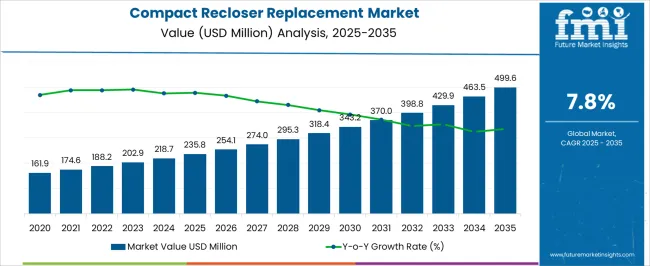

The compact recloser replacement market is expected to rise from USD 235.8 million in 2025 to USD 499.6 million in 2035, registering a CAGR of 7.8%. This expansion represents an absolute dollar opportunity of USD 263.8 million over the forecast period. Early growth phases see the market increasing from USD 254.1 million in 2026 to USD 295.3 million in 2029, reflecting steady adoption and incremental revenue gains.

By 2031, the market will reach USD 343.2 million, highlighting mid-term growth momentum. These predictable increments provide manufacturers and distributors opportunities to optimize production, enhance supply chains, and strengthen their presence in the market. In the later phase, the market experiences the most significant absolute gains, advancing from USD 398.8 million in 2032 to USD 499.6 million in 2035. This period accounts for roughly USD 100.8 million in incremental revenue, illustrating accelerated adoption and replacement cycles. Intermediate benchmarks, such as USD 370.0 million in 2031 and USD 429.9 million in 2034, indicate bridging periods where steady growth sustains momentum.

The cumulative USD 263.8 million opportunity underscores the potential for long-term revenue generation. Companies aligning production, inventory, and distribution strategies with these growth milestones will capture maximum value in the compact recloser replacement market.

| Metric | Value |

|---|---|

| Compact Recloser Replacement Market Estimated Value in (2025 E) | USD 235.8 million |

| Compact Recloser Replacement Market Forecast Value in (2035 F) | USD 499.6 million |

| Forecast CAGR (2025 to 2035) | 7.8% |

In the compact recloser replacement market, the first breakpoint occurs between 2025 and 2027, as the market grows from USD 235.8 million to USD 254.1 million. This early phase reflects steady adoption with annual increments of roughly USD 9–10 million, establishing a foundation for predictable growth. The next notable breakpoint is observed around 2029–2031, when the market advances from USD 295.3 million to USD 343.2 million.

During this stage, the market experiences faster expansion, signaling higher absolute dollar growth and highlighting opportunities for manufacturers and distributors to scale production, enhance supply chains, and capture incremental revenue during this accelerating phase. The final major breakpoint emerges between 2032 and 2035, as the market surges from USD 398.8 million to USD 499.6 million, representing the largest absolute dollar increase in the forecast period. Intermediate years, such as USD 429.9 million in 2034, act as bridging periods that maintain momentum before reaching the peak.

The compact recloser replacement market is witnessing robust growth as aging electrical distribution infrastructure drives demand for advanced, reliable fault management solutions. The current market scenario is shaped by increasing investments in grid modernization, driven by the need for improved power quality, enhanced reliability, and integration of renewable energy sources.

Growing urbanization and industrialization have amplified the requirement for smart reclosers that enable faster fault detection and isolation, minimizing outage duration. Technological advancements in compact, modular designs allow easier installation and maintenance, contributing to wider adoption.

Future growth opportunities are expected to be supported by regulatory mandates for grid resilience, rising adoption of automated distribution networks, and expanding deployment of smart grids across developing and developed regions. The shift towards electronic controls and vacuum interruption technologies further enhances system efficiency and safety, positioning the market for sustained expansion.

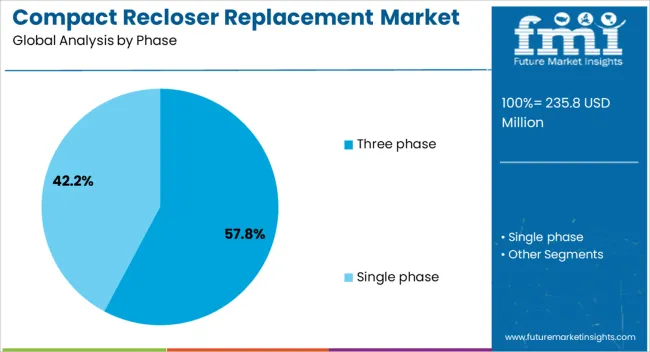

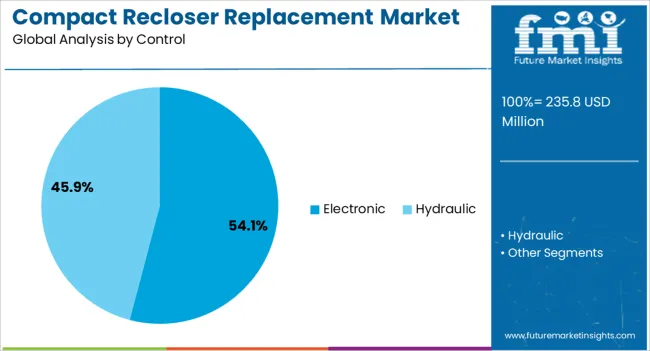

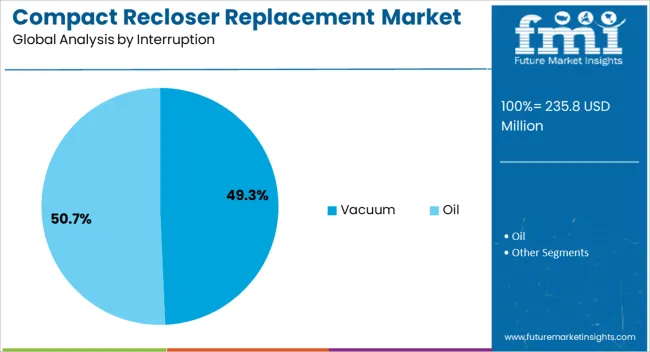

The compact recloser replacement market is segmented by phase, control, interruption, voltage rating, and geographic regions. By phase, the compact recloser replacement market is divided into three-phase and single-phase. In terms of control, compact recloser replacement market is classified into Electronic and Hydraulic. Based on interruption, compact recloser replacement market is segmented into Vacuum and Oil.

By voltage rating, compact recloser replacement market is segmented into 27 kV, 15 kV, and 38 kV. Regionally, the compact recloser replacement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The three phase segment is projected to hold 57.8% of the Compact Recloser Replacement market revenue share in 2025, making it the leading phase type. This dominance is attributed to its suitability for high-load, complex distribution systems requiring balanced power flow and enhanced fault management.

The growth of this segment is driven by the increasing replacement of traditional reclosers in commercial and industrial grids where three phase systems are prevalent. The capability to manage load interruptions and protect critical infrastructure without impacting service continuity has accelerated adoption.

Furthermore, three phase reclosers support advanced automation protocols and grid integration, enabling utilities to improve reliability and operational efficiency while reducing downtime.

The electronic control segment is expected to capture 54.1% of the market revenue share in 2025, emerging as the dominant control technology. This leadership position is owed to the enhanced precision, programmability, and diagnostic capabilities offered by electronic controls compared to electromechanical alternatives.

The need for real-time monitoring, remote operation, and integration with smart grid technologies is driving the increased adoption of electronic control systems. Electronic controls facilitate sophisticated fault analysis and event recording, supporting predictive maintenance and faster fault resolution.

Their compact design and lower power consumption further support deployment in diverse environments, making electronic controls the preferred choice for modern grid operators focusing on automation and resilience.

The vacuum interruption segment is anticipated to hold 49.3% of the Compact Recloser Replacement market revenue share in 2025, positioning it as the leading interruption technology. This prominence is being driven by the superior arc quenching properties, longer service life, and reduced maintenance requirements offered by vacuum interrupters.

Vacuum technology enables fast and reliable fault interruption with minimal environmental impact compared to oil or gas-based alternatives. The growth of this segment is also supported by increasing regulatory emphasis on safety and environmental compliance in electrical equipment.

Additionally, vacuum interrupters’ compatibility with compact recloser designs facilitates easier installation in constrained urban and industrial settings. As utilities prioritize durable and eco-friendly solutions, vacuum interruption technology is expected to remain central to market growth.

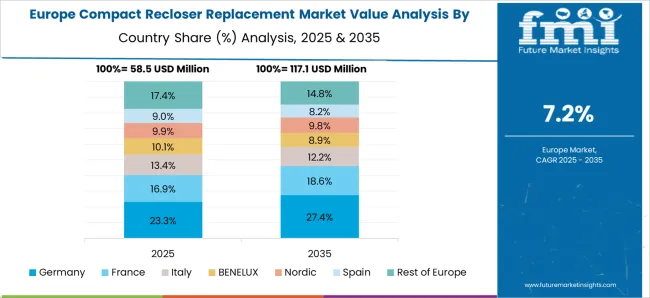

The compact recloser replacement market is growing due to aging power distribution infrastructure, increasing grid reliability demands, and renewable energy integration. North America and Europe lead with replacements in urban and industrial grids, emphasizing automation, monitoring, and fault detection. Asia-Pacific is witnessing rapid growth driven by network modernization, rural electrification, and industrial expansion. Manufacturers differentiate through device type, rated voltage, operational flexibility, and digital communication protocols. Regional variations in regulatory frameworks, utility budgets, and technological adoption influence replacement cycles, procurement strategies, and competitive positioning globally.

Compact recloser replacement decisions depend on rated voltage, current capacity, and compatibility with existing distribution networks. North America and Europe emphasize units that seamlessly integrate with medium-voltage urban and industrial grids, supporting automation and remote fault detection. Utilities prefer standardized equipment for interoperability, ensuring minimal disruption during replacement and maintenance. In Asia-Pacific, utilities often deploy mid-range devices suitable for rural and semi-urban distribution, balancing performance with cost-effectiveness. Differences in ratings and grid compatibility influence procurement strategies, installation planning, and operational efficiency. Leading suppliers target high-capacity, fully automated replacements, while regional producers focus on cost-sensitive, durable devices. These contrasts shape adoption patterns, replacement frequency, and competitiveness across global power distribution markets.

Automation and digital communication protocols are crucial for modern compact reclosers. North America and Europe prioritize devices supporting SCADA integration, remote monitoring, and fault management to minimize outage durations and improve service reliability. Asia-Pacific markets are gradually adopting communication-enabled devices, often focusing on essential automation for budget-conscious utility projects. Differences in automation capabilities affect operational response, maintenance requirements, and overall grid performance. Suppliers offering advanced digital features and reliable automation gain a competitive edge, while regional manufacturers target affordable, functional replacements. The degree of digital integration directly shapes adoption rates, utility efficiency, and long-term grid modernization outcomes in different regions.

Distribution and service infrastructure significantly influence compact recloser replacement adoption. North America and Europe rely on structured OEM partnerships, professional distributors, and long-term maintenance contracts to ensure timely replacement and post-installation support. Asia-Pacific utilizes regional dealers, local service providers, and online channels for wider accessibility, especially in rural or semi-urban regions. Differences in distribution and service capabilities affect downtime, reliability, and utility confidence. Leading suppliers combine multi-channel networks with integrated technical support, while regional players emphasize accessibility and affordability. Distribution contrasts shape market penetration, customer satisfaction, and replacement cycles across commercial and industrial grid applications globally.

Adherence to electrical safety standards, IEC specifications, and regional utility regulations significantly impacts recloser replacement decisions. Europe and North America enforce strict certification and quality testing, ensuring reliable and safe operation within complex urban grids. Asia-Pacific regulations vary; high-income countries adopt similar standards, while emerging markets often allow flexible specifications for cost-sensitive deployments. Differences in compliance affect installation approvals, product selection, and project timelines. Manufacturers meeting global standards gain access to high-value replacement contracts, while regional producers cater to local regulatory environments. Regulatory contrasts influence adoption speed, market access, and competitive positioning across mature and developing power distribution networks.

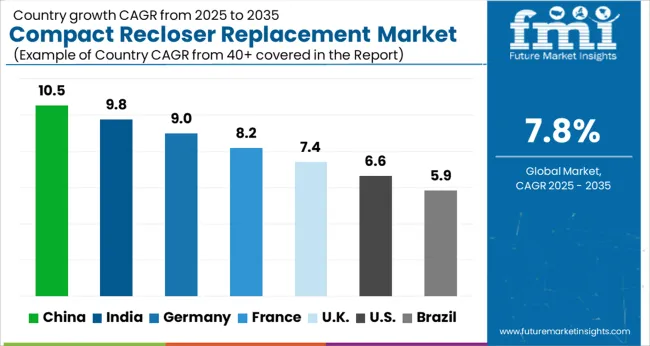

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global compact recloser replacement market was projected to grow at a 7.8% CAGR through 2035, driven by demand in power distribution, utility maintenance, and industrial electrical systems. Among BRICS nations, China recorded 10.5% growth as large-scale production and replacement facilities were commissioned and compliance with electrical and safety standards was enforced, while India at 9.8% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 9.0% maintained substantial output under strict industrial and operational regulations, while the United Kingdom at 7.4% relied on moderate-scale operations for distribution network upgrades. The USA, expanding at 6.6%, remained a mature market with steady demand across utility, industrial, and commercial segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The compact recloser replacement market in China is growing at a CAGR of 10.5% due to rising investments in power distribution networks, grid modernization, and reliability improvement initiatives. Utilities and industrial operators are replacing old reclosers with compact models to improve fault isolation, reduce outage durations, and enhance overall system efficiency. Growth is supported by government programs aimed at strengthening electrical infrastructure, increasing adoption of automated distribution systems, and improving operational safety. Suppliers provide compact reclosers with advanced protection features, remote control capabilities, and high reliability suited for urban and rural grids. Distribution through electrical equipment distributors, utility partnerships, and direct sales ensures broad market accessibility. Adoption is further driven by the need to reduce maintenance costs, improve grid reliability, and meet growing electricity demand. China remains a leading market due to large-scale infrastructure expansion and modernization of distribution networks.

India is witnessing growth at a CAGR of 9.8% in the compact recloser replacement market due to the need for improving power distribution reliability and minimizing outage times. Utilities are replacing conventional reclosers with compact models to enhance fault detection, isolation, and recovery in urban and rural areas. Growth is supported by government initiatives to modernize electrical grids, increase automation in distribution networks, and improve energy efficiency. Suppliers offer compact reclosers with advanced protection, remote monitoring, and high reliability for a range of voltage levels. Distribution is facilitated through electrical equipment dealers, utility partnerships, and service providers. Adoption is further driven by rising electricity demand, cost efficiency considerations, and the need for enhanced operational safety. India continues to see strong market momentum due to infrastructure expansion and increasing emphasis on smart grid deployment.

Germany is growing at a CAGR of 9.0% in the compact recloser replacement market due to rising demand for modern, automated distribution systems and reliable fault management. Utilities and industrial operators are adopting compact reclosers to enhance protection, reduce outage durations, and improve overall network efficiency. Growth is supported by investments in smart grids, automation of electrical distribution networks, and regulatory emphasis on energy reliability. Suppliers provide compact reclosers with remote monitoring capabilities, advanced fault detection, and high durability suitable for urban and rural grids. Distribution channels include electrical equipment dealers, utility partnerships, and direct supply networks. Adoption is further driven by the need for maintenance reduction, improved safety, and compliance with grid reliability standards. Germany remains a key European market due to its focus on advanced energy infrastructure and smart grid technologies.

The United Kingdom market is expanding at a CAGR of 7.4% due to increasing replacement of conventional reclosers with compact models across utility distribution networks. Utilities are adopting compact reclosers to improve fault isolation, reduce outage durations, and enhance grid efficiency. Growth is supported by infrastructure modernization, smart grid initiatives, and rising electricity demand in urban and suburban areas. Suppliers provide compact reclosers with high reliability, remote monitoring, and automated fault management features suitable for diverse voltage levels. Distribution through utility partnerships, electrical equipment dealers, and service providers ensures accessibility across regions. Adoption is further driven by operational efficiency requirements, cost reduction goals, and compliance with reliability standards. The United Kingdom continues to see steady growth as utilities focus on improving network resilience and implementing advanced distribution equipment.

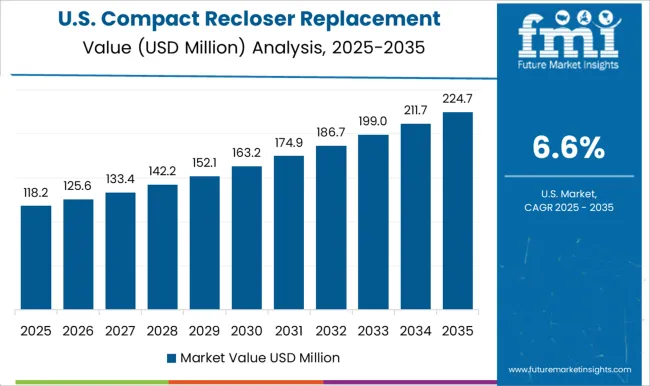

The United States market is growing at a CAGR of 6.6% due to rising replacement of aging distribution equipment with compact reclosers across urban and rural utilities. Utilities adopt these reclosers to improve fault isolation, enhance system reliability, and reduce power outage durations. Growth is supported by smart grid investments, automated distribution systems, and increasing electricity demand from commercial and industrial sectors. Suppliers provide compact reclosers with advanced monitoring, remote control, and high durability suitable for a wide range of voltage applications. Distribution is facilitated through electrical equipment dealers, utility partnerships, and service providers. Adoption is further driven by operational efficiency, maintenance reduction, and compliance with utility reliability standards. The United States remains a significant market due to its large distribution infrastructure, focus on automation, and demand for reliable energy supply.

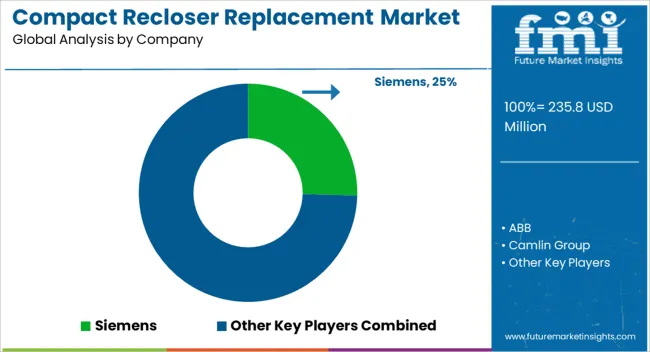

The compact recloser replacement market is served by key suppliers including Siemens, ABB, Camlin Group, Eaton, G&W Electric, Hubbell Power Systems, Hughes Power System, NOJA Power Switchgear Pty Ltd, Rockwill Electric Group, Schneider Electric, Sriwin Electric, and Tavrida Electric. These companies provide solutions designed to improve the reliability and safety of medium-voltage distribution networks. Compact reclosers are increasingly preferred for their ability to automatically isolate faults, minimize outage times, and integrate with modern grid management systems. Major suppliers focus on enhanced operational efficiency, modular design, and remote monitoring capabilities. Siemens, ABB, and Schneider Electric lead with high-performance models suitable for urban and industrial grids, offering advanced control and communication features. Eaton, G&W Electric, and NOJA Power provide adaptable reclosers optimized for varied environmental conditions and ease of installation.

Regional players like Camlin Group, Rockwill Electric, Sriwin Electric, and Tavrida Electric cater to localized grid requirements, offering cost-effective solutions for smaller networks and emerging markets. The market is evolving with an emphasis on digital integration, predictive maintenance, and automation. Utilities are increasingly adopting reclosers with SCADA-compatible systems, IoT connectivity, and energy metering features to enhance grid visibility. Rising demand for resilient distribution networks, combined with aging infrastructure replacement programs, is fueling the growth of compact recloser solutions. Suppliers are also expanding technical support, training, and maintenance services to ensure seamless adoption and long-term reliability in diverse electrical distribution environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 235.8 Million |

| Phase | Three phase and Single phase |

| Control | Electronic and Hydraulic |

| Interruption | Vacuum and Oil |

| Voltage Rating | 27 kV, 15 kV, and 38 kV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, Camlin Group, Eaton, G&W Electric, Hubbell Power Systems, Hughes Power System, NOJA Power Switchgear Pty Ltd, Rockwill Electric Group, Schneider Electric, Sriwin Electric, and Tavrida Electric |

| Additional Attributes | Dollar sales vary by product type, including vacuum, SF6, and hybrid compact reclosers; by application, such as distribution networks, industrial facilities, and renewable integration; by end-use industry, spanning utilities, industrial plants, and commercial establishments; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by aging infrastructure replacement, grid modernization, and increasing demand for reliable power distribution. |

The global compact recloser replacement market is estimated to be valued at USD 235.8 million in 2025.

The market size for the compact recloser replacement market is projected to reach USD 499.6 million by 2035.

The compact recloser replacement market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in compact recloser replacement market are three phase and single phase.

In terms of control, electronic segment to command 54.1% share in the compact recloser replacement market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Wheel Loaders Market Size and Share Forecast Outlook 2025 to 2035

Compact Loader Market Size and Share Forecast Outlook 2025 to 2035

Compact Pick-up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Compact Track and Multi-Terrain Loader Market Size and Share Forecast Outlook 2025 to 2035

Compacted Graphite Iron Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Compaction Machines Market Growth - Trends & Forecast 2025 to 2035

Compact Power Equipment Rental Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Compact Construction Equipment

Compact E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Compact Road Sweepers Market

Compaction equipment Market

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Self-Compacting Concrete Market Size and Share Forecast Outlook 2025 to 2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Refuse Compactor Market

Germany Compact Construction Equipment Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA