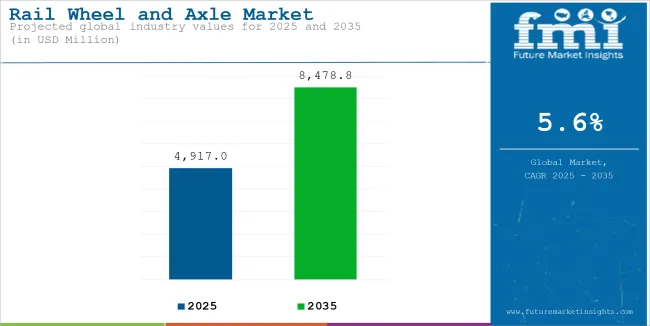

The global Rail Wheel and Axles Market were reported at USD 4,656.2 million in 2024, with a growing demand increase from end users at 5.6% CAGR over the forecast period. The market value is forecast to grow from USD 4,917.0 million in 2025 to USD 8,478.8 million by 2035.

| Attributes | Key Insights |

|---|---|

| Market Value, 2024 | USD 4,656.2 Million |

| Estimated Market Value, 2025 | USD 4,917.0 Million |

| Projected Market Value, 2035 | USD 8,478.8 Million |

| Market Value CAGR (2025 to 2035) | 5.6% |

Rail wheels and axles are critical components used in the construction of rail vehicles, and hence contribute to the worldwide railway transport business. Some market trends include sustainability, digitization, increasing maintenance services, consolidation, and technical advancements.

Current efforts in the market include development of digital tools and technologies to make products by reducing waste, mergers and acquisitions of smaller companies in order to expand product ranges, the application of intelligent technologies, and the use of advanced materials.

Furthermore, it is anticipated that the industry will develop in the upcoming years, particularly due to urbanization, increasing populations and growing concerns for the environment, which will contribute to rising transport rail demand.

Recent changes, such as Ford concentrating on lightweight engine parts and targeted partnerships for the creation of new materials, are changing the industry and market. These factors, in concert, account for substantial growth of the Rail Wheel and Axle market on a global scale.

The increasing demand for lightweight and durable materials, such as alloys and composites, to increase fuel efficiency and performance is a major driver of market expansion. Technological improvements, such as the integration of smart sensors and real-time monitoring systems, improve operating efficiency and safety, accelerating market acceptance.

Geographically, Asia-Pacific and Europe dominate the market as a result of significant investments in updating rail infrastructure and developing metro and high-speed rail networks. Meanwhile, North America is experiencing sustained expansion, aided by freight rail modernization and urban transportation initiatives.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Rail Wheel and Axle market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

The below table presents the expected CAGR for the global Rail Wheel and Axle sales over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 5.2%, followed by a slightly higher growth rate of 5.7% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 5.2% (2024 to 2034) |

| H2 | 5.7% (2024 to 2034) |

| H1 | 5.3% (2025 to 2035) |

| H2 | 5.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 5.3% in the first half and remain relatively moderate at 5.9% in the second half. In the first half (H1) the market witnessed an increase of 10 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

This section below examines the value shares of the leading segments in the industry. In terms of axle type, the Roller axles segment will likely dominate and generate a CAGR of around 5.4% in 2025.

Based on the end use, the High-Speed Railway segment is projected to account for a share of 53.5% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Roller axles (axle type) |

|---|---|

| Value CAGR (2024) | 5.4% |

Roller axles, which are used extensively in rail cars, have cornered the international market. As a result of their advanced systems for sealing and their seamless connection with other parts, roller axles are extremely dependable. They're practical in every way: simple to handle, sturdy, and effective. Since the American Association of Railroads has given its stamp of approval, roller axles have found widespread application in freight wagons across the globe (AAR).

Japan's lengthy history of using axles in rail containers has earned the country a great reputation for quality and reliability among industry professionals and end customers alike. The latest Shinkansen models, along with standard electric and diesel trains, have all started utilizing rolling bearings in their design and construction.

| Segment | High-Speed Railway (end use) |

|---|---|

| Value Share (2024) | 43.5% |

The High-Speed Railway segment is experiencing substantial growth and is expected to continue expanding over the coming years, holding a significant share in the Rail Wheel and Axle Market. Estimated to account for around 40-45% of the market share, this segment is being driven by the increasing demand for rapid, efficient, and eco-friendly transportation systems, especially in countries like China, Japan, and much of Europe.

High-speed rail networks, known for speeds exceeding 300 km/h, require advanced rail wheels and axles to ensure stability, safety, and longevity at such high operational speeds. This demand is further fueled by government-backed investments in infrastructure and technological advancements aimed at improving performance and sustainability.

The high-speed rail sector also benefits from a global shift towards green transportation solutions, as high-speed trains are more energy-efficient compared to air travel, making them an attractive option for long-distance travel.

Global Rail Infrastructure Expansion

The expansion and renovation of rail networks around the world are major drivers of the Locomotive Drive Shaft market. Governments and the corporate sector are making significant investments in rail infrastructure as part of long-term plans to stimulate economic growth, increase transportation efficiency, and encourage sustainable travel.

Countries such as China, India, and Europe are actively constructing rail infrastructure to meet growing population and freight demands. The Chinese government's Belt and Road Initiative (BRI), for example, is a huge infrastructure project including the construction of railway networks throughout Asia, Europe, and Africa. This development not only involves the construction of new railroads but also increases demand.

China's Belt and Road Initiative (BRI) has increased demand for contemporary rail components, such as Locomotive Drive Shaft, that meet demanding safety and operating criteria across many geographic locations and climates.

Urbanization and Growing Demand for Public Transport

Urbanization is accelerating globally, with more than half of the world’s population now residing in urban areas. This rapid urban growth has heightened the demand for efficient, sustainable, and reliable public transport systems, making railways a cornerstone of urban mobility. As cities expand, governments and transit authorities are increasingly investing in metro systems, suburban trains, and high-speed rail networks to address congestion, reduce emissions, and meet the mobility needs of growing populations.

Rail wheels and axles are critical components of these systems, ensuring the safety, durability, and performance of trains. The surge in public transport demand directly fuels the rail wheel and axle market as manufacturers strive to meet the requirements of both new infrastructure and the replacement of aging components.

Innovations, such as lightweight materials and smart monitoring technologies, are enhancing product performance, aligning with the global push for green and cost-effective public transport solutions. This synergy between urbanization and public transport demand positions the rail wheel and axle market for sustained growth.

Increasing Investments in Rail Infrastructure Development

The key drivers for the rail wheel and axle market is the increasing investment in rail infrastructure development globally. Governments and private entities are prioritizing railways as a critical component of transportation systems due to their efficiency, environmental benefits, and ability to handle high passenger and freight volumes. These investments encompass the construction of new rail networks, expansion and modernization of existing lines, and the development of high-speed rail projects.

Emerging economies, particularly in Asia-Pacific, are witnessing a surge in rail infrastructure projects to support rapid urbanization, economic growth, and industrial expansion. Countries such as India, China, and Indonesia are allocating significant budgets to enhance metro rail systems and long-distance rail connectivity. Similarly, in developed regions like Europe, investments in cross-border high-speed rail corridors and the electrification of tracks are gaining traction to promote green transportation solutions.

Rail wheels and axles are integral to the safe and efficient functioning of these rail networks. The expansion of rail infrastructure directly drives the demand for new trains, increasing the need for high quality, durable, and technologically advanced wheels and axles. Furthermore, modern rail projects emphasize lightweight components and advanced materials to enhance energy efficiency and reduce maintenance costs, leading to innovations in the rail wheel and axle market.

High Initial Investment Costs: A Significant Restraint

The critical restraints for the rail wheel and axle market is the high initial investment costs associated with manufacturing, installing, and maintaining rail infrastructure and components. Rail wheels and axles are engineered for precision, durability, and performance, often requiring advanced manufacturing processes, specialized materials, and rigorous quality control measures. These factors significantly increase production costs, which are eventually reflected in market pricing.

For rail operators and infrastructure developers, the cost of acquiring high-quality wheels and axles can be a considerable financial burden, especially in developing regions with constrained budgets. Additionally, the expense extends beyond procurement to encompass the installation of advanced components and regular maintenance to ensure safety and efficiency. This financial strain can delay rail projects or lead to a preference for cheaper, less durable alternatives, thereby affecting the market's growth.

The challenge is compounded by the need for ongoing technological upgrades. With the rail industry increasingly adopting innovations such as lightweight materials, smart monitoring systems, and noise-reduction technologies, manufacturers face higher R&D expenditures. These costs are often passed on to end-users, further elevating the financial barrier.

Between 2020 and 2024, the global Rail Wheel and Axle sales experienced steady growth, expanding at an annual rate of approximately 5.6% and reaching a market value of USD 4,656.2 million in 2024, up from USD 3,686.0 million in 2020.

Across the globe, governments are spending money to upgrade railways by incorporating innovative technology. It is hoped that by making these changes, operational efficiency is likely to also improve. Governments everywhere are also making headlines with announcements of the future to invest in and develop innovative rail technology and tracking systems in the short term.

For the next five years, Urbanization and population growth are driving the expansion of rail networks in many countries around the world. As urban areas become more densely populated, the demand for efficient and reliable public transportation systems increases, which is expected to drive the demand for rail wheel and axle products in the midterm.

The rail industry is constantly evolving and improving, with new technologies being developed to improve efficiency and reduce costs. This includes the development of new rail wheel and axle products, which are designed to be more durable, reliable, and cost-effective. The demand for rail wheels and axles is expected to rise in the long term.

Tier 1 companies include industry leaders with annual revenues exceeding USD 100 Million. These companies are currently capturing a significant share of 50% to 60% globally. These frontrunners are characterized by high production capacity and a wide product portfolio. They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base.

These firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Nippon Steel Corporation, GHH-BONATRANS, Amsted Rail, Lucchini RS Group, Vyksa Steel Works (OMK Group), EVRAZ NTMK and others.

Tier 2 includes most of the small-scale companies operating at the local level-serving niche Rail Wheel and Axle vendors with low revenue. These companies are notably oriented toward fulfilling local demands. They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the analysis of the Rail Wheel and Axle industry in different countries. Demand analysis of key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. China is anticipated to remain at the forefront in East Asia, with a value share of 72.7% in 2035. In South Asia, India is projected to witness a CAGR of 5.6% through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| Japan | 6.1% |

| India | 5.6% |

| China | 5.4% |

| Germany | 4.7% |

| The USA | 3.9% |

China is a dominant player in the global rail wheel and axle market due to its massive rail infrastructure and strategic investments in high-speed rail. The country has the largest high-speed rail network globally, exceeding 40,000 kilometers, and continues to expand its rail systems. This rapid expansion creates significant demand for rail wheels and axles, both for new trainsets and for replacement in existing fleets.

China's focus on urbanization and public transportation as part of its long-term economic plans further drives the need for metro and suburban rail systems. Additionally, China's Belt and Road Initiative (BRI) promotes rail connectivity across Asia, Europe, and Africa, boosting domestic production and export of rail components.

Key domestic manufacturers like Taiyuan Heavy Industry and international collaborations ensure a robust supply chain and technological advancement. Government policies favoring domestic manufacturing also strengthen China's position in the global market.

The United States is a major player in the global rail wheel and axle market, primarily driven by its vast and well-established freight rail network. The country boasts the largest freight rail system in the world, spanning over 140,000 miles, making rail transportation integral to its logistics and supply chain operations. This extensive infrastructure generates a substantial demand for durable, high-performance rail wheels and axles capable of withstanding heavy loads and harsh conditions.

Moreover, significant investments in modernizing aging rail infrastructure and adopting advanced technologies like smart monitoring systems further drive market growth. The USA is also home to leading manufacturers, such as Amsted Rail, which provide innovative solutions for freight and passenger rail systems.

The focus on environmental sustainability and reducing carbon emissions has increased the reliance on rail freight over road transport, as rail is more energy-efficient and eco-friendly. This trend continues to boost the demand for advanced rail wheel and axle systems.

Germany stands out as a key player in the global rail wheel and axle market, driven by its advanced rail engineering expertise and strong emphasis on sustainable transport solutions. As the backbone of the European rail network, Germany’s rail industry is heavily invested in high-speed rail, urban transit systems, and freight transport.

Companies like GHH-BONATRANS and Lucchini RS Group dominate the European market with high-quality rail components, making Germany a hub for innovation and production. The country’s commitment to green transportation and reducing reliance on road freight has spurred demand for efficient and durable rail wheel and axle solutions.

Germany also benefits from being a leader in technological advancements, such as lightweight materials and smart monitoring systems, which align with Europe’s strict safety and sustainability standards. The nation’s export-oriented rail industry further enhances its position as a major contributor to the global market.

The rail wheel and axle market is experiencing substantial growth driven by technological advancements, sustainability initiatives, and increasing demand for high-performance rail components. Key themes of product development include innovations in material science, such as the use of lightweight alloys and composites, as well as the integration of smart technologies for real-time monitoring and predictive maintenance.

Manufacturers are focusing on creating more durable, efficient, and environmentally friendly solutions to meet the evolving needs of the global rail industry.

After-sales support has become a significant competitive strategy, with companies offering services such as installation, maintenance, and comprehensive warranty programs. Preventive maintenance, rapid spare parts supply, and customized solutions are essential for ensuring the reliability and longevity of rail systems. Companies with well-established after-sales networks and service structures are positioning themselves as trusted partners to customers, enhancing brand loyalty and customer retention.

The global reach of manufacturers is expanding as countries invest in upgrading and expanding their rail networks, particularly in high-speed and freight transport. Regional partnerships and localized production hubs are being developed to provide faster, more efficient service and spare parts supply.

Additionally, advancements in precision manufacturing and material efficiency allow companies to offer cost-effective solutions while maintaining high-quality performance. These factors, coupled with sustainability-focused designs, are helping companies gain a competitive edge in the rail wheel and axle market.

Industry Updates

In terms of wheel type, the industry is segmented into monoblock wheels, resilient wheels, rubber tyred wheels, steel tyred wheels and other special wheels

In terms of axle type, the industry is segmented hollow axles, solid axles and roller axles

By end use, the industry is segmented into high-speed railway, fast speed railway, subway and other end use

By Sales Channel, the industry is segmented into OEM and Aftermarket

Regions considered in the study are North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The industry was valued at USD 4,656.2 Million in 2024

The industry is set to reach USD 4,917.0 Million in 2025

The industry value is anticipated to rise at 5.6% CAGR through 2035

The industry is anticipated to reach USD 8,478.8 Million by 2035

China accounts for 17.2% of the global Rail Wheel and Axle market revenue share alone.

Japan is predicted to witness the highest CAGR of 6.1% in the Rail Wheel and Axle market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Wheel Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Wheel Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Wheel Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Wheel Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Wheel Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Wheel Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Wheel Type, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Wheel Type, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 42: Europe Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 44: Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 46: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Wheel Type, 2018 to 2033

Table 52: Asia Pacific Market Volume (Units) Forecast by Wheel Type, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 54: Asia Pacific Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: Asia Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Wheel Type, 2018 to 2033

Table 64: MEA Market Volume (Units) Forecast by Wheel Type, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 66: MEA Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 68: MEA Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 72: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Wheel Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Wheel Type, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Wheel Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Wheel Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Wheel Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 31: Global Market Attractiveness by Wheel Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Axle Type, 2023 to 2033

Figure 33: Global Market Attractiveness by End Use, 2023 to 2033

Figure 34: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 35: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Wheel Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Wheel Type, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Wheel Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Wheel Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Wheel Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 67: North America Market Attractiveness by Wheel Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Axle Type, 2023 to 2033

Figure 69: North America Market Attractiveness by End Use, 2023 to 2033

Figure 70: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Wheel Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Wheel Type, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Wheel Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Wheel Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Wheel Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Wheel Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Axle Type, 2023 to 2033

Figure 105: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Wheel Type, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Wheel Type, 2018 to 2033

Figure 120: Europe Market Volume (Units) Analysis by Wheel Type, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Wheel Type, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Wheel Type, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 124: Europe Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 128: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 132: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 136: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 139: Europe Market Attractiveness by Wheel Type, 2023 to 2033

Figure 140: Europe Market Attractiveness by Axle Type, 2023 to 2033

Figure 141: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 142: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Wheel Type, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Wheel Type, 2018 to 2033

Figure 156: Asia Pacific Market Volume (Units) Analysis by Wheel Type, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Wheel Type, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Wheel Type, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 160: Asia Pacific Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 164: Asia Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 168: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 172: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Wheel Type, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Axle Type, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Wheel Type, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Wheel Type, 2018 to 2033

Figure 192: MEA Market Volume (Units) Analysis by Wheel Type, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Wheel Type, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Wheel Type, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 196: MEA Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 200: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 204: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 208: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 211: MEA Market Attractiveness by Wheel Type, 2023 to 2033

Figure 212: MEA Market Attractiveness by Axle Type, 2023 to 2033

Figure 213: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 214: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 215: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Rail Transit Vehicle Glass Market Size and Share Forecast Outlook 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Rail Car Drying System Market Size and Share Forecast Outlook 2025 to 2035

Rail Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Rail Tank Cars Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Railway After-Cooler Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA