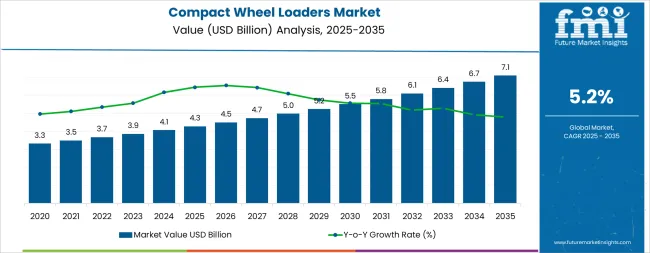

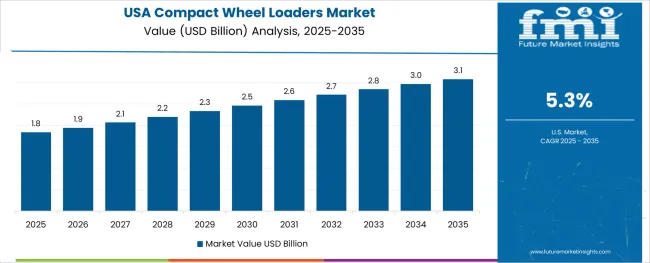

The compact wheel loaders market is projected to grow steadily from USD 4.27 billion in 2025 to USD 7.09 billion in 2035, reflecting a CAGR of 5.2%. Growth momentum is expected to be supported by increasing demand in construction, agriculture, and material handling sectors. The need for versatile, efficient, and compact machinery in space-constrained environments is likely to drive adoption, particularly in urban construction projects and small-to-medium scale industrial operations. Manufacturers are anticipated to focus on fuel-efficient engines, enhanced hydraulic systems, and ergonomic operator cabins, which will help sustain interest and maintain consistent growth.

Between 2025 and 2030, the market is likely to experience steady momentum as replacement demand and new project investments contribute to incremental adoption. During this period, technological improvements such as automation, telematics integration, and emission-compliant engines will further strengthen market activity. From 2030 to 2035, momentum may gain additional support from expanding infrastructure projects in emerging regions, along with increased focus on operational efficiency and safety standards. Overall, the market exhibits a stable upward trajectory, with growth momentum sustained through a combination of technological advancements, broader applications, and rising demand for compact, versatile machinery. The pattern indicates continuous market expansion without abrupt fluctuations, highlighting long-term opportunities for manufacturers and suppliers globally.

The wheel loaders market is primarily derived from two main parent markets: Original Equipment Manufacturers (OEMs) and the aftermarket sector. OEMs dominate the market, accounting for approximately 63% of the share. This dominance is driven by established partnerships with construction and mining equipment manufacturers, ensuring a steady demand for wheel loaders during the production of new machinery. The aftermarket segment, comprising about 37% of the market, caters to consumers seeking replacement parts, upgrades, and customization options for their existing wheel loaders. The increasing need for maintenance and performance enhancement in operational equipment fuels this sector's growth. Recent trends in the wheel loaders market indicate a shift towards electrification and automation. Electric wheel loaders are gaining traction due to their environmental benefits and lower operational costs, with projections indicating significant growth in their adoption between 2023 and 2030. Advancements in automation technologies are leading to the development of autonomous wheel loaders, which enhance efficiency and safety on construction sites. These innovations demonstrate the industry's dedication to sustainability and technological advancement, aiming to meet the evolving needs of contemporary construction and mining operations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.27 billion |

| Forecast Value in (2035F) | USD 7.09 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

Market expansion is being supported by the increasing demand for versatile construction equipment and the corresponding need for high-performance compact machinery in material handling applications across global construction, agricultural, and utility operations. Modern construction contractors are increasingly focused on specialized compact equipment technologies that can improve operational efficiency, reduce site footprint requirements, and enhance project delivery while meeting stringent safety and performance requirements. The proven efficacy of compact wheel loaders in various applications makes them an essential component of comprehensive construction equipment fleets and agricultural mechanization strategies.

The growing emphasis on construction productivity optimization and advanced material handling capabilities is driving demand for ultra-efficient compact wheel loaders that meet stringent performance specifications and regulatory requirements for construction and agricultural applications. Equipment operators' preference for reliable, high-performance compact machinery that can ensure consistent project outcomes is creating opportunities for innovative technologies and customized equipment solutions. The rising influence of safety regulations and emission standards is also contributing to increased adoption of premium-grade compact wheel loaders across different construction applications and equipment fleets requiring specialized material handling technology.

The compact wheel loaders market represents a specialized growth opportunity, expanding from USD 4.27 billion in 2025 to USD 7.09 billion by 2035 at a 5.2% CAGR. As construction contractors prioritize operational efficiency, equipment versatility, and jobsite productivity in complex material handling processes, compact wheel loaders have evolved from basic construction machinery to essential equipment enabling precise material placement, efficient excavation support, and multi-functional operations across construction sites, agricultural facilities, and utility infrastructure projects.

The convergence of construction activity expansion, increasing agricultural mechanization, specialized equipment technology development, and infrastructure modernization requirements creates sustained momentum in demand. High-performance skid steer configurations offering superior maneuverability, advanced compact track loader systems balancing traction with versatility, and specialized electric variants for indoor applications will capture market premiums, while geographic expansion into high-growth Asian construction markets and infrastructure development regions will drive volume leadership. Regulatory emphasis on operator safety and emission compliance provides structural support.

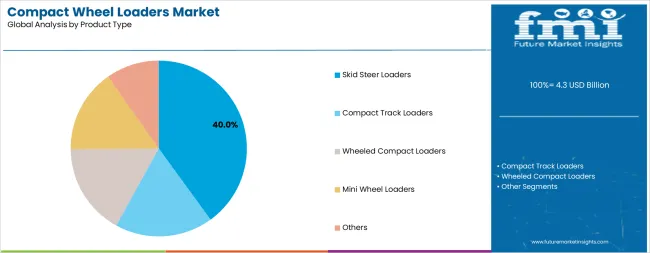

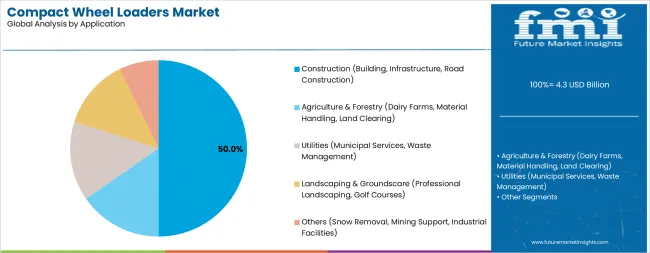

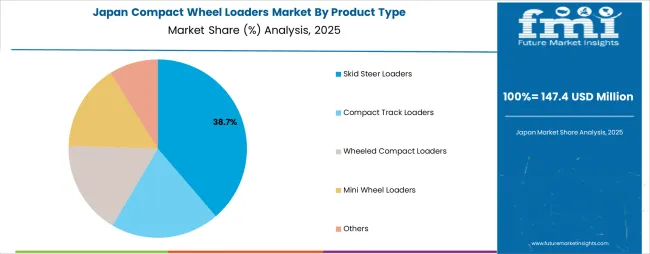

The market is segmented by product type, application, operating weight, and region. By product type, the market is divided into Skid Steer Loaders, Compact Track Loaders, Wheeled Compact Loaders, and Others. Based on application, the market is categorized into Construction, Agriculture & Forestry, Utilities, Landscaping & Groundscare, and Others. By operating weight, the market includes Under 2,000 lbs, 2,000-3,000 lbs, and Above 3,000 lbs. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The skid steer loaders segment is projected to account for over 40% of the compact wheel loaders market by 2035, reaffirming its position as the category's dominant product type. Equipment manufacturers and construction contractors increasingly recognize the exceptional versatility and maneuverability offered by skid steer configurations for diverse construction and material handling applications, particularly in confined space operations and multi-attachment utilization. This product type addresses both operational efficiency requirements and economic considerations while providing reliable performance across diverse jobsite conditions.

This product type forms the foundation of most construction equipment fleets for material handling applications, as it represents the most versatile and commercially proven configuration in the compact loader industry. Attachment compatibility standards and extensive field testing continue to strengthen confidence in skid steer loader platforms among equipment rental companies and construction contractors. With increasing recognition of the operational flexibility requirements in urban construction and renovation projects, Skid Steer Loaders align with both productivity enhancement and cost-effectiveness goals, making them the central growth driver of comprehensive equipment fleet strategies.

Construction applications are projected to exhibit the strongest growth trajectory at a 50% share through 2035, underscoring the sector's role as the primary application driving market expansion and equipment innovation. Construction contractors recognize that jobsite material handling requirements, including excavation support, material placement, and site preparation tasks, increasingly require specialized compact equipment that larger machinery cannot efficiently provide in space-constrained environments. Compact wheel loaders offer enhanced operational efficiency and project versatility in construction applications.

The segment is supported by the growing complexity of urban construction projects, requiring maneuverable equipment systems, and the increasing recognition that specialized compact machinery can improve labor productivity and project timeline outcomes. Construction industry stakeholders are increasingly adopting equipment selection guidelines that prioritize compact loader deployment for optimal material handling efficiency. As understanding of construction productivity optimization advances and urban development intensity increases, compact wheel loaders will continue to play a crucial role in comprehensive construction strategies within the building and infrastructure market.

The compact wheel loaders market is advancing steadily due to increasing recognition of compact equipment technologies' importance and growing demand for high-efficiency material handling systems across the construction, agricultural, and utility sectors. The market faces challenges, including cyclical construction market fluctuations, potential for equipment underutilization during economic downturns, and concerns about skilled operator availability for advanced machinery. Innovation in telematics technologies and electrification initiatives continues to influence product development and market expansion patterns.

The growing dominance of equipment rental channels is enabling broader access to advanced compact loader technologies and driving standardization of equipment specifications across regional markets. Specialized rental companies offer comprehensive equipment portfolios, including diverse attachment options that are particularly important for contractors requiring application-specific capabilities without capital equipment investments. Advanced rental business models provide access to latest-generation machinery that can optimize project efficiency and reduce equipment ownership costs while maintaining flexibility for varying project requirements across construction and infrastructure development sectors.

Modern equipment manufacturers are incorporating digital technologies such as real-time machine monitoring, automated maintenance alerts, and fleet management integration to enhance compact wheel loader utilization and operational reliability. These technologies improve equipment uptime, enable proactive maintenance scheduling, and provide better coordination between equipment owners and service networks throughout the equipment lifecycle. Advanced telematics platforms also enable customized performance optimization and early identification of potential mechanical issues or operator training needs, supporting reliable construction project execution and equipment investment protection.

Regulatory pressures across European and North American markets combined with indoor application requirements are driving equipment manufacturers toward electric and hybrid powertrain development for compact loader platforms. Battery-electric configurations offer zero-emission operation, reduced noise levels, and lower operating costs for suitable applications, creating differentiation opportunities in urban construction and enclosed workspace segments. Leading manufacturers including Wacker Neuson are pioneering electric compact loader commercialization, targeting municipal contractors, commercial construction companies, and industrial facility operators requiring emission-free material handling solutions. As battery technologies improve energy density and fast-charging capabilities expand, electric compact loaders are transitioning from niche applications to mainstream consideration for specific operational profiles.

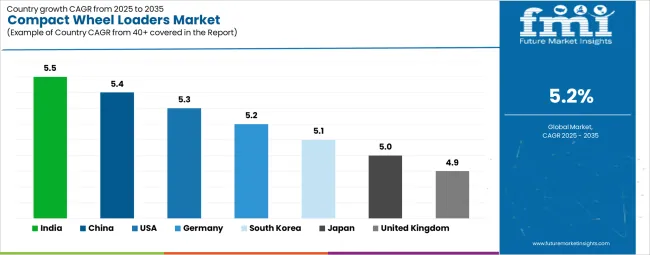

| Country | CAGR (2025-2035) |

|---|---|

| United States | 5.3% |

| India | 5.5% |

| China | 5.4% |

| Germany | 5.2% |

| Japan | 5.0% |

| South Korea | 5.1% |

| United Kingdom | 4.9% |

The compact wheel loaders market is experiencing varied growth globally, with the United States leading at a 5.3% CAGR through 2035, driven by robust construction activity, established equipment rental infrastructure, and ongoing infrastructure modernization initiatives. India follows at an estimated 5.5% CAGR, supported by rapid urbanization, infrastructure development programs, and increasing agricultural mechanization adoption. China demonstrates growth at 5.4%, emphasizing construction equipment manufacturing capacity and domestic infrastructure investment. Germany shows growth at 5.2%, representing advanced equipment technology adoption and precision construction methodologies. Japan records 5.0% growth, with a focus on compact equipment preferences and urban construction requirements. South Korea exhibits 5.1% growth, driven by infrastructure development and modernization projects. The United Kingdom demonstrates 4.9% growth, supported by construction sector recovery and urban development initiatives.

The demand for compact wheel loaders in the United States is projected to exhibit robust growth with a CAGR of 5.3% through 2035, driven by established equipment rental business models and increasing recognition of compact loaders as essential construction equipment for diverse material handling applications. The country's extensive rental fleet infrastructure and growing availability of advanced compact loader technologies are creating significant opportunities for equipment deployment across both commercial construction and residential development projects. Major international and domestic equipment manufacturers maintain comprehensive dealer and rental networks to serve the growing population of construction contractors and infrastructure developers requiring high-performance compact machinery across diverse applications throughout the United States' major construction markets.

The American construction industry's emphasis on productivity optimization and equipment standardization is driving substantial investments in compact loader fleet modernization. This trend, combined with the country's mature rental market dynamics and preference for latest-generation equipment technologies, creates a favorable environment for compact wheel loader market development. American contractors are increasingly focusing on telematics-equipped machinery to improve equipment utilization, with advanced compact loaders representing a key component in this construction efficiency transformation.

Demand for compact wheel loaders in India is expanding at an estimated CAGR of 5.5%, supported by accelerating infrastructure development, growing construction mechanization, and increasing recognition of compact equipment benefits across the country's rapidly expanding construction and agricultural sectors. The country's massive infrastructure investment programs and increasing adoption of modern construction methods are driving demand for efficient compact loader solutions in both urban development and rural mechanization applications. International equipment manufacturers and domestic construction equipment companies are establishing comprehensive distribution channels to serve the growing demand for reliable compact machinery while supporting the country's position as an emerging construction equipment market.

India's construction sector continues to benefit from government infrastructure initiatives, expanding urbanization, and growing contractor sophistication regarding equipment productivity benefits. The country's focus on affordable housing development, smart city programs, and agricultural modernization is driving investments in compact construction equipment and mechanized material handling infrastructure. This development is particularly important for compact wheel loader applications, as contractors seek versatile equipment capable of diverse material handling tasks to maximize equipment utilization and return on investment.

The compact wheel loaders market in China is expanding at an estimated CAGR of 5.4%, driven by ongoing infrastructure development, domestic construction equipment manufacturing capacity, and increasing urbanization supporting continuous construction activity. The country's position as both the world's largest construction equipment market and dominant manufacturing base creates unique market dynamics combining massive domestic demand with competitive equipment supply. The market is characterized by diverse manufacturer presence, evolving emission regulations, and increasing technology sophistication as domestic brands compete with established international equipment companies.

China's compact loader market benefits from complete manufacturing supply chains, government infrastructure investment programs, and the world's largest construction industry. The country's Belt and Road Initiative, domestic high-speed rail expansion, and new urbanization policies create sustained demand for construction equipment including compact loaders. As Chinese manufacturers advance technology capabilities and improve product quality, domestic equipment brands are increasingly competitive in both price-sensitive and mid-tier market segments.

Demand for compact wheel loaders in Germany is projected to grow at a CAGR of 5.2%, supported by well-established construction equipment markets and advanced technology adoption that emphasizes efficiency, precision, and emission compliance. German construction contractors consistently utilize high-performance compact equipment for diverse applications, with particular strength in urban construction projects and specialized material handling operations. The market is characterized by premium equipment preferences, comprehensive operator training standards, and established relationships between equipment manufacturers and construction companies that support long-term equipment partnerships and technology collaboration.

Germany's construction equipment industry benefits from advanced engineering capabilities, stringent emission regulations driving technology innovation, and strong emphasis on operator safety and equipment reliability. The country's leadership in electric compact loader development, particularly through companies like Wacker Neuson, demonstrates the market's focus on sustainable construction equipment solutions and indoor application capabilities. This emphasis on technological advancement and environmental responsibility positions Germany as a reference market for compact loader innovation globally.

The compact wheel loaders market in Japan is projected to grow at a CAGR of 5.0% through 2035, supported by the country's established preference for compact machinery solutions, comprehensive equipment quality standards, and systematic approach to construction project execution that emphasizes precision, reliability, and operational efficiency. Japanese construction contractors emphasize appropriate equipment sizing for space-constrained urban environments, with compact loaders playing essential roles in building construction, infrastructure maintenance, and agricultural operations. The market is characterized by high equipment quality expectations, established brand loyalty, and long-term equipment ownership patterns.

Japan's construction equipment market benefits from advanced manufacturing capabilities, sophisticated hydraulic system technologies, and strong cultural emphasis on equipment maintenance and longevity. The country's dense urban environment and limited construction site space create ideal conditions for compact loader deployment, while emphasis on operational safety supports investment in latest-generation equipment with advanced visibility and control systems.

Demand for compact wheel loaders in South Korea is projected to grow at a CAGR of 5.1% through 2035, driven by infrastructure modernization programs, urban redevelopment initiatives, and growing construction mechanization supporting productivity improvements. The Korean market represents a technology-forward construction equipment environment characterized by rapid adoption of advanced features, growing rental market development, and increasing integration of telematics and automation technologies. The market benefits from domestic construction equipment manufacturing presence and government infrastructure investment programs supporting sustained construction activity.

South Korea's position as an advanced manufacturing economy creates opportunities for technology integration in construction equipment, including compact loaders equipped with advanced control systems, operator assistance features, and connectivity platforms. The country's compact urban geography and emphasis on construction efficiency drive demand for versatile compact machinery capable of diverse material handling applications.

The compact wheel loaders industry in the United Kingdom is projected to grow at a CAGR of 4.9% through 2035, supported by construction sector recovery, urban development initiatives, and comprehensive equipment safety regulations that emphasize operator protection and emission compliance. British construction contractors consistently utilize compact equipment as part of integrated material handling approaches, emphasizing operational efficiency and equipment versatility across building construction and infrastructure maintenance applications. The market benefits from established equipment rental infrastructure, comprehensive dealer networks, and well-developed operator training systems.

The UK's construction equipment market is characterized by mature rental penetration, strong emphasis on equipment utilization optimization, and increasing focus on emission reduction and sustainable construction practices. The country's urban construction activity and renovation project prevalence create consistent demand for compact loader deployment in space-constrained environments.

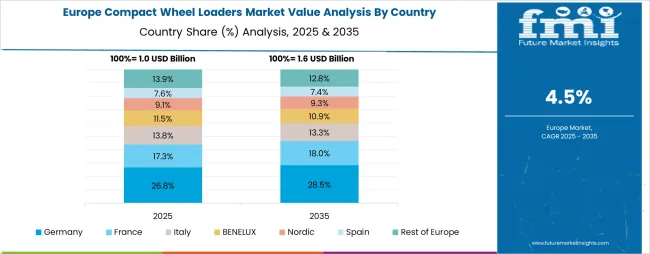

The compact wheel loaders market in Europe is projected to grow from USD 1.18 billion in 2025 to USD 1.89 billion by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership position with a 29.3% market share in 2025, rising to 30.1% by 2035, supported by its advanced construction equipment manufacturing infrastructure, strong rental market penetration, and extensive compact loader deployment throughout construction and agricultural sectors. The United Kingdom follows with a 21.7% share in 2025, projected to reach 21.2% by 2035, driven by established rental fleet infrastructure and urban construction activity. France holds an 17.8% share in 2025, expected to increase to 18.2% by 2035, supported by infrastructure investment programs and agricultural mechanization. Italy commands a 13.4% share in 2025, projected to reach 13.7% by 2035, reflecting strong construction equipment adoption. Spain accounts for 9.1% in 2025, expected to reach 9.3% by 2035. The Nordic region maintains a 5.2% share in 2025, growing to 5.4% by 2035, supported by advanced construction practices and forestry applications. The Rest of Europe region is anticipated to hold 3.5% in 2025, declining slightly to 3.1% by 2035.

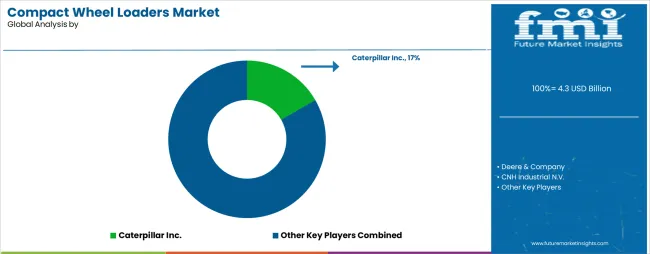

The compact wheel loaders market is characterized by concentrated competition among established global equipment manufacturers, specialized compact equipment brands, and emerging technology-focused companies delivering high-performance, reliable, and technologically advanced compact machinery. Companies are investing in hydraulic system optimization, telematics platform development, strategic dealer network expansion, and comprehensive aftermarket support programs to deliver effective, efficient, and operator-friendly compact wheel loader solutions that meet demanding construction and agricultural application requirements. Product innovation, attachment ecosystem development, and service excellence are central to strengthening market positions and customer loyalty.

Caterpillar Inc. leads the market with comprehensive compact loader offerings spanning diverse size classes, with a focus on innovative technologies including remote operation capabilities and extensive global dealer infrastructure for equipment support. Deere & Company provides specialized compact construction equipment with emphasis on user-friendly operator interfaces, ergonomic cab designs, and integrated JDLink telematics systems for fleet management. CNH Industrial N.V. focuses on durable all-terrain loader configurations and advanced telematics integration for agricultural and construction markets. Kubota Corporation delivers agile, fuel-efficient compact equipment with hydrostatic transmission systems popular in agricultural and landscaping applications.

Wacker Neuson SE operates as a technology pioneer specializing in electric compact loader development, targeting urban construction and indoor application segments requiring zero-emission solutions. Additional industry participants provide regional market expertise, specialized attachment systems, and rental fleet optimization services that complement primary equipment manufacturers' offerings and support comprehensive material handling solutions across diverse construction and agricultural application requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4.27 billion |

| Product Type | Skid Steer Loaders, Compact Track Loaders, Wheeled Compact Loaders, Others |

| Application | Construction, Agriculture & Forestry, Utilities, Landscaping & Groundscare, Others |

| Operating Weight | Under 2,000 lbs, 2,000-3,000 lbs, Above 3,000 lbs |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, India, China, Germany, Japan, South Korea, United Kingdom and 40+ countries |

| Key Companies Profiled | Caterpillar Inc., Deere & Company, CNH Industrial N.V., Kubota Corporation, Wacker Neuson SE |

| Additional Attributes | Dollar sales by product type and application, regional demand trends, competitive landscape, contractor preferences for specific loader configurations, integration with specialty attachment ecosystems, innovations in telematics and electrification, performance optimization, and rental fleet dynamics |

The global compact wheel loaders market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the compact wheel loaders market is projected to reach USD 7.1 billion by 2035.

The compact wheel loaders market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in compact wheel loaders market are skid steer loaders, compact track loaders, wheeled compact loaders, mini wheel loaders and others.

In terms of application, construction (building, infrastructure, road construction) segment to command 50.0% share in the compact wheel loaders market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Compacted Strand Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Compact Rotary Actuator Market Size and Share Forecast Outlook 2025 to 2035

Compact Pneumatic Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Compact Resin Type Silencer Market Size and Share Forecast Outlook 2025 to 2035

Compact Loader Market Size and Share Forecast Outlook 2025 to 2035

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Excavator Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Balancing Market Size and Share Forecast Outlook 2025 to 2035

Compact Recloser Replacement Market Size and Share Forecast Outlook 2025 to 2035

Compact Pick-up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Compact Track and Multi-Terrain Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Aligner Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compacted Graphite Iron Market Size and Share Forecast Outlook 2025 to 2035

Wheel Tractor Scrapers Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA