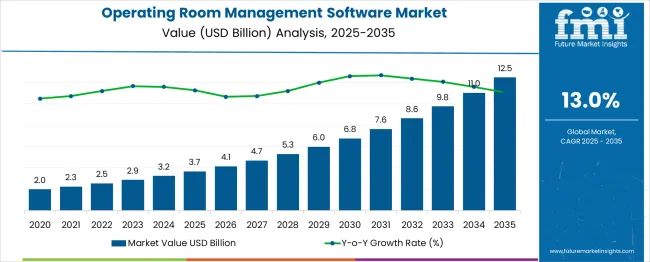

The operating room management software market is expected to rise from USD 3.7 billion in 2025 to USD 12.5 billion in 2035, achieving a compound annual growth rate (CAGR) of 13% over the period. Between 2020 and 2025, the market experienced its slowest growth, with values increasing from USD 2 billion in 2020 to USD 3.7 billion in 2025, reflecting gradual adoption and early-stage implementation in healthcare facilities. Significant acceleration is observed post-2025, with the market reaching USD 6 billion by 2030 and peaking at USD 12.5 billion in 2035, driven by widespread adoption, integration with hospital information systems, and demand for efficiency and workflow optimization. The trough period, 2020–2023, contrasts sharply with the peak growth years of 2032–2035, marking the fastest expansion in market value.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.7 billion |

| Forecast Value in (2035F) | USD 12.5 billion |

| Forecast CAGR (2025 to 2035) | 13% |

The operating room management software market demonstrates a strong long-term growth trajectory, rising from USD 3.7 billion in 2025 to USD 12.5 billion in 2035 at a compound annual growth rate (CAGR) of 13%. Market expansion is supported by increasing adoption of digital solutions in hospitals, growing demand for workflow optimization, and the integration of software with electronic health records and hospital information systems. Values show consistent year-on-year increases, with USD 4.1 billion in 2026, USD 6 billion by 2030, and USD 9.8 billion in 2033, indicating sustained growth rather than stagnation or decline. Early adoption hurdles gradually diminish, and operational efficiency gains continue to reinforce market expansion.

Growth momentum is expected to accelerate toward the latter half of the decade, driven by advanced analytics, predictive scheduling features, and AI-enabled optimization tools. By 2035, the market reaches USD 12.5 billion, reflecting increased penetration in developed and emerging healthcare markets. Adoption across mid-sized hospitals and surgical centers contributes to incremental value. Overall, the market is clearly on an upward trajectory, with no periods of stagnation or contraction observed across the ten-year forecast window, indicating robust long-term expansion potential.

Market expansion is being supported by the increasing focus on healthcare operational efficiency and the corresponding demand for integrated surgical workflow management solutions. Modern healthcare facilities are increasingly focused on optimizing OR utilization rates, reducing surgical delays, and improving patient outcomes through systematic workflow management. Operating room management software's proven efficacy in streamlining surgical processes, managing resources, and enhancing communication makes it a preferred solution in advanced healthcare environments.

The growing emphasis on patient safety and regulatory compliance is driving demand for software solutions that provide comprehensive documentation, real-time monitoring, and audit trail capabilities. Healthcare provider preference for integrated platforms that combine scheduling, inventory management, and performance analytics is creating opportunities for innovative software solutions. The rising influence of value-based healthcare models and evidence-based surgical practices is also contributing to increased product adoption across different healthcare facility types and specialties.

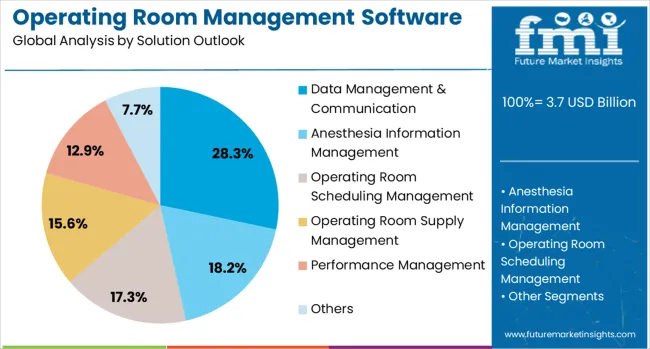

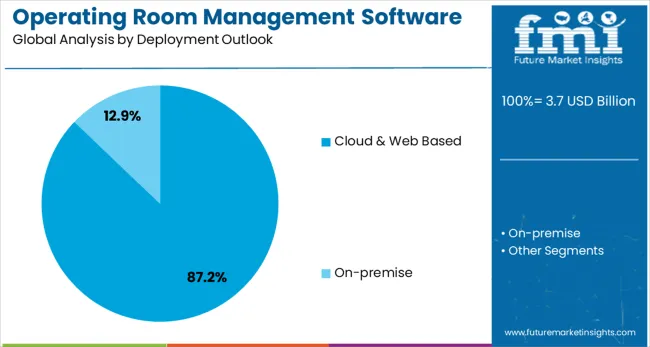

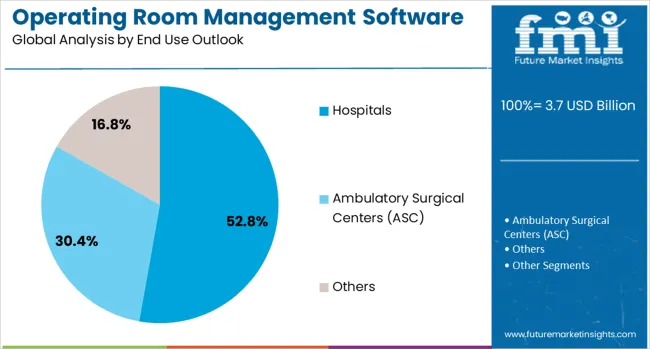

The market is segmented by solution outlook, deployment outlook, end use outlook, and region. By solution outlook, the market is divided into data management & communication, anesthesia information management, operating room scheduling management, operating room supply management, performance management, and others. Based on deployment outlook, the market is categorized into cloud & web based and on-premise. In terms of end use outlook, the market is segmented into hospitals and ambulatory surgical centers (ASC). Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Data management & communication solutions are expected to account for 28.3% of the operating room management software market in 2025, reaffirming their position as a core functional category. These solutions enable seamless information flow, real-time collaboration, and centralized access to patient records, surgical schedules, equipment status, and staff coordination, addressing the complex operational demands of modern ORs. Hospitals and surgical centers increasingly rely on integrated platforms to optimize workflow, reduce errors, and enhance patient safety. The segment forms the backbone of most OR software systems, ensuring operational efficiency while supporting clinical decision-making across diverse surgical specialties.

Cloud and web-based deployment is projected to account for 87.2% of OR management software demand in 2025, emphasizing its dominance as the preferred delivery model. Healthcare facilities increasingly adopt cloud platforms for their flexibility, remote accessibility, cost-effectiveness, and ability to scale across multiple locations. Cloud-based systems allow real-time updates, automated maintenance, enhanced security, and disaster recovery capabilities, ensuring continuity in critical surgical operations. The segment also facilitates interoperability with hospital IT infrastructure, supporting long-term system integration and operational efficiency. These benefits make cloud deployment the standard choice for modern OR management, enabling healthcare providers to optimize surgical workflows while reducing administrative burden.

Hospitals are projected to account for 52.8% of the operating room management software market in 2025, reflecting their high-volume surgical operations and complex coordination needs. With multiple operating rooms and diverse surgical specialties, hospitals require comprehensive platforms to manage scheduling, staff allocation, and equipment usage efficiently. Significant IT budgets and focus on operational excellence further support adoption. OR management software enables hospitals to maximize surgical throughput, maintain regulatory compliance, and enhance patient outcomes. The segment’s dominance is reinforced by administrators’ recognition of integrated systems as critical infrastructure, making hospitals the primary driver of software investments and a key market segment for solution providers.

The operating room management software market is strongly shaped by its ability to integrate with hospital-wide information systems. By connecting with electronic health records, billing solutions, and staff management platforms, the software ensures smooth communication across departments. This integration provides surgeons and administrators with real-time access to patient histories, lab results, and procedure updates within the operating room system. The seamless flow of information reduces miscommunication and improves collaboration, leading to better surgical outcomes. Hospitals increasingly seek interoperable solutions that eliminate redundancies and create a unified system. This trend highlights how integration has become a central factor in driving adoption and shaping the growth of operating room management software.

The demand for data-driven decision making is becoming a critical dynamic in the operating room management software market. Hospitals rely on analytics from this software to optimize resources, balance workloads, and improve patient care quality. The system collects and analyzes data on procedure times, staff performance, patient throughput, and turnover rates. Administrators use these insights to forecast demand, plan resource allocation, and improve operational efficiency. Surgeons also benefit from performance feedback that highlights areas for improvement. By transforming raw operating room data into actionable insights, the software empowers hospitals to make informed choices. This focus on data-driven management is fueling adoption across healthcare facilities.

Customization has become another important driver for the operating room management software market. Different surgical specialties such as orthopedics, cardiology, and neurosurgery require tailored scheduling, equipment tracking, and workflow features. Vendors are developing solutions designed to meet these specific needs, allowing surgeons and staff to operate more effectively. For instance, cardiology departments may need scheduling tools for catheterization labs, while orthopedic surgery requires implant tracking capabilities. This level of customization improves both usability and satisfaction among healthcare providers. As hospitals expand their range of complex surgical procedures, the need for specialized management features grows. Customization ensures efficiency and supports better patient outcomes across various specialties.

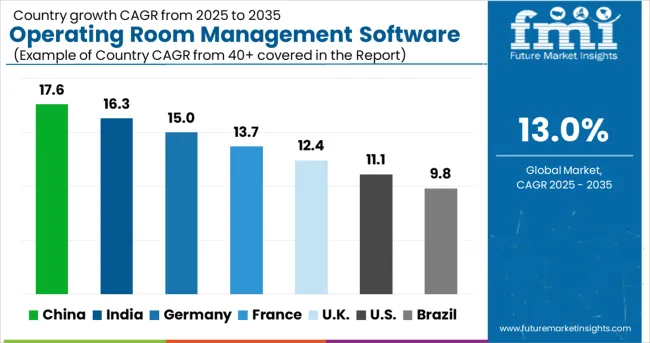

| Country | CAGR (2025-2035) |

|---|---|

| China | 17.6% |

| India | 16.3% |

| Germany | 15% |

| France | 13.7% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

The operating room management software market is experiencing robust growth globally, with China leading at a 17.6% CAGR through 2035, driven by rapid healthcare digitization, increasing healthcare infrastructure investment, and growing adoption of advanced surgical technologies. India follows closely at 16.3%, supported by expanding healthcare sector, government digital health initiatives, and increasing demand for operational efficiency solutions. Germany shows steady growth at 14.9%, emphasizing integrated healthcare systems and advanced surgical workflow management. France records 13.7%, focusing on healthcare innovation and comprehensive OR management platforms. The UK shows 12.4% growth, prioritizing NHS digitization and evidence-based surgical practices.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Operating room management software in China is projected to grow at a CAGR of 17.6% through 2035, driven by rapid digitization of healthcare facilities, increasing government investment in healthcare infrastructure, and growing emphasis on surgical efficiency. Competition involves both domestic and international healthcare technology providers establishing distribution networks to serve tier-1 and tier-2 hospitals. Adoption is accelerated compared with India and Brazil due to strong government support and large-scale hospital modernization initiatives. Investments in certified, integrated platforms, advanced analytics, and workflow optimization tools have enhanced operational efficiency, enabling hospitals to improve surgical outcomes and strengthen China’s position in advanced healthcare management solutions.

Operating room management software in India is projected to grow at a CAGR of 16.3%, supported by rising healthcare infrastructure investment, growing surgical volumes, and adoption of digital healthcare solutions. Competition exists among domestic solution providers and international technology companies forming partnerships to address the demand for workflow optimization tools. Compared with China, adoption is slower due to regional disparities, yet the market shows high growth potential because of government digital health initiatives and expanding healthcare access. Investments in training, system integration, and process optimization have improved operational efficiency. Indian hospitals are increasingly implementing OR management platforms to enhance surgical workflows and patient outcomes.

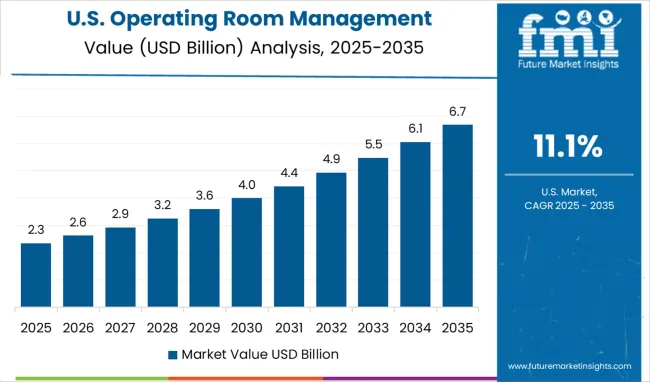

Operating room management software in the USA is projected to grow at a CAGR of 11.1%, supported by healthcare providers’ preference for integrated solutions and the adoption of value-based healthcare models. Competition is led by manufacturers providing platforms that combine OR scheduling, resource management, and performance analytics. Compared with China and India, adoption is more mature and technology-focused, emphasizing measurable operational and clinical outcomes. Investments in interoperability, advanced analytics, and staff training are enhancing workflow efficiency and patient safety. Hospitals are increasingly relying on comprehensive OR management platforms to improve surgical precision, optimize resource utilization, and strengthen evidence-based clinical practices.

Operating room management software in Germany is projected to grow at a CAGR of 14.9% through 2035, supported by advanced healthcare infrastructure, systematic technology adoption, and focus on surgical workflow optimization. Competition is shaped by providers delivering integrated platforms that combine workflow management with operational analytics. Adoption is regulated and quality-driven, with hospitals prioritizing measurable efficiency gains and safety standards. Investments in interoperability, clinical partnerships, and advanced analytics enhance solution capabilities. German healthcare facilities are increasingly deploying next-generation OR management systems to improve surgical coordination, optimize resources, and maintain high standards of operational and patient care performance across public and private hospitals.

Operating room management software in the UK is projected to grow at a CAGR of 12.4%, supported by NHS digitization initiatives, focus on operational efficiency, and adoption of evidence-based surgical practices. Competition involves providers delivering integrated platforms emphasizing workflow management, system integration, and clinical performance. Adoption is moderate compared with China and India, yet hospitals increasingly implement OR management software to enhance surgical workflow and patient safety. Investments in digital platforms, staff training, and operational optimization tools strengthen platform efficiency. Hospitals across the country are relying on OR management systems to streamline scheduling, improve resource utilization, and ensure high-quality surgical outcomes.

Operating room management software in France is projected to grow at a CAGR of 13.7%, supported by healthcare system modernization, focus on surgical workflow optimization, and medical technology innovation. Competition is focused on providers offering integrated solutions validated for clinical performance and operational efficiency. Compared with Germany, adoption emphasizes high-quality, innovative platforms for niche clinical applications. Investments in advanced analytics, interoperability, and staff training have improved hospital efficiency and patient safety. Public and private hospitals are increasingly deploying OR management platforms to optimize surgical scheduling, streamline resource allocation, and enhance operational outcomes, reinforcing France’s position as a key market for advanced healthcare technology adoption.

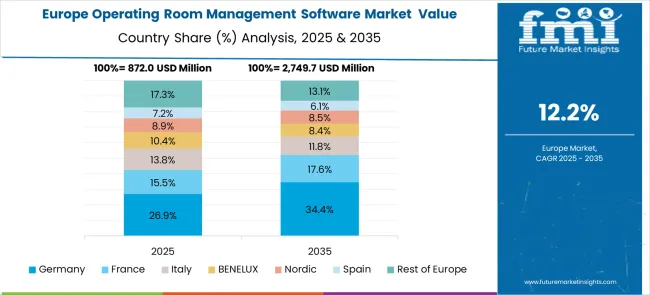

The operating room management software market in Europe demonstrates mature development across major healthcare systems with Germany showing strong presence through its advanced healthcare infrastructure and systematic approach to surgical workflow optimization, supported by healthcare technology companies leveraging clinical research to develop effective OR management solutions that enhance surgical efficiency and patient safety outcomes. France represents a significant market driven by its comprehensive healthcare system and emphasis on healthcare technology innovation, with companies pioneering advanced OR management platforms that combine French healthcare expertise with sophisticated surgical workflow optimization systems.

The UK exhibits considerable growth through its National Health Service digitization initiatives and focus on healthcare operational efficiency, with healthcare technology providers leading the development of integrated OR management solutions and comprehensive staff training programs about surgical workflow optimization benefits. Germany and France show expanding adoption of cloud-based OR management platforms, particularly in comprehensive surgical workflow solutions targeting operational efficiency and patient safety enhancement. BENELUX countries contribute through their focus on healthcare innovation and digital transformation initiatives, while Eastern Europe and Nordic regions display growing potential driven by increasing healthcare digitization and expanding access to advanced OR management solutions across diverse healthcare facilities.

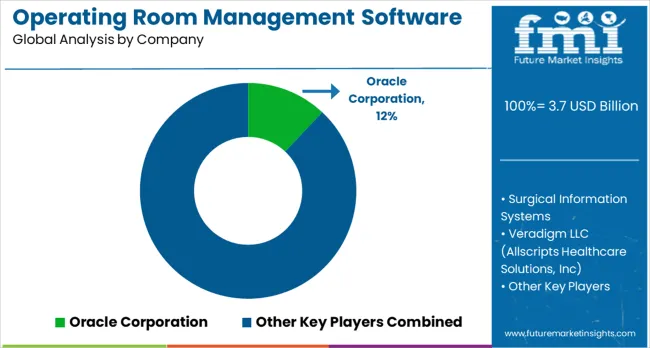

The operating room management software market is shaped by healthcare IT providers and clinical workflow specialists. Oracle Corporation delivers integrated platforms with advanced scheduling and analytics capabilities. Veradigm LLC, part of Allscripts Healthcare Solutions, Inc., applies electronic health record integration and data-driven operational insights. Picis Clinical Solutions, Inc., a division of N. Harris Computer Corporation, emphasizes perioperative management modules and resource optimization. GE HealthCare provides software solutions aligned with imaging, monitoring, and patient flow management. Koninklijke Philips N.V. integrates clinical decision support and OR workflow automation.

Competition is driven by interoperability, data analytics, and operational efficiency. PerfectServe, Inc. applies secure communication platforms for care coordination and real-time notifications. Getinge incorporates surgical suite management and instrument tracking tools for enhanced efficiency. Max Systems Inc. delivers customizable software with modular dashboards for surgical planning and performance monitoring. Technical brochures highlight key features, including scheduling algorithms, analytics dashboards, integration capabilities, and compliance with healthcare standards. End users are guided by system reliability, ease of implementation, and workflow optimization.

Product differentiation relies on software scalability, real-time analytics, and integration flexibility. Cloud-based deployment, modular design, and secure data management are emphasized across promotional material. User interface efficiency, reporting capabilities, and decision-support features are consistently showcased. Customizable workflows and validated performance metrics are highlighted to demonstrate operational impact. Market visibility is enhanced by technical specifications, client case studies, and mission-focused software solutions designed to streamline surgical operations and improve patient outcomes.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.7 billion |

| Solution Outlook | Data Management & Communication, Anesthesia Information Management, Operating Room Scheduling Management, Operating Room Supply Management, Performance Management, Others |

| Deployment Outlook | Cloud & Web Based, On-premise |

| End Use Outlook | Hospitals, Ambulatory Surgical Centers (ASC) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Oracle Corporation, Veradigm LLC (Allscripts Healthcare Solutions, Inc), Picis Clinical Solutions Inc., GE HealthCare, Koninklijke Philips N.V., BD PerfectServe Inc., Getinge, and Max Systems Inc. |

| Additional Attributes | Dollar sales by solution type and deployment model, regional adoption trends, competitive landscape, healthcare facility preferences for cloud versus on-premise deployment, integration with healthcare information systems, innovations in AI-powered analytics, IoT integration, and interoperability enhancement |

The global operating room management software market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the operating room management software market is projected to reach USD 12.5 billion by 2035.

The operating room management software market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in operating room management software market are data management & communication, anesthesia information management, operating room scheduling management, operating room supply management, performance management, and others.

In terms of deployment outlook, cloud & web based segment to command 87.2% share in the operating room management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Operating Room Supplies Market Analysis Size and Share Forecast Outlook 2025 to 2035

Operating Room Equipment Market Analysis - Growth & Forecast 2025 to 2035

Robot Operating System Market Trends – Size, Demand & Forecast 2023-2033

Equine Operating Tables Market Size and Share Forecast Outlook 2025 to 2035

Server Operating Environments Market

Mobile Operating Rooms Market Analysis – Size, Trends & Forecast 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Bedroom Furniture Market

Mushroom Packaging Market Size and Share Forecast Outlook 2025 to 2035

Mushroom-Powered Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

Mushroom-Based Snacks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Mushroom Supplement Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Remodeling Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Vanities Market Analysis - Growth, Trends and Forecast from 2025 to 2035

Mushroom Beer Market Trends - Brewing Innovation & Consumer Growth 2025 to 2035

Bathroom Worktops Market Analysis - Trends & Forecast 2025 to 2035

Competitive Overview of Mushroom Packaging Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA