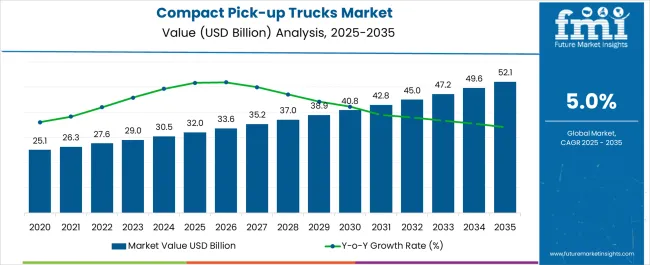

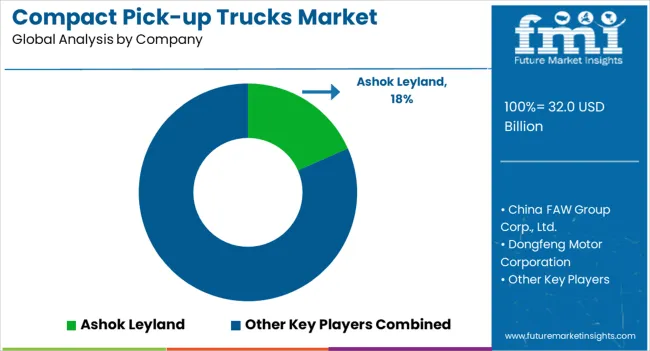

The Compact Pick-up Trucks Market is estimated to be valued at USD 32.0 billion in 2025 and is projected to reach USD 52.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. This growth, while steady globally, is expected to exhibit notable regional imbalances driven by variations in infrastructure development, consumer preferences, regulatory frameworks, and fleet modernization programs. Asia-Pacific is anticipated to maintain the largest market share throughout the forecast period due to high adoption in emerging economies, increasing commercial and small-scale fleet utilization, and strong local manufacturing capabilities.

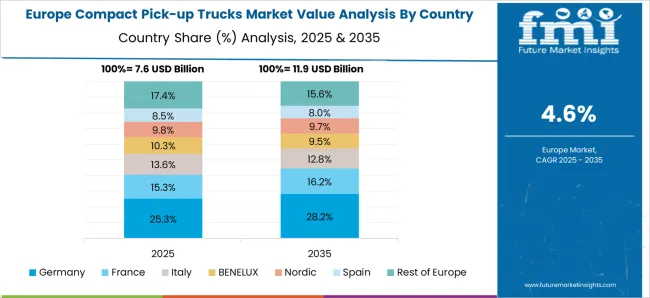

The region benefits from cost-competitive production and a robust supply chain network that accelerates market penetration, leading to an outsized contribution to global revenue growth. Europe is projected to register moderate growth, influenced by stringent emission regulations, electrification mandates, and a focus on fuel efficiency. Although market expansion is slower than in the Asia-Pacific region, premium and environmentally compliant models drive value growth. North America is expected to sustain steady demand, underpinned by consumer preference for compact pickups in urban and suburban applications, coupled with fleet replacement cycles and technological upgrades. By 2035, Asia-Pacific is likely to account for more than 40% of the global market, Europe around 30%, and North America slightly under 30%. This regional imbalance highlights the influence of regulatory policies, manufacturing cost structures, and adoption trends in shaping market dynamics across key geographies.

| Metric | Value |

|---|---|

| Compact Pick-up Trucks Market Estimated Value in (2025 E) | USD 32.0 billion |

| Compact Pick-up Trucks Market Forecast Value in (2035 F) | USD 52.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The compact pick-up trucks market is experiencing considerable traction due to increasing demand for fuel-efficient utility vehicles with urban mobility flexibility. Rising consumer preference for affordable and practical transportation solutions is accelerating the adoption of compact models in both developed and emerging markets.

Automakers are responding with product innovations focused on maneuverability, cargo versatility, and better fuel economy. Regulatory shifts encouraging low-emission vehicles and expanding infrastructure projects are further supporting market penetration, particularly among small businesses and independent contractors.

As fleet owners seek to balance operational cost with vehicle functionality, compact pick-up trucks are becoming the preferred choice in utility segments. The market outlook remains positive as manufacturers introduce advanced powertrain options, lightweight platforms, and feature-rich variants aimed at both personal and commercial users.

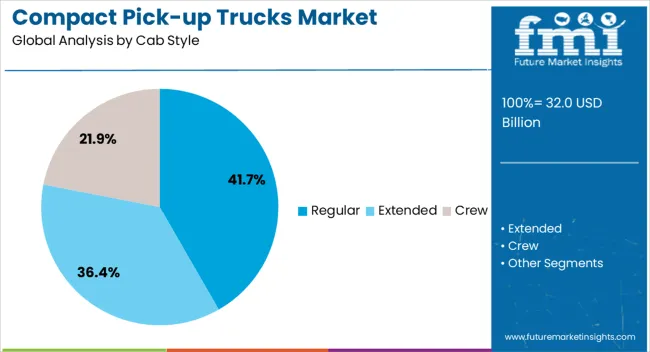

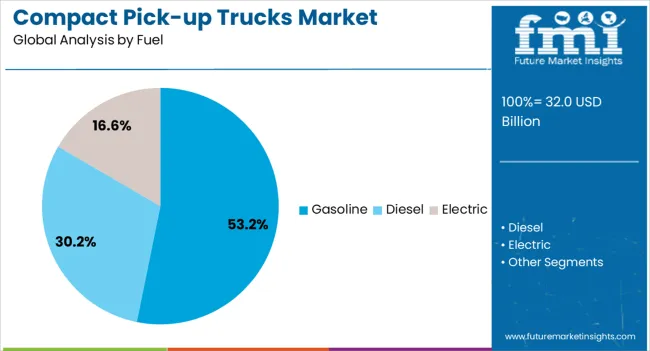

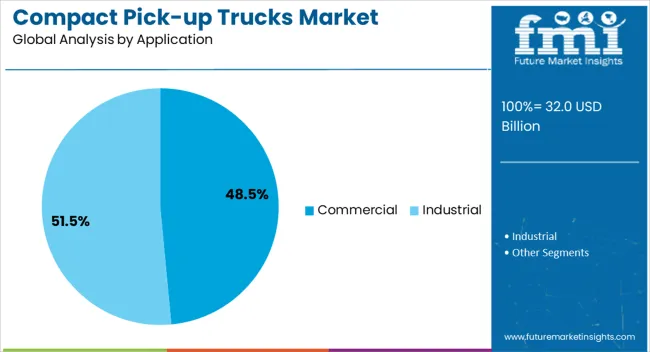

The compact pick-up trucks market is segmented by cab style, fuel, application, and geographic regions. By cab style, the compact pick-up trucks market is divided into Regular, Extended, and Crew. In terms of fuel, the compact pick-up trucks market is classified into Gasoline, Diesel, and Electric. Based on the application, the compact pick-up trucks market is segmented into Commercial and Industrial. Regionally, the compact pick-up trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The regular cab style segment is projected to hold 41.70% of total revenue by 2025 within the cab style category, establishing it as the leading format. This preference is attributed to its cost efficiency, structural simplicity, and compatibility with utility-focused tasks.

Regular cab configurations offer a larger cargo bed relative to vehicle length, making them ideal for load carrying in commercial operations. Their ease of maintenance and lower manufacturing cost have further contributed to fleet adoption across construction, logistics, and agriculture sectors.

With businesses prioritizing practicality and affordability in vehicle selection, the regular cab style continues to lead in compact pick-up truck adoption.

The gasoline segment is expected to account for 53.20% of total market revenue by 2025 under the fuel category, making it the dominant fuel type. The widespread availability of gasoline infrastructure, lower upfront costs compared to diesel or hybrid alternatives, and better suitability for light-duty applications have supported its continued dominance.

Additionally, gasoline engines offer quieter operation, quicker throttle response, and lower maintenance complexity, aligning well with urban and suburban transport needs.

As emission regulations tighten, manufacturers have also optimized gasoline engines to meet efficiency and environmental standards, reinforcing their relevance in the compact pick-up truck segment.

The commercial application segment is projected to contribute 48.50% of overall market revenue by 2025, positioning it as the leading end-use category. This growth is driven by rising adoption among small to medium enterprises, last-mile delivery operators, and service providers requiring reliable and compact transportation solutions.

The compact size of these trucks allows for greater maneuverability in urban areas while retaining sufficient payload capacity for various operational needs. Furthermore, the balance between functionality and cost has made them an attractive option for businesses seeking to expand or upgrade their fleets.

As commercial sectors continue to demand agile and cost-effective vehicles, compact pick-up trucks are increasingly recognized as practical assets for everyday utility.

The market has grown due to rising demand for vehicles that combine maneuverability, fuel efficiency, and versatility. These trucks have been widely used for urban deliveries, small-scale logistics, and recreational purposes where full-size trucks are less practical. Manufacturers have focused on improving engine performance, safety systems, and interior comfort, while incorporating technology-driven solutions. Adoption has been driven by commercial fleet needs, e-commerce delivery expansion, and individual consumer preference for multi-functional vehicles. Compact pick-up trucks have been positioned as efficient, affordable, and reliable solutions for short-haul and utility applications.

The market has been influenced strongly by urban transportation and last-mile logistics requirements. These trucks have been preferred for deliveries in congested city streets, small business operations, and short-distance distribution where maneuverability is crucial. Fleet operators have utilized them for transporting goods, tools, and equipment without the higher operational costs associated with larger vehicles. The rise of e-commerce has further reinforced their adoption, as rapid, flexible, and cost-effective delivery solutions have become essential. Their smaller size and lighter weight have reduced fuel consumption and parking challenges, making them suitable for dense urban environments. Manufacturers have introduced multiple configurations to meet diverse operational needs, including cargo bed options, enhanced payload capacity, and safety features. As urbanization trends continue to impact transportation efficiency, compact pick-up trucks have become increasingly critical for logistics optimization in crowded metropolitan areas.

Technological innovation has played a central role in the compact pick-up trucks market by improving engine performance and fuel efficiency. Modern powertrains have been designed to balance load-carrying capability with lower fuel consumption, which has reduced total cost of ownership for operators. Turbocharged and multi-fuel engines have been integrated to meet emissions regulations while maintaining performance standards. Lightweight materials and aerodynamic designs have further enhanced energy efficiency and handling characteristics. Hybrid solutions have also been explored as transitional alternatives to fully electric drivetrains, especially for short-haul operations. Advanced engine management systems have allowed improved torque delivery and optimized power utilization under varying load conditions. These enhancements have made compact pick-up trucks competitive not only in operating costs but also in reliability and responsiveness, reinforcing their adoption for both commercial and personal users in multiple markets worldwide.

Safety and digital technology integration has emerged as a key factor shaping the compact pick-up trucks market. Features such as anti-lock braking systems, airbags, electronic stability control, and traction control have been widely incorporated to ensure compliance with safety standards and reduce accident risks. Telematics and vehicle monitoring solutions have allowed fleet operators to track performance, optimize maintenance schedules, and reduce downtime. Connected infotainment systems have improved user experience, particularly in urban and professional settings, offering navigation, smartphone integration, and real-time traffic updates. Driver assistance systems, including rear-view cameras and parking sensors, have been added to facilitate maneuvering in tight spaces. The combination of safety and connectivity has elevated compact pick-up trucks beyond basic utility vehicles, enhancing customer confidence and broadening market appeal for both individual buyers and business fleets.

Cost efficiency has been a major factor driving the adoption of compact pick-up trucks in commercial fleets and small business operations. Their lower acquisition costs, fuel expenses, and maintenance requirements have made them favorable alternatives to larger trucks for businesses with limited budgets. Fleet operators have leveraged these vehicles to transport goods efficiently over short distances, reducing operational costs while maintaining delivery reliability. Leasing programs and flexible financing options have further encouraged uptake, especially among small enterprises and urban delivery service providers. Additionally, the combination of durability, payload versatility, and reduced environmental footprint has strengthened their position as practical fleet assets. The focus on cost-effective operations, coupled with reliable performance, has ensured steady demand for compact pick-up trucks, particularly in emerging markets and high-density urban regions where large vehicles face operational constraints.

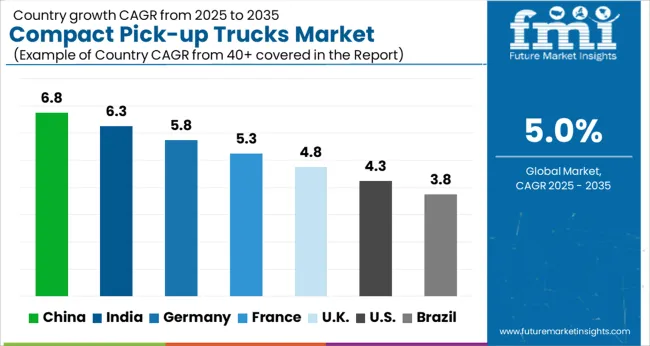

The market is projected to grow at a CAGR of 5.0% from 2025 to 2035, fueled by increasing urban transport needs, light commercial applications, and consumer preference for fuel-efficient vehicles. China leads with a 6.8% CAGR, expanding through growing domestic production and rising demand for compact utility vehicles. India follows at 6.3%, adopting modernized fleets and urban logistics solutions. Germany grows at 5.8%, supported by technological advancements and integration of efficient powertrains. The UK, at 4.8%, focuses on fleet modernization and regulatory compliance. The USA, at 4.3%, sees steady growth from commercial and light-duty applications in urban and semi-urban regions. This report covers 40+ countries, with the top markets highlighted here for reference.

The market in China is anticipated to expand at a CAGR of 6.8% from 2025 to 2035, driven by increasing demand for urban logistics solutions and light commercial transportation. Manufacturers are developing fuel-efficient engines and hybrid powertrains to meet stricter environmental and emission regulations. Rising industrial activities, construction projects, and small-scale manufacturing operations are contributing to heightened demand for versatile vehicles. The consumer interest in multipurpose utility vehicles for business and leisure is boosting market adoption. Strong aftersales service networks, increasing availability of domestic and international brands, and government incentives for cleaner vehicles are further accelerating growth prospects in China.

India is projected to witness a CAGR of 6.3% in the compact pick-up trucks market over the next decade, propelled by expanding small and medium enterprises, growing agricultural transportation needs, and rising demand in rural and semi-urban regions. Domestic manufacturers are focusing on modern engine technologies, rugged designs, and cost-effective solutions, while international players are introducing competitive models with advanced features. Government initiatives supporting cleaner fuel vehicles and emission compliance are encouraging adoption, while fleet modernization trends in logistics and construction sectors are further enhancing demand. Increasing consumer preference for versatile and multipurpose vehicles for both work and personal use is expected to reinforce market expansion.

Germany’s market is expected to grow at a CAGR of 5.8% from 2025 to 2035, driven by industrial logistics, construction operations, and lifestyle utility vehicle demand. Manufacturers are emphasizing vehicle electrification, lightweight materials, and integrated connectivity solutions to meet stringent European Union emission and safety standards. Rising consumer preference for multipurpose vehicles, combined with government support for electric and hybrid commercial vehicles, is fostering adoption. The strong dealership networks, aftersales service support, and strategic alliances between domestic and international automotive companies are further enhancing market expansion in Germany, positioning the country as a key growth region in Europe.

The United Kingdom is forecasted to grow at a CAGR of 4.8% in the market from 2025 to 2035, fueled by increasing adoption in urban transport, light commercial operations, and last-mile delivery. Manufacturers are focusing on hybrid technologies, fuel-efficient engines, and advanced safety systems to meet regulatory requirements. Rising demand for multifunctional vehicles catering to both commercial and personal usage is driving sales. Expansion of small and medium business fleets, construction and infrastructure projects, and the need for efficient rural transportation are contributing to market growth. Strategic partnerships and promotional programs by domestic and global manufacturers are supporting penetration in key regions across the UK.

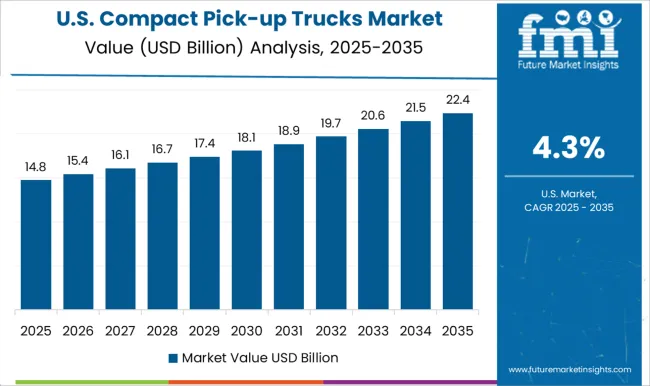

The market in the United States is projected to expand at a CAGR of 4.3% between 2025 and 2035, supported by small-scale logistics, construction, and lifestyle vehicle usage. Manufacturers are investing in electric and hybrid powertrains, connected vehicle technology, and lightweight materials to enhance performance and comply with environmental regulations. Fleet renewal programs and the rise of last-mile delivery operations are increasing market demand. The consumer preference for versatile vehicles suitable for both work and recreational purposes is encouraging adoption. Domestic and international players are actively launching competitive models and strategic alliances to strengthen market presence in key states.

Ford Motor Company and General Motors Company lead the segment with the Ranger and Colorado/Canyon models, offering strong performance, advanced safety features, and adaptability for urban and light commercial use. Toyota Motor Corporation has maintained a strong foothold with its Hilux and Tacoma models, known for reliability, off-road capability, and long-term durability. Nissan Motor Co., Ltd. and Honda Motor Co., Ltd. contribute with trucks emphasizing efficiency, modern design, and practical load-handling capabilities suitable for both personal and business applications.

Hyundai Motor Corporation continues to expand its compact truck offerings, integrating innovative technology and appealing styling to attract younger consumers and small business owners. Emerging players and regional manufacturers are also influencing the market dynamics. Tata Motors and Ashok Leyland focus on cost-effective, fuel-efficient compact trucks for the South Asian market, prioritizing reliability and ease of maintenance. China FAW Group Corp., Ltd. and Dongfeng Motor Corporation deliver competitively priced models with local market adaptability, advanced infotainment systems, and emissions-compliant engines, catering to growing demand in China and neighboring regions. Across the market, key strategies include product upgrades, R&D investments, and adoption of eco-friendly powertrains, which enhance market share while meeting evolving consumer and regulatory expectations globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.0 Billion |

| Cab Style | Regular, Extended, and Crew |

| Fuel | Gasoline, Diesel, and Electric |

| Application | Commercial and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ashok Leyland, China FAW Group Corp., Ltd., Dongfeng Motor Corporation, Ford Motor Company, General Motors Company, Honda Motor Co., Ltd., Hyundai Motor Corporation, Nissan Motor Co. Ltd., Tata Motors, and Toyota Motor Corporation |

| Additional Attributes | Dollar sales by model and drivetrain, demand dynamics across commercial and personal segments, regional trends in urban and semi-urban adoption, innovation in fuel efficiency and connectivity features, environmental impact of emissions, and emerging use cases in last-mile delivery and recreational transport. |

The global compact pick-up trucks market is estimated to be valued at USD 32.0 billion in 2025.

The market size for the compact pick-up trucks market is projected to reach USD 52.1 billion by 2035.

The compact pick-up trucks market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in compact pick-up trucks market are regular, extended and crew.

In terms of fuel, gasoline segment to command 53.2% share in the compact pick-up trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Wheel Loaders Market Size and Share Forecast Outlook 2025 to 2035

Compact Loader Market Size and Share Forecast Outlook 2025 to 2035

Compact Recloser Replacement Market Size and Share Forecast Outlook 2025 to 2035

Compact Track and Multi-Terrain Loader Market Size and Share Forecast Outlook 2025 to 2035

Compacted Graphite Iron Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Compaction Machines Market Growth - Trends & Forecast 2025 to 2035

Compact Power Equipment Rental Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Compact Construction Equipment

Compact E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Compact Road Sweepers Market

Compaction equipment Market

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Self-Compacting Concrete Market Size and Share Forecast Outlook 2025 to 2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Refuse Compactor Market

Germany Compact Construction Equipment Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA