The automotive wheel rims marketis projected to develop at a 5.48% CAGR from 2025 to 2035. By re-estimating the previous projected values, the industry is anticipated to reach an estimated value of approximately USD 51.4 billion by 2025 and rise to about USD 87.6 billion by 2035. Growth in this direction is predominantly supported by increasing consumer demand for enhanced vehicle look and performance, coupled with growing vehicle production globally, particularly within developing countries.

The demand for light, strong, and corrosion-resistant wheel rims is on the rise as car makers intensify their efforts to improve fuel efficiency and reduce vehicular emissions. Alloy wheels and aluminum wheels are gaining momentum with their weight-saving features and design flexibility. The adoption of electric vehicles (EVs) is also a major driver, as EVs usually have customized wheel rim designs for optimal performance and thermal management.

Moreover, aftermarket style trends are significantly influencing product innovation in the wheel rims category. Customized rim designs are gaining the interest of car owners to suit style needs and brand loyalty, which is pushing rim coating, finishing, and structural innovation. The expansion of car e-commerce sites is also facilitating increased access to customized rim solutions.

OEMs are collaborating closely with wheel rim manufacturers to develop intelligent and lightweight rims together with sensors that monitor tire pressure, rim temperature, and other performance characteristics. This cooperation is for functional and safety enhancement, leading to an improved overall driving experience. Additionally, technological advancements in rim manufacturing techniques like flow forming and 3D printing are reducing production costs while enabling complex designs.

Geographically, the industry is dominated by the Asia-Pacific region due to its superior vehicle manufacturing capabilities and low-cost manufacturing base. North America and Europe, however, are experiencing steady growth due to premium vehicle sales and government policies favoring lightweight vehicles. Overall, the industry is on the verge of dynamic change, driven by technological developments and shifting consumer trends.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 51.4 billion |

| Industry Value (2035F) | USD 87.6 billion |

| CAGR (2025 to 2035) | 5.48% |

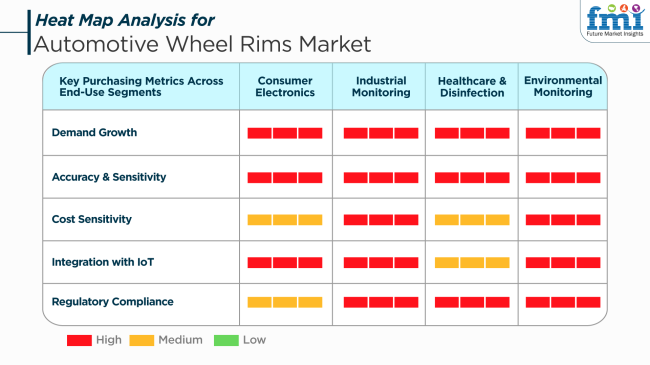

Across the industry, various end-use segments rank various purchasing criteria by application intensity and regulatory requirements. Industrial monitoring is the dominant growth driver and accuracy requirements come from intelligent rim system uses in fleet operations and logistics, where predictive modeling and structural diagnostic analysis are prime focus areas.

Medical transport vehicles and other health and disinfection applications for cars prioritize precision and regulatory compliance, requiring rims that can endure sterilization-favoring environments and stringent standards. Environmental monitoring programs increasingly use wheel rim sensors to gather road, weather, and emissions information, leading to excessive demand and integration into IoT systems.

Consumer automobile accessories revolve around looks, customization, and timely diagnosis. In this context, buying decisions are biased towards highly integrated, fashionable, yet cost-effective rims. In all segments, the balance between performance, safety, and regulatory compliance dictates industry direction and technology adoption levels.

The industry managed to register healthy growth during 2020 to 2024, and this growth can be attributed to rising global vehicle production, aftermarket customization trends, and increasing demand for lightweight alloy rims. The statistics shown that customers had started preferring for the speed, aesthetic and mileage at a much faster rate which was in favor of the aluminum and forged alloy rims over the steel ones.

Because car owners wanted to give their vehicles a customized look, aftermarket business boomed (particularly in the Asia-Pacific and North American regions). The jarring avoid on raw material price changes, supply hardships, and higher EVs penetrating the current transport pie, however, are injuring manufacturers compared to a tendency to inventive growth wheels without incurring costs. From 2025 to 2035, the industry will turn its attention to these areas on the sustainable material, smart rim, and aerodynamics.

Carbon-fiber composite wheels will gain traction, especially for EVs and sports cars, as weight savings can be directly transferred to extended range or performance. With sensors built into the intelligent rims, smart data on tire pressure, load transfer, wear, and temperature can be obtained in real-time, which is further useful for safety and predictive maintenance.

On-demand, bespoke wheel production will be realized with the use of additive manufacturing and 3D printing. As electric and autonomous vehicles become more common, wheels will be designed with energy efficiency and aerodynamics in mind. Manufacturers will encourage environmentally sound production processes and end-of-life recycling through recycling initiatives and circular design principles.

Comparative Market Shift Table (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Vehicle production, aftermarket customization, fuel efficiency | EV and AV integration, sustainability, smart vehicle systems |

| Steel (budget), aluminum alloys, forged alloys | Carbon fiber composites, magnesium alloys, recycled hybrid materials |

| Style, durability, and brand appeal | Aerodynamics, weight reduction, sensor integration |

| OEM and aftermarket for ICE vehicles | EV-centric rims, smart rims, performance-focused lightweight rims |

| Minimal tech, visual upgrades | Smart rims with embedded sensors, AI diagnostics, IoT connectivity |

| Low; focus on durability and cost | High; focus on recyclable, low-carbon manufacturing and circular economy design |

| Traditional forging, casting | 3D printing, additive manufacturing, customizable on-demand production |

| High in North America, Europe, China | Expanding in Southeast Asia, LATAM, and urban smart mobility hubs |

The industry faces the threat of medium to high intensity due to raw materials such as aluminum and steel, upon which production economics are directly exposed, being exposed to price uncertainty. Uncertainty of the world supply chain, hitherto caused by either geopolitical tensions or trade embargoes, overhangs OEMs and aftermarket suppliers in an effort to sustain steady manufacturing levels.

Technological disruption, though a cause of growth, is risky. The faster innovation cycle can make current production lines or rim designs obsolete if companies do not follow through. Second, integration with smart technologies is an issue of cybersecurity and reliability issues, especially in safety-critical use where failure of performance can be catastrophic.

Emission regulatory drivers, together with the areas of recyclability and safety, present regulatory drivers that offer the potential to develop risk of noncompliance, most importantly so for cross-border presence manufacturers. It will be necessary to cope with such dynamic legal surroundings through careful follow-through and expenditures in technology regarding responsiveness. These all are kindling the search for a hesitant, responsive approach towards risk hedging for the industry of wheel rims during the prediction period.

In 2025, the industry will be diversified by the types of materials used. Thus, aluminum alloy rims and steel disc rims are two prominent categories into which this industry is divided. Leading this trend is the aluminum alloy rim, with an estimated industry share of 28% in scope. Used in lightweight, corrosion resistance, and aesthetic appeal, these rims add to higher fuel efficiency and vehicle handling, which makes them highly popular in passenger and luxury cars.

Location-wise, this trend has a strong demand for aluminum alloy rims in North America, Europe, and Asia-Pacific, encouraging industry growth through an increasing drive of consumer preferences toward customizing vehicles and enhancing their performance. Leading manufacturers like Enkei Corporation, CITIC Dicastal, Ronal Group, and BBS Japan comprise this innovation category and offer a wide array of precision-engineered alloy rims for OEM and aftermarket applications.

Around 20% of the industry share in 2025 is steel disc rims. Steel rims are known to be the most affordable and durable load bearers used mostly by commercial vehicles, entry-level passenger cars, and utility vehicles. They are predominantly proven in developing regions such as Latin America, Africa, and parts of Asia, where cost efficiency is prioritized over appearance.

Steel rims are popular among consumers in winter because they are made to withstand the elements and road salt. Key players in this setup are Accuride Corporation, Maxion Wheels, and Steel Strips Wheels Ltd., operating on the basis of standard and custom offerings to satisfy global and regional demand.

The industry will be primarily driven by two end-user segments, namely manufacturing and automotive workshops, by the year 2025. Of these, the manufacturing industry will contribute a highly estimated sum of 65% of the industry share owing to the favorable high-volume demand for wheel rims in original equipment manufacturing (OEM) of both passenger and commercial vehicles.

OEM-centric businesses have a consistent and superior supply of rims to fulfill the global production targets of automakers, primarily mechanical engineering replicas. OEMs continuously need high-quality rims, especially from the present-day automotive industry, which is focusing on lightweight and fuel economy as a target for adding more materials like aluminum alloy in passenger and commercial vehicles.

The Asia-Pacific regions, led by China, India, and Japan, play a central role because they mostly generate automotive production hubs. Leading rim manufacturers, including CITIC Dicastal, Ronal Group, and Enkei Corporation, have a strong association with leaders in the automotive industry, such as Toyota, Volkswagen, and General Motors, providing them with factory-fitted rims for new vehicles.

The other segment would be workshops, which would occupy around 35% of the industry space and, therefore, the strong aftermarket demand for replacement and customization of rims. Independent garages, service centers, and tire retailers are part of this segment, wherein consumers go for upgrades for aesthetic, performance, or seasonal wheel change (e.g., winter rims).

The workshop segment is now slowly growing, especially in Europe and North America, because of the mature vehicle fleet and consumer trends toward personalization, which are driving sales of aftermarket rims. Increased penetration of e-commerce platforms and the convenience that is provided by tire-and-wheel packages have made rim selection and purchase easy for end users, thus further facilitating this channel.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| UK | 3.8% |

| France | 3.6% |

| Germany | 4.5% |

| Italy | 3.4% |

| South Korea | 4.1% |

| Japan | 3.7% |

| China | 5.2% |

| Australia | 3.3% |

| New Zealand | 2.9% |

The USA industry is anticipated to register a consistent CAGR of 4.2% during the forecast period 2025 to 2035, driven by a surge in demand for sports cars and increasing customer preference for aftermarket styling. The nation's established automobile industry is seeing renewed energies through penetration with innovative materials like carbon fiber and aluminum alloys that enhance fuel efficiency and look.

Increased car ownership levels and EV sales growth are driving rim innovation and product range diversity. Players like Maxion Wheels, Accuride Corporation, and American Racing are speeding up the competition by means of light and corrosion-resistant rim design through strategic investment.

In addition, regulatory pressure to strengthen fuel economy regulation is driving the uptake of advanced rim technology. Expansion in online retailing channels is also changing the buying habits of customers, further fueling aftermarket demand in major metropolitan and suburban industries.

The UK industry will grow at a 3.8% CAGR from 2025 to 2035. Industry growth is mainly spurred on by increasing customer demand for premium and luxury cars and increasing customer demand for hybrid and electric cars. Personalization is also positively impacting the purchase of alloy as well as one-off designed rims, especially within urban areas, as aesthetics plays the deciding role.

Major producers like Wolfrace Wheels, Rimstock Limited, and Momo UK are themselves transforming their product lines to suit changing consumer trends. Government policies promoting sustainable transport and emissions reduction are inspiring motor vehicle manufacturers to employ lighter and stronger rim materials. With growing momentum towards the electrification of vehicles, rim styling is becoming more closely associated with aerodynamic efficiency and regenerative capability, which supports long-term industry stability.

The French industry is anticipated to progress at a 3.6% CAGR between the period of 2025 to 2035. Upsurge in the production of vehicles and the need for edge-of-the-circle design aesthetics, along with on-road performance, is driving consumers toward premium rims. Carbon-emission reduction regulation and environmental awareness are compelling producers to adopt weight-reduced rims.

Major local and global brands such as Ronal Group and Superior Industries are leveraging technological advances and strategic collaborations to increase their presence. The French automobile industry places greater emphasis on electric mobility and hybrid platforms, which facilitate the utilization of aluminum and forged rims, leading to overall weight savings and better vehicle efficiency. Furthermore, the digitalization of automobile sales and servicing is facilitating easy accessibility to aftermarket rim upgrades.

Germany can achieve a healthy CAGR of 4.5% between 2025 and 2035 in the industry, as it is a prime automobile innovation center. Consumers have a strong demand for luxury and performance cars, combined with a scope for precision manufacturing that is fueling the uptake of high-end alloy and forged rims. Focus on quality, performance, and safety attributes continues to influence procurement and design programs in the industry.

Recognizable players like BBS Kraftfahrzeugtechnik, ATS Wheels, and Borbet GmbH are tapping into Germany's engineering heritage to manufacture lightweight and high-strength rim products. OEM backing, particularly in the performance vehicle industry segment, is driving penetration deeper into the industry. The blending of sustainable production practices and intelligent material technologies instills strength into Germany's position as a leader in automotive wheel rim innovation.

Italy's industry will grow at a CAGR of 3.4% during 2025 to 2035. The reason for this growth is the country's rich design culture and the widespread presence of premium car brands that emphasize aesthetics as well as functionality. Lightweight, customized rims are in greater demand, particularly among high-end car buyers and motorsport enthusiasts.

Producers like OZ Racing, MAK Wheels, and Fondmetal are prime movers, focusing on design innovation and material optimization. Increasing exports of high-performance cars favor local production of high-performance rims, while a surge in the electric vehicle industry is persuading suppliers to look at new lightweight solutions. Italy's strong aftermarket ecosystem is also a prime mover for charting future demand, especially in the luxury and sports car segments.

The industry in South Korea is also expected to expand at a 4.1% CAGR between 2025 and 2035. The country's dominance of electronic integration in the automotive industry is influencing wheel rim development, especially towards smartness and connectivity. Increased consumer interest in electric vehicles and compact cars is also altering rim size and material specifications.

The first users of lightweight rim technology are industry leaders like Donghwa Casting, Seojin Industrial, and Korea Wheel Corporation. The partnerships among international automobile original equipment manufacturers are driving the development of flow-formed and forged rim technology. Harmonization of government policy with green mobility targets is fueling investment in next-generation materials, and South Korea has become a competitive exporter of wheel rims.

Japan's automotive wheel rims industry is expected to attain a CAGR of 3.7% from 2025 to 2035. Demand is underpinned by a balanced combination of conventional combustion engine cars and rising electric and hybrid vehicles. High safety, aesthetics, and efficiency standards are encouraging greater innovation in wheel rim design and materials.

Major industry participants such as Enkei Corporation, Weds Co., and Topy Industries are investing in new manufacturing technologies, such as high-precision casting and heat treatment processes. The increased popularity of compact and kei cars is fueling demand for smaller, fuel-efficient rims, while the high-end markets still prefer beauty and performance-oriented designs. Domestic production is healthy, underpinned by steady car production and increasing aftermarket demand.

China will dominate the industry at a CAGR of 5.2% from 2025 to 2035. Urbanization, rise in vehicle penetration, and aggressive government promotion of electric vehicles are playing a crucial role in industry dynamics. Advancements in technology and affordable manufacturing are facilitating bulk utilization of alloy and hybrid-material rims.

Major local producers like Zhejiang Jingu Co., Lizhong Group, and CITIC Dicastal are increasing capacities and investing in robotic production lines. Smart manufacturing and real-time quality inspection are improving product consistency and performance. With domestic customers increasingly requiring more customization and premium capabilities, the rim industry is diversifying in terms of design, finish, and interoperability with electric mobility trends.

The Australian industry is expected to grow at a CAGR of 3.3% over the forecast period of 2025 to 2035. Demand is driven by increasing consumer demand for utility vehicles, SUVs, and off-road vehicles, each of which requires durable and stylish rim alternatives. The aftermarket segment remains robust, driven by broad adoption of lifestyle changes across the automotive industry.

Specialists such as ROH Wheels, CSA Alloy Wheels, and Performance Wheels Australia are making an industry presence through the formation of region-specific solutions for rims. The trend towards green cars is driving light and fuel-efficient wheel design demand. Car personalization services and e-commerce shopping sites are also impacting consumer involvement and product selection trends.

The industry in New Zealand is anticipated to grow at the rate of a CAGR of 2.9% between the years 2025 and 2035. Industry growth remains moderately consistent in nature with largely replacement and aftermarket-driven demand. Four-wheel-drive and utility-vehicle demand constitutes a common tendency that drives rim choice with a greater focus on robustness and adaptability of terrains.

Firms like Dynamic Wheel Co. and Arrow Wheels are leading the way by providing customized options to align with local driving conditions. The trend towards low-emission cars is helping sustain steady migration towards light rims, despite the fact that penetration in the industry is still in the embryonic stage. Rising vehicle imports and intensifying car culture will assumedly moderately boost industry performance during the period under forecast.

The industry is flooded with stiff competition, characterized by a meticulous matrix of both local and global manufacturers as well as luxury wheel specialists along with aftermarket suppliers. The major players include TSW Alloy Wheels, Euromax Wheel, Maxion Wheels, and Voxx Wheel, among others, including MHT Luxury Wheels, applying revolutionary innovations of lightweight materials and superior aesthetic designs to set themselves apart. Nevertheless, within the aftermarket segment, companies put more focus on making rims that are more durable, aerodynamic, corrosion-resistant, and adaptable towards OEM as well as other aftermarket needs.

The capabilities of supply chain integration in relation to the manufacturing capacities of various companies are critically important. For example, Maxion Wheels utilizes the global supply chain in collaboration with partner automakers for large-scale original equipment manufacturer (OEM) production.

In contrast, companies like TSW Alloy Wheels and MHT Luxury Wheels focus on aftermarket customization, specializing in high-end forged aluminum as well as carbon fiber rims. Investments in smart manufacturing enhanced automated machining, and precision engineering contribute to increased production efficiency and improved product consistency.

Innovation and differentiation in products are also competitive means for companies. The new rivalry among players is now based on product innovations that include lightweight materials like aluminum alloys, magnesium, and carbons. Increased demand in the luxury and off-road segments for customized finishes, multi-piece constructions, and forged wheel technology is followed by emerging brands like Fuel Offroad Wheels and Status Wheels (TUFF A.T) for the adventure and sports vehicle aficionado.

Indications for the competition would also include strategic alliances and geographic expansion with possible examples of brand positioning. These OEM suppliers have entered into contractual agreements with the leading automobile manufacturers for many years, while aftermarket companies are enhancing and strengthening their distribution networks through dealerships, online platforms, and specialty retailers. In addition, brands are extending their positions into emerging industries where growing vehicle ownership abounds the demand for premium and aesthetically enhanced wheel rims.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| TSW Alloy Wheels | 12-16% |

| Euromax Wheel | 10-14% |

| Maxion Wheels | 9-13% |

| Voxx Wheel | 8-12% |

| MHT Luxury Wheels | 7-11% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| TSW Alloy Wheels | Specializes in high-performance alloy wheels, offering lightweight, durable, and stylish designs for sports and luxury vehicles. |

| Euromax Wheel | A major supplier of custom and aftermarket wheels, focusing on precision engineering and aesthetic customization. |

| Maxion Wheels | Leading OEM supplier manufacturing steel and aluminum wheels for passenger, commercial, and off-road vehicles. |

| Voxx Wheel | Provides a diverse range of wheels, including performance, luxury, and off-road models with premium finishes. |

| MHT Luxury Wheels | Specializes in high-end custom wheels, including forged and multi-piece designs for luxury and exotic vehicles. |

Key Company Insights

TSW Alloy Wheels (12-16%)

Known for its lightweight, high-performance designs, TSW Alloy Wheels dominates the sports and luxury vehicle segments with innovative manufacturing techniques.

Euromax Wheel (10-14%)

With a strong aftermarket presence, Euromax Wheel excels in custom rim designs and precision engineering, targeting style-conscious consumers.

Maxion Wheels (9-13%)

A global leader in OEM wheel production, Maxion Wheels supplies steel and aluminum rims for passenger cars, trucks, and commercial vehicles.

Voxx Wheel (8-12%)

Voxx Wheel offers a broad selection of wheels for different vehicle categories, leveraging its expertise in both performance and aesthetic customization.

MHT Luxury Wheels (7-11%)

A premium player in the luxury rim industrie, MHT specializes in custom, forged, and multi-piece wheel designs for high-end and exotic vehicles.

Other Key Players (40-50% Combined)

By product type, the industry is segmented into wire spoke, steel disc, light alloy, aluminum alloy, magnesium alloy, titanium alloy, chrome, and teflon.

By size, the industry is segmented into measuring 13-20, measuring 21-25, and measuring 25-30.

By end user, the industry is segmented into manufacturing industry and workshops.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry is estimated to be USD 51.4 billion in 2025.

By 2035, the industry is projected to reach approximately USD 87.6 billion, driven by growing automotive production, consumer preference for vehicle customization, and the rise in lightweight materials.

China is expected to grow at a 5.2% CAGR, supported by its large-scale automotive manufacturing and expanding aftermarket segment.

Aluminum alloy rims dominate the industry due to their strength-to-weight ratio, corrosion resistance, and visual appeal.

Leading companies include TSW Alloy Wheels, Euromax Wheel, Maxion Wheels, Voxx Wheel, MHT Luxury Wheels, Sota Offroad, Status Wheels (TUFF A.T), Fuel Offroad Wheels, Wheel Pros LLC, and BORBET GmbH.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Size, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Size, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Size, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Size, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Size, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Size, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Size, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Size, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Size, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Size, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Size, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Size, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Size, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA