand dynamics across distribution networks, renewable energy integration, and utility grid modernization, regional trends in deployment across North America, Europe, and Asia-Pacific, innovation in smart grid connectivity, fault detection, and automated switching technologies, environmental impact of reduced outage-related emissions, equipment lifecycle management, and material recycling, and emerging use cases in microgrid protection, renewable power stabilization, and automated utility network operations. |

The global recloser market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the recloser market is projected to reach USD 4.1 billion by 2035.

The recloser market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in recloser market are single phase and three phase.

In terms of control, electronic segment to command 58.3% share in the recloser market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compact Recloser Replacement Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Recloser Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Solid Vacuum Reclosers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA